A Declaration of Income Source is a formal statement detailing the origins of an individual's or entity's earnings. This document is essential for verifying financial transparency and ensuring compliance with tax regulations. Accurate disclosure helps prevent fraud and supports proper financial auditing.

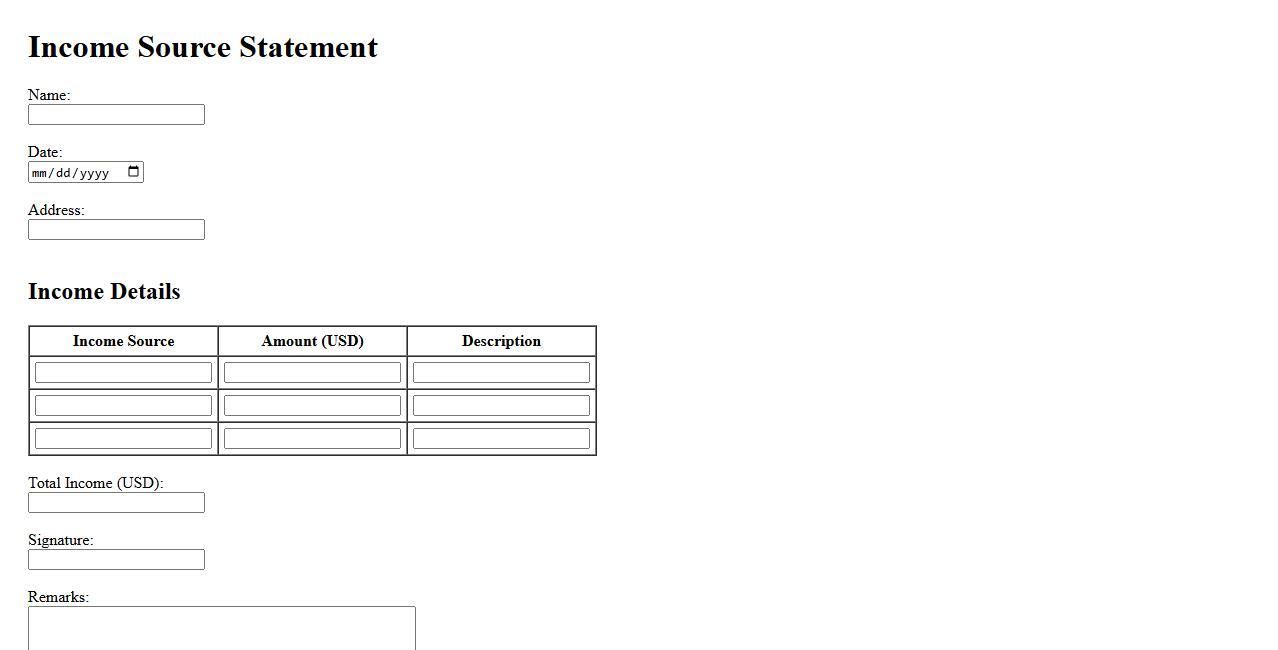

Income Source Statement

An Income Source Statement is a detailed document that outlines the origins and amounts of an individual's or business's income. It is essential for financial analysis, loan applications, and tax reporting. This statement ensures transparency and helps verify financial stability.

Earnings Verification Form

The Earnings Verification Form is a crucial document used to confirm an individual's income details. It is commonly required by lenders, landlords, and other organizations to validate employment and salary information. Accurate completion of this form ensures timely processing of financial applications.

