A Request for Verification of Non-filing is a formal document used to confirm that an individual did not file a tax return for a specific year. This verification is often required by financial institutions or government agencies to confirm the taxpayer's status. Obtaining this verification helps ensure compliance with tax regulations and supports applications for loans, scholarships, or other financial assistance.

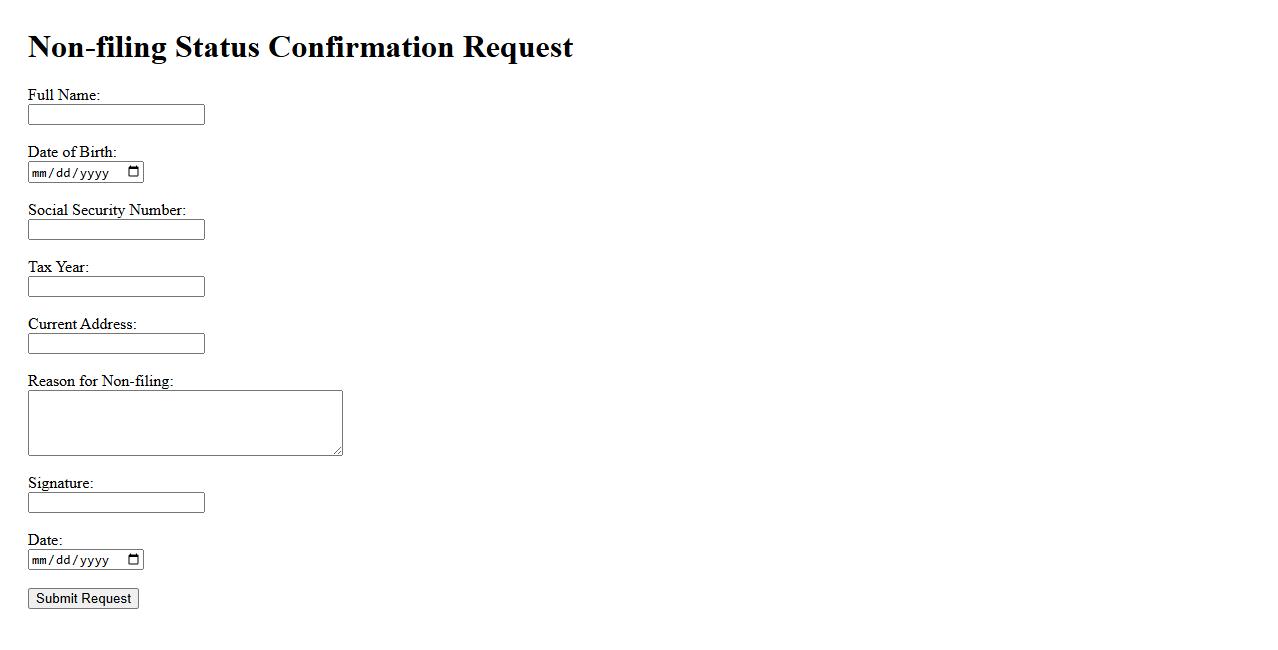

Non-filing Status Confirmation Request

A Non-filing Status Confirmation Request is a formal document used to confirm that an individual has not filed a tax return for a specific year. This request is often required for educational, financial aid, or legal purposes to verify non-filing status. It serves as official proof that no tax return was submitted to the tax authorities during the requested period.

