The Consent to Obtain Consumer Credit Report Form authorizes a lender or service provider to access an individual's credit history from credit reporting agencies. This form is essential for evaluating creditworthiness and assessing risk before approving credit, loans, or other financial products. Signing this consent ensures compliance with legal requirements and protects both parties during the credit evaluation process.

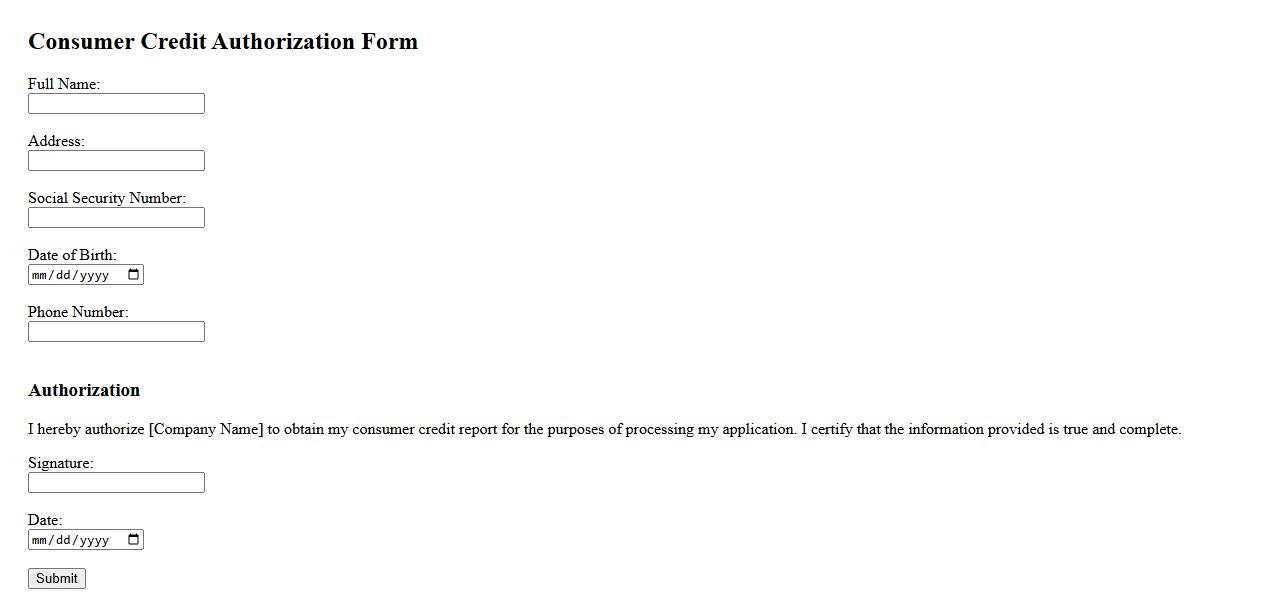

Consumer Credit Authorization Form

The Consumer Credit Authorization Form is a crucial document that grants permission to verify an individual's credit history. It ensures transparency and compliance during financial transactions or loan applications. Proper authorization helps protect both the consumer and the lender by confirming accurate credit information.

