Providing Consent to Share Insurance Information allows authorized parties to access personal insurance details for verification and claims processing. This consent ensures efficient communication between insured individuals, insurance companies, and third-party service providers. Protecting privacy and complying with legal requirements are essential during the information-sharing process.

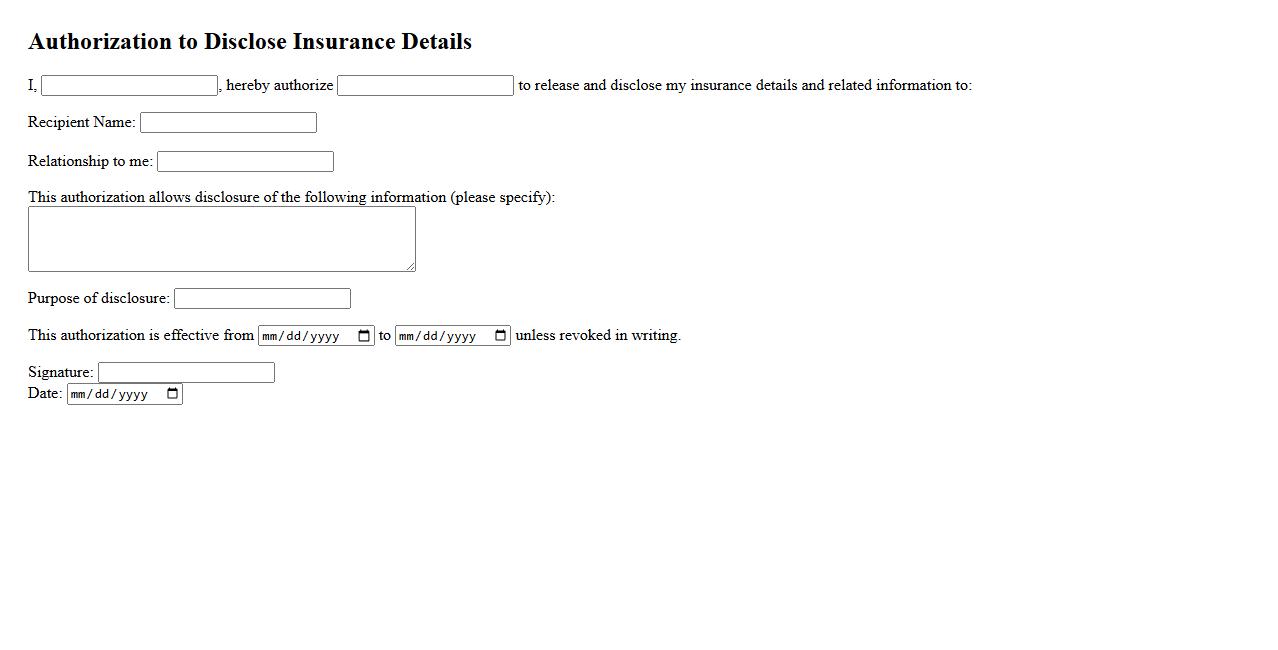

Authorization to Disclose Insurance Details

Authorization to Disclose Insurance Details is a formal consent allowing insurance companies to share policy information with designated parties. This authorization ensures that relevant details are disclosed securely and in compliance with privacy regulations. It is essential for processing claims and facilitating communication between insured individuals and providers.

