An invoice for Virtual Assistant outlines the services provided, including the hours worked and the agreed hourly rate or project fee. It serves as a formal request for payment, detailing the tasks completed, payment terms, and contact information. Proper documentation ensures clarity and professionalism in financial transactions between virtual assistants and their clients.

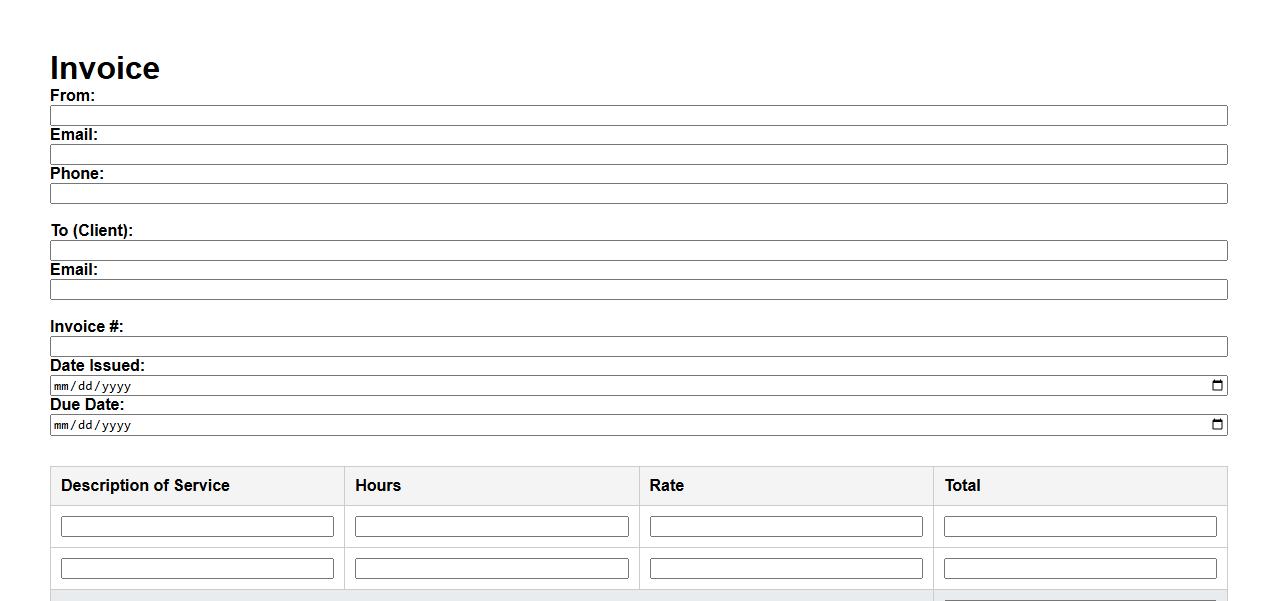

Freelance Virtual Assistant Invoice

A Freelance Virtual Assistant Invoice is a professional document used to request payment for services rendered by a virtual assistant. It details the tasks completed, hours worked, and the agreed-upon rates to ensure clear communication between the freelancer and client. Proper invoicing helps maintain organized finances and ensures timely compensation.

