A Certificate of Guarantor is an official document that verifies an individual's commitment to guarantee the obligations of another party. It serves as legal proof ensuring the guarantor's responsibility in case the primary party defaults. This certification is commonly required in financial agreements, loans, or rental contracts to provide security and trust.

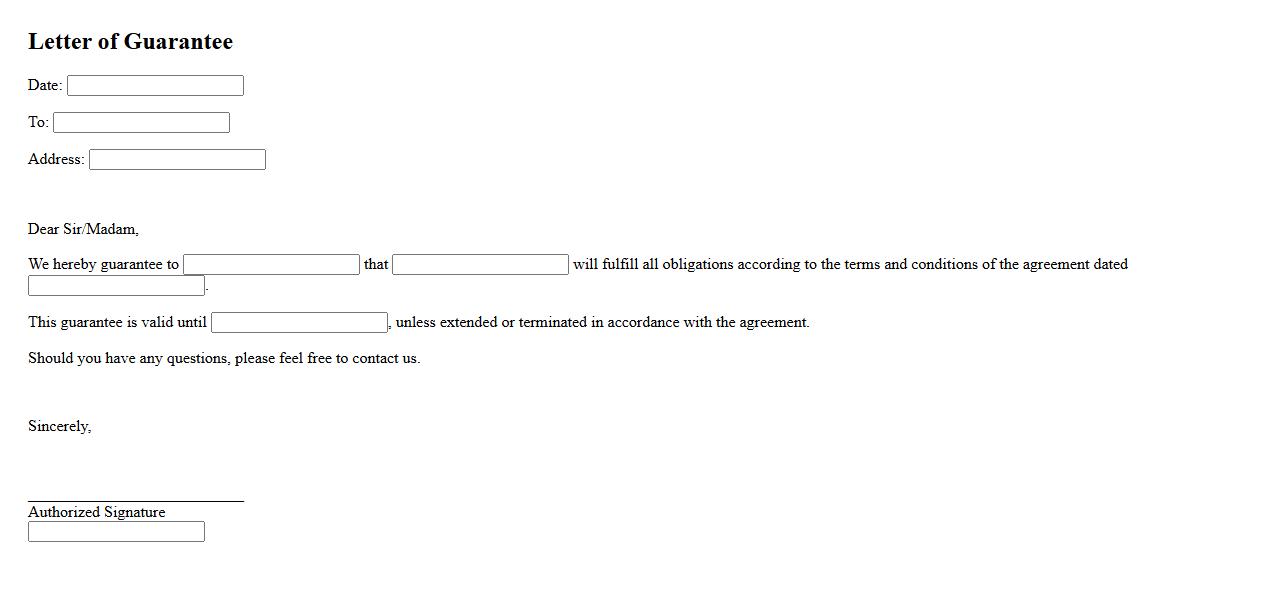

Letter of Guarantee

A Letter of Guarantee is a formal document issued by a bank or financial institution assuring payment to a beneficiary in case the applicant fails to fulfill contractual obligations. It serves as a financial security tool in commercial transactions, ensuring trust between parties. This guarantee is crucial in mitigating risks and facilitating smoother business operations.

