The Request for Taxpayer Identification Number and Certification is a crucial IRS form used to collect an individual's or entity's taxpayer identification number (TIN). This form helps verify the identity of taxpayers and ensures proper reporting of income to the IRS. Accurate completion prevents withholding errors and facilitates compliance with tax regulations.

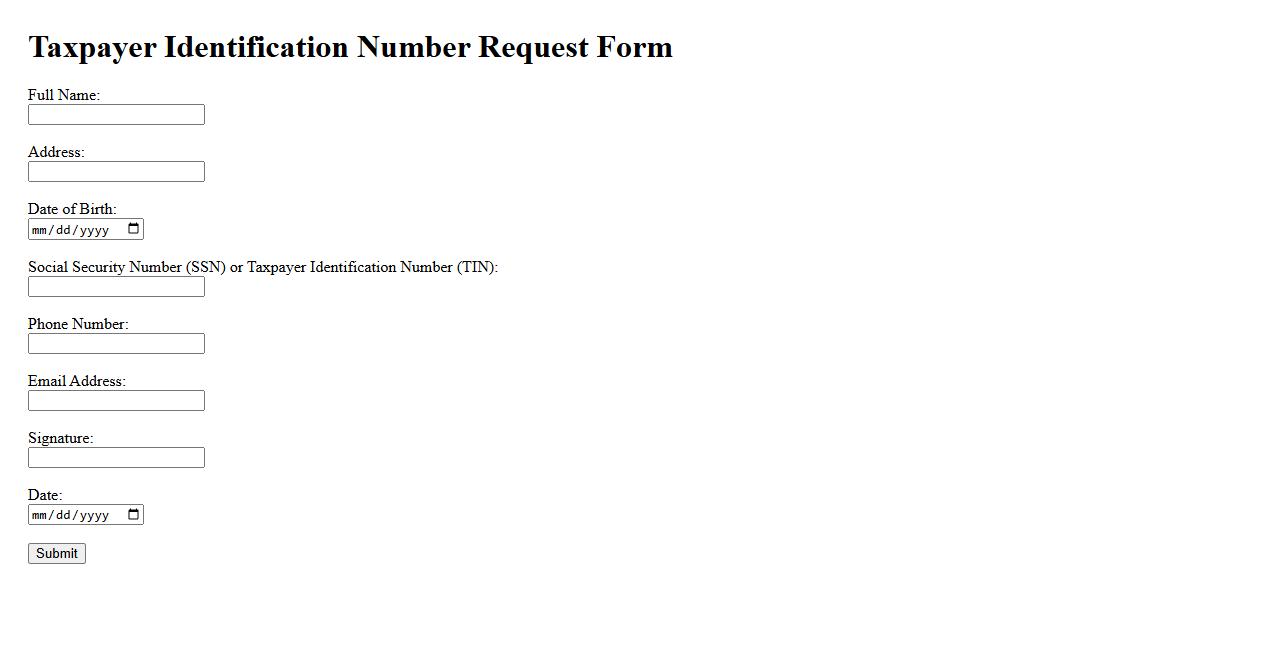

Taxpayer Identification Number Request Form

The Taxpayer Identification Number Request Form is used to apply for a unique identifier assigned by the government for tax purposes. This form helps individuals and businesses report income and fulfill tax obligations accurately. Completing this form is essential for proper tax filing and compliance.