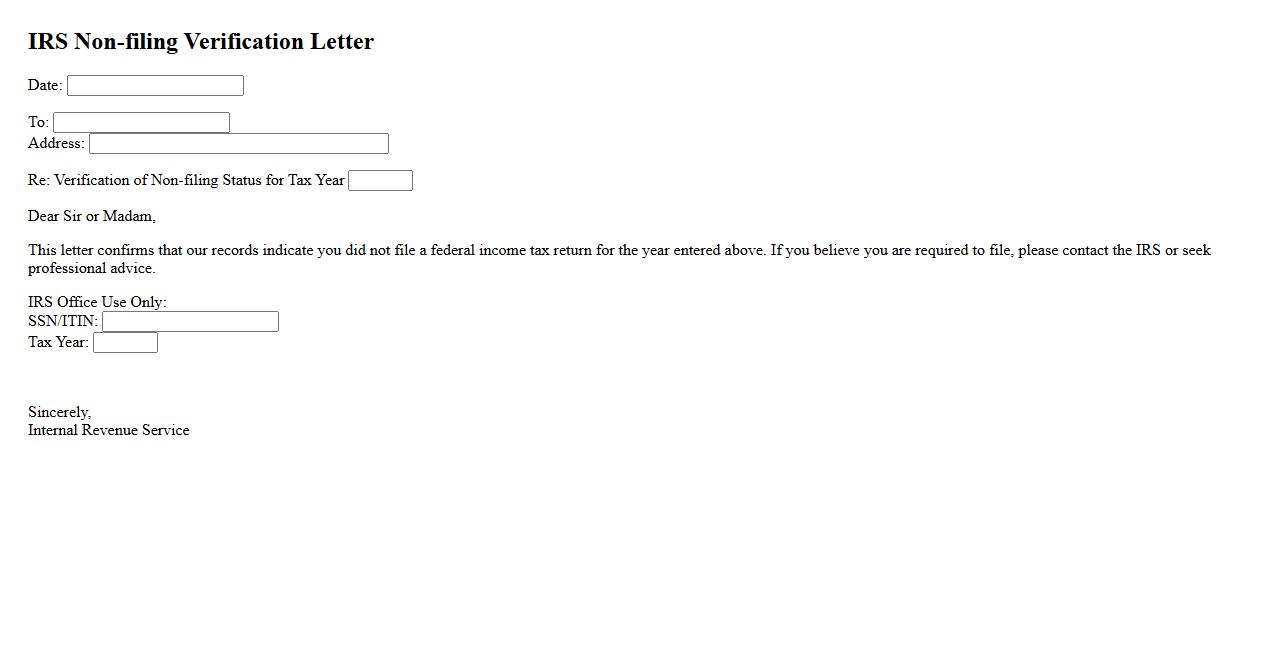

IRS Non-filing Verification Letter

An IRS Non-filing Verification Letter is an official document from the IRS confirming that a taxpayer did not file a tax return for a specific year. This letter is often required for financial aid applications, loan approvals, or other legal purposes. Obtaining it ensures compliance with IRS regulations and provides proof of non-filing status.

