A Certificate of Account Balance is an official document issued by a financial institution confirming the current status and balance of an account. This certificate serves as proof of funds for various purposes, such as loan applications, legal matters, or financial verification. It typically includes details like the account holder's name, account number, and the exact amount held at the time of issuance.

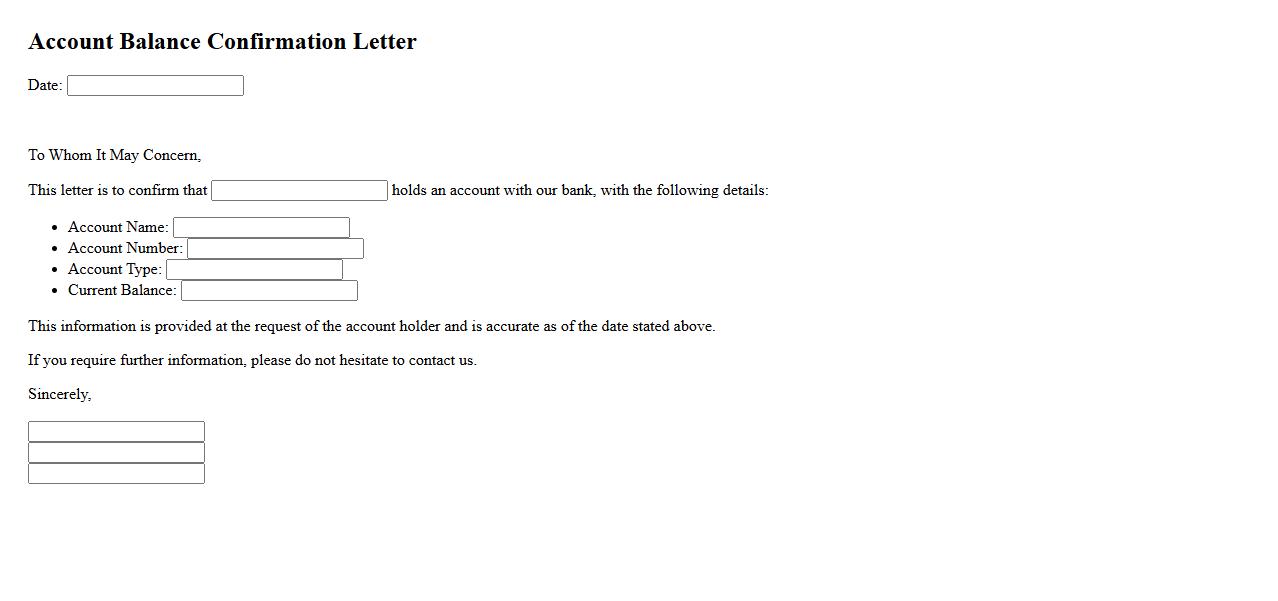

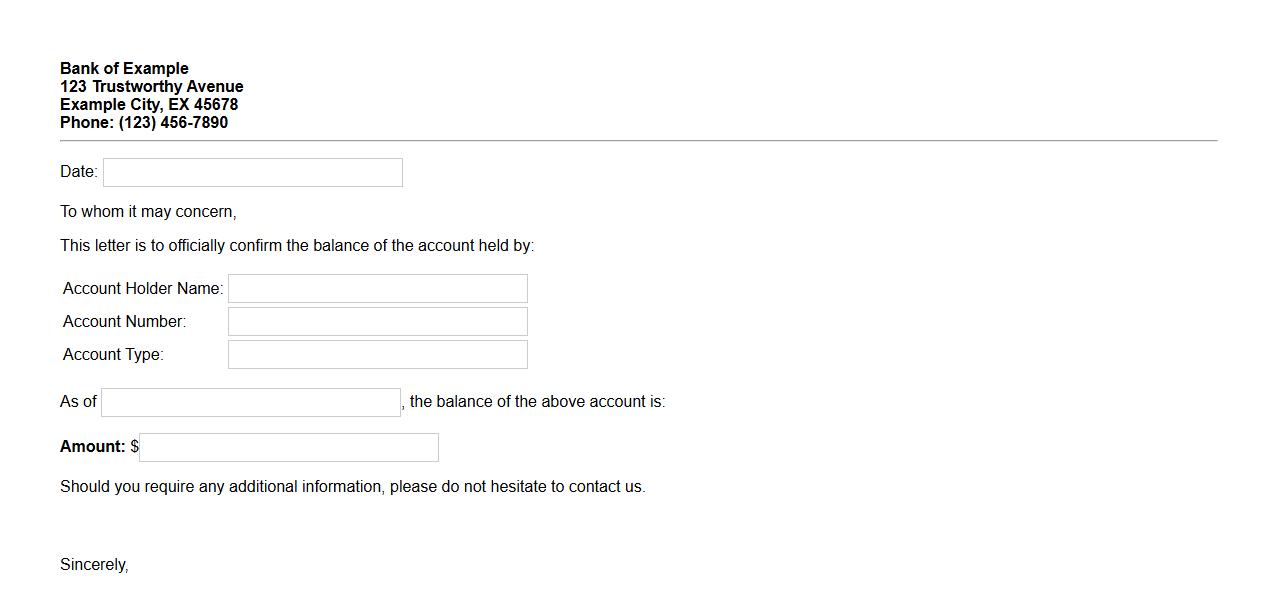

Account Balance Confirmation Letter