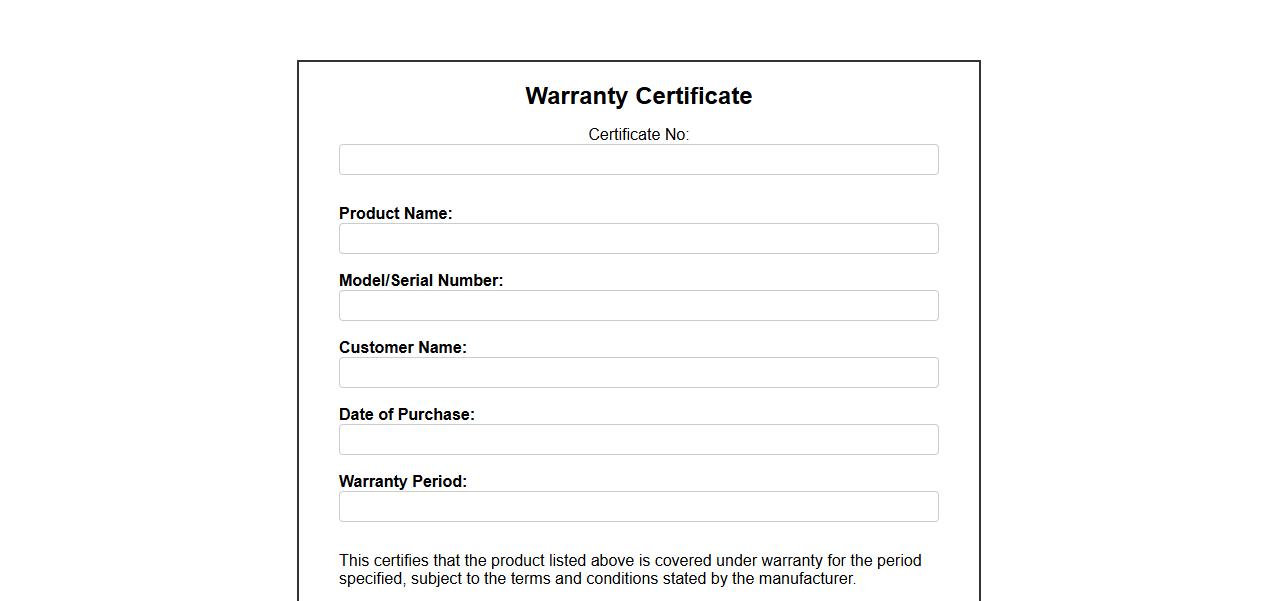

Warranty Certificate

A warranty certificate serves as proof of a product's guarantee from the manufacturer, ensuring repairs or replacements within a specified period. It outlines the terms, coverage, and conditions protecting consumers against defects or malfunctions. Keeping this document safe is essential for claiming after-sales service.