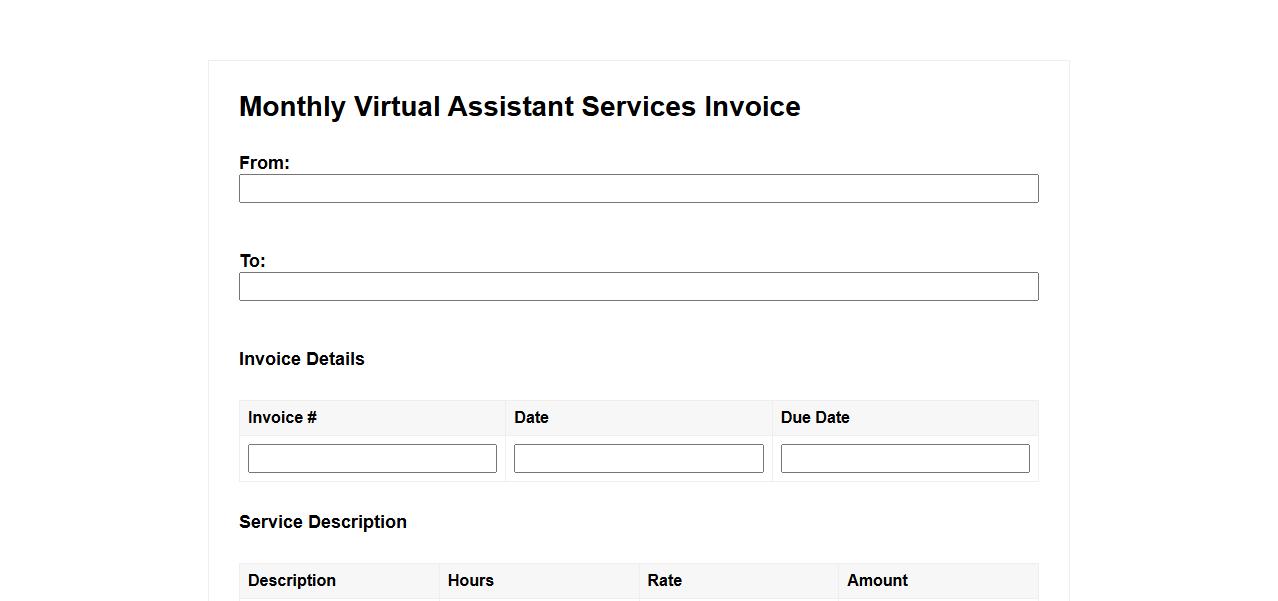

Monthly Virtual Assistant Services Invoice

The Monthly Virtual Assistant Services Invoice provides a detailed summary of all tasks completed and hours billed within the month. It ensures transparent communication between clients and virtual assistants regarding payments. This invoice facilitates timely and accurate financial transactions for ongoing support services.