An Account Balance Confirmation Letter is a formal document issued by financial institutions to verify the current balance of a customer's account. It serves as official proof for audits, loan applications, or personal record-keeping. This letter ensures transparency and accuracy in financial transactions.

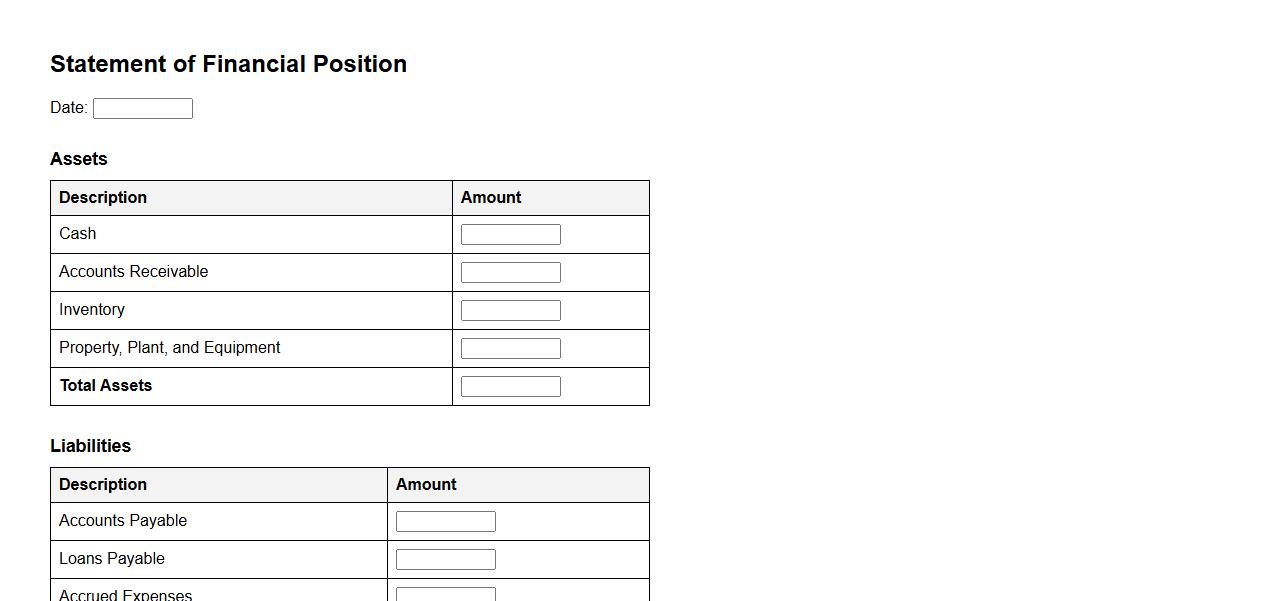

Financial Position Statement

The Financial Position Statement provides a snapshot of an entity's assets, liabilities, and equity at a specific point in time. It is essential for assessing the overall financial health and stability of a business. This statement helps stakeholders make informed decisions regarding investments and credit.

