An Agreement to Settle Debt is a legally binding contract between a debtor and a creditor outlining the terms for repayment of an outstanding obligation. This agreement typically includes the settlement amount, payment schedule, and any concessions made by the creditor, such as reduced interest or waived fees. It ensures clarity and prevents disputes by clearly defining the responsibilities of both parties during the debt resolution process.

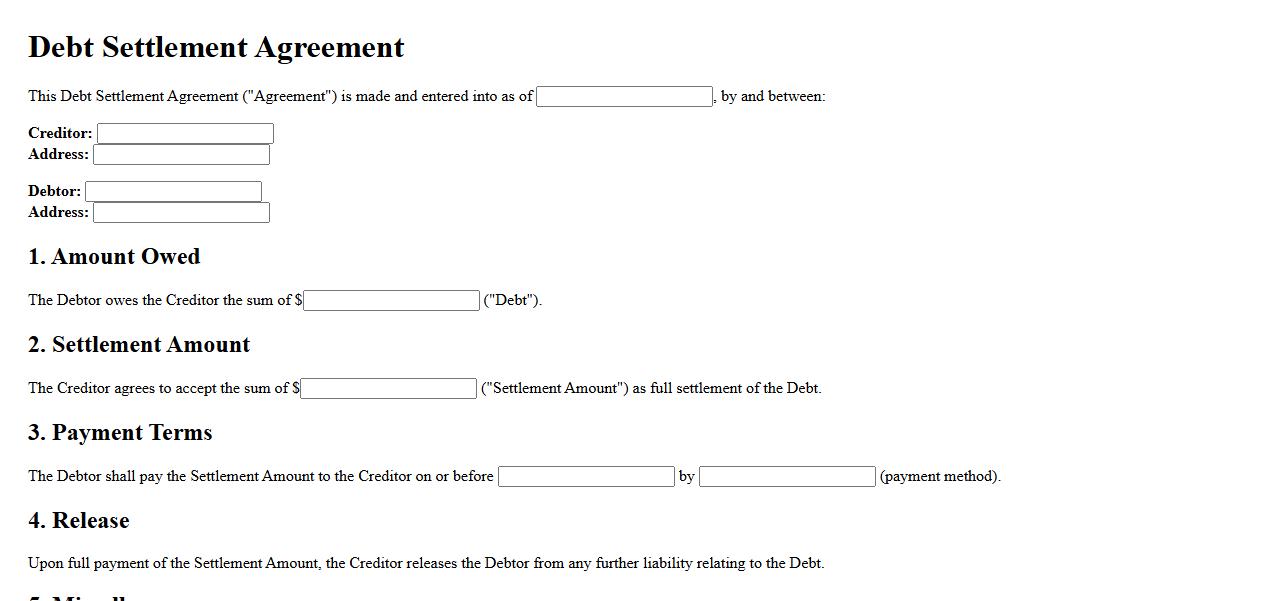

