A Request for Bank Statement is a formal inquiry submitted to a financial institution to obtain a detailed record of all transactions within a specified period. This document serves as proof of income, expenses, and account activity, often required for loan applications, audits, or personal record-keeping. Banks typically provide statements electronically or in printed form upon receiving such a request.

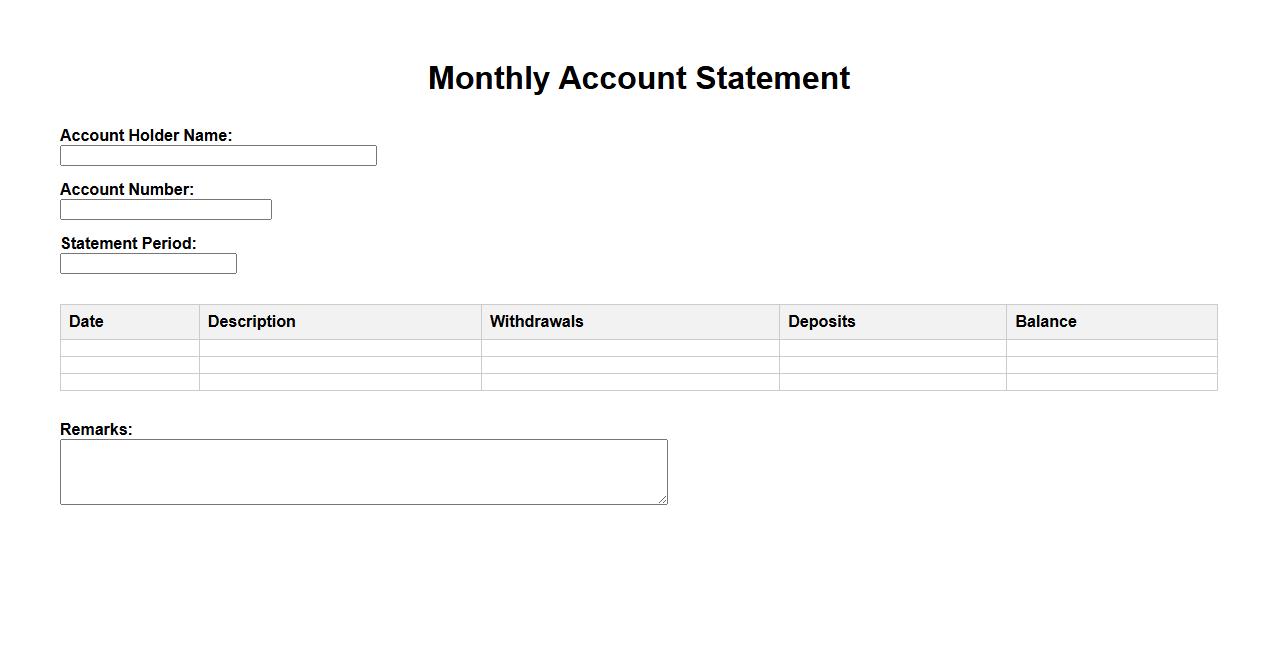

Monthly Account Statement

The Monthly Account Statement provides a detailed summary of all transactions and account activities within a specific month. It helps users track expenses, deposits, and balances efficiently. This statement ensures transparency and aids in financial planning and record-keeping.

