A Declaration of No Business Activities is an official statement confirming that an individual or entity has not engaged in any commercial or business operations during a specified period. This document is often required for tax purposes, reporting compliance, or regulatory filings to clarify the absence of income-generating activities. It helps authorities ensure accurate record-keeping and maintain transparency in financial or legal obligations.

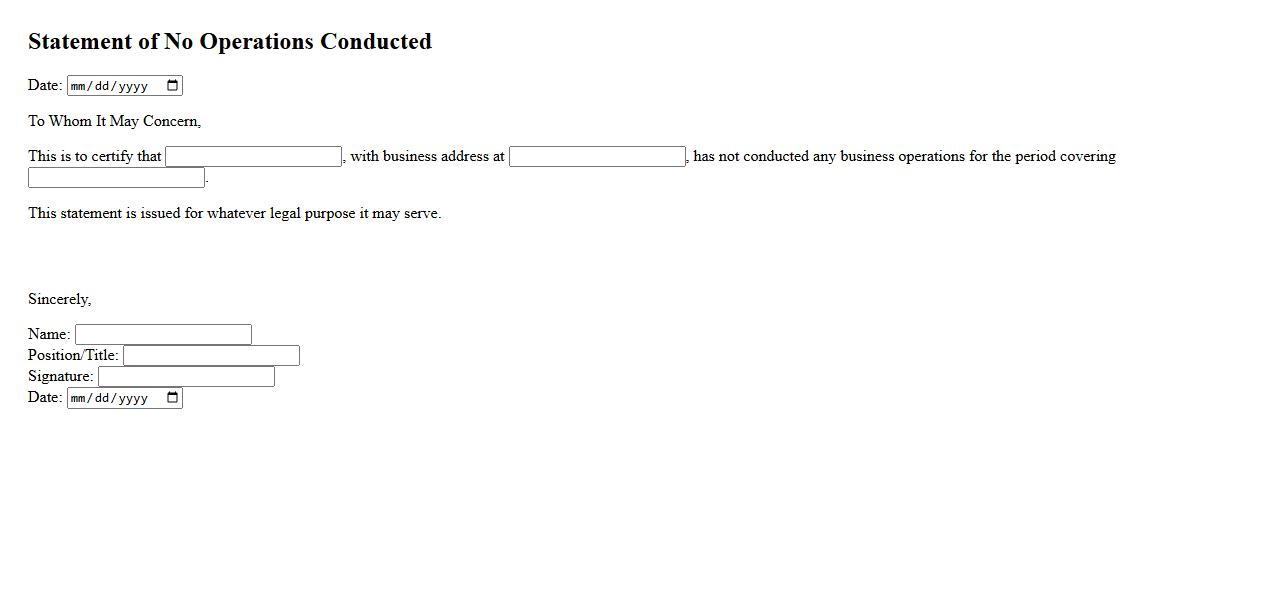

Statement of No Operations Conducted

The Statement of No Operations Conducted is a formal declaration indicating that no business activities or transactions were carried out during a specific period. This document is essential for maintaining compliance with regulatory requirements and informing stakeholders. It ensures transparency when no operational changes have occurred.

