The Consent for Release of Tax Information Form authorizes a third party to access an individual's or business's confidential tax records. This form ensures compliance with privacy laws while allowing authorized entities to obtain necessary tax data for various purposes. It is essential for tax professionals, financial institutions, or legal representatives to facilitate proper handling of tax information.

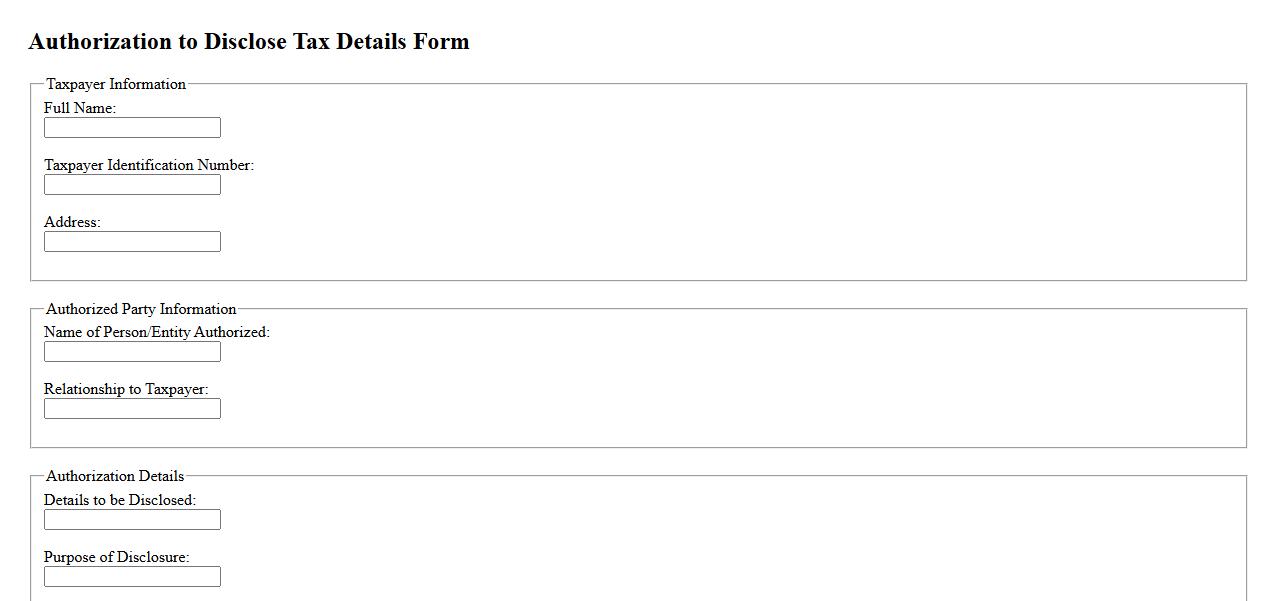

Authorization to Disclose Tax Details Form

The Authorization to Disclose Tax Details Form allows individuals to grant permission to third parties to access their confidential tax information. This form ensures that sensitive data is shared securely and only with authorized entities. It is essential for maintaining privacy while facilitating tax-related communications.

