A Request for Direct Deposit is a formal document submitted to an employer or financial institution to authorize the electronic transfer of funds directly into a bank account. This process ensures timely and secure payment of salaries, benefits, or other recurring payments without the need for physical checks. Completing a Request for Direct Deposit typically requires providing bank account details and a voided check.

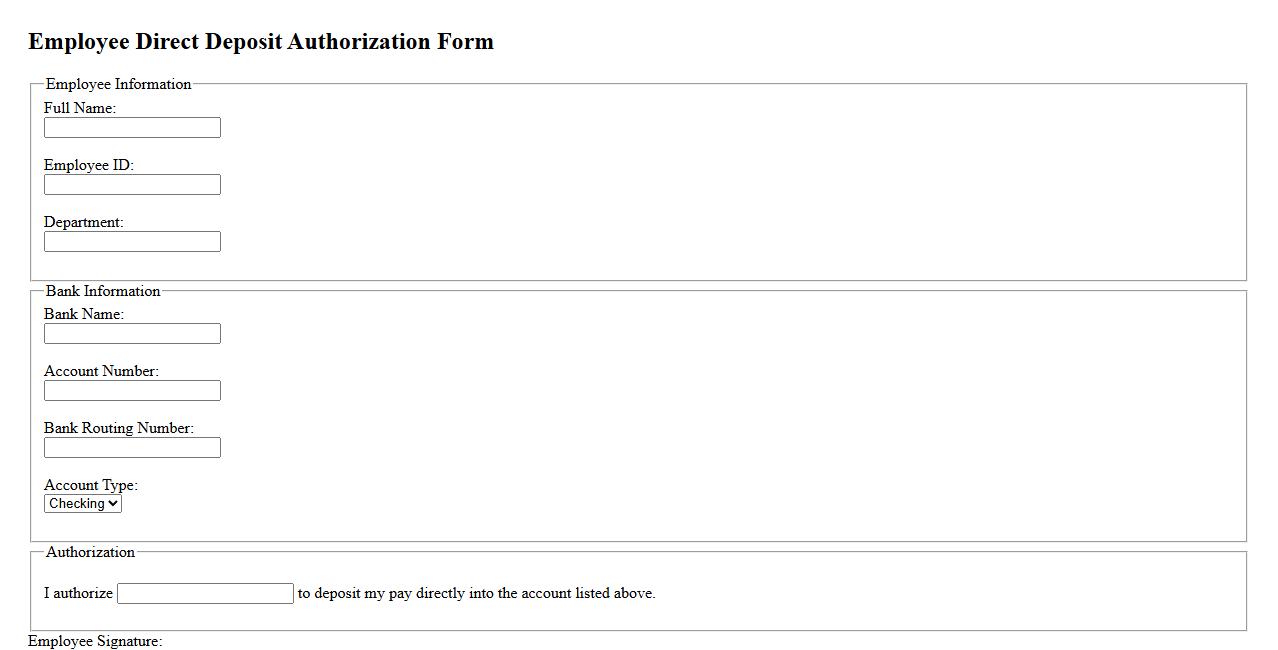

Employee Direct Deposit Authorization Form

The Employee Direct Deposit Authorization Form is a secure document that allows employees to authorize their employer to deposit paychecks directly into their bank accounts. This form ensures timely and efficient salary payments, reducing the need for paper checks and manual deposits. Employees provide essential banking details to facilitate this convenient and reliable payment method.

