The Consent for Financial Information Release Form authorizes a third party to access an individual's financial records securely. This form ensures compliance with privacy laws while allowing necessary information sharing for purposes like loan processing or financial planning. Signing this document protects both parties by clearly defining the scope and limitations of data access.

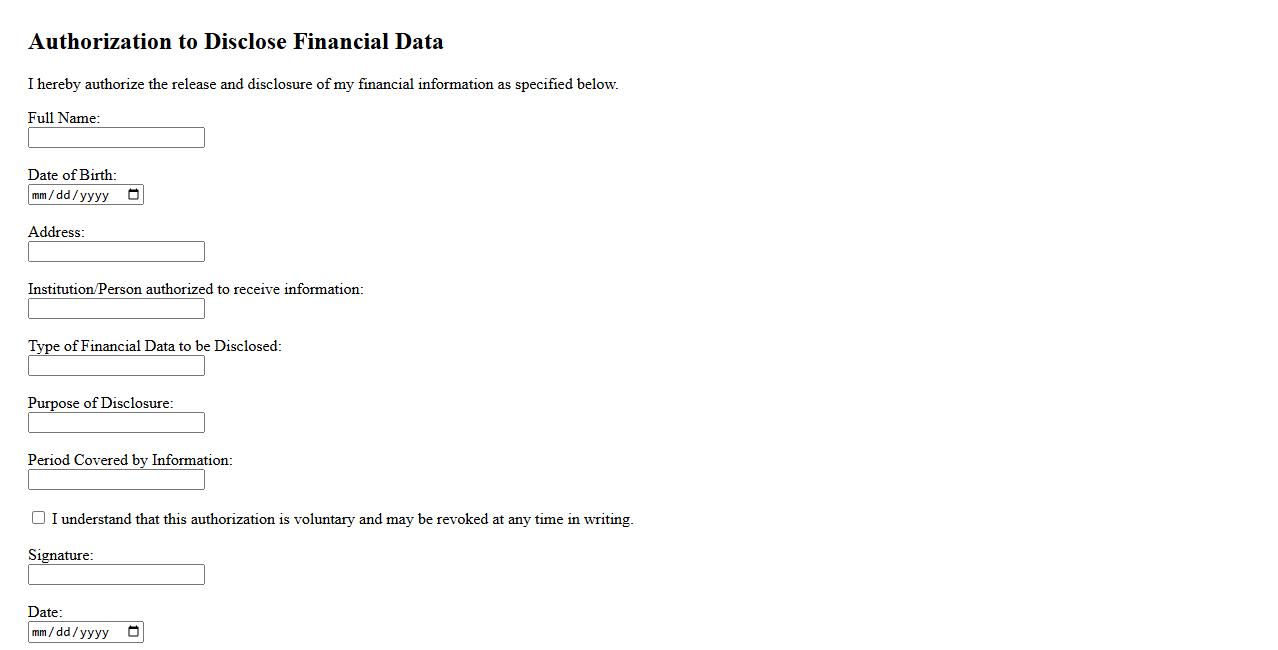

Authorization to Disclose Financial Data Form

The Authorization to Disclose Financial Data Form is a critical document that permits the sharing of sensitive financial information between authorized parties. It ensures compliance with privacy laws while facilitating transparency in financial transactions. This form is essential for securely managing and verifying financial records in a trusted manner.

