Consent for Payment Authorization is a formal agreement that allows a business or service provider to charge a customer's account for specified transactions. This authorization ensures secure and authorized processing of payments, protecting both parties from unauthorized charges. Clear Consent for Payment Authorization is essential for compliance with legal and financial regulations.

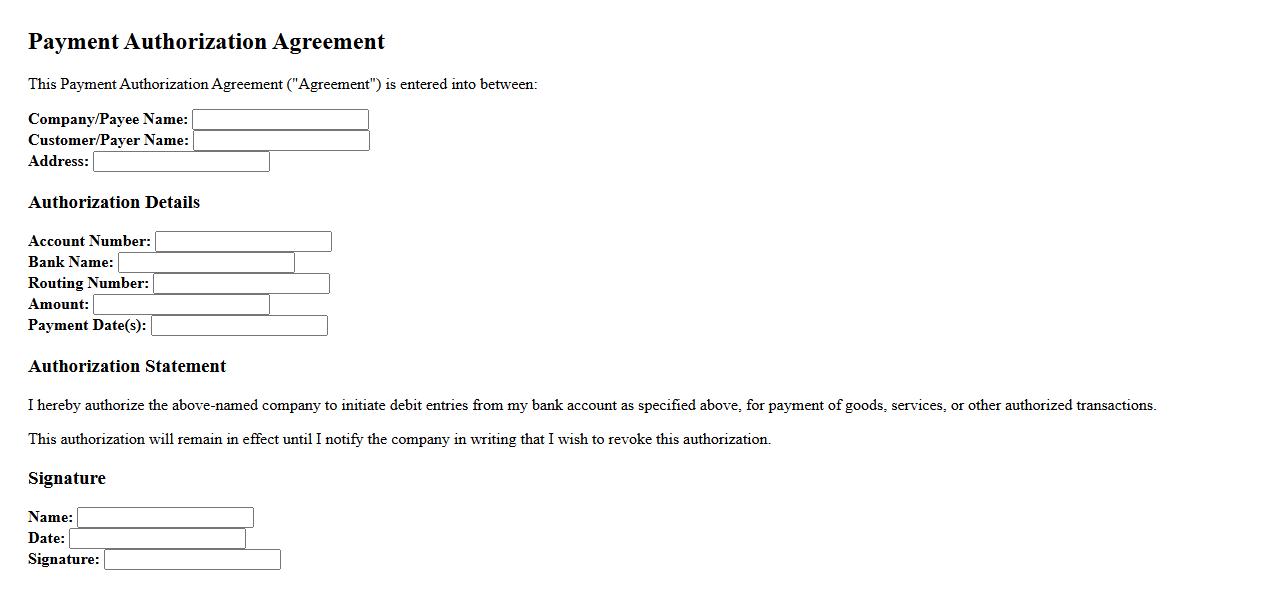

Payment Authorization Agreement

This Payment Authorization Agreement outlines the terms under which a customer authorizes a business to process payments on their behalf. It ensures clear consent and establishes the methods, amounts, and frequency of payments. This agreement protects both parties by providing a formal record of payment approval.