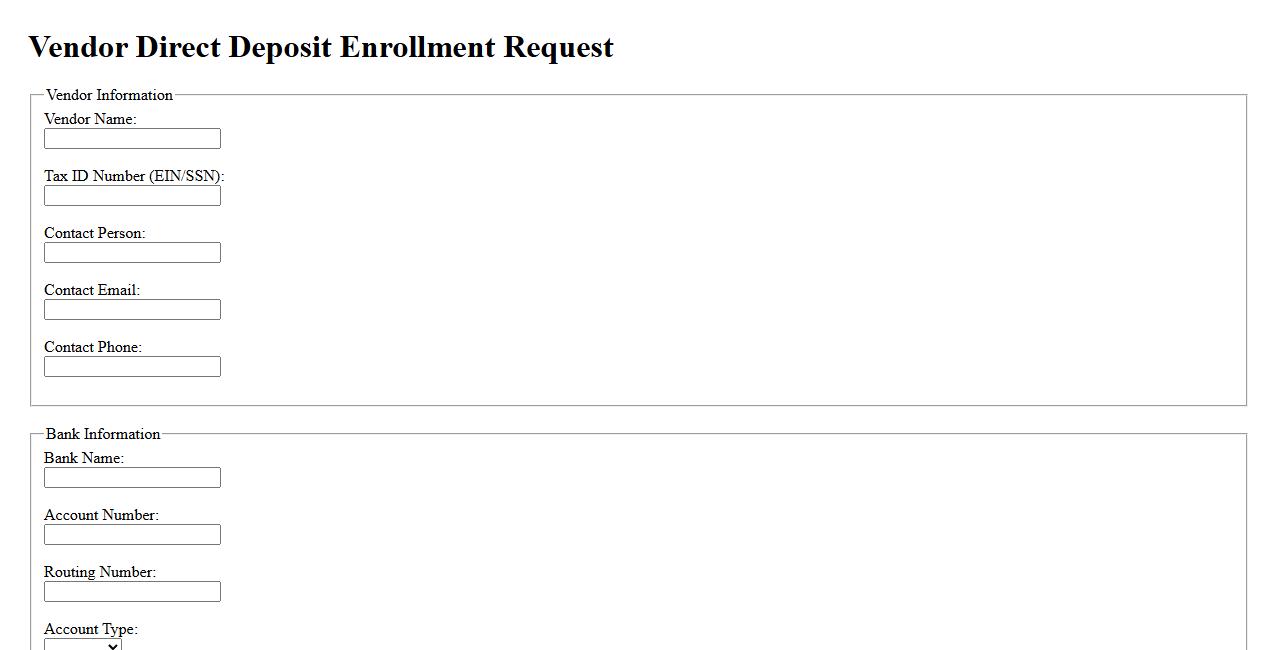

Vendor Direct Deposit Enrollment Request

The Vendor Direct Deposit Enrollment Request streamlines payment processing by allowing vendors to receive funds directly into their bank accounts. This secure method ensures timely and efficient transactions, reducing the need for paper checks. Completing this enrollment enhances financial operations for both vendors and organizations.