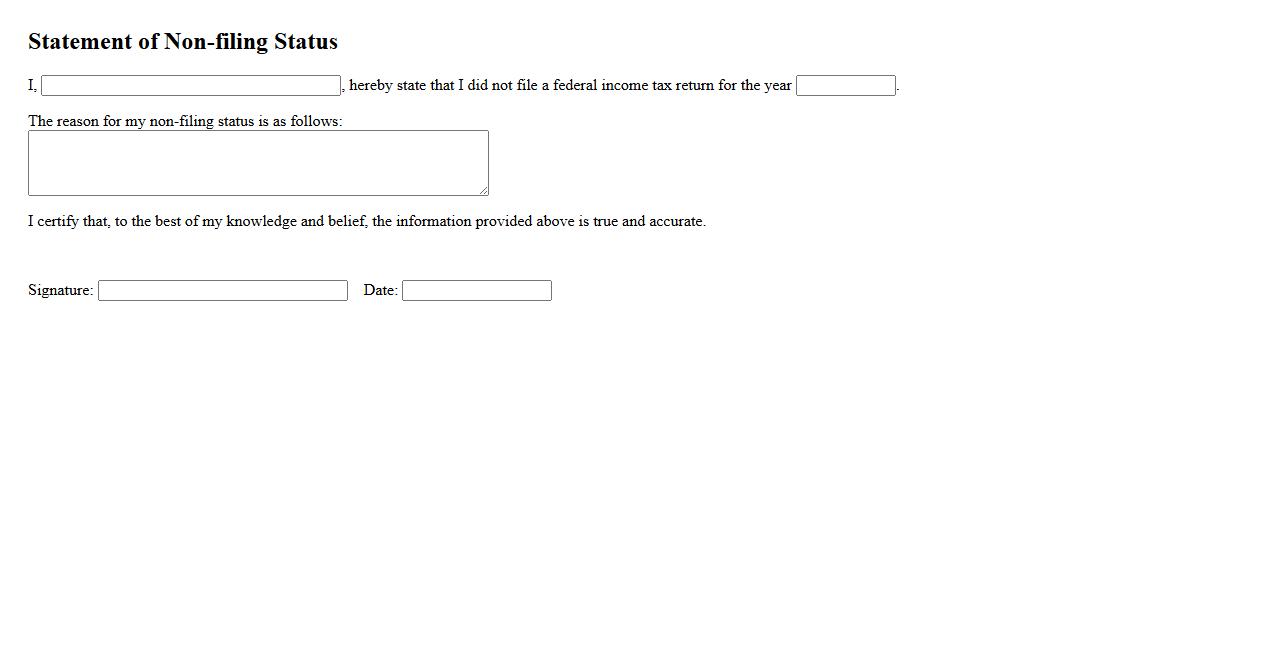

Statement of Non-filing Status

A Statement of Non-filing Status is an official document issued by tax authorities confirming that an individual or entity did not file a tax return for a specific year. This statement is often required for financial aid applications or loan processing when proof of non-filing is necessary. It ensures transparency and verification of tax compliance history.

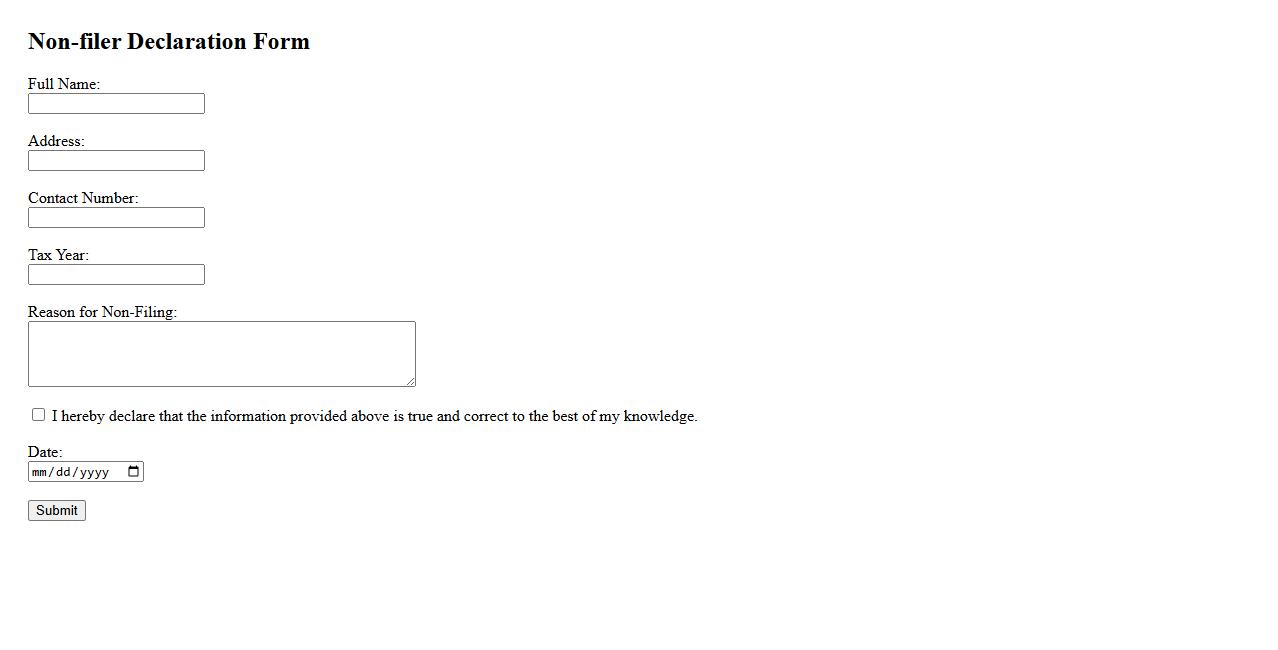

Non-filer Declaration Form

The Non-filer Declaration Form is a crucial document for individuals who have not filed tax returns for a specific period. It serves as an official declaration stating their income status and reasons for not filing. This form helps in maintaining transparency with tax authorities and ensuring compliance with legal requirements.