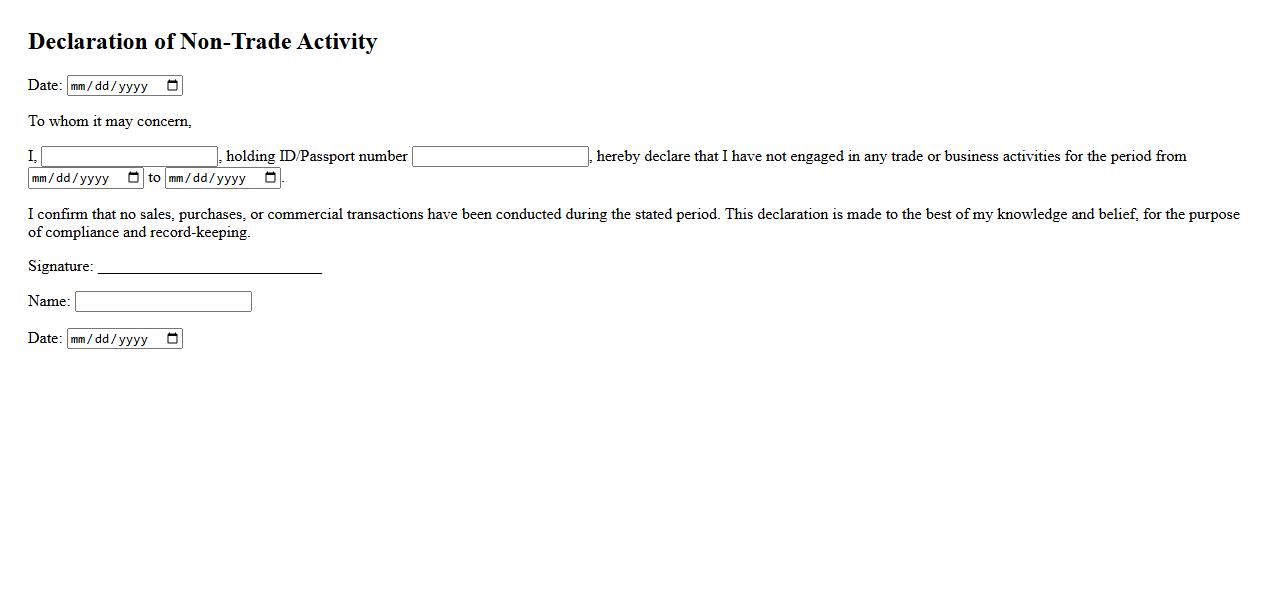

Declaration of Non-Trade Activity

The Declaration of Non-Trade Activity is a formal statement used to confirm that an individual or organization is not engaged in any commercial or trade-related activities. This declaration ensures compliance with legal or tax regulations by clarifying the non-trading status. It is essential for maintaining transparent financial records and fulfilling regulatory requirements.

