A Request for Transcript of Tax Return allows individuals to obtain a summary of their tax return information from the IRS without receiving a full copy of their return. This transcript includes essential details such as income, filing status, and adjustments made during processing. It is often used for loan applications, tax preparation, and verifying tax information.

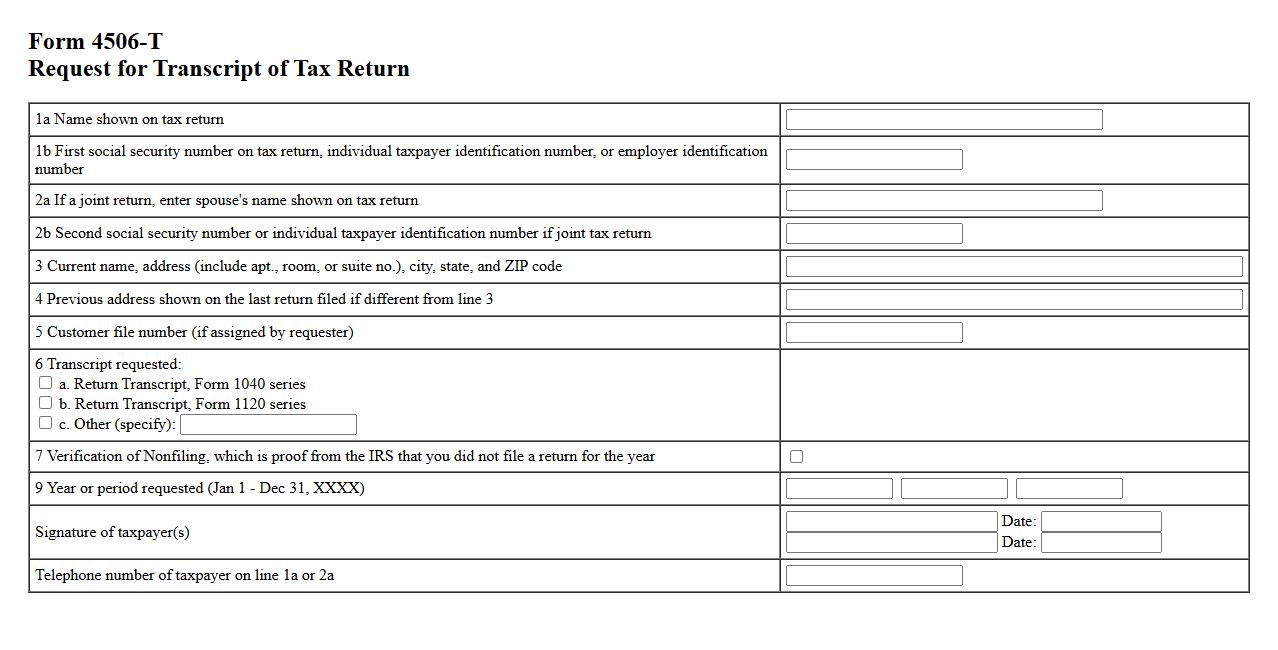

IRS Form 4506-T

The IRS Form 4506-T is used to request a transcript of a tax return from the Internal Revenue Service. This form helps individuals and businesses obtain tax return information for various purposes, such as loan applications or tax audits. It simplifies the process of verifying income and tax details directly from the IRS.