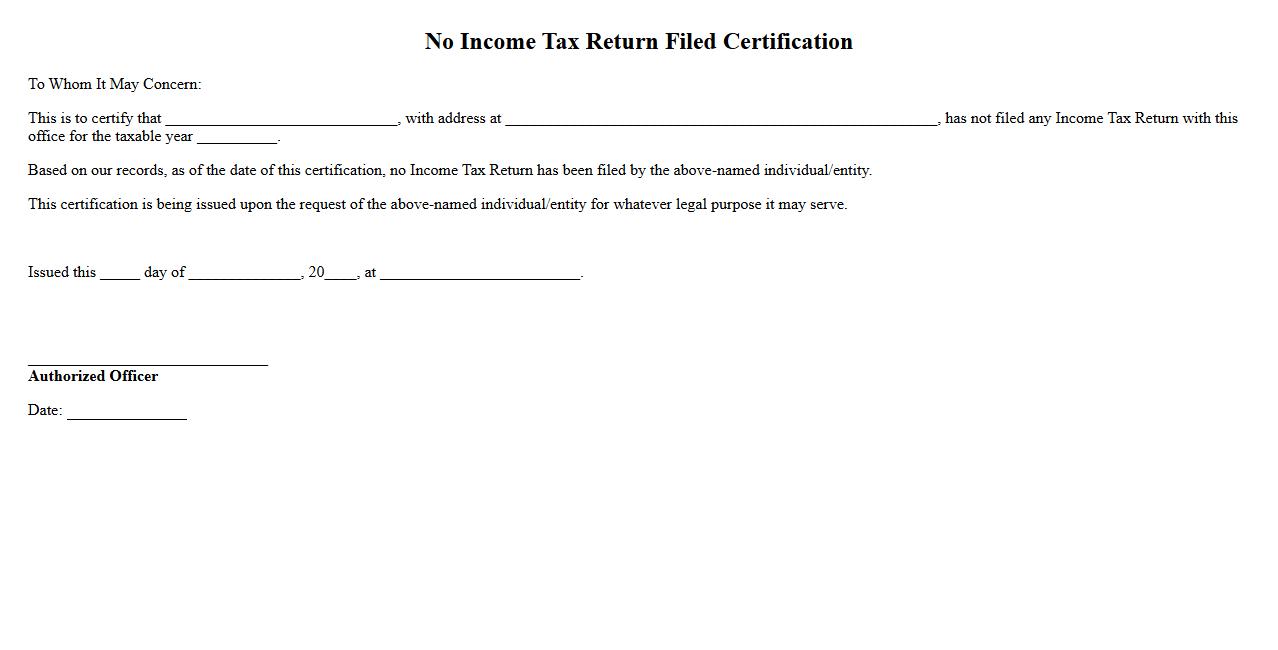

No Income Tax Return Filed Certification

The No Income Tax Return Filed Certification is an official document that verifies an individual has not submitted an income tax return for a specific period. This certification is often required for government schemes, loan applications, or legal procedures where proof of non-filing is necessary. It serves as authoritative evidence that no taxable income was declared during the mentioned timeframe.