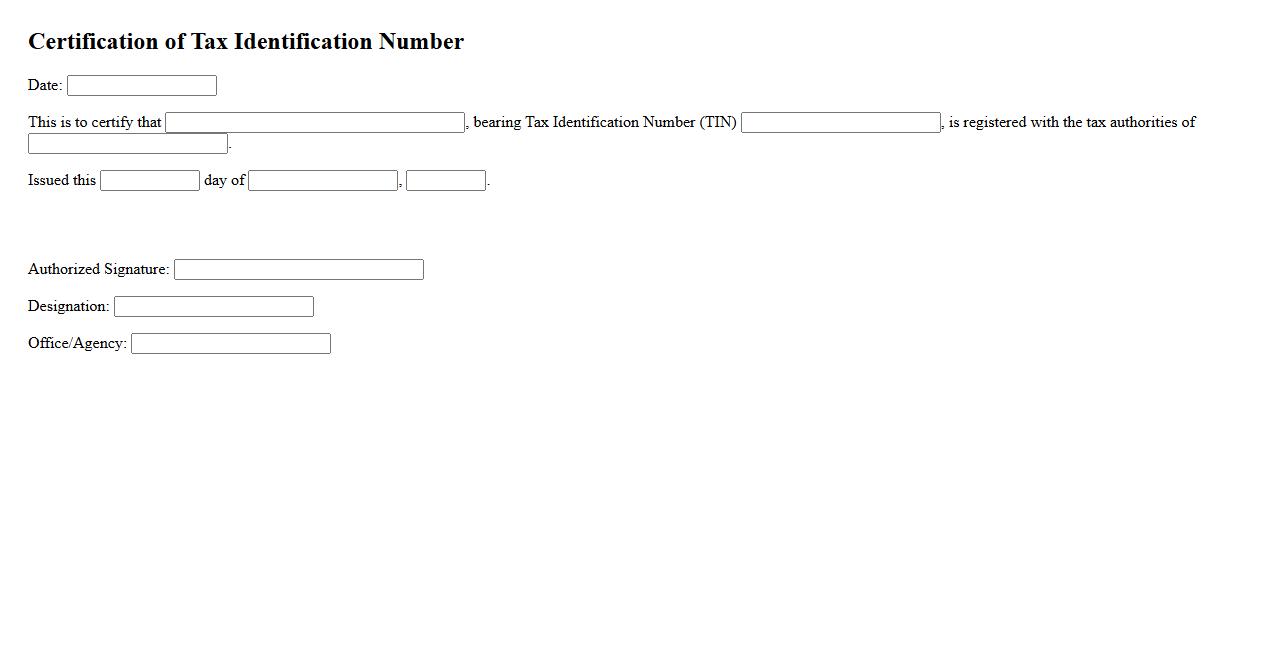

Certification of Tax Identification Number

The Certification of Tax Identification Number is an official document issued by the tax authority to verify an individual's or business's unique tax identification number. This certification is essential for tax compliance and is often required for various financial and legal transactions. It ensures accurate identification and streamlines the tax reporting process.