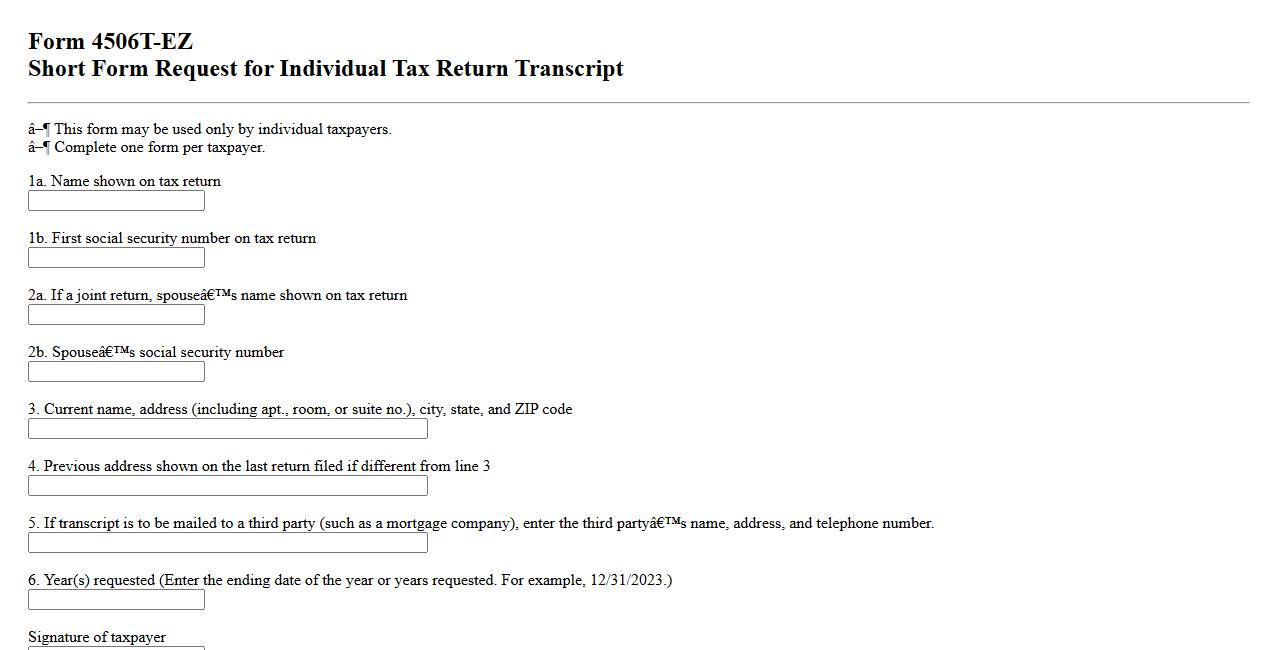

IRS Form 4506T-EZ

The IRS Form 4506T-EZ is a simplified request form used to obtain a transcript of a tax return from the Internal Revenue Service. It is primarily used by individuals to verify income for loan applications, financial aid, and other purposes. This form helps streamline the process by providing a quick and easy method to access tax return information.