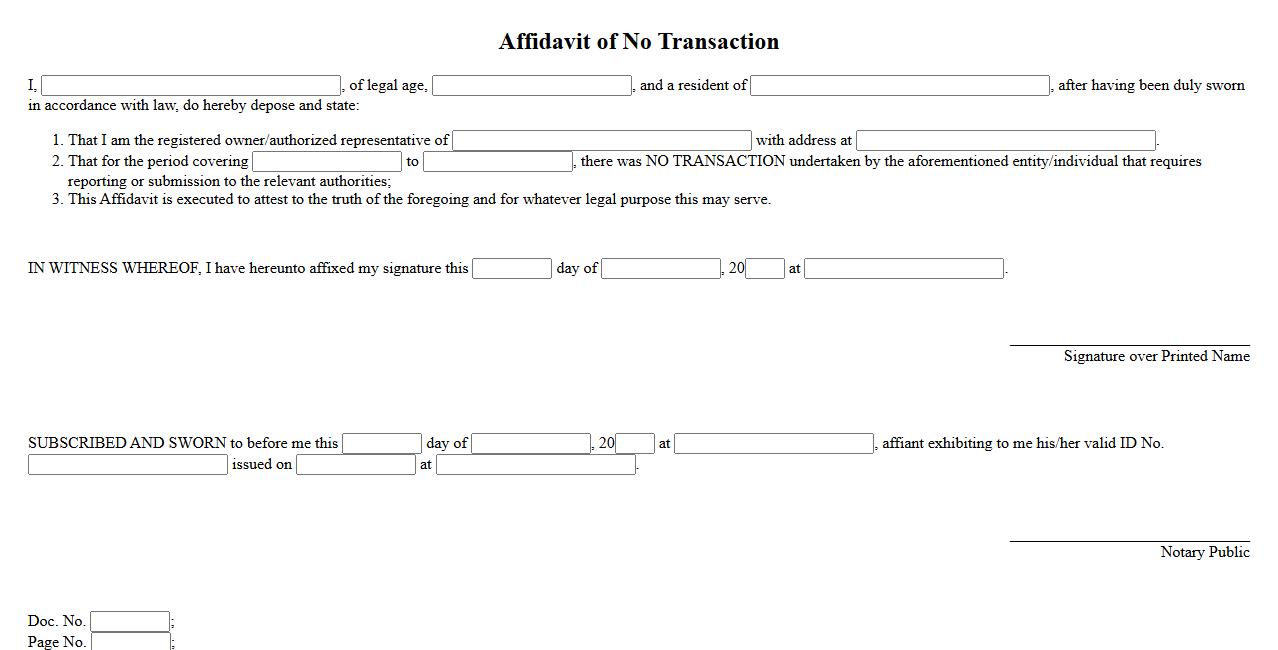

Affidavit of No Transaction

An Affidavit of No Transaction is a sworn statement declaring that no financial or business transactions have occurred within a specified period. This document is often required for legal, tax, or audit purposes to confirm the absence of activity. It serves as formal evidence to authorities or institutions verifying the status of accounts or agreements.

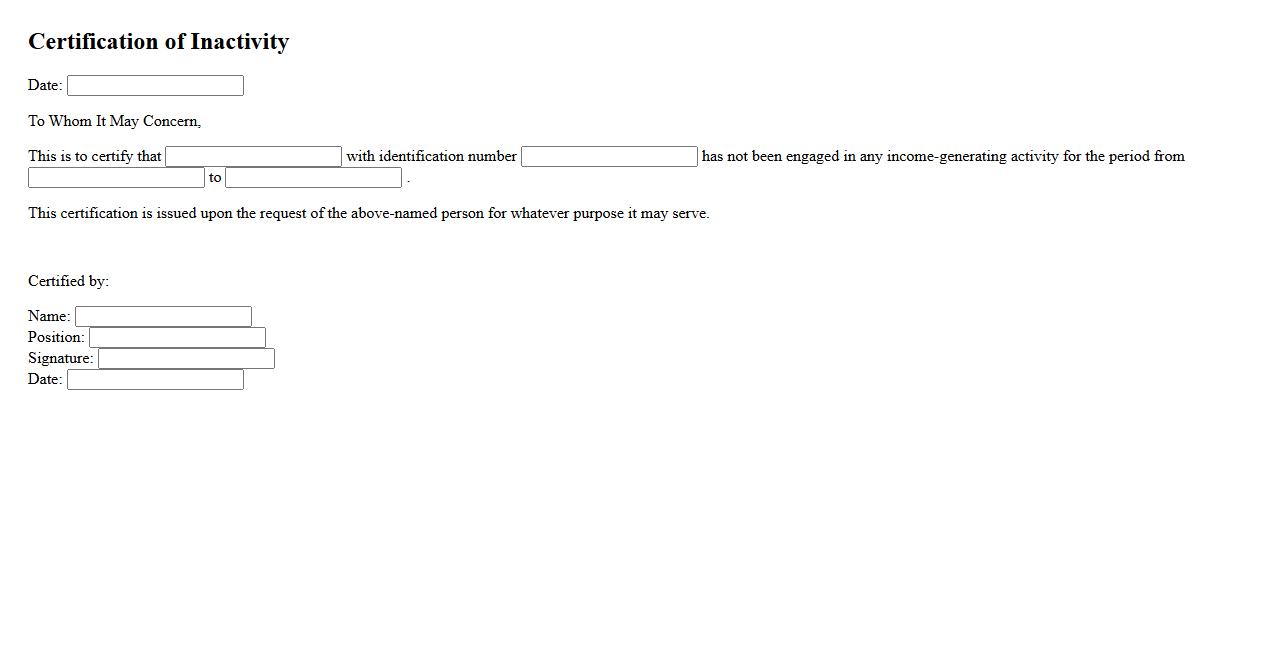

Certification of Inactivity

The Certification of Inactivity is an official document that verifies a business or individual is not currently engaged in any activity. It is often required for tax purposes or to maintain compliance with regulatory agencies. This certification helps to demonstrate a period of non-operation without incurring penalties.