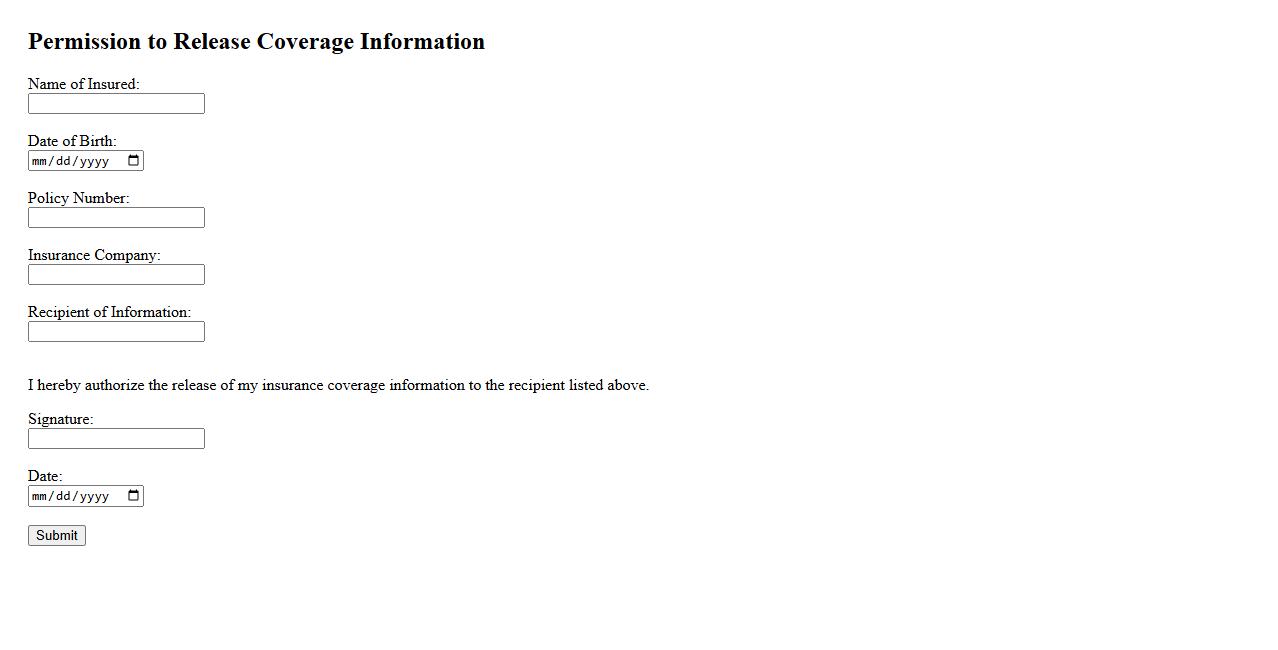

Permission to Release Coverage Information

Permission to Release Coverage Information is a crucial authorization that allows healthcare providers to share your insurance details with relevant parties. This consent ensures accurate processing of claims and verification of benefits, streamlining your medical billing experience. Granting this permission helps maintain transparent communication between you, your insurer, and healthcare professionals.