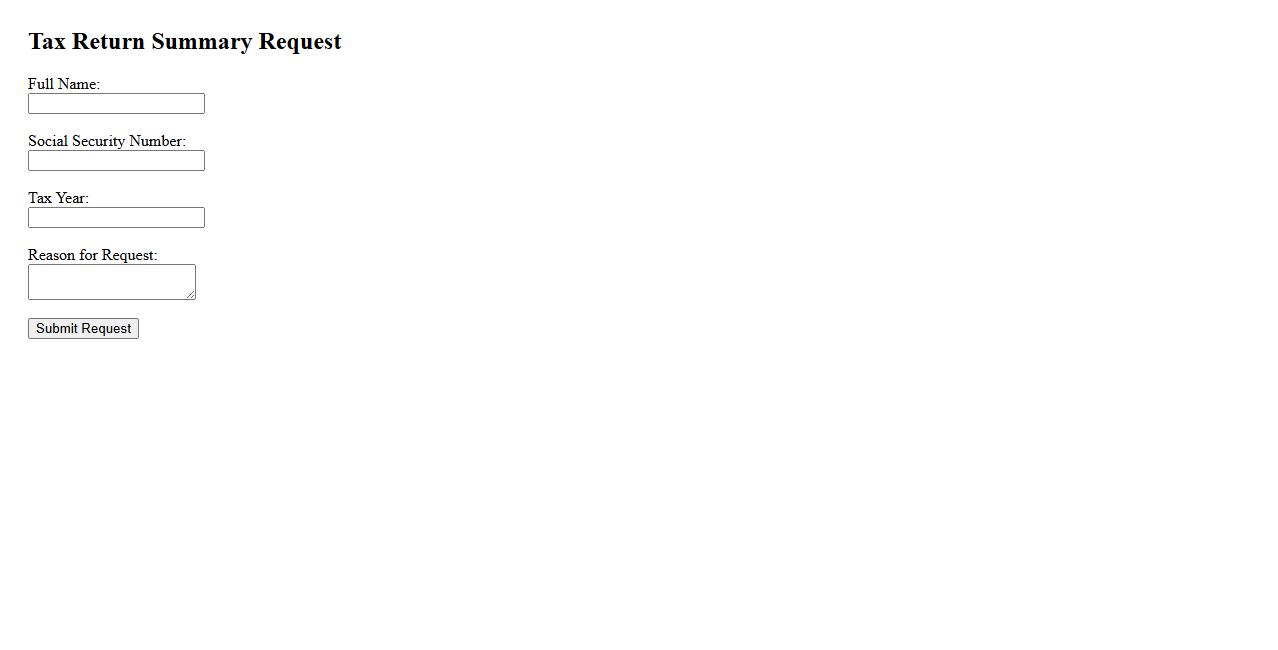

Tax Return Summary Request

A Tax Return Summary Request provides a concise overview of your filed tax documents for a specific period. This summary helps individuals and businesses track tax payments, deductions, and refunds efficiently. It is essential for financial planning and ensuring compliance with tax regulations.

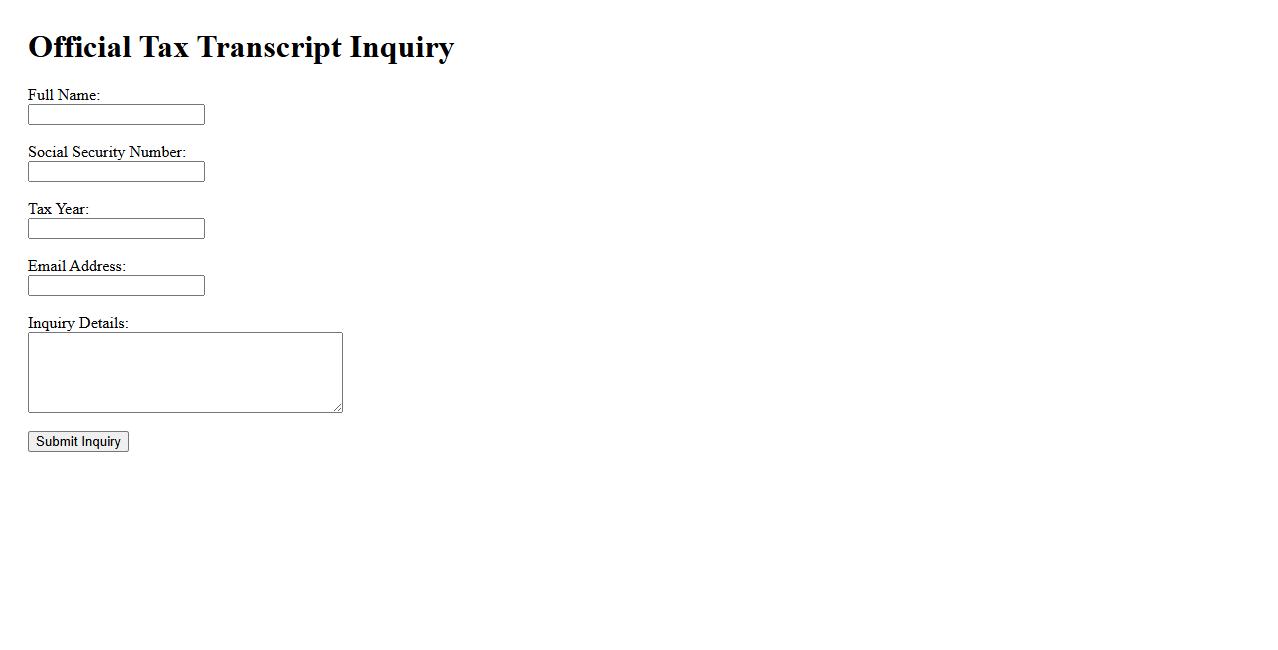

Official Tax Transcript Inquiry

Requesting an Official Tax Transcript allows individuals to obtain an exact copy of their tax return information directly from the IRS. This document is essential for verifying income, applying for loans, or resolving tax-related issues. The inquiry process ensures authenticity and accuracy in accessing personal tax data.