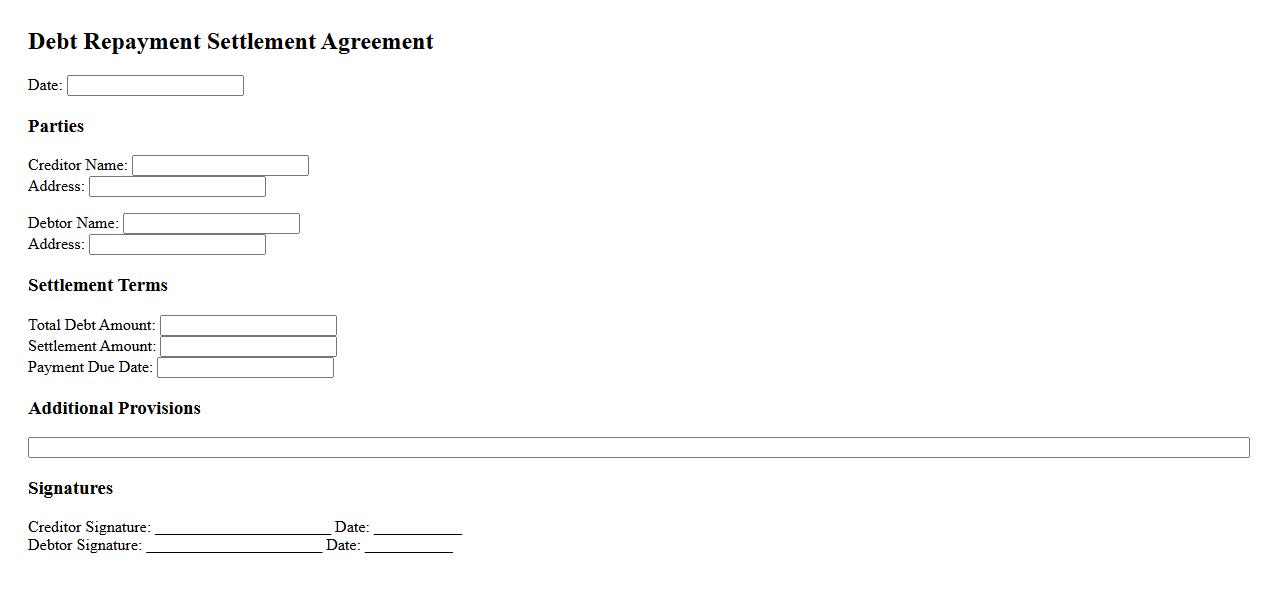

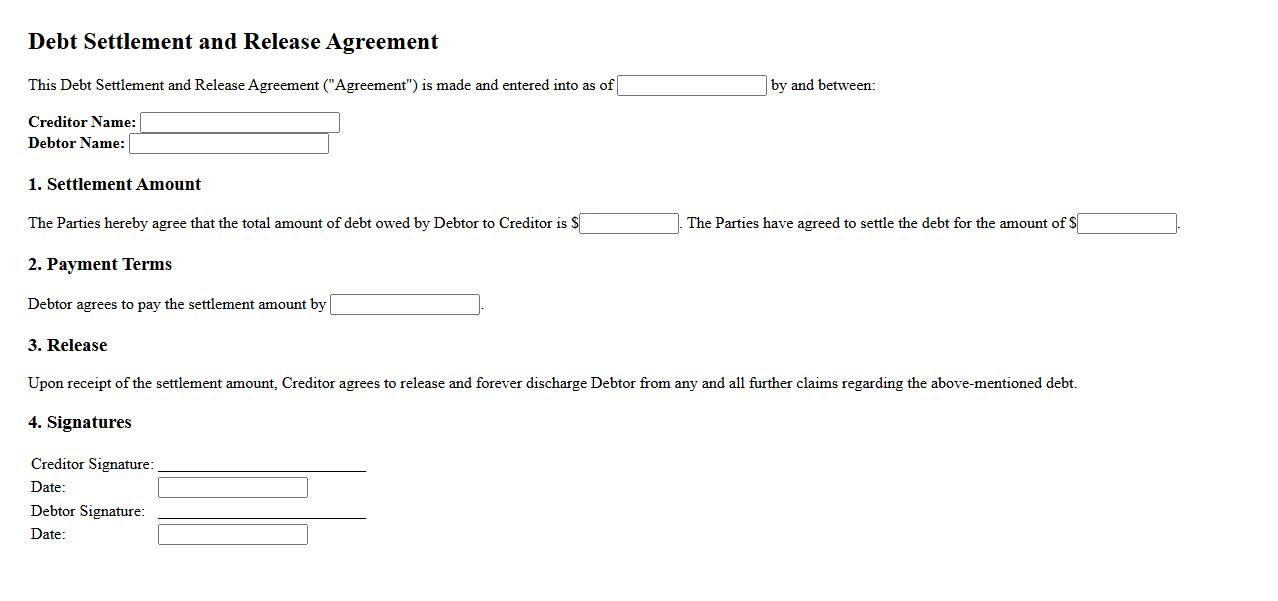

Debt Settlement Agreement

A Debt Settlement Agreement is a legally binding contract between a debtor and a creditor that outlines the terms for settling a debt for less than the full amount owed. This agreement helps both parties avoid lengthy litigation and provides a clear path to resolving outstanding financial obligations. It typically includes payment details, deadlines, and conditions for debt forgiveness.