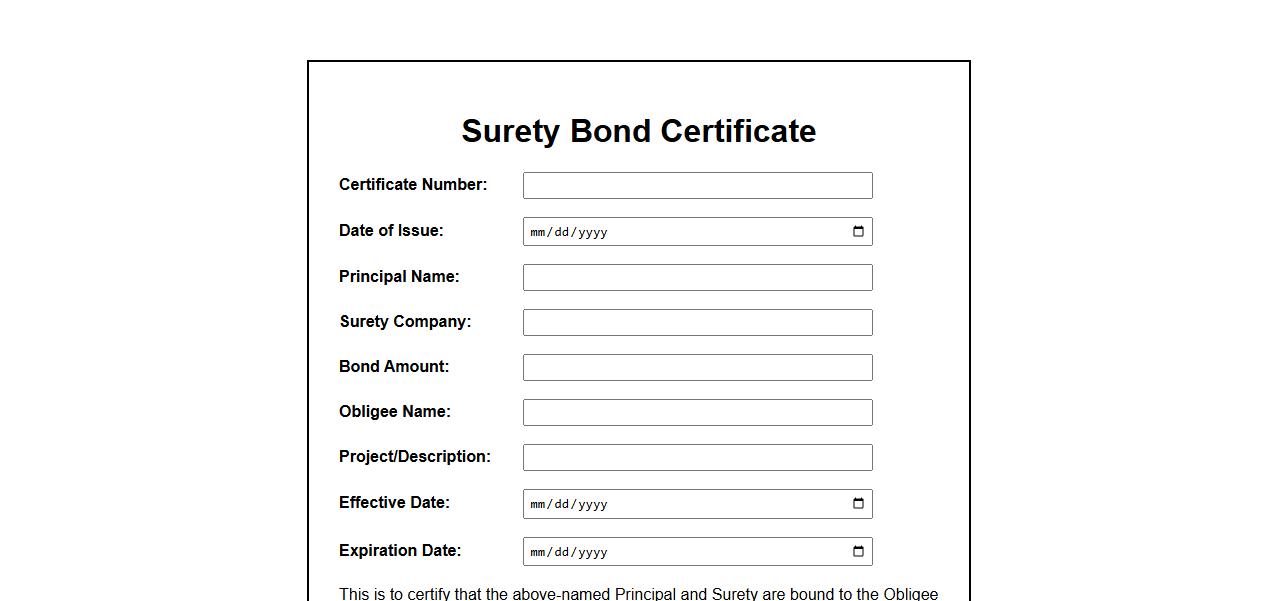

Surety Bond Certificate

A Surety Bond Certificate is a legal document ensuring the fulfillment of contractual obligations between parties. It protects the obligee by guaranteeing compensation if the principal fails to meet the agreed terms. This certificate is essential for businesses requiring proof of financial responsibility and trustworthiness.

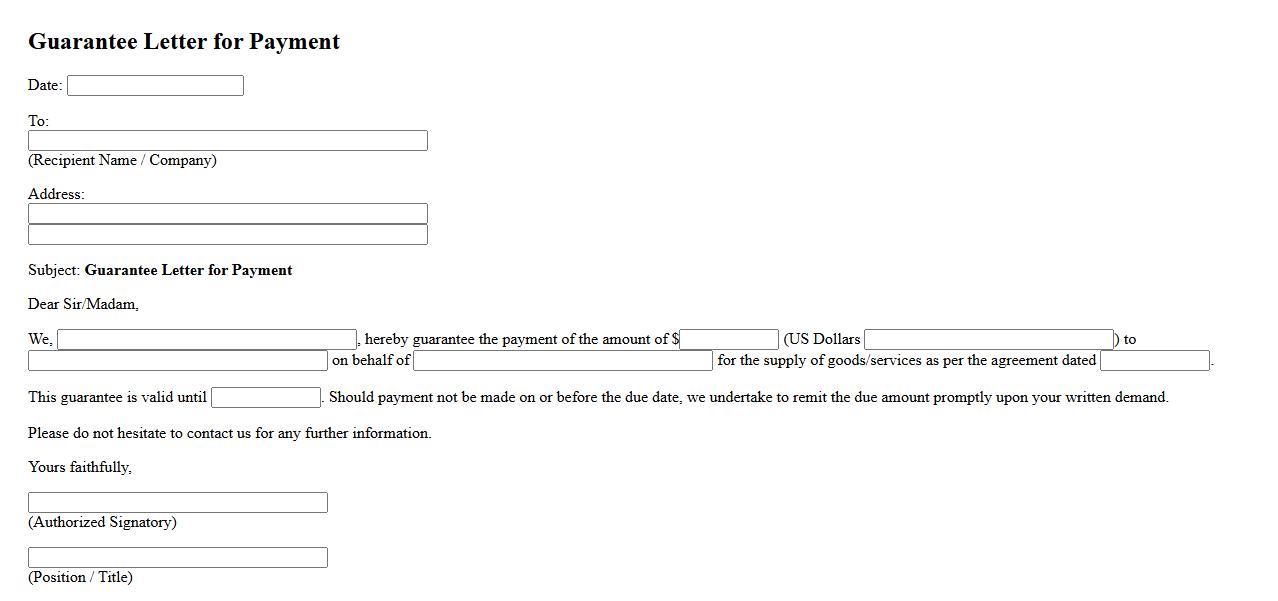

Guarantee Letter for Payment

A Guarantee Letter for Payment is a formal document assuring the recipient that the payment will be made as promised. It serves as a commitment from the guarantor to cover the payment if the original payer defaults. This letter is commonly used in business transactions to build trust and secure financial agreements.

Financial Guarantee Certificate

A Financial Guarantee Certificate is a formal document issued by a financial institution to assure the recipient that a certain amount of money will be paid if specified conditions are met. It acts as a security measure in business transactions, providing confidence to sellers or lenders. This certificate helps mitigate risks by guaranteeing payment in case of default.