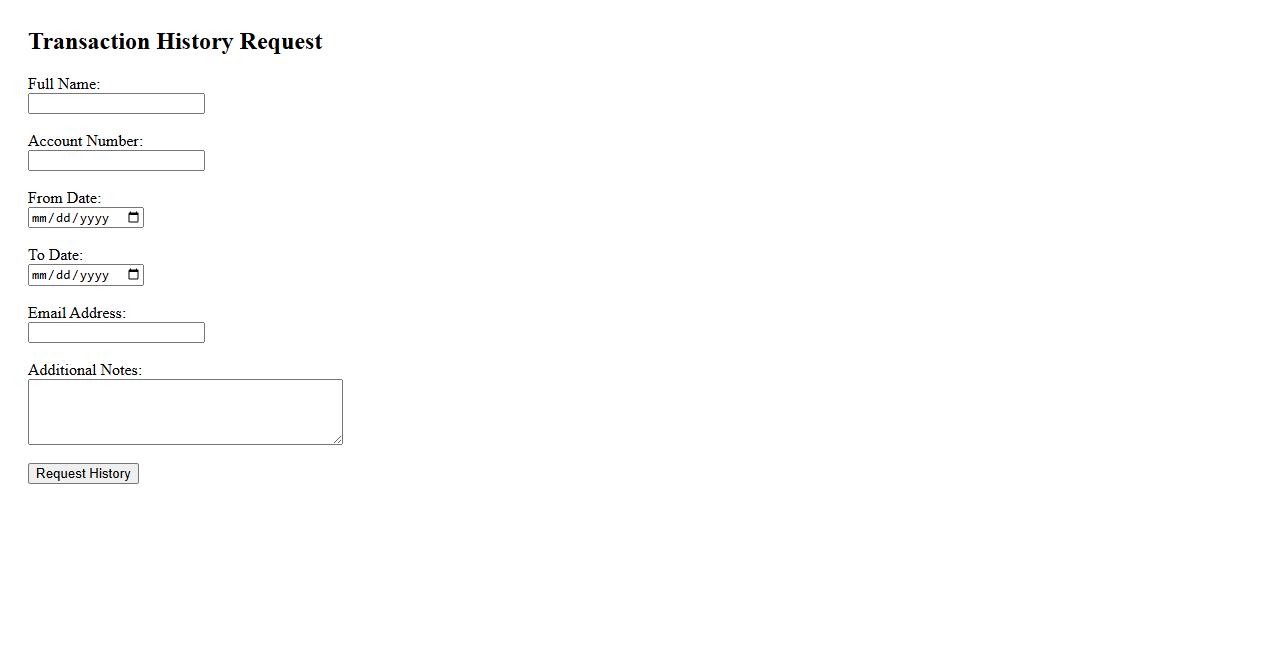

Transaction History Request

The Transaction History Request allows users to access a detailed record of their past financial activities. This feature helps in tracking payments, deposits, and other transactions efficiently. It ensures transparency and easy management of your account's financial data.

