The Consent to Obtain Credit Report Form is a legal document that authorizes a lender or organization to access an individual's credit history from credit bureaus. This form ensures that the individual is aware of and agrees to the credit check as part of the application or approval process. It protects both parties by maintaining transparency and compliance with credit reporting laws.

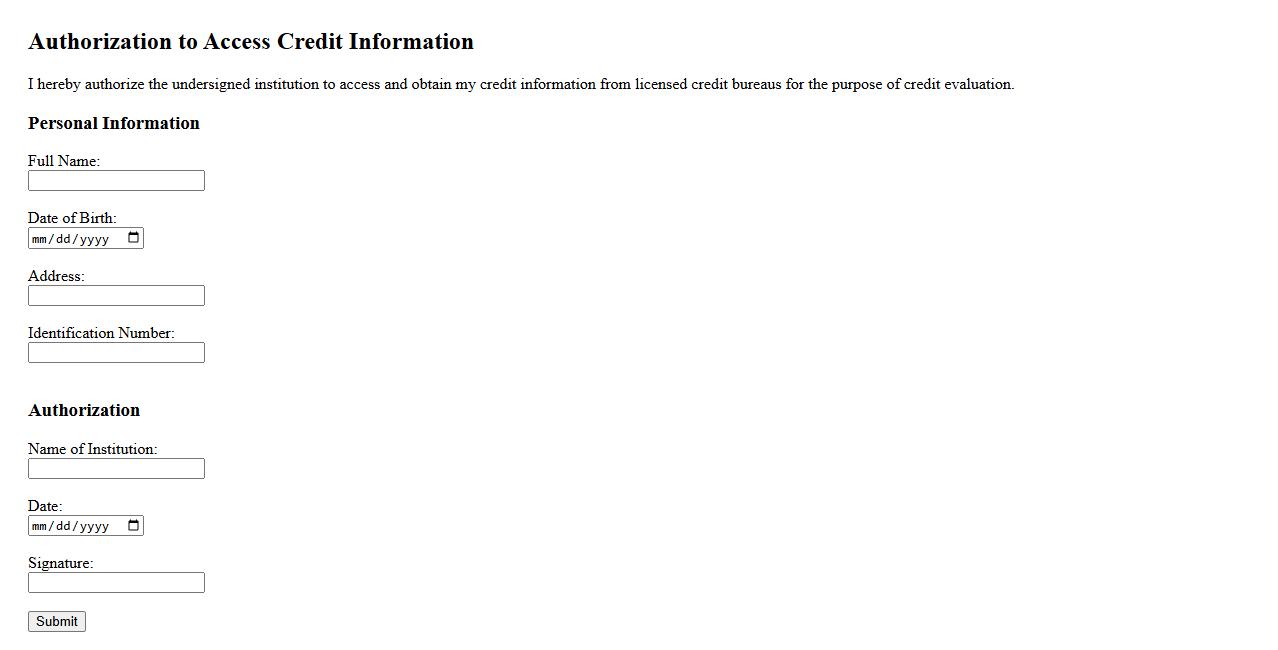

Authorization to Access Credit Information Form

The Authorization to Access Credit Information Form grants permission for an entity to review an individual's credit data. This document is essential for processes like loan approvals or credit evaluations. It ensures transparency and consent in accessing sensitive financial details.