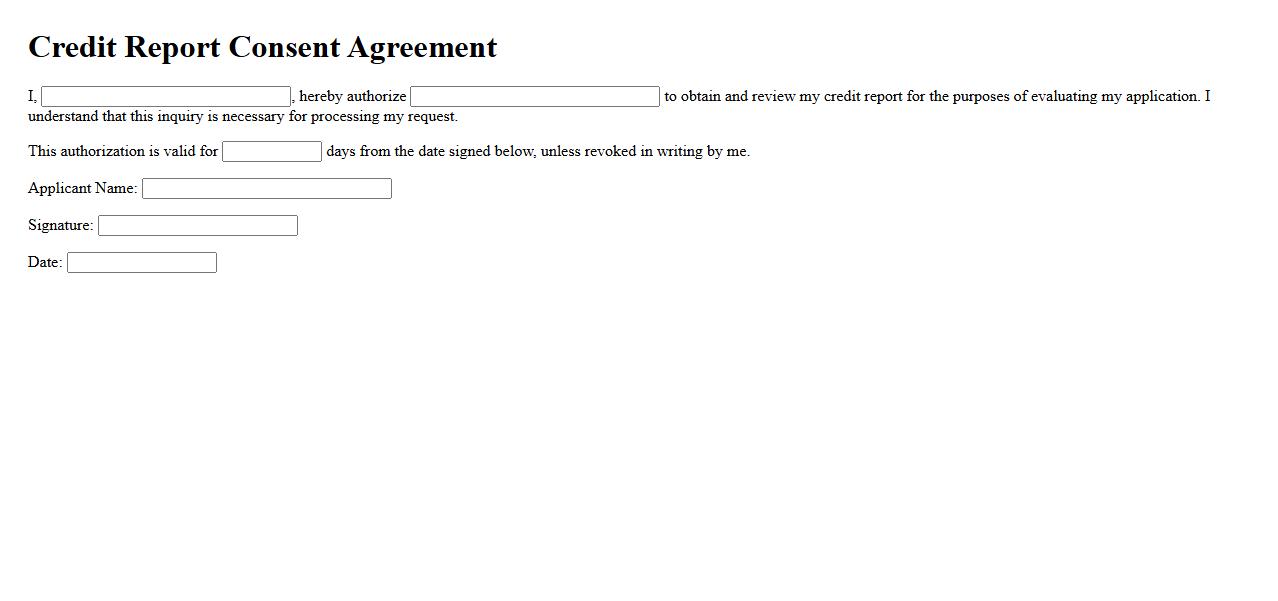

Credit Report Consent Agreement

The Credit Report Consent Agreement is a legal document that authorizes a company to obtain and review an individual's credit history. This agreement ensures transparency and compliance with privacy laws before accessing sensitive financial information. It is essential for processes like loan applications, rental agreements, and employment screenings.

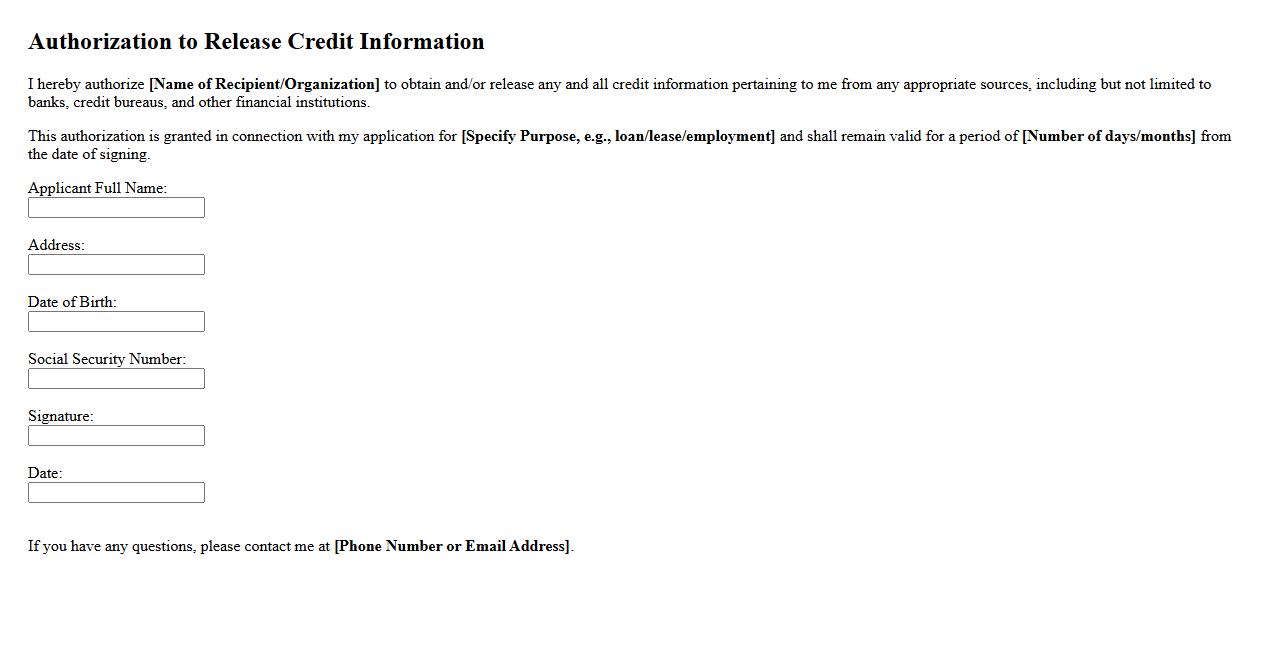

Authorization to Release Credit Information

Authorization to Release Credit Information is a formal consent allowing lenders or financial institutions to share your credit details with authorized third parties. This authorization is essential for processes like loan approvals and credit assessments. It ensures transparency and compliance with privacy regulations.

