Consent to Release Tax Information authorizes a third party to access an individual's or business's tax records, ensuring proper handling of confidential data. This Consent to Release Tax Information is essential for tax professionals, legal representatives, or financial institutions when managing tax-related matters on behalf of the taxpayer. Proper documentation guarantees compliance with privacy laws and enables efficient communication with tax authorities.

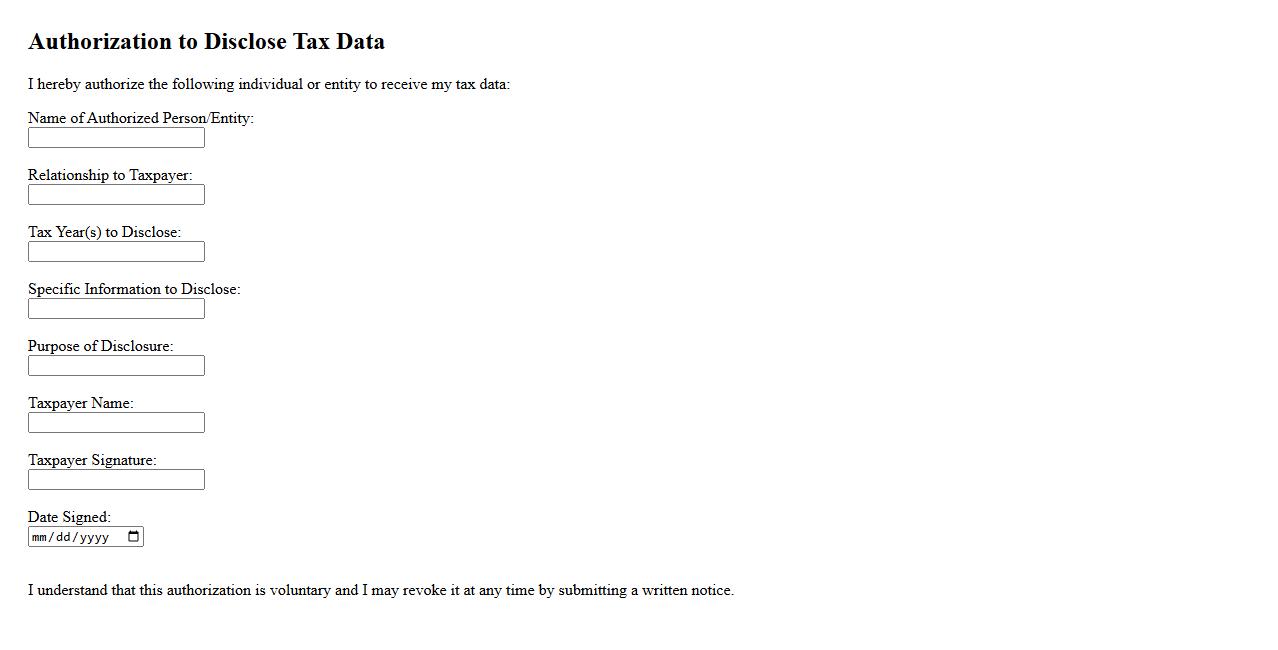

Authorization to Disclose Tax Data

Authorization to Disclose Tax Data is a formal consent allowing designated parties to access an individual's or organization's tax information. This authorization ensures confidentiality while enabling necessary data sharing with authorized entities such as tax professionals or government agencies. It plays a crucial role in facilitating accurate tax filings and compliance.