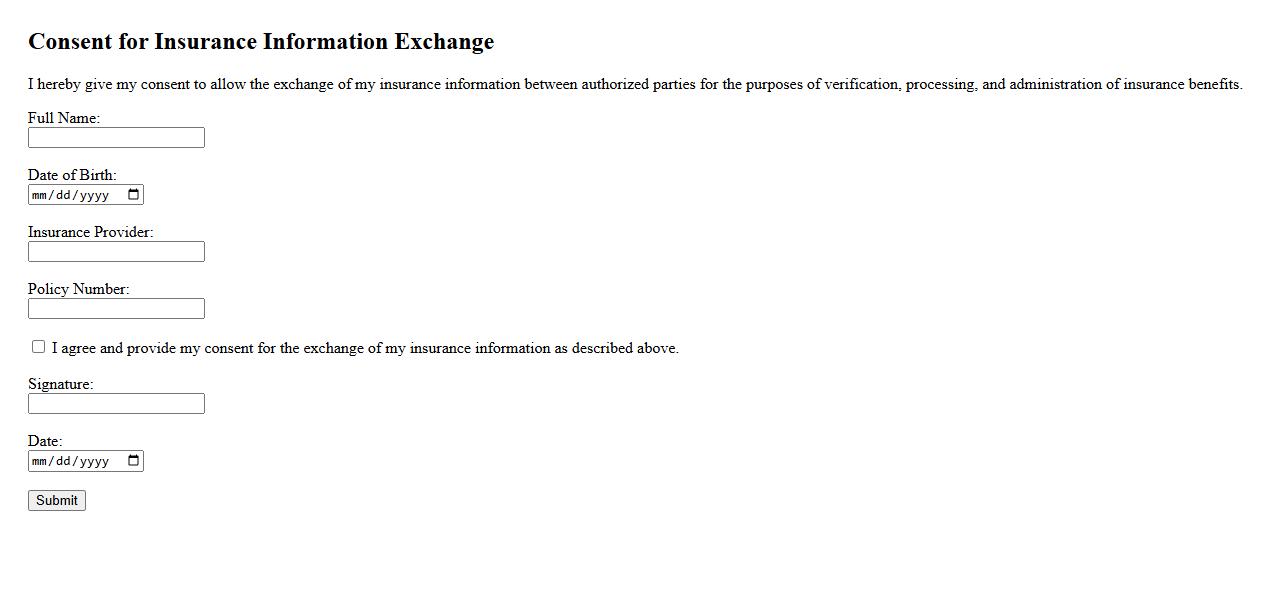

Consent for Insurance Information Exchange

Consent for Insurance Information Exchange is a crucial agreement that allows the sharing of your insurance details between relevant parties. This consent ensures that your information is handled securely and used solely for processing claims and benefits. Providing consent helps streamline communication and supports accurate insurance transactions.

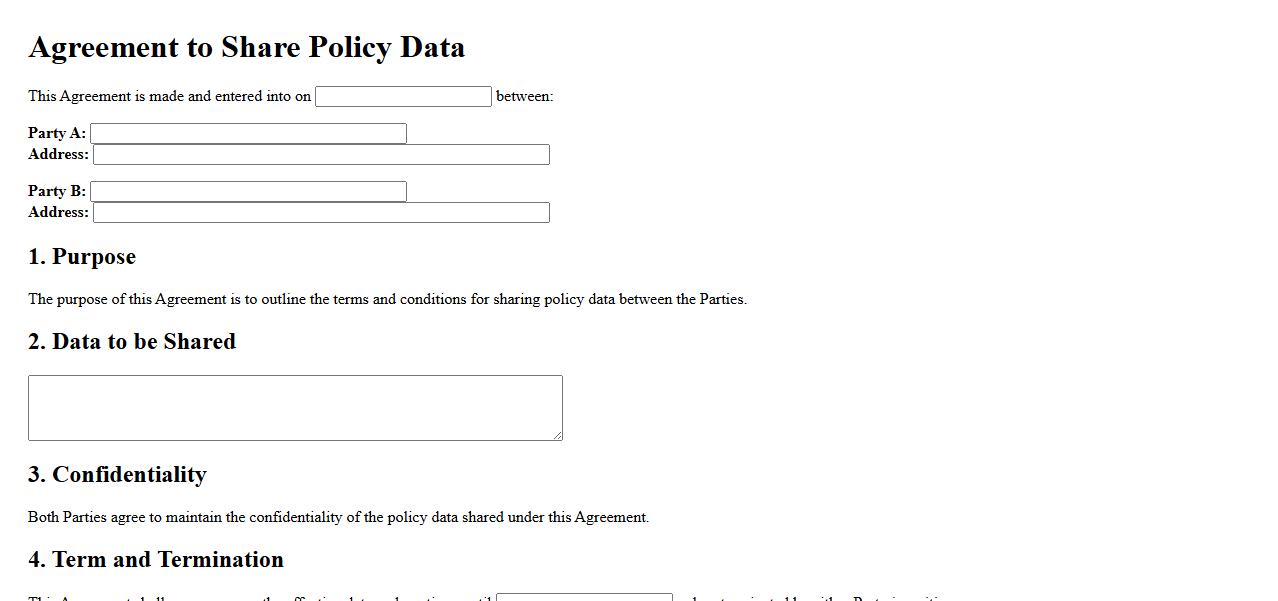

Agreement to Share Policy Data

An Agreement to Share Policy Data facilitates the secure exchange of insurance policy information between parties. It ensures that all shared data complies with privacy regulations and maintains confidentiality. This agreement promotes transparency and efficiency in policy management and claims processing.