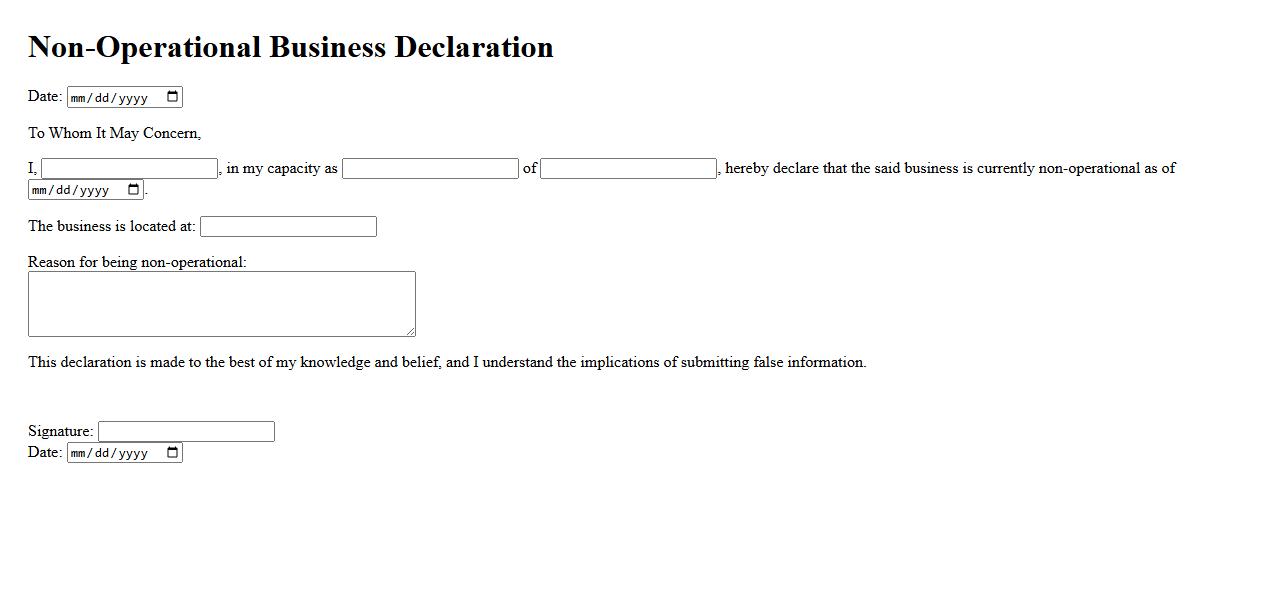

Non-Operational Business Declaration

A Non-Operational Business Declaration is a formal statement submitted to regulatory authorities indicating that a business is temporarily inactive or not conducting any commercial activities. This declaration helps ensure compliance with legal requirements and avoid penalties. It is essential for businesses undergoing restructuring, seasonal closures, or awaiting reactivation.

