The Declaration of Income is a formal statement detailing an individual's or entity's earnings over a specific period. It is essential for taxation purposes, ensuring compliance with financial regulations. Accurate reporting in the Declaration of Income helps determine tax liabilities and eligibility for deductions or credits.

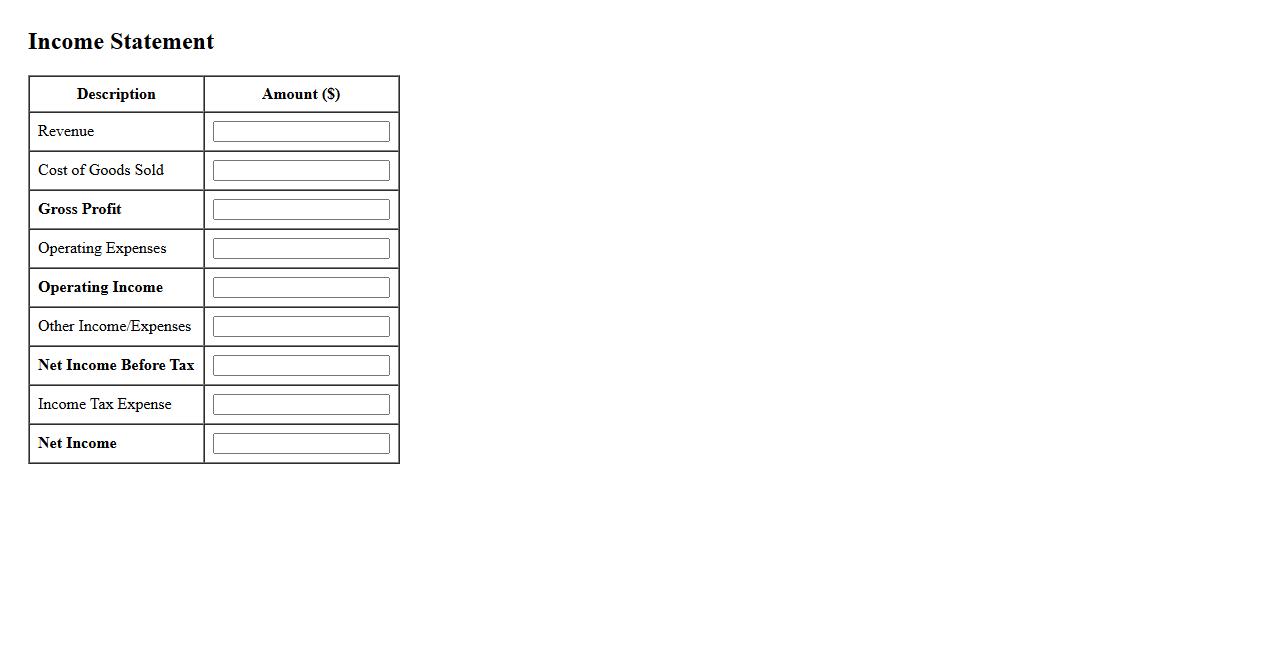

Income Statement

The Income Statement is a fundamental financial document that summarizes a company's revenues and expenses over a specific period. It provides insight into the organization's profitability by showing net income or loss. This statement is essential for investors, management, and stakeholders to assess financial performance.