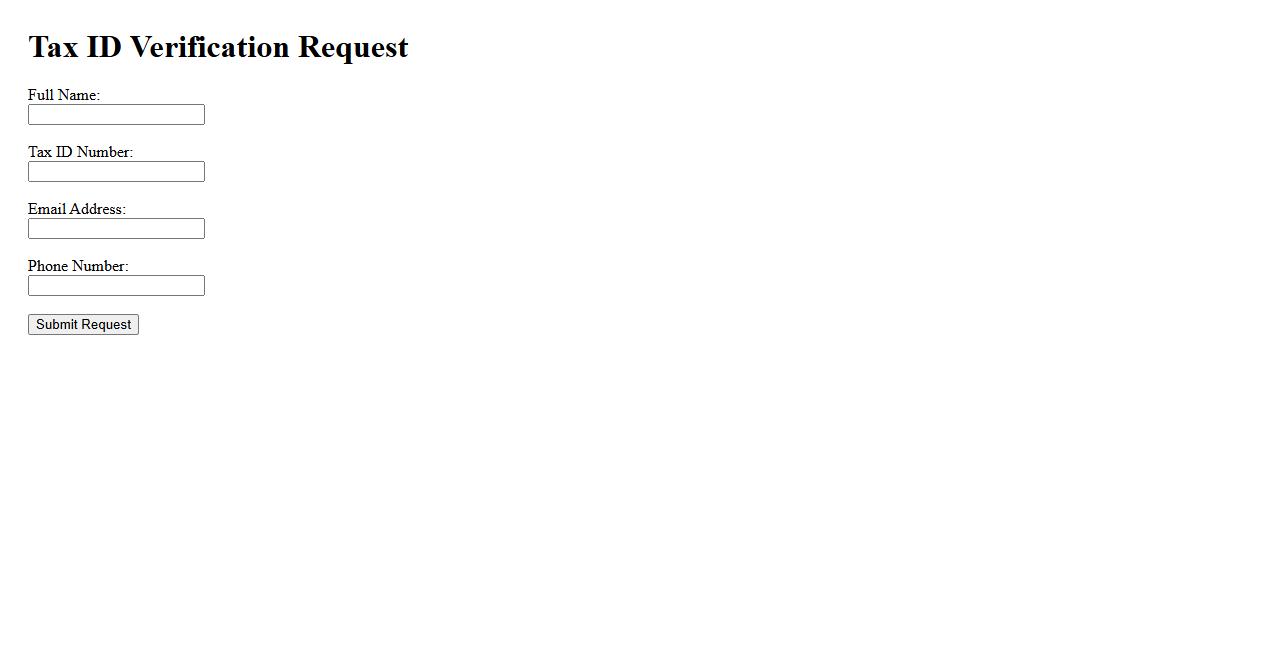

Tax ID Verification Request

Submitting a Tax ID Verification Request is essential to confirm the authenticity of a taxpayer's identification number. This process helps prevent fraud and ensures compliance with tax regulations. Accurate verification supports seamless financial and legal transactions.

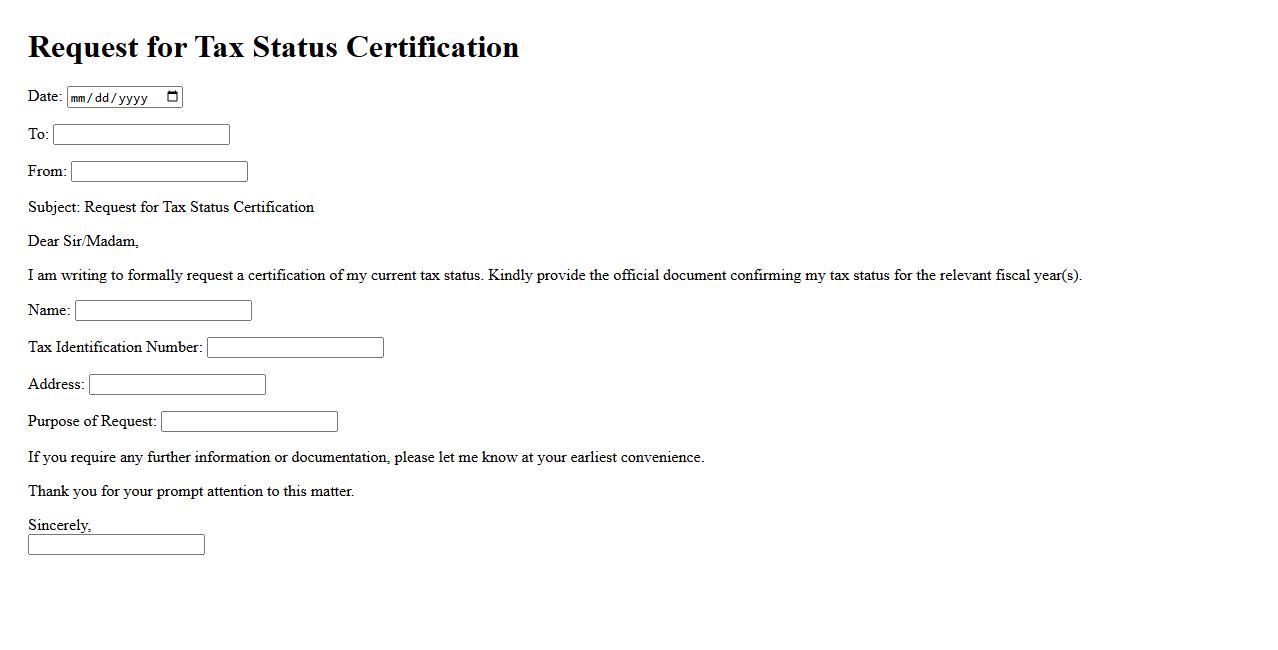

Request for Tax Status Certification

A Request for Tax Status Certification is a formal document used to verify an individual or organization's tax standing with relevant authorities. This certification confirms whether all tax obligations have been met or if there are any outstanding liabilities. It is often required for legal, financial, or business transactions to ensure compliance.