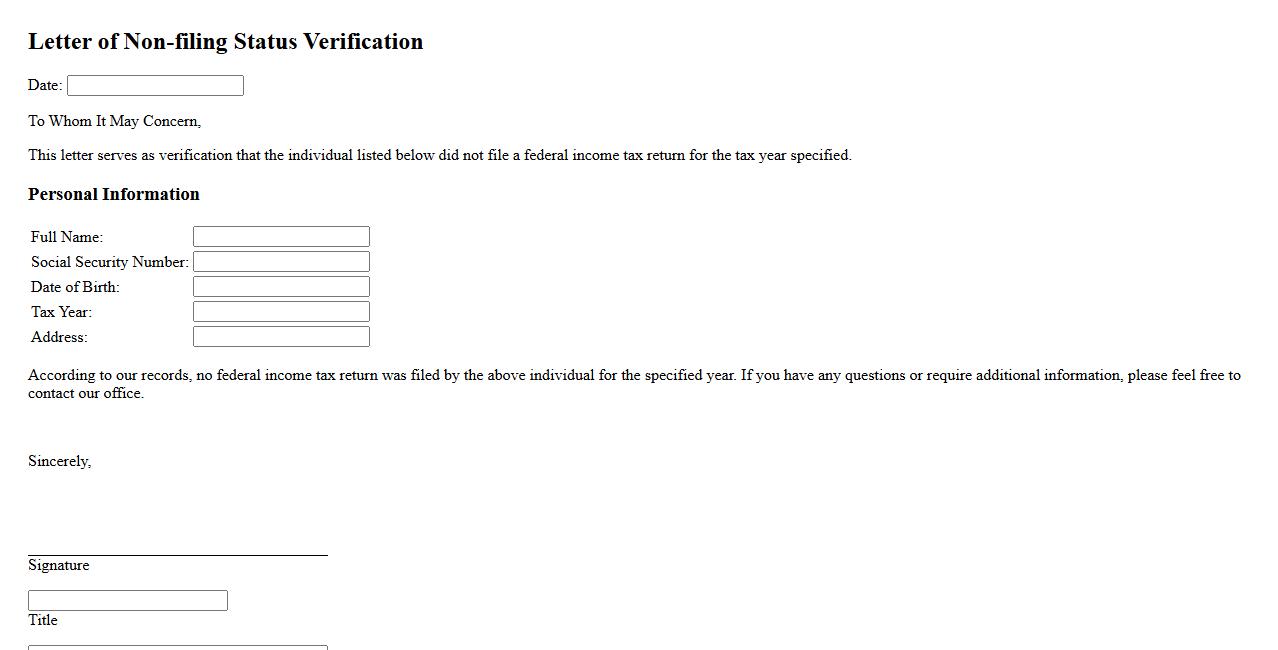

Letter of Non-filing Status Verification

The Letter of Non-filing Status Verification is an official document issued by the tax authorities confirming that an individual did not file a tax return for a specific year. This letter is often required for financial aid applications, loan approvals, or government benefit programs to verify income status. It provides assurance that no tax return was filed, ensuring compliance with necessary eligibility criteria.