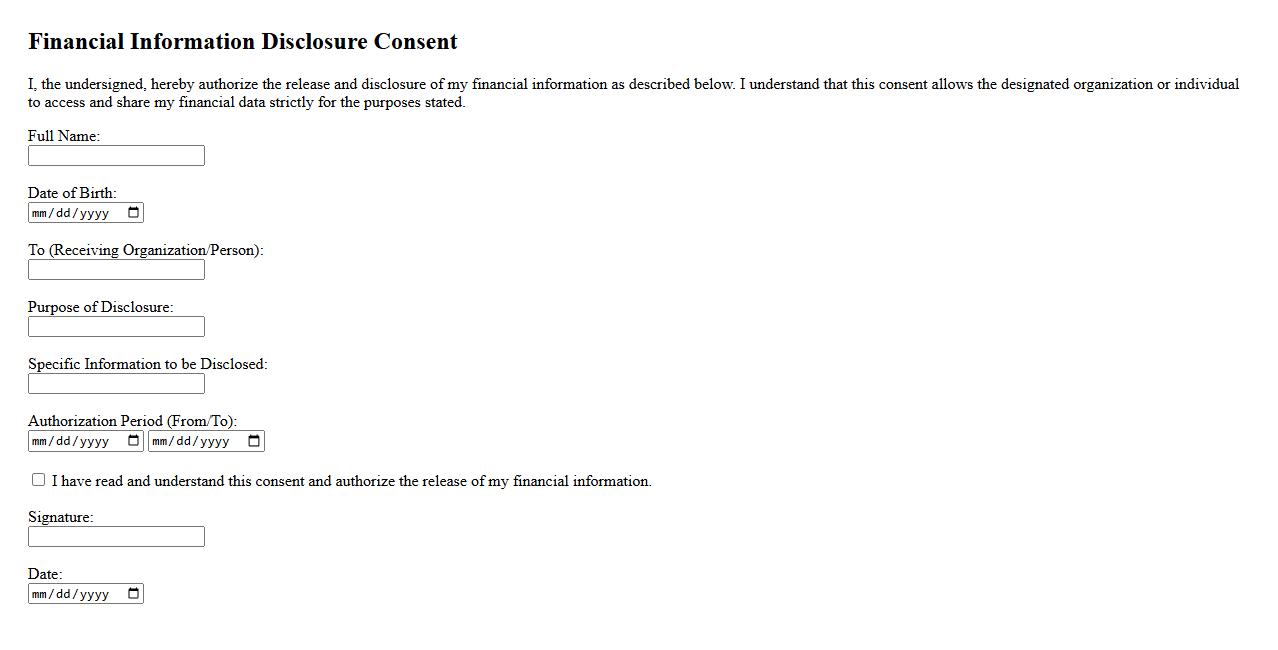

Financial Information Disclosure Consent

Financial Information Disclosure Consent is a formal agreement that allows organizations to access and share an individual's financial data. This consent ensures transparency and compliance with legal requirements while protecting personal information. It is essential for processes such as loan approvals, credit checks, and financial planning.