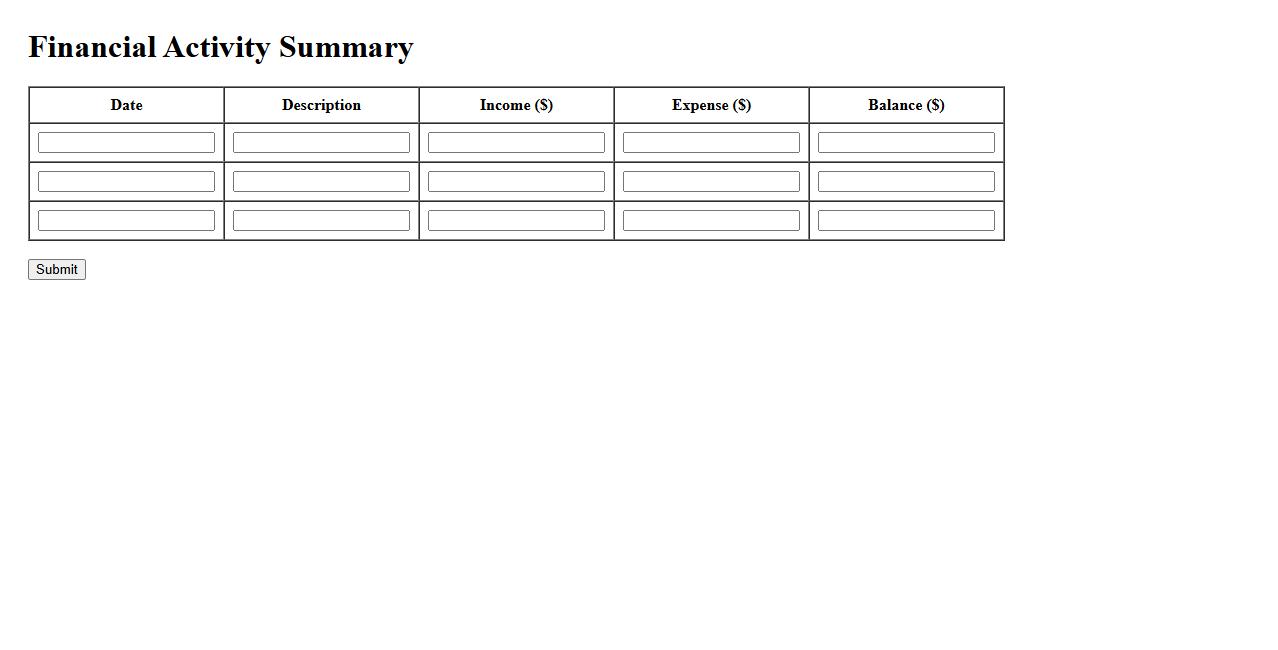

Financial Activity Summary

The Financial Activity Summary provides a concise overview of all monetary transactions within a specific period. It highlights key inflows and outflows, ensuring clarity in financial management. This summary is essential for tracking budget adherence and making informed fiscal decisions.

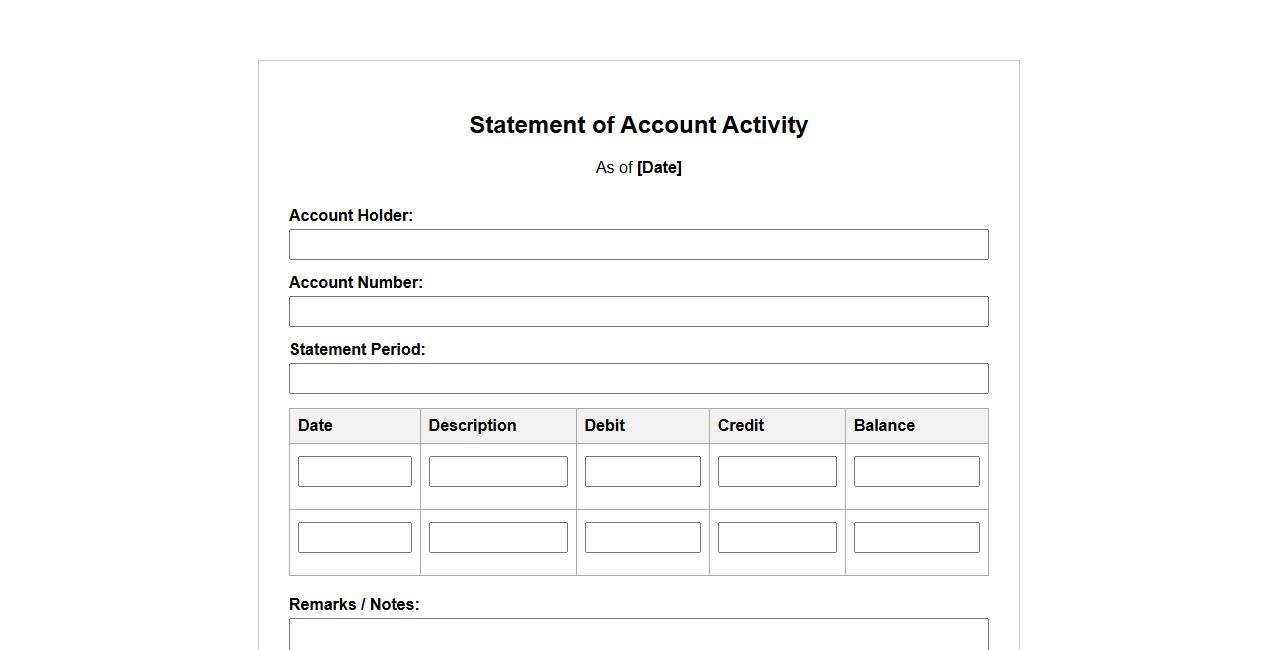

Statement of Account Activity

The Statement of Account Activity provides a detailed summary of all financial transactions within a specific period. It includes deposits, withdrawals, fees, and interest accrued to help users track their account status effectively. This document is essential for maintaining accurate financial records and ensuring transparency.