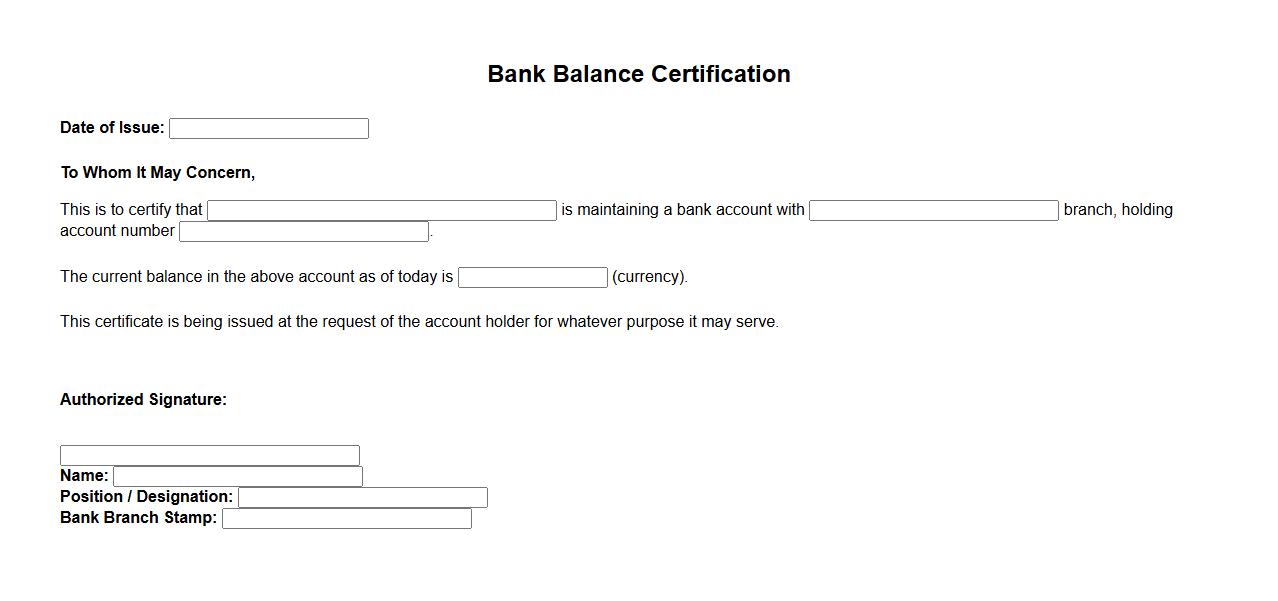

Bank Balance Certification

Bank Balance Certification is an official document issued by a bank confirming the exact amount of funds available in an account holder's bank account. This certification is commonly required for visa applications, loan approvals, and other financial verifications. It serves as proof of financial stability and ensures transparency in monetary transactions.