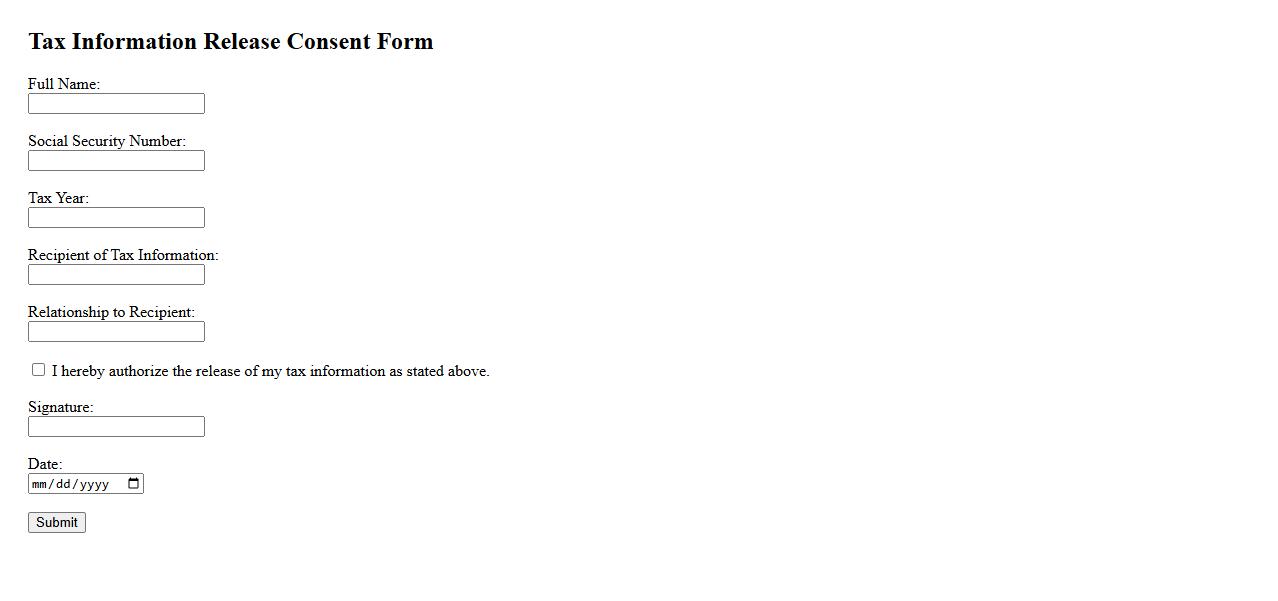

Tax Information Release Consent Form

The Tax Information Release Consent Form authorizes the release of your tax records to designated parties. This form ensures compliance with privacy laws while facilitating the secure exchange of sensitive financial data. It is essential for processes involving financial verification or tax-related inquiries.

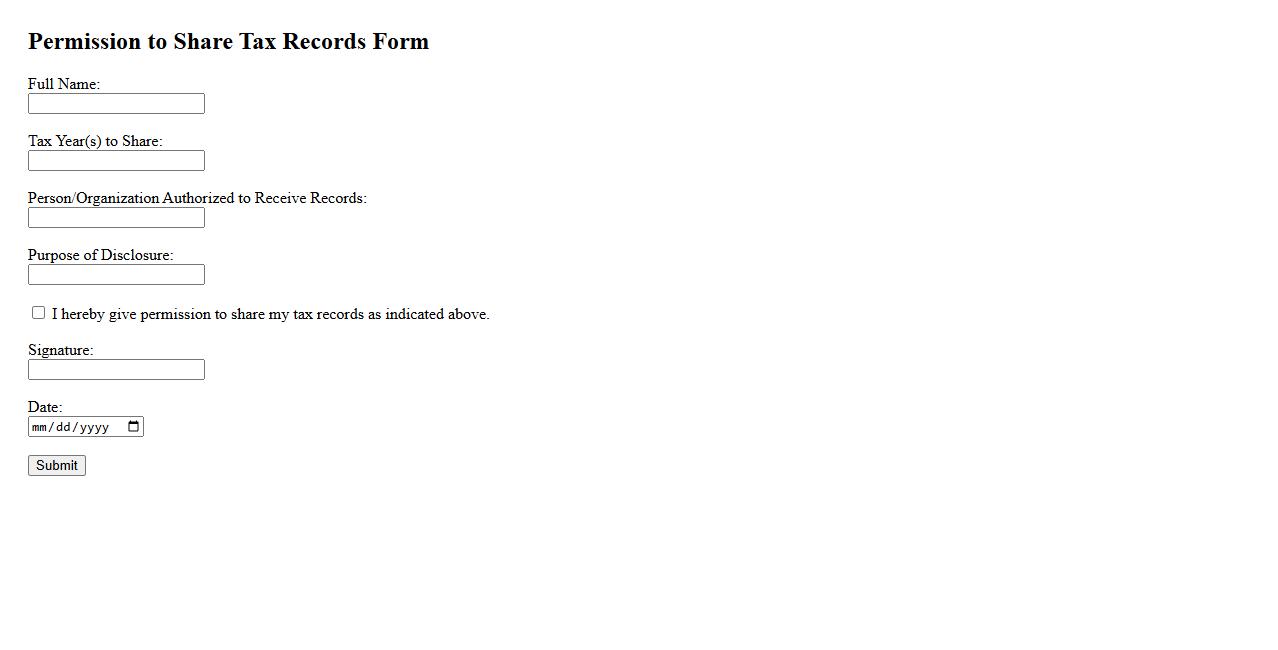

Permission to Share Tax Records Form

The Permission to Share Tax Records Form authorizes authorized parties to access and share your tax information securely. This form ensures compliance with privacy regulations while facilitating necessary data exchange. It is essential for applications requiring verification of your financial records.