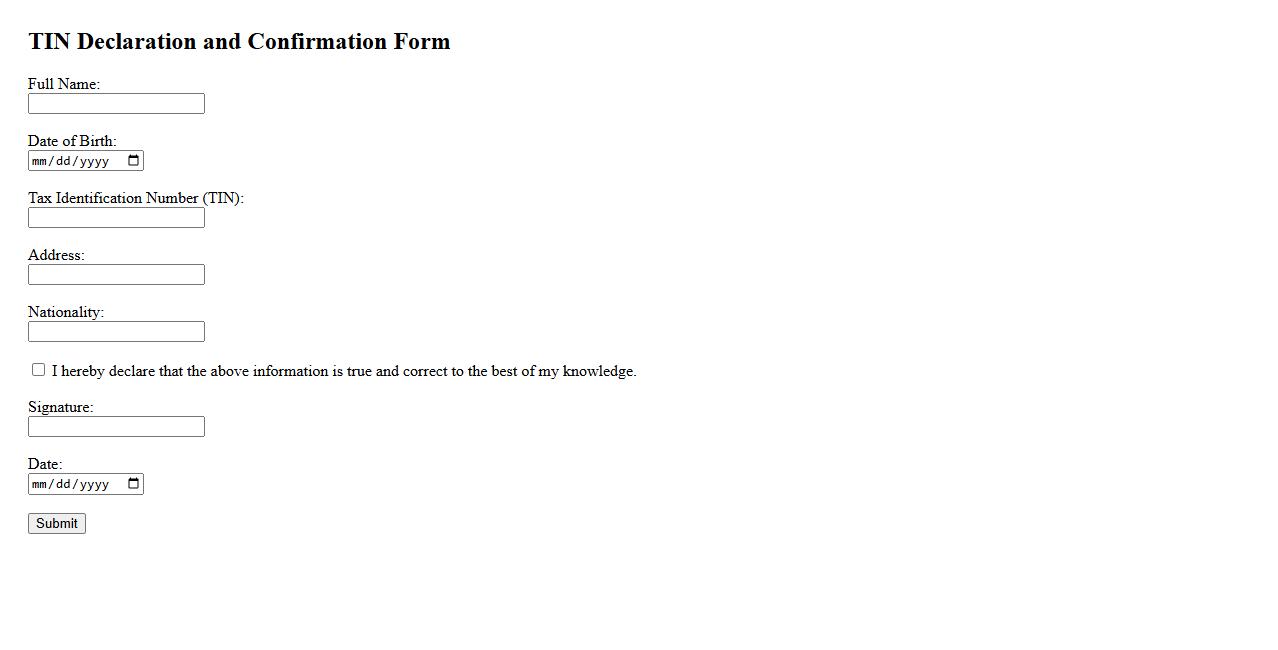

TIN Declaration and Confirmation Form

The TIN Declaration and Confirmation Form is a crucial document used to verify an individual's or entity's Tax Identification Number (TIN). It ensures accurate tax reporting and compliance with government regulations. Completing this form helps prevent errors and facilitates smooth processing of tax-related transactions.