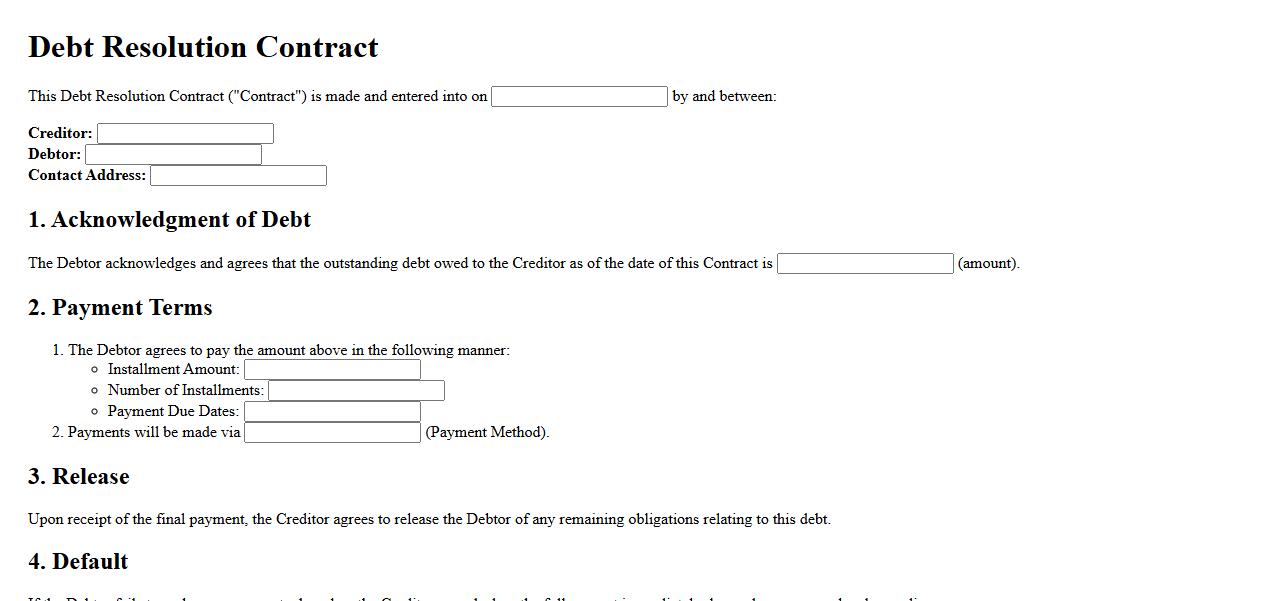

Debt Resolution Contract

A Debt Resolution Contract is a legally binding agreement between a debtor and a creditor outlining the terms to settle outstanding debts. It often involves negotiating reduced payments or a structured repayment plan to resolve the debt amicably. This contract helps both parties avoid lengthy litigation and provides a clear path to financial recovery.

