The Declaration of Self-Employment is a formal document confirming an individual's status as a self-employed worker. It often includes details about the nature of the business, income sources, and tax responsibilities. This declaration is essential for legal and financial purposes, such as obtaining loans or tax filing.

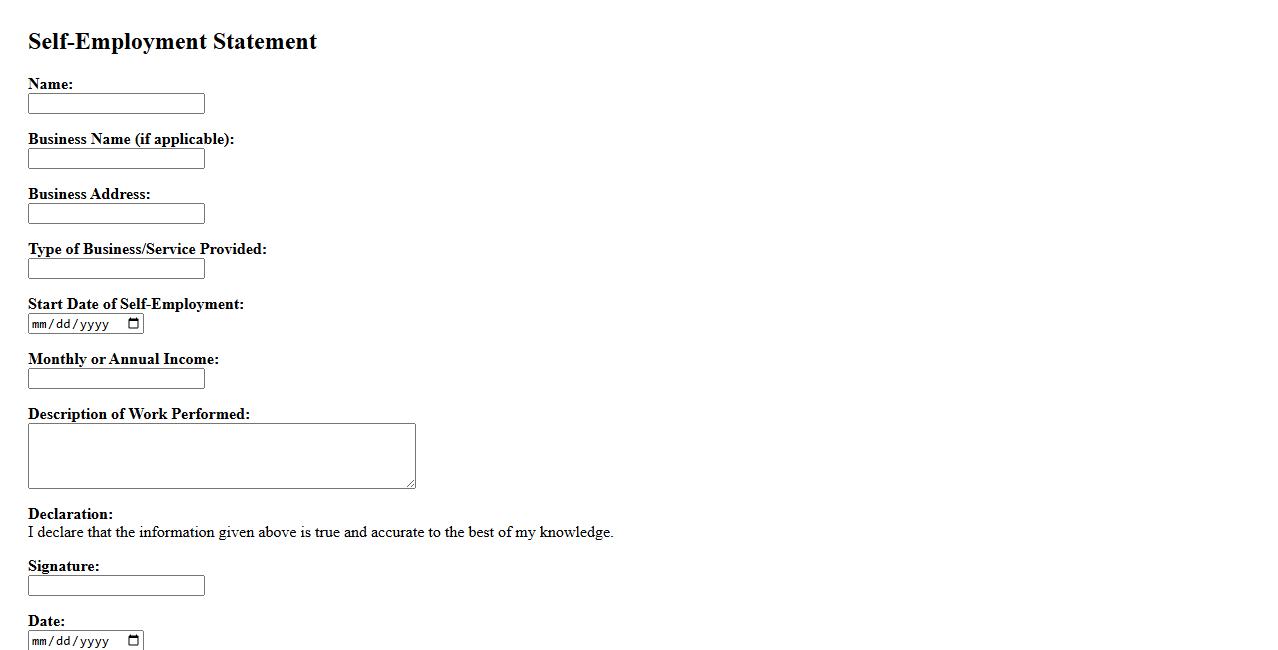

Self-Employment Statement

A Self-Employment Statement is a formal document that verifies an individual's income and employment status as a self-employed person. It is often required for loan applications, tax purposes, or legal verification. This statement typically outlines business activities, earnings, and duration of self-employment.