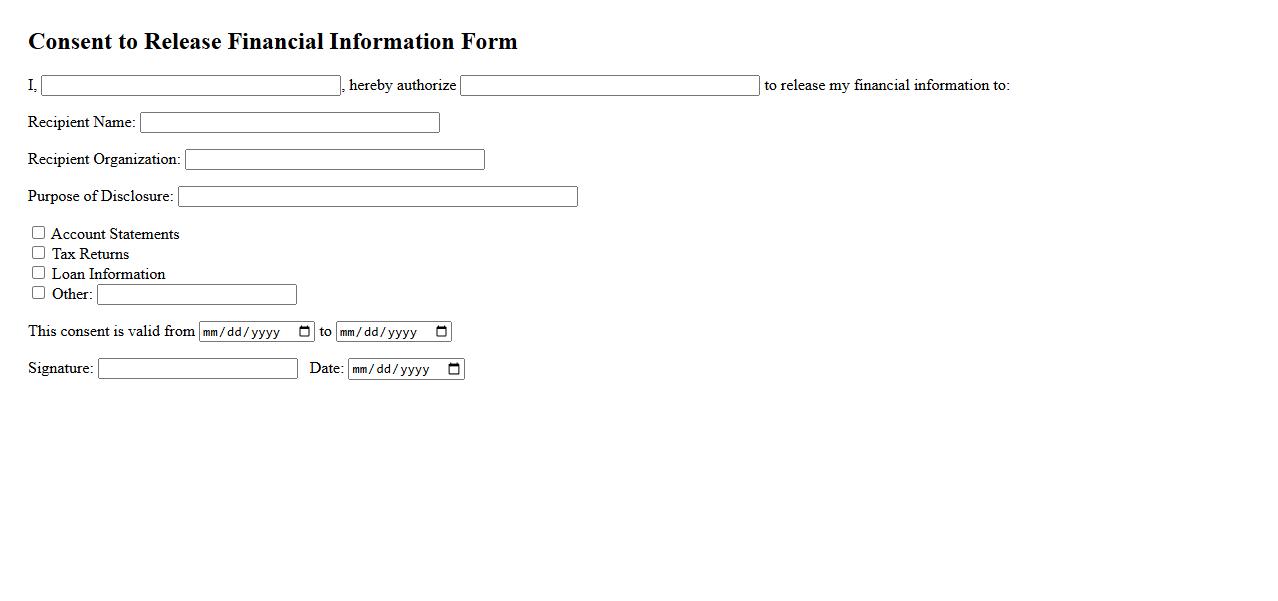

Consent to Release Financial Information Form

The Consent to Release Financial Information Form is a crucial document that authorizes organizations to share your financial data with designated third parties. This form ensures transparency and compliance with privacy regulations. Completing it enables secure and efficient exchange of your financial details for verification or assessment purposes.