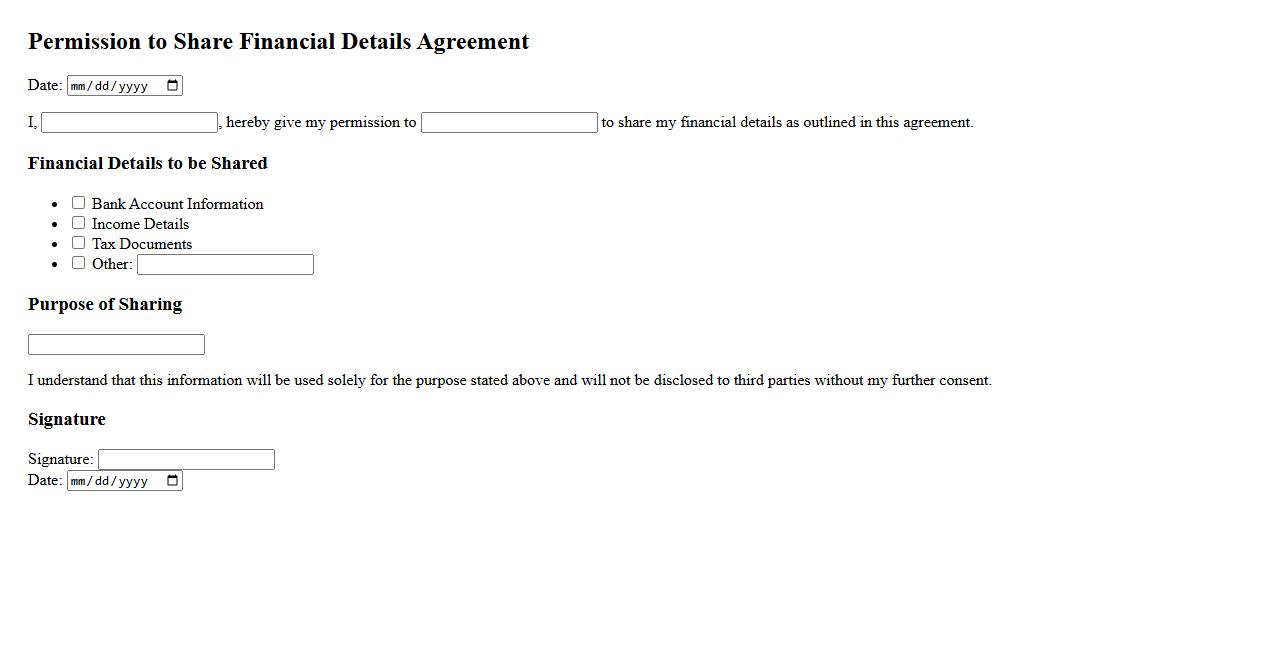

Permission to Share Financial Details Agreement

The Permission to Share Financial Details Agreement is a legal document that authorizes one party to disclose their financial information to a specified third party. This agreement ensures clarity and consent, protecting the privacy and rights of all involved. It is essential for maintaining trust and compliance in financial transactions.

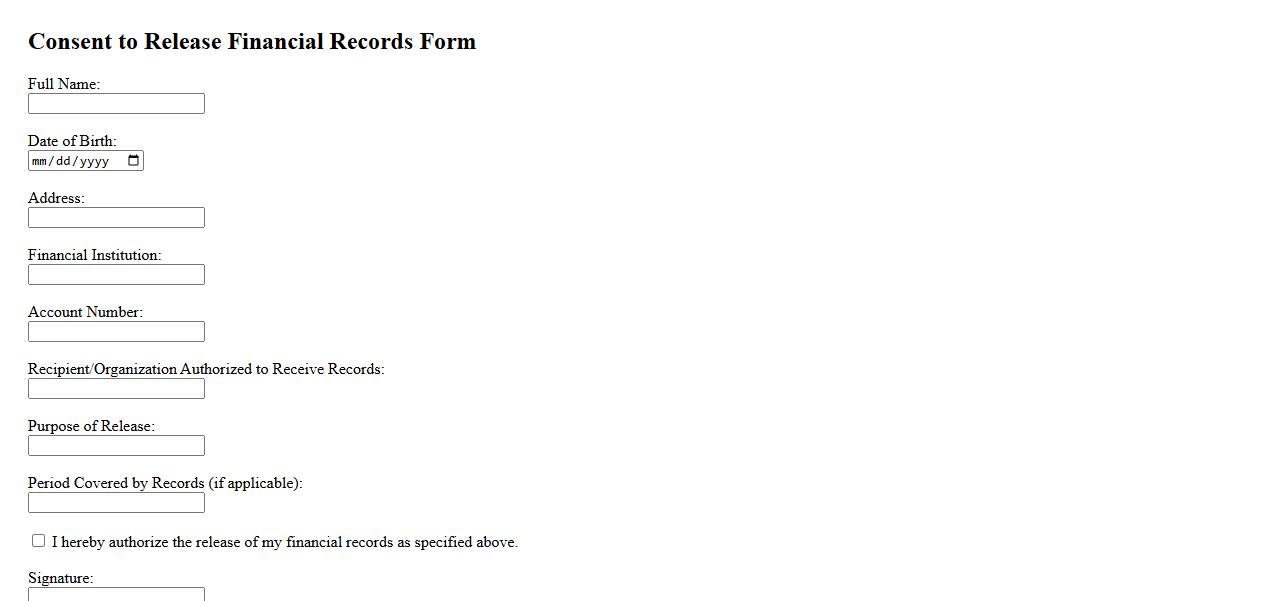

Consent to Release Financial Records Form

The Consent to Release Financial Records Form authorizes third parties to access your confidential financial information securely. This form ensures compliance with privacy laws while facilitating transparent communication between financial institutions and authorized individuals. It is essential for processing requests related to loans, audits, or legal matters.