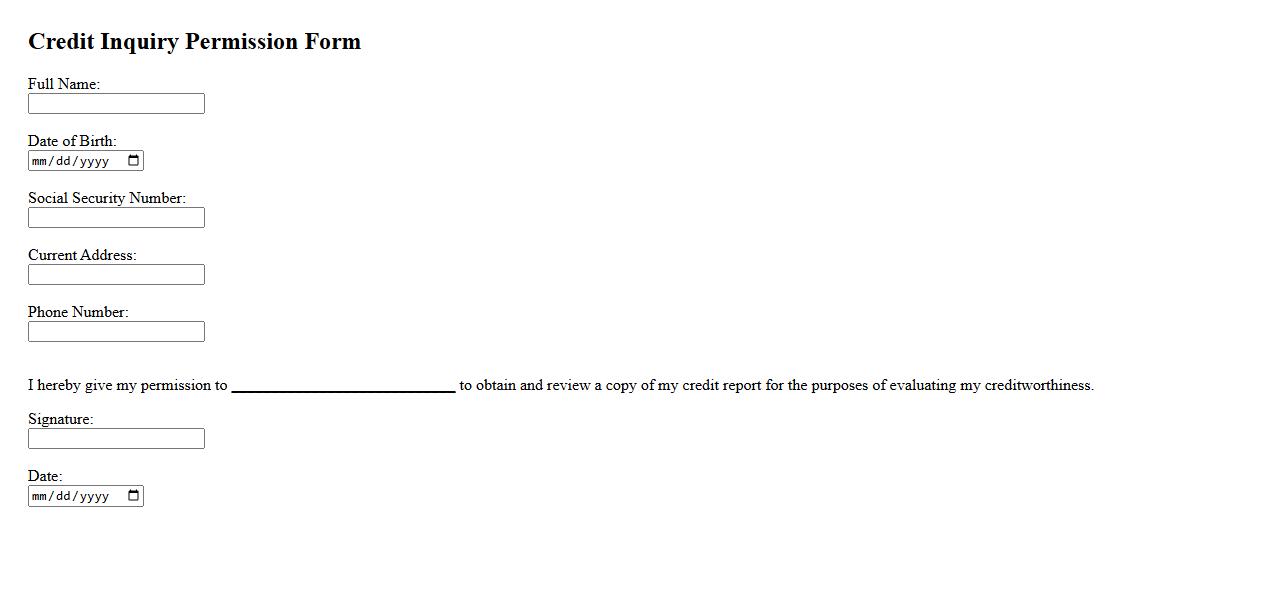

Credit Inquiry Permission Form

The Credit Inquiry Permission Form authorizes a company or organization to access an individual's credit report for evaluation purposes. This form is essential for verifying creditworthiness before approving loans or services. It ensures transparency and consent in the credit checking process.

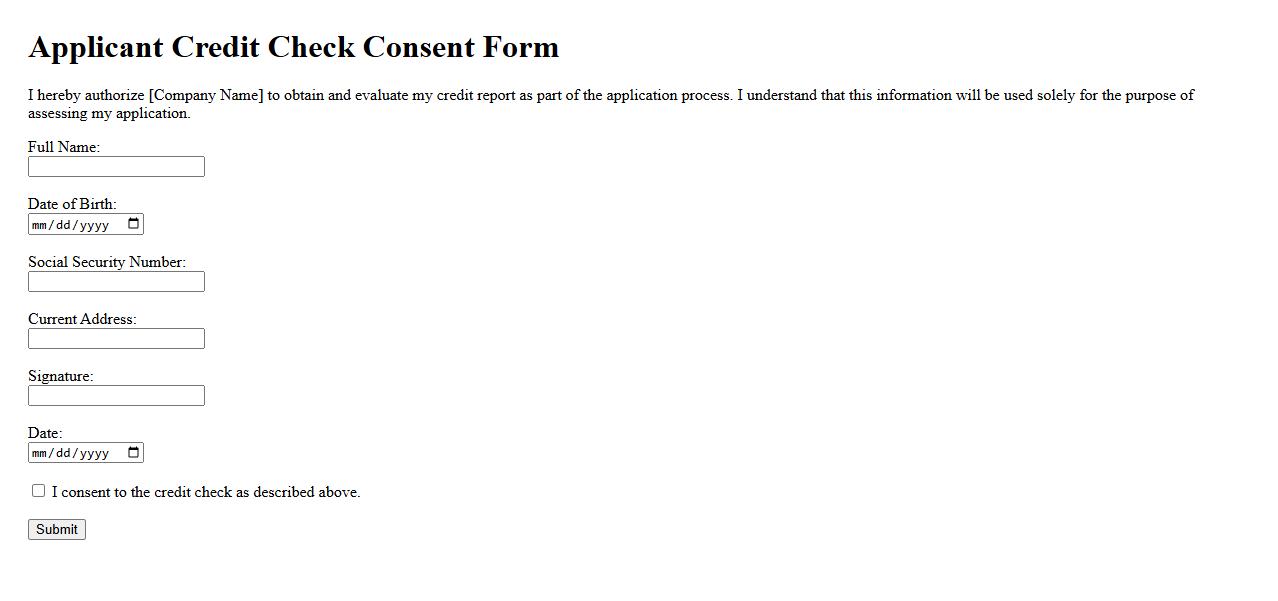

Applicant Credit Check Consent Form

The Applicant Credit Check Consent Form is a crucial document that authorizes landlords or lenders to review an applicant's credit history. This consent ensures transparency and helps in assessing the applicant's financial reliability. Signing the form grants permission to obtain and verify credit information securely.