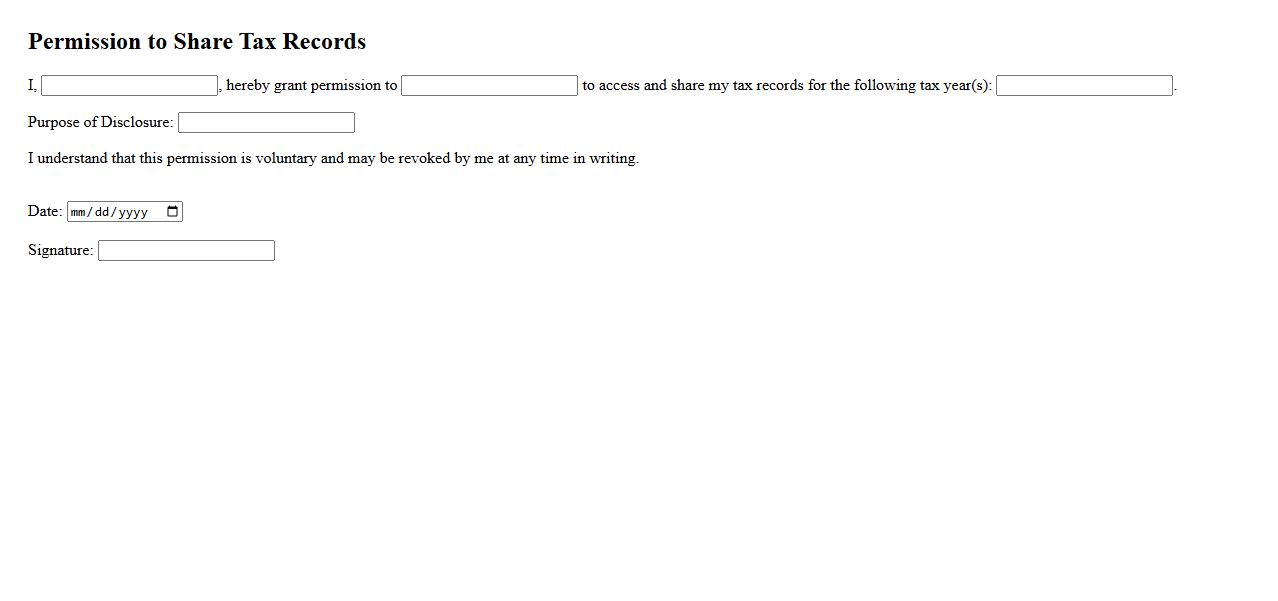

Permission to Share Tax Records

Obtaining permission to share tax records is crucial for ensuring privacy and compliance with legal standards. This authorization allows designated parties to access sensitive financial information securely. Proper consent helps protect personal data while facilitating necessary financial transactions or audits.

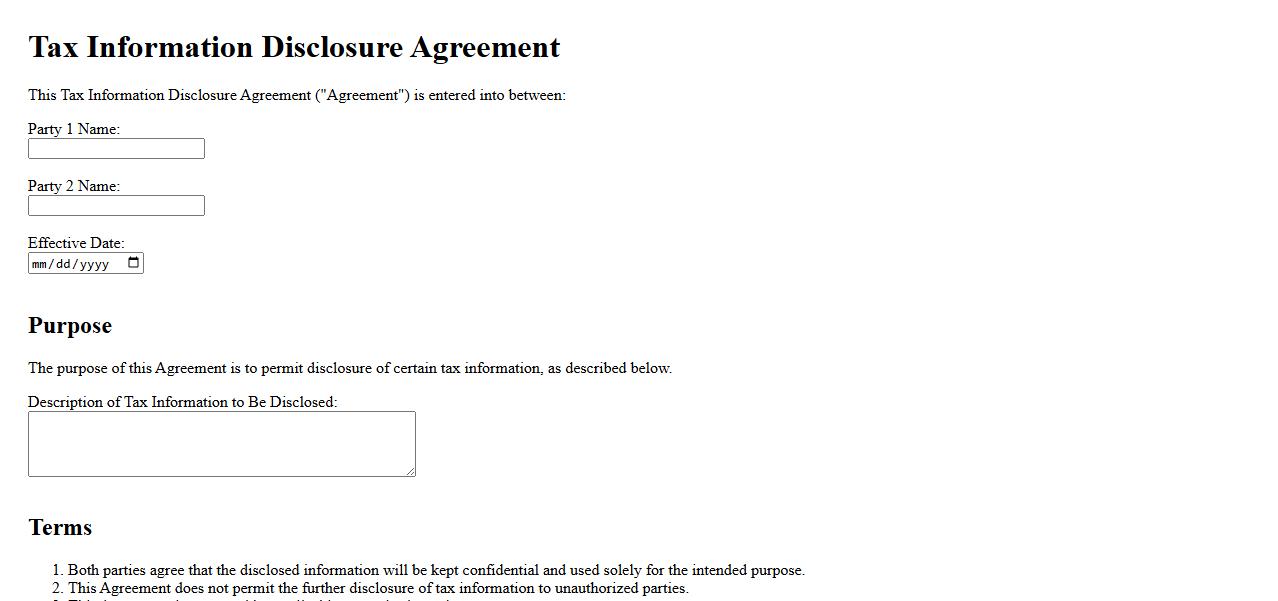

Tax Information Disclosure Agreement

The Tax Information Disclosure Agreement is a legal document that outlines the terms for sharing confidential tax-related information between parties. It ensures compliance with privacy laws while facilitating transparent financial dealings. This agreement protects sensitive data and establishes clear responsibilities for all involved entities.

