A request for extension of time to file tax return allows taxpayers to formally seek extra time beyond the original deadline to submit their tax documents. This extension helps prevent late filing penalties while providing additional time to gather necessary financial information. Taxpayers must submit the request through the appropriate tax authority before the filing deadline to ensure approval.

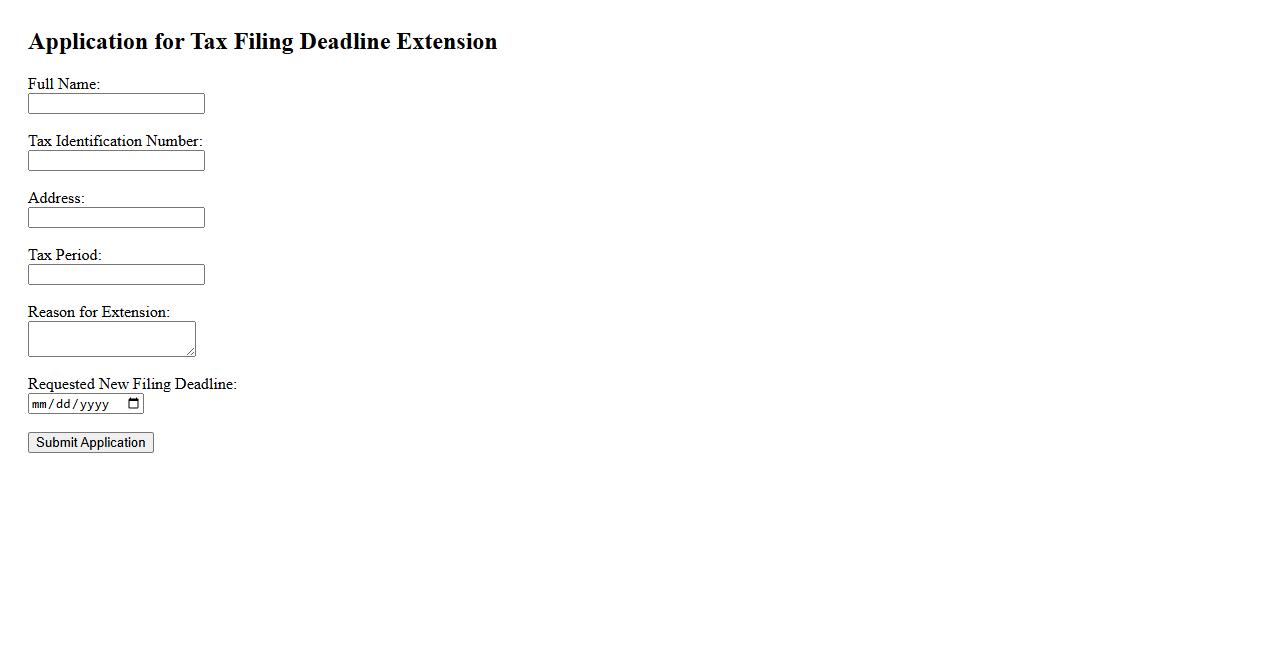

Application for Tax Filing Deadline Extension

An Application for Tax Filing Deadline Extension allows taxpayers to request additional time to file their tax returns. This helps avoid penalties and ensures accurate reporting when extra preparation time is needed. Filing an extension grants a temporary delay, but taxes owed must still be paid by the original deadline.