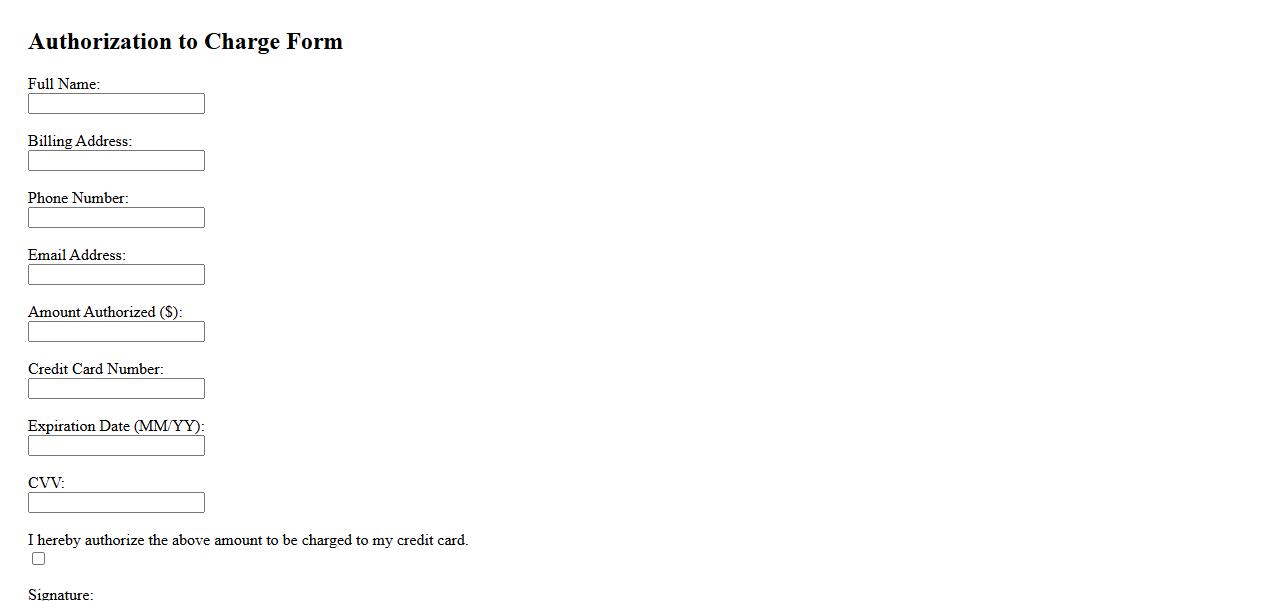

Authorization to Charge Form

The Authorization to Charge Form is a crucial document that grants permission to a business or service provider to debit funds from a customer's account. This form ensures clear consent and helps prevent unauthorized transactions. It is essential for secure and transparent payment processing.

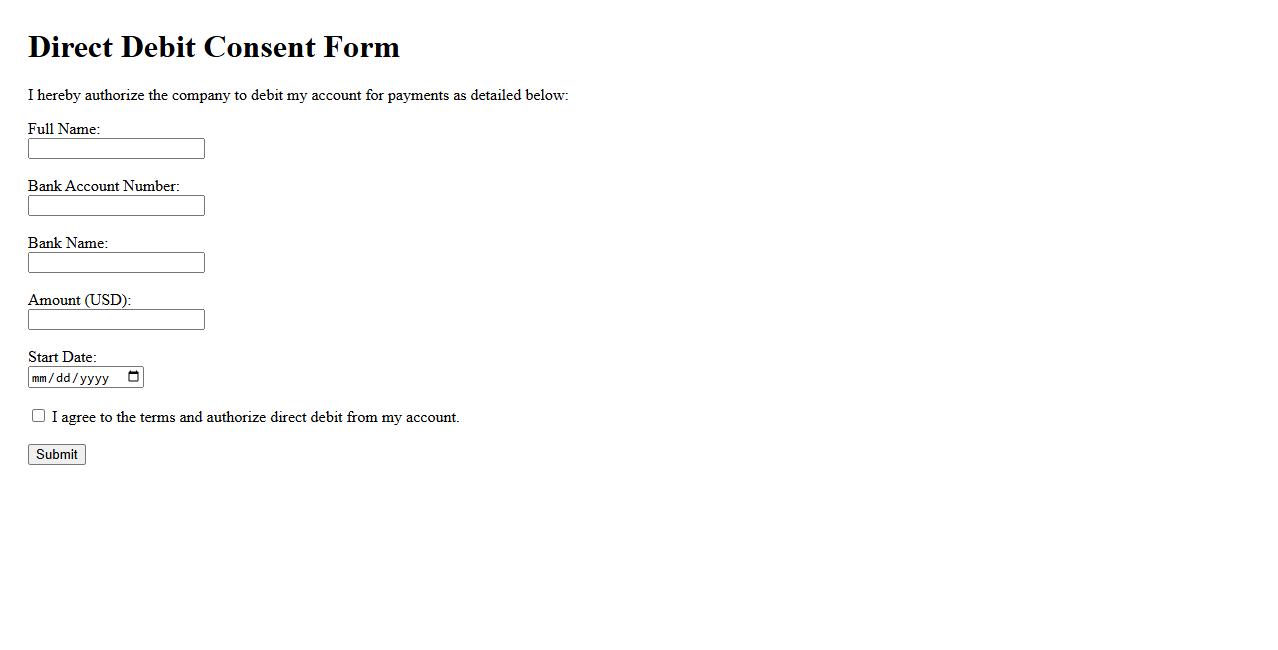

Direct Debit Consent

Direct Debit Consent is the authorization given by an individual to allow an organization to withdraw funds directly from their bank account. This consent ensures secure and timely payments without manual intervention. It simplifies billing processes and provides convenience for both parties involved.