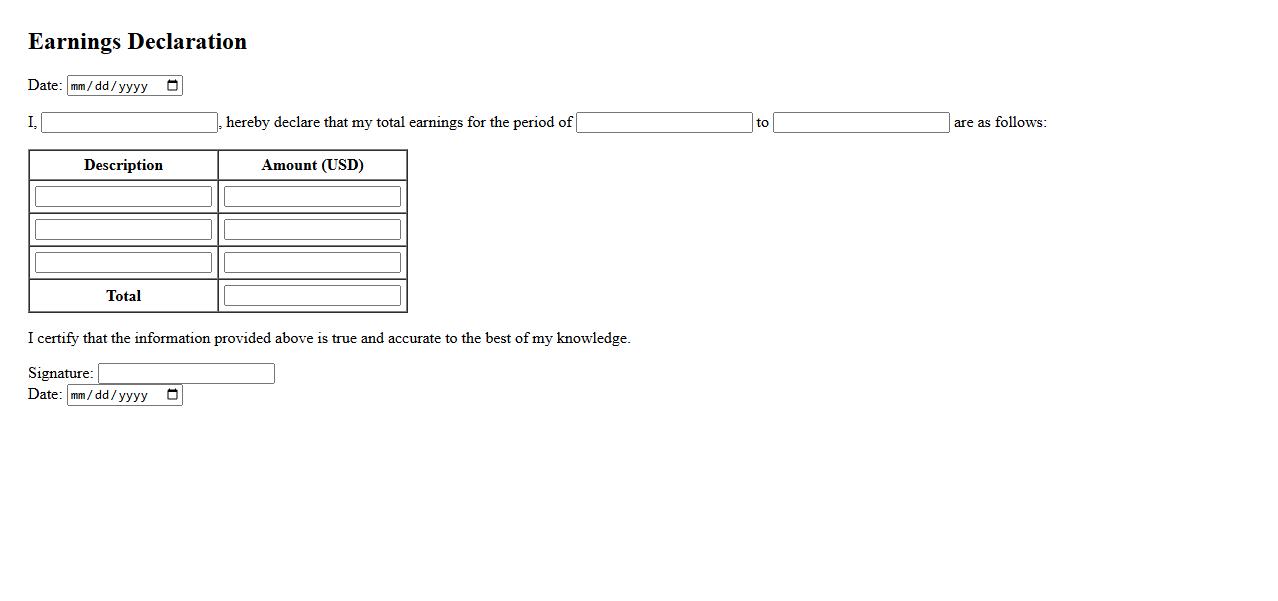

Earnings Declaration

The earnings declaration is a formal announcement made by a company regarding its financial performance over a specific period. It provides key details such as net income, revenue, and earnings per share, offering valuable insights to investors and stakeholders. Timely earnings declarations help maintain transparency and influence market confidence.

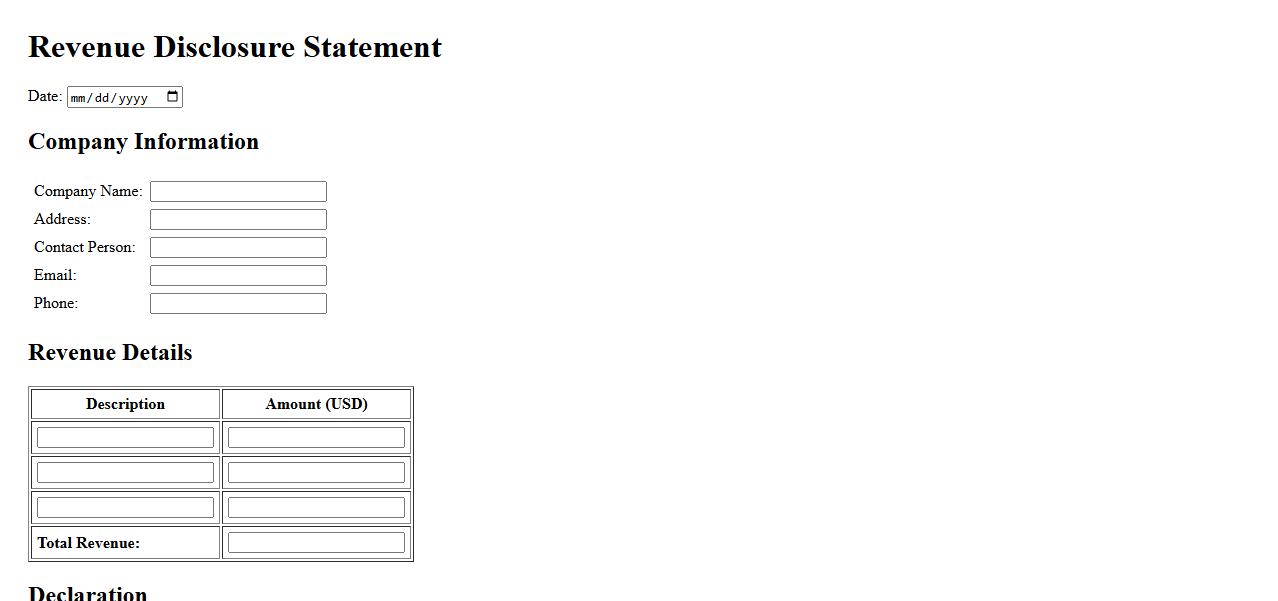

Revenue Disclosure

Revenue Disclosure refers to the transparent reporting of a company's income generated from its business activities. It is essential for providing stakeholders with accurate financial information to assess the organization's performance and profitability. Clear revenue disclosure enhances trust and supports informed decision-making.