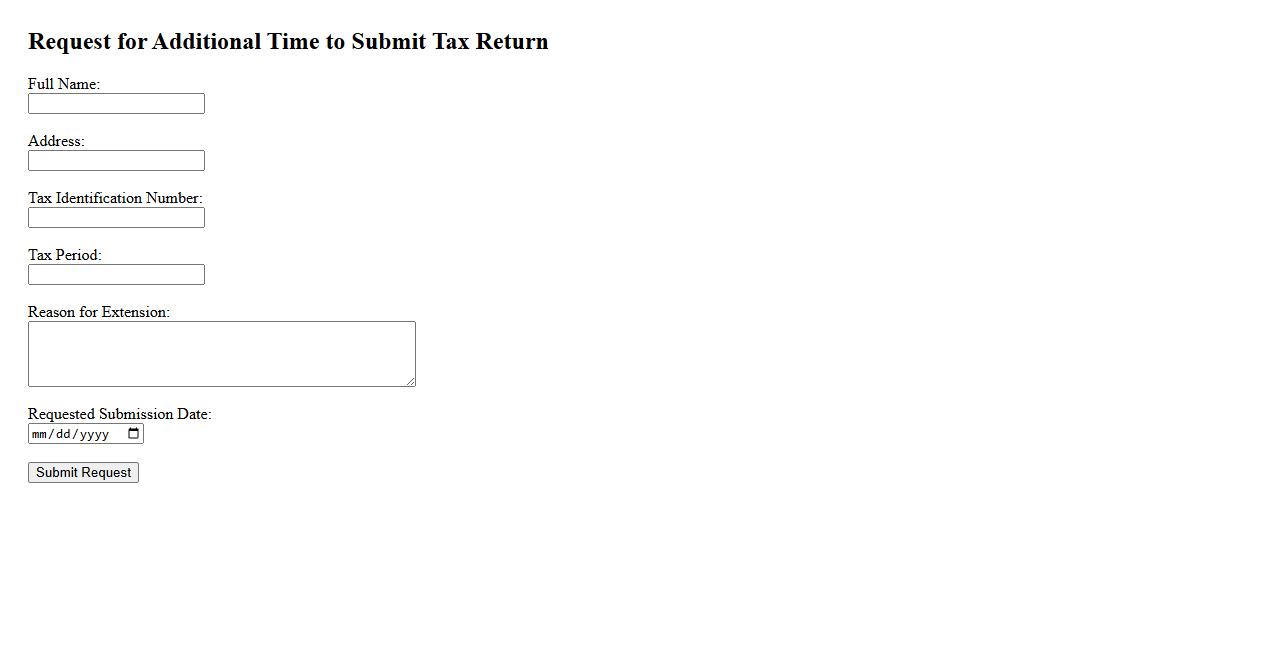

Request for Additional Time to Submit Tax Return

If you need more time to file your tax return, submitting a Request for Additional Time to Submit Tax Return is essential. This request allows taxpayers to avoid penalties by extending the deadline beyond the original due date. Be sure to file the extension before the initial deadline to ensure it is accepted.