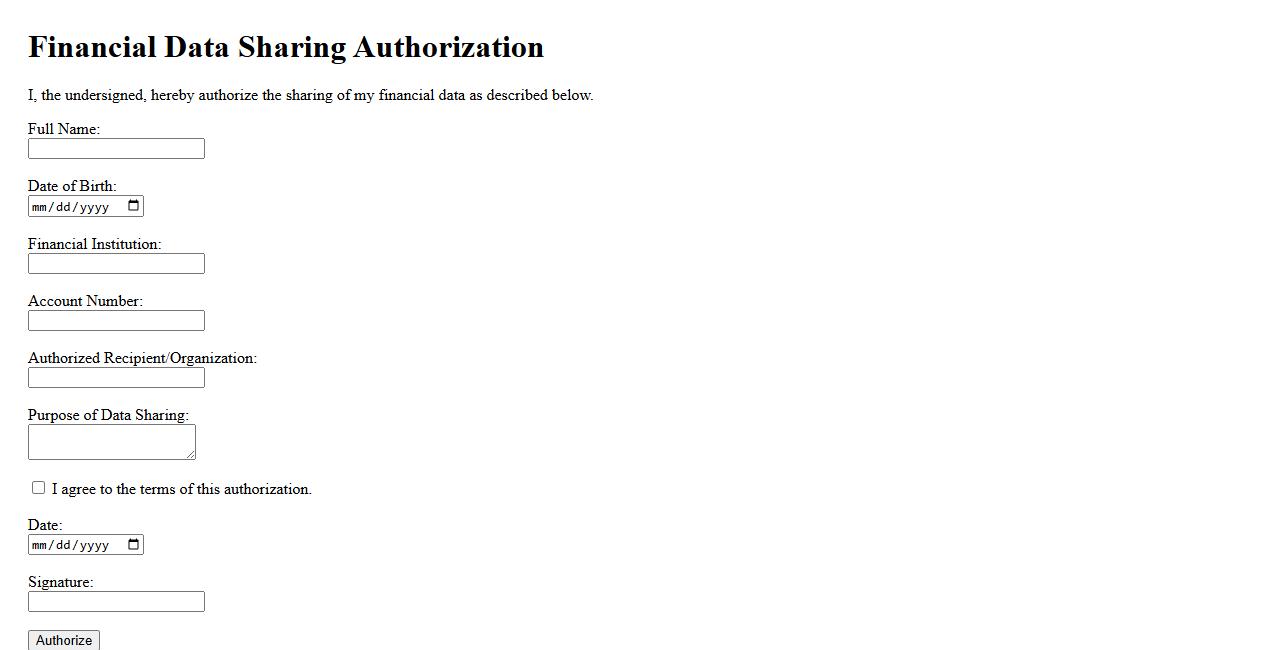

Financial Data Sharing Authorization

Financial Data Sharing Authorization empowers individuals and organizations to securely grant access to their financial information. This process ensures transparency and control over who can view or use sensitive financial data. Proper authorization enhances trust and compliance in financial transactions.