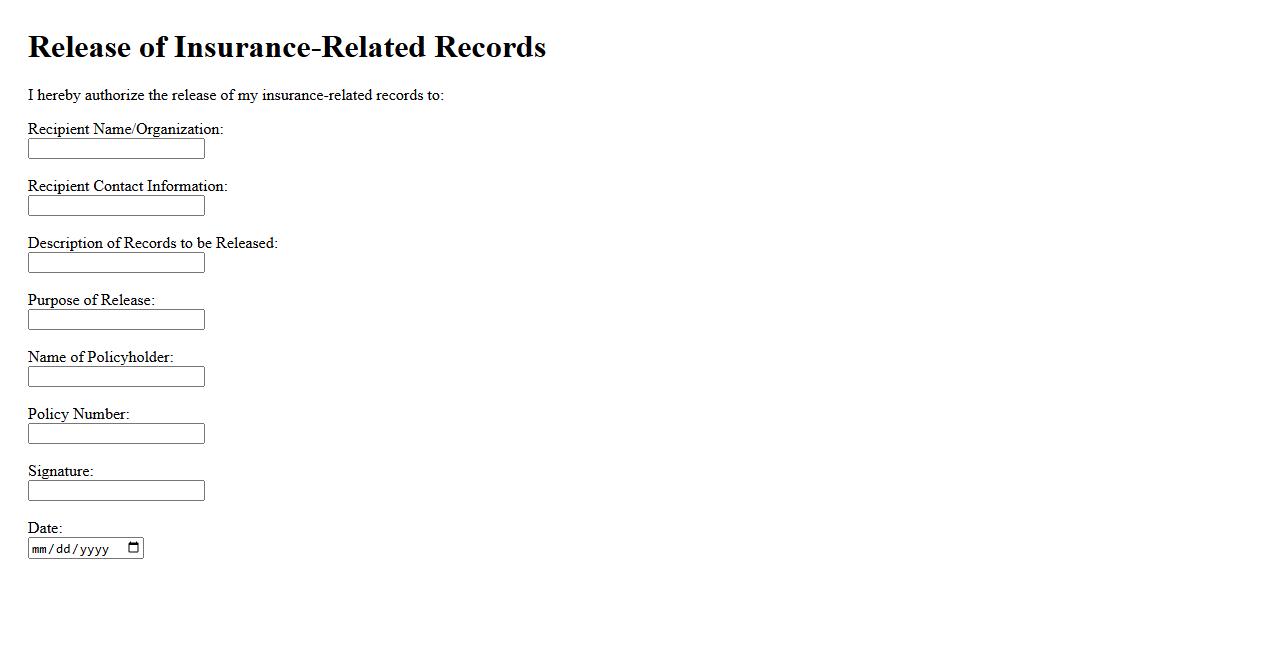

Release of Insurance-Related Records

The release of insurance-related records involves providing authorized parties access to policy documents, claim information, and medical records. This process ensures transparency and facilitates claims processing while protecting sensitive information. Proper authorization and compliance with privacy laws are essential for a secure release.