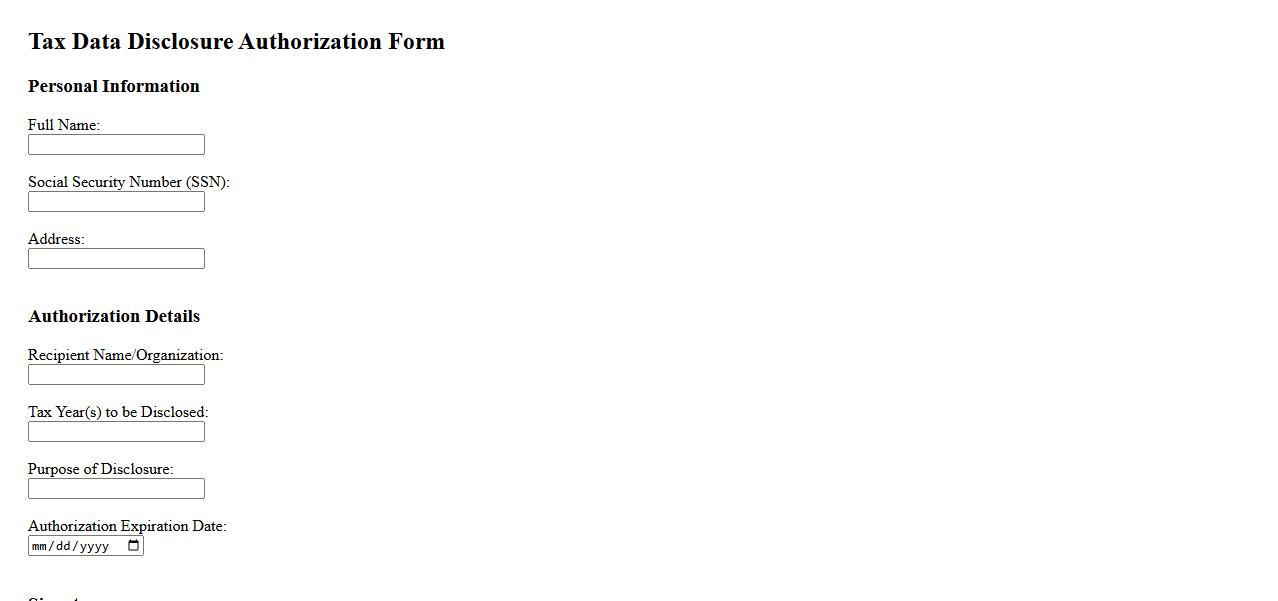

Tax Data Disclosure Authorization Form

The Tax Data Disclosure Authorization Form allows individuals or entities to grant permission for their tax information to be shared with authorized parties. This form ensures compliance with privacy regulations while facilitating transparent communication between taxpayers and tax authorities. Proper completion of the form is essential to maintain data security and accuracy.

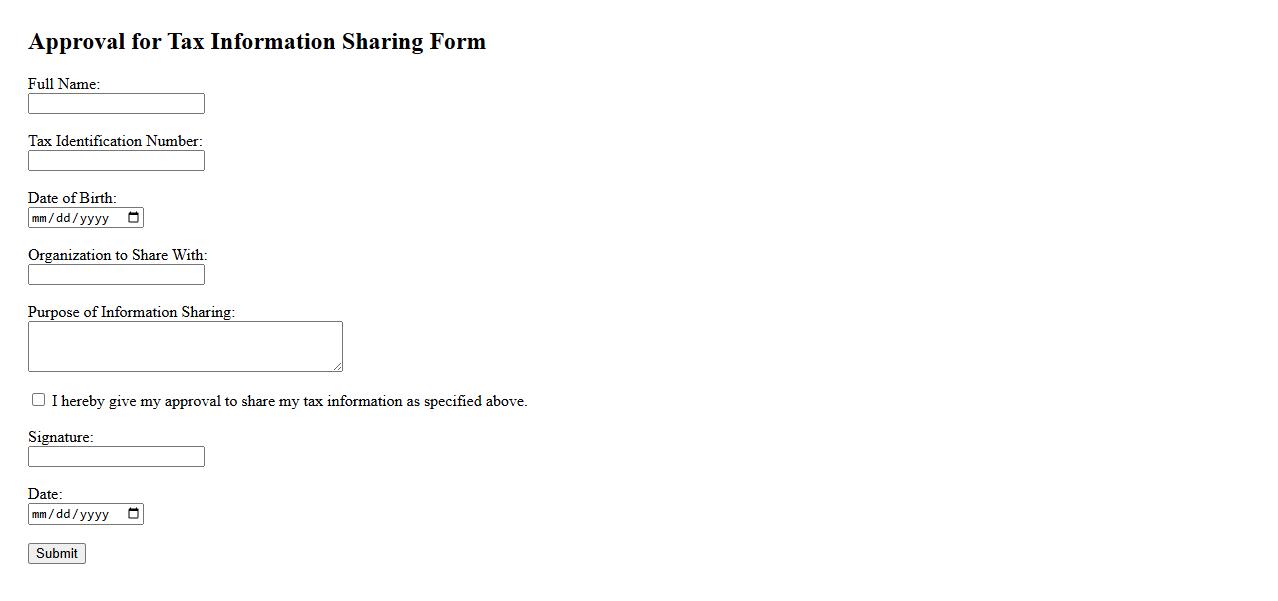

Approval for Tax Information Sharing Form

The Approval for Tax Information Sharing Form is a document that authorizes the exchange of tax-related data between relevant parties. It ensures compliance with legal requirements while protecting sensitive information. This form streamlines communication and facilitates accurate tax reporting.

