Registration for Securities Offering is a critical process that involves filing necessary documents with regulatory authorities to ensure compliance with securities laws. This process provides transparency, protecting investors by disclosing relevant financial and business information about the offering. Proper registration facilitates legal sale and distribution of securities within established markets.

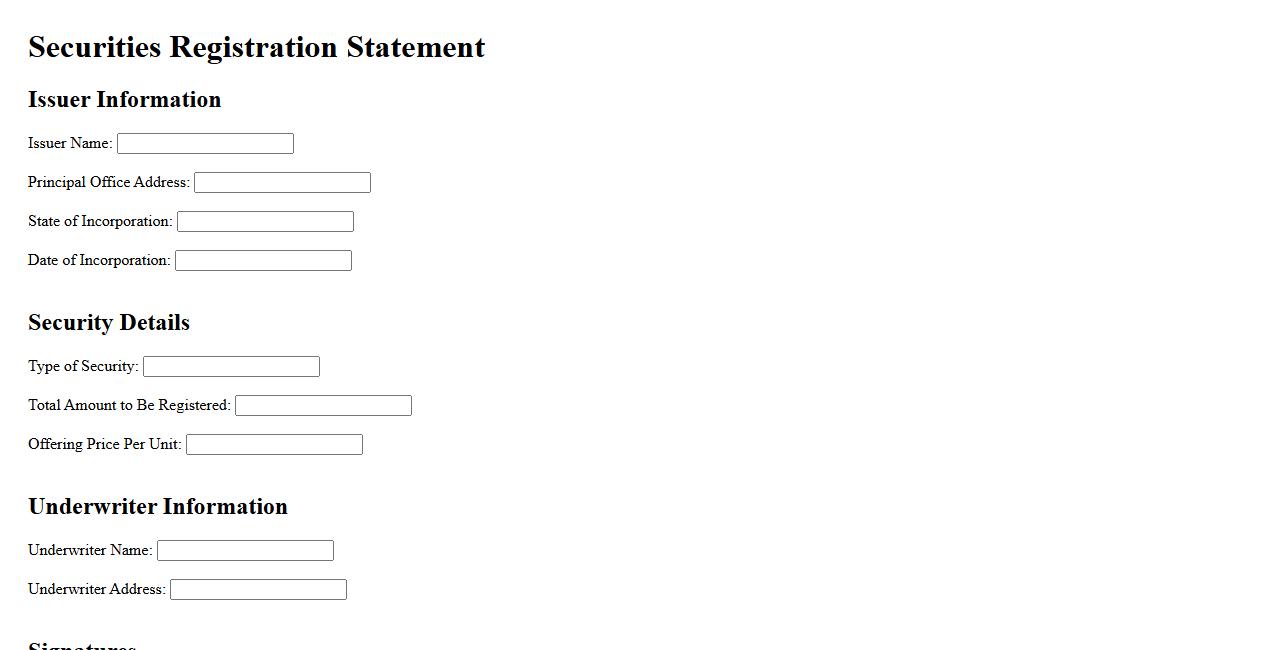

Securities Registration Statement

A Securities Registration Statement is a legal document filed with regulatory authorities, detailing important information about a company's securities offering. It ensures transparency for investors by providing comprehensive data on financials, management, and risks. This document is essential for complying with securities laws before public sales.

Prospectus Filing

The Prospectus Filing is a crucial document submitted to regulatory authorities to provide detailed information about a company's securities offering. It ensures transparency for potential investors by disclosing financial data, risks, and business plans. Filing a prospectus is mandatory for compliance with securities laws and investor protection.