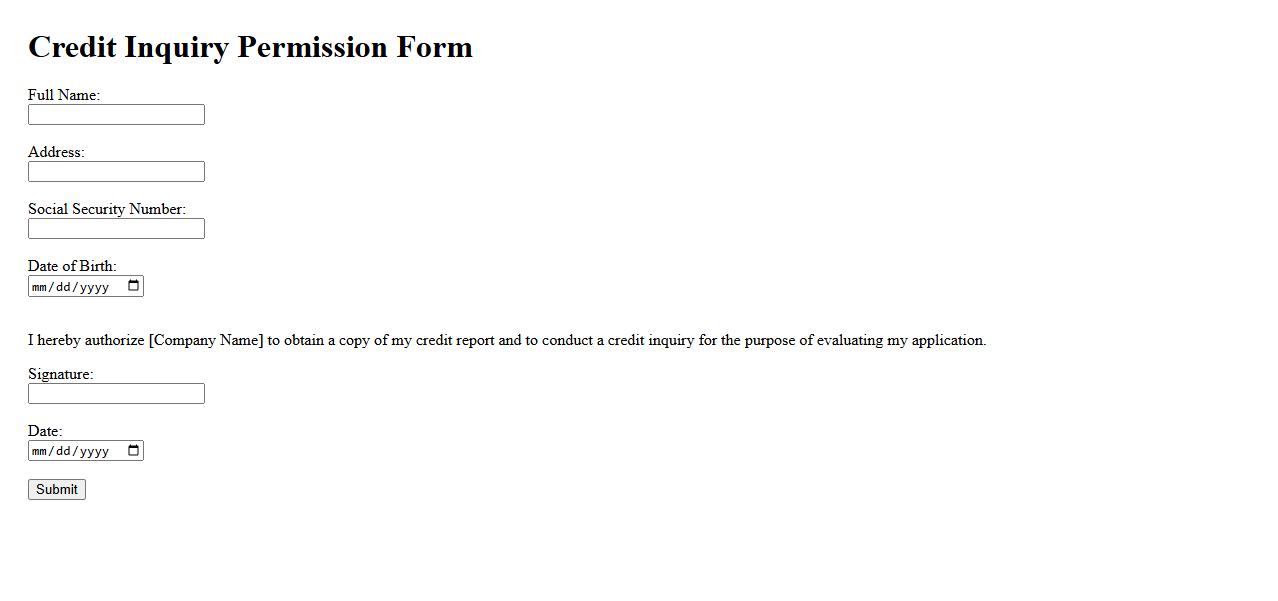

Credit Inquiry Permission Form

The Credit Inquiry Permission Form is a document that allows organizations to obtain authorization before accessing an individual's credit report. This form ensures transparency and compliance with legal regulations by securing explicit consent. It plays a crucial role in protecting consumer rights during credit evaluations.