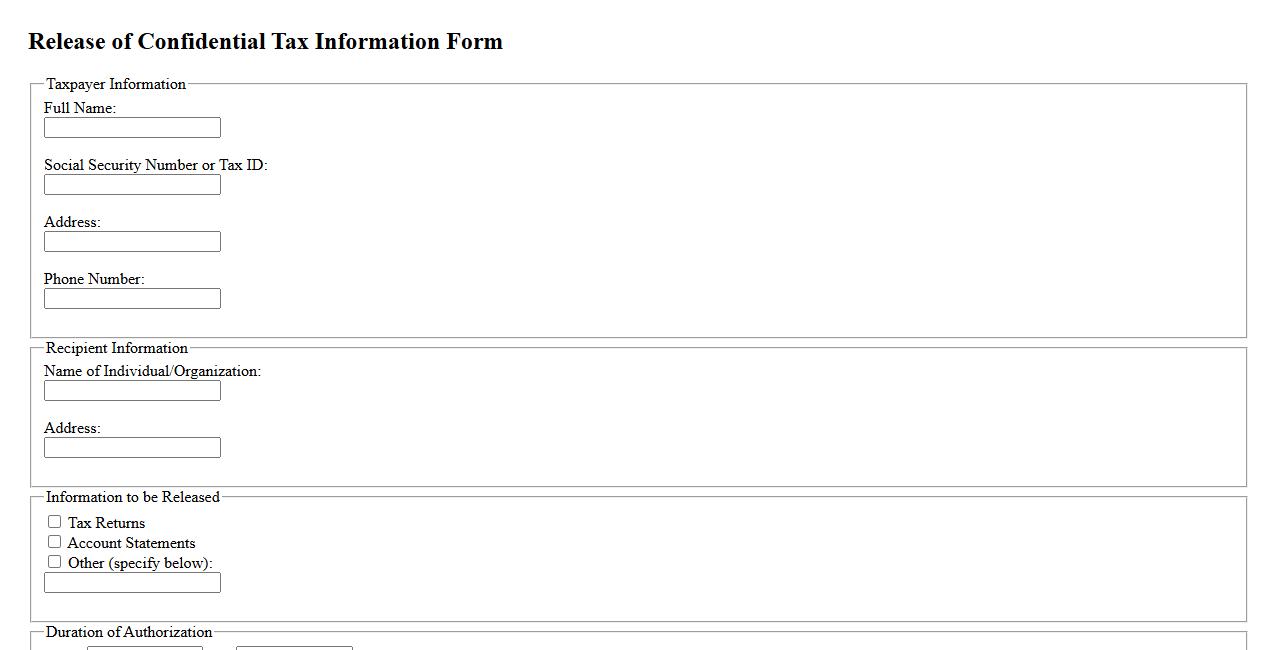

Release of Confidential Tax Information Form

The Release of Confidential Tax Information Form authorizes the disclosure of private tax data to designated individuals or organizations. This document ensures compliance with privacy laws while facilitating necessary information exchange. Proper completion of the form is essential for timely processing and security.