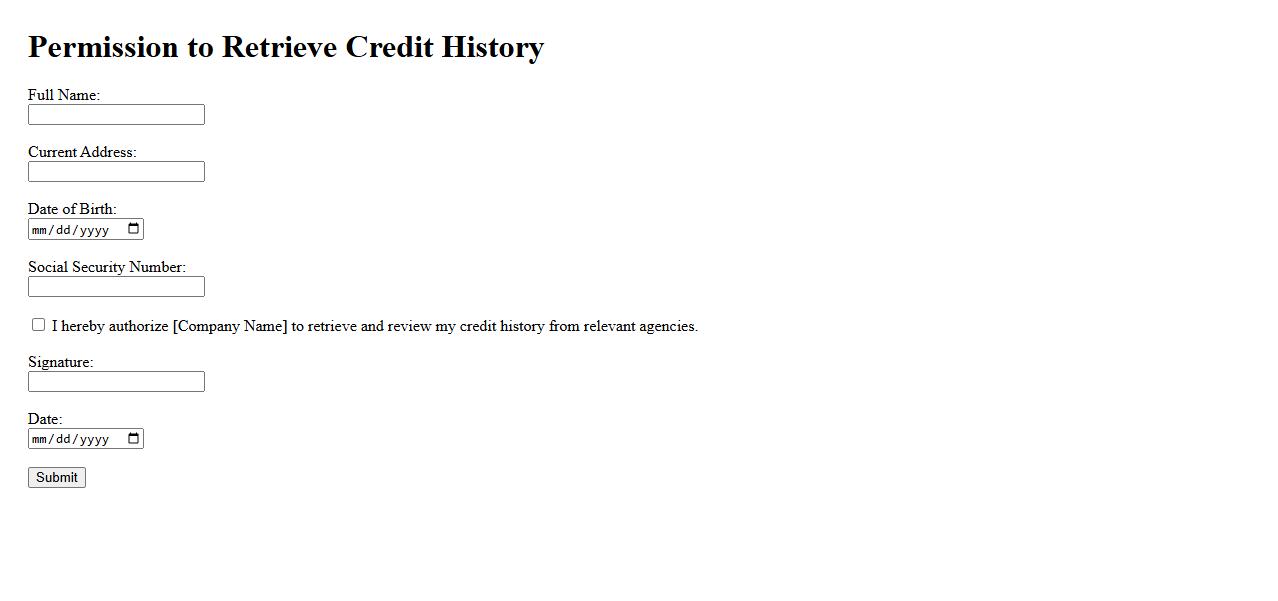

Permission to Retrieve Credit History Form

The Permission to Retrieve Credit History Form is a document that authorizes a company or institution to access an individual's credit report. This form ensures compliance with privacy laws while allowing lenders or service providers to evaluate creditworthiness. Signing this form is often a crucial step in loan applications or rental agreements.