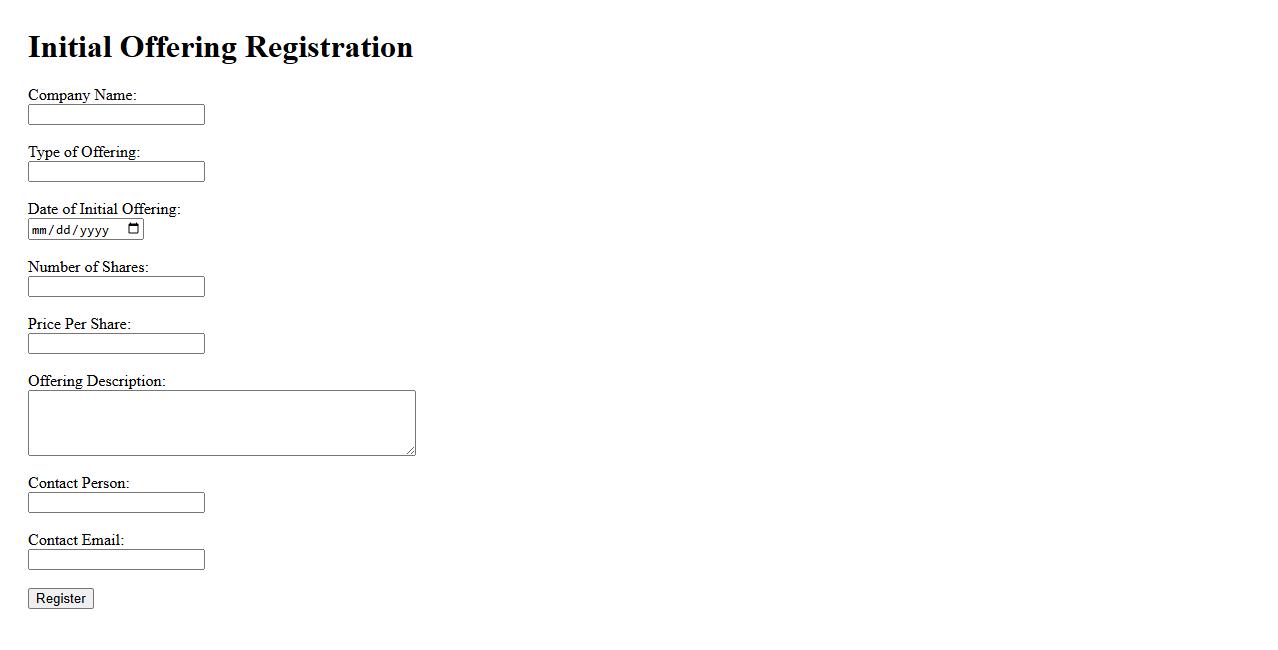

Initial Offering Registration

Initial Offering Registration is the formal process by which a company registers its securities with regulatory authorities before making them available to the public. This procedure ensures compliance with legal requirements and provides transparency to potential investors. Successful registration is essential for a company to proceed with its public offering.