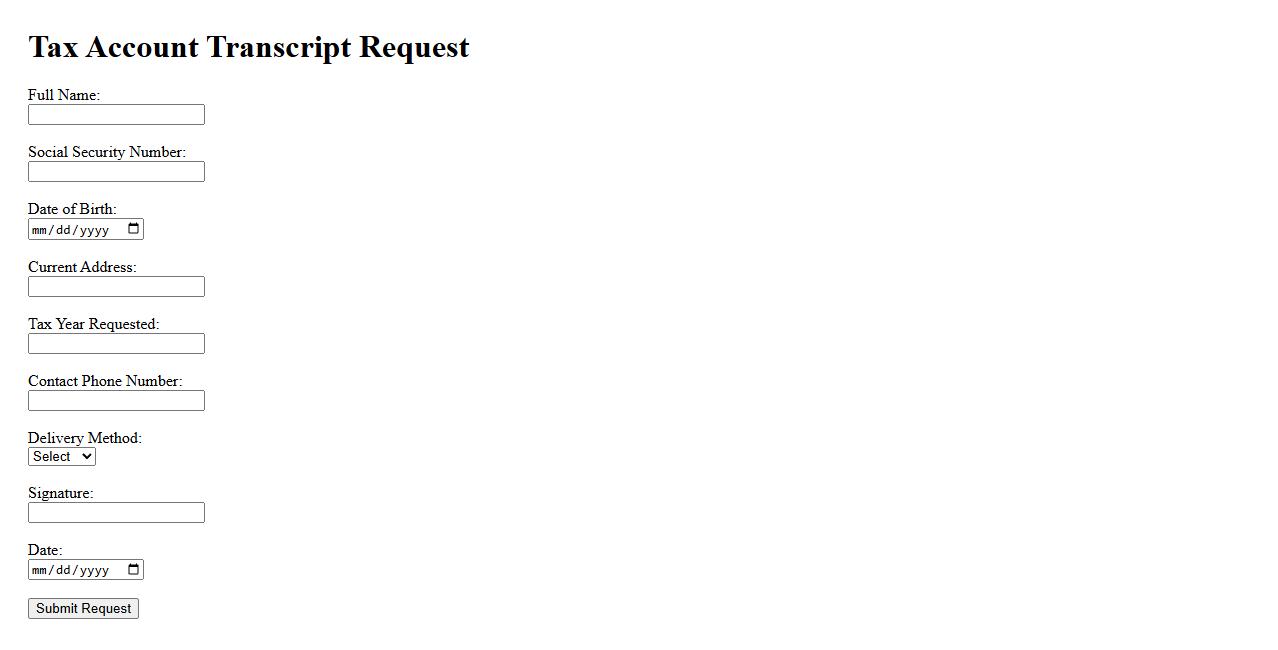

Tax Account Transcript Request

Requesting a Tax Account Transcript provides a detailed summary of your tax return information as recorded by the IRS. This transcript includes data such as filing status, income, and payments, making it essential for tax verification and financial records. You can obtain it online, by mail, or by phone for accurate and timely tax information.