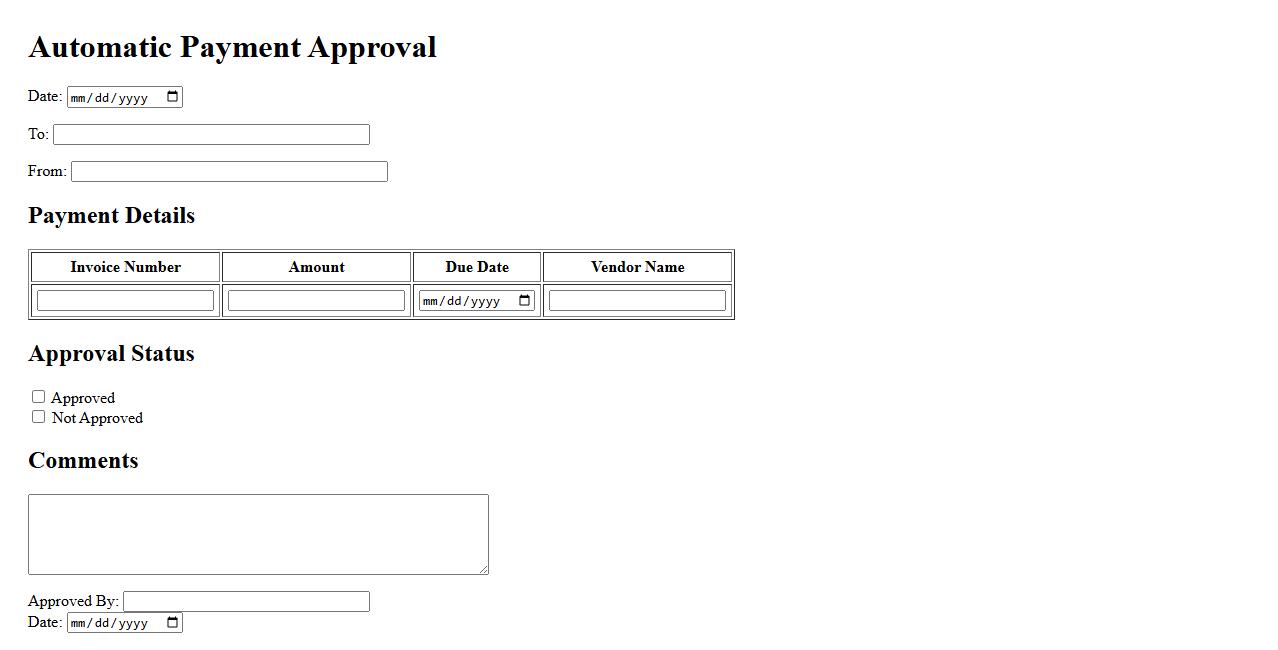

Automatic Payment Approval

Automatic Payment Approval streamlines financial processes by instantly validating transactions without manual intervention. This system enhances efficiency and reduces errors, ensuring timely payments. Businesses benefit from faster cash flow and improved operational accuracy.