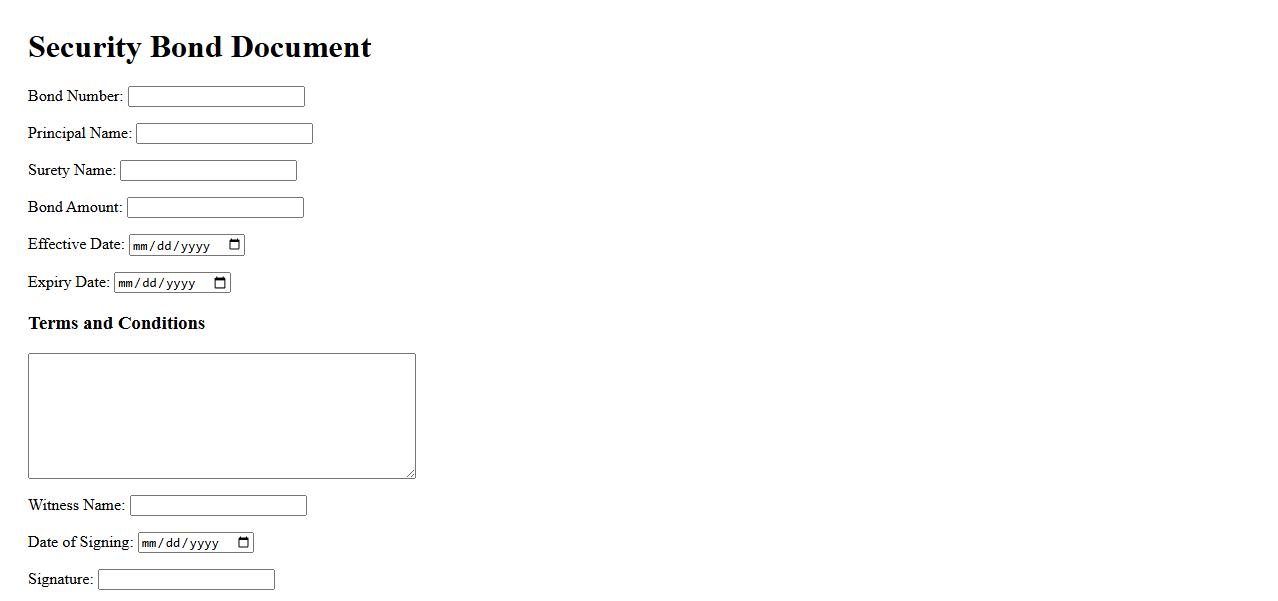

Security Bond Document

The Security Bond Document serves as a formal agreement ensuring the fulfillment of contractual obligations. It protects parties involved by guaranteeing compensation in case of default or breach. This document is essential for maintaining trust and accountability in legal and financial transactions.