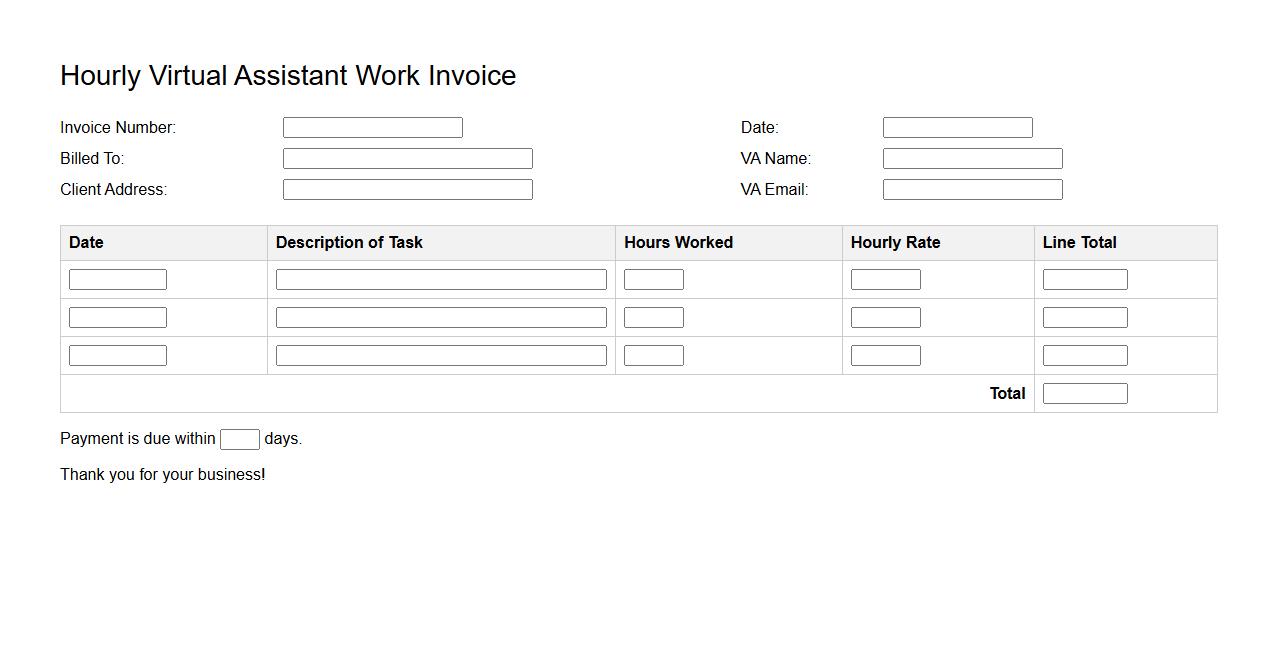

Hourly Virtual Assistant Work Invoice

The Hourly Virtual Assistant Work Invoice is a detailed document that outlines the hours worked and services provided by a virtual assistant. It ensures clear communication between the assistant and client regarding payment. This invoice helps streamline billing and maintains accurate financial records.

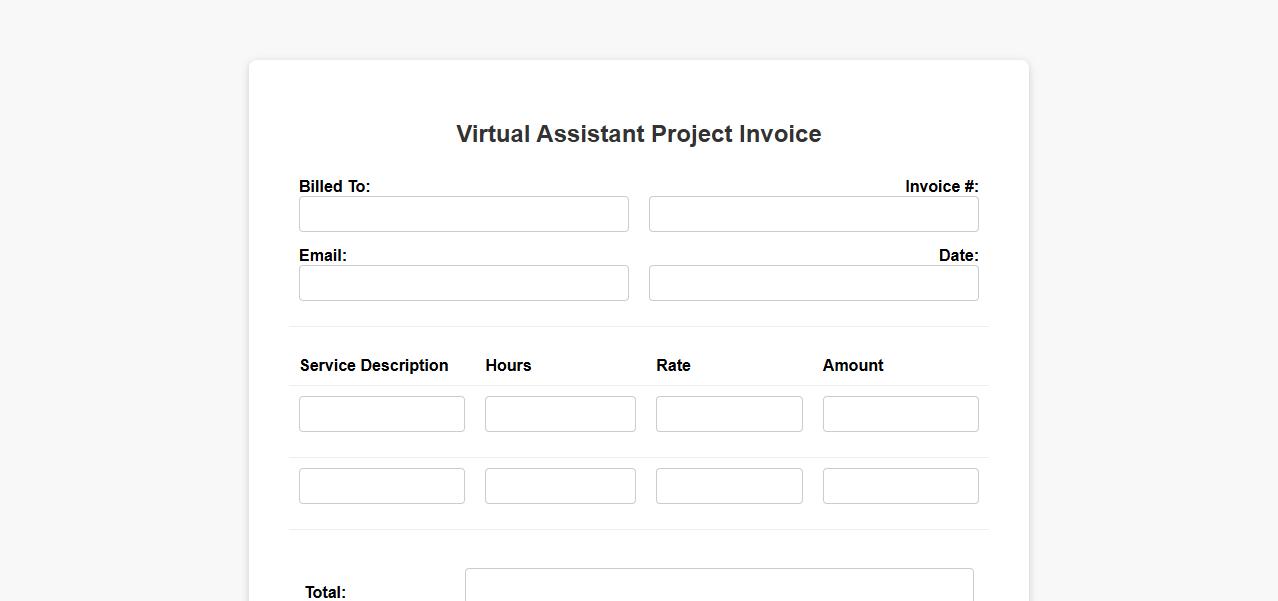

Virtual Assistant Project Invoice

An Virtual Assistant Project Invoice details the services provided by a virtual assistant, including task descriptions and hours worked. It ensures clear communication between the assistant and client for timely payments. This document is essential for maintaining accurate financial records and professional accountability.