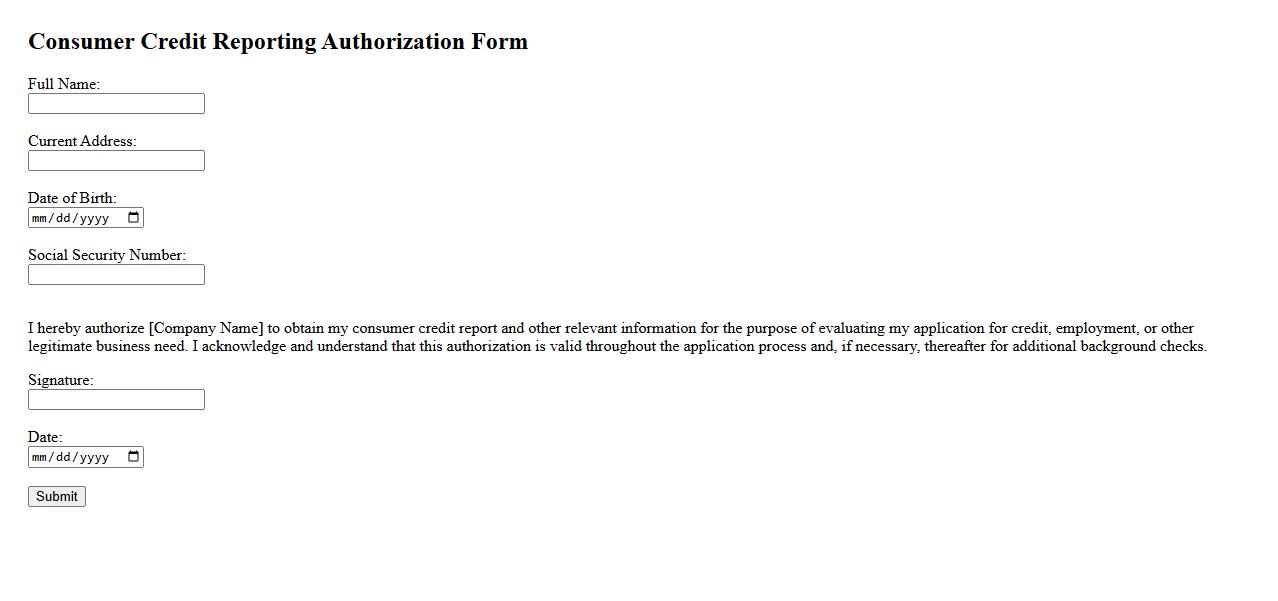

Consumer Credit Reporting Authorization Form

The Consumer Credit Reporting Authorization Form is a crucial document that allows businesses to obtain credit information about an individual. This form ensures compliance with legal requirements while protecting consumer privacy. It plays a vital role in assessing creditworthiness efficiently and securely.

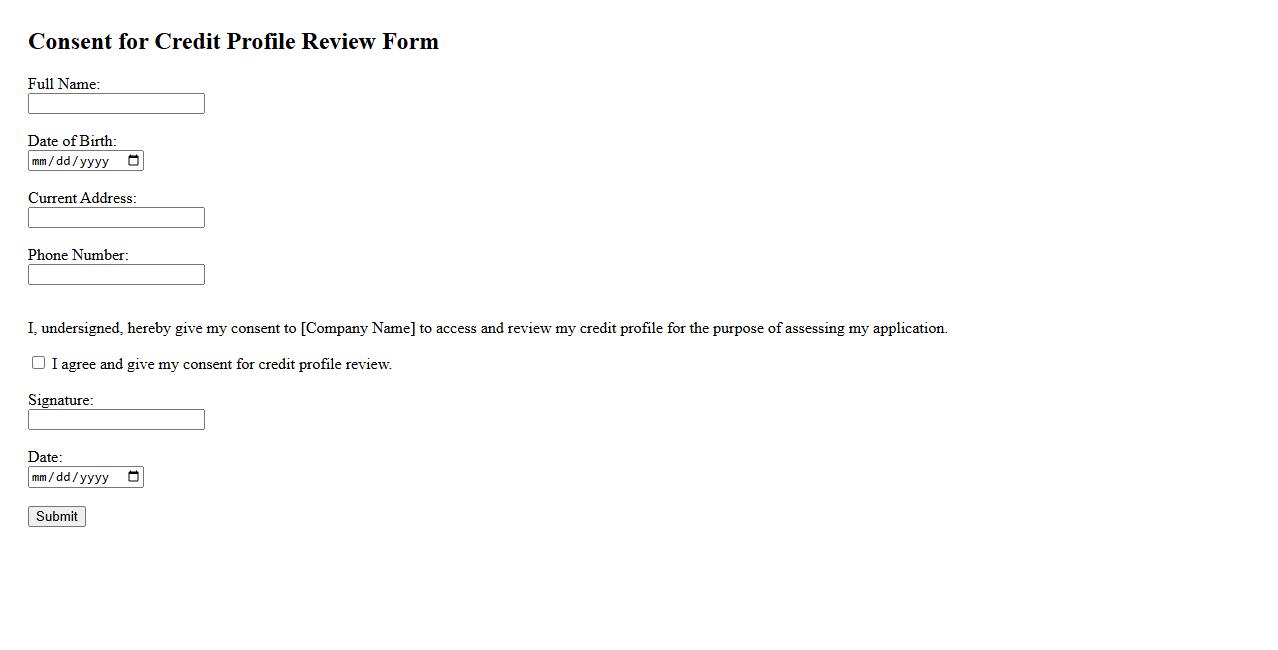

Consent for Credit Profile Review Form

The Consent for Credit Profile Review Form is a document that authorizes an organization to access an individual's credit history. This form ensures transparency and compliance with privacy regulations by clearly outlining the purpose and scope of the credit check. It protects both the consumer and the company by securing informed consent before any review is conducted.