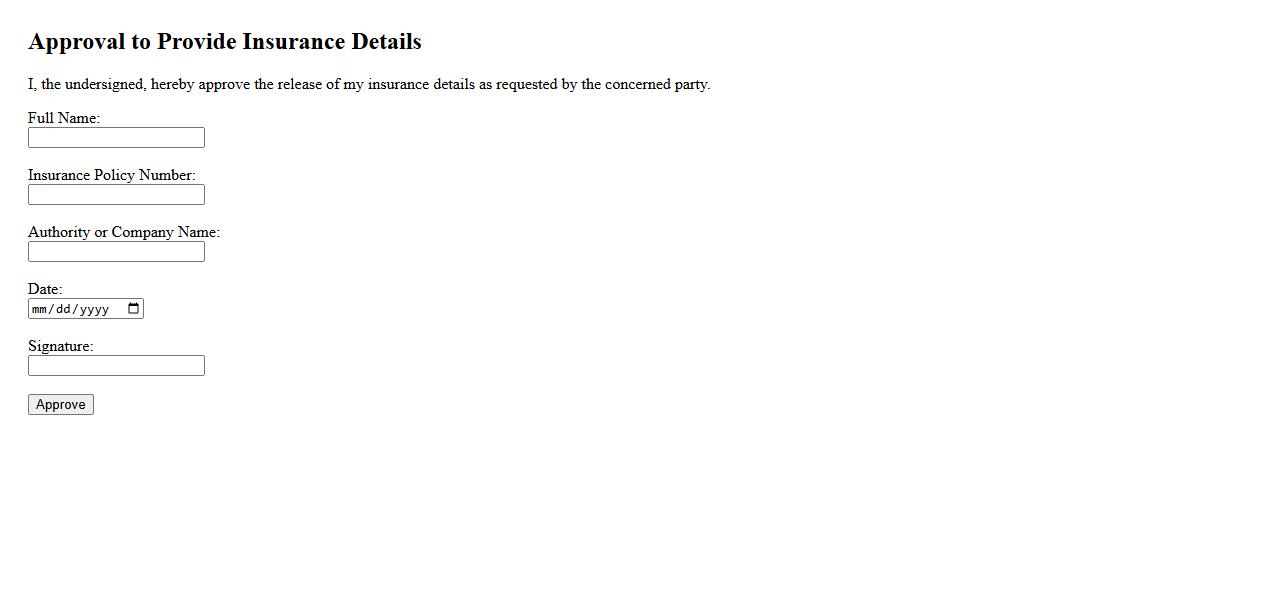

Approval to Provide Insurance Details

Approval to Provide Insurance Details is a necessary step to ensure that sensitive information is shared securely and with authorized parties only. This process safeguards personal and financial data, maintaining trust and compliance with legal regulations. Obtaining approval before disclosing insurance details helps prevent unauthorized access and potential misuse.

