A Certificate of Tax Payment is an official document issued by tax authorities confirming that an individual or business has settled their tax obligations. This certificate is often required for legal transactions, securing permits, or participating in government bids. It serves as proof of compliance with tax regulations and helps avoid penalties or legal issues.

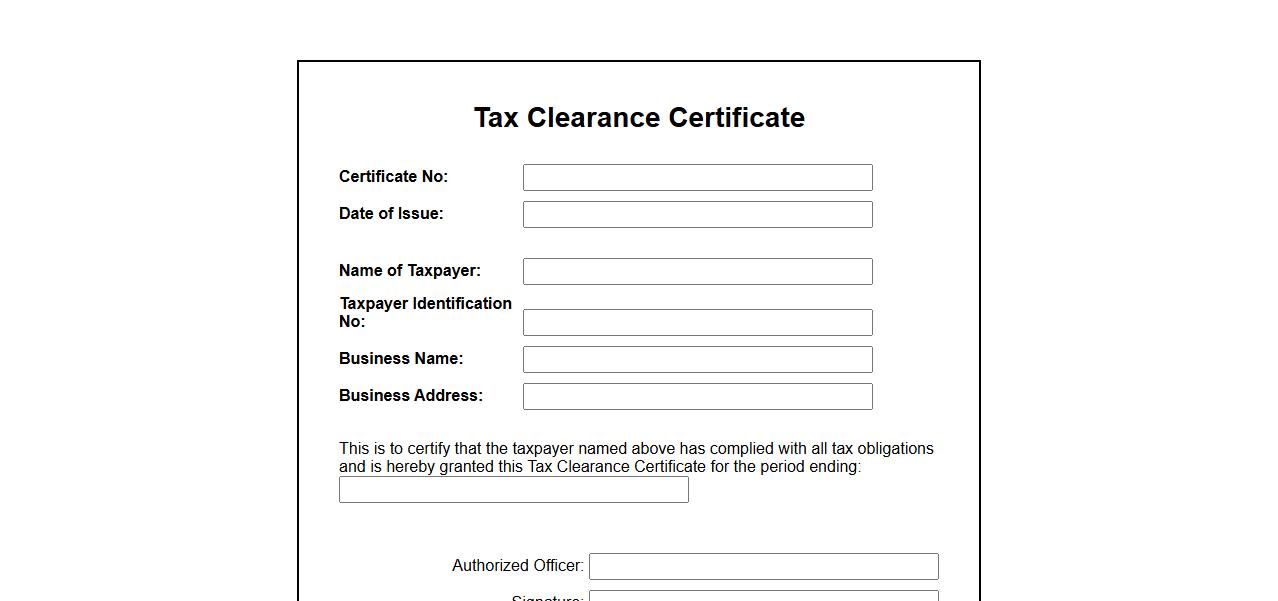

Tax Clearance Certificate

A Tax Clearance Certificate is an official document issued by tax authorities confirming that an individual or business has fulfilled all tax obligations. It is often required for government contracts, business registrations, and other legal purposes. Obtaining this certificate ensures compliance and eliminates any tax-related liabilities.