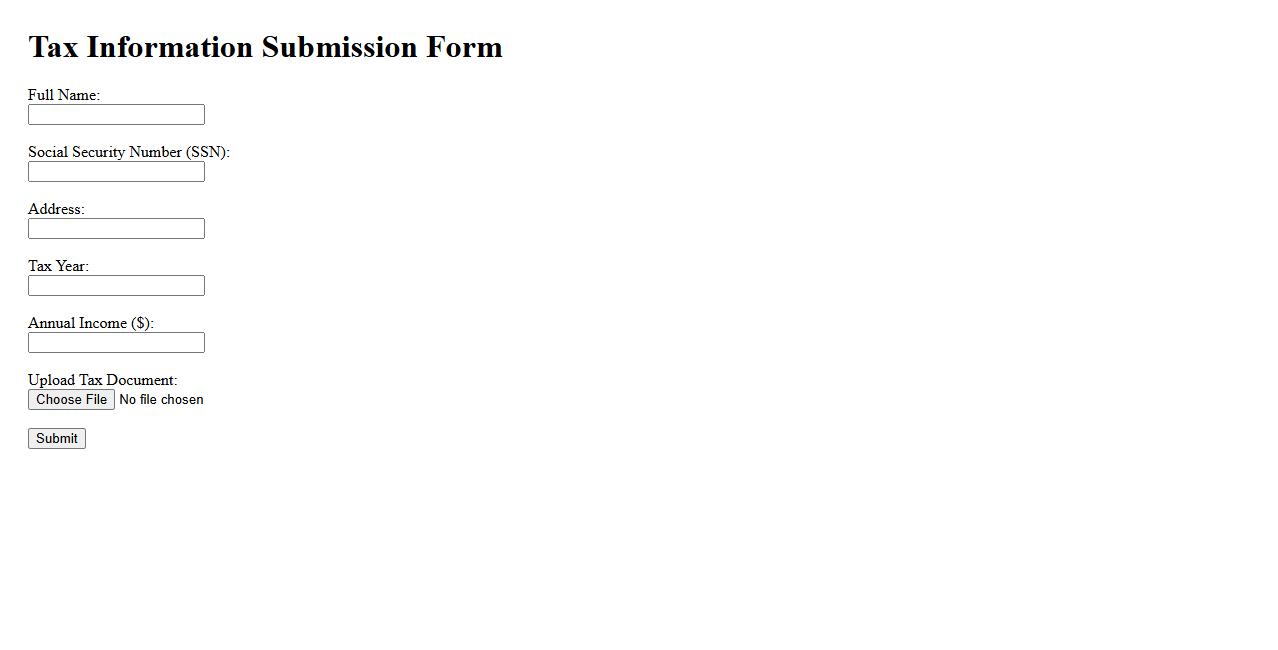

Tax Information Submission Form

The Tax Information Submission Form is essential for accurately reporting your tax details to relevant authorities. It ensures compliance with tax regulations by collecting necessary financial data. Timely and correct submission helps avoid penalties and supports efficient tax processing.