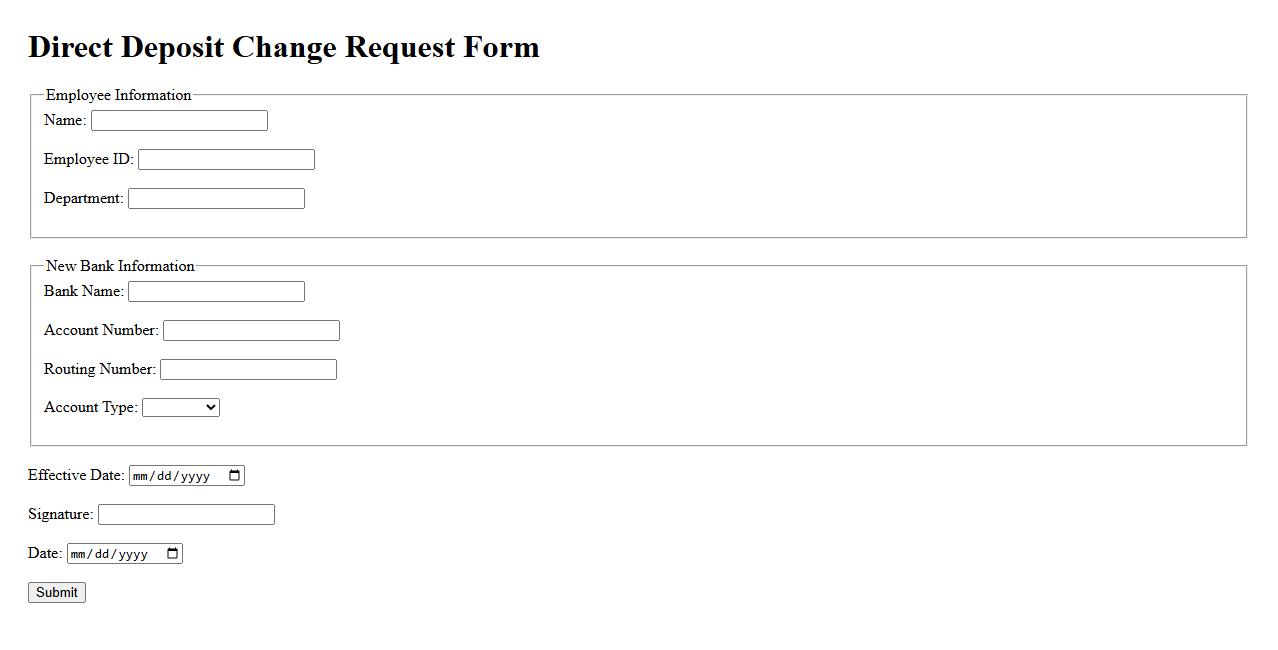

Direct Deposit Change Request Form

The Direct Deposit Change Request Form allows employees to update their bank account information for payroll deposits securely and efficiently. This form ensures timely and accurate processing of salary payments directly into the new designated account. Employers rely on it to maintain accurate financial records and streamline payment processes.

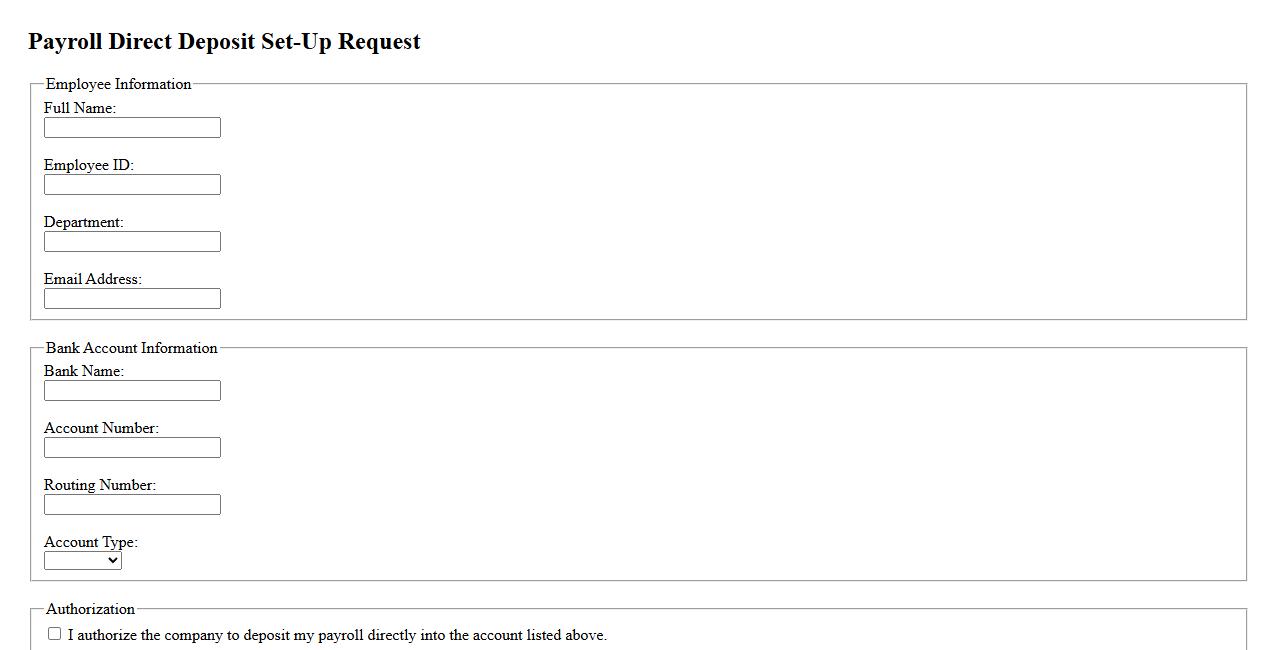

Payroll Direct Deposit Set-Up Request

Submit a Payroll Direct Deposit Set-Up Request to securely and conveniently have your paycheck deposited directly into your bank account. This process ensures timely access to your funds without the need for physical checks. Setting up direct deposit streamlines payment management and enhances financial efficiency.