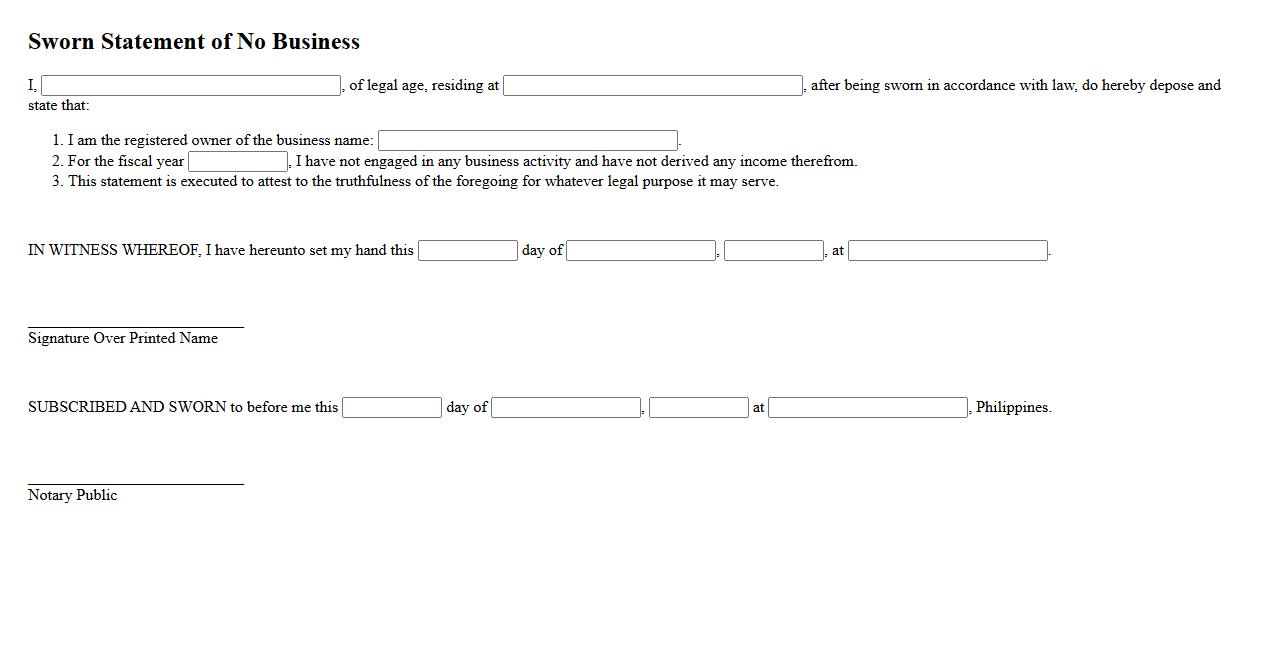

Sworn Statement of No Business

A Sworn Statement of No Business is a legal document affirming that an individual or entity does not currently operate any business. It is often required for various administrative or governmental purposes to verify business status. This statement helps maintain accurate records and ensures compliance with relevant regulations.