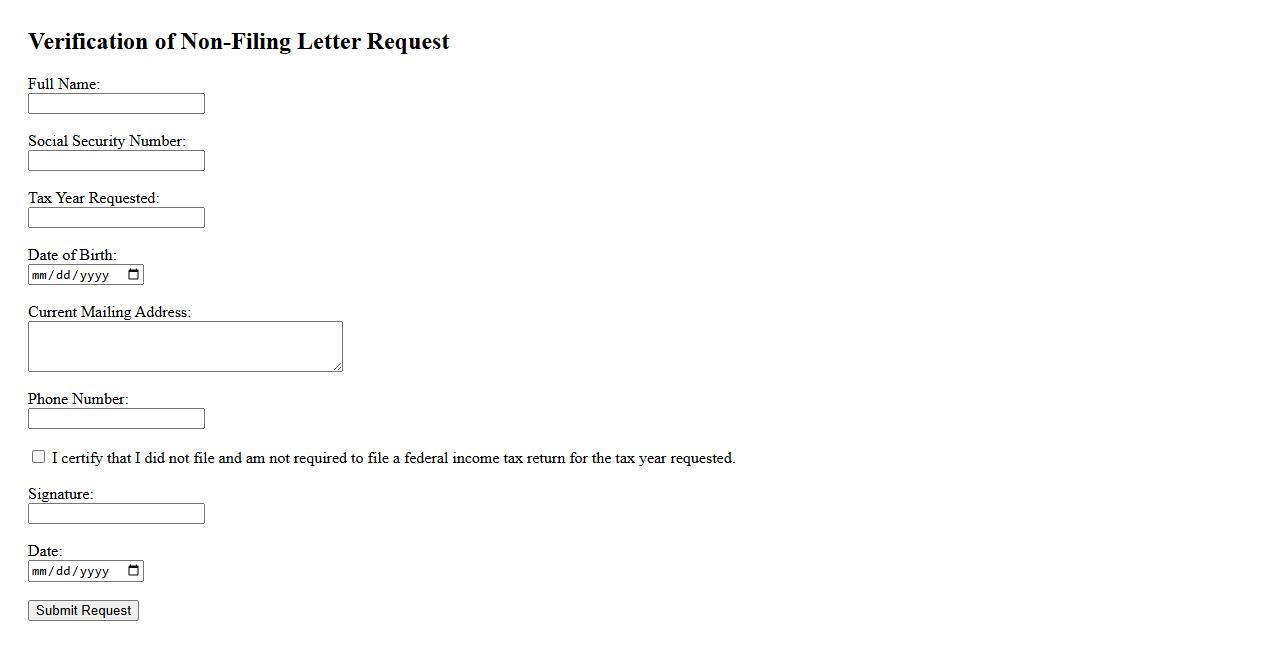

Verification of Non-Filing Letter Request

The Verification of Non-Filing Letter Request is a formal document used to confirm that an individual or entity has not filed a tax return for a specific year. This letter is often required by financial institutions or government agencies to verify tax status. Obtaining this verification helps ensure compliance and supports various financial or legal processes.

