The Report of Non-Resident Alien Income is a crucial tax document used to report income earned by non-resident aliens in the United States. This report ensures compliance with IRS regulations by detailing sources of income subject to U.S. tax, such as wages, scholarships, and investment earnings. Accurate filing of the Report of Non-Resident Alien Income helps prevent penalties and facilitates proper tax withholding.

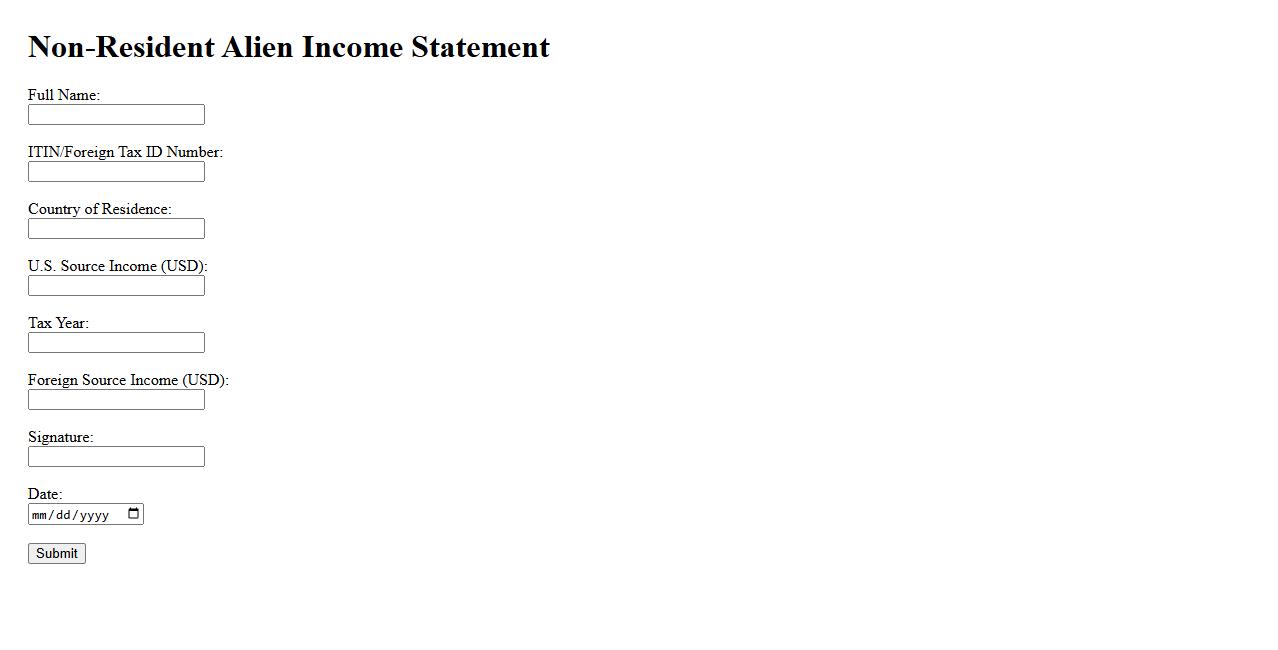

Non-Resident Alien Income Statement

The Non-Resident Alien Income Statement is a financial document used to report income earned by individuals who are not U.S. residents. It details various sources of income subject to U.S. tax regulations. This statement ensures compliance with tax laws and accurate reporting for non-resident aliens.