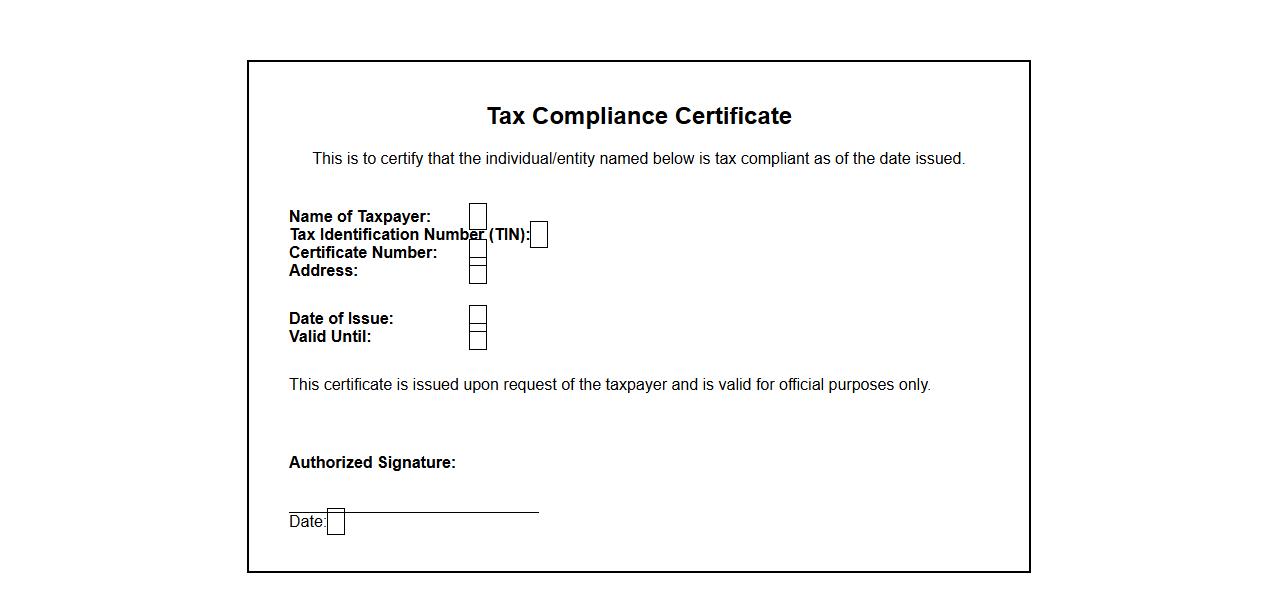

Tax Compliance Certificate

The Tax Compliance Certificate is an official document issued by tax authorities confirming that an individual or business is up-to-date with their tax obligations. This certificate is essential for various transactions, including government contracts and financial audits. It ensures credibility and legal compliance in financial dealings.

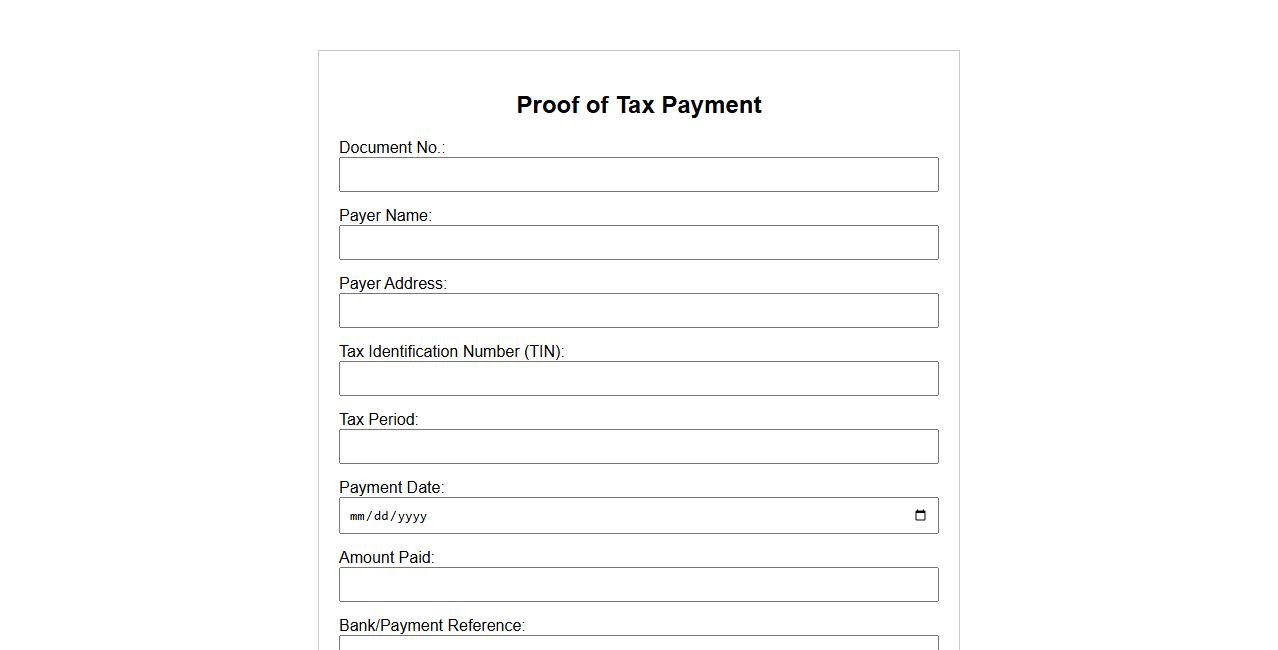

Proof of Tax Payment

Proof of Tax Payment is an official document verifying that an individual or business has fulfilled their tax obligations. It serves as evidence for various legal and financial transactions. This proof is essential for maintaining compliance with tax authorities and avoiding penalties.