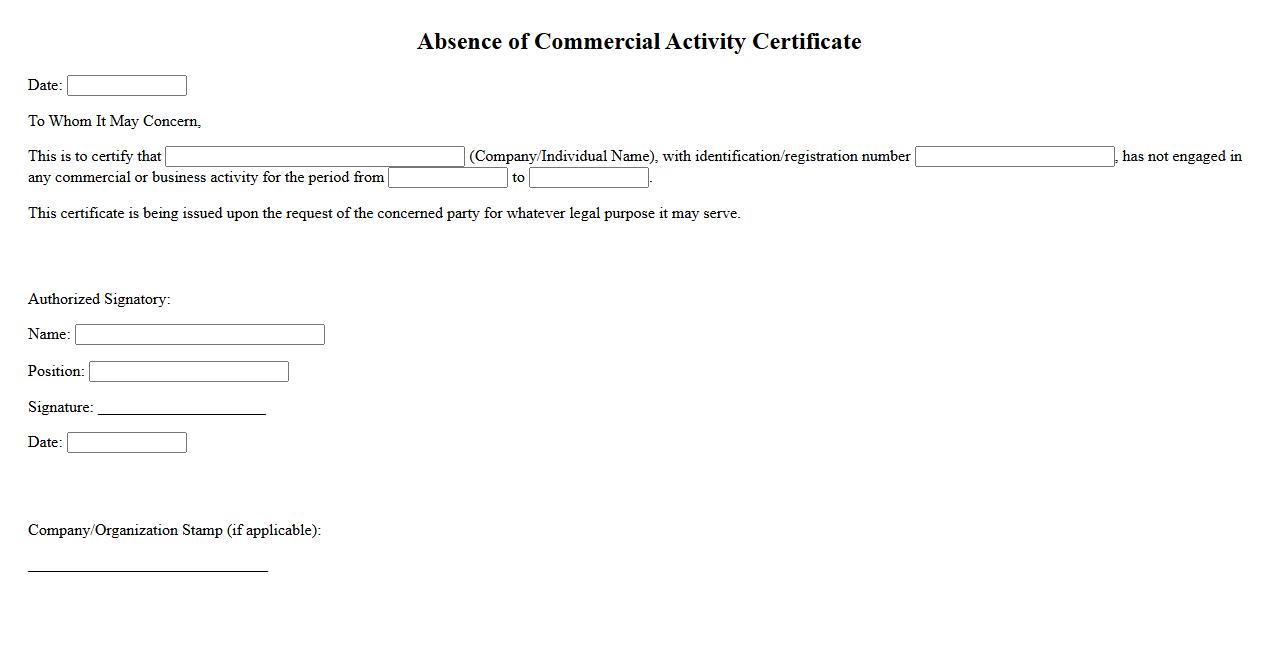

Absence of Commercial Activity Certificate

The Absence of Commercial Activity Certificate is an official document confirming that no commercial activities have been conducted by a business entity within a specified period. This certificate is often required by authorities to verify that a company remains inactive for taxation or regulatory purposes. It ensures compliance with local laws and helps avoid penalties for unreported business operations.

No Revenue Activity Declaration

The No Revenue Activity Declaration is an official statement confirming that a business has not generated any income during a specific period. This declaration is often required for tax or regulatory purposes to verify the company's financial status. It helps maintain transparency and compliance with legal obligations.

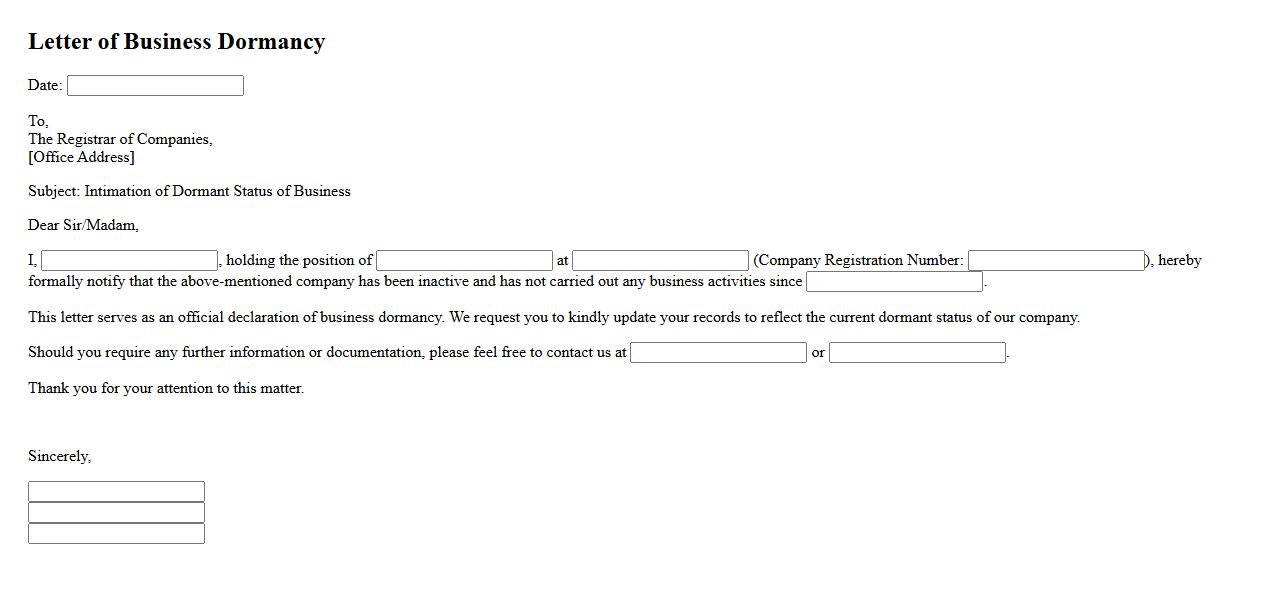

Letter of Business Dormancy

A Letter of Business Dormancy is an official document confirming that a business is temporarily inactive. It is often required by regulatory authorities or financial institutions to verify the status of the company. This letter helps in maintaining compliance without the need for full operational activity during the dormant period.