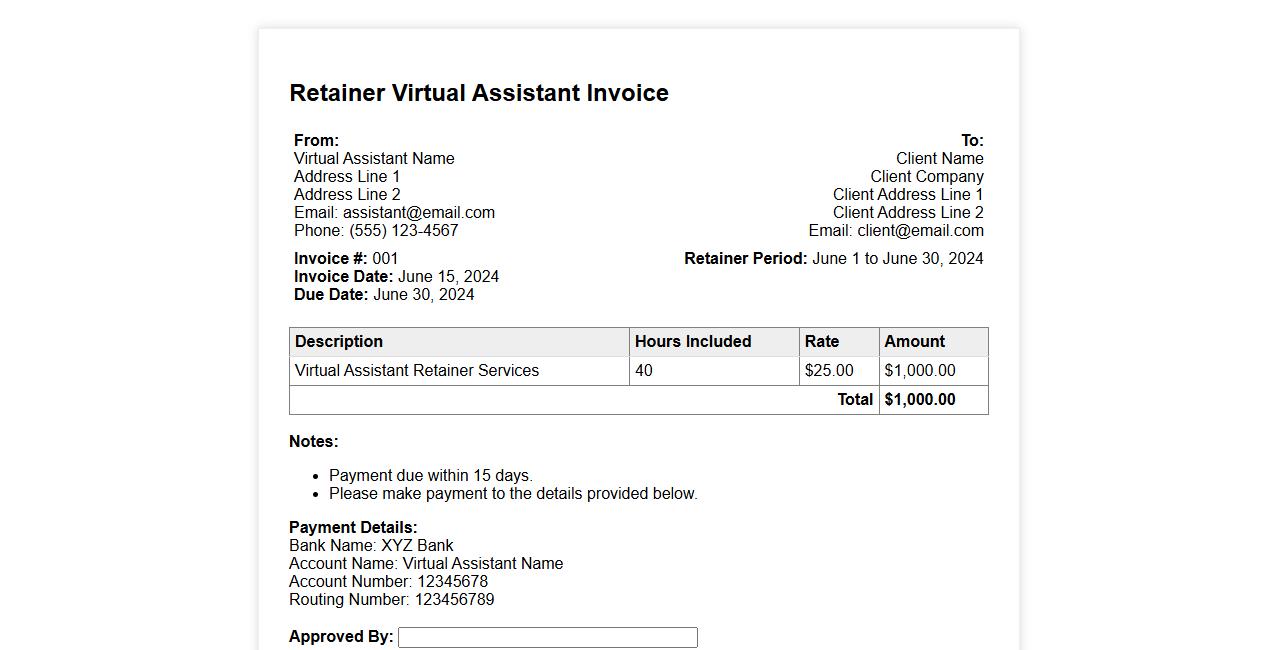

Retainer Virtual Assistant Invoice

A Retainer Virtual Assistant Invoice is a document used to bill clients for ongoing virtual assistant services provided on a retainer basis. It details the agreed-upon fee, service period, and tasks completed. This invoice ensures clear communication and timely payment for continuous support.