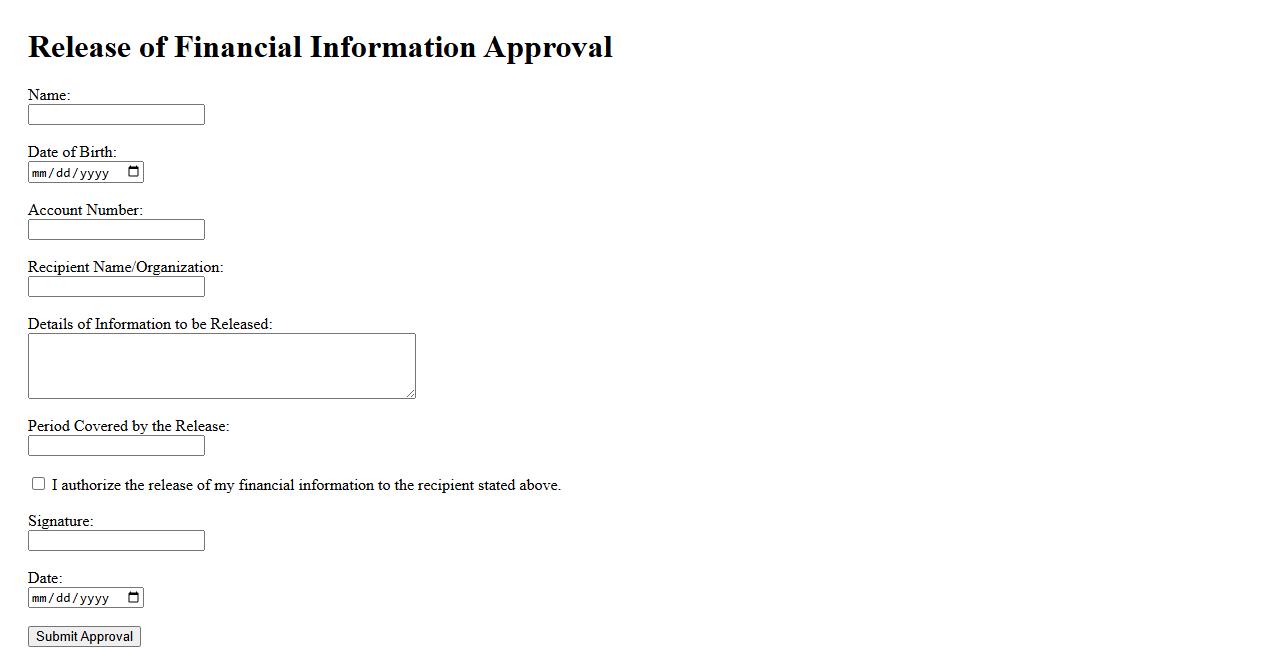

Release of Financial Information Approval

The Release of Financial Information Approval is a critical process ensuring that all financial data shared externally meets compliance and accuracy standards. This approval safeguards sensitive information and maintains transparency with stakeholders. Proper authorization helps prevent errors and protects organizational integrity.