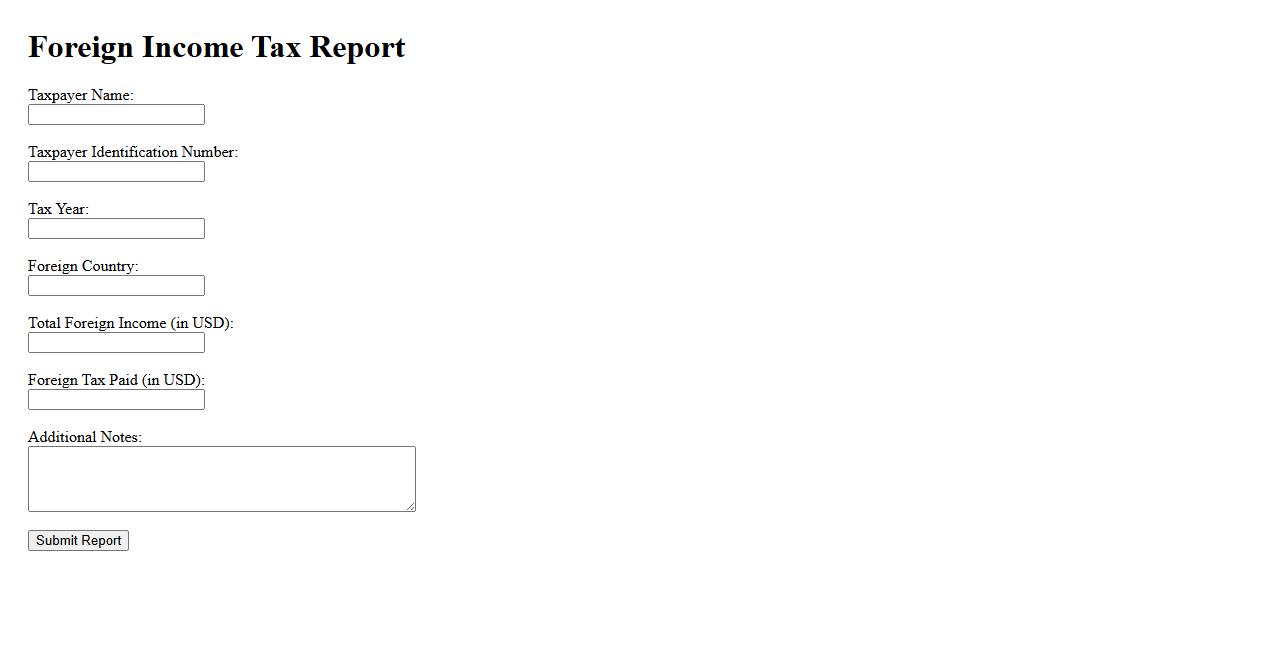

Foreign Income Tax Report

The Foreign Income Tax Report provides a comprehensive summary of all income earned abroad and the corresponding taxes paid to foreign governments. This report is essential for accurate tax filing and compliance with international tax regulations. It helps individuals and businesses avoid double taxation and ensures proper credit for foreign taxes paid.