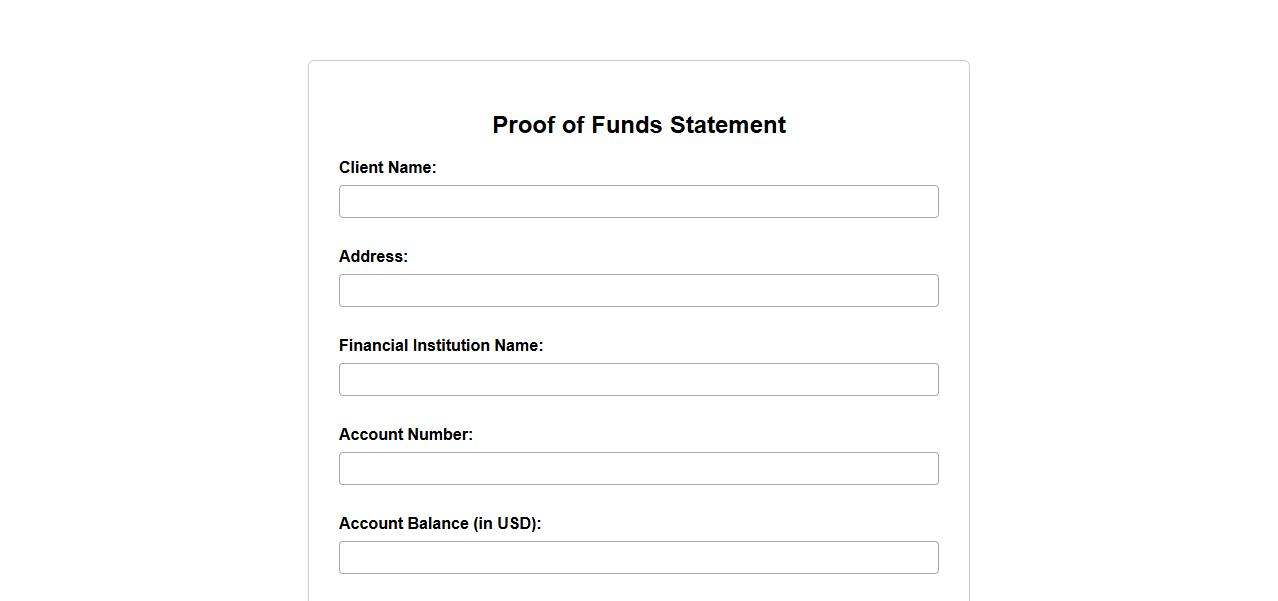

Proof of Funds Statement

A Proof of Funds Statement is a financial document that verifies an individual's or company's available funds. It is often required during transactions such as real estate purchases or business deals to demonstrate liquidity. This statement ensures that the buyer or investor has sufficient resources to complete the transaction.

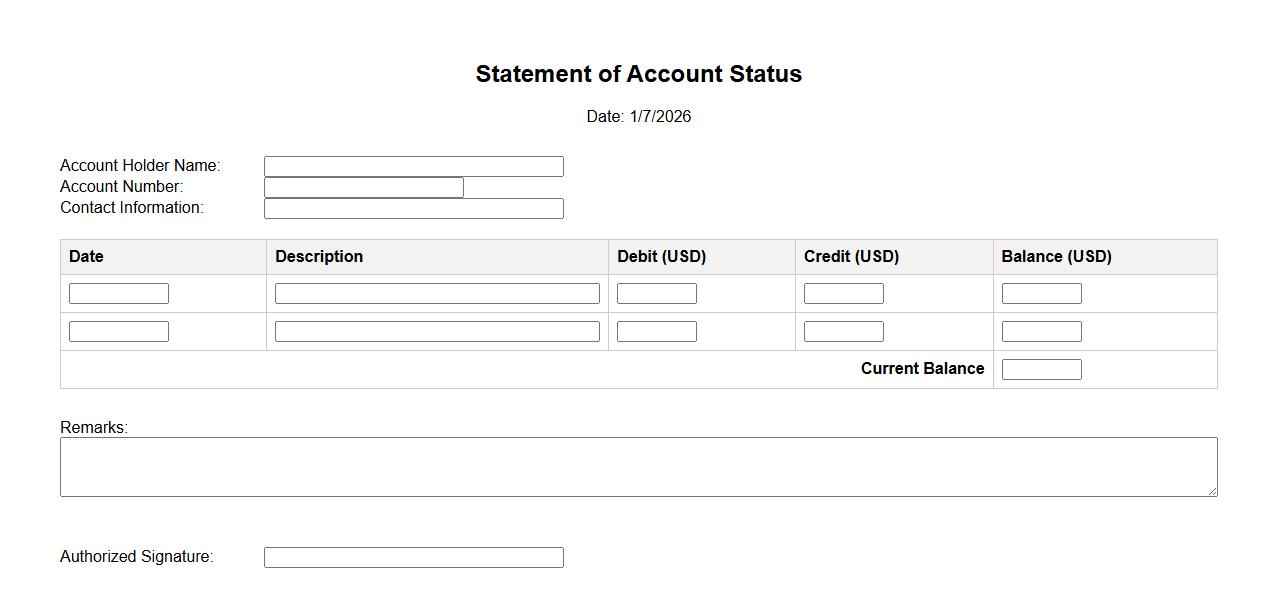

Statement of Account Status

The Statement of Account Status provides a detailed summary of all recent transactions, including debits and credits, on your account. It helps you track current balances and identify any discrepancies. Regular review of this statement ensures accurate financial management and timely resolution of any issues.