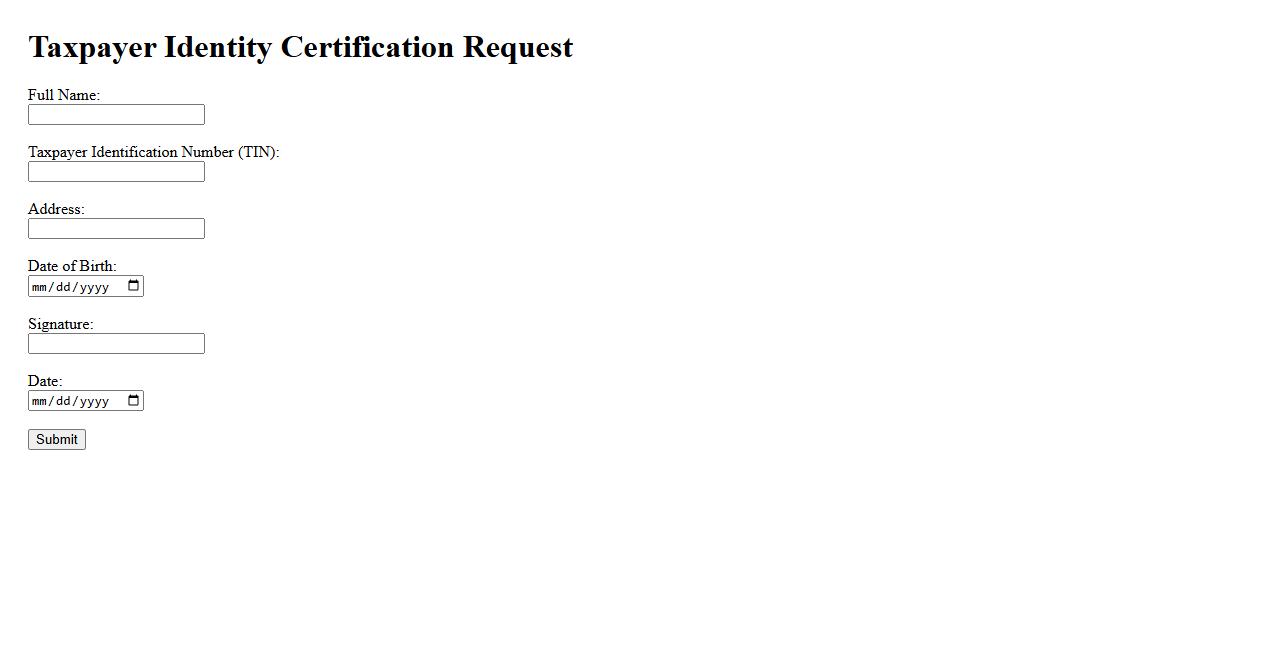

Taxpayer Identity Certification Request

The Taxpayer Identity Certification Request is a formal process used to verify an individual's or entity's tax identification information. This certification ensures accurate and secure handling of tax-related data by authorized agencies. It is essential for compliance with governmental tax regulations and record accuracy.

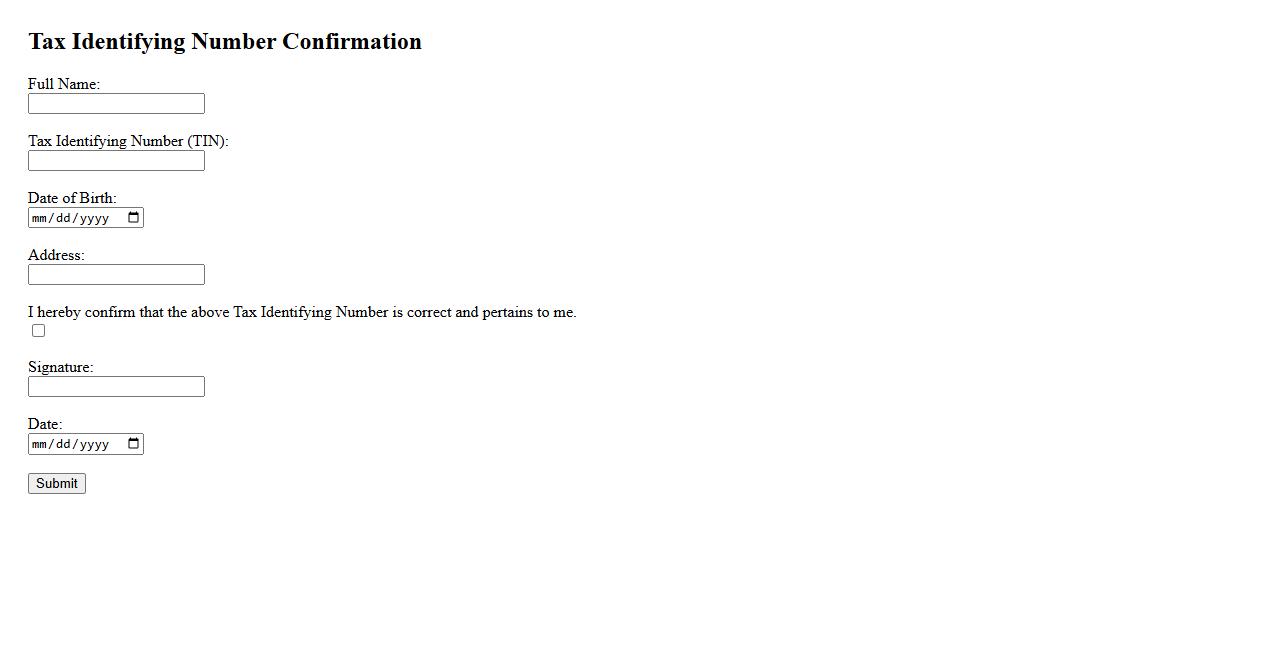

Tax Identifying Number Confirmation

The Tax Identifying Number Confirmation is a crucial process used to verify the accuracy of your tax identification details. This confirmation ensures that all tax records are correctly linked to the individual or business entity. Accurate verification helps prevent errors and potential issues with tax filing and reporting.