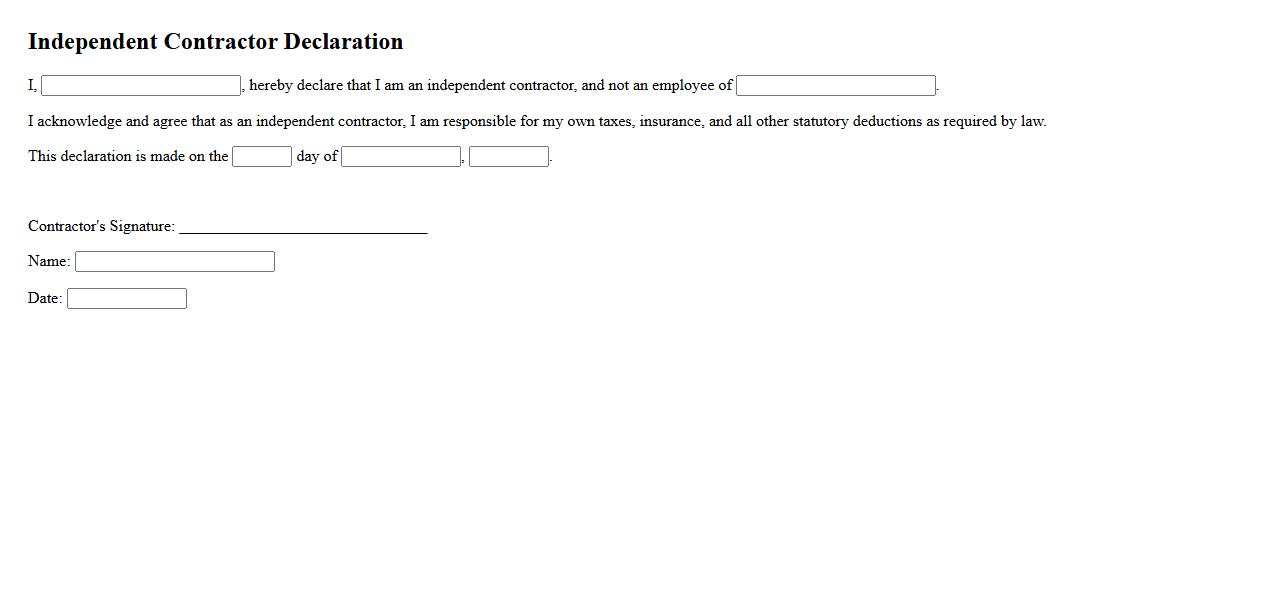

Independent Contractor Declaration

The Independent Contractor Declaration is a formal document used to outline the relationship between a contractor and a company, confirming the contractor's status as an independent entity. It establishes the terms of service, responsibilities, and tax obligations, ensuring clarity for both parties. This declaration helps prevent misclassification and legal disputes regarding employment status.

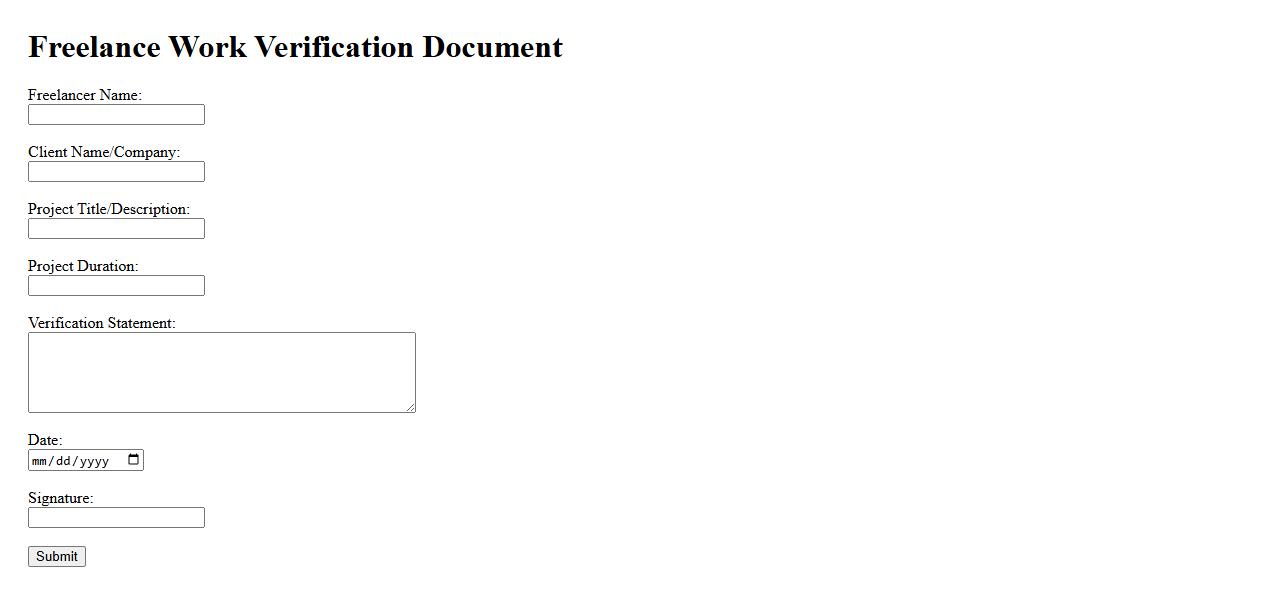

Freelance Work Verification

Freelance Work Verification is the process of confirming the authenticity and quality of freelance projects completed by an individual. It ensures trust between clients and freelancers by validating skills, experience, and project outcomes. This verification helps build credible professional profiles in the gig economy.