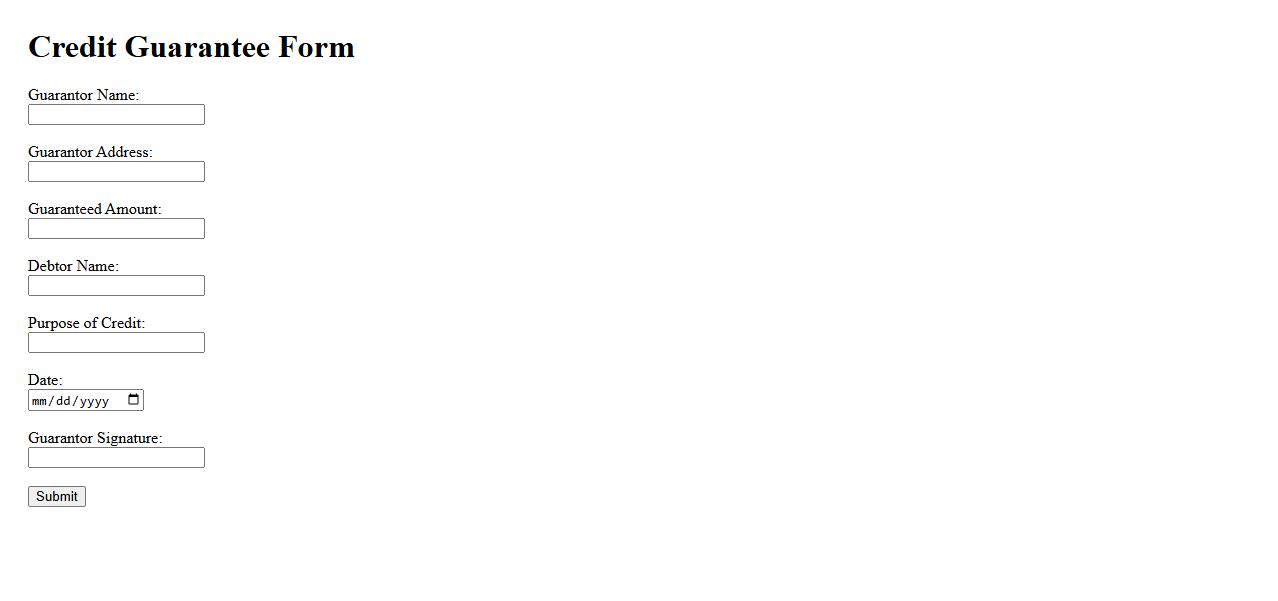

Credit Guarantee Form

The Credit Guarantee Form is a crucial document used to assure lenders or financial institutions of repayment security. It outlines the terms and conditions under which the guarantor agrees to take responsibility if the borrower defaults. This form enhances trust and facilitates smoother credit approval processes.

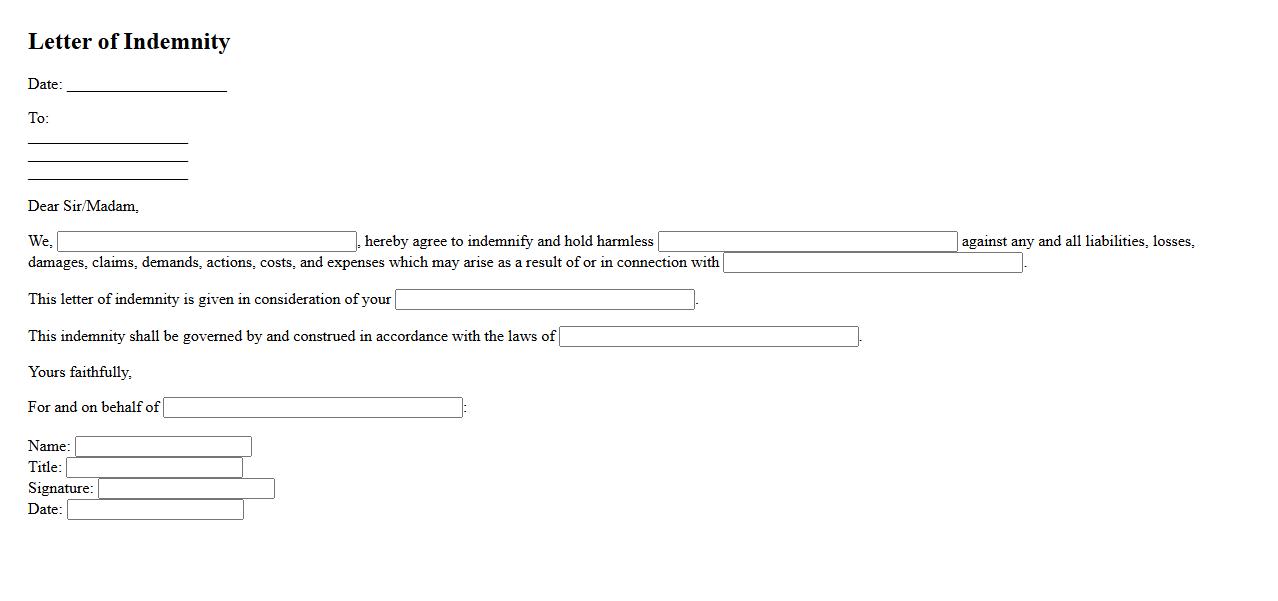

Letter of Indemnity

A Letter of Indemnity is a legal document that provides a guarantee against potential losses or damages. It is commonly used in shipping and financial transactions to protect parties from unforeseen risks. This letter ensures that the party issuing it will compensate for any specified liabilities.