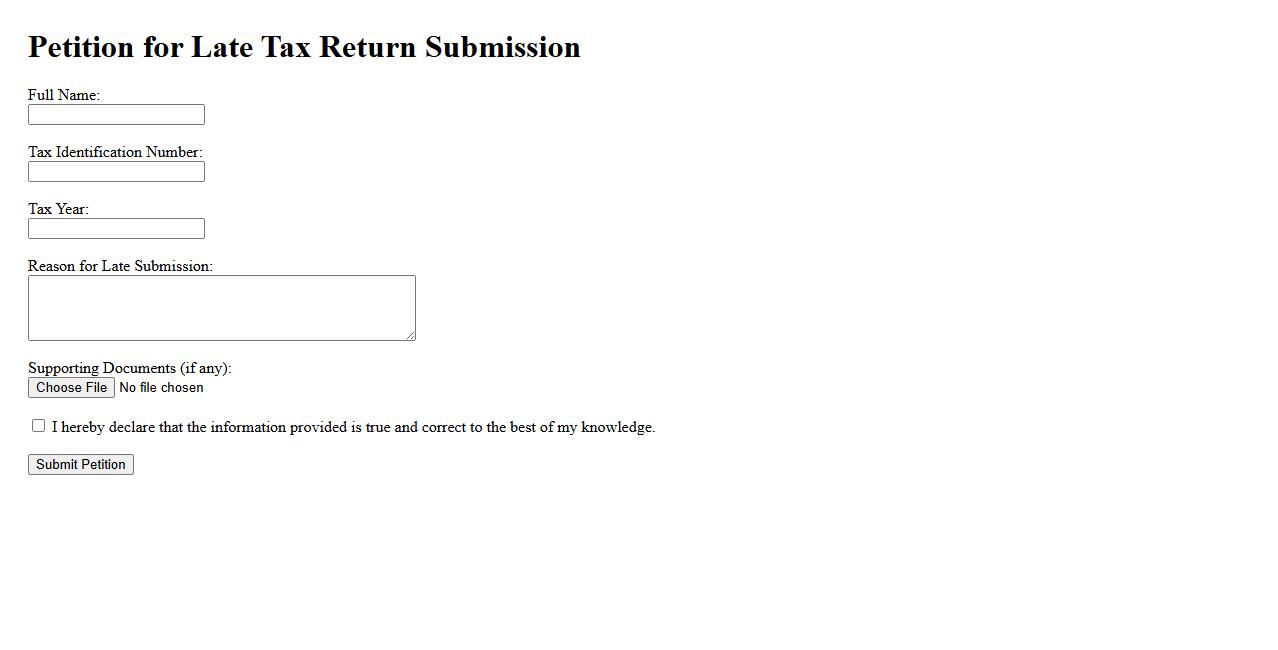

Petition for Late Tax Return Submission

A petition for late tax return submission is a formal request made to tax authorities to accept a tax return filed after the deadline. This petition typically includes reasons for the delay and any supporting documentation. Successfully submitting this petition may help avoid penalties and interest charges.

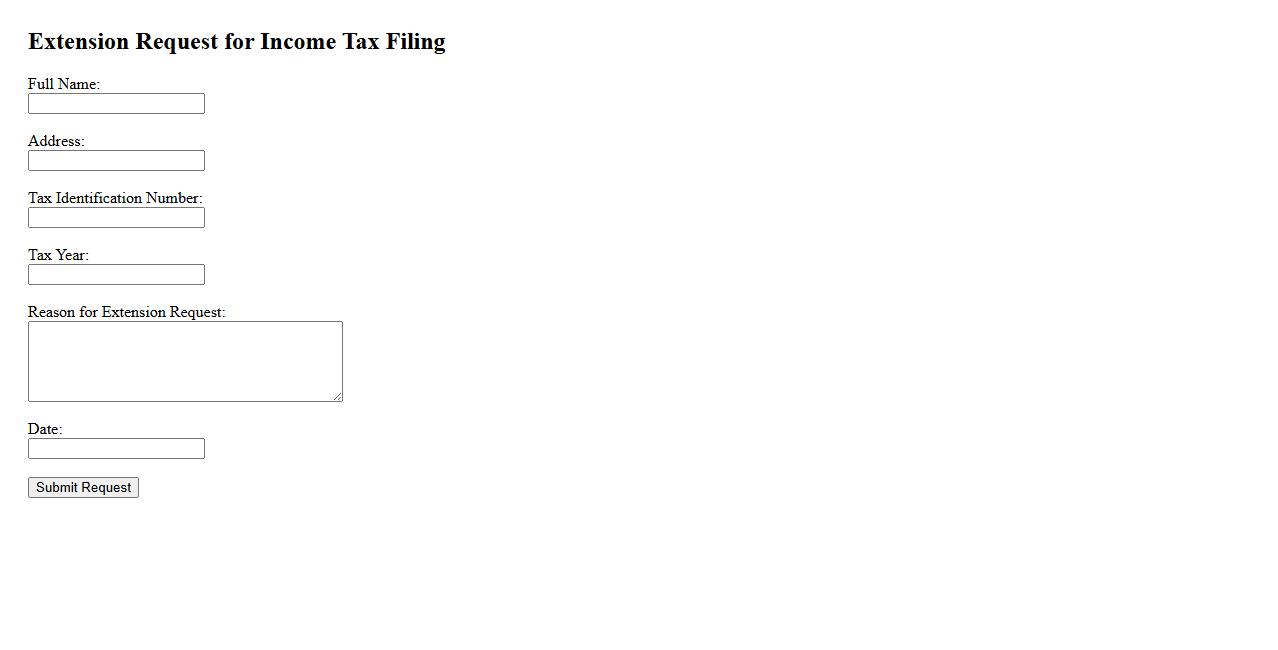

Extension Request for Income Tax Filing

An Extension Request for Income Tax Filing allows taxpayers to delay submitting their tax returns beyond the original deadline. This request helps avoid penalties by providing additional time to gather necessary documents and ensure accurate reporting. Filing an extension does not postpone tax payment deadlines, so estimated taxes should still be paid on time.