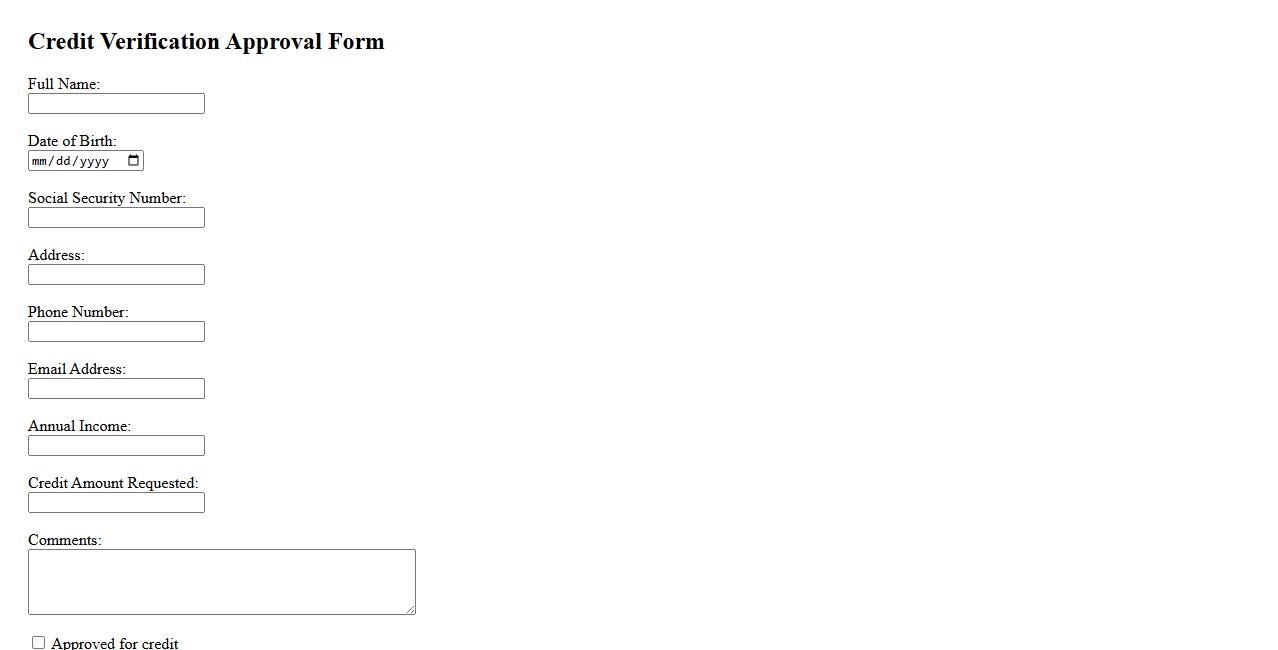

Credit Verification Approval Form

The Credit Verification Approval Form is a crucial document used to validate an individual's credit information before granting financial approvals. It ensures accuracy and helps maintain trust between lenders and applicants. Proper completion of this form streamlines the credit assessment process efficiently.