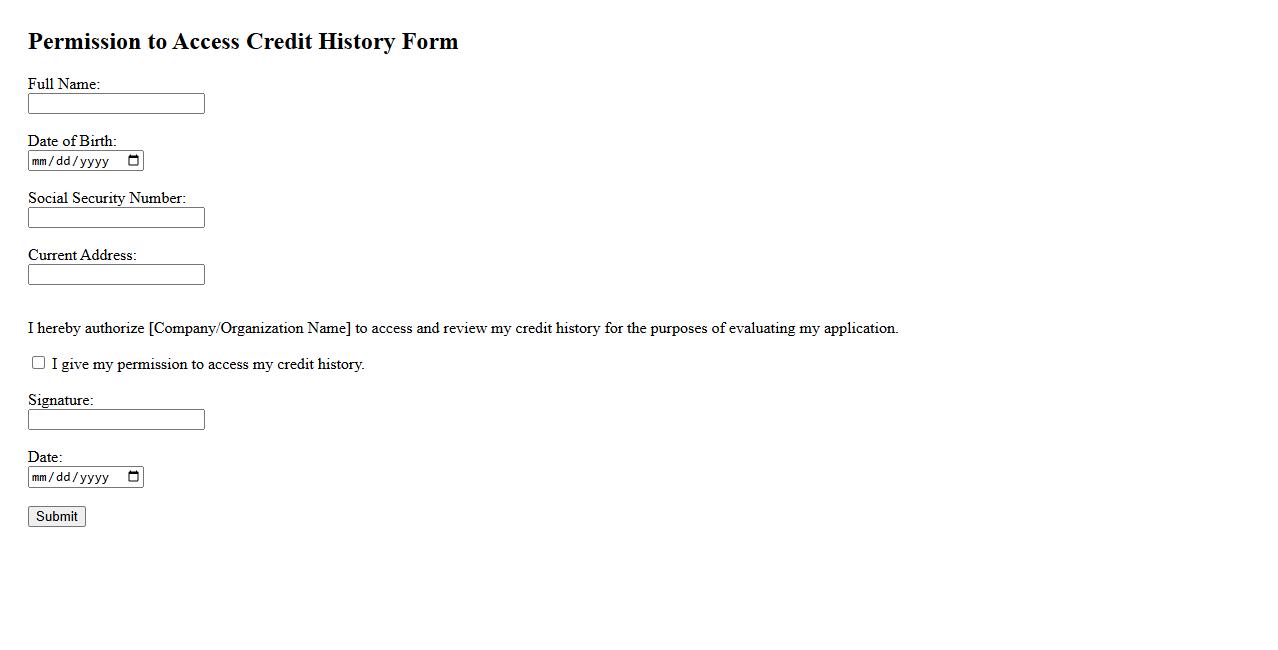

Permission to Access Credit History Form

The Permission to Access Credit History Form is an essential document that allows lenders or organizations to review an individual's credit report. This form ensures that the borrower consents to the credit check, maintaining transparency and compliance with privacy laws. It is a crucial step in the credit approval process, helping assess financial responsibility.

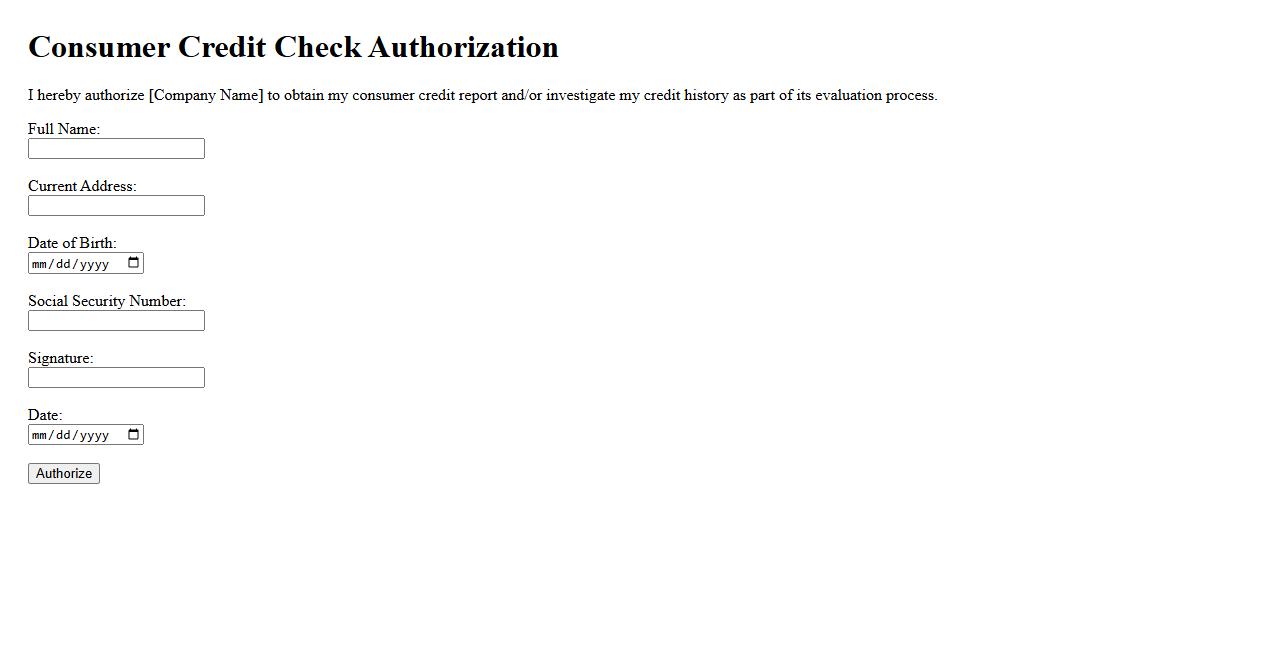

Consumer Credit Check Authorization

Consumer Credit Check Authorization is a formal consent given by an individual allowing a lender or service provider to access their credit report. This authorization helps assess the consumer's creditworthiness and financial history for loan or credit applications. Ensuring transparency and compliance, this process protects both parties involved in credit evaluation.