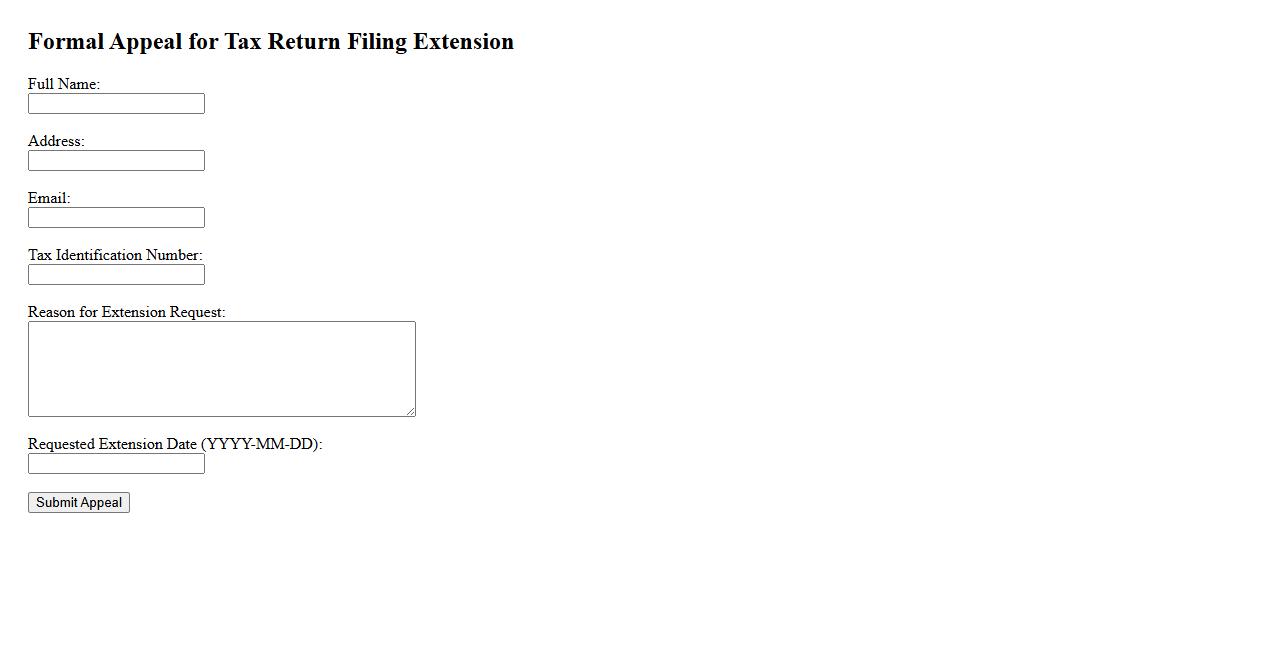

Formal Appeal for Tax Return Filing Extension

If you need more time to submit your tax documents, a formal appeal for tax return filing extension allows you to request additional time legally. This appeal must include valid reasons and supporting documentation to be considered by tax authorities. Submitting a timely and well-documented appeal helps avoid penalties and ensures compliance with tax regulations.