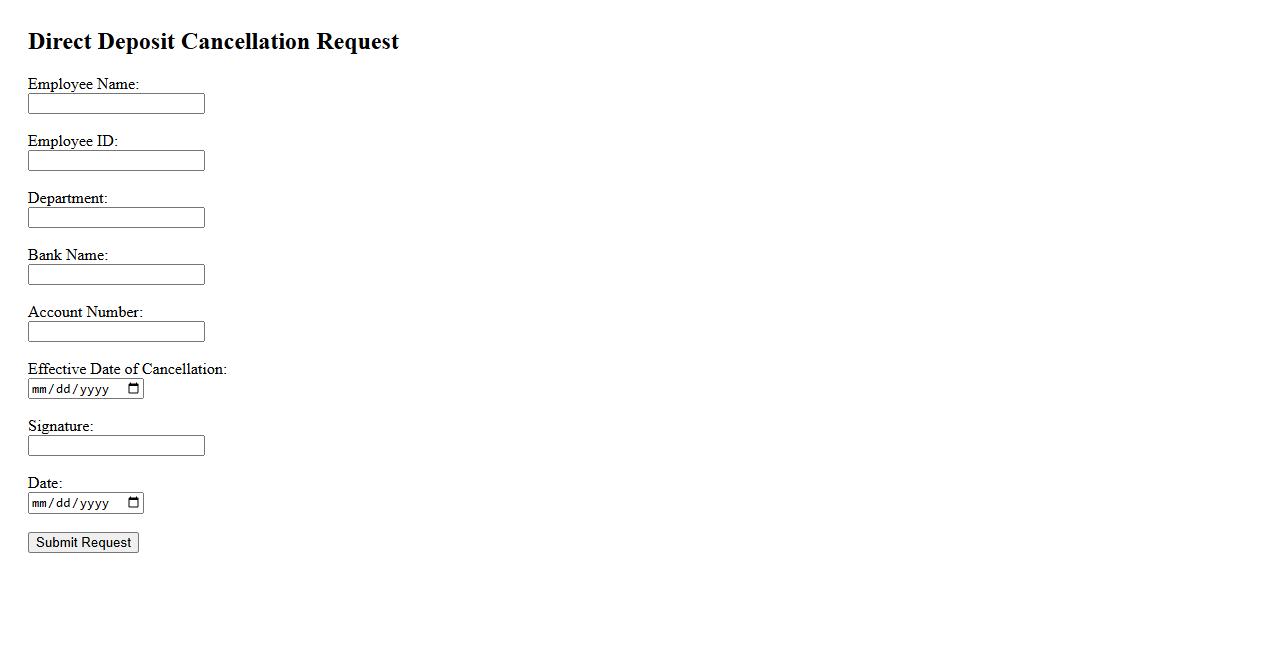

Direct Deposit Cancellation Request

If you need to stop payments through Direct Deposit Cancellation Request, this procedure allows you to formally notify your bank or employer. It ensures your funds are no longer automatically transferred to your account. Timely submission helps prevent any unauthorized deposits or transaction issues.