Wage Confirmation

Wage Confirmation is the process of verifying an individual's income through official documents or employer statements. This ensures accuracy and legitimacy for purposes such as loan applications, rental agreements, or financial assessments. Reliable wage confirmation helps maintain transparency and trust between parties involved.

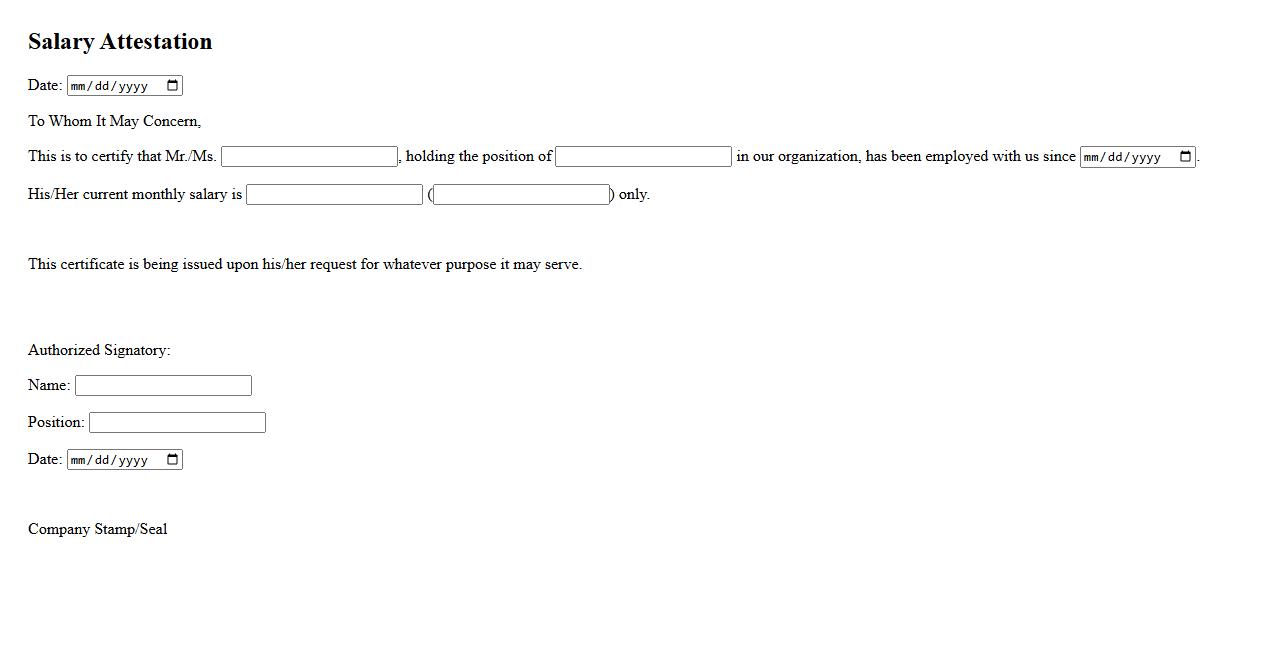

Salary Attestation

Salary attestation is an official document provided by an employer confirming an employee's income details. It serves as proof of salary for various purposes such as loan applications, visa processing, and rental agreements. This certificate ensures the authenticity of the employee's earnings and employment status.