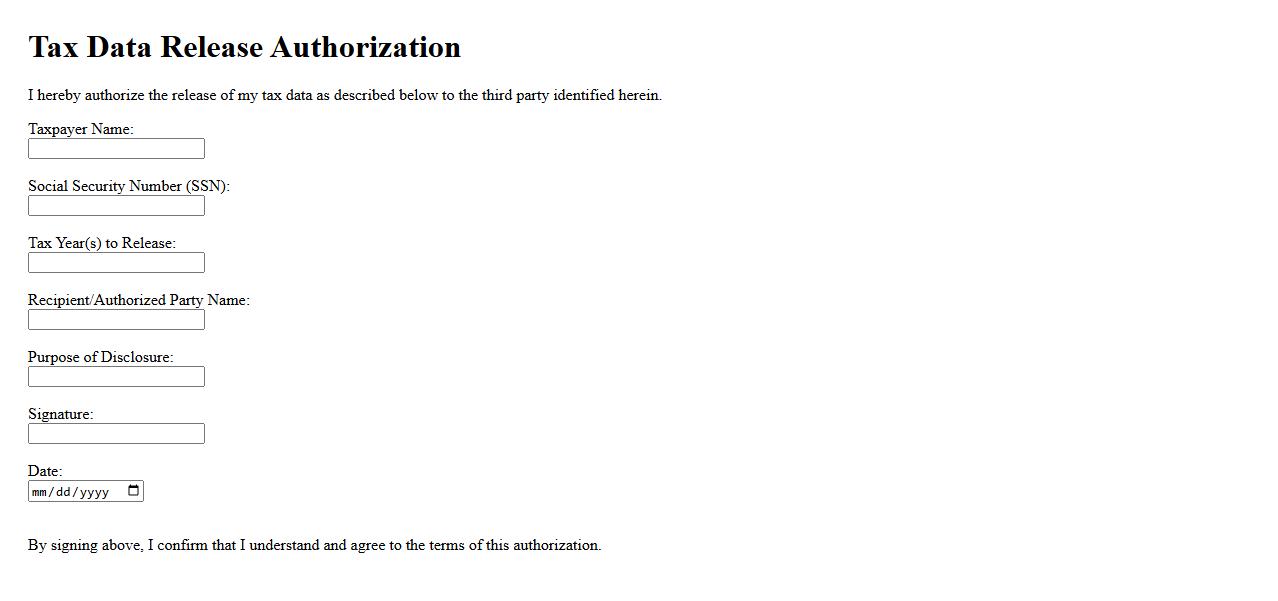

Tax Data Release Authorization

The Tax Data Release Authorization is a legal document that permits authorized parties to access an individual's tax information. It ensures compliance with privacy laws while facilitating the sharing of essential tax data for financial or legal purposes. This authorization streamlines processes such as loan applications or audits by granting necessary data access securely.