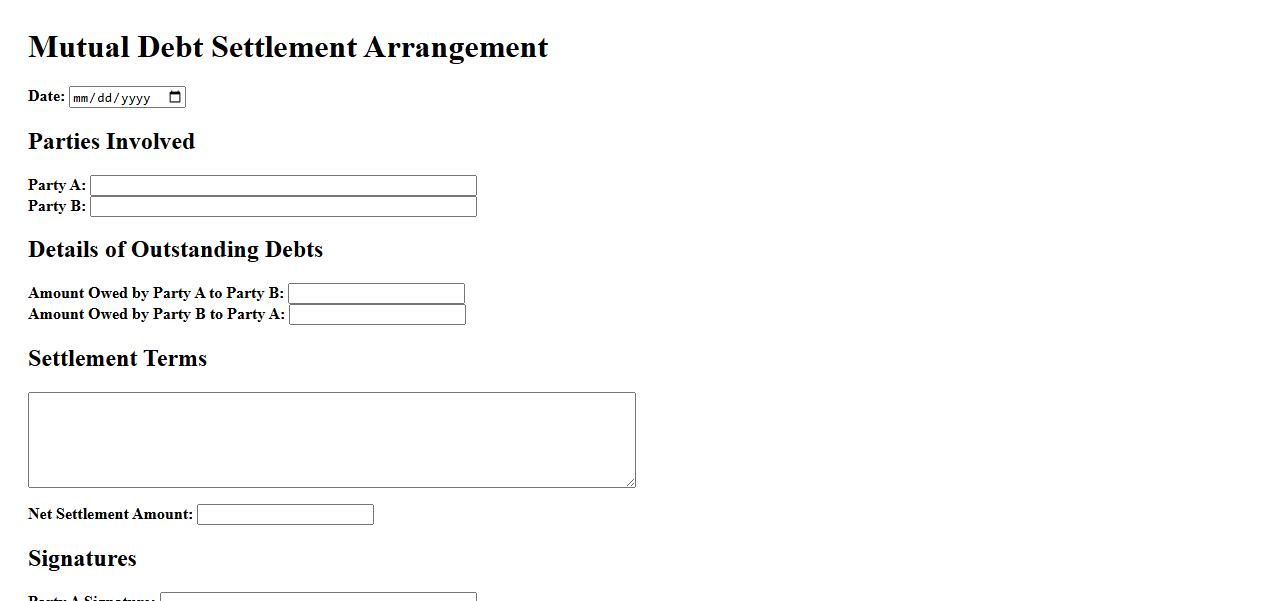

Mutual Debt Settlement Arrangement

A Mutual Debt Settlement Arrangement is an agreement between two or more parties to resolve outstanding debts through negotiation and compromise. This arrangement aims to create a fair payment plan that benefits all involved while avoiding legal disputes. It fosters cooperation and financial relief for both creditors and debtors.

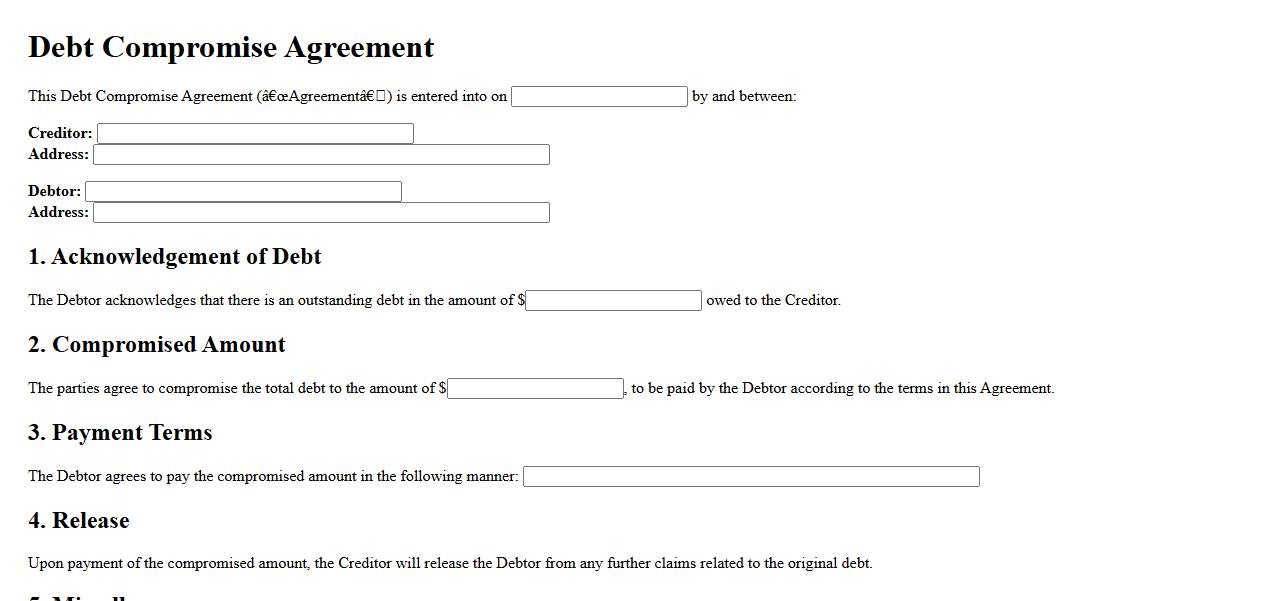

Debt Compromise Agreement

A Debt Compromise Agreement is a legally binding contract between a debtor and a creditor to settle a debt for less than the full amount owed. This agreement helps both parties avoid lengthy litigation by agreeing on a reduced payment plan. It provides a clear resolution that benefits the debtor while ensuring the creditor recovers a portion of the owed funds.