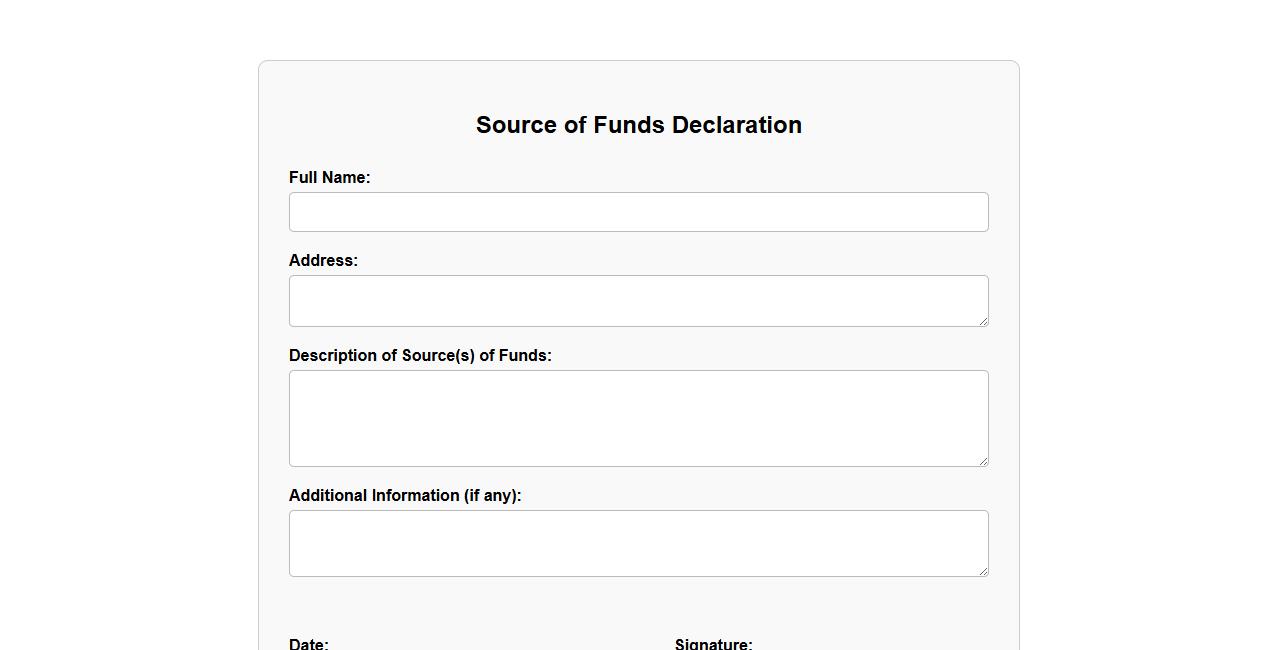

Source of Funds Declaration

The Source of Funds Declaration is a crucial document that verifies the origin of the money used in financial transactions. It helps institutions ensure compliance with anti-money laundering regulations and maintain transparency. This declaration provides assurance that the funds come from legitimate activities.