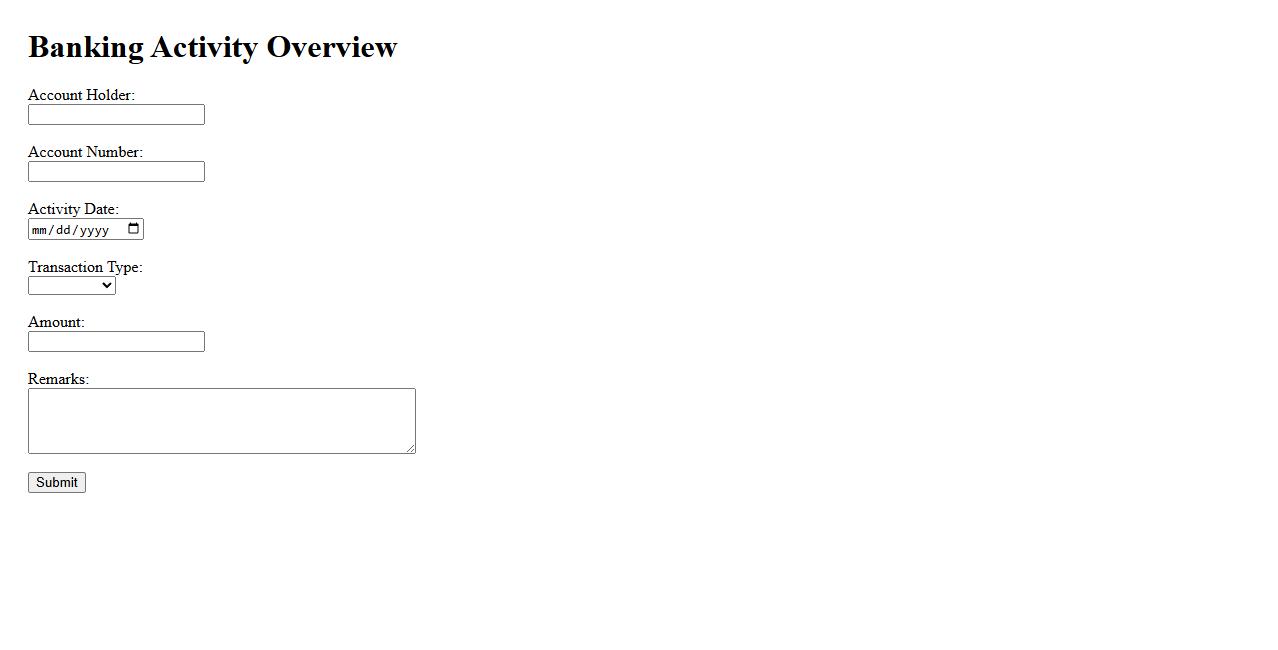

Banking Activity Overview

Banking Activity Overview provides a comprehensive summary of all financial transactions and services conducted within a banking institution. It highlights key metrics such as deposits, withdrawals, loan approvals, and customer interactions. This overview helps stakeholders monitor operational efficiency and financial health effectively.