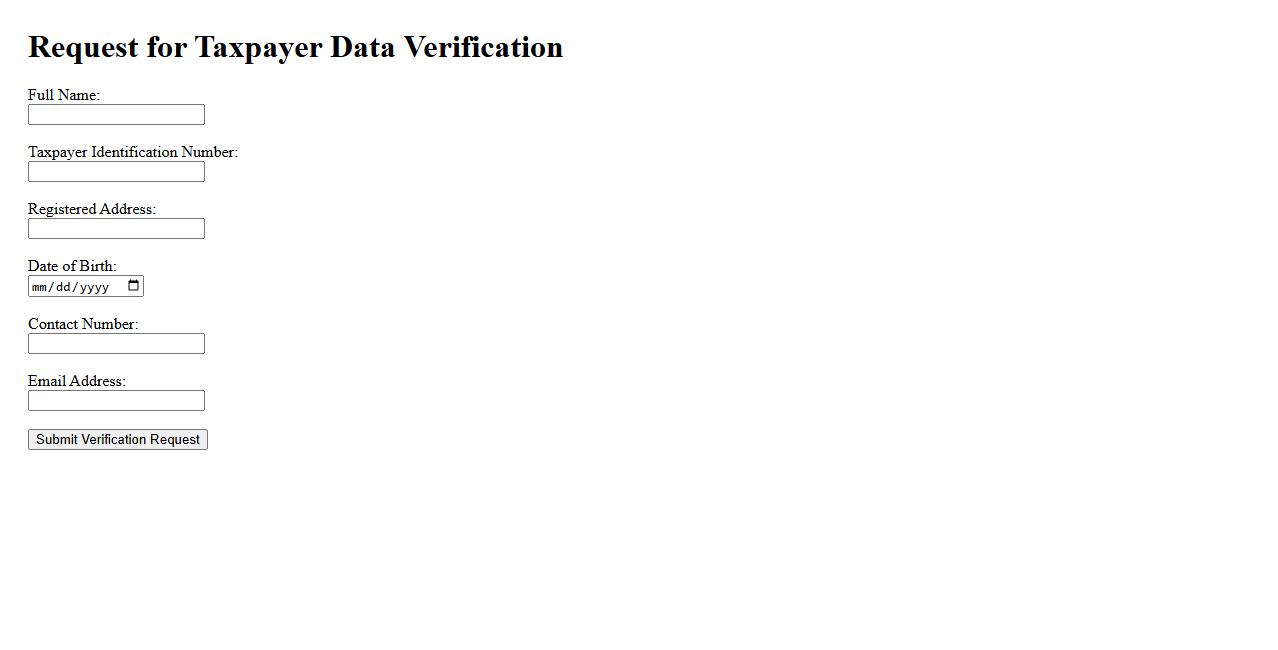

Request for Taxpayer Data Verification

Request for Taxpayer Data Verification ensures the accuracy and integrity of taxpayer information held by authorities. This process involves confirming personal and financial details to maintain compliance with tax regulations. Prompt verification helps prevent errors and potential fraud in tax records.