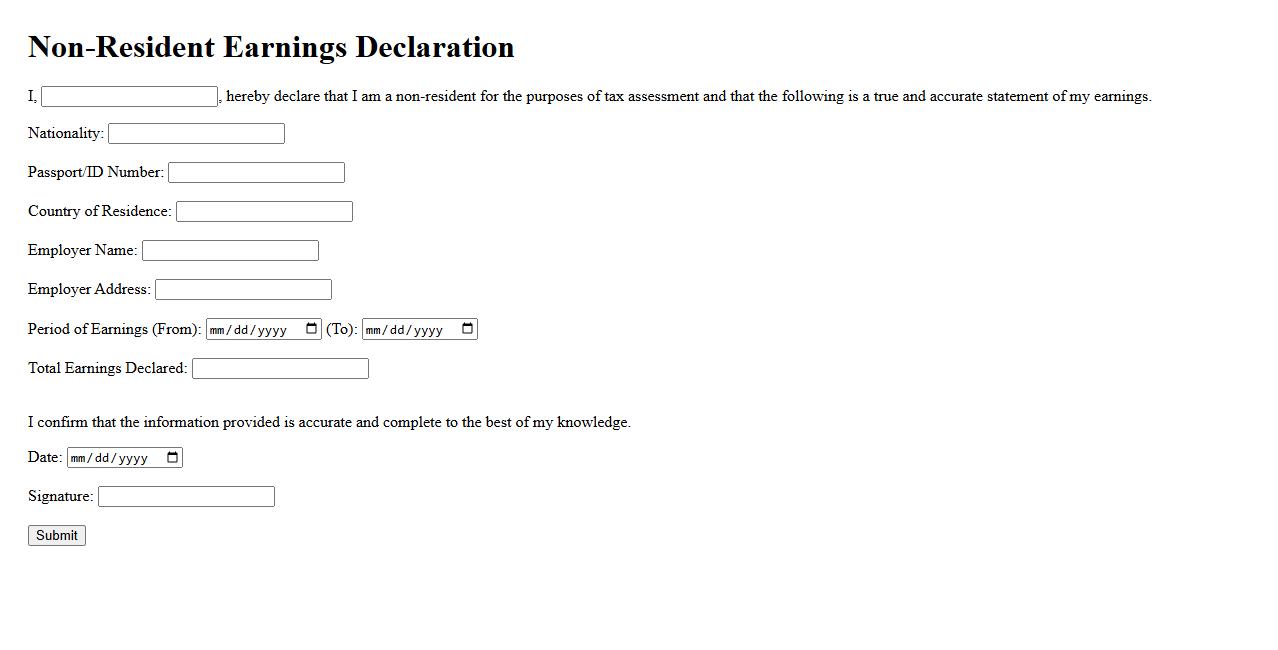

Non-Resident Earnings Declaration

The Non-Resident Earnings Declaration is a formal document required to disclose income earned by individuals or entities residing outside the country. This declaration ensures compliance with tax regulations and helps in the accurate assessment of foreign income. Proper submission of this form is essential for legal and financial transparency.

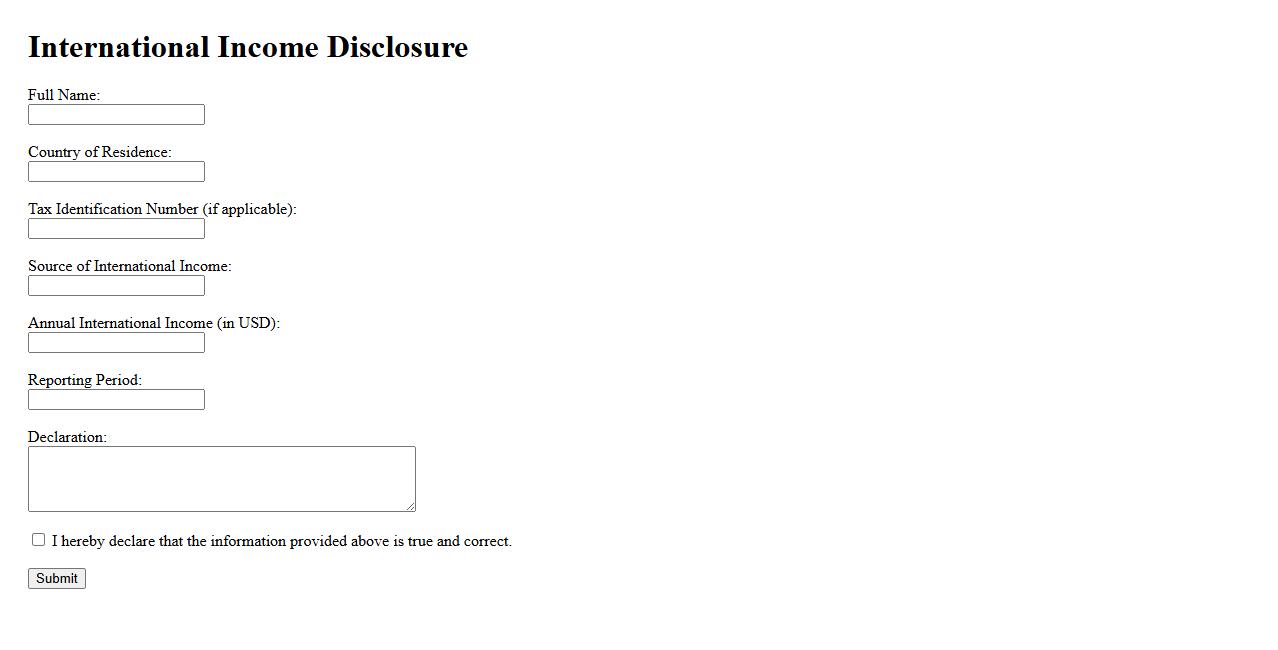

International Income Disclosure

The International Income Disclosure policy ensures transparent reporting of income earned across multiple countries. It helps taxpayers comply with global tax regulations by accurately declaring foreign earnings. This disclosure is essential for avoiding legal complications and penalties.