Debt Repayment Settlement

Debt repayment settlement is a financial agreement where a debtor settles their outstanding debt for less than the full amount owed. This process helps individuals or businesses reduce their debt burden and avoid bankruptcy. It often involves negotiation between the debtor and creditor to reach mutually acceptable terms.

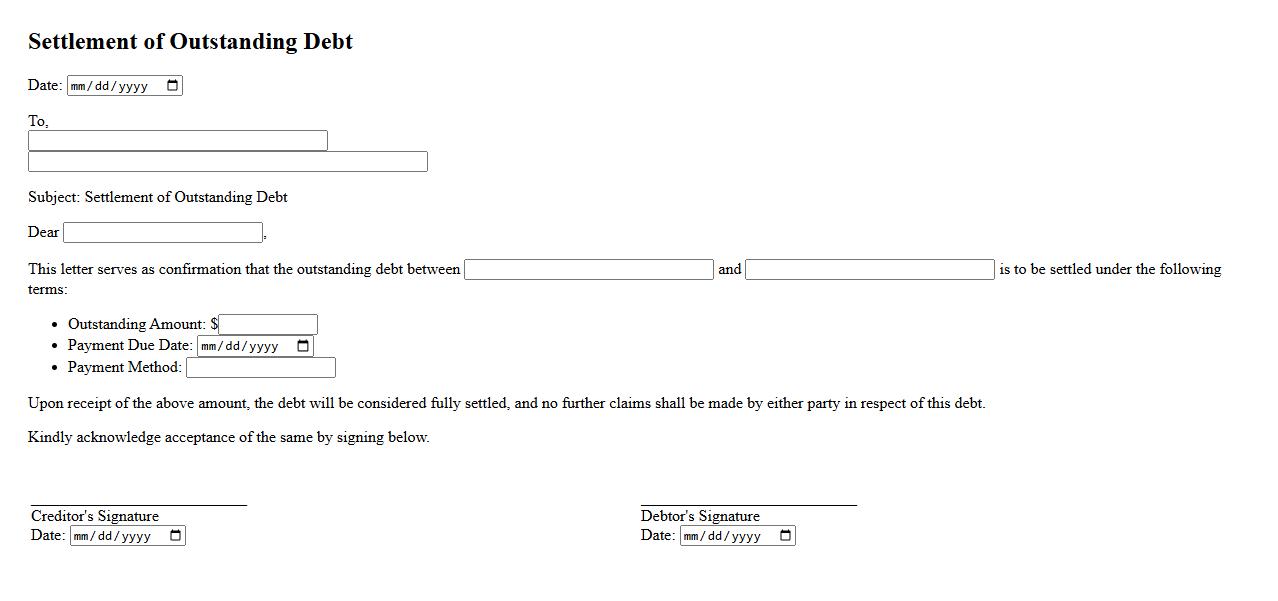

Settlement of Outstanding Debt

The settlement of outstanding debt involves negotiating with creditors to pay a reduced amount as a full resolution of the owed balance. This process can help individuals or businesses avoid bankruptcy and improve financial stability. Successfully settling debts requires clear communication and a structured repayment plan.