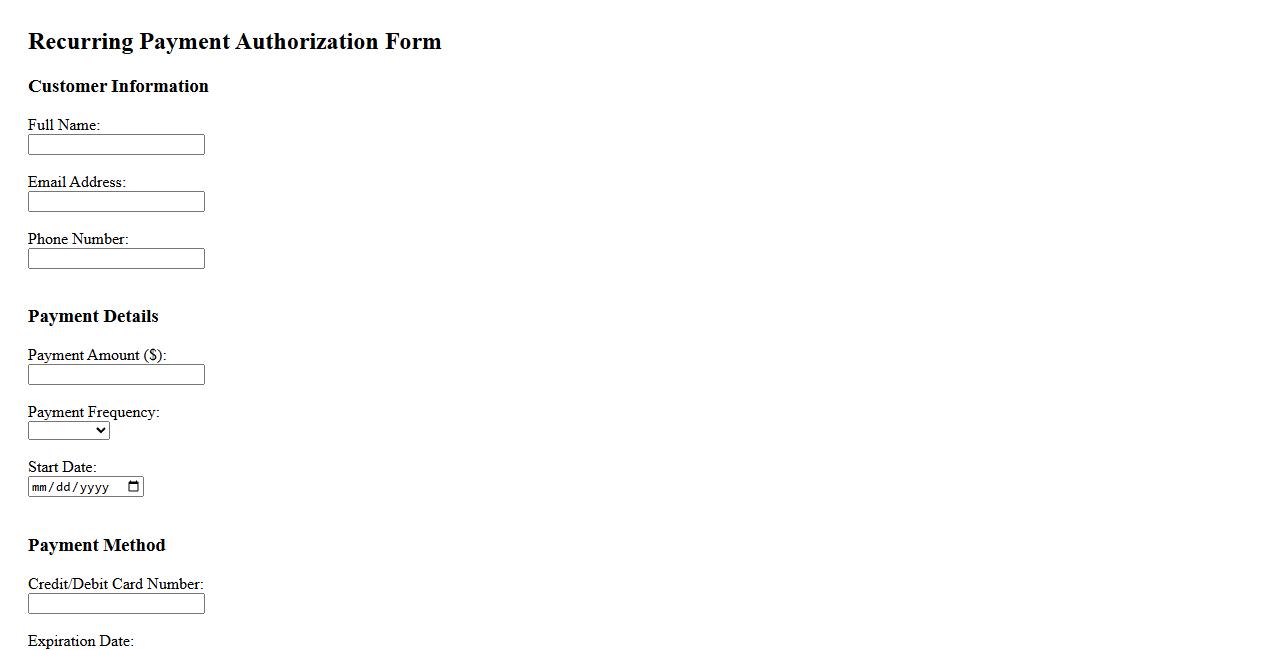

Recurring Payment Authorization

Recurring Payment Authorization allows businesses to securely process automatic payments from customers on a scheduled basis. This authorization ensures timely transactions without requiring manual approval for each payment. It simplifies billing and improves cash flow management for subscription-based services.