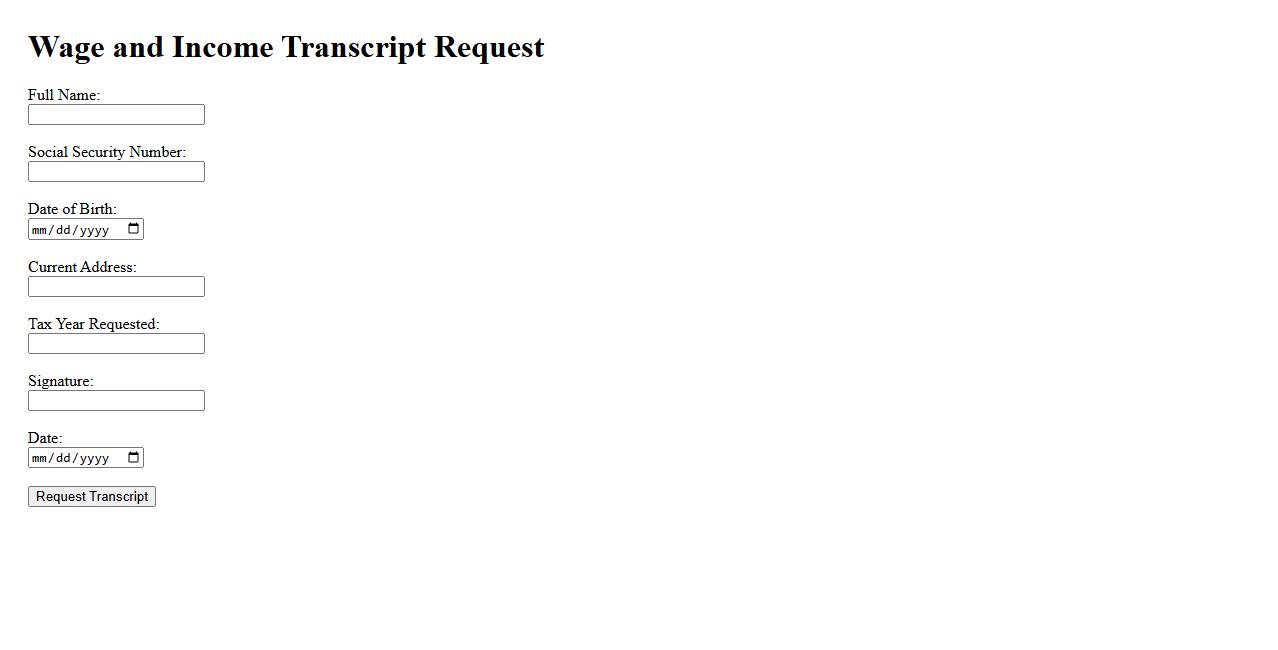

Wage and Income Transcript Request

To obtain a wage and income transcript, individuals can request a detailed record of their earnings and tax information from the IRS. This transcript provides important data used for tax filing and verification purposes. It is accessible online or by submitting a formal request to the tax authority.

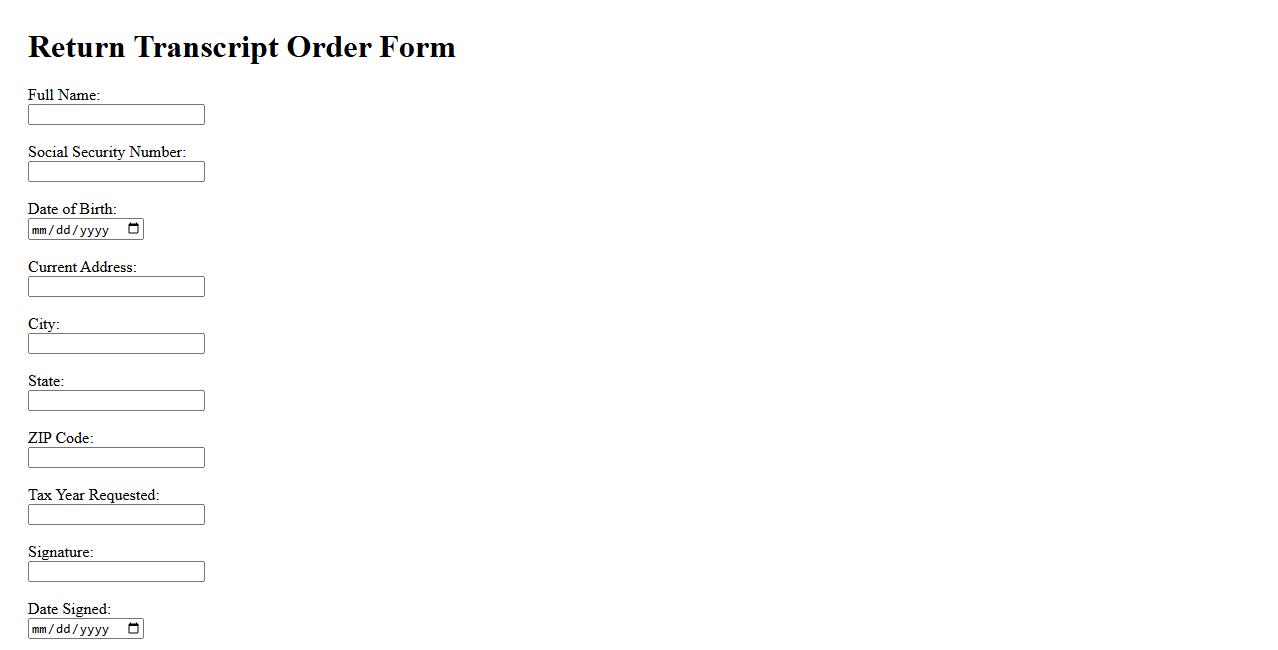

Return Transcript Order Form

The Return Transcript Order Form is a simple document used to request official copies of academic transcripts. It ensures the proper processing and delivery of your records from educational institutions. Completing this form accurately helps facilitate timely receipt of your transcripts.