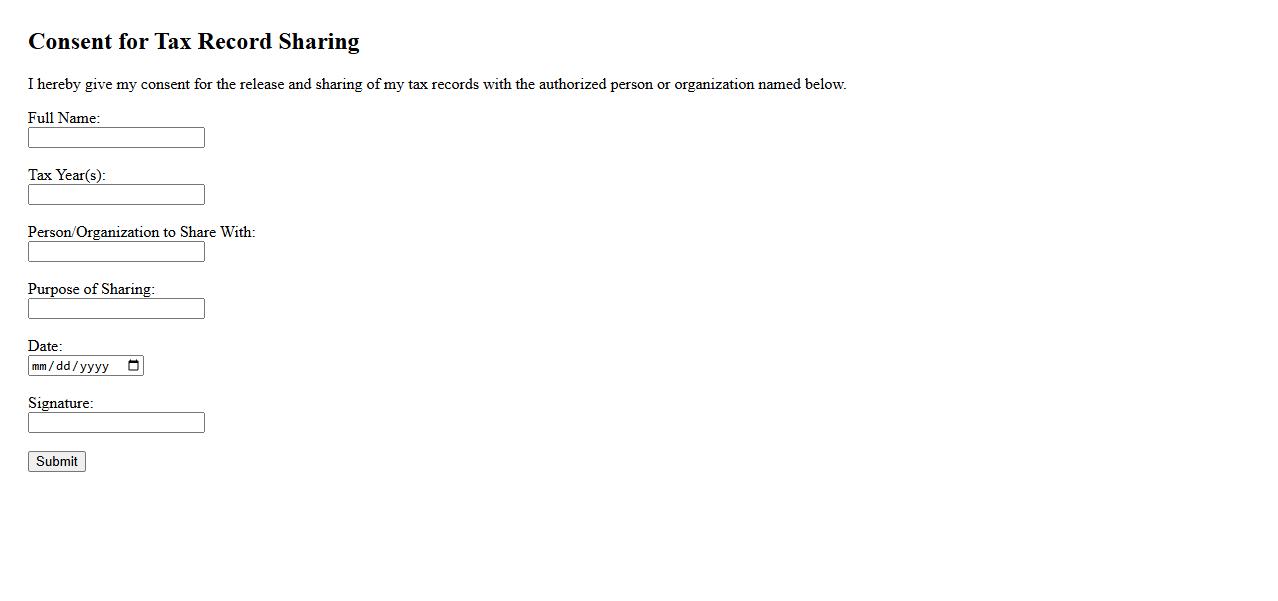

Consent for Tax Record Sharing

Consent for Tax Record Sharing is a formal agreement allowing an individual to authorize the sharing of their tax documents with third parties such as financial advisors or government agencies. This consent ensures transparency and compliance with privacy regulations while enabling efficient processing of tax-related matters. Providing clear consent helps protect sensitive financial information from unauthorized access.

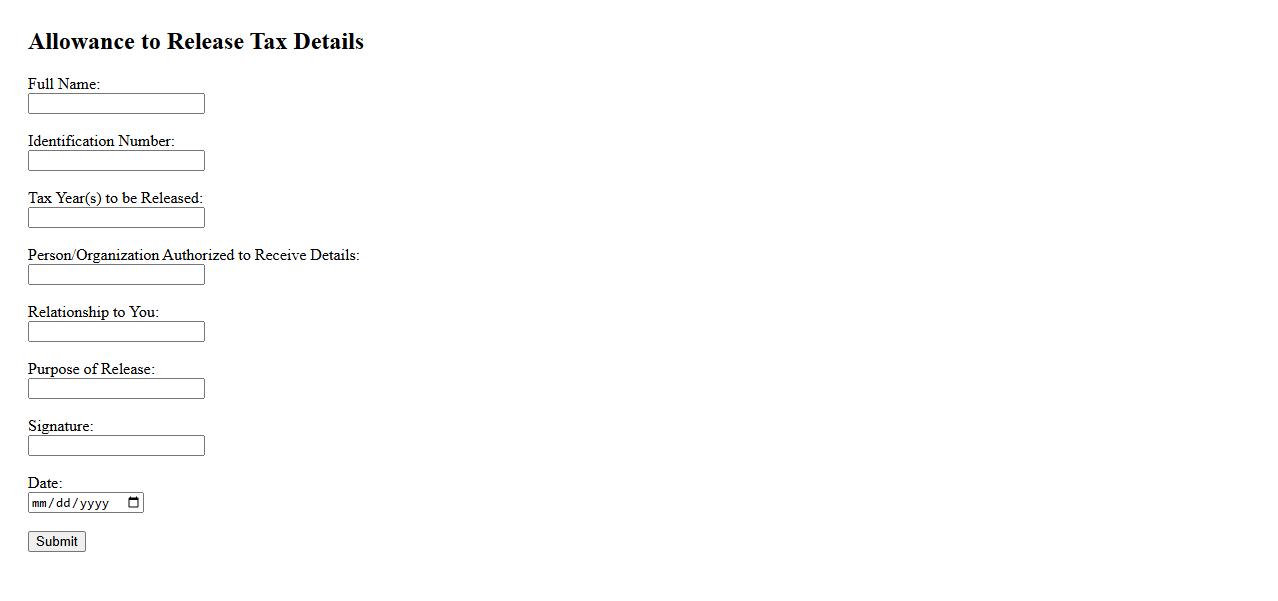

Allowance to Release Tax Details

The Allowance to Release Tax Details enables authorized individuals to access specific tax information securely. This provision ensures transparent communication between taxpayers and relevant authorities. It facilitates accurate financial reporting and compliance with legal requirements.