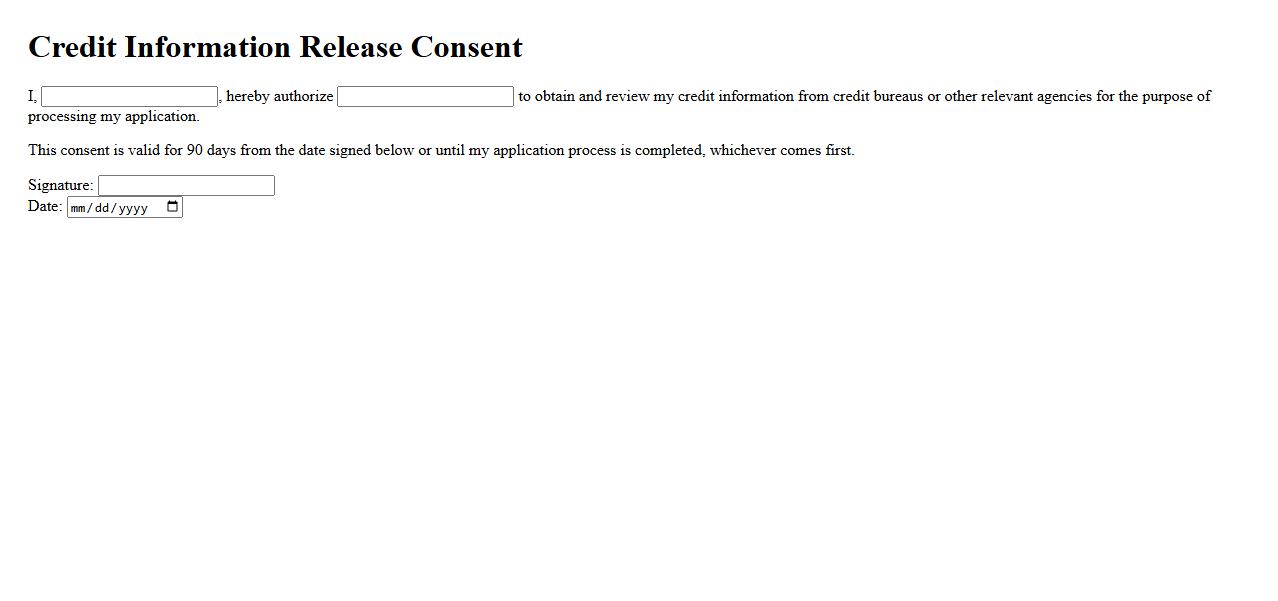

Credit Information Release Consent

The Credit Information Release Consent is a formal agreement allowing authorized parties to access an individual's credit report. This consent ensures transparency and compliance with privacy laws during credit evaluations. It helps lenders make informed decisions based on accurate financial data.