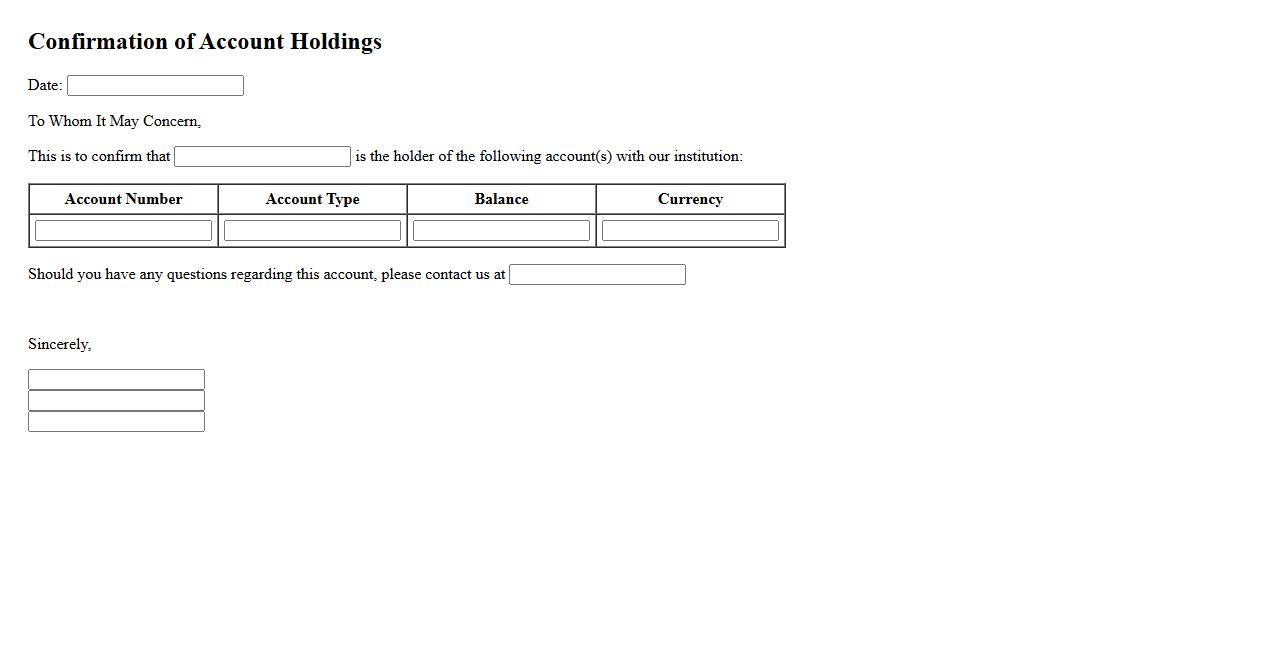

Confirmation of Account Holdings

Confirmation of Account Holdings is a critical process where financial institutions verify the details of assets held in a client's account. This ensures transparency and accuracy in reporting financial positions. Clients receive an official statement confirming their holdings to maintain trust and compliance.

Official Account Balance Letter

An Official Account Balance Letter is a formal document issued by a bank or financial institution that confirms the current balance of an account holder. It serves as proof of funds for various purposes such as loan applications, visa processing, or legal matters. This letter typically includes the account holder's name, account number, and the exact balance as of a specified date.