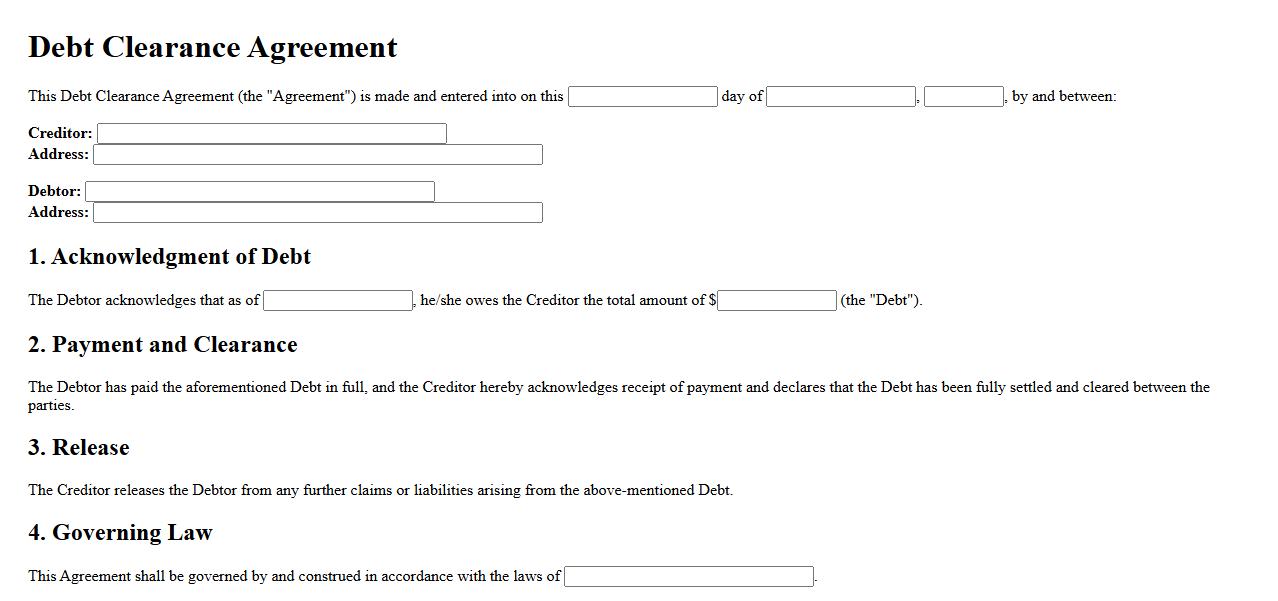

Debt Clearance Agreement

A Debt Clearance Agreement is a legal contract between a debtor and creditor outlining the terms for settling outstanding debts. It specifies repayment schedules, amounts, and any concessions agreed upon to clear the debt. This agreement helps prevent future disputes by clearly defining the obligations of both parties.

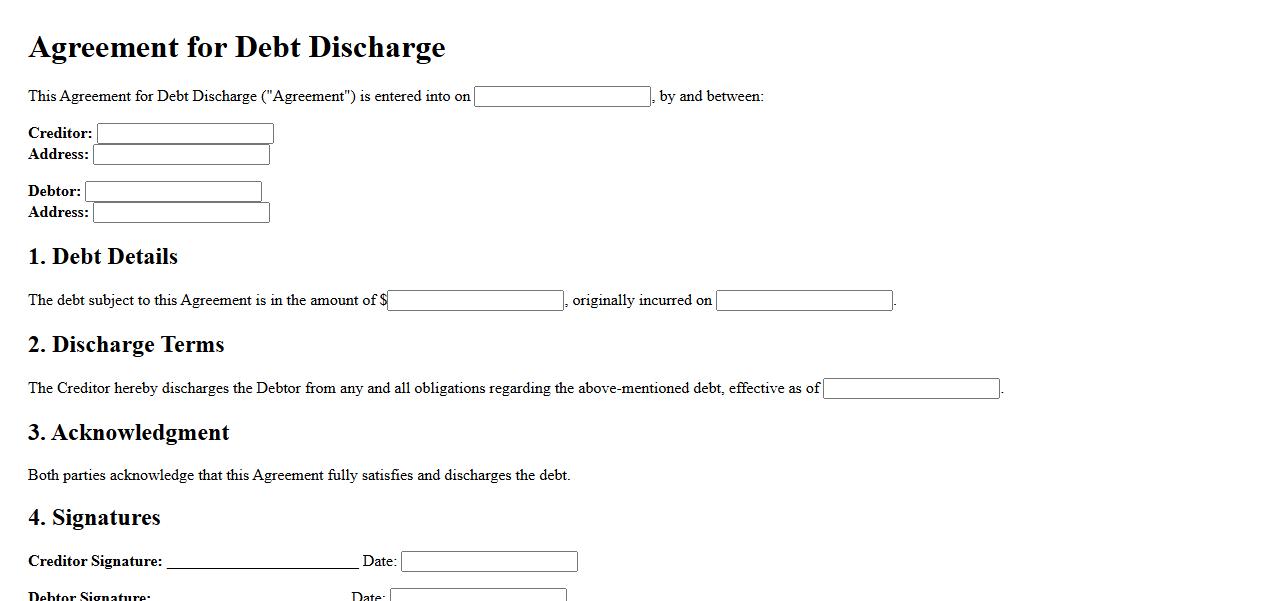

Agreement for Debt Discharge

An Agreement for Debt Discharge is a legal document outlining the terms under which a debtor is released from their financial obligations. This agreement specifies the conditions of debt forgiveness and protects both parties involved. It ensures clear understanding and formal consent to the debt release terms.