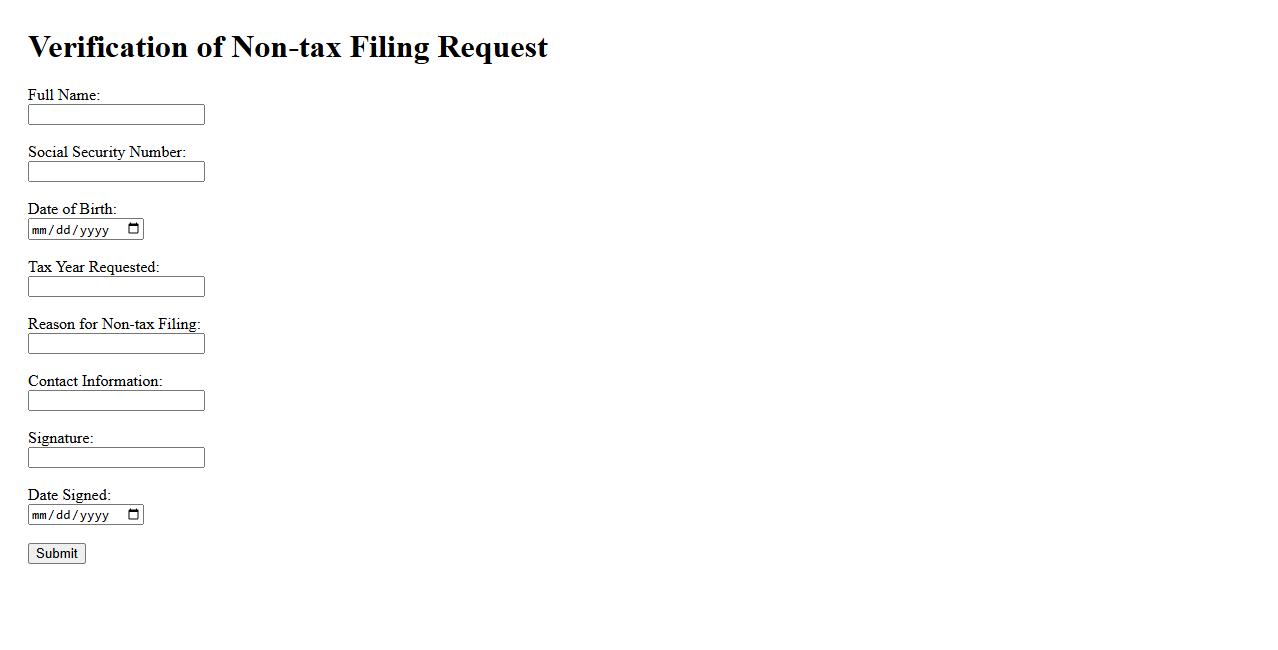

Verification of Non-tax Filing Request

The Verification of Non-tax Filing Request is a process used to confirm that an individual or entity has not filed a tax return for a specific period. This verification is often required for loan applications, financial aid, or other official purposes. It ensures accuracy and compliance with tax regulations.

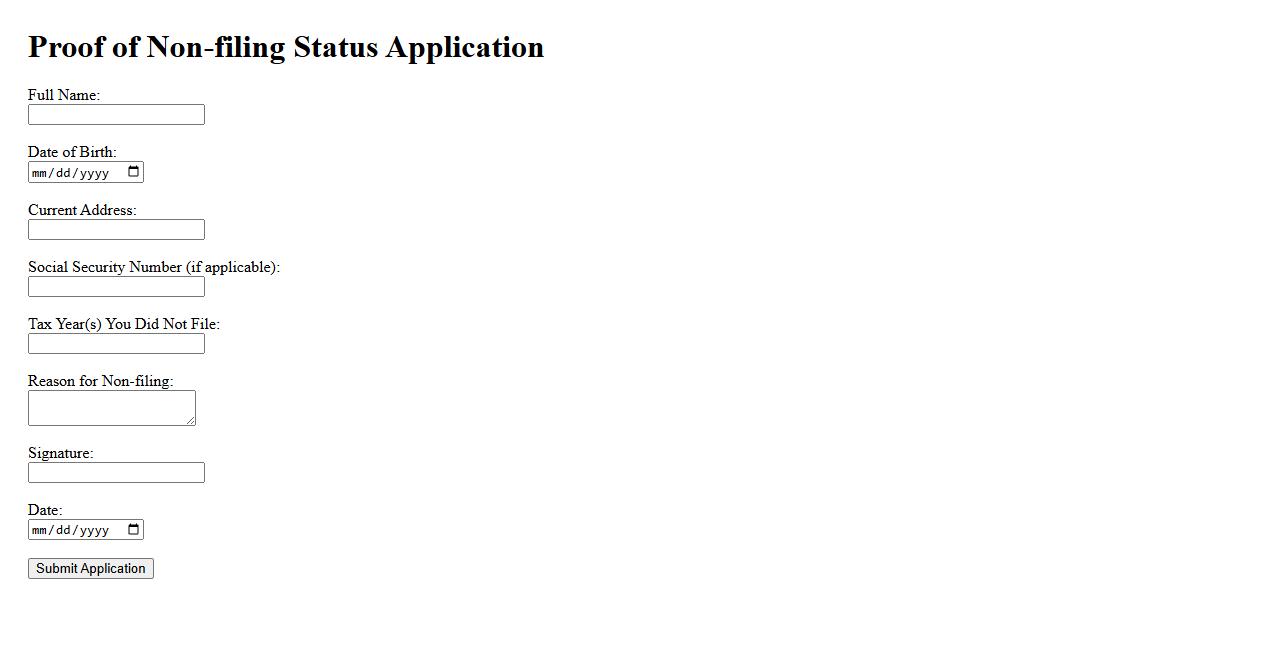

Proof of Non-filing Status Application

The Proof of Non-filing Status Application is an official document issued by tax authorities to confirm that an individual did not file a tax return for a specific year. This proof is often required for financial aid, loan applications, or verification purposes. Obtaining this certification ensures clarity in financial and legal matters.