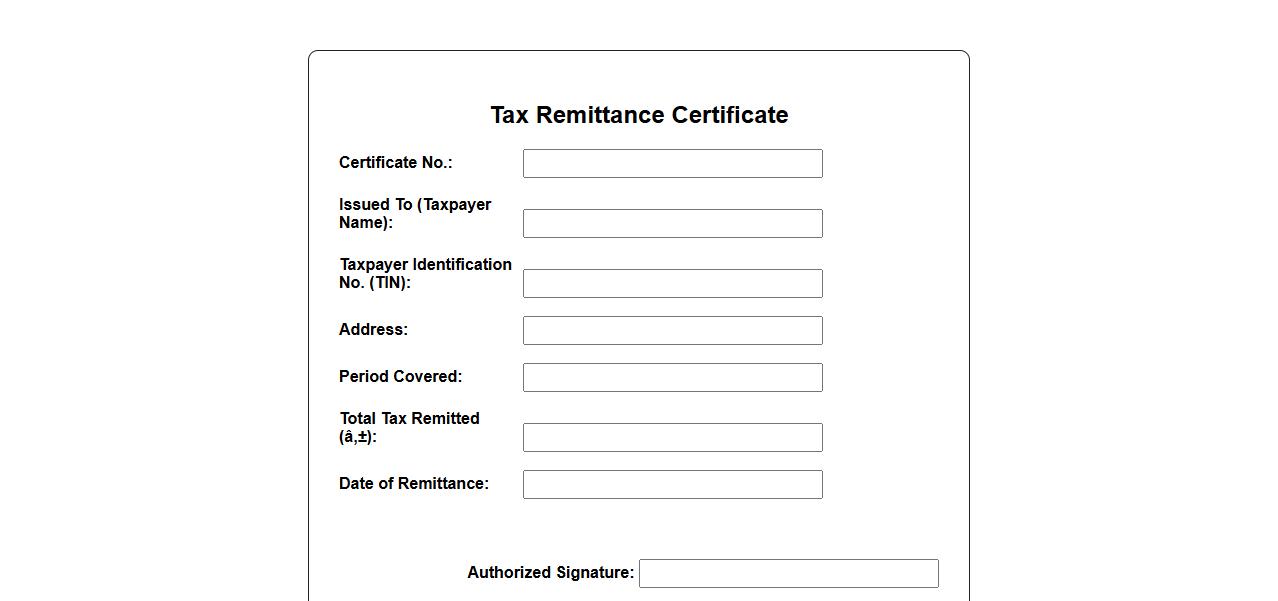

Tax Remittance Certificate

A Tax Remittance Certificate is an official document issued by tax authorities confirming that a taxpayer has paid the required taxes. It serves as proof of compliance with tax obligations and is often needed for legal and financial transactions. This certificate helps businesses and individuals avoid penalties by validating timely tax payments.