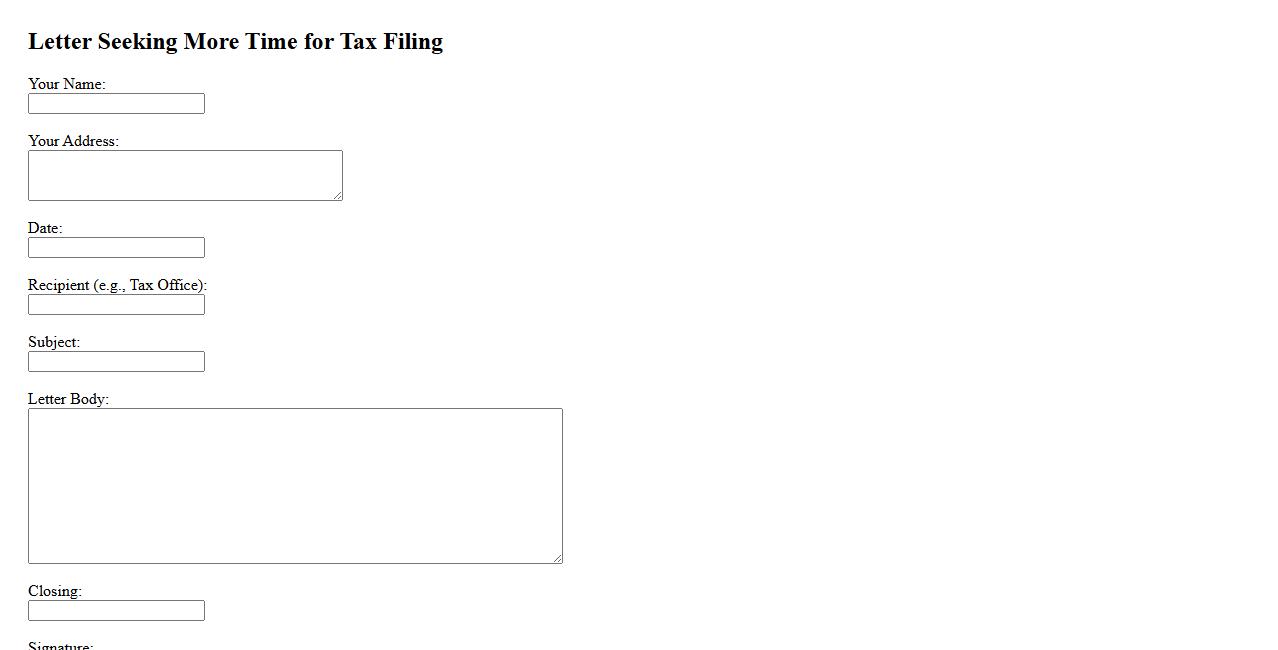

Letter Seeking More Time for Tax Filing

If you need additional time to file your taxes, a letter seeking more time for tax filing is essential. This formal request explains your situation and asks the tax authority for an extension. It helps ensure you avoid penalties while preparing accurate documents.