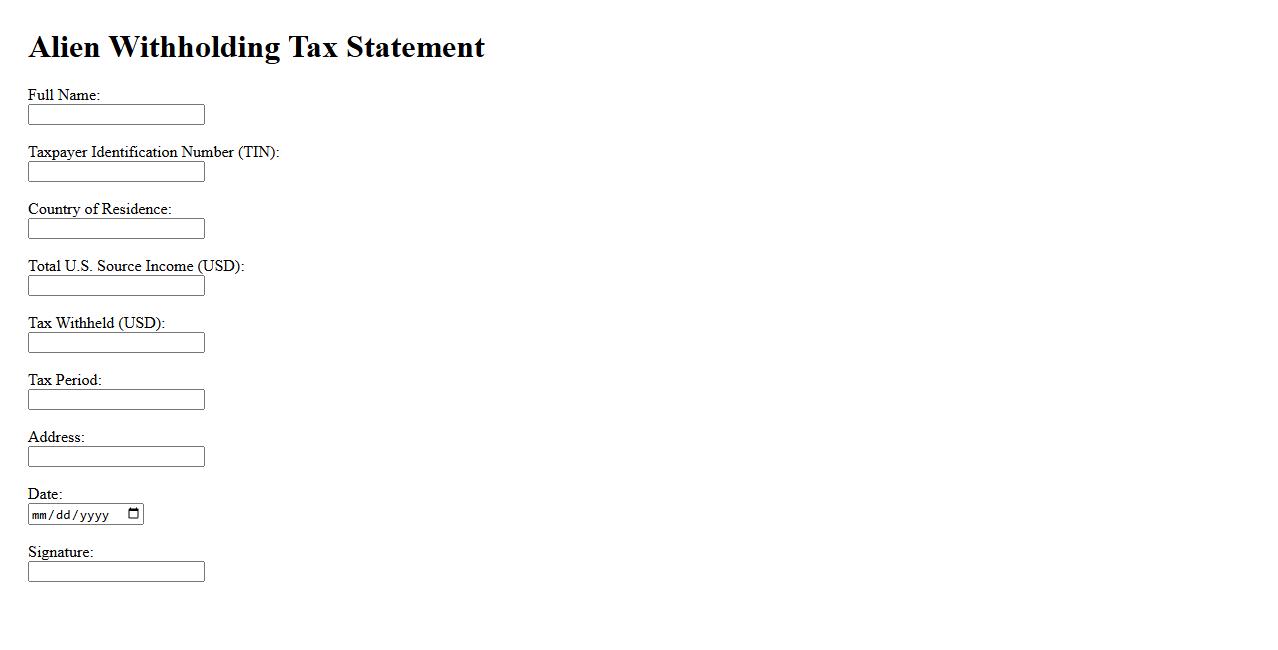

Alien Withholding Tax Statement

The Alien Withholding Tax Statement is a document used to report taxes withheld on income earned by non-resident aliens in the United States. It ensures proper tax compliance between foreign individuals and the IRS. This statement is essential for accurately filing tax returns and claiming any applicable tax credits or refunds.