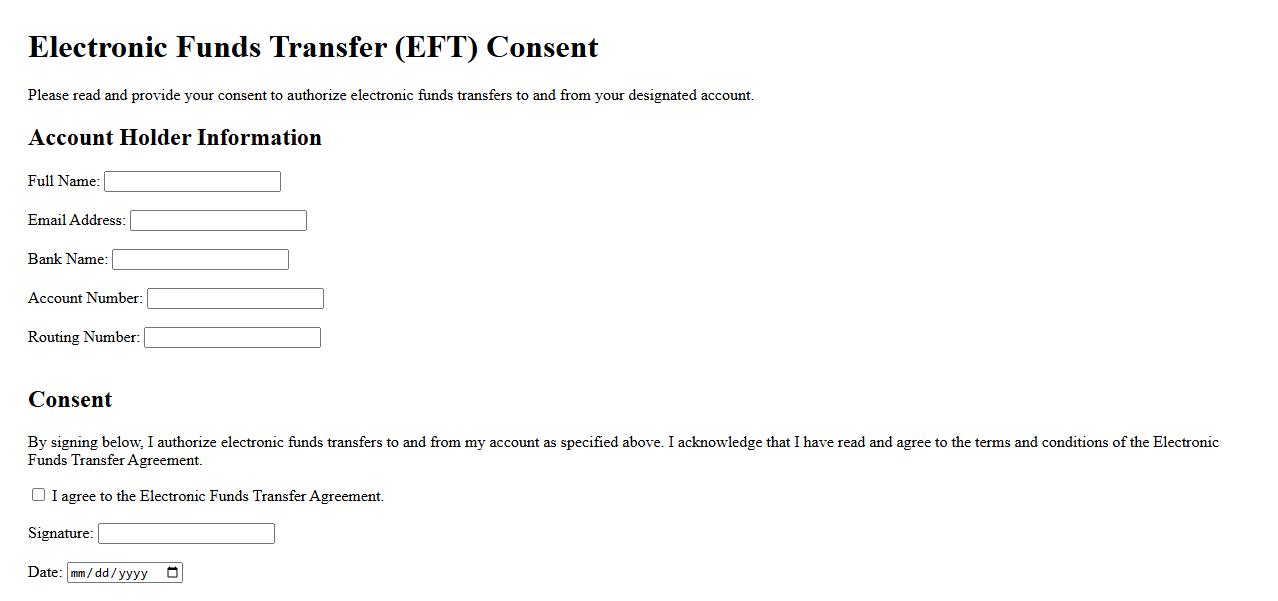

Electronic Funds Transfer Consent

Electronic Funds Transfer Consent is a formal agreement allowing businesses or financial institutions to electronically withdraw or deposit funds from a customer's bank account. This consent ensures secure and authorized transactions, streamlining payments and transfers. Customers can enjoy faster processing and reduced paperwork with electronic fund management.

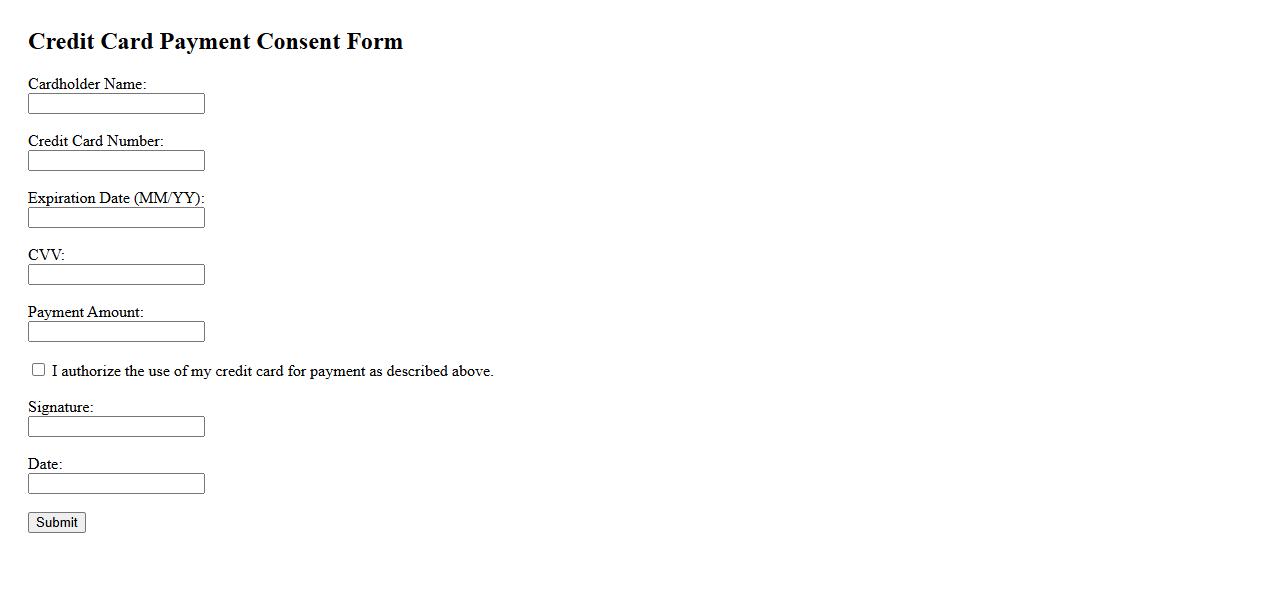

Credit Card Payment Consent

Credit Card Payment Consent is an authorization given by the cardholder allowing a merchant or service provider to charge their credit card for a specified amount. This consent ensures secure and transparent transactions between the customer and the business. It is essential for protecting both parties from unauthorized charges and disputes.