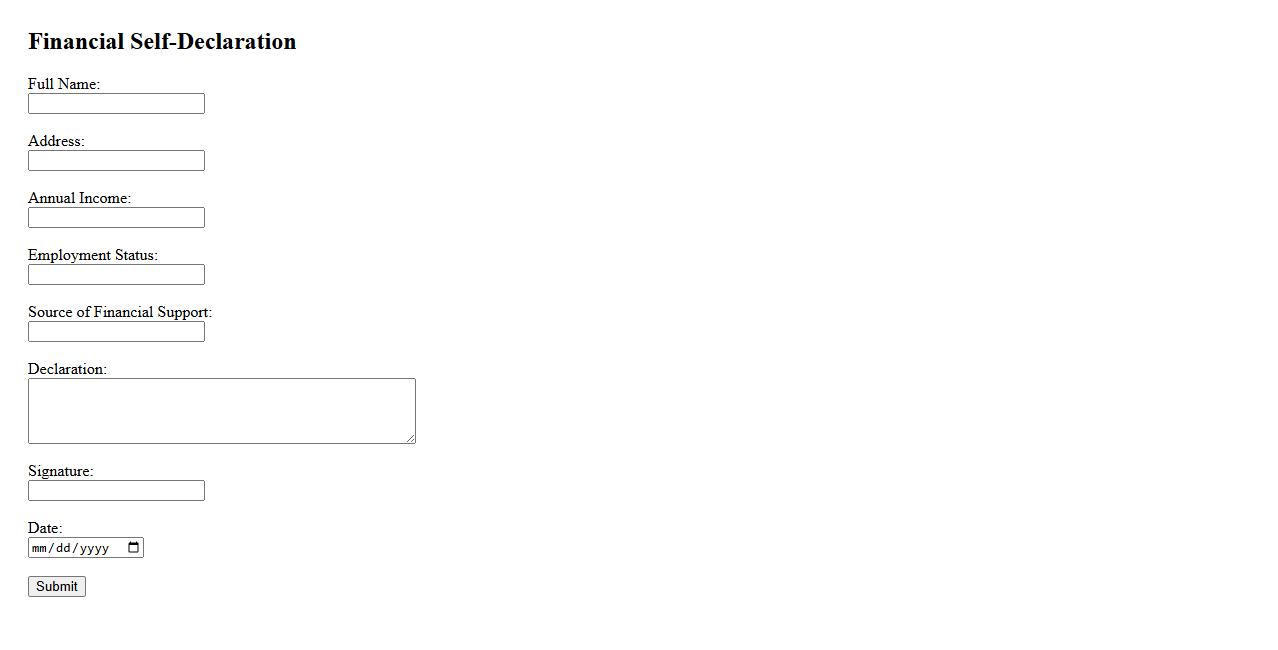

Financial Self-Declaration

A Financial Self-Declaration is a personal statement detailing an individual's income, assets, and liabilities. It is used to provide transparent and accurate financial information for various applications. This document helps institutions assess financial stability and eligibility effectively.