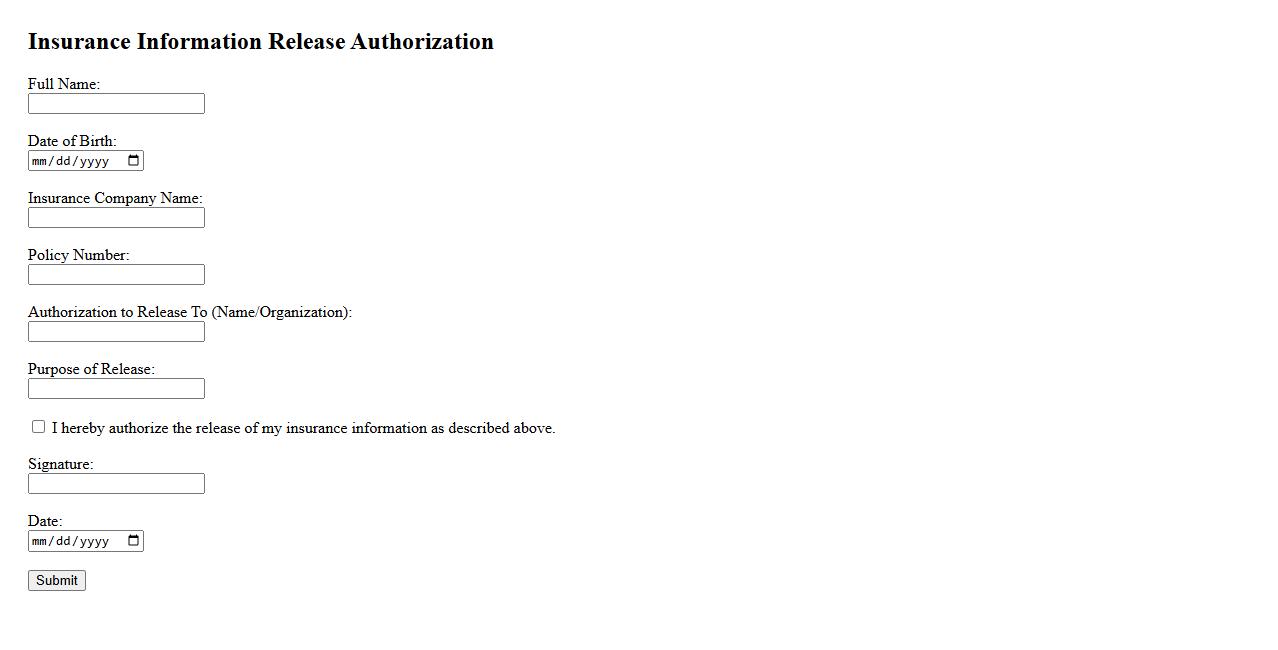

Insurance Information Release Authorization

The Insurance Information Release Authorization is a formal consent allowing the release of your insurance details to authorized parties. This document ensures that your personal and policy information is shared securely and only with those permitted. It is essential for processing claims and verifying coverage efficiently.

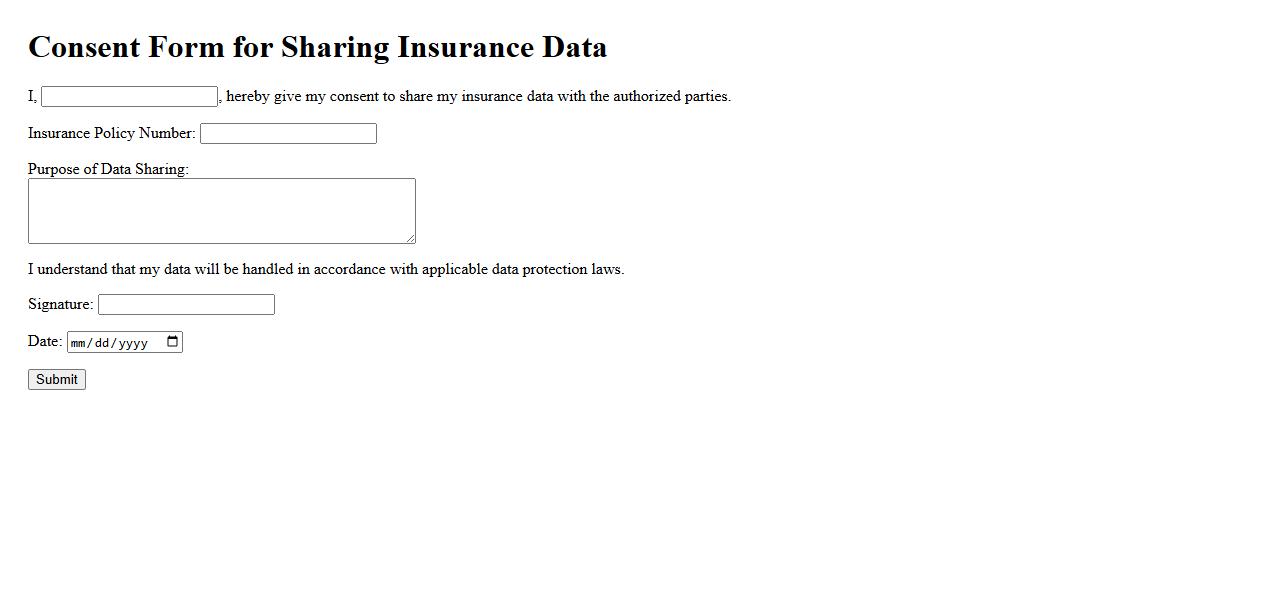

Consent Form for Sharing Insurance Data

The Consent Form for Sharing Insurance Data ensures that individuals provide explicit permission before their insurance information is shared with third parties. This form details the types of data being shared and the purposes for which it will be used. By signing, users maintain control over their personal insurance information and its distribution.

Authorization for Insurance Data Sharing

Authorization for Insurance Data Sharing allows individuals to grant permission for their insurance information to be accessed and shared between authorized parties. This process ensures transparency and protects personal data while facilitating efficient claim processing and policy management. Proper authorization helps maintain compliance with privacy regulations and enhances trust between policyholders and providers.