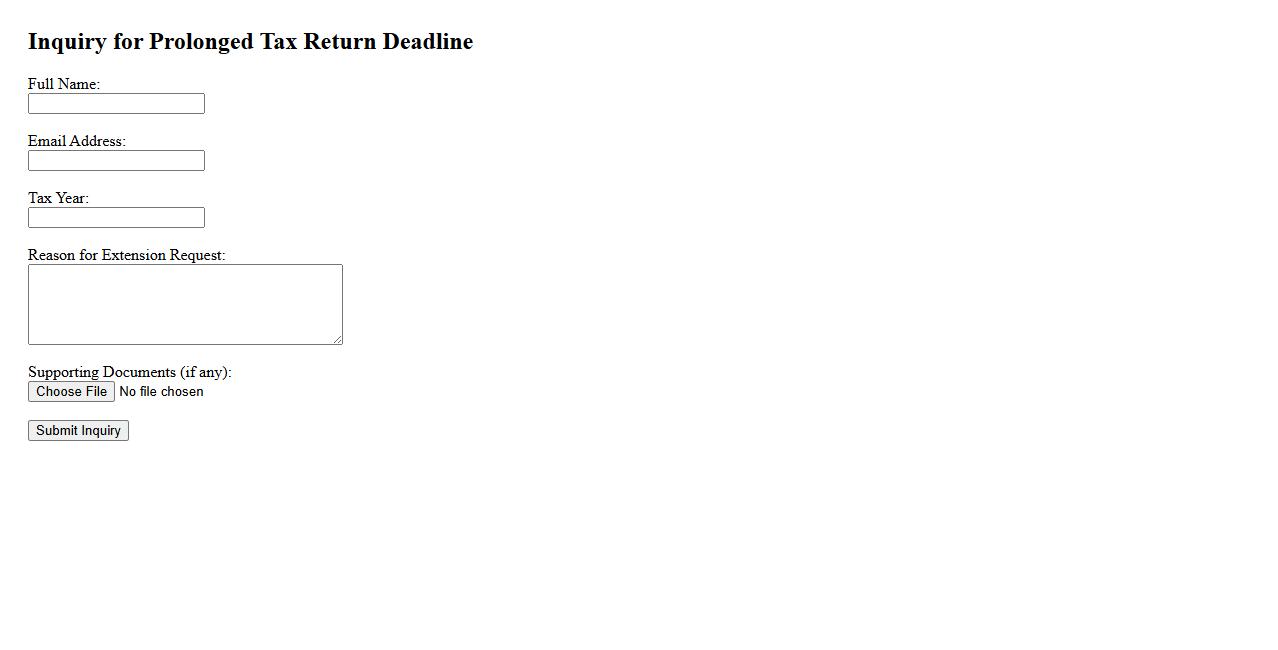

Inquiry for Prolonged Tax Return Deadline

If you need an inquiry for prolonged tax return deadline, it is essential to formally request an extension from the tax authorities. This process allows taxpayers additional time to prepare and submit their returns without penalties. Make sure to provide all necessary documentation to support your request for a deadline extension.