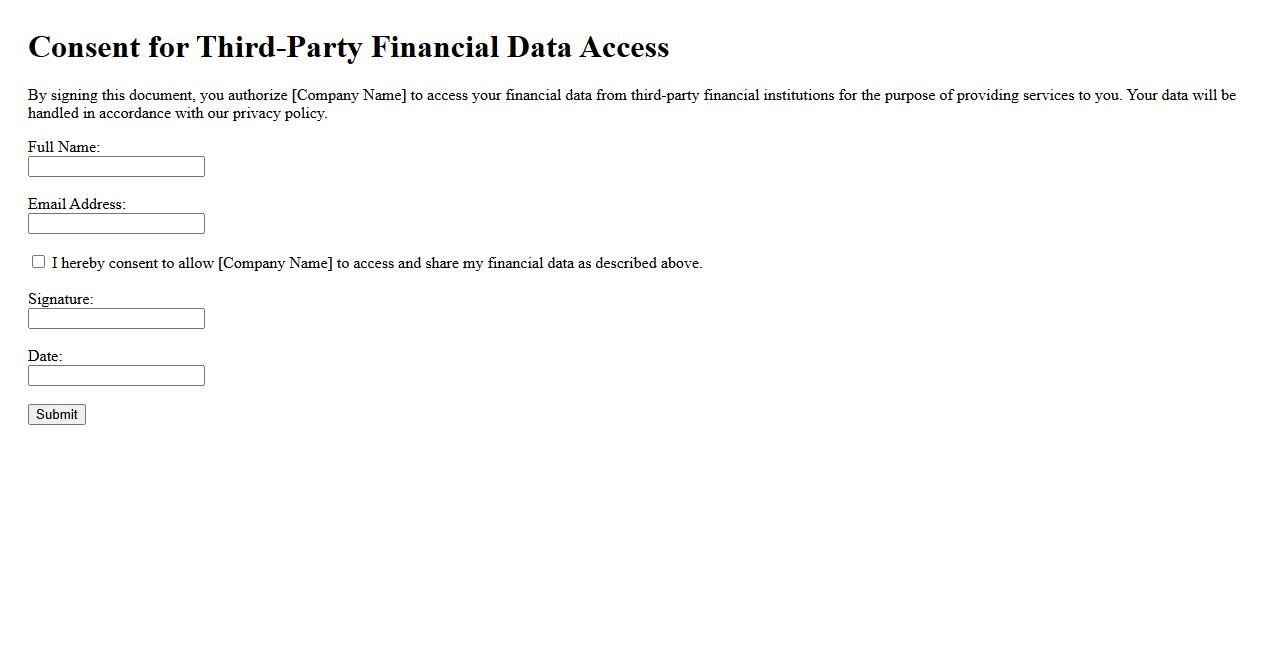

Consent for Third-Party Financial Data Access

Consent for Third-Party Financial Data Access is a crucial process that allows individuals to authorize trusted external entities to view and manage their financial information securely. This consent ensures transparency and control over personal data sharing, promoting trust between users and service providers. Proper consent mechanisms protect privacy while enabling seamless financial services integration.