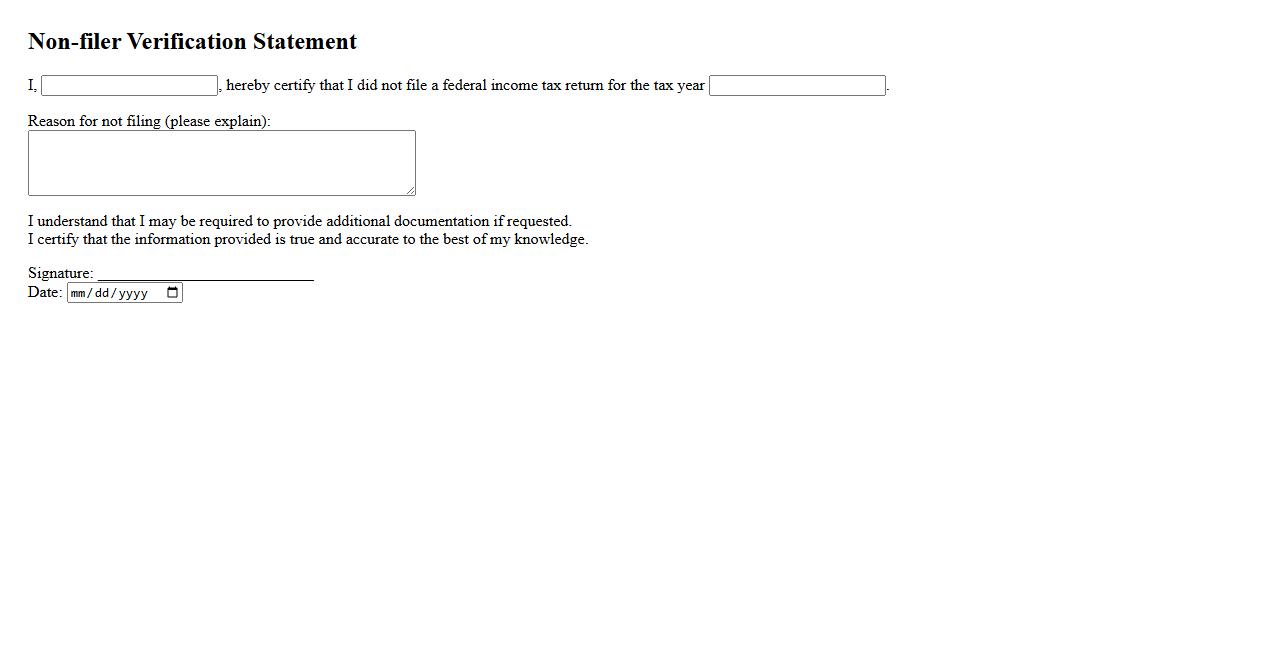

Non-filer Verification Statement

The Non-filer Verification Statement is a document used to confirm that an individual did not file a tax return for a specific year. It provides essential proof of non-filing status required for various financial or legal processes. This statement is often requested by lenders or government agencies to verify income or eligibility.