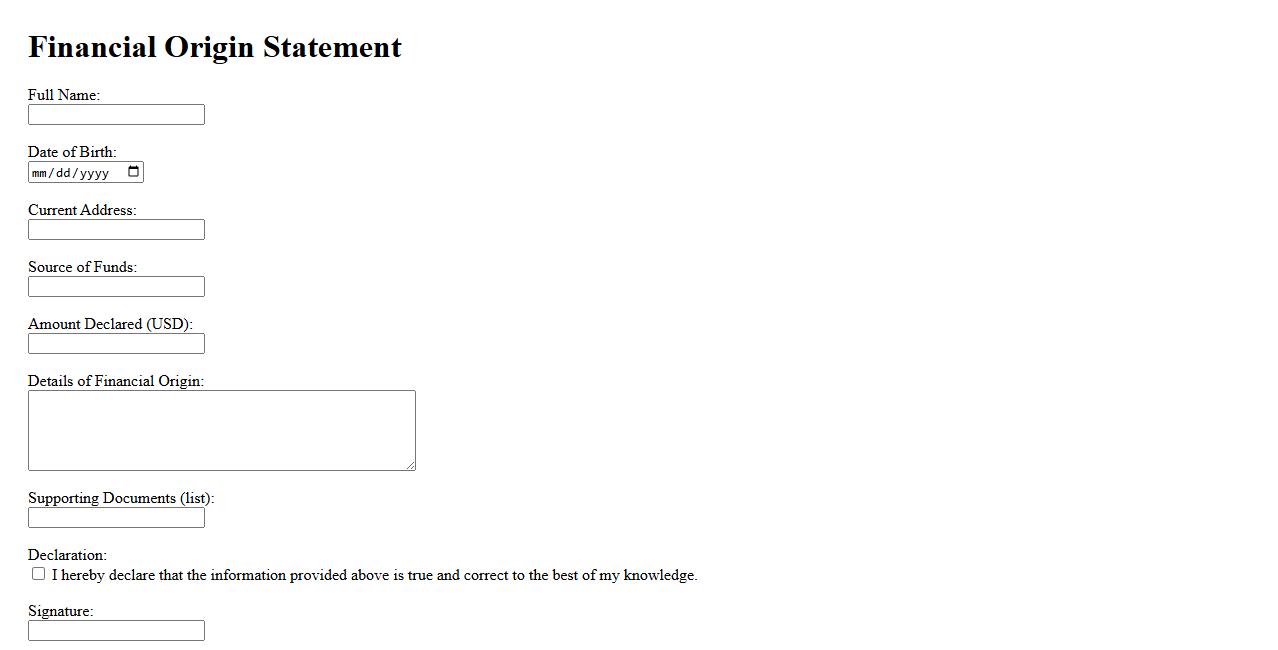

Financial Origin Statement

The Financial Origin Statement is a crucial document that outlines the source of funds used in a transaction or investment. It provides transparency and compliance with regulatory requirements, ensuring all financial activities are legitimate. This statement helps prevent money laundering and fraud by verifying the origin of the capital involved.

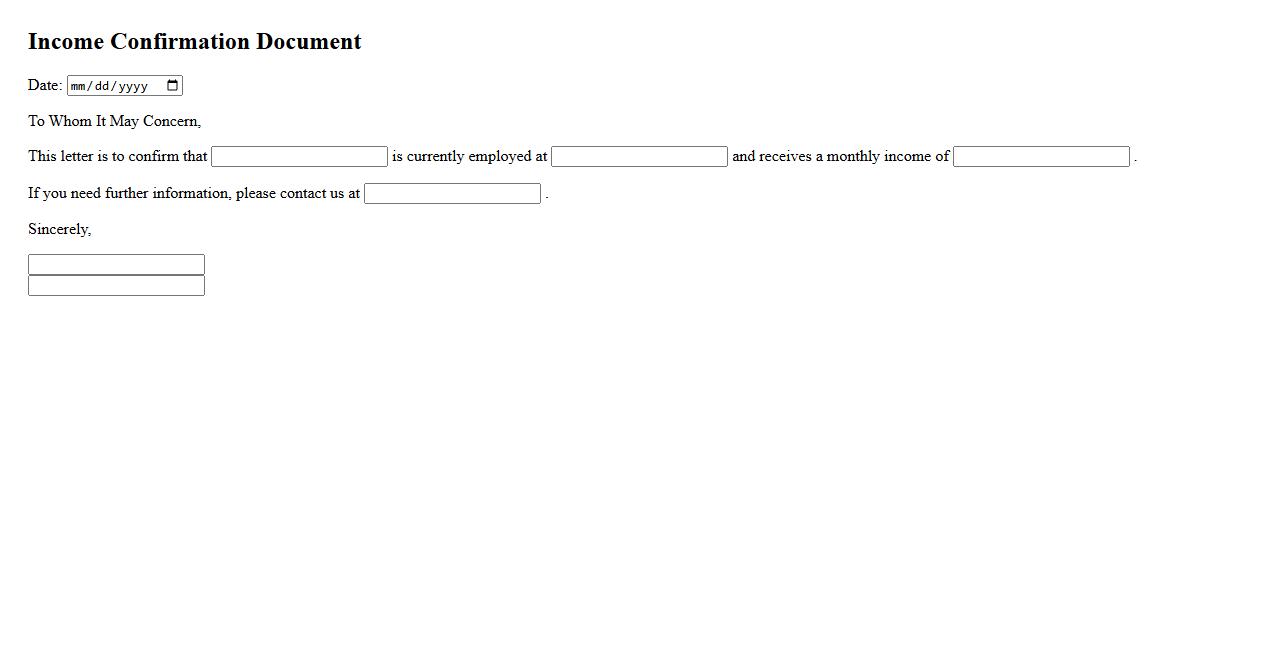

Income Confirmation Document

An Income Confirmation Document is a crucial financial record used to verify an individual's earnings. It is commonly required by employers, lenders, or government agencies to ensure accurate income assessment. This document helps facilitate loan approvals, rental agreements, and other financial transactions.