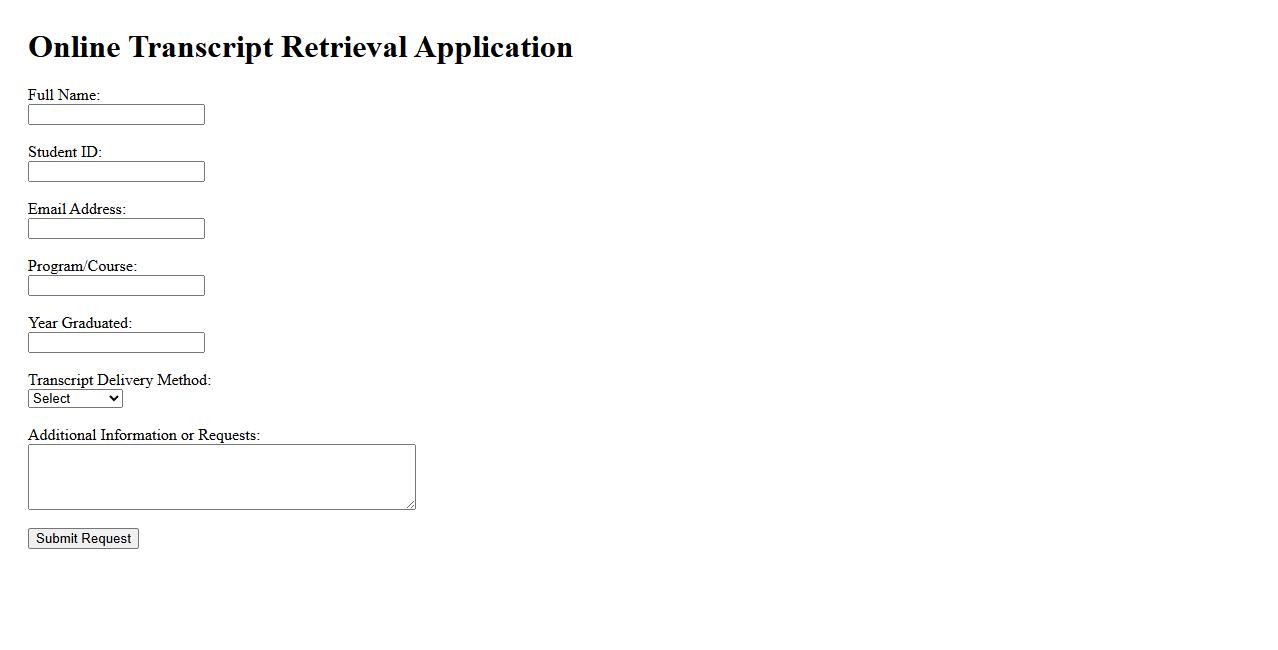

Online Transcript Retrieval Application

The Online Transcript Retrieval Application provides a secure and efficient way for students to request and receive their academic transcripts digitally. This streamlined process eliminates the need for physical visits, saving both time and resources. Users can easily track their transcript requests and access them anytime, enhancing convenience and accessibility.