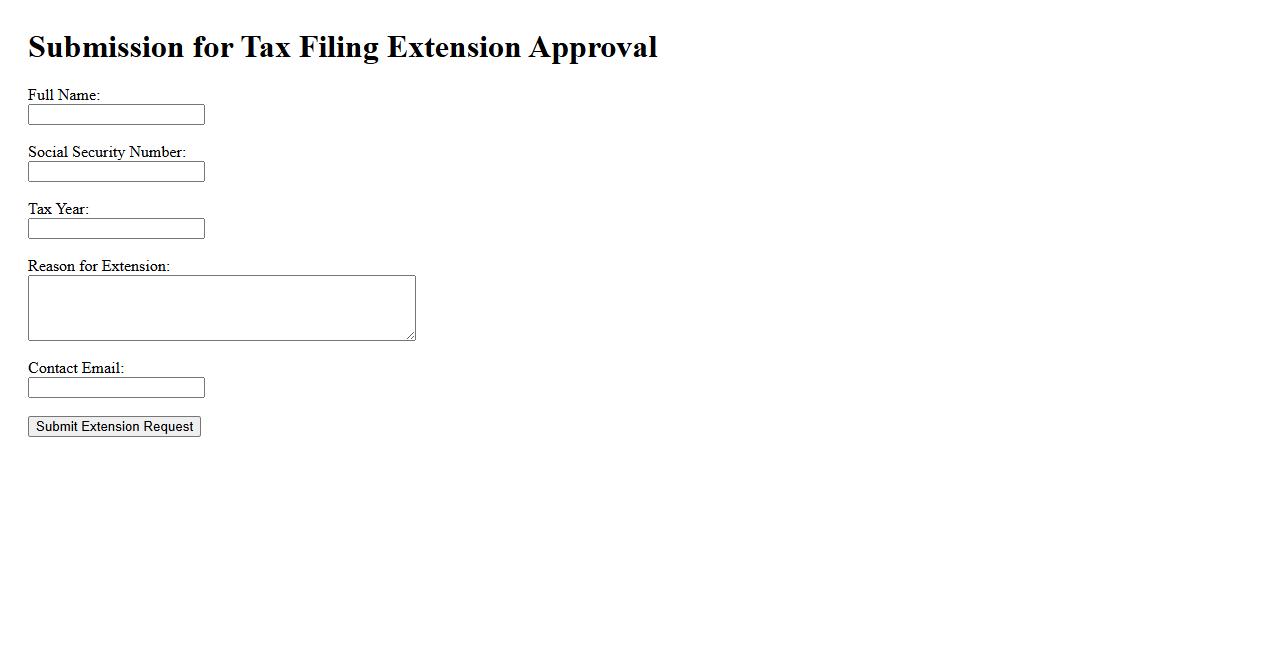

Submission for Tax Filing Extension Approval

Submitting a tax filing extension request allows taxpayers extra time to complete their returns accurately. This formal submission must be made before the original filing deadline to avoid penalties. Extensions provide relief without delaying the payment of any taxes owed.

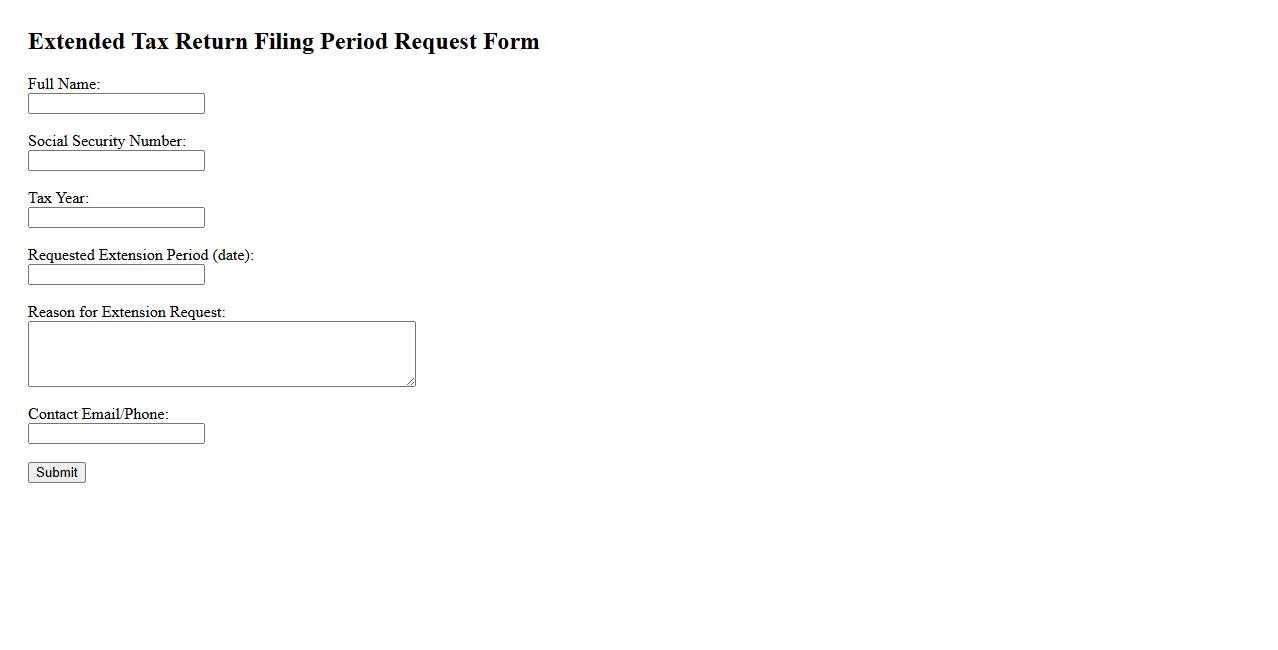

Form for Extended Tax Return Filing Period

The Form for Extended Tax Return Filing Period allows taxpayers to request additional time to submit their tax returns. This extension helps ensure accurate and complete documentation without incurring late penalties. Filing this form promptly is essential to benefit from the extended deadline.