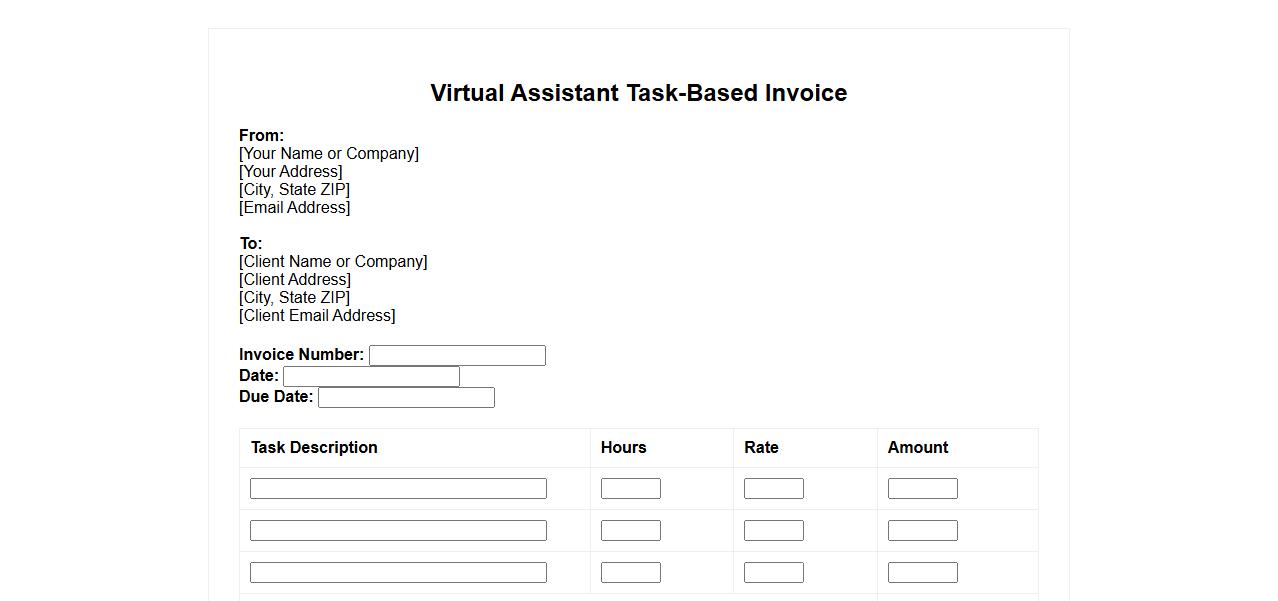

Virtual Assistant Task-Based Invoice

A Virtual Assistant Task-Based Invoice outlines the specific tasks completed by a virtual assistant along with their corresponding charges. This invoice format helps both clients and assistants track payments based on individual assignments rather than hourly rates. It ensures transparency and precise billing for task-oriented services.