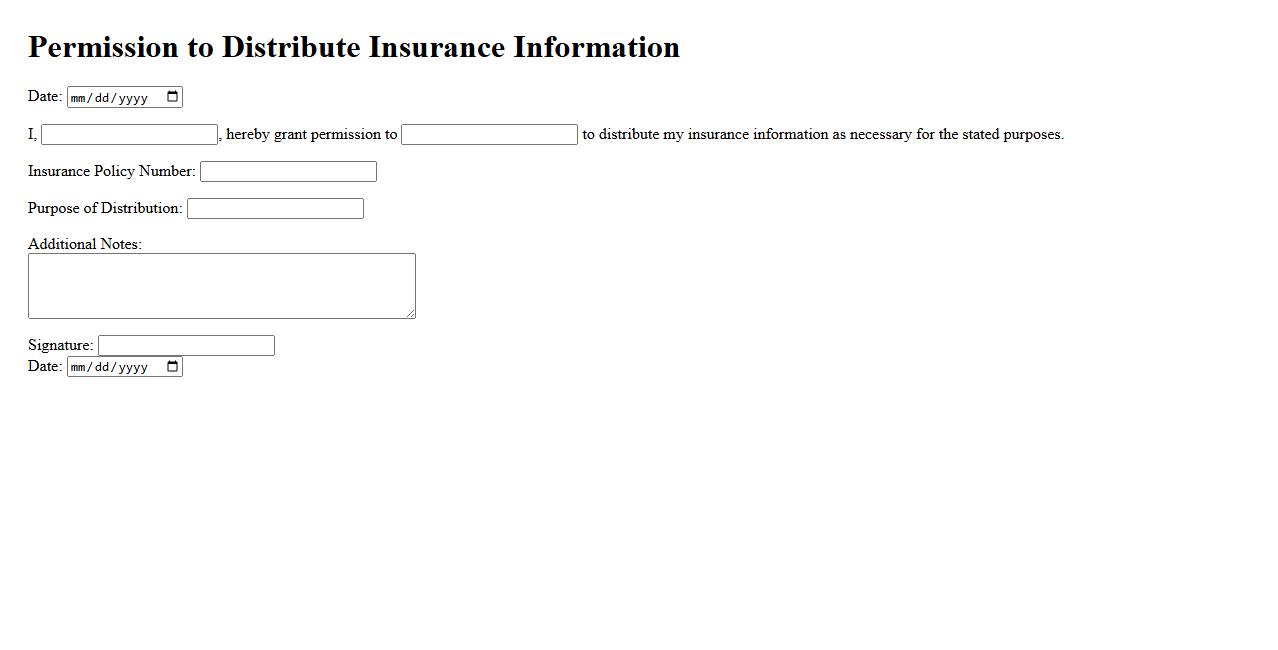

Permission to Distribute Insurance Information

Obtaining permission to distribute insurance information ensures compliance with privacy laws and protects sensitive data. This authorization allows organizations to share relevant insurance details confidentially. It fosters trust and transparency between all involved parties.

What specific types of insurance information are being consented to for sharing?

The consent typically covers all relevant insurance policy details including coverage limits, beneficiary information, and claim history. It also includes sensitive data such as payment records and premium details. This comprehensive sharing ensures accurate verification and processing of insurance claims.

Who is authorized to receive and access the shared insurance information?

Only designated authorized parties such as insurance companies, healthcare providers, and third-party administrators are permitted to access the shared insurance information. Access is strictly controlled to protect the confidentiality and integrity of the data. Unauthorized individuals or entities are prohibited from viewing or using this information.

For what purposes can the shared insurance information be used?

The shared insurance information is primarily used for claim processing, eligibility verification, and policy administration. It may also be utilized for fraud detection, risk assessment, and customer service enhancements. All uses adhere to legal and regulatory standards to ensure data protection.

How long is the consent valid before it expires or needs renewal?

The consent for sharing insurance information typically remains valid for a specified period, often one year, unless otherwise stated. After this period, renewal is required to continue sharing the data. This timeframe ensures ongoing control and awareness for the individual granting consent.

What procedures are in place to revoke consent for sharing insurance information?

Individuals can revoke their consent at any time through a formal written request or online submission. Upon revocation, the sharing of insurance information ceases immediately, except for actions already underway. Clear procedures guarantee the individual retains control over their private data.