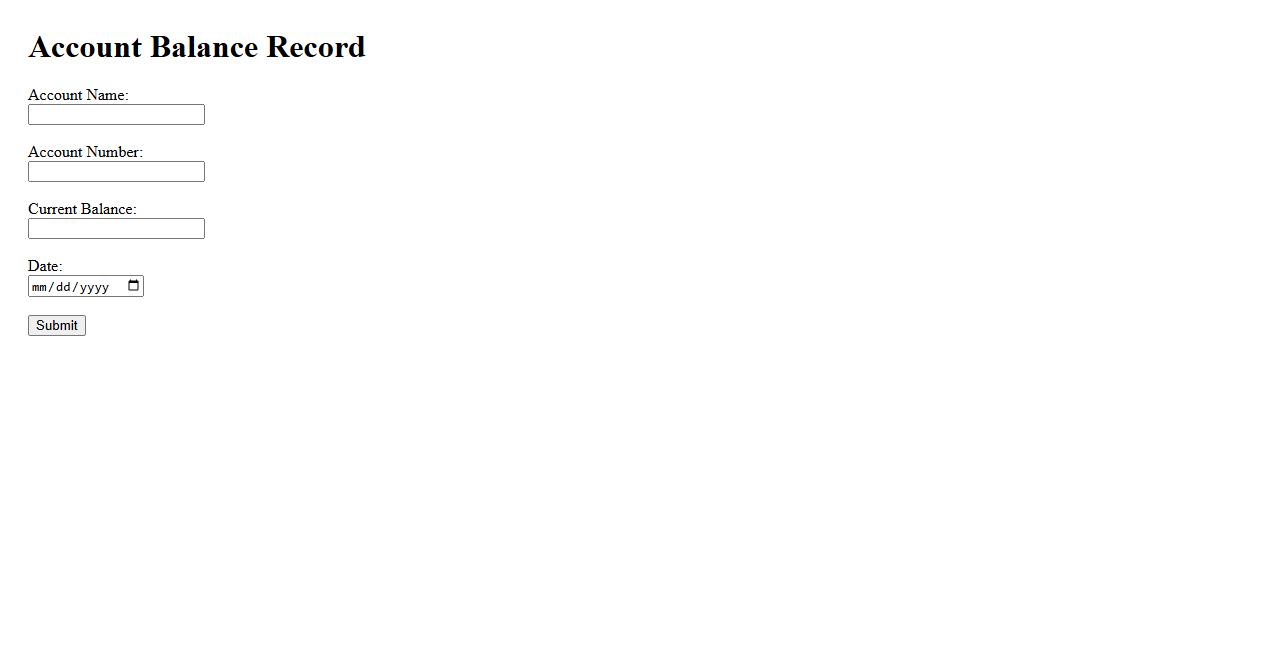

Account Balance Record

The Account Balance Record provides an accurate summary of the financial status in an account at any given time. It tracks all deposits, withdrawals, and transactions to ensure precise management. Maintaining this record is essential for transparent and efficient financial monitoring.