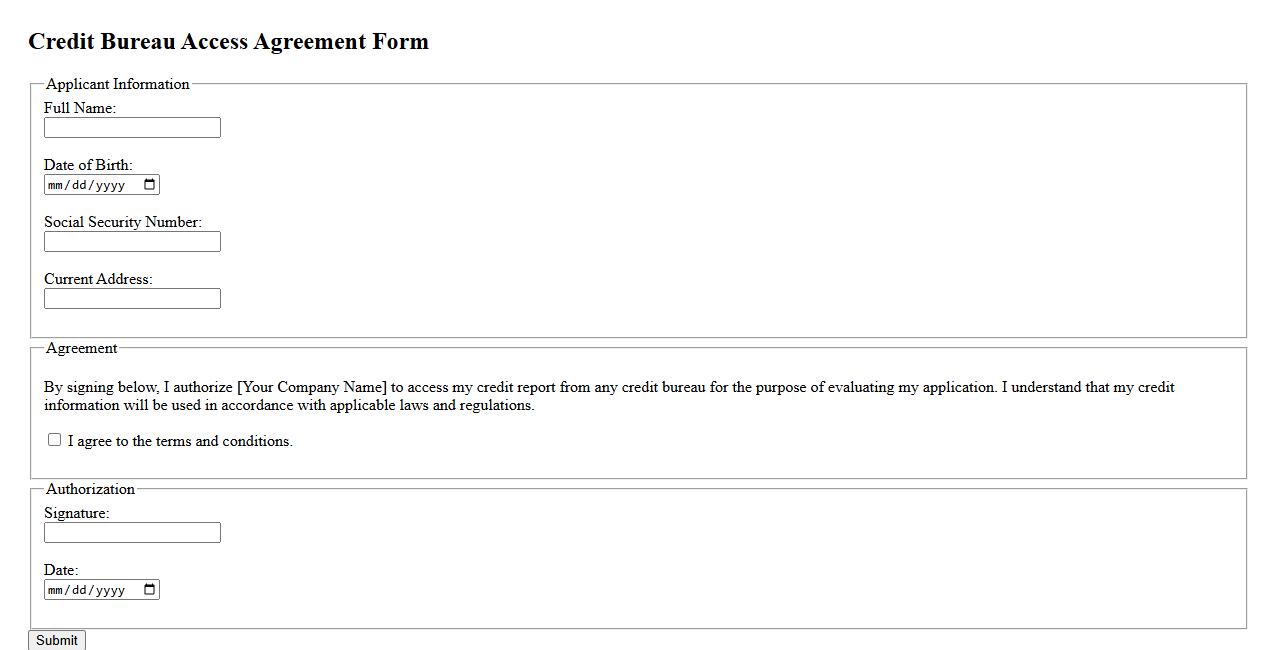

Credit Bureau Access Agreement Form

The Credit Bureau Access Agreement Form is a crucial document that authorizes organizations to retrieve an individual's credit information. This form ensures compliance with legal requirements while protecting consumer privacy. It facilitates transparent and secure access to credit data for decision-making purposes.

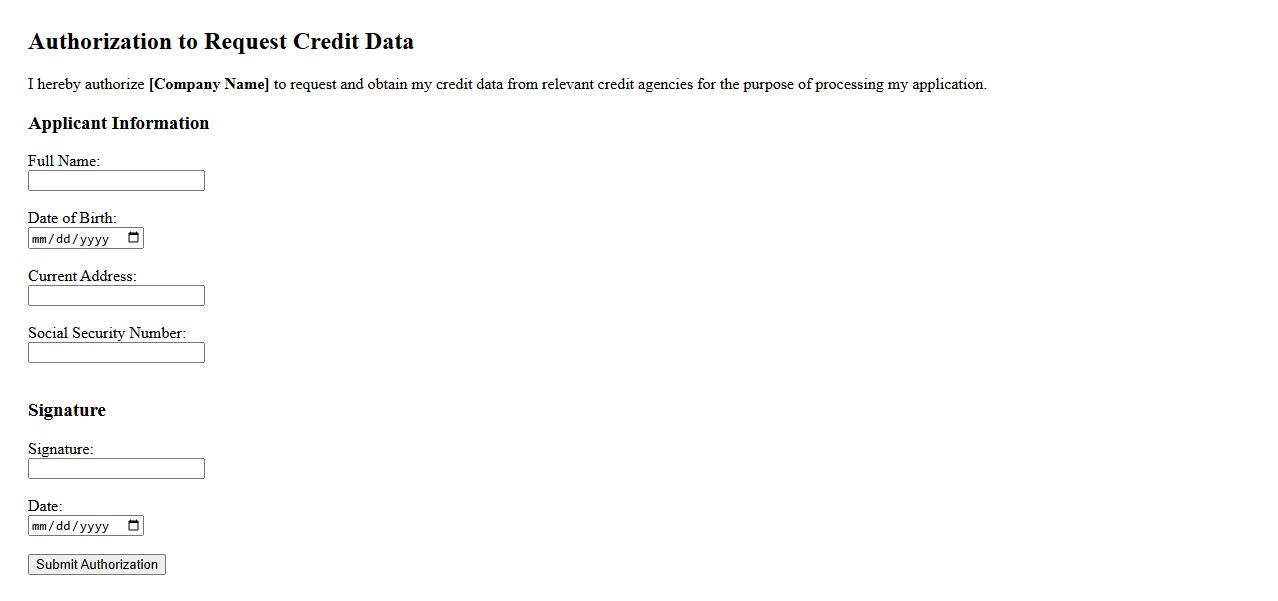

Authorization to Request Credit Data Form

The Authorization to Request Credit Data Form is a crucial document that grants permission to access an individual's credit information. It ensures legal compliance and protects both parties by clearly outlining the consent given. This form is essential for financial institutions, landlords, and employers when evaluating creditworthiness.