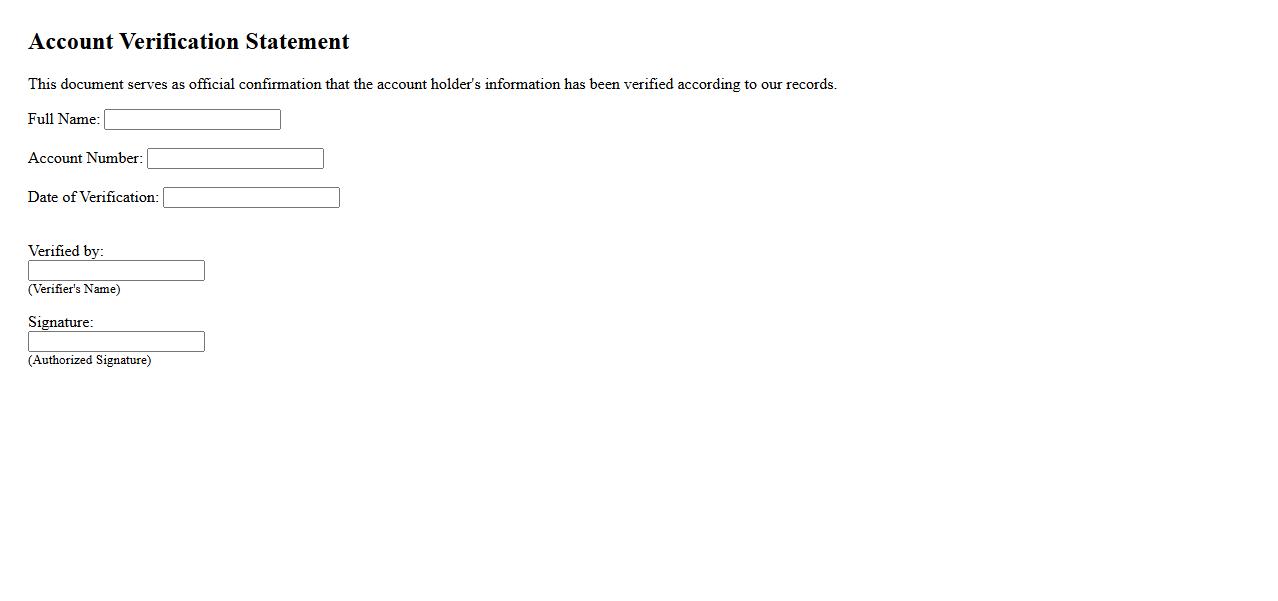

Account Verification Statement

The Account Verification Statement is a crucial document used to confirm the authenticity and details of an account holder. It ensures that all provided information is accurate and meets compliance standards. This statement is often required for financial transactions and identity verification processes.

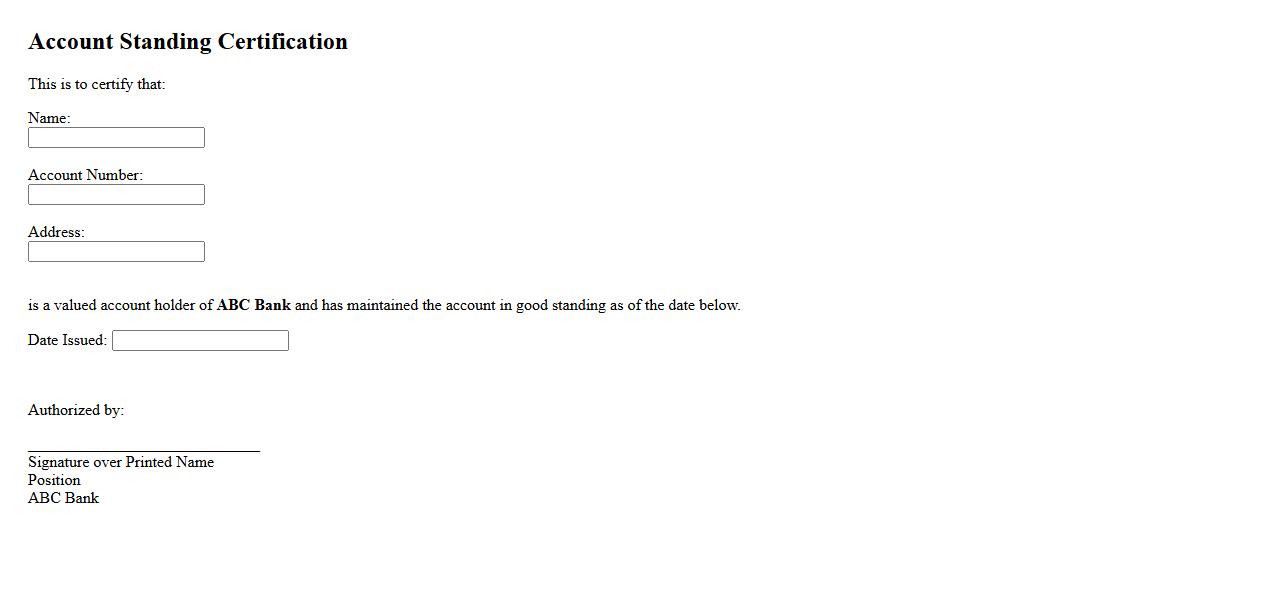

Account Standing Certification

The Account Standing Certification is an official document verifying the current status of an account. It confirms that the account holder is in good standing, meeting all necessary requirements and obligations. This certification is often required for financial, legal, or business purposes.