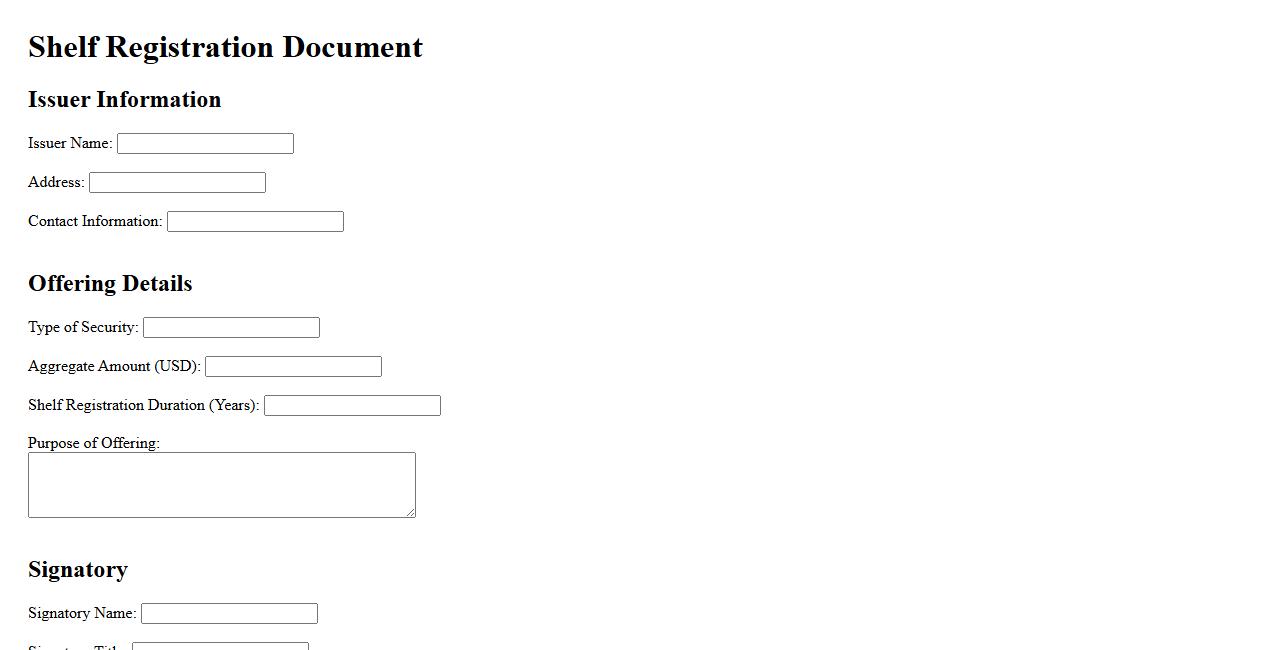

Shelf Registration Document

The Shelf Registration Document is a regulatory filing that allows companies to register a new issue of securities without having to sell the entire issue at once. This document enables issuers to offer and sell securities over a specified period, providing flexibility and efficiency in capital raising. It is commonly used by public companies to streamline future offerings.

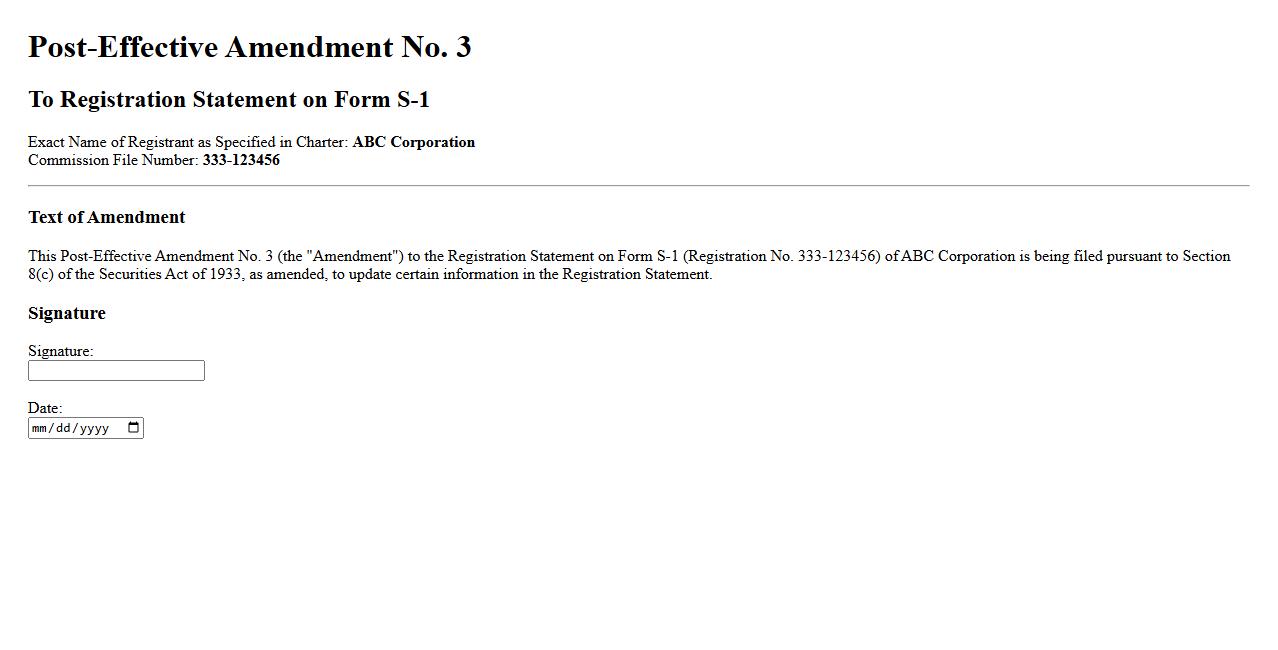

Post-Effective Amendment

A Post-Effective Amendment is a filing submitted to update or correct information in a registration statement after it has become effective. It ensures that the document remains accurate and compliant with regulatory requirements. This amendment is crucial for maintaining transparency with investors and regulatory bodies.