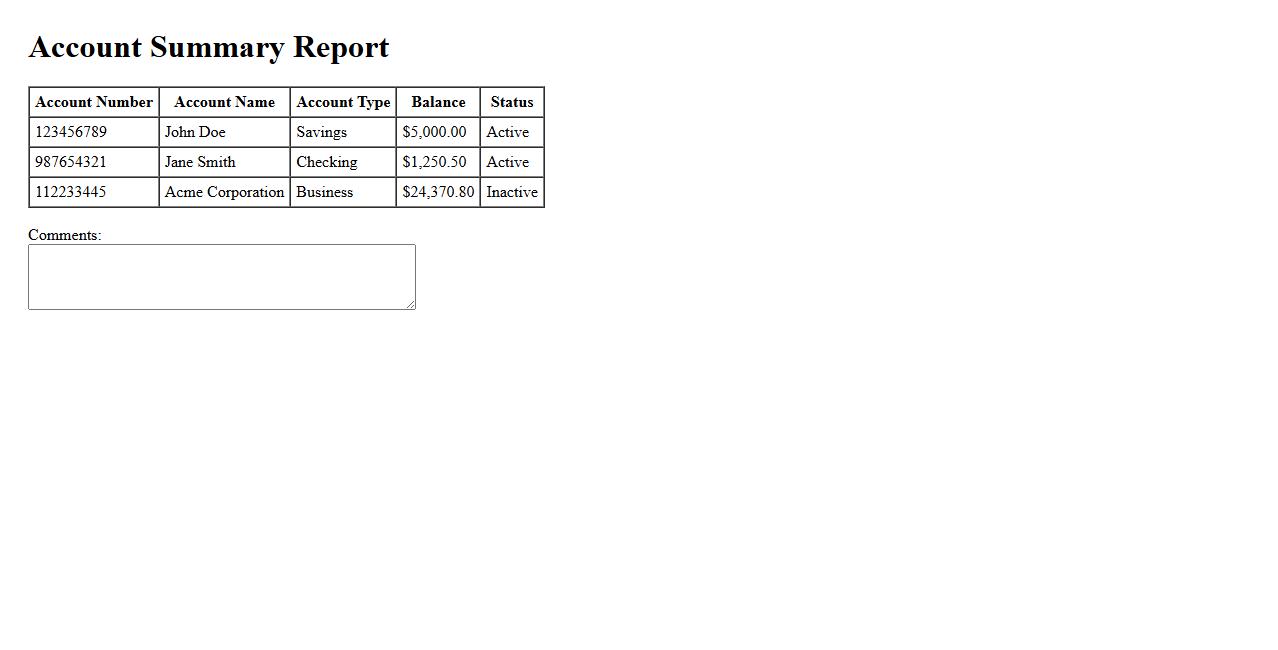

Account Summary Report

The Account Summary Report provides a comprehensive overview of all account activities, including balances, transactions, and recent updates. It is essential for tracking financial performance and ensuring accuracy in records. This report helps users make informed decisions by presenting critical account information in a clear and concise manner.

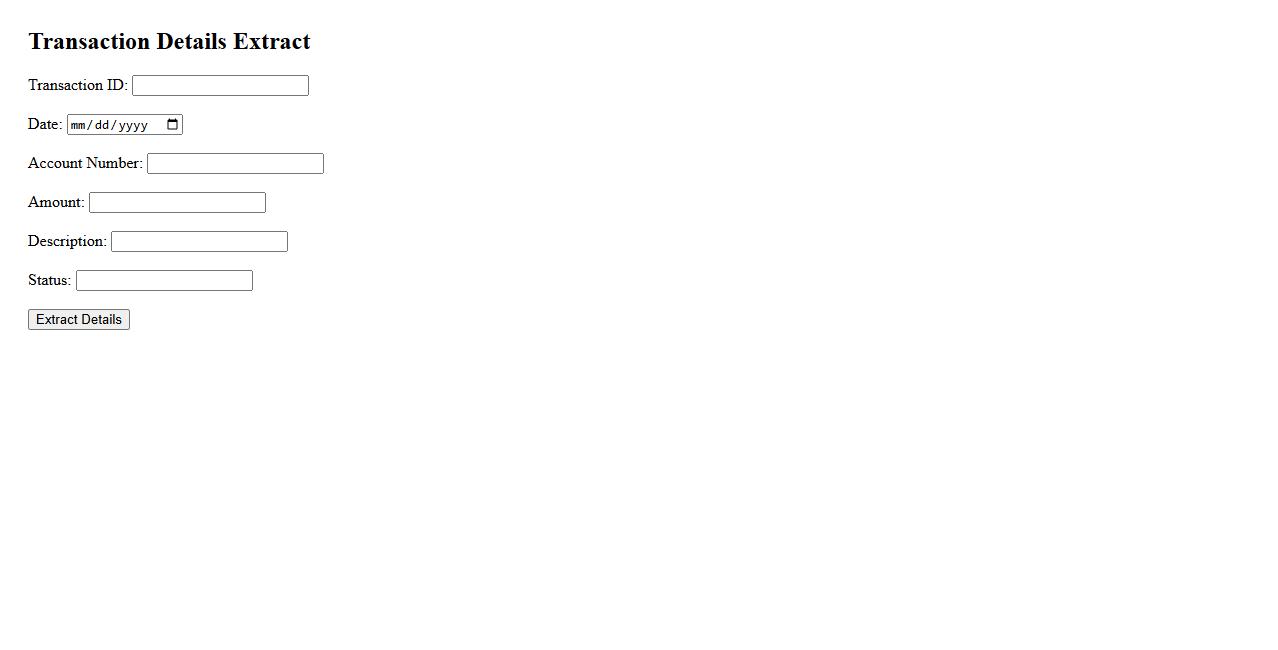

Transaction Details Extract

The Transaction Details Extract provides a comprehensive summary of financial transactions, including dates, amounts, and involved parties. This detailed report helps users track spending, verify payments, and manage their accounts efficiently. With clear and organized data, monitoring financial activity becomes straightforward and reliable.