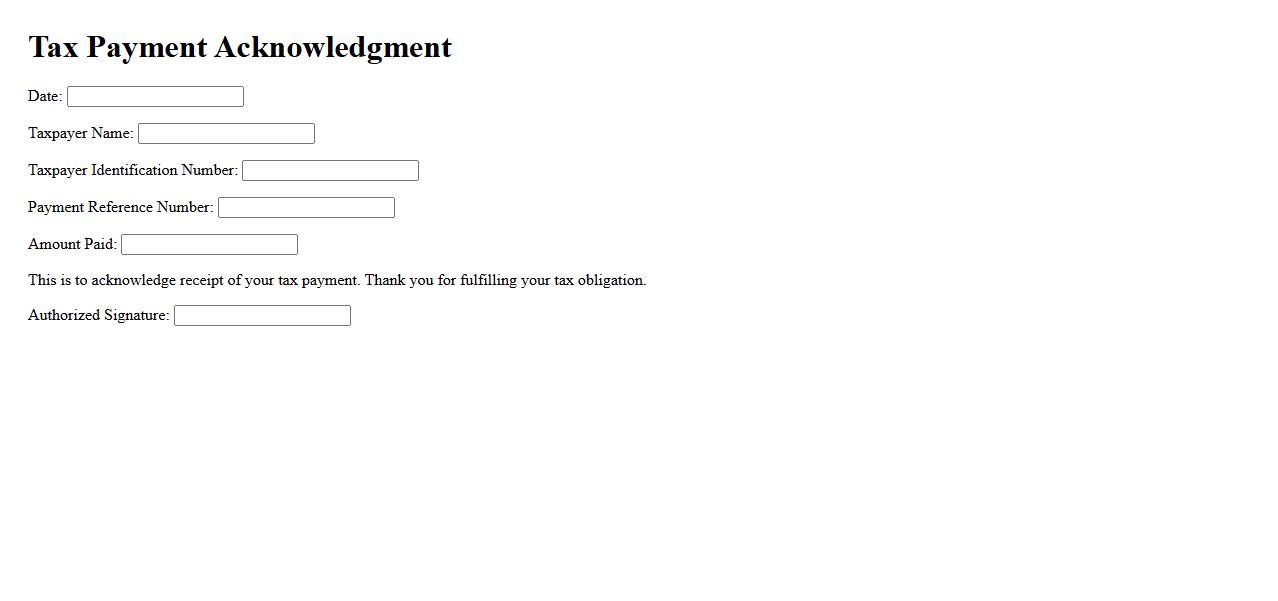

Tax Payment Acknowledgment

The Tax Payment Acknowledgment serves as an official confirmation that your tax dues have been successfully received by the tax authorities. This document is essential for keeping accurate financial records and verifying compliance with tax obligations. Always retain a copy for future reference and potential audits.

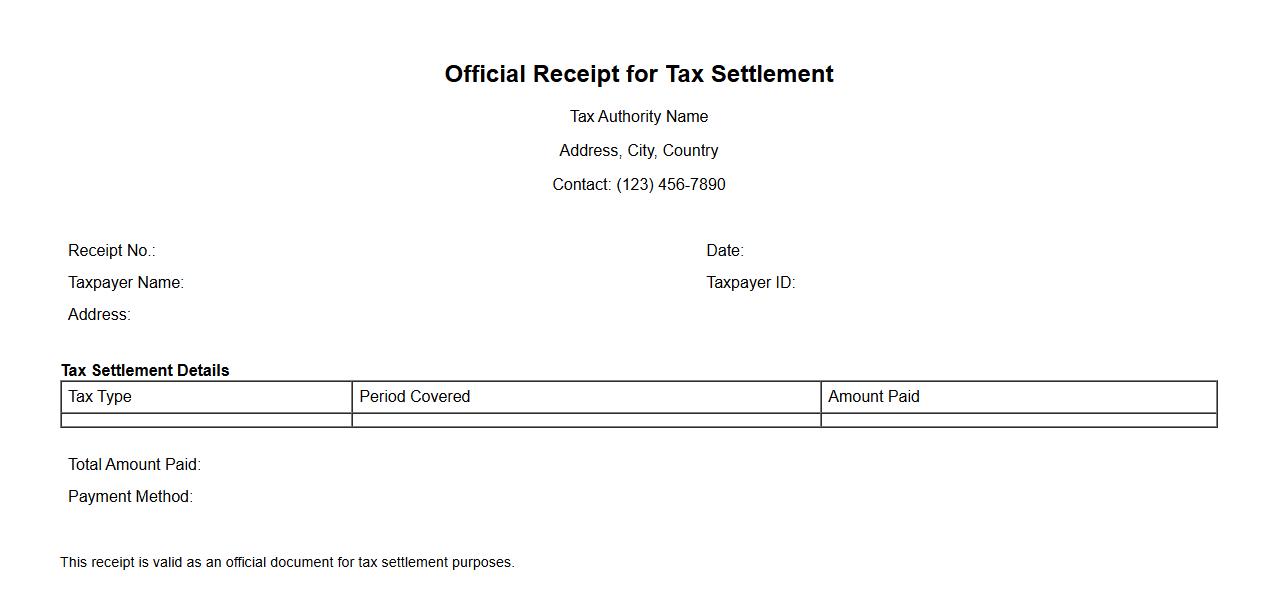

Official Receipt for Tax Settlement

The Official Receipt for Tax Settlement serves as proof of payment for taxes owed to the government. It confirms that the taxpayer has fulfilled their tax obligations for a specific period. This document is essential for record-keeping and future reference in tax-related transactions.