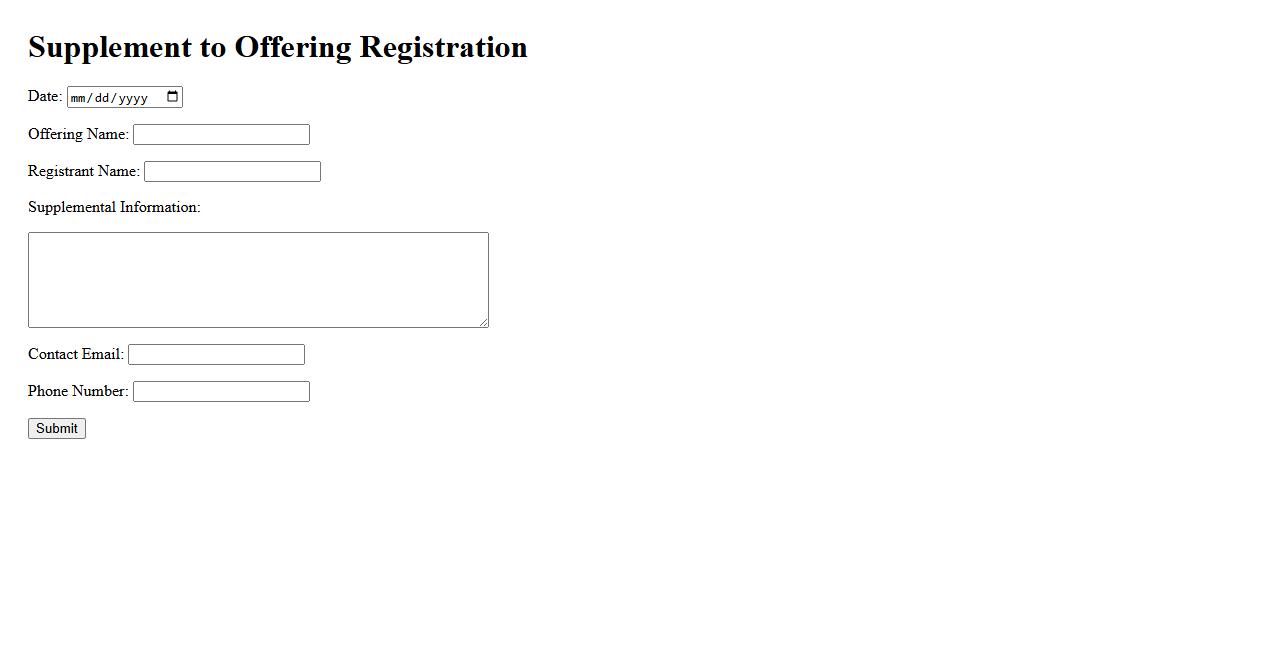

Supplement to Offering Registration

Supplement to Offering Registration provides updated information about a security offering after the initial registration statement has been filed. This supplement ensures that all material changes or new facts are disclosed to investors. It helps maintain transparency and compliance with regulatory requirements.