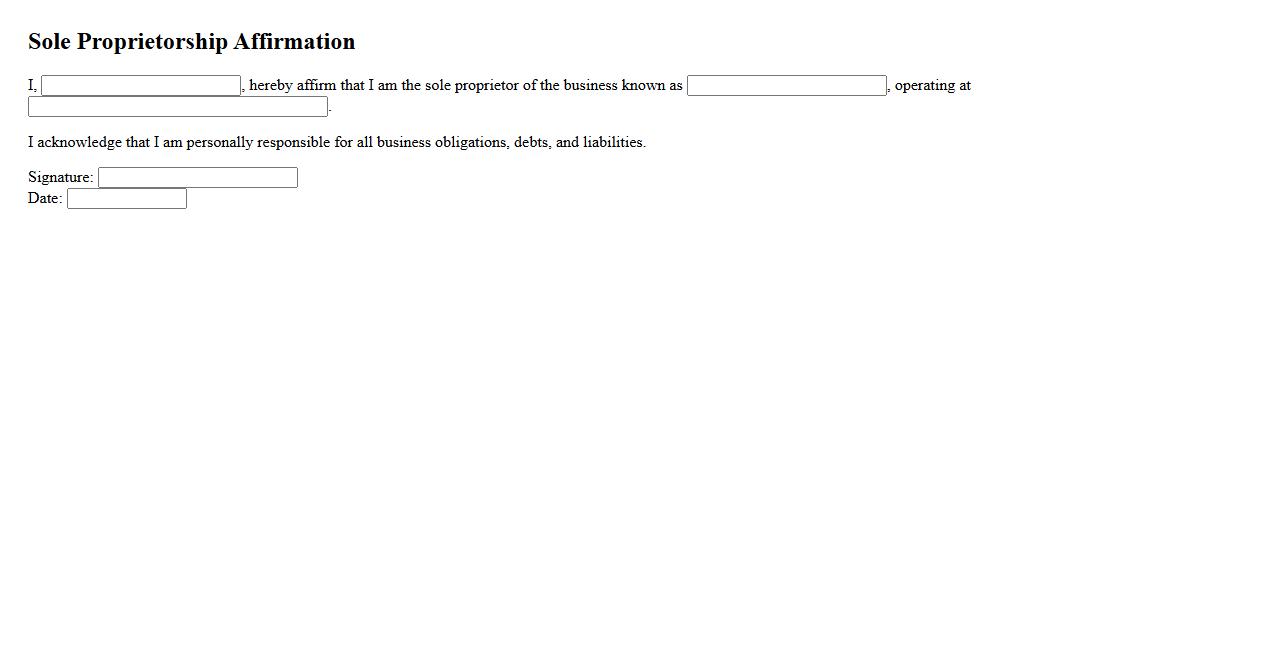

Sole Proprietorship Affirmation

The sole proprietorship affirmation is a legal declaration that verifies the owner's exclusive rights and responsibilities over their business. This affirmation helps establish the legitimacy and accountability of the sole proprietorship. It is essential for maintaining clear ownership and simplifying tax and legal processes.