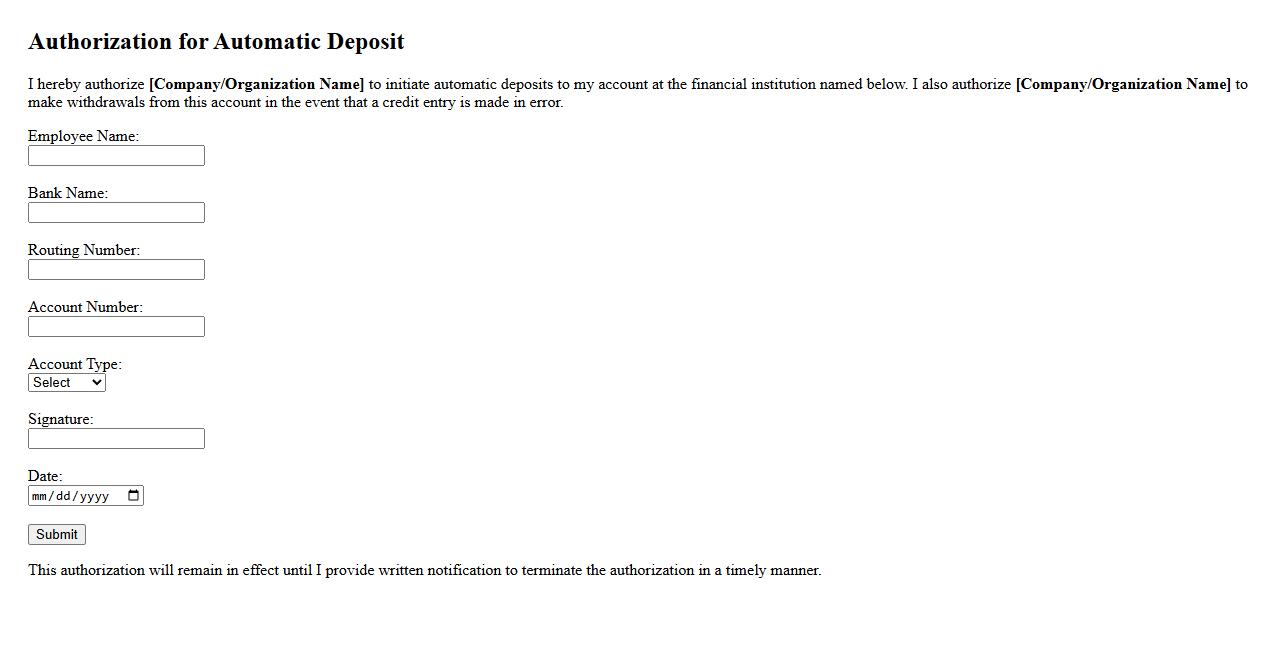

Authorization for Automatic Deposit

Authorization for Automatic Deposit allows individuals or businesses to securely permit funds to be electronically transferred directly into their bank accounts. This process ensures timely and accurate payments without the need for physical checks. It streamlines transactions, reducing delays and enhancing convenience for both payers and recipients.