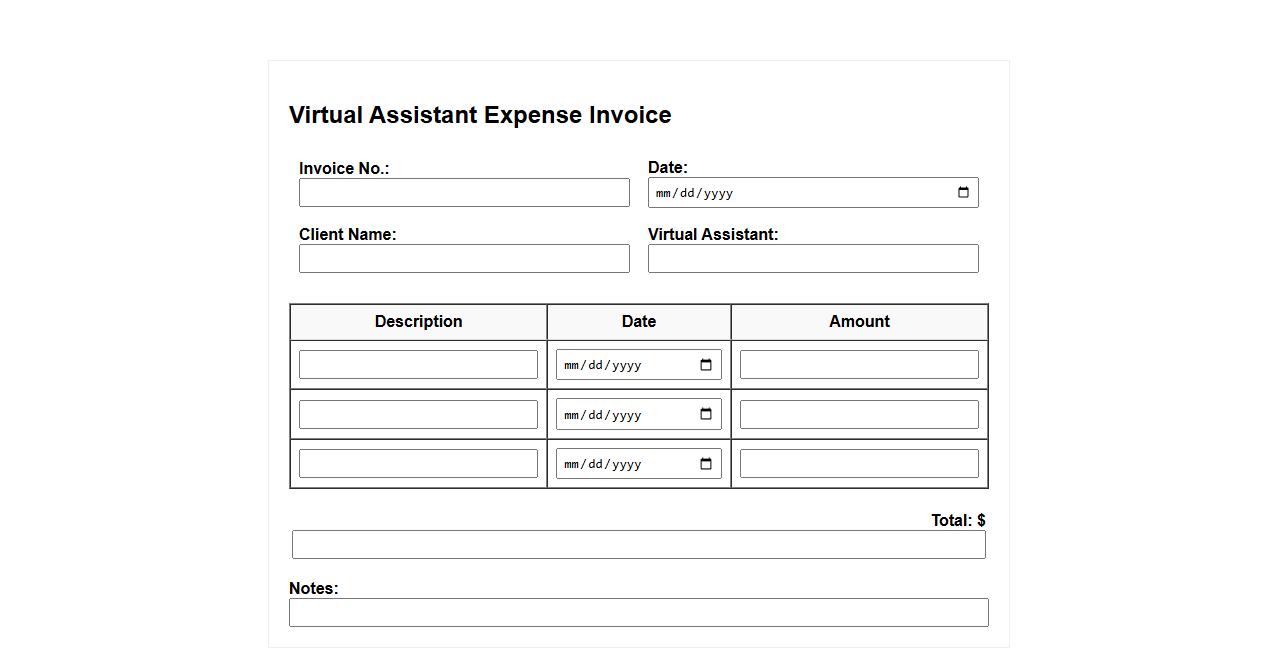

Virtual Assistant Expense Invoice

An invoice for Virtual Assistant expenses details the costs incurred for administrative and support services provided remotely. It itemizes tasks completed, hours worked, and associated fees, ensuring clear financial documentation. This Virtual Assistant Expense Invoice aids in transparent billing and efficient budget management.

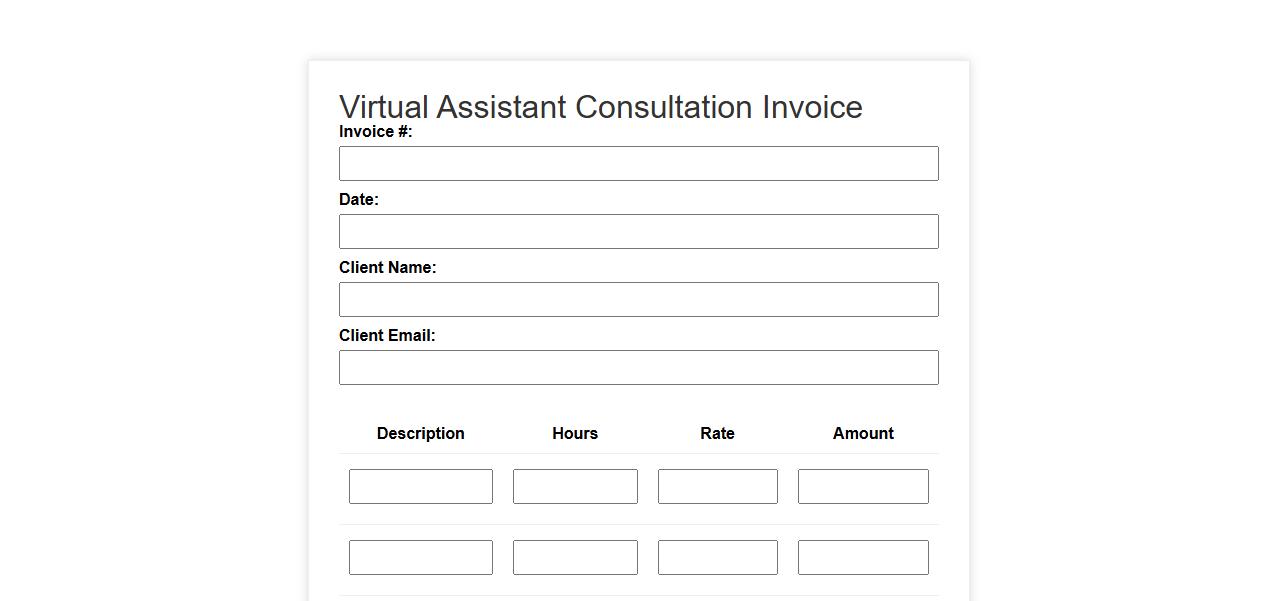

Virtual Assistant Consultation Invoice

This Virtual Assistant Consultation Invoice provides a detailed summary of services rendered and payment terms for virtual assistant sessions. It ensures clear communication between the consultant and client regarding charges and billing dates. Proper invoicing helps maintain organized financial records and prompt payments.