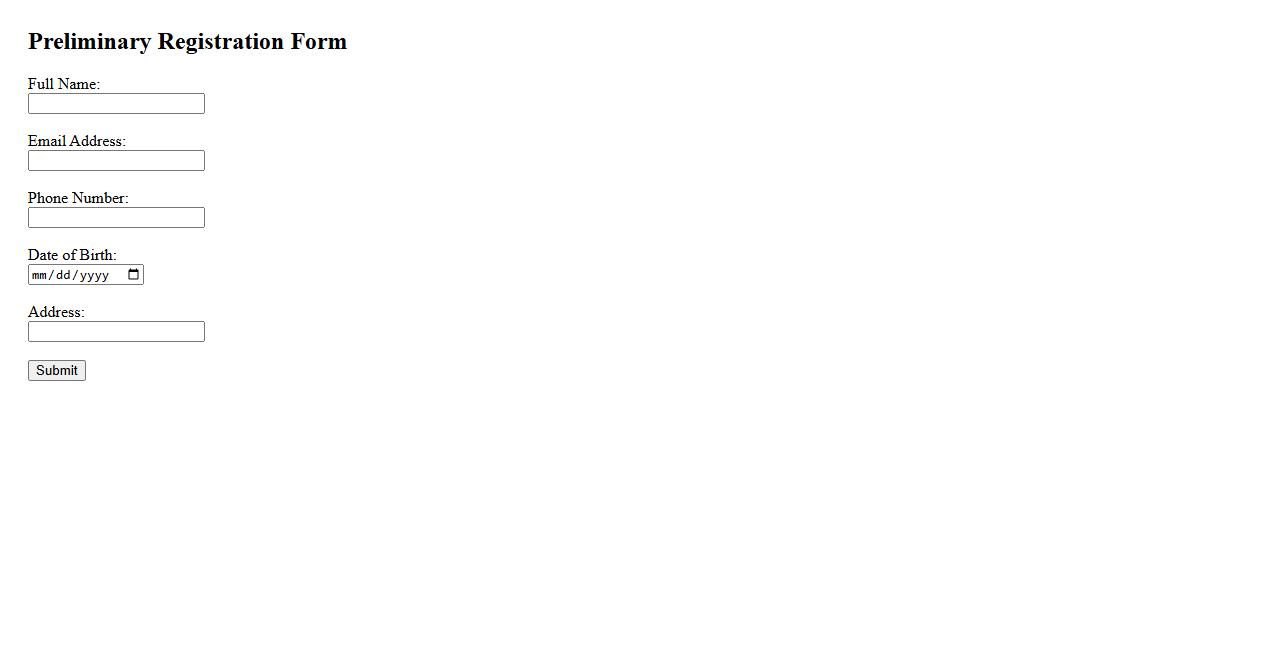

Preliminary Registration Form

The Preliminary Registration Form serves as the initial step for participants to provide essential information before fully enrolling in an event or program. This form helps organizers collect basic details efficiently to streamline the registration process. Submitting this form early ensures reserved spots and timely communication.

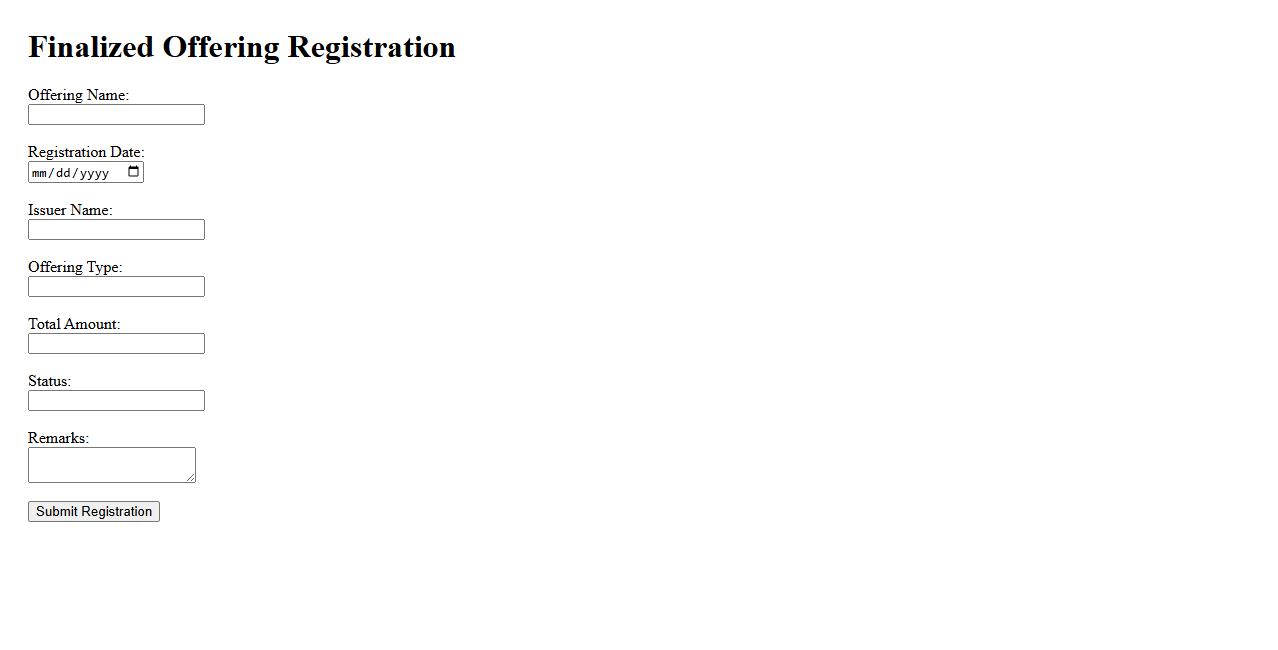

Finalized Offering Registration

The Finalized Offering Registration marks the official completion of the regulatory process for a securities offering. This step confirms that all necessary filings and disclosures have been reviewed and approved by the relevant authorities. It ensures the offering complies with legal requirements and is ready for public distribution.