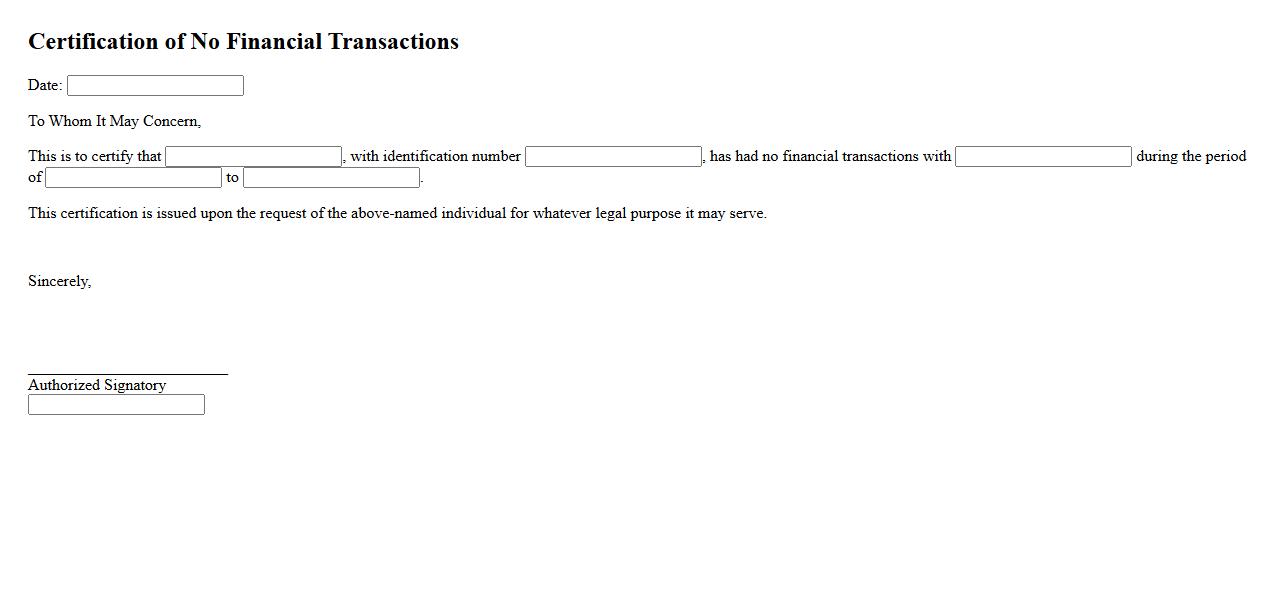

Certification of No Financial Transactions

The Certification of No Financial Transactions is an official document confirming the absence of any monetary exchanges within a specified period. This certification is often required for auditing, compliance, or legal purposes to verify financial inactivity. It assures stakeholders that no financial operations have taken place.

What does the Declaration of No Business Activities confirm regarding company operations during the specified period?

The Declaration of No Business Activities confirms that the company did not undertake any commercial or operational transactions during the specified period. It serves as official verification that the business remained inactive. This declaration helps ensure transparency and compliance with regulatory bodies.

Does the entity acknowledge the absence of any income-generating transactions or activities?

The entity explicitly acknowledges it had no income-generating transactions or activities within the reporting timeframe. This admission is critical for accurate financial reporting and tax compliance. It assures authorities that no revenue was earned during that period.

Is the declaration being submitted in compliance with specific regulatory, legal, or tax requirements?

The declaration is typically submitted to comply with regulatory, legal, or tax requirements mandating companies to report inactive periods. This ensures the company meets all statutory obligations despite lacking business activity. Timely submission avoids penalties and maintains good standing with authorities.

Has the company disclosed whether it maintained bank accounts or financial movements despite not conducting business?

The declaration often requires disclosure about the maintenance of bank accounts or financial movements during the inactive period. Even without business operations, there may be ongoing financial transactions such as fees or interest payments. Transparency in this area helps clarify the company's financial status accurately.

Does the declaration state the accounting period or fiscal year it covers for no business activities?

The Declaration of No Business Activities clearly states the accounting period or fiscal year during which the company was inactive. This time-specific information is crucial for regulatory clarity and financial audits. It defines the scope of inactivity precisely for official records.