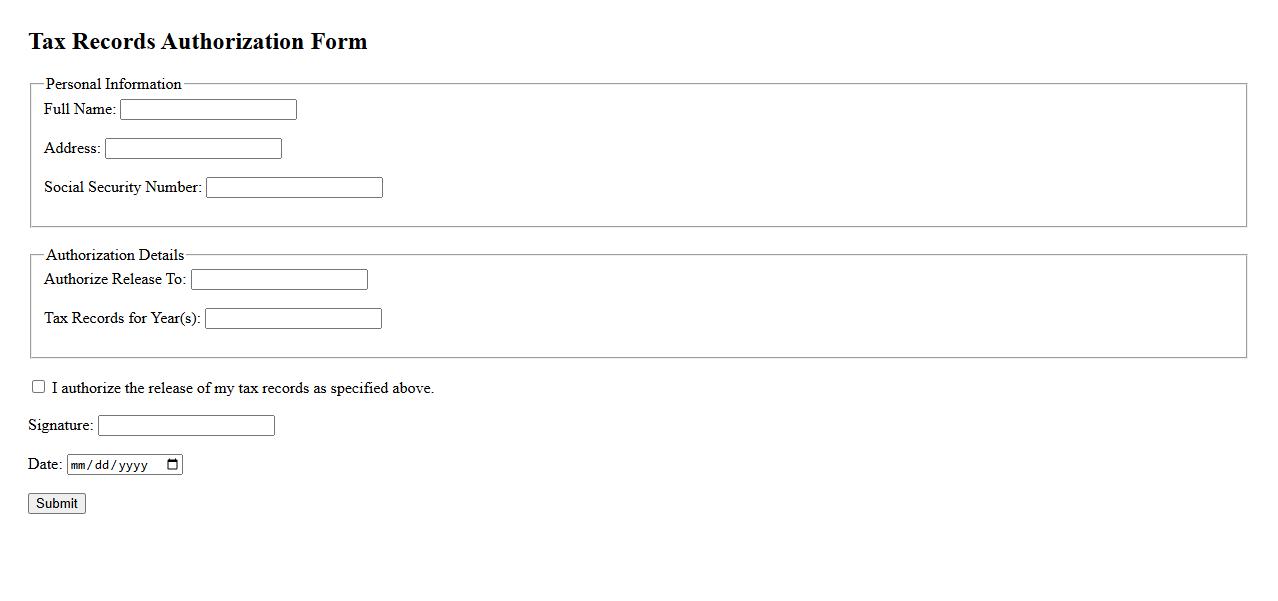

Tax Records Authorization Form

The Tax Records Authorization Form is a crucial document that grants permission to access an individual's or business's tax records. This form ensures compliance with privacy regulations while facilitating information sharing between tax authorities and authorized parties. Proper completion and submission of this form streamline the verification and processing of tax-related matters.

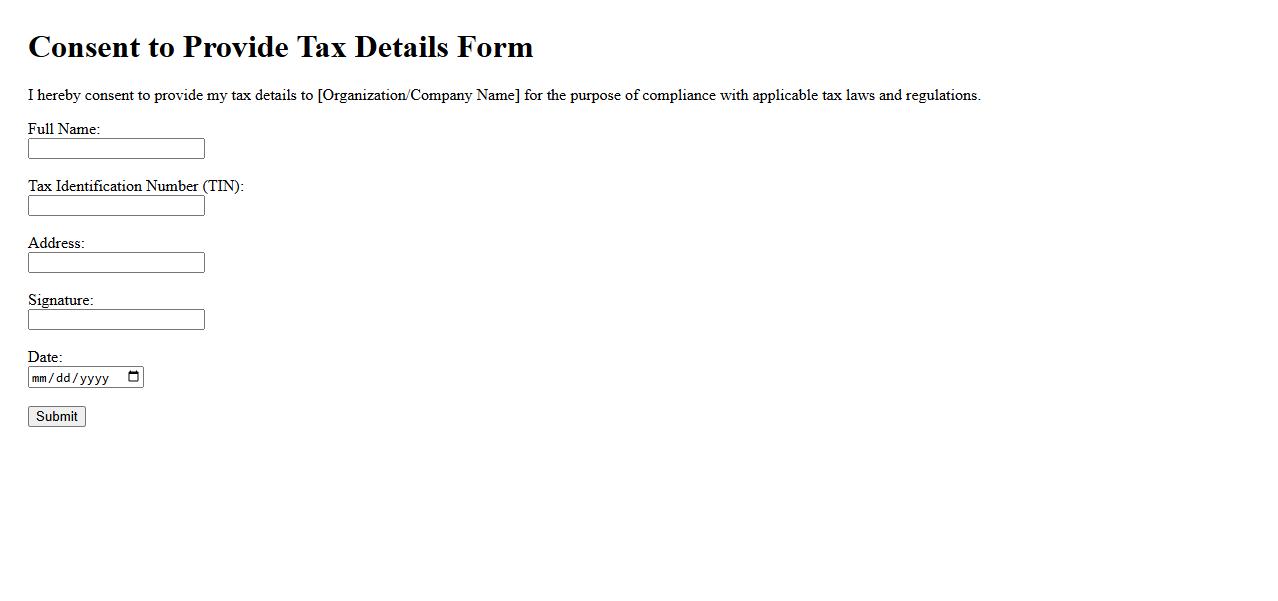

Consent to Provide Tax Details Form

The Consent to Provide Tax Details Form is a document used to authorize the sharing of personal tax information with designated parties. It ensures transparency and compliance with tax laws by obtaining explicit permission from the individual. This form is essential for accurate financial reporting and verification purposes.