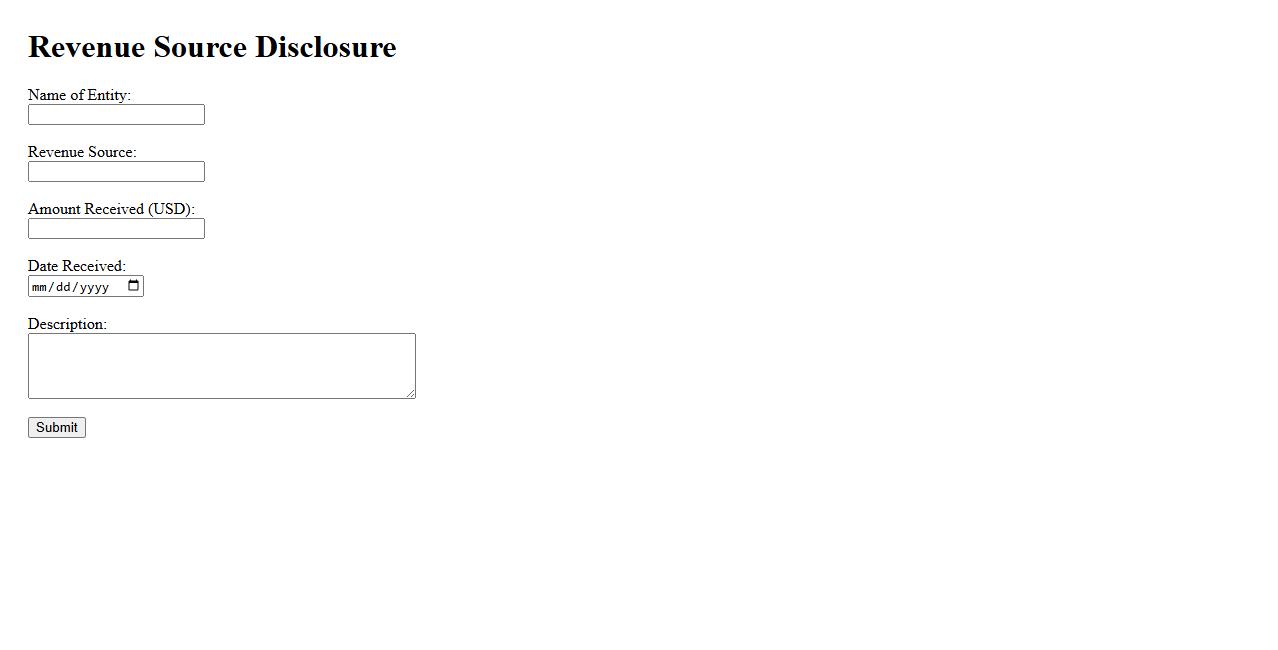

Revenue Source Disclosure

Revenue Source Disclosure is a transparent practice where organizations openly share detailed information about their income streams. This disclosure helps stakeholders understand the origin of funds, promoting trust and accountability. By clearly identifying revenue sources, entities ensure compliance with regulatory standards and foster ethical financial management.