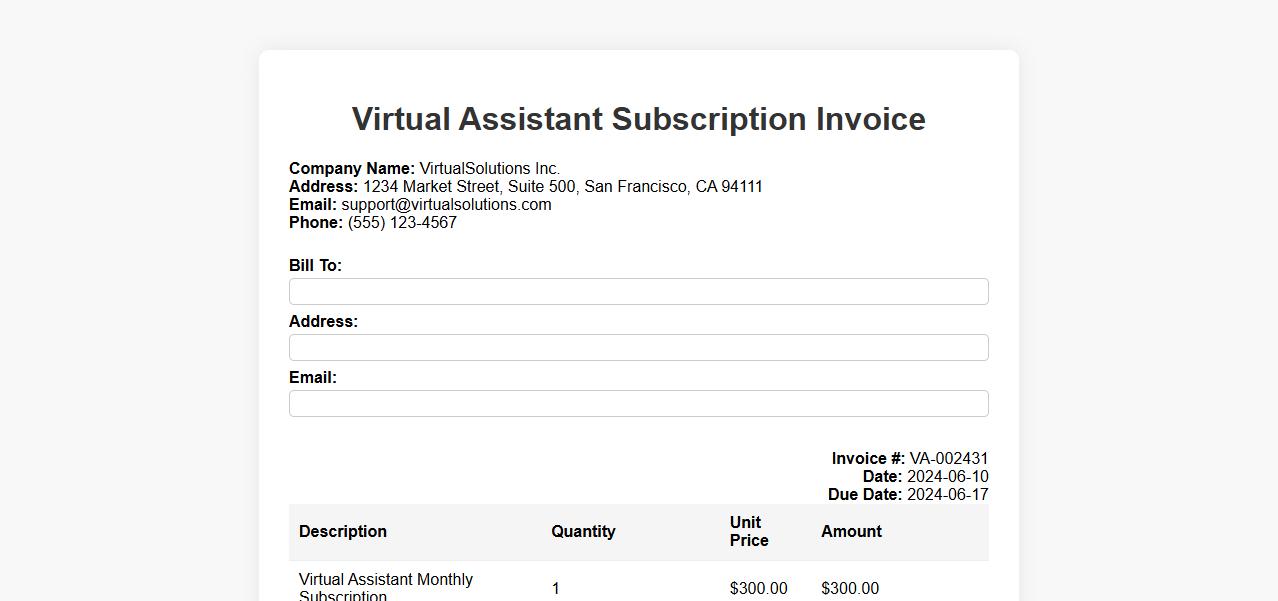

Virtual Assistant Subscription Invoice

The Virtual Assistant Subscription Invoice provides a clear and detailed record of monthly service charges for virtual assistant support. It ensures transparency by itemizing tasks and subscription fees, facilitating seamless payment processing. This invoice helps both businesses and clients maintain organized financial documentation.

Virtual Assistant Time Tracking Invoice

Virtual Assistant Time Tracking Invoice is an essential tool for accurately recording hours worked and streamlining billing processes. It helps virtual assistants monitor their time efficiently while providing clients with clear, detailed invoices. This system ensures transparency and simplifies payment management for both parties.

What essential details must an invoice for a Virtual Assistant include?

An invoice for a Virtual Assistant must include the freelancer's name and contact information clearly stated at the top. It should also have a unique invoice number and the date of issue for proper tracking. Including the client's information and a detailed description of the services rendered is crucial.

How should hours worked and rates be clearly documented on the invoice?

The invoice must list hours worked alongside the agreed hourly rate in a clear tabular format. Each task or time period worked should be itemized to enhance transparency. Calculating the total amount due by multiplying hours by rates helps avoid confusion.

What payment terms and methods are commonly specified for Virtual Assistant invoices?

Commonly, invoices specify payment terms such as net 15 or net 30 days from the invoice date. Accepted payment methods like bank transfer, PayPal, or credit cards should be clearly mentioned to facilitate smooth transactions. Late payment fees or discounts for early payment may also be included.

How is a client's identity and project description represented in the invoice?

The client's name and contact details appear prominently to ensure accurate billing. A concise project description or list of completed tasks provides context on the services provided. This alignment aids in client satisfaction and reduces the risk of disputes.

What legal or tax information should accompany a Virtual Assistant invoice?

An invoice should include the Virtual Assistant's tax identification number or VAT number where applicable for legal compliance. Including any applicable tax rates and the total amount inclusive of taxes is necessary. A statement about business registration or invoicing authority can add legitimacy.