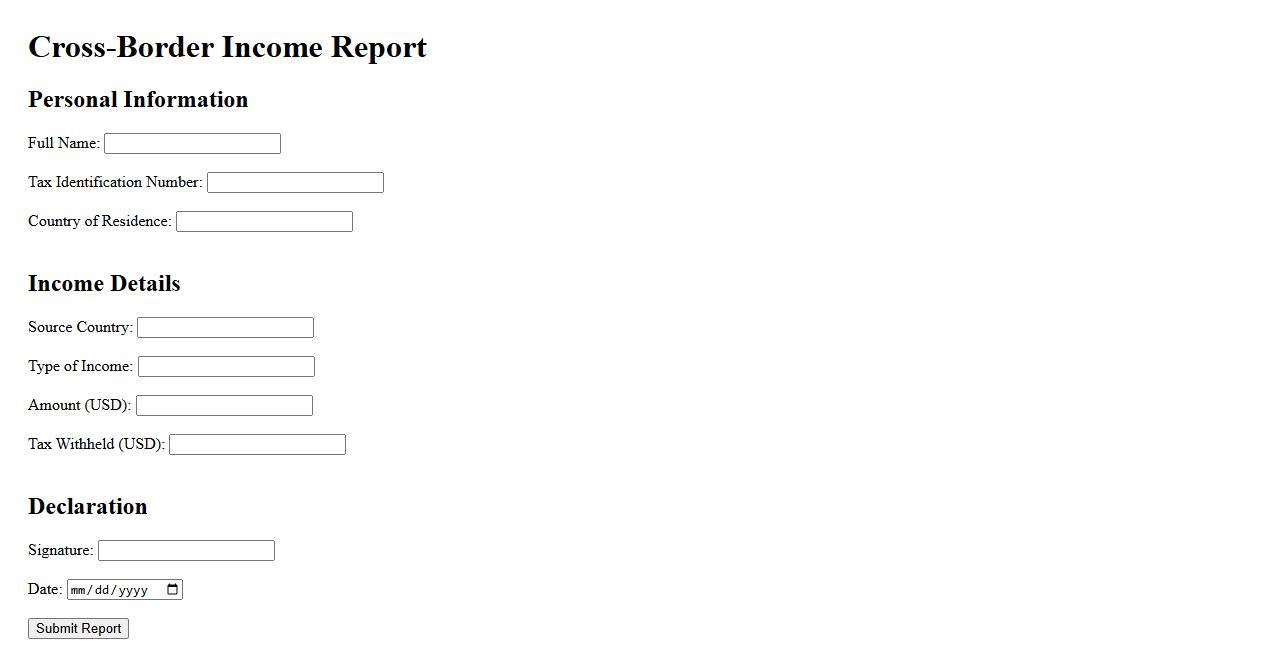

Cross-Border Income Report

The Cross-Border Income Report provides a comprehensive analysis of income generated across different countries, helping businesses and individuals understand international revenue streams. It highlights key trends, tax implications, and compliance requirements for multinational income. This report is essential for strategic financial planning in global markets.