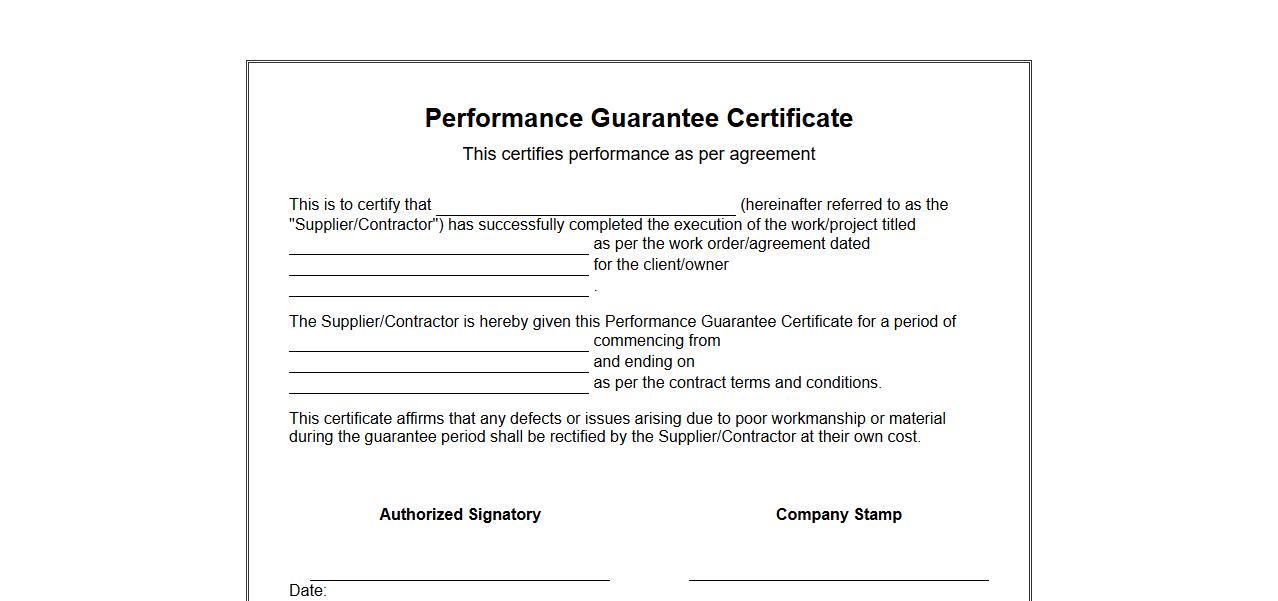

Performance Guarantee Certificate

A Performance Guarantee Certificate is a formal document ensuring that a project or service meets specified standards and requirements. It provides assurance to clients or stakeholders that the obligations will be fulfilled satisfactorily. This certificate is essential for building trust and accountability in contractual agreements.