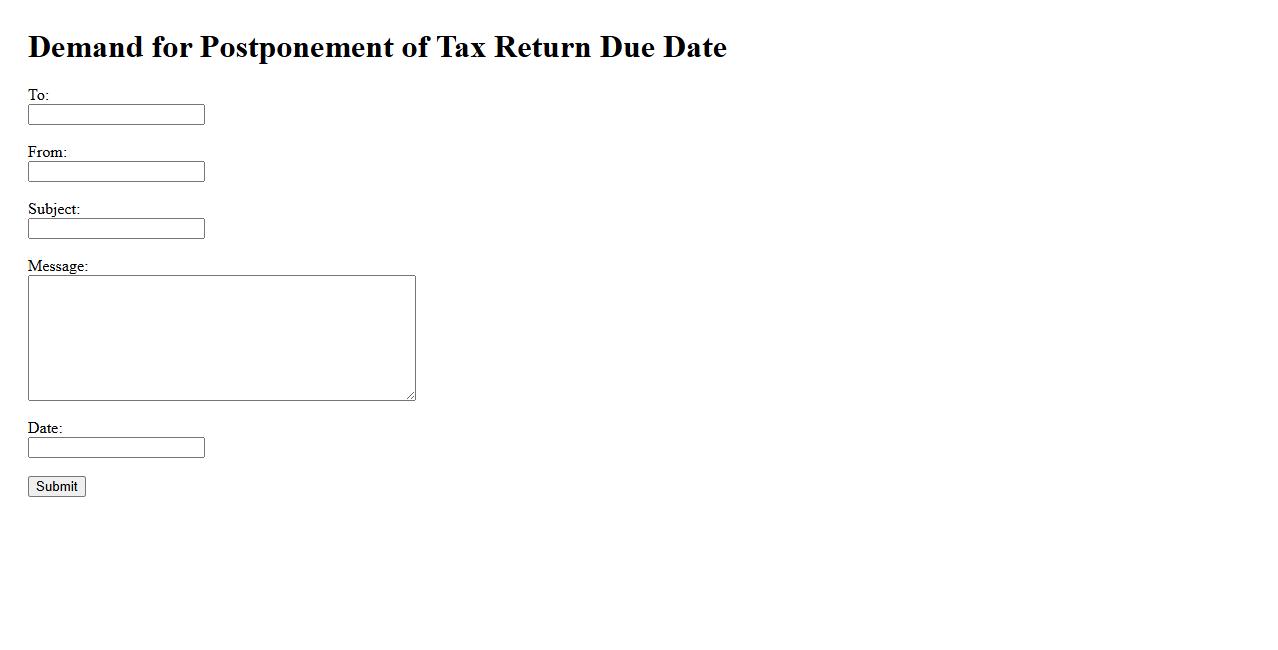

Demand for Postponement of Tax Return Due Date

The demand for postponement of tax return due date has increased significantly as many taxpayers face challenges in meeting the original deadlines. This extension allows individuals and businesses extra time to gather necessary documents and ensure accurate filings. Consequently, it helps reduce errors and penalties associated with late submissions.

What is the primary reason for requesting an extension of time to file a tax return?

The primary reason for requesting an extension is to gain additional time to accurately complete the tax return. Many taxpayers need more time to gather essential financial documents or resolve complex tax issues. Granting an extension helps ensure the return is filed without penalties for late submission.

Which tax year or period does the extension request pertain to?

The extension request must clearly specify the tax year or period it relates to, such as the calendar year 2023 or a specific fiscal period. Accurate identification avoids confusion and ensures the correct tax return is extended. This detail is critical for tax authorities to process the request appropriately.

What is the new proposed deadline for submitting the tax return?

The new proposed deadline is the date by which the taxpayer intends to file the completed return. Generally, extensions grant an additional six months beyond the original due date. Adhering to this new deadline prevents late filing penalties and interest charges.

Has any previous extension been granted for this specific tax return?

It is important to disclose whether a previous extension has already been granted for the same tax return. Most tax authorities limit the number of extensions allowed per tax year. Knowing this helps verify eligibility and avoids rejection of the current extension request.

What supporting documentation or justification accompanies the extension request?

The extension request should include supporting documentation such as proof of unforeseen circumstances, financial hardship, or pending information. Providing a detailed justification strengthens the case for approval by tax authorities. This ensures transparency and facilitates timely processing of the extension.