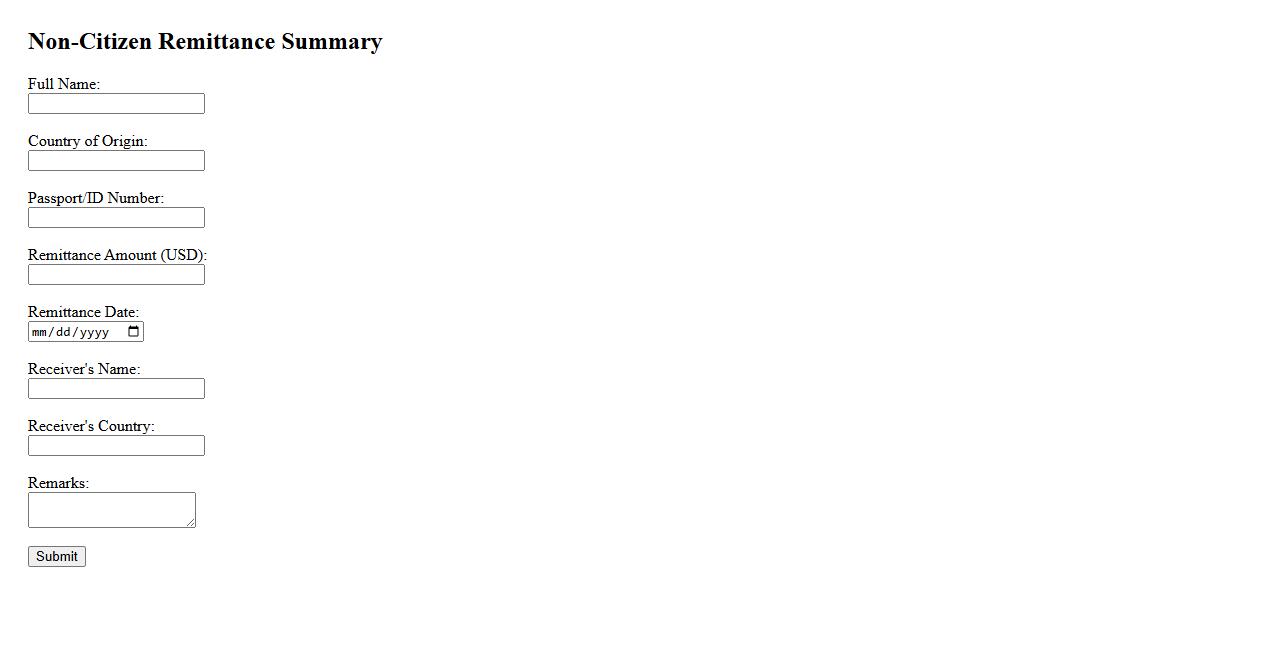

Non-Citizen Remittance Summary

The Non-Citizen Remittance Summary provides a detailed overview of funds sent by non-citizens. It helps track international transactions for compliance and financial management. This summary ensures transparent and accurate reporting of remittance activities.

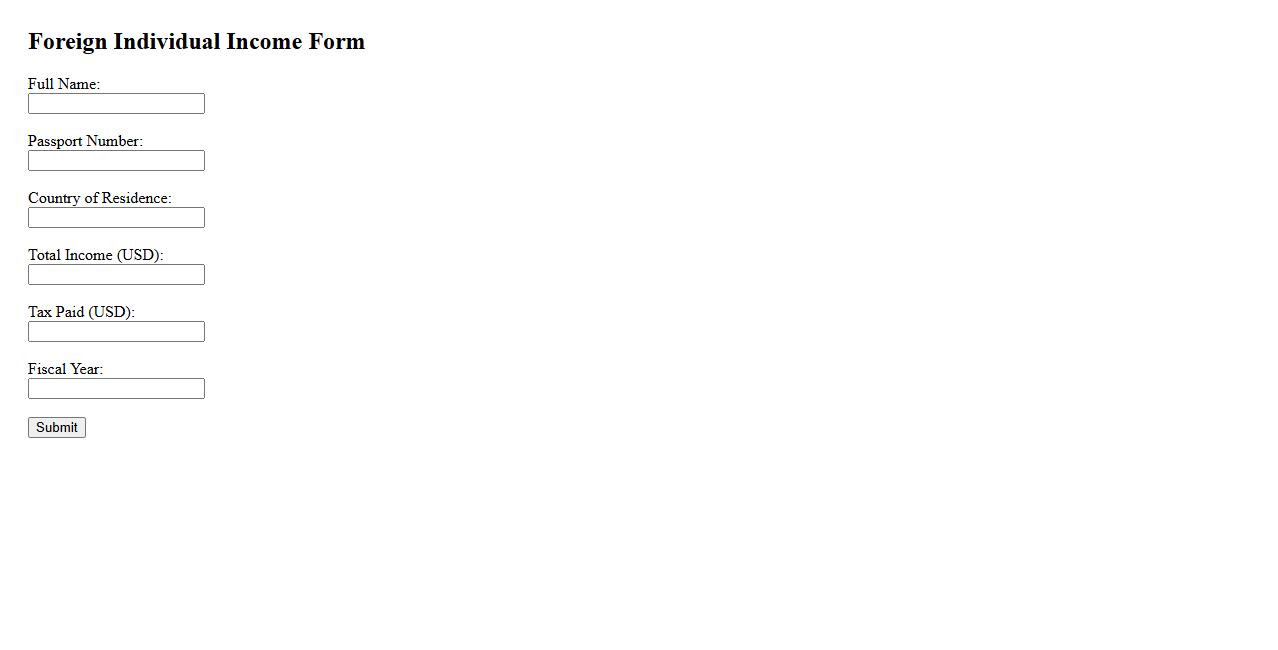

Foreign Individual Income Form

The Foreign Individual Income Form is a crucial document used by non-resident individuals to report income earned within a foreign jurisdiction. This form ensures proper tax compliance and helps avoid legal complications. Accurate completion of this form supports transparent financial reporting for international taxpayers.