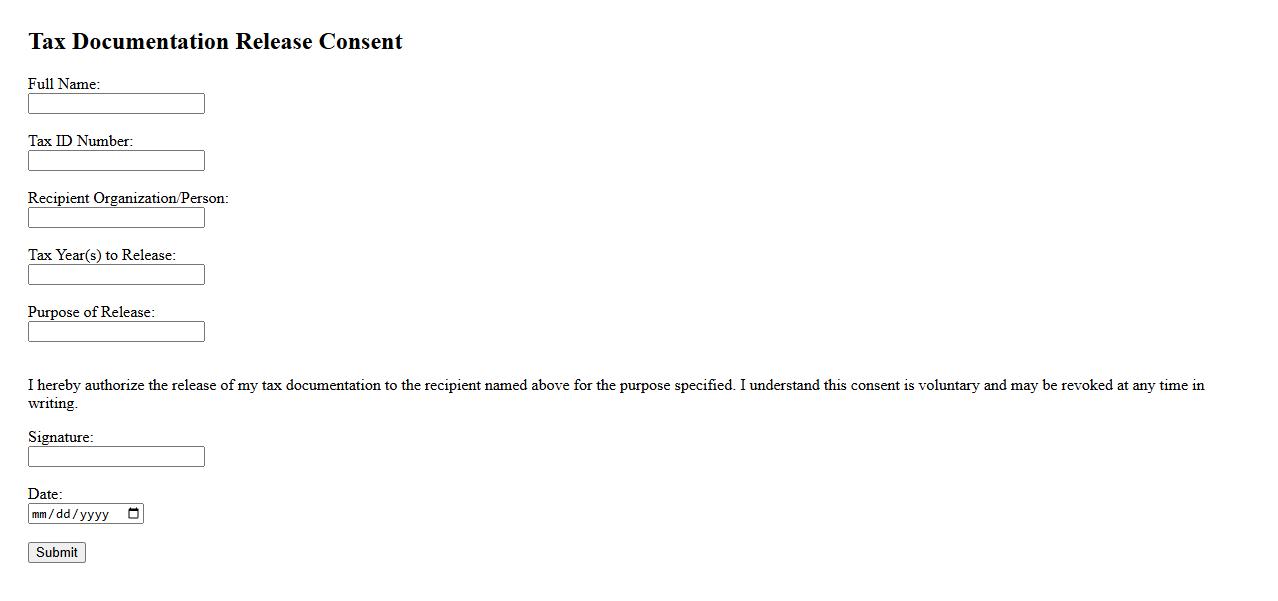

Tax Documentation Release Consent

The Tax Documentation Release Consent is a formal agreement allowing authorized parties to access and share your tax records. This consent ensures compliance with privacy regulations while facilitating efficient processing of financial information. It is essential for transactions requiring verified tax data.