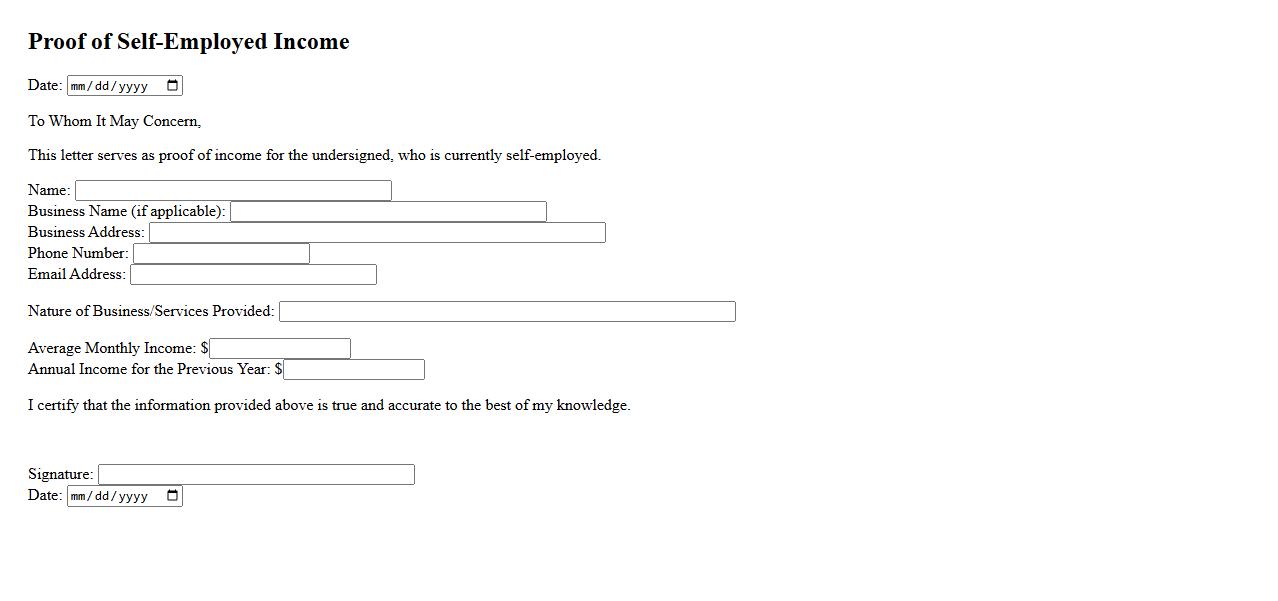

Proof of Self-Employed Income

Proof of Self-Employed Income is essential documentation used to verify the earnings of individuals who run their own businesses or work as freelancers. It typically includes tax returns, bank statements, and profit and loss statements to validate consistent income. Lenders and financial institutions require this proof to assess creditworthiness and loan eligibility.

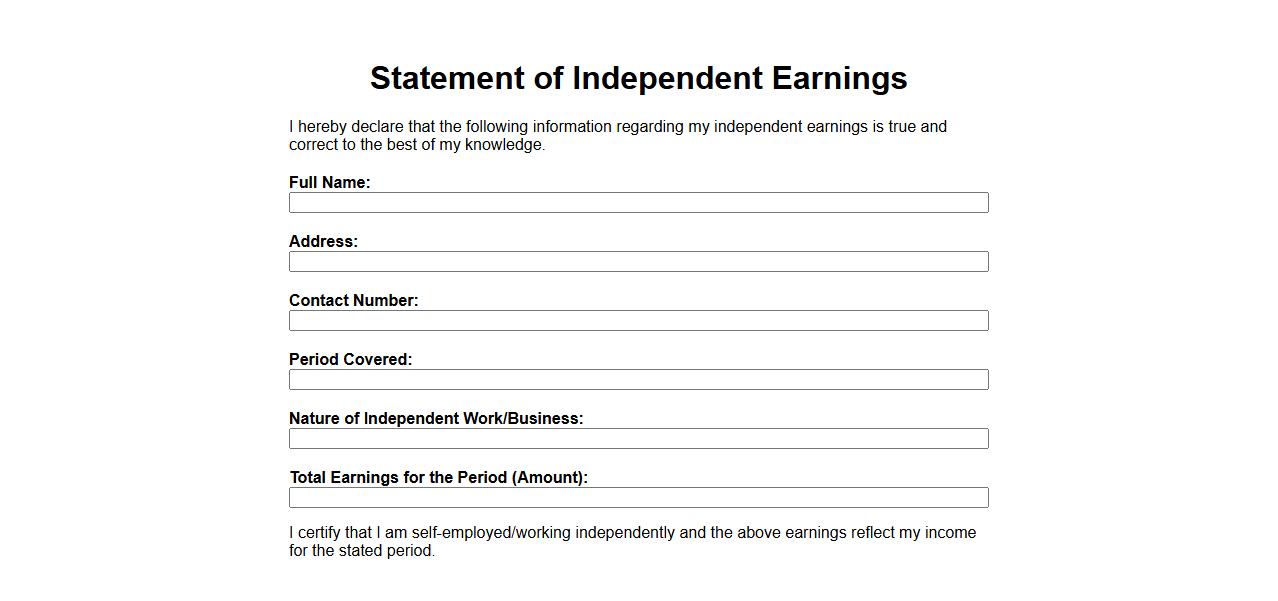

Statement of Independent Earnings

The Statement of Independent Earnings is a financial document that details the income generated by an individual or sole proprietor. It provides a clear overview of all sources of earnings, helping to assess financial performance. This statement is essential for tax reporting and personal financial management.