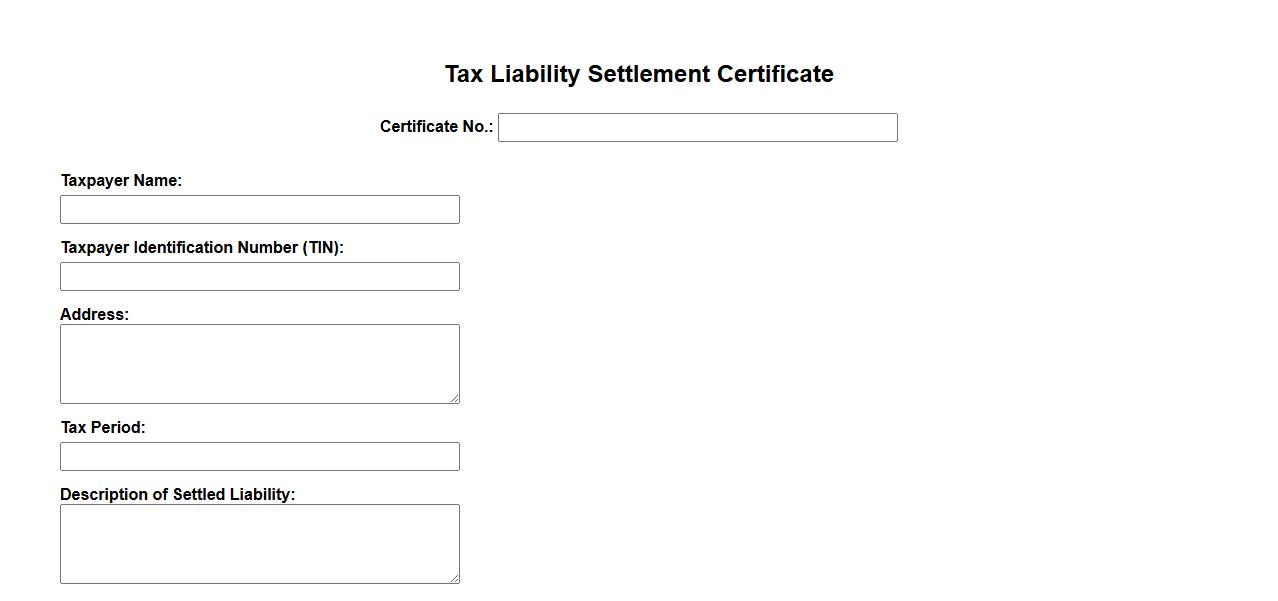

Tax Liability Settlement Certificate

The Tax Liability Settlement Certificate is an official document issued by tax authorities confirming that the taxpayer has fully settled their outstanding tax liabilities. This certificate serves as proof of compliance and is often required for legal or financial transactions. Obtaining this certificate ensures transparency and trust in tax-related matters.