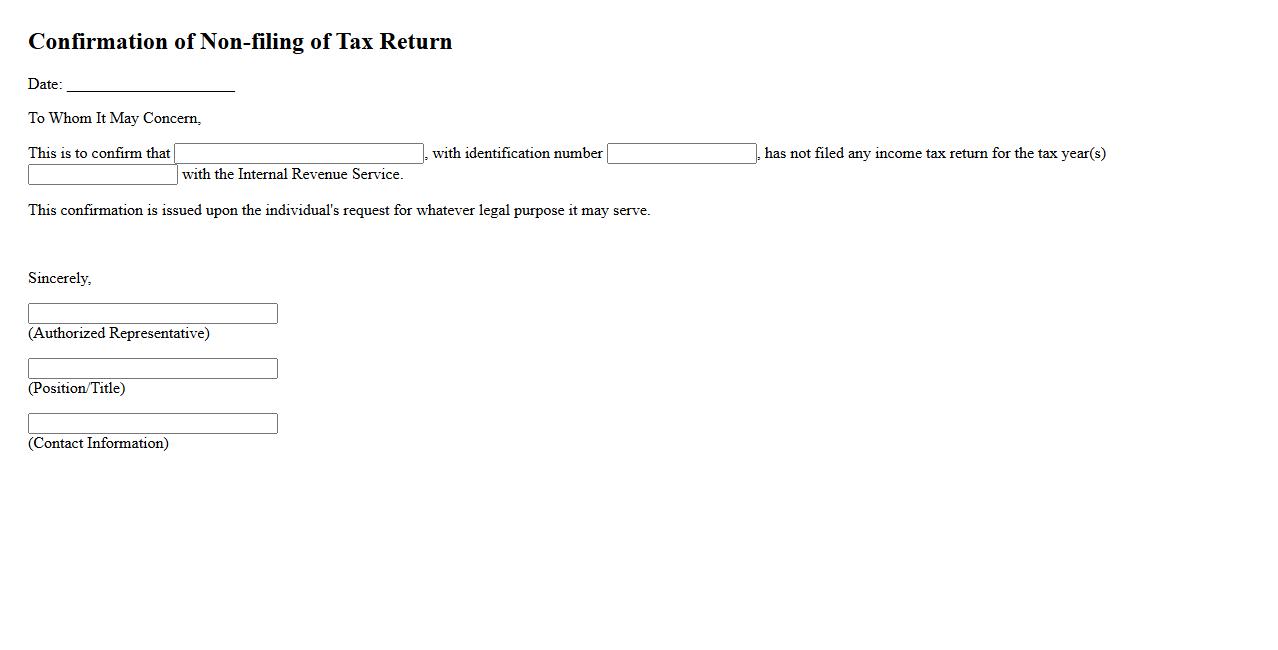

Confirmation of Non-filing of Tax Return

The confirmation of non-filing of tax return is an official document issued by tax authorities to verify that an individual or entity has not submitted a tax return for a specific period. This confirmation is often required for loan applications, visa processing, or financial assessments. It serves as proof that there is no tax filing record during the stated timeframe.

What is the primary purpose of a Request for Verification of Non-filing document?

The primary purpose of a Request for Verification of Non-filing document is to confirm that an individual did not file a federal income tax return for a specific tax year. This verification is crucial when proof is needed that no tax return was submitted to the IRS. It serves as official evidence for various financial and legal processes.

Which individuals or entities typically need to submit a Verification of Non-filing?

Typically, individuals who did not file taxes because their income was below the filing threshold must submit this verification. It is also required by financial institutions, government agencies, and educational organizations. These entities need assurance that no tax return exists for the individual in question.

What information must be provided on a Request for Verification of Non-filing?

A Request for Verification of Non-filing must include personal identification details such as the individual's name, Social Security number, and the tax year(s) in question. The requester must complete IRS Form 4506-T and specify the need for proof of non-filing. Accurate information ensures timely and correct processing by the IRS.

How does the Verification of Non-filing differ from a standard tax return transcript?

The Verification of Non-filing confirms that a tax return was not filed, while a standard tax return transcript provides a summary of a filed tax return. The transcript includes financial details reported to the IRS, whereas the non-filing verification serves to show the absence of such details. Each document serves different verification needs for official purposes.

In what situations is a Verification of Non-filing required for financial aid or loan applications?

A Verification of Non-filing is required when applicants or their parents did not file a tax return but need to prove this status for financial aid or loan eligibility. It is often requested by schools, lenders, and government programs to verify income non-reporting. This document helps ensure that applicants meet the criteria for assistance or loan approval without tax records.