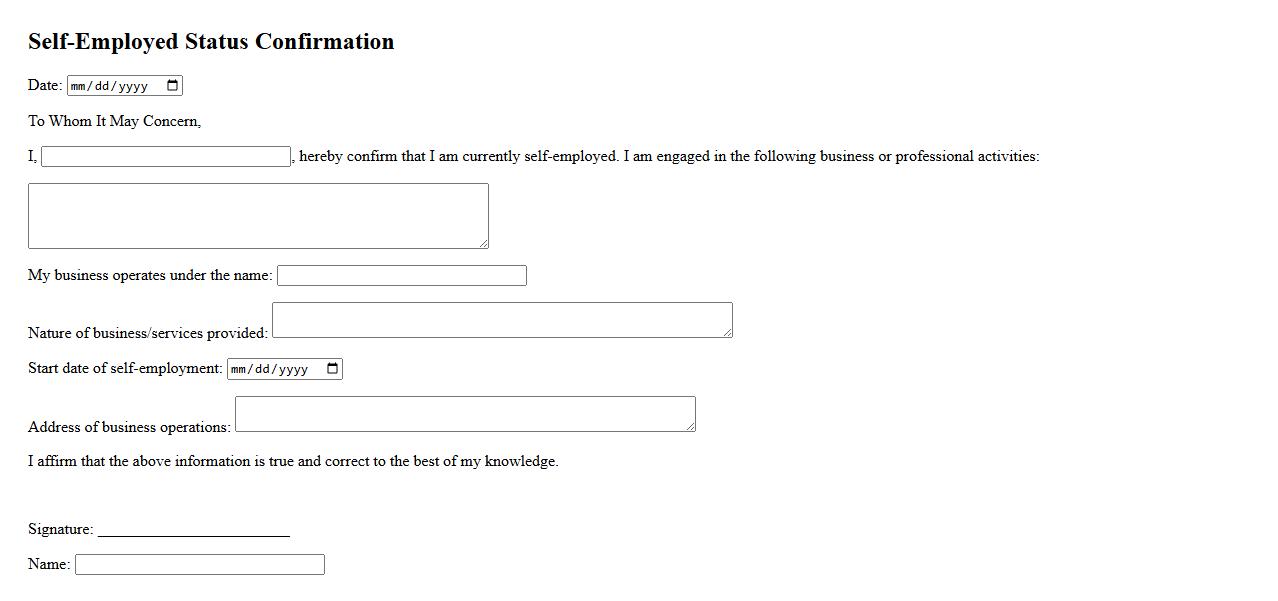

Self-Employed Status Confirmation

Confirming Self-Employed Status is essential for verifying an individual's work independence and income source. This process involves providing documentation such as tax returns, business licenses, or invoices. Accurate confirmation helps ensure eligibility for loans, benefits, or other financial services.