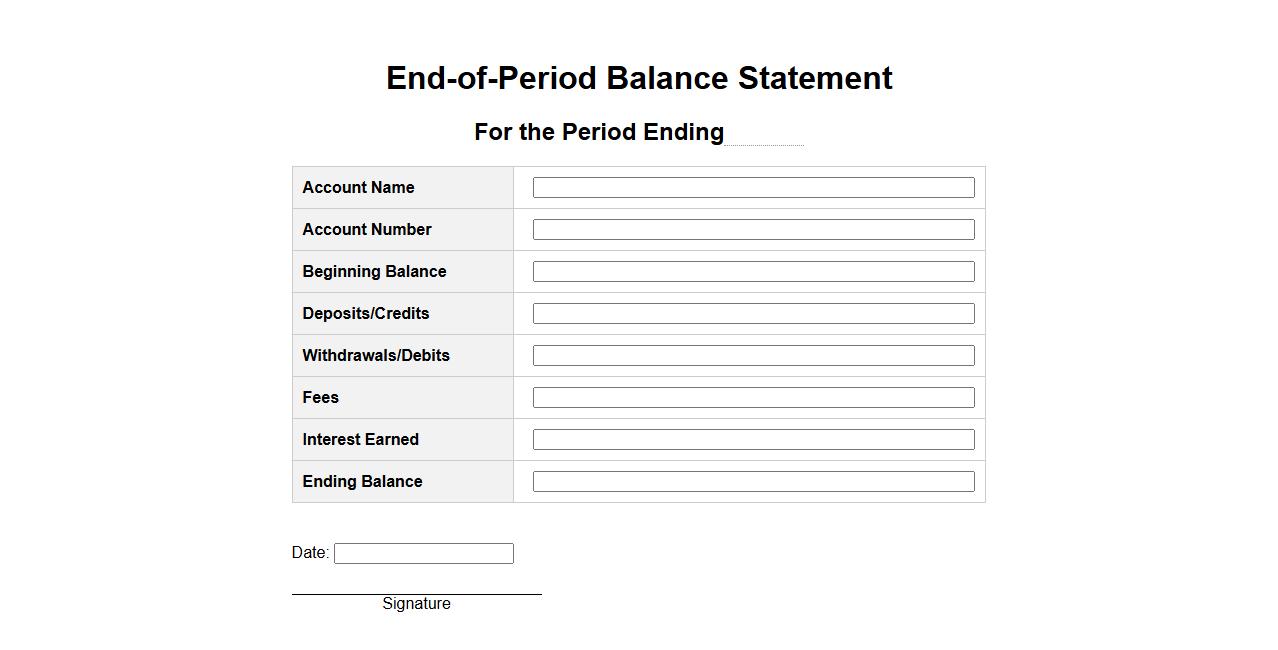

End-of-Period Balance Statement

The End-of-Period Balance Statement provides a clear summary of an account's financial position at the close of a specific period. It details the ending balances of assets, liabilities, and equity, ensuring accurate financial reporting. This statement is essential for evaluating an organization's financial health and making informed business decisions.

What information must a Certificate of Account Balance include for validity?

A valid Certificate of Account Balance must include the account holder's name, the exact balance as of a specific date, and the account number. It should also contain the date of issuance and the signature or seal of the authorized financial institution representative. Including these details ensures the document's authenticity and legal validity.

How does a Certificate of Account Balance differ from an account statement?

The Certificate of Account Balance provides a snapshot of the account balance at a particular moment, while an account statement lists all transactions over a period. Certificates are typically used for official confirmation, whereas statements are for routine review. This makes the certificate a more formal and concise verification document.

In what situations is a Certificate of Account Balance typically required?

This certificate is usually required for loan applications, legal proceedings, or when proving financial status for official verifications. It serves as a formal proof of funds or financial standing. Additionally, it may be requested for property transactions or visa applications.

Who is authorized to issue a Certificate of Account Balance within a financial institution?

The certificate must be issued by a designated official within the bank, such as a branch manager, account officer, or authorized representative. These individuals have the authority to verify and certify the account information. This authority ensures the document's credibility and trustworthiness.

What verification procedures are necessary before releasing a Certificate of Account Balance?

Before issuing the certificate, the bank must verify the account holder's identity and confirm the balance through internal records. This includes checking for any discrepancies or recent transactions affecting the balance. The verification process guarantees the accuracy of the certificate being provided.