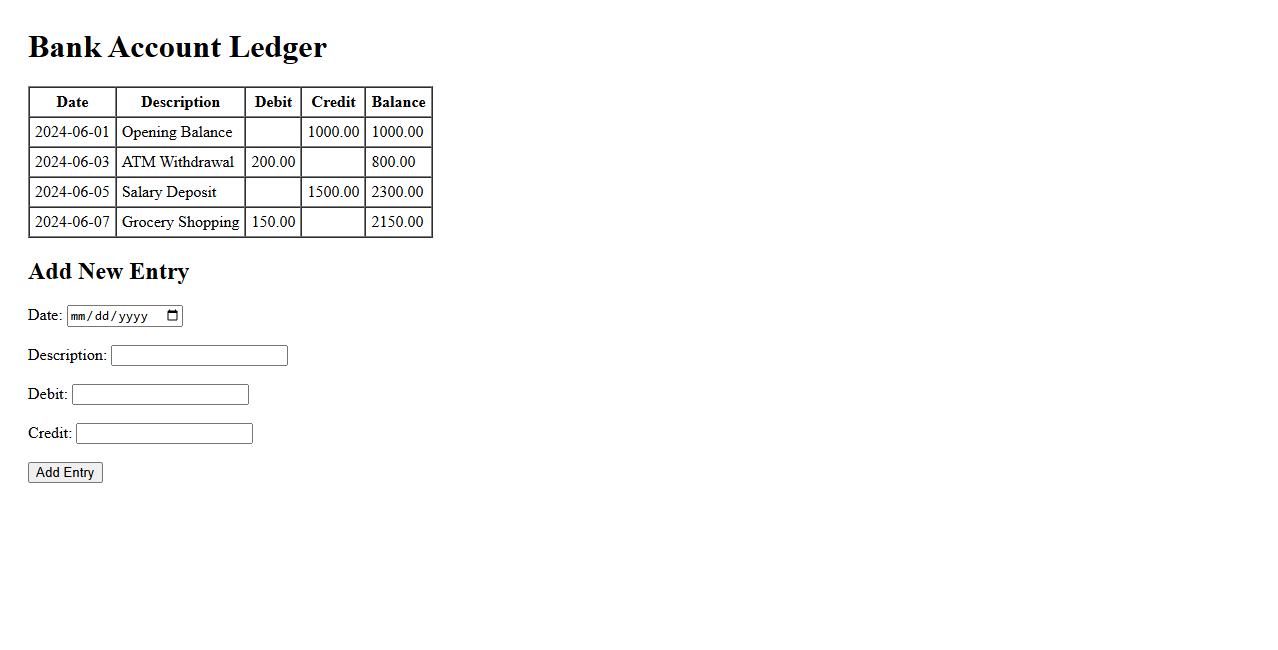

Bank Account Ledger

The Bank Account Ledger is a detailed record of all transactions within a bank account, including deposits, withdrawals, and balances. It helps individuals and businesses track their financial activities accurately. Maintaining a clear ledger is essential for effective financial management and auditing purposes.

Financial Statement Request

A Financial Statement Request is a formal inquiry made to obtain detailed financial records from an individual or organization. These statements provide essential information about income, expenses, assets, and liabilities. They are crucial for financial analysis, audits, or loan applications.

What is the purpose of requesting a bank statement in this document?

The primary purpose of requesting a bank statement in this document is to verify financial transactions and account balances. It provides a detailed record of deposits, withdrawals, and transfers. This verification is essential for accurate financial reconciliation and auditing purposes.

Which account details are required to process the bank statement request?

To process the bank statement request, the document requires the account number and the account holder's full name. Additionally, the bank's branch information may be necessary. These details ensure the statement corresponds to the correct financial account.

Who is authorized to make the bank statement request according to the document?

The document specifies that only authorized account holders or their legal representatives can request the bank statement. Proper identification and authorization proof must be provided. This measure protects against unauthorized access to sensitive financial information.

What is the preferred time period or date range for the requested bank statement?

The bank statement request should specify a clear and precise date range, typically reflecting the recent months or a particular financial period. The preferred time frame often aligns with the period of review or audit. Accurate date ranges ensure relevant financial data is retrieved.

What method or format is specified for receiving the bank statement in the document?

The document typically requests that the bank statement be provided in a secure digital format, such as PDF. This format facilitates easy sharing and storing while maintaining document integrity. Email or secure online portals are common delivery methods mentioned for receiving the statement.