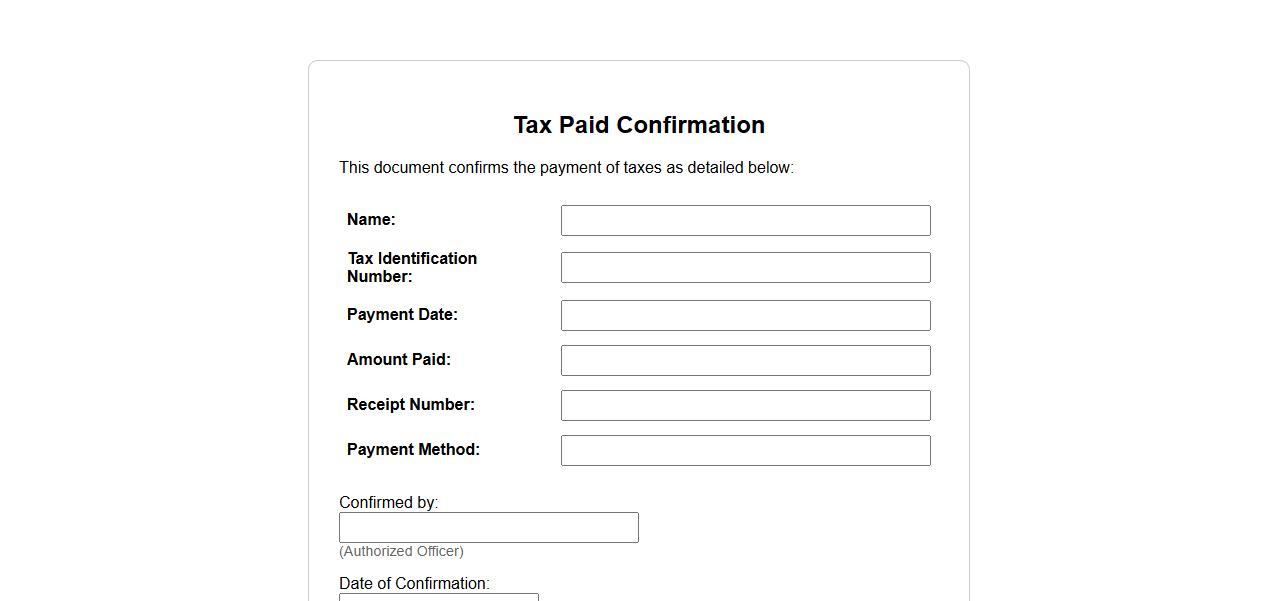

Tax Paid Confirmation

The Tax Paid Confirmation serves as an official document verifying that all required taxes have been duly paid. It provides assurance to authorities and businesses that tax obligations have been fulfilled. This confirmation is essential for maintaining compliance and avoiding legal issues.

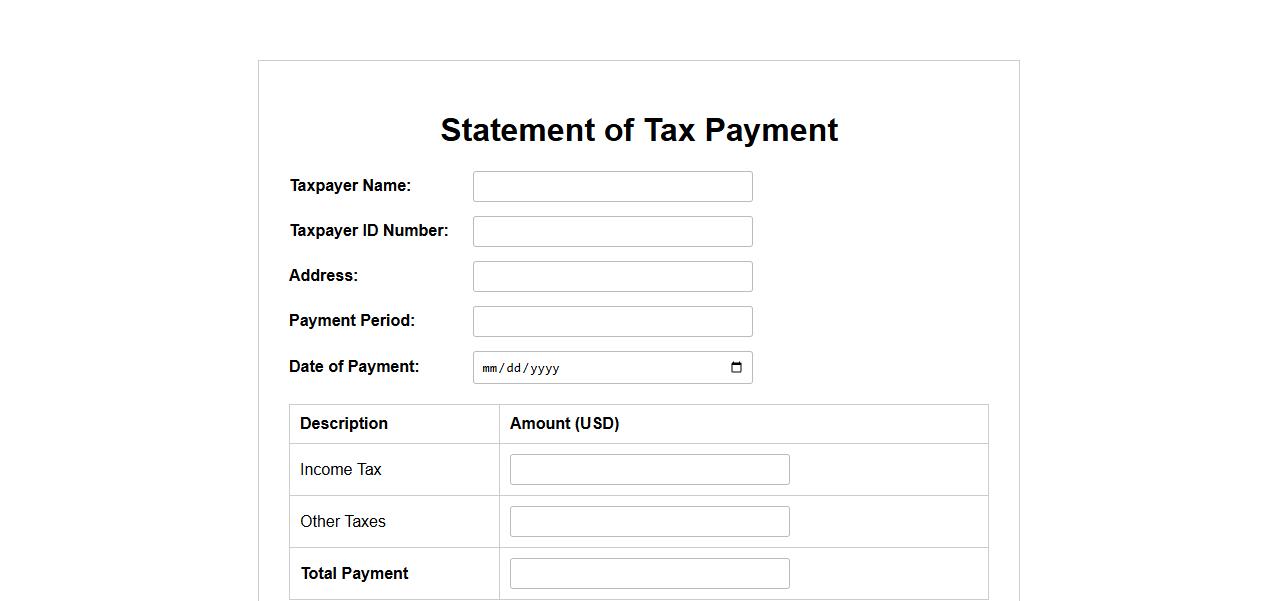

Statement of Tax Payment

The Statement of Tax Payment is an official document confirming the payment of taxes to the relevant authorities. It serves as proof of compliance with tax obligations and is often required for legal and financial transactions. Keeping this statement ensures transparency and accountability in tax reporting.