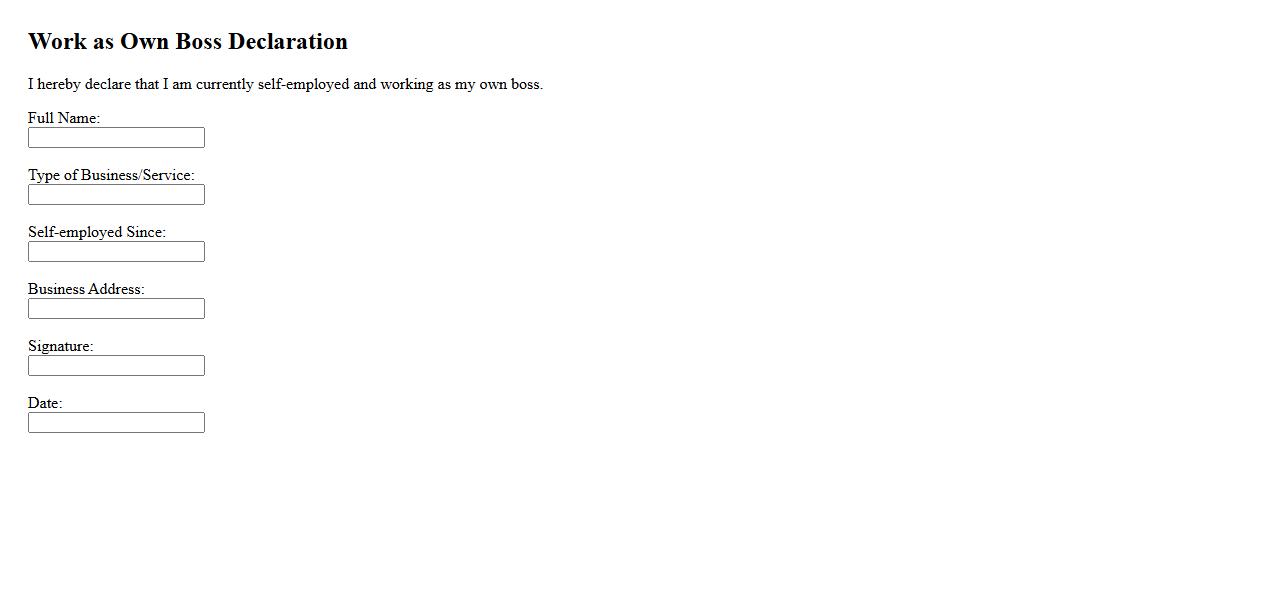

Work as Own Boss Declaration

The Work as Own Boss Declaration is a statement confirming an individual's independent work status. It emphasizes self-employment without the involvement of an employer. This declaration is essential for legal and tax purposes, ensuring clear recognition of one's autonomous business activities.

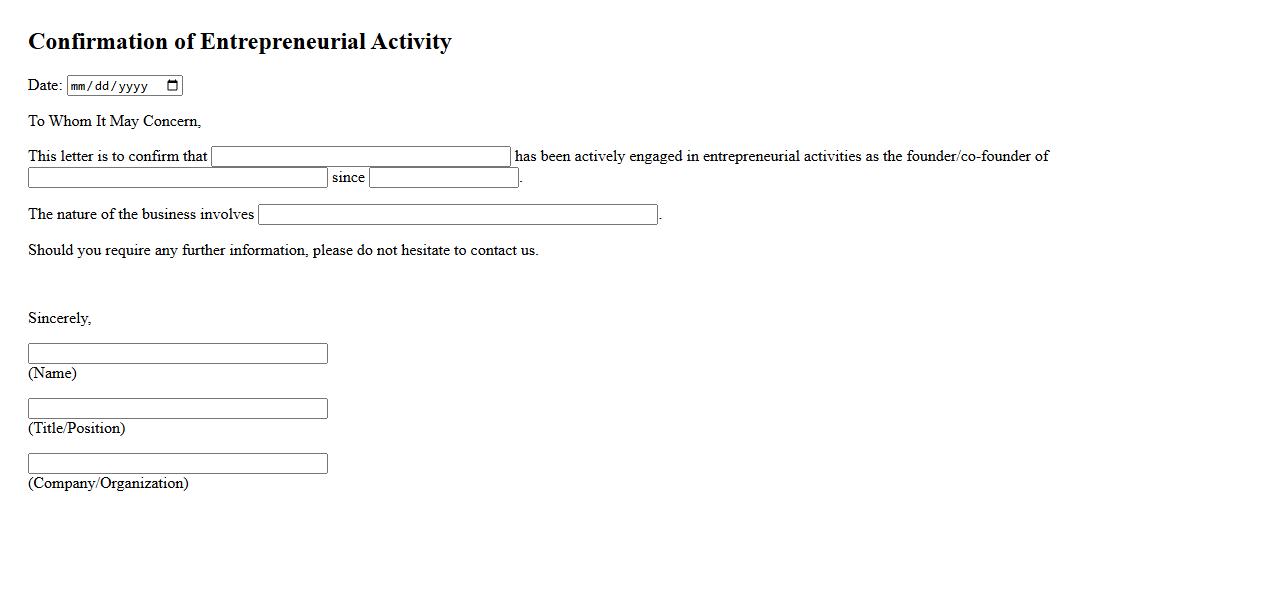

Confirmation of Entrepreneurial Activity

Confirmation of Entrepreneurial Activity is an official document verifying an individual's engagement in business operations. This confirmation is essential for legal, financial, and administrative purposes, ensuring the entrepreneur's status is recognized by authorities. It serves as proof of active business management and compliance with regulatory requirements.