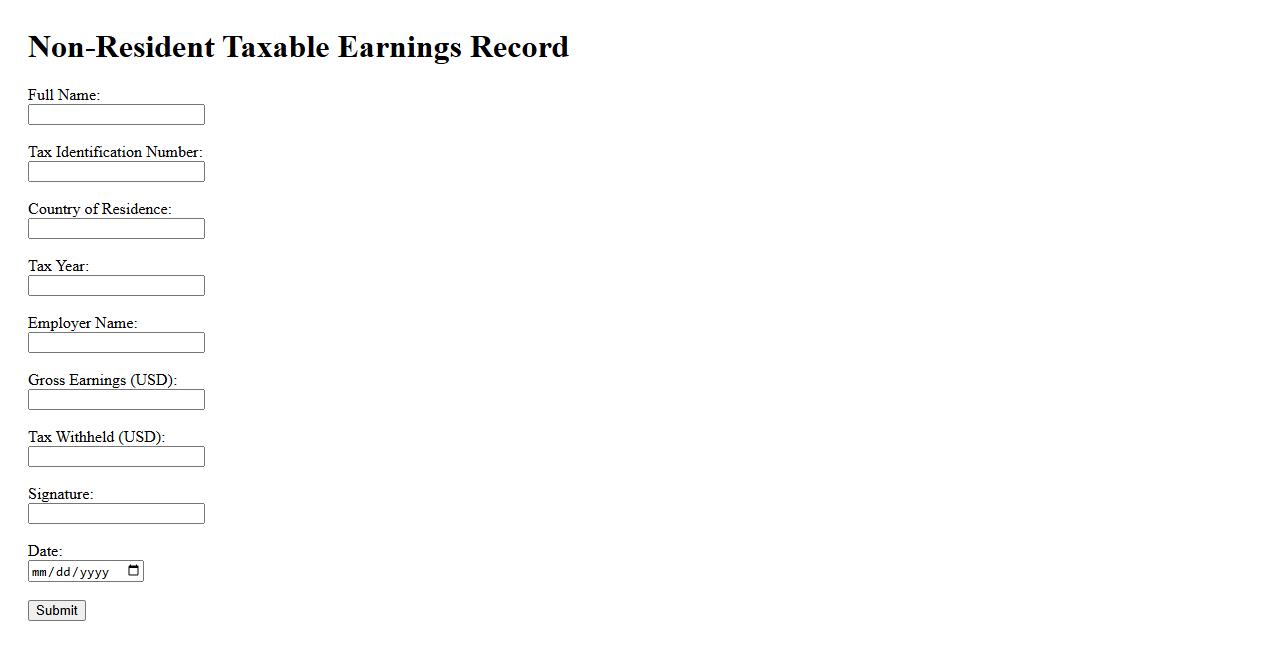

Non-Resident Taxable Earnings Record

The Non-Resident Taxable Earnings Record tracks income earned by individuals who are not residents for tax purposes. This document ensures proper reporting and compliance with tax regulations. It is essential for accurate tax withholding and filing obligations.