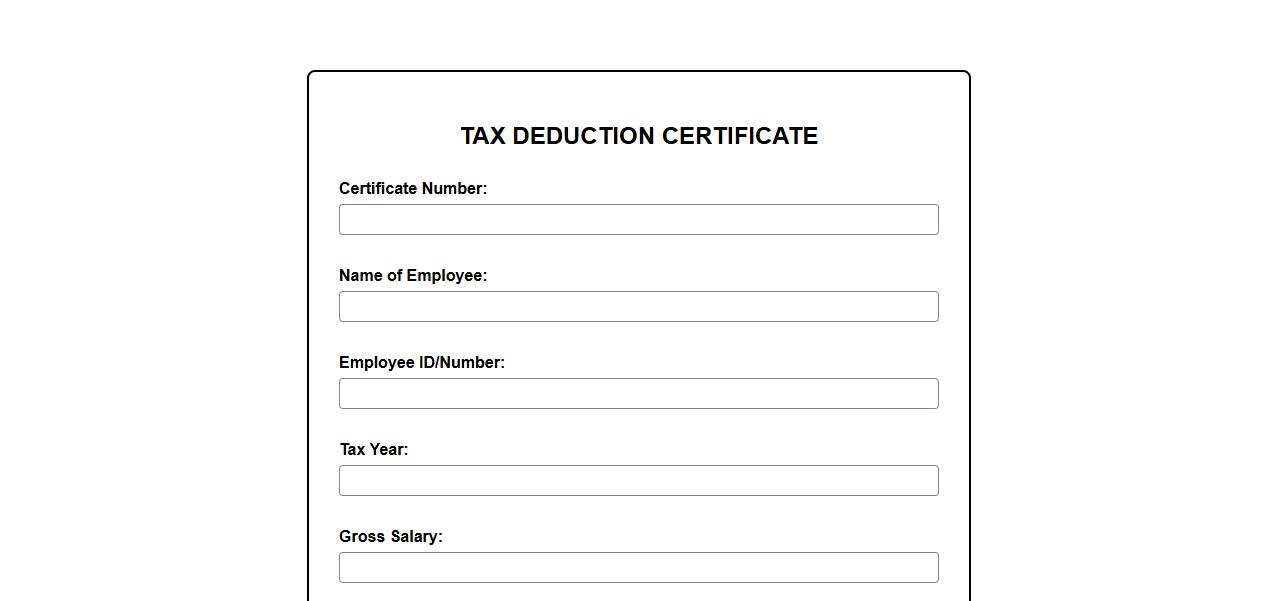

Tax Deduction Certificate

A Tax Deduction Certificate is an official document issued by a tax authority or employer that verifies the amount of tax deducted at source (TDS) from an individual's or entity's income. This certificate serves as proof of tax payment and can be used to claim tax credits during filing returns. It ensures transparency and aids in accurate financial record-keeping.

What is the primary purpose of a Certificate of Tax Payment?

The primary purpose of a Certificate of Tax Payment is to provide official evidence that an individual or business has settled their tax liabilities. This certificate acts as a formal document confirming that all due taxes have been paid within the stipulated period. It helps in ensuring transparency and accountability in fiscal transactions.

Which government authority issues the Certificate of Tax Payment?

The Certificate of Tax Payment is typically issued by the local or national tax authority, such as the Bureau of Internal Revenue (BIR) in many countries. These government agencies are responsible for tax collection and compliance enforcement. Their role includes verifying that the taxpayer has fulfilled payment obligations before issuing this certificate.

What essential information is typically included in a Certificate of Tax Payment?

A Certificate of Tax Payment usually contains essential information such as the taxpayer's name, tax identification number, the amount of tax paid, and the date of payment. It also includes details about the tax period covered by the payment and the issuing authority's official seal or signature. This information ensures the certificate's authenticity and relevance.

In what situations or transactions is a Certificate of Tax Payment required?

The Certificate of Tax Payment is required in various situations such as property transfers, business registrations, and loan applications. It serves as a prerequisite to prove tax compliance before completing these transactions. Authorities and financial institutions use this certificate to validate that no outstanding taxes impede the process.

How does the Certificate of Tax Payment serve as proof of compliance with tax obligations?

The Certificate of Tax Payment acts as a proof of compliance by formally documenting that all assessed taxes have been paid. It demonstrates the taxpayer's adherence to legal requirements, preventing disputes related to tax arrears. This certificate gives confidence to third parties about the taxpayer's law-abiding financial status.