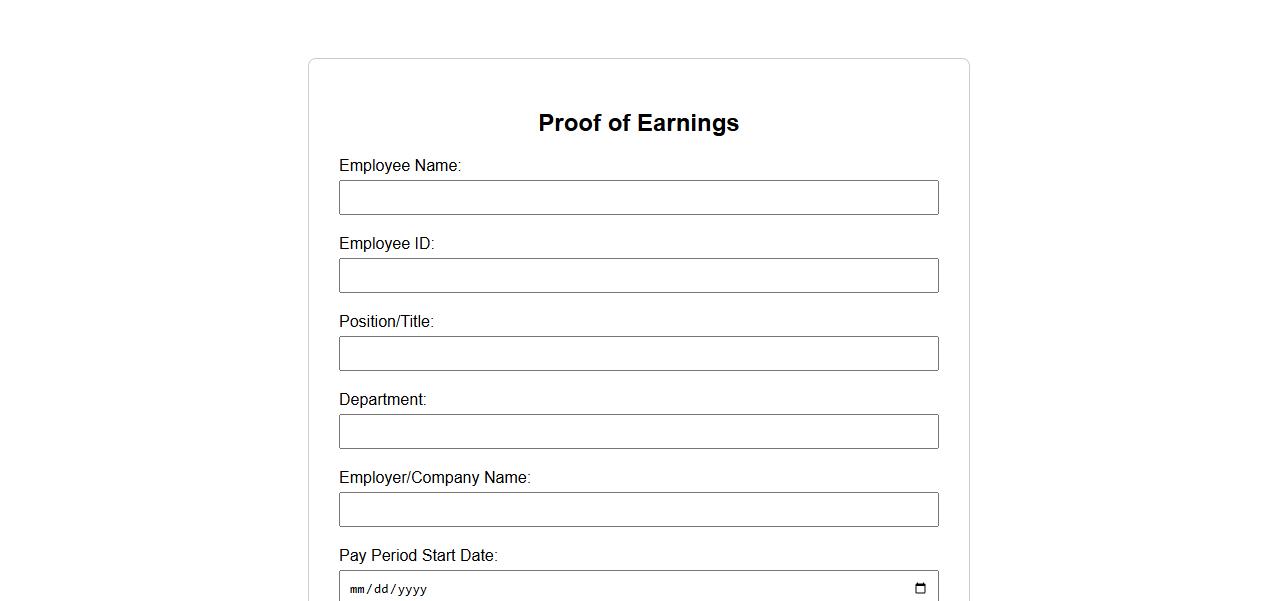

Proof of Earnings

Proof of Earnings is a crucial document that verifies an individual's income. It is commonly required for loan applications, rental agreements, and financial assessments. Reliable proof ensures transparency and trust in financial transactions.

Income Verification Form

The Income Verification Form is a crucial document used to confirm an individual's earnings. It ensures lenders, landlords, or agencies have accurate financial information for decision-making. This form helps streamline the approval process by providing verifiable income details.

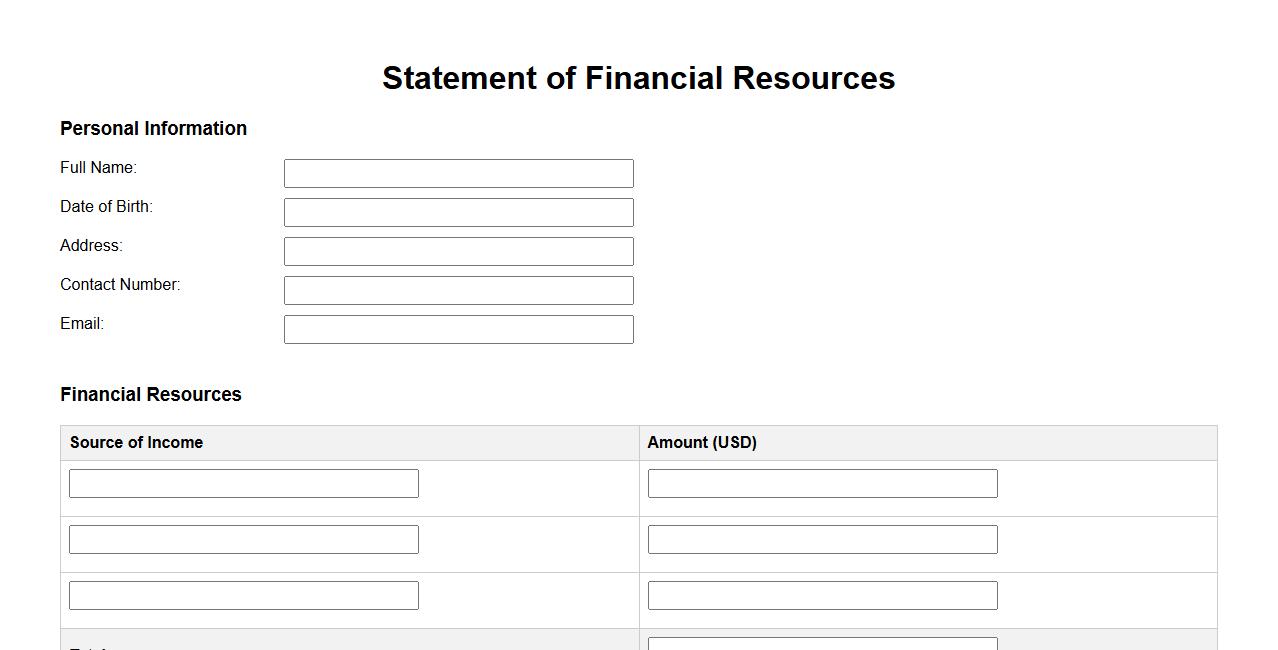

Statement of Financial Resources

The Statement of Financial Resources is a crucial document that outlines an individual's or organization's available assets and funds. It provides a clear overview of financial stability and liquidity. This statement is essential for budgeting, planning, and securing loans or investments.