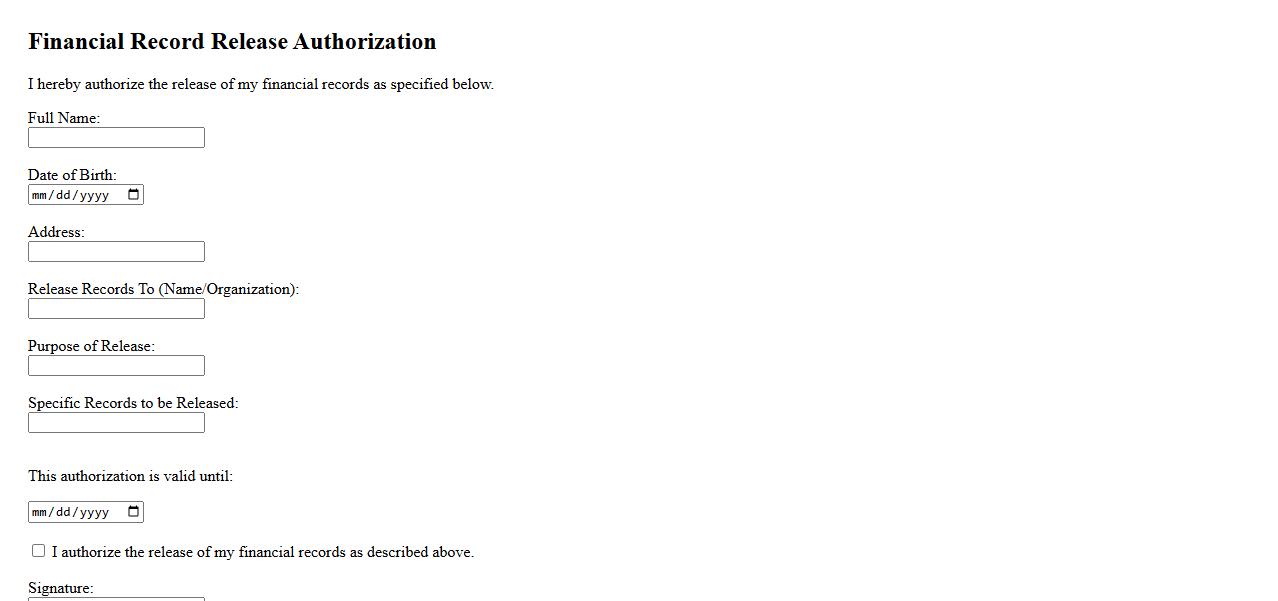

Financial Record Release Authorization

The Financial Record Release Authorization is a legal document that permits the sharing of an individual's financial information. It ensures confidentiality while allowing authorized parties to access necessary records. This authorization is essential for financial transactions, audits, and legal processes.

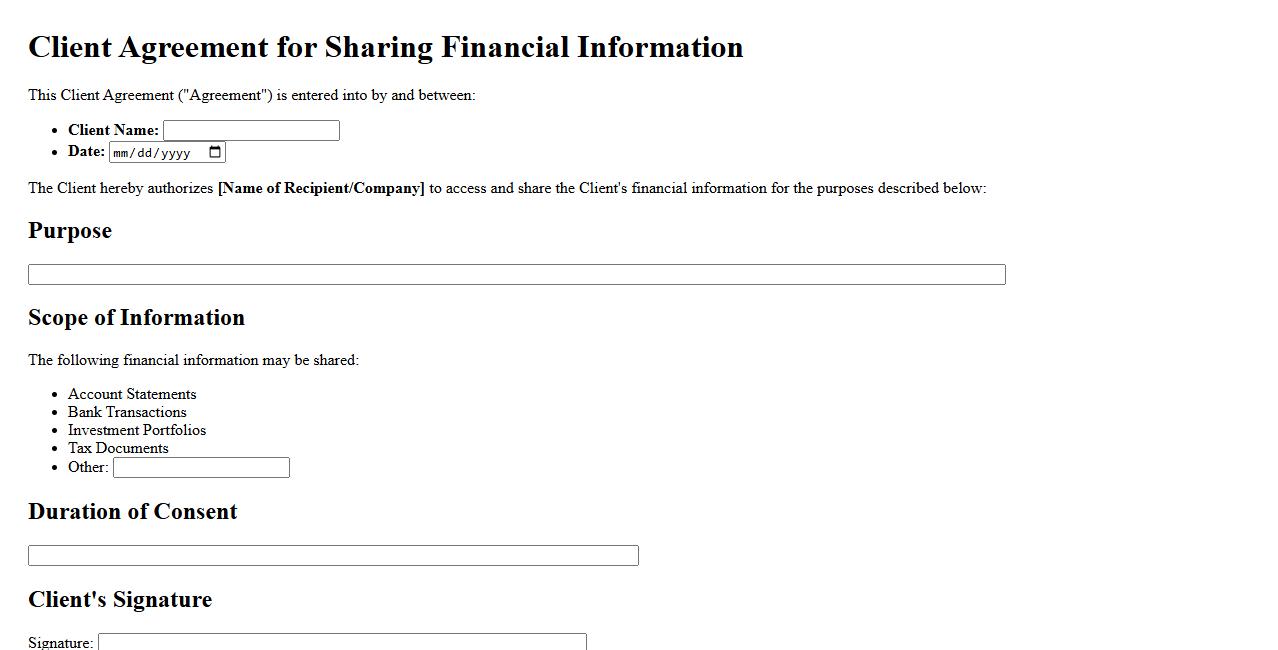

Client Agreement for Sharing Financial Information

A Client Agreement for Sharing Financial Information outlines the terms under which a client consents to disclose their financial data to a third party. This agreement ensures transparency and protects both parties by clearly defining the scope and purpose of the information shared. It is essential for maintaining trust and compliance with relevant privacy laws.