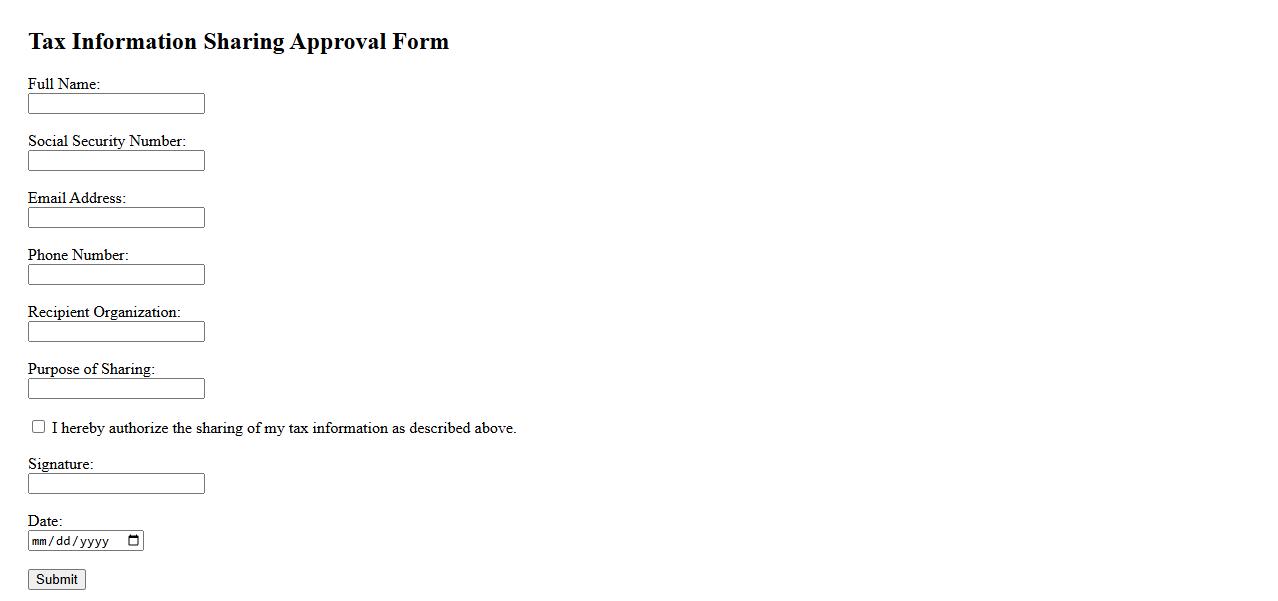

Tax Information Sharing Approval Form

The Tax Information Sharing Approval Form authorizes the exchange of confidential tax data between relevant parties. It ensures compliance with legal standards while facilitating accurate and efficient tax processing. Completing this form is essential for maintaining transparency and cooperation in tax-related matters.

What specific tax information is being authorized for release by this form?

The form authorizes the release of detailed tax information such as income statements, tax returns, and payment history. It includes both past and current tax records necessary for review or audit purposes. This allows authorized parties to access accurate and comprehensive tax data.

Who is permitted to receive the tax information according to this consent?

The consent typically designates specific entities or individuals such as tax professionals, government agencies, or financial institutions. Only those explicitly named in the form are authorized to receive the information. This ensures controlled and secure distribution of sensitive tax details.

What is the duration or validity period of the consent provided?

The consent usually remains valid for a fixed period, often specified in the form, such as months or years from the date of signing. Alternatively, it may be valid until a particular event or completion of a specific purpose. This period governs when the tax information can be accessed or used.

What is the purpose for which the tax information may be used?

The tax information is authorized for use solely for specified purposes, such as tax compliance, verification, audit, or financial assessments. The form restricts any use of the data outside these predefined objectives. This limitation protects taxpayer privacy and data integrity.

Can the consent be revoked, and if so, what is the process for revocation?

Yes, the consent can generally be revoked at any time by submitting a written notice to the relevant authority or party. The revocation halts any further information release beyond the date of receipt. This process empowers individuals to maintain control over their tax data privacy.