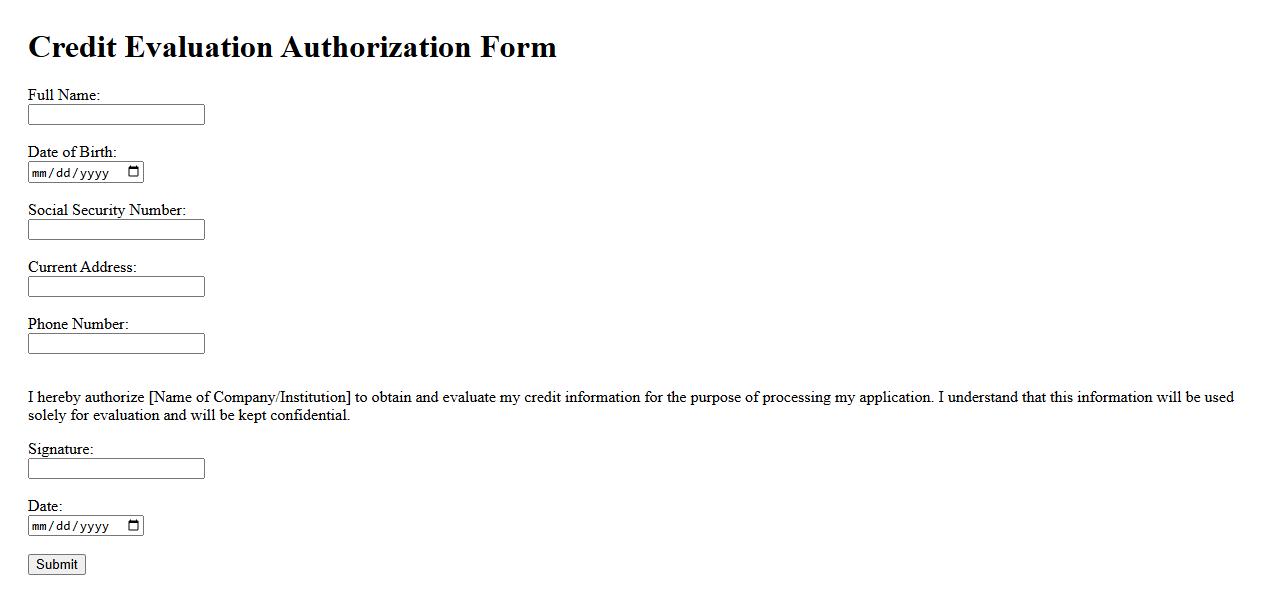

Credit Evaluation Authorization Form

The Credit Evaluation Authorization Form is a crucial document that allows businesses to obtain and assess an individual's or company's credit information. This form ensures consent is given before accessing financial records to determine creditworthiness. Proper use of this authorization helps streamline lending and approval processes effectively.

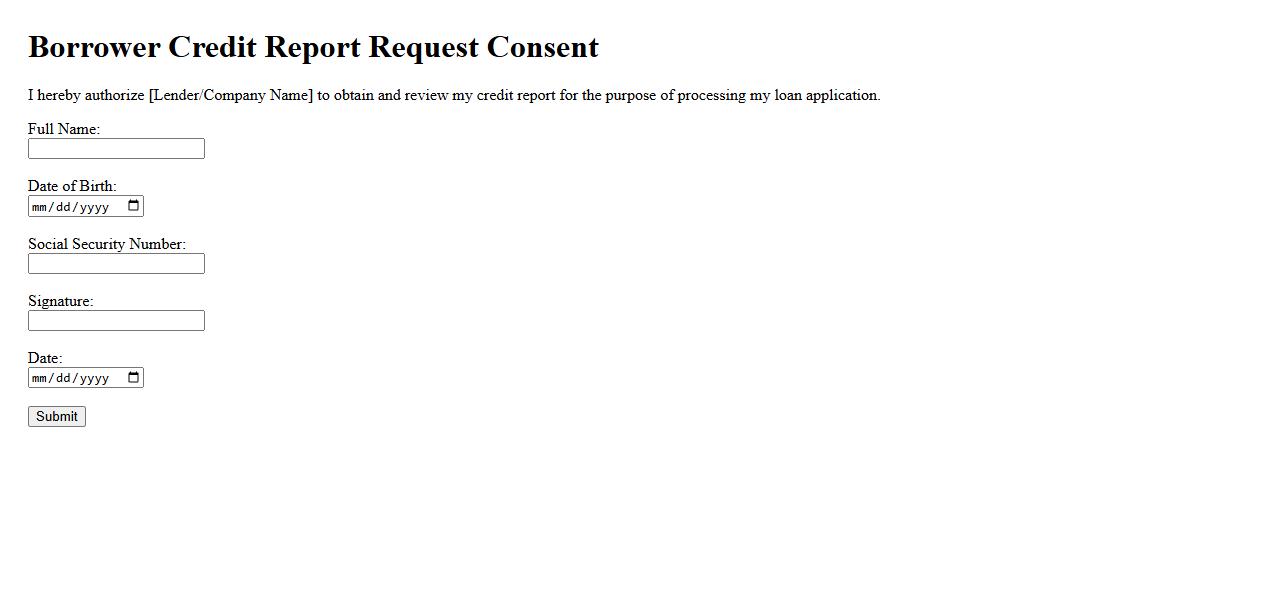

Borrower Credit Report Request Consent

By providing Borrower Credit Report Request Consent, you authorize us to obtain your credit report for the purpose of evaluating your loan application. This consent allows lenders to verify your creditworthiness and financial history. Rest assured, your information will be handled securely and confidentially.