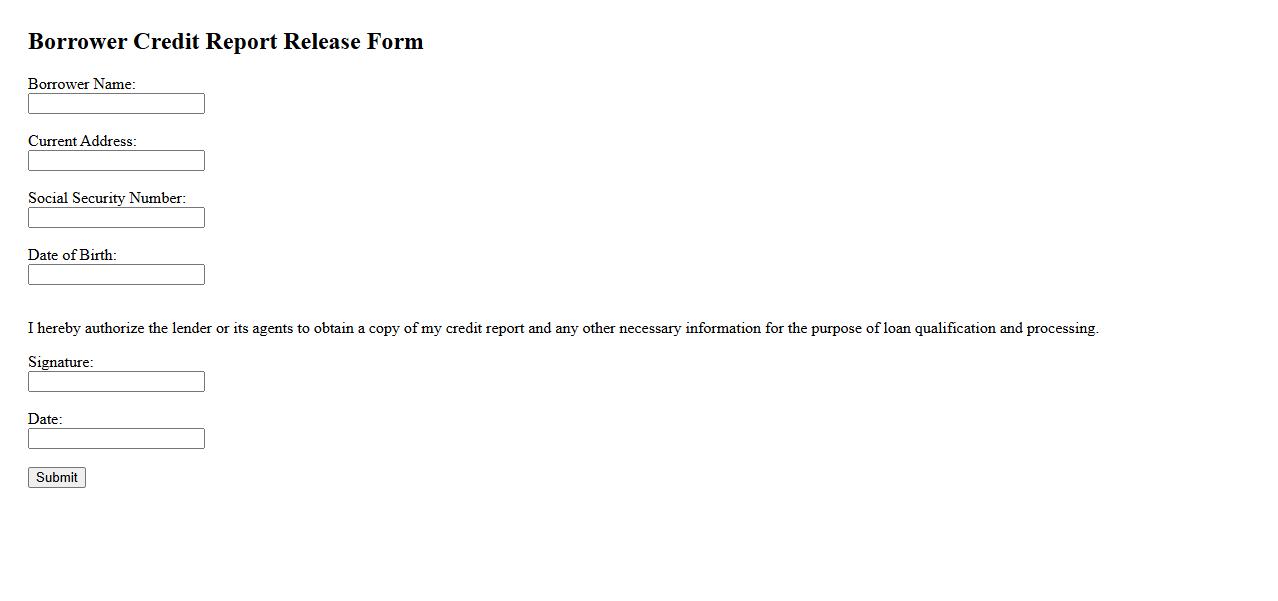

Borrower Credit Report Release Form

The Borrower Credit Report Release Form is a crucial document that authorizes lenders to access an individual's credit information. This form ensures transparency and consent before any credit report is reviewed. It helps streamline the loan approval process while protecting borrower privacy.

What personal information is required to consent to a credit report request?

To consent to a credit report request, you must provide your full legal name, date of birth, and Social Security number. Additionally, your current address and contact information are often required to verify your identity. This information ensures accurate matching and prevents unauthorized access.

Who is authorized to access your credit report based on this consent form?

The authorized parties specified on the consent form typically include lenders, financial institutions, and credit bureaus. Employers or background check companies may also access your credit report if explicitly stated. Only individuals or organizations with a legitimate need are granted access under this consent.

For what specific purpose will your credit report be obtained and used?

Your credit report will be obtained for a defined financial or employment purpose, such as loan approval, rental agreements, or background screening. The consent form clearly outlines the reason to ensure transparency. This limits usage to only the agreed-upon purpose, protecting your privacy.

How long is your consent valid for obtaining your credit information?

Your consent is generally valid for a specified period, commonly ranging from 30 to 90 days after signing. During this time, authorized entities can access your credit report without needing to request new permission. After expiration, new consent is required to obtain updated information.

What rights do you have to revoke or withdraw your consent after signing the form?

You have the right to revoke or withdraw your consent at any time by providing written notice to the requesting party. Once revoked, no further access to your credit report can be made under the original consent. This right ensures you maintain control over your personal credit information.