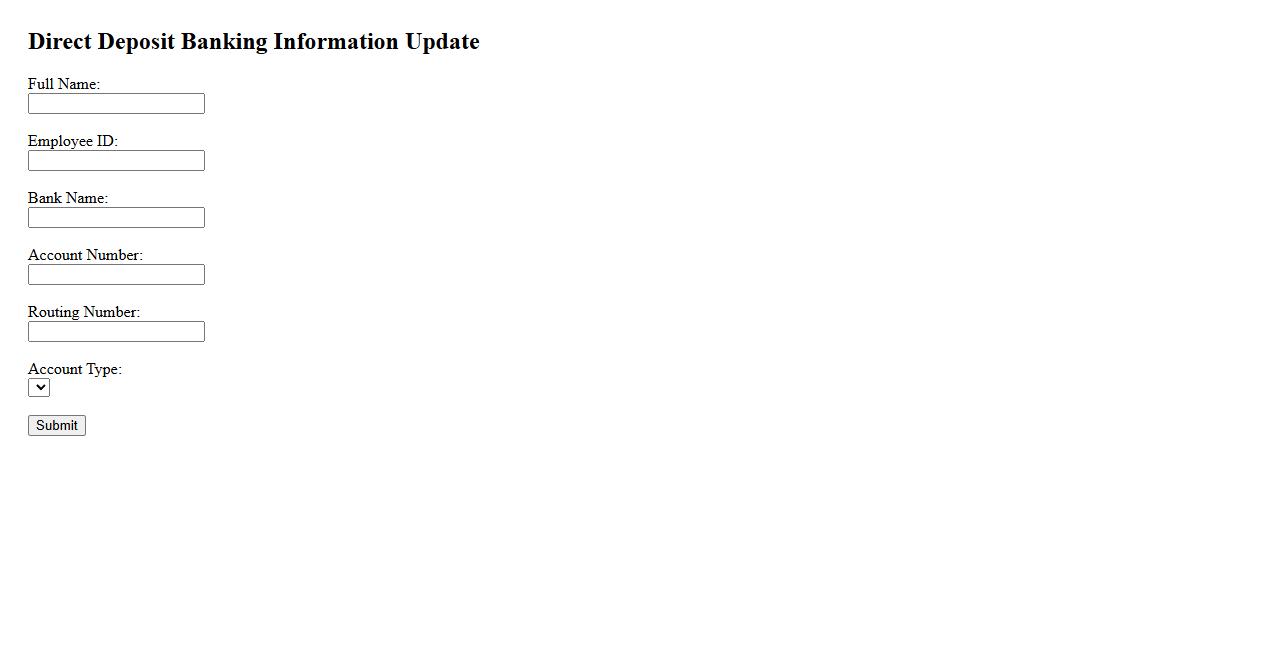

Direct Deposit Banking Information Update

Updating your direct deposit banking information ensures your payments are processed accurately and on time. Please provide your new bank account details promptly to avoid any disruptions. This simple update safeguards the seamless transfer of funds directly into your account.

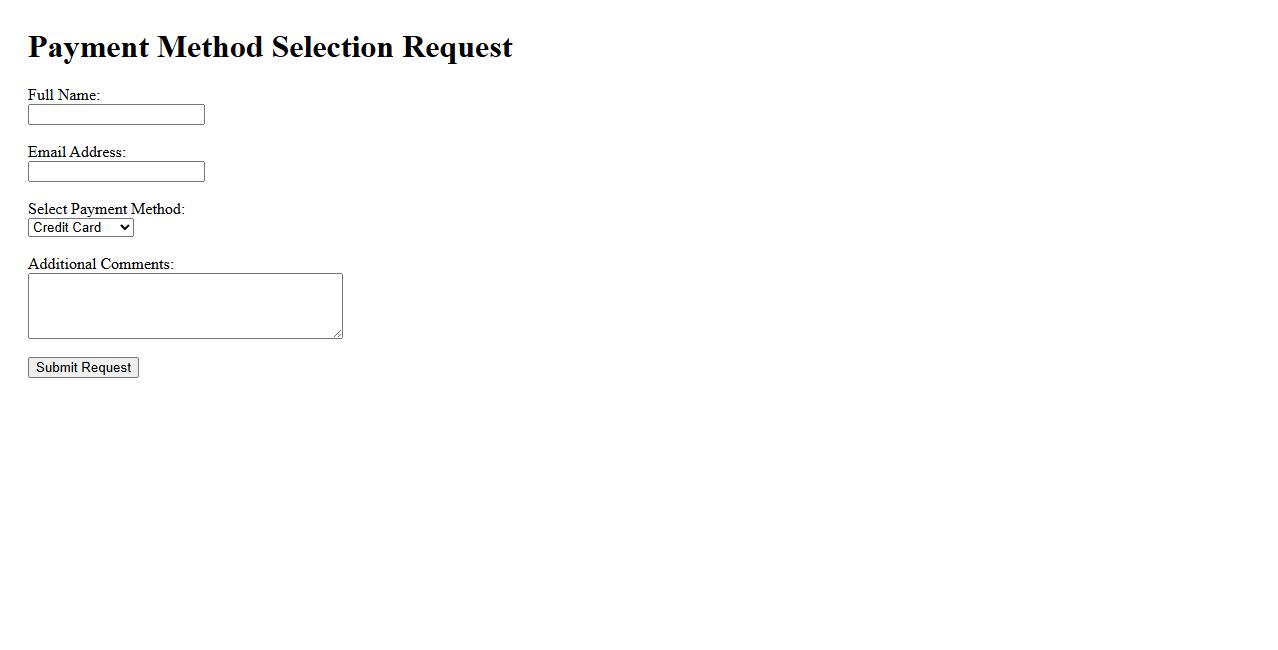

Payment Method Selection Request

The Payment Method Selection Request allows users to choose their preferred payment option during the checkout process. This step ensures a seamless and secure transaction by presenting various payment methods tailored to user preferences. Efficient selection enhances the overall payment experience and reduces checkout time.