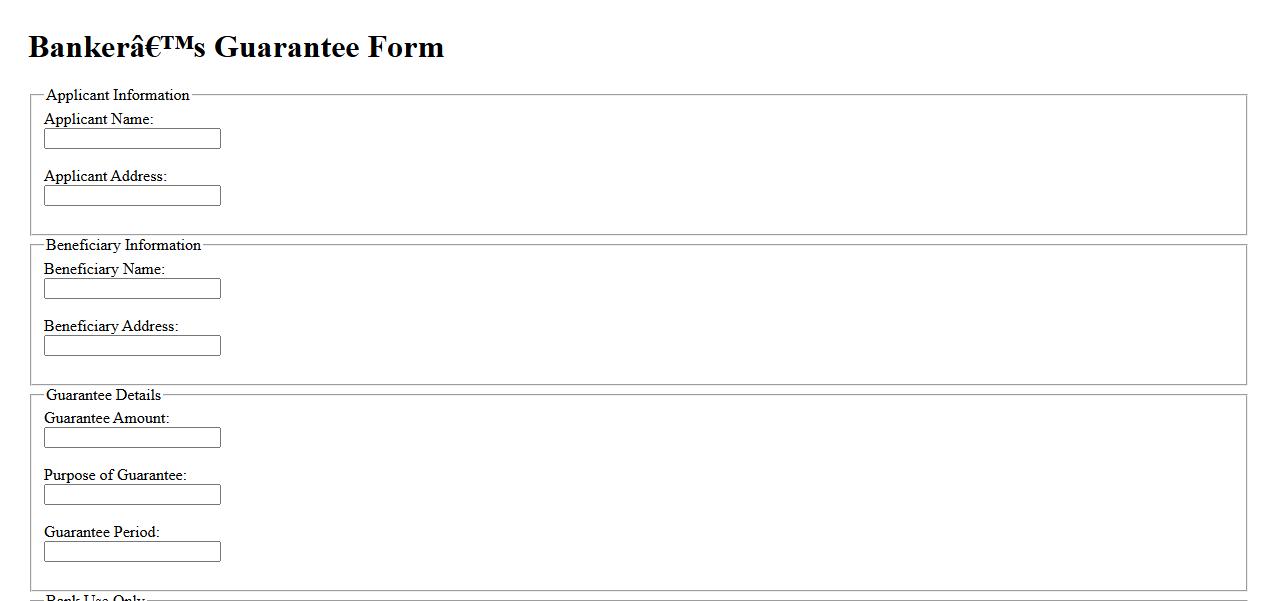

Banker’s Guarantee Form

The Banker's Guarantee Form is a vital financial document ensuring that a bank will honor a client's payment obligations. It provides security and trust in commercial transactions by backing guarantees issued on behalf of clients. This form is essential for mitigating risks between businesses and financial institutions.

What is the Primary Purpose of a Certificate of Guarantor Within a Legal or Financial Document?

The primary purpose of a Certificate of Guarantor is to formally acknowledge the guarantor's commitment in a legal or financial arrangement. It serves as an official declaration that the guarantor agrees to fulfill certain obligations if the primary party defaults. This certificate provides assurance to lenders, creditors, or other concerned entities about the guarantor's financial responsibility.

Which Parties Are Legally Recognized as Guarantors on the Certificate?

The parties legally recognized as guarantors are explicitly named individuals or entities who have signed the certificate. These parties typically have the legal capacity and authority to assume guarantee obligations. Their identification is crucial for validating the contract and ensuring accountability under the terms specified.

What Specific Obligations or Liabilities Are Outlined for the Guarantor in the Certificate?

The certificate clearly outlines the guarantor's obligations, including payment obligations, performance guarantees, or indemnity clauses. It specifies the extent and limits of liabilities the guarantor agrees to undertake. These obligations ensure that the guarantor understands and consents to their role in the event of default by the principal party.

What Are the Conditions or Events That Activate the Guarantor's Responsibilities as Per the Document?

The guarantor's responsibilities are triggered under defined conditions or events, such as the default or non-performance by the primary party. The certificate specifies these activation events to eliminate ambiguity and protect all involved parties. This clarity ensures prompt enforcement of the guarantee when necessary.

What Documentation or Proof Is Required to Validate the Guarantees Mentioned in the Certificate?

To validate the guarantees, the certificate may require supporting documentation or proof such as signed contracts, payment records, or default notices. These documents confirm the occurrence of triggering events and substantiate the guarantor's obligations. Validation mechanisms safeguard the enforceability and legal standing of the guarantees.