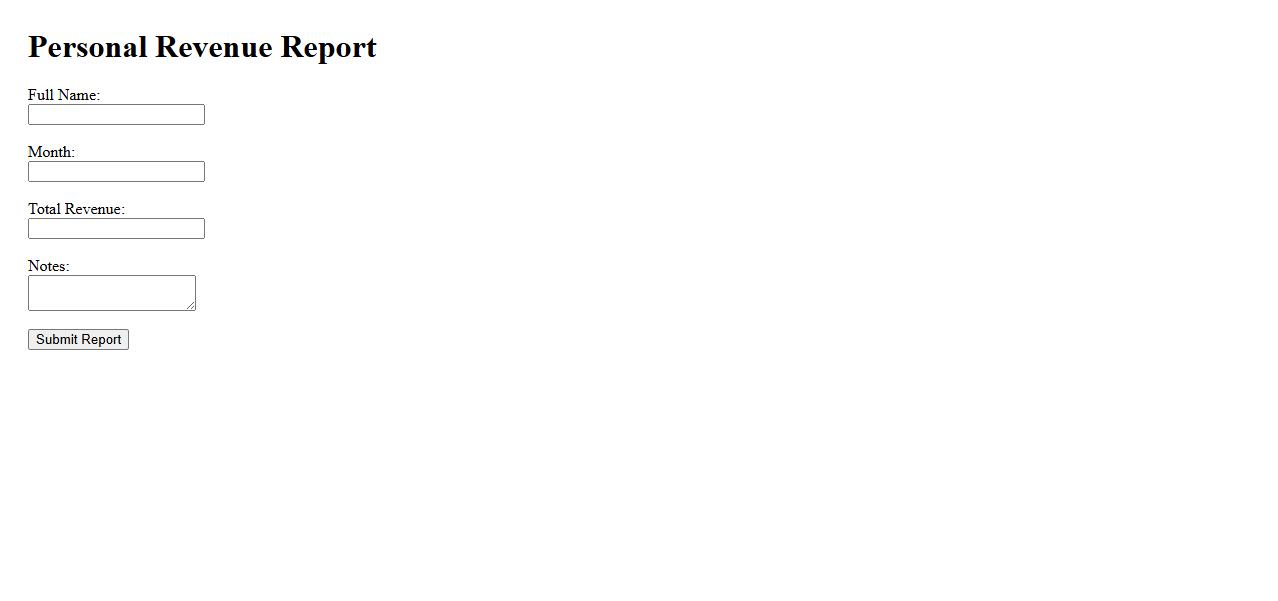

Personal Revenue Report

The Personal Revenue Report provides a detailed summary of your income sources and financial performance over a specified period. This report helps track earnings trends, identify key revenue drivers, and support informed decision-making for personal financial growth. Use it to gain clear insights and optimize your revenue strategies effectively.

What is the primary purpose of a Declaration of Income document?

The primary purpose of a Declaration of Income is to formally state an individual's or entity's earnings over a specific period. It serves as a transparent record for financial assessments and legal compliance. This document helps various institutions evaluate financial status efficiently.

Which essential details must be included in a valid Declaration of Income?

A valid Declaration of Income must include the full name of the declarant, the total amount of income earned, and the specific reporting period. It should also list sources of income and any relevant deductions or allowances. Accurate and complete details ensure the document's legitimacy and utility.

Who is authorized to issue and sign a Declaration of Income?

The Declaration of Income is typically issued and signed by the individual or entity declaring their earnings. In some cases, authorized representatives such as accountants or legal guardians may sign on behalf of the declarant. The signature confirms the authenticity and truthfulness of the declared information.

In which situations is a Declaration of Income typically required?

A Declaration of Income is often required for loan applications, government aid programs, and tax assessments. It serves as proof of financial capability in rental agreements or visa applications as well. This document is essential when verifiable income information is needed quickly.

How does a Declaration of Income differ from official tax documents?

A Declaration of Income is a self-reported statement and may not carry the same legal weight as official tax documents issued by tax authorities. Official tax documents are verified and certified, often used for formal tax filings and audits. Declarations provide a preliminary overview, whereas tax documents are legally binding records.