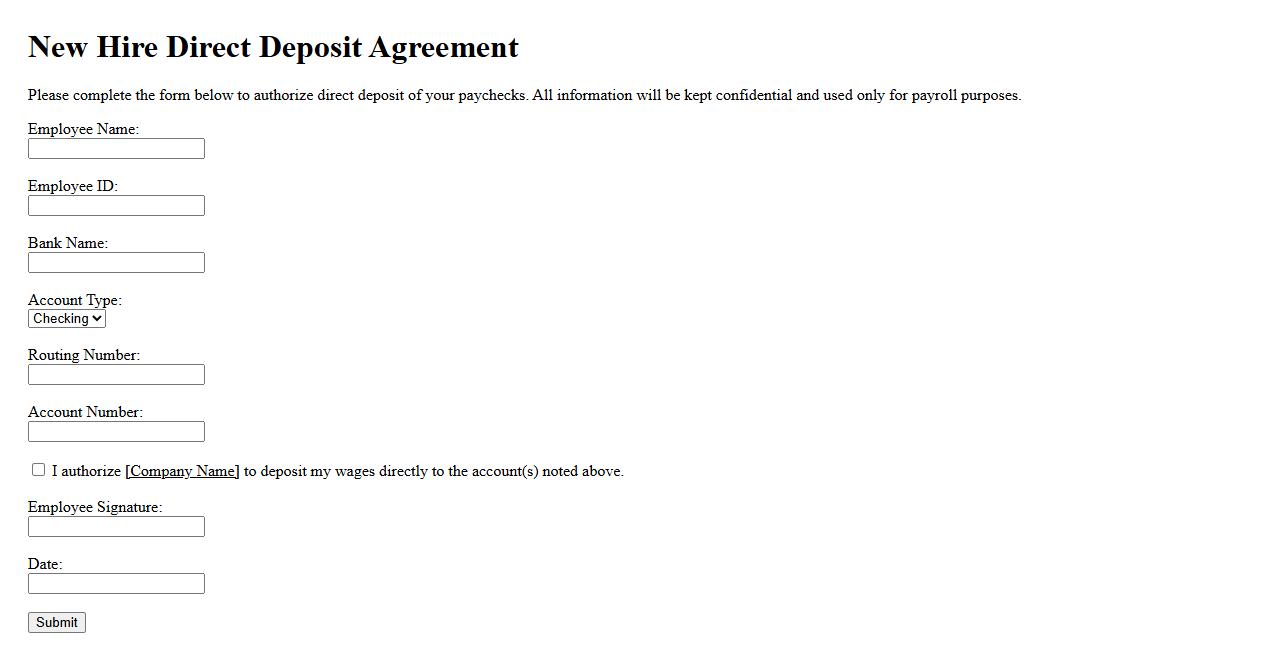

New Hire Direct Deposit Agreement

The New Hire Direct Deposit Agreement authorizes an employer to deposit an employee's paycheck directly into their chosen bank account. This agreement streamlines payroll processing and ensures timely and secure payment delivery. Employees benefit from increased convenience and faster access to their earnings.