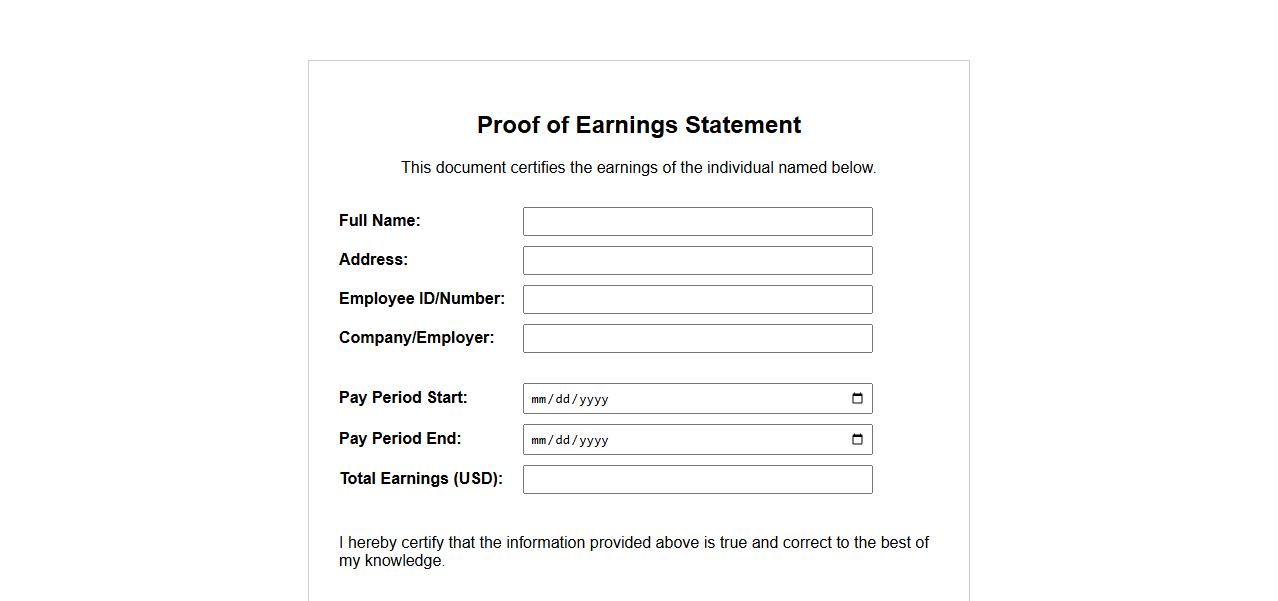

Proof of Earnings Statement

A Proof of Earnings Statement is a document that verifies an individual's income over a specific period. It is commonly used for loan applications, rental agreements, and financial assessments. This statement provides essential information to confirm the applicant's ability to meet financial obligations.

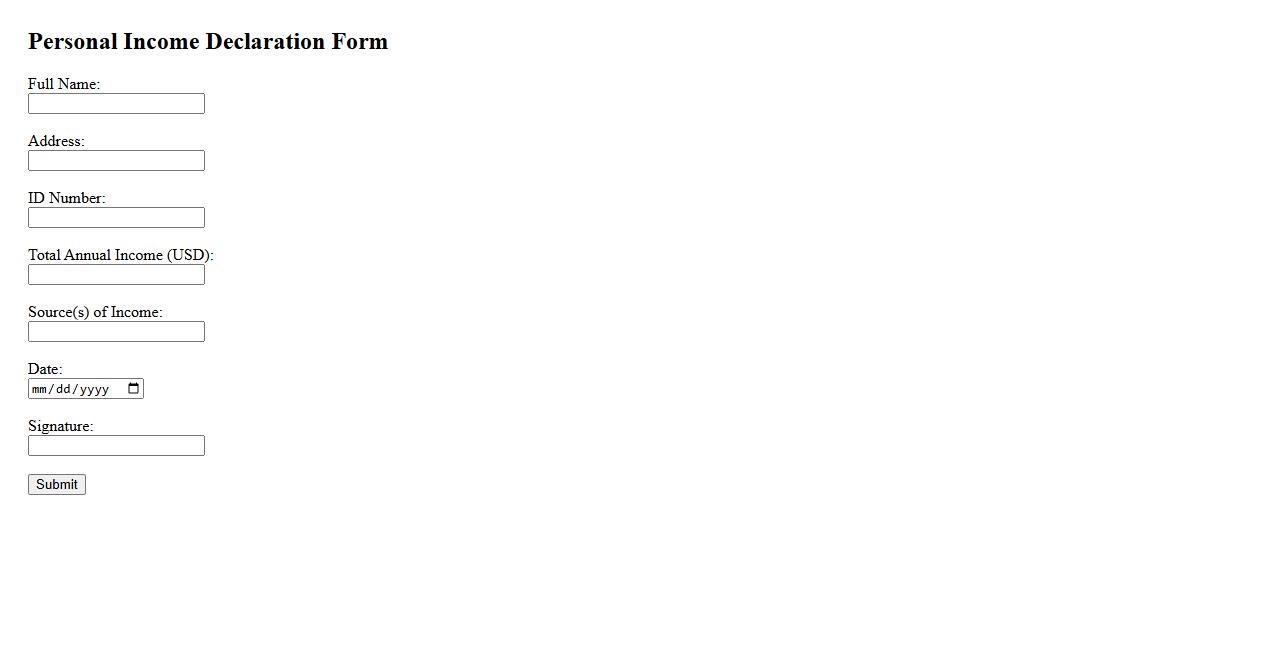

Personal Income Declaration

The Personal Income Declaration is a document that outlines an individual's total earnings from various sources. It is essential for tax reporting and financial assessments, ensuring transparency and compliance with legal requirements. Accurate declaration helps in proper evaluation of one's financial status for loans, benefits, or governmental records.

Funds Source Attestation

Funds Source Attestation is a formal declaration verifying the origin of funds used in financial transactions. It ensures compliance with regulatory requirements by confirming that the money comes from legitimate sources. This attestation is essential in preventing money laundering and maintaining transparency in financial operations.