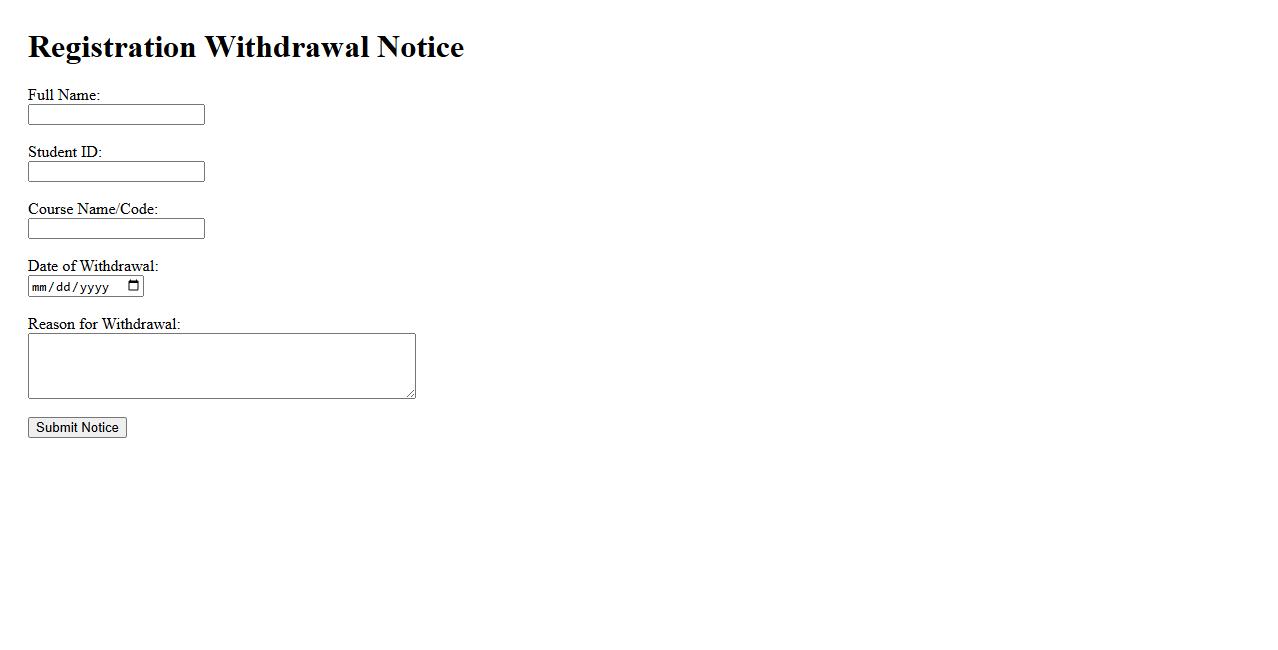

Registration Withdrawal Notice

If you need to cancel your enrollment, please submit a Registration Withdrawal Notice as soon as possible. This notice helps process your withdrawal efficiently and avoid any unnecessary charges. Make sure to follow the institution's guidelines for timely submission.

Registration Renewal Form

The Registration Renewal Form is essential for updating your current registration details with the relevant authority. This form ensures uninterrupted service and compliance by verifying and renewing your registration information. Timely submission of the form helps avoid penalties and maintains your active status.

What is the purpose of registering securities before an offering to the public?

The primary purpose of registering securities is to ensure transparency and provide essential information to the public. This process helps investors make informed decisions by requiring issuers to disclose their financial condition and risks. Registration also enforces regulatory standards designed to protect the integrity of the securities market.

Which documents are typically required for a securities registration statement?

A securities registration statement commonly includes a prospectus and detailed financial statements. It also requires information on the issuer's business, management, and any material risks. These documents collectively provide a comprehensive overview of the offering and the company's financial health.

What exemptions exist that may allow an issuer to avoid registration for a securities offering?

Certain exemptions from registration exist to facilitate capital raising without the full regulatory burden. Common exemptions include private placements, offerings to accredited investors, and intrastate offerings. These provisions aim to balance investor protection with market efficiency.

How does the registration process protect potential investors in a securities offering?

The registration process protects investors by mandating full disclosure of material facts and financial information. It reduces the risk of fraud by requiring transparency and compliance with securities laws. This process ensures investors have access to the data necessary to evaluate investment risks accurately.

What key disclosures must be included in a securities registration filing?

Key disclosures in a registration filing include the issuer's financial statements, risk factors, management discussion, and details of the securities being offered. Additionally, any legal proceedings and related-party transactions must be disclosed. These elements provide a clear and thorough perspective of the investment opportunity.