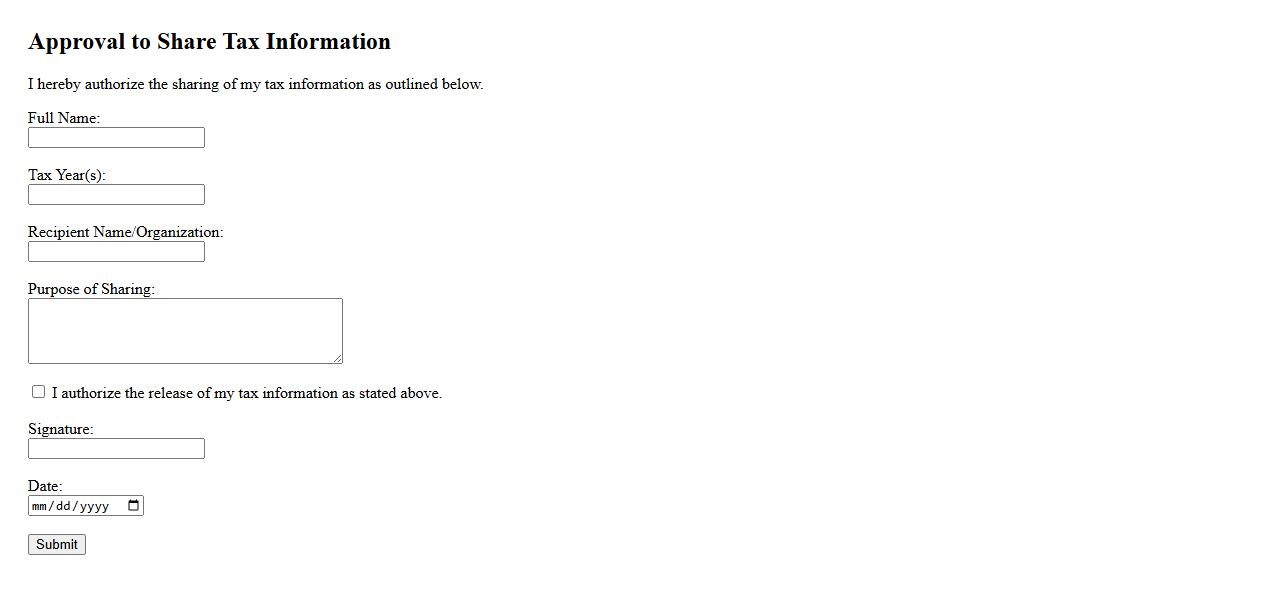

Approval to Share Tax Information

Approval to Share Tax Information is a crucial authorization that allows individuals or entities to permit the disclosure of their tax details to designated parties. This consent ensures compliance with privacy laws while facilitating necessary financial transactions or audits. Proper approval safeguards sensitive data during the sharing process.

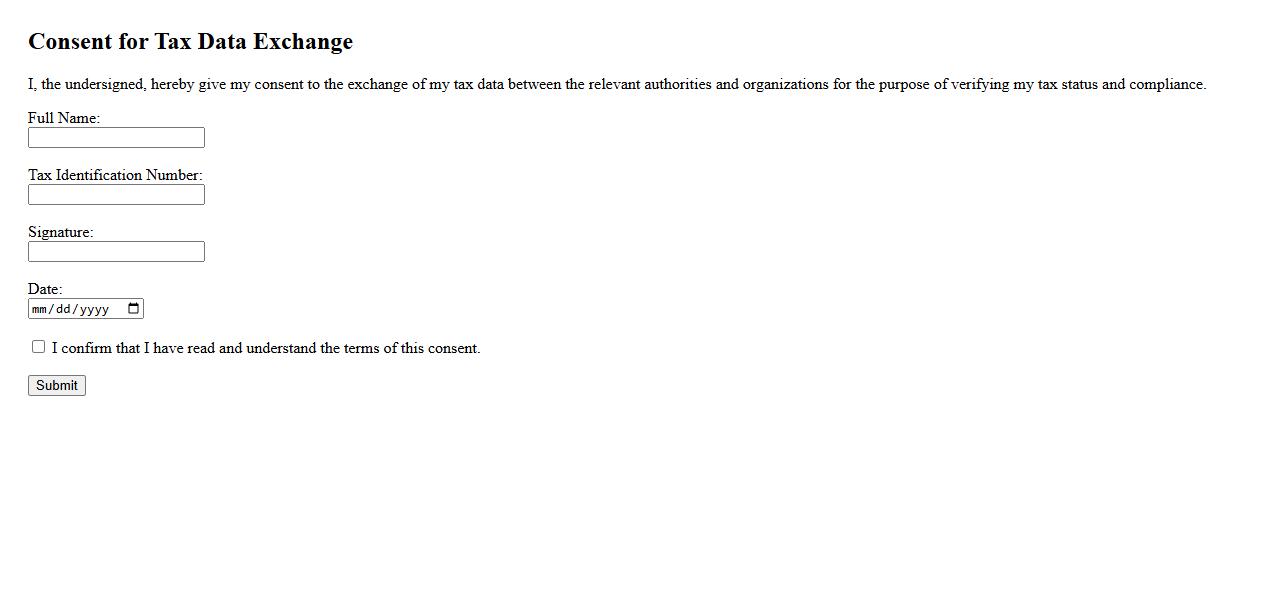

Consent for Tax Data Exchange

Providing consent for tax data exchange is essential for complying with international tax regulations. This authorization allows the sharing of financial information between tax authorities to ensure transparency and prevent tax evasion. It safeguards both individual and corporate taxpayers by promoting lawful fiscal practices.