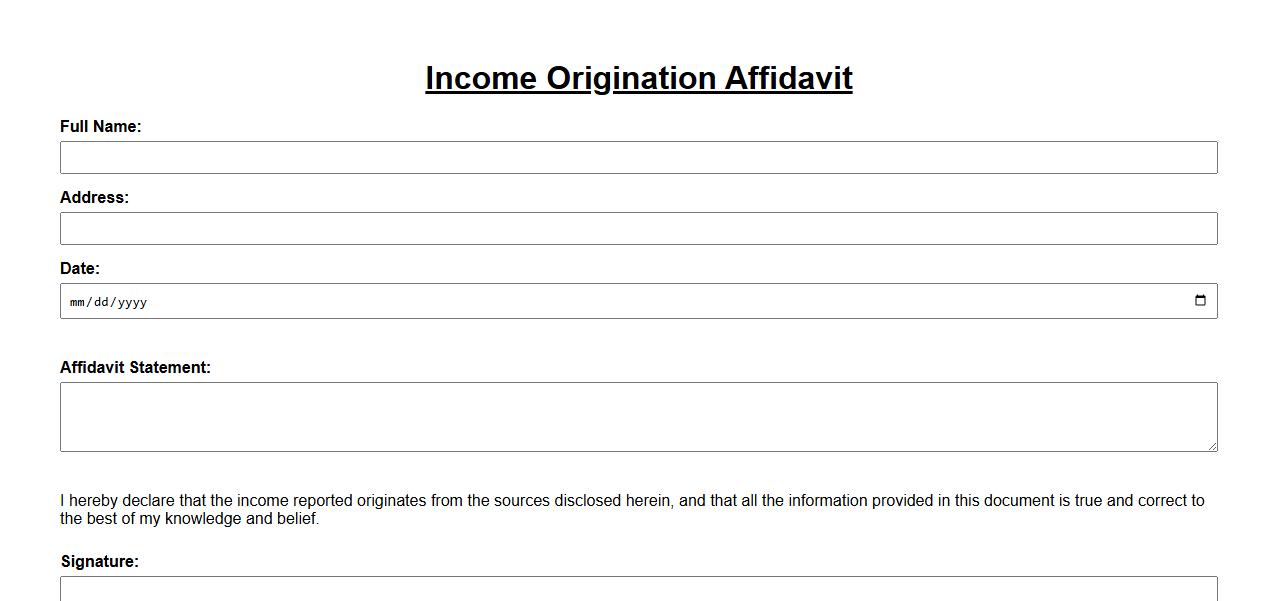

Income Origination Affidavit

An Income Origination Affidavit is a legal document that verifies an individual's source of income. It is commonly used in financial and legal processes to confirm earnings are legitimate. This affidavit helps lenders and authorities assess financial stability and trustworthiness.

What is the primary purpose of a Declaration of Income Source document?

The primary purpose of a Declaration of Income Source document is to provide a transparent record of an individual's or entity's earnings. This declaration ensures that all income is accounted for and assessed for tax or legal purposes. It helps maintain financial accountability and integrity in various transactions.

Which specific income sources must be disclosed in the declaration?

All income sources must be disclosed, including salaries, business profits, rental income, dividends, and interest earnings. Additionally, any irregular or non-traditional income such as freelance work, alimony, or gifts often requires reporting. Full disclosure ensures compliance with legal and tax regulations.

Who is legally required to complete and submit a Declaration of Income Source?

Individuals or entities engaged in financial transactions or tax reporting are legally required to complete and submit this declaration. This includes employees, business owners, freelancers, and sometimes beneficiaries of inheritance. The obligation ensures that the relevant authorities have accurate data for monitoring income and taxation.

How is the accuracy and honesty of the declared income sources verified?

The accuracy of declared income is verified through audits, cross-referencing with tax returns, bank statements, and employer records. Authorities may employ investigative techniques and require supporting documentation to ensure honesty. Regular compliance checks help prevent fraud and maintain the integrity of financial systems.

What are the potential consequences of providing false information on the declaration?

Providing false information can lead to legal penalties including fines, interest charges, and even criminal prosecution. It may damage an individual's or entity's reputation and result in loss of licenses or financial benefits. Authorities treat misrepresentation seriously to deter fraud and uphold the rule of law.