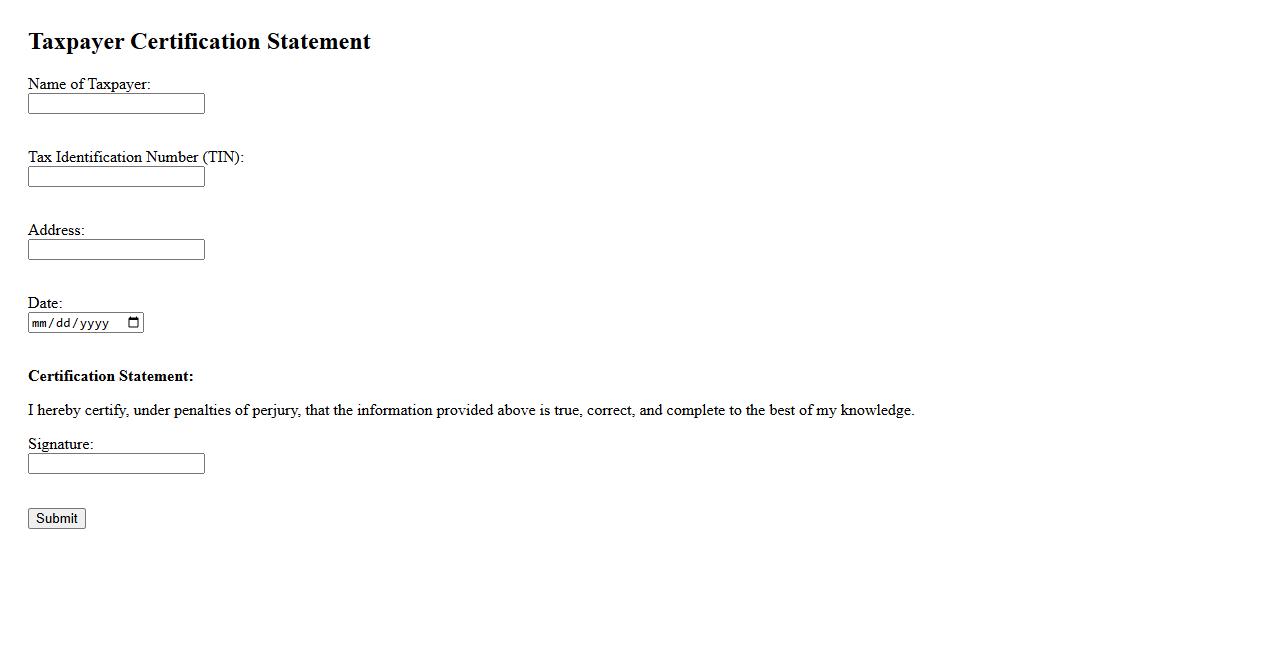

Taxpayer Certification Statement

The Taxpayer Certification Statement is a formal declaration used to verify the accuracy of tax-related information provided by an individual or entity. It ensures compliance with tax laws and prevents fraudulent claims. This statement is essential for maintaining transparency and accountability in tax reporting.

What is the primary purpose of a Request for Taxpayer Identification Number and Certification form?

The primary purpose of the Request for Taxpayer Identification Number and Certification form is to collect accurate taxpayer identification information from individuals or entities. This form facilitates the proper reporting of income to the Internal Revenue Service (IRS). Ensuring correct taxpayer data helps in tax compliance and prevents misreporting.

Which types of taxpayer identification numbers are acceptable on this document?

The acceptable types of taxpayer identification numbers (TINs) on this form include the Social Security Number (SSN), Employer Identification Number (EIN), and Individual Taxpayer Identification Number (ITIN). Each identification number corresponds to the taxpayer's specific status or entity type. Providing the correct TIN is essential for accurate tax reporting and verification.

Why is certification of the information provided on the form required?

Certification of the information ensures that the taxpayer confirms the authenticity and accuracy of the details submitted. This step helps maintain the integrity of tax documentation and prevents fraudulent data submission. The certification acts as a legal confirmation binding the taxpayer to their declarations.

What penalties may result from providing false information on the Request for Taxpayer Identification Number and Certification?

Providing false information can lead to significant penalties and legal consequences imposed by the IRS. These may include fines and potential criminal charges for tax fraud or false statements. Accurate and truthful reporting is mandatory to avoid such severe repercussions.

Who is generally required to complete and submit this document to a payor?

Individuals or entities who receive income reportable to the IRS are typically required to complete and submit this form to the payor. This includes contractors, vendors, and certain employees. The form enables the payor to report payments correctly and comply with tax regulations.