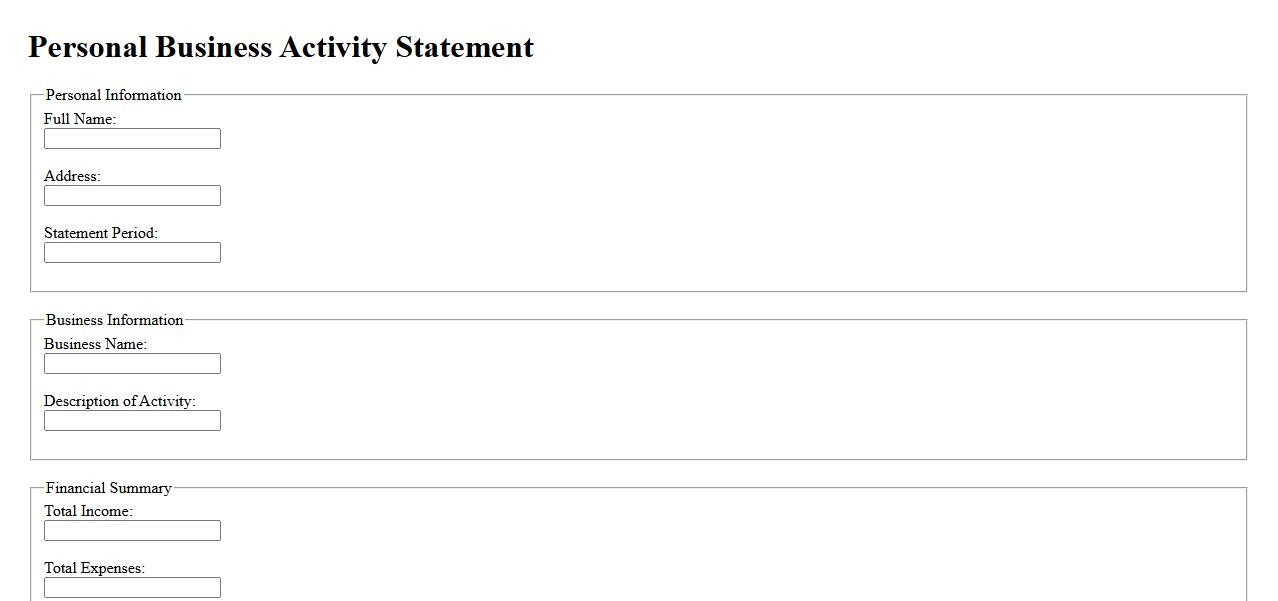

Personal Business Activity Statement

The Personal Business Activity Statement is a crucial document used by individuals to report their business income, expenses, and taxes to the tax authorities. It helps ensure accurate calculation of tax liabilities and compliance with regulatory requirements. Filing this statement regularly is essential for managing personal business finances effectively.

What is the primary purpose of a Declaration of Self-Employment document?

The primary purpose of a Declaration of Self-Employment document is to formally confirm an individual's status as a self-employed person. This declaration serves as an official statement for various legal and financial processes. It establishes a clear record of self-employment for verification purposes.

Which essential details must be included to validate a Declaration of Self-Employment?

A valid Declaration of Self-Employment must include the full name of the individual, the start date of self-employment, and a detailed description of the business activities. It should also contain contact information and a signature to confirm authenticity. These details ensure the document's reliability and acceptance by authorities.

How does a Declaration of Self-Employment support income verification for self-employed individuals?

The Declaration acts as proof of active self-employment, supporting claims of income generation. It is often used alongside financial statements to verify income for loans, tax filings, or rental agreements. This document helps clarify income sources where traditional payslips are unavailable.

In what scenarios would authorities or organizations require a Declaration of Self-Employment?

Authorities or organizations may require a Declaration of Self-Employment during loan applications, tax assessments, or government benefit claims. It is crucial for verifying an individual's employment status when standard employment proofs are lacking. This declaration facilitates smoother administrative and financial processes.

How does the accuracy of information in a Declaration of Self-Employment impact legal and financial proceedings?

Accurate information in a Declaration of Self-Employment is essential to maintain legal compliance and avoid penalties. Inaccuracies can lead to disputes, rejected applications, and legal consequences. Reliable data ensures trust and proper assessment during financial and legal evaluations.