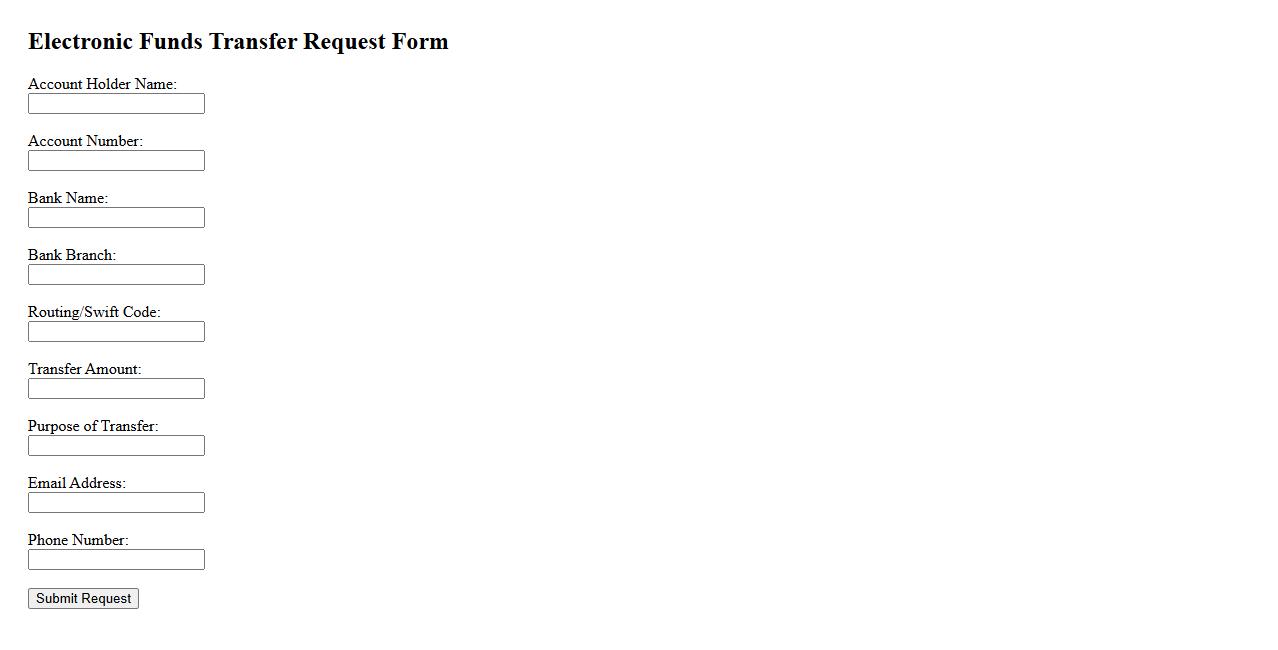

Electronic Funds Transfer Request Form

The Electronic Funds Transfer Request Form is a secure document used to authorize and facilitate the transfer of funds between bank accounts electronically. It ensures accurate and efficient processing by capturing essential details such as account numbers, transfer amounts, and recipient information. This form streamlines financial transactions, reducing the need for paper checks and manual processing.

What information is required to process a direct deposit request?

To process a direct deposit request, essential details include the bank account number and the bank's routing number. Additionally, personal identification information such as the account holder's full name and social security number is typically necessary. This ensures proper verification and prevents errors in fund transfers.

Who is authorized to approve and submit the direct deposit form?

The authorization to approve and submit a direct deposit form is usually granted to designated payroll or finance personnel within an organization. In some cases, the employee or account holder themselves may submit the form directly to the employer or bank. Proper approval ensures the legitimacy and accuracy of the direct deposit setup.

Which types of bank accounts can receive direct deposits via this request?

Direct deposits can typically be sent to checking, savings, and certain money market accounts. These accounts must be capable of accepting electronic fund transfers to receive payments. It's important to confirm with the bank that the specific account type supports direct deposits.

What is the expected processing time for activating direct deposit after submission?

The processing time for activating direct deposit usually ranges from one to two pay cycles after the form is submitted. Some institutions may require additional verification, which can extend the timeline. Users should check with their payroll or bank for precise activation schedules.

How can a user update or cancel an existing direct deposit request?

To update or cancel a direct deposit, the user must typically contact their payroll department or financial institution directly. This process often involves submitting a new form or written request specifying the changes. Prompt communication is crucial to avoid disruptions in payment delivery.