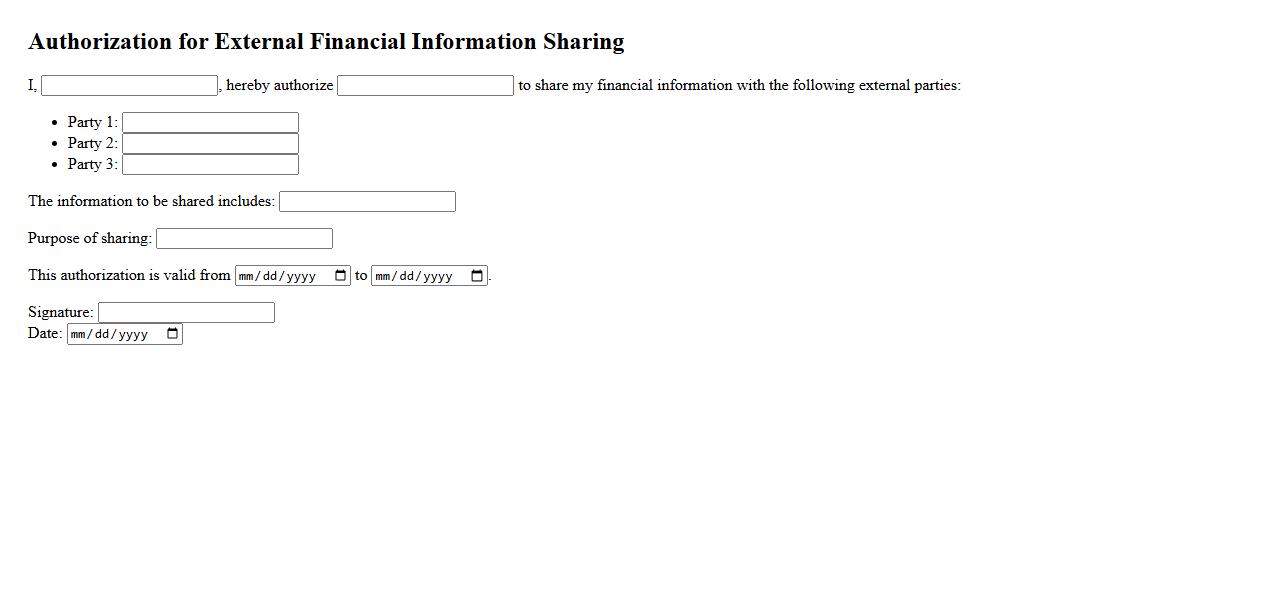

Authorization for External Financial Information Sharing

Authorization for External Financial Information Sharing ensures that individuals or organizations grant permission to share their financial data with third parties securely and transparently. This process safeguards sensitive information while enabling necessary access for services like credit assessments or financial advice. Proper authorization helps maintain trust and compliance with privacy regulations.

Authorized Parties for Financial Information

The consent form specifies which parties are granted permission to receive the financial information. Typically, these include trusted entities such as financial institutions, legal representatives, or designated third parties. Ensuring clarity on authorized recipients protects the privacy and security of sensitive data.

Types of Financial Information Covered

The consent form explicitly outlines the specific types of financial details that are subject to disclosure. Common categories include bank statements, tax returns, income documentation, and credit reports. Clearly defining the data scope helps prevent unauthorized sharing of irrelevant or sensitive information.

Validity Period of Consent

The duration for which the consent for release remains valid is stated within the form. This period may range from a set number of months to an indefinite timeframe, depending on the agreement. Knowing the consent timeframe ensures that information sharing is appropriately controlled and time-limited.

Purpose of Financial Information Usage

The form clearly states the intended purpose for which the financial information may be utilized. Common uses include loan processing, financial assessment, or legal compliance. Specifying the purpose maintains transparency and aligns information use with the individual's expectations.

Procedures to Revoke or Withdraw Consent

The consent form describes the steps required to revoke or withdraw permission after signing. Typically, this involves providing written notification to the entity holding the information. Clear revocation procedures empower individuals to maintain control over their personal financial data.