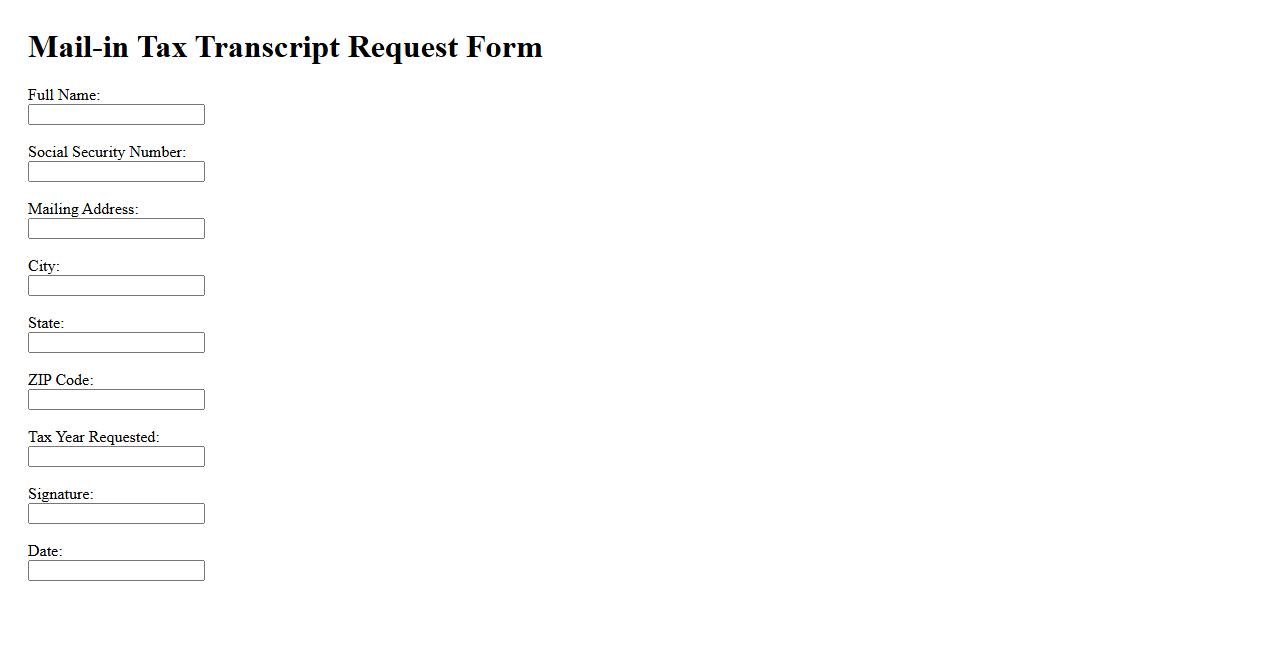

Mail-in Tax Transcript Request Form

The Mail-in Tax Transcript Request Form allows taxpayers to obtain their tax transcripts directly from the IRS by mailing a completed request. This form simplifies access to important tax records without needing to visit an IRS office. It is essential for verifying income information and supporting tax filings or loan applications.

What specific tax years are covered in your Request for Transcript of Tax Return?

The tax years covered in the Request for Transcript of Tax Return must be clearly stated to ensure accurate documentation. Typically, you can request transcripts for the previous 3 to 10 years depending on the IRS system. Specifying the correct years helps avoid delays and ensures you receive the relevant tax information.

Which type of transcript (Tax Return Transcript, Account Transcript, Record of Account, etc.) are you requesting?

Choosing the correct type of transcript is essential based on your needs. A Tax Return Transcript shows the original tax return details, while an Account Transcript reflects changes made after processing. Selecting the appropriate transcript type ensures you obtain the precise data required.

For what purpose or institution (e.g., college, mortgage, personal use) are you requesting the transcript?

Identify the purpose or institution for your transcript request to meet specific guidelines. Transcript requirements vary between colleges, mortgage lenders, and personal use scenarios. Providing this information expedites processing and ensures compliance with the intended use.

What is the designated delivery method or recipient for your transcript request?

The delivery method or recipient of the transcript is a critical factor in the request process. Options include electronic delivery, mail, or direct submission to an institution. Clarifying how and where the transcript should be sent guarantees timely and secure receipt.

Are you listed as the taxpayer, spouse, or authorized third party on the tax transcript request form?

Confirming if you are the taxpayer, spouse, or an authorized third party is necessary for proper access authorization. Only those listed on the form or with appropriate permissions can legally request a transcript. This ensures compliance with privacy laws and IRS regulations.