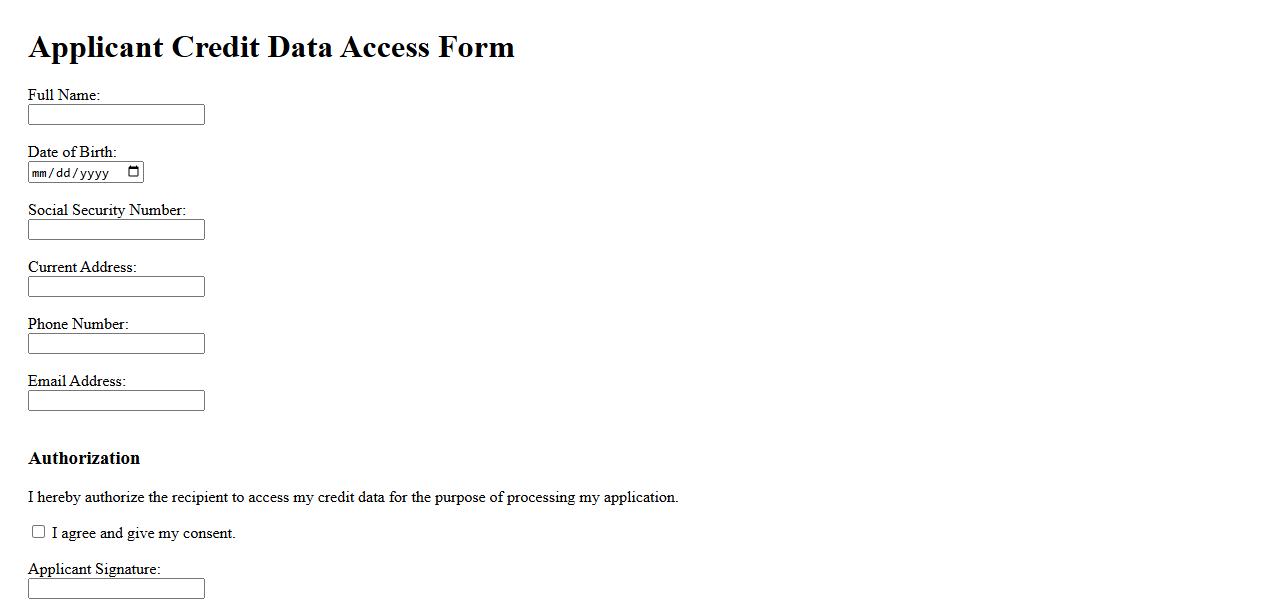

Applicant Credit Data Access Form

The Applicant Credit Data Access Form is a crucial document that authorizes lenders to obtain credit information about an applicant. This form ensures transparency and compliance with privacy regulations during the credit evaluation process. By signing, applicants grant permission for their credit history to be reviewed efficiently and securely.

What is the primary purpose of the Consent to Obtain Consumer Credit Report Form?

The primary purpose of the Consent to Obtain Consumer Credit Report Form is to authorize a third party to access your credit information. This form ensures that your credit report is accessed legally and with your approval. It protects your privacy and complies with credit reporting laws.

Who is authorized to access your credit report based on this consent form?

The entities authorized to access your credit report include lenders, landlords, and employers as specified in the form. Only those explicitly named in the consent form may review your credit history. Unauthorized parties are prohibited from obtaining your credit information without your permission.

What specific information may be collected through this consent form?

The consent form allows collection of detailed credit history information, such as credit accounts, payment history, and outstanding debts. It may also include personal identification data like your name, address, and social security number. This comprehensive data helps the requesting party assess your creditworthiness.

How will the obtained credit information be used by the requesting party?

The obtained credit report is primarily used to evaluate your financial responsibility for purposes like loan approval, rental agreements, or employment screening. The requesting party analyzes this information to make informed decisions. It ensures fair assessment based on your credit performance.

What are your rights regarding refusing or revoking consent on this form?

You have the right to refuse or revoke consent at any time, preventing further access to your credit report. However, refusal may affect your eligibility for financial services, rentals, or jobs that require credit checks. Your rights are protected under consumer credit laws to maintain control over your personal information.