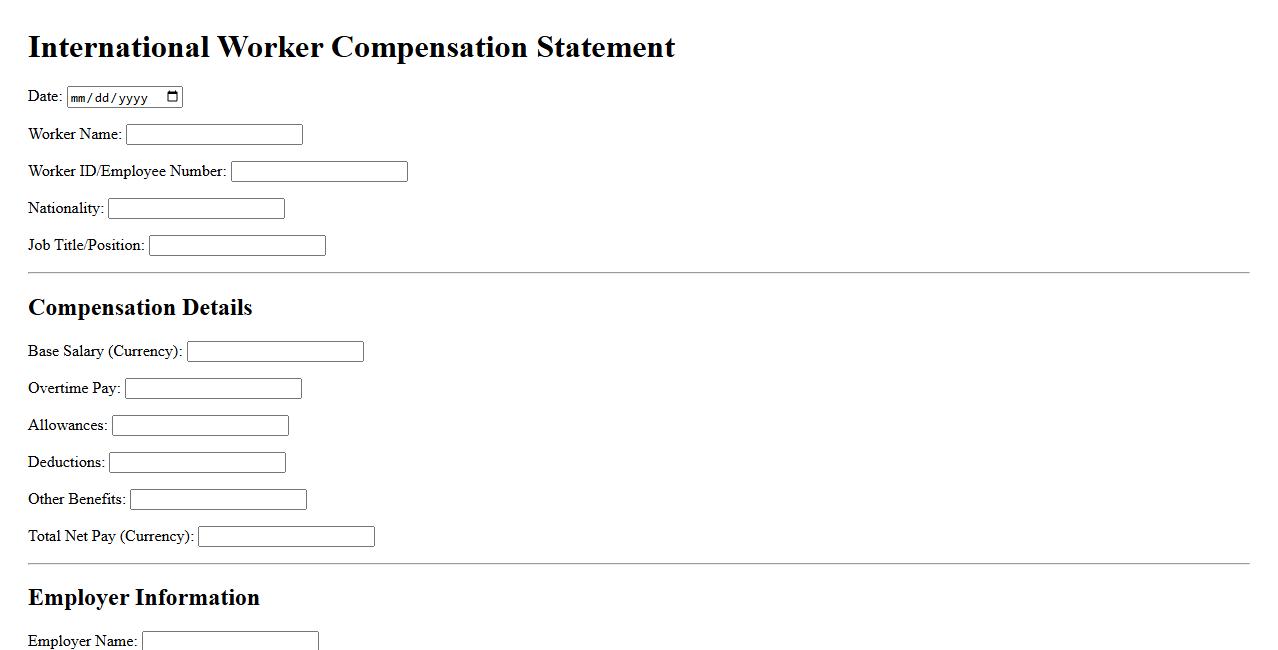

International Worker Compensation Statement

The International Worker Compensation Statement outlines the rights and protections for employees working abroad, ensuring they receive appropriate benefits regardless of location. It covers details on insurance, wages, and workplace safety standards applicable in various countries. This statement is essential for multinational companies and expatriate workers to understand their compensation entitlements globally.

What types of income should be reported by a non-resident alien on the Report of Non-Resident Alien Income?

Non-resident aliens must report all U.S. source income on the Report of Non-Resident Alien Income. This includes wages, salaries, interest, dividends, and rental income derived from the United States. Additionally, income from any trade or business conducted within the U.S. must also be included.

Which IRS forms are commonly used for reporting non-resident alien income?

The IRS Form 1040-NR is the primary form used by non-resident aliens to report income. For withholding purposes, Form W-8BEN is commonly submitted to certify foreign status and claim tax treaty benefits. Additionally, Form 8233 is used to claim exemption from withholding on compensation for independent personal services.

What is the definition of "effectively connected income" for non-resident aliens?

Effectively connected income (ECI) refers to income that is connected with the active conduct of a trade or business within the United States. This income includes earnings from services performed, business profits, rents, and royalties associated with a U.S. business. ECI is subject to U.S. taxation at graduated rates applicable to residents.

How are tax withholding requirements determined for non-resident alien income?

Tax withholding requirements depend on the type of income and whether it is effectively connected with a U.S. trade or business. Generally, a flat withholding rate of 30% applies to non-effectively connected income unless a tax treaty stipulates a lower rate. For effectively connected income, withholding follows graduated tax rates and payroll withholding requirements.

What documentation is required to substantiate non-resident alien status for income reporting?

Non-resident aliens must provide documentation such as a valid visa, I-94 arrival/departure record, and passport to verify status. Form W-8BEN is often required to certify foreign status for withholding purposes. Additionally, supporting documents may include tax treaty certificates and state residency proofs, ensuring proper tax treatment and withholding.