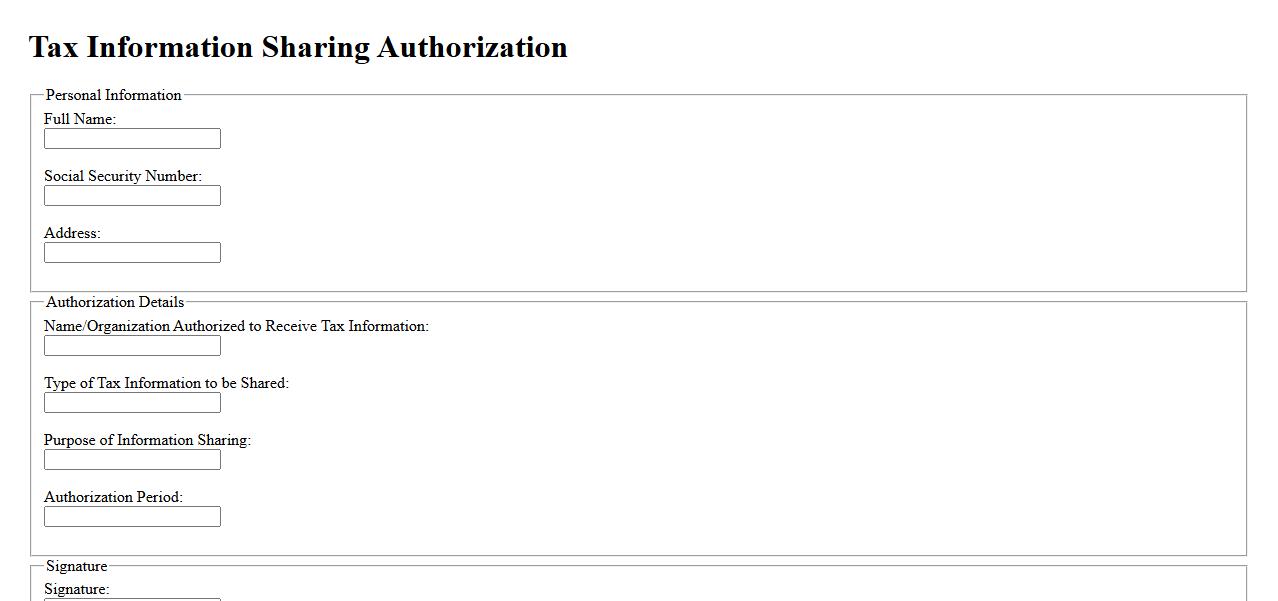

Tax Information Sharing Authorization

The Tax Information Sharing Authorization allows individuals or entities to grant permission for their tax-related information to be shared with designated parties. This authorization ensures compliance with legal requirements while facilitating efficient communication between tax authorities and authorized representatives. It protects sensitive data by clearly defining the scope and duration of information sharing.

What specific tax information is being authorized for release in the document?

The document authorizes the release of comprehensive tax information including income tax returns, tax assessments, and related financial details. This information may encompass past, current, and future tax records pertinent to the individual or entity. The authorization ensures access to all necessary data for effective tax handling and verification.

Who is permitted to receive the released tax information according to the consent?

The consent allows designated authorized parties such as tax professionals, legal representatives, or specified third parties to receive the tax information. Only those explicitly named or described within the document are granted permission. This restriction protects the confidentiality and limits access to sensitive data.

For what purpose(s) can the released tax information be used?

The information released under this consent can be used specifically for tax preparation, filing, and compliance purposes. It may also serve in financial planning, audit representation, or resolving tax disputes. The usage is strictly confined to legitimate and permissible activities outlined within the consent agreement.

What is the effective date and duration of the consent for releasing tax information?

The consent becomes effective on a clearly stated effective date, from which authorized access to tax records begins. Its duration is specified, either for a fixed period or until revoked by the consent provider. These terms ensure control over the timeframe during which the tax information can be accessed and used.

Does the document outline the process for revoking consent, and how can it be done?

Yes, the document defines a formal process for revoking consent, typically requiring written notification to the authorized parties or tax authorities. Revocation terminates the permission to access and use the tax information moving forward. This safeguard allows the provider to maintain control over their private financial data at any time.