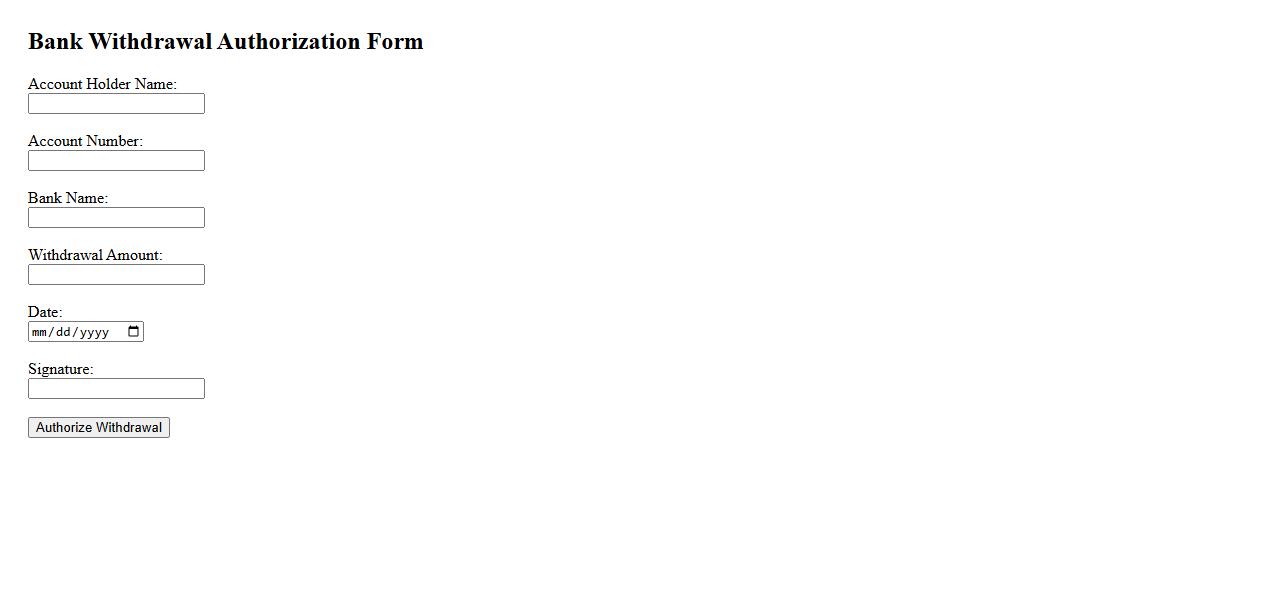

Bank Withdrawal Authorization

Bank Withdrawal Authorization is a formal permission granted by an account holder allowing a bank or a third party to withdraw funds from their bank account. This authorization ensures secure and authorized transactions, preventing unauthorized access to the account. It is commonly used for payment processing, automatic bill payments, and fund transfers.

Single Payment Approval

Single Payment Approval is a streamlined process that ensures each payment is verified and authorized by a designated individual. This method enhances security by minimizing errors and preventing unauthorized transactions. It is crucial for maintaining financial accuracy and accountability in business operations.

Billing Authorization Form

The Billing Authorization Form is a crucial document that grants permission for charges to be billed to a specified account. It ensures transparency and consent between the service provider and the customer. Proper use of this form helps streamline payment processing and prevents unauthorized transactions.

What specific payment methods are authorized in the consent document?

The consent document clearly outlines the authorized payment methods to ensure transparency and compliance. Common methods include credit cards, debit cards, and electronic bank transfers. This specification helps to prevent unauthorized transactions and safeguard the payer's interests.

Does the consent specify the frequency and amount of authorized payments?

The document explicitly states the frequency (e.g., monthly, quarterly) and the amount of payments authorized by the payer. This detailed information enables clear budgeting and financial planning for both parties. Such clarity mitigates the risk of disputes related to unexpected charges.

Are there terms outlined for revoking or modifying the payment authorization?

The consent includes defined terms for revoking or modifying the payment authorization to protect the payer's rights. Procedures for cancellation or amendment are stated with required notice periods. These provisions ensure flexibility and control over ongoing financial commitments.

Who is identified as the payee and payer within the consent document?

The document distinctly identifies the payee (recipient) and payer (authorizing party) to clearly establish financial responsibility. Accurate identification facilitates successful transaction processing and record-keeping. This clarity reduces confusion and administrative errors.

Are data privacy and security measures addressed regarding payment information?

Data privacy and security measures are explicitly addressed to protect sensitive payment information. The document outlines compliance with applicable regulations such as GDPR or PCI DSS standards. These measures ensure confidentiality, integrity, and trust in the payment process.