Debt Settlement and Release

Debt settlement is a financial strategy where a debtor negotiates with creditors to reduce the total amount owed. This process often results in a legally binding release, freeing the debtor from further obligations once agreed payments are made. It offers an alternative to bankruptcy, helping individuals regain control over their finances.

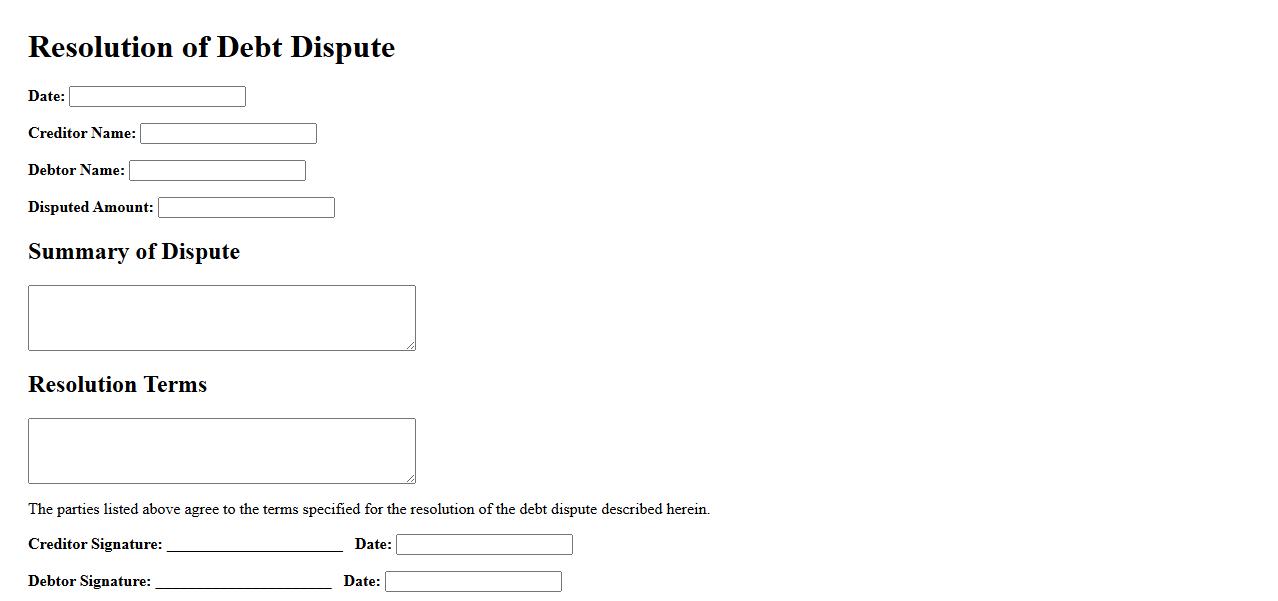

Resolution of Debt Dispute

The resolution of debt dispute involves negotiating terms to settle outstanding financial obligations between parties. It aims to find a mutually agreeable solution that prevents legal action and financial stress. Effective communication and mediation are key to achieving a fair outcome.

Essential Parties Involved in the Agreement to Settle Debt

The essential parties involved in the Agreement to Settle Debt typically include the debtor and the creditor. Both parties must have legal capacity to enter into the agreement to ensure its validity. In some cases, third-party negotiators or attorneys may also be involved to facilitate the settlement process.

Specific Debts or Obligations Covered Under the Agreement

The agreement specifically outlines the debts or obligations that are subject to settlement. It can cover various types of debts like credit card balances, loans, or other financial liabilities. Clear identification of the debts ensures there is no confusion about the obligations being resolved.

Agreed-Upon Settlement Terms Including Payment Amount and Schedule

The settlement terms detail the payment amount that the debtor must pay to satisfy the debt, which is often less than the total owed. Additionally, the agreement specifies the payment schedule, including due dates and installment amounts. These terms are clearly outlined to provide a manageable framework for repayment.

Consequences of Failing to Meet Obligations Under the Agreement

If either party fails to meet their obligations, the agreement typically includes provisions for remedies or penalties. The creditor may have the right to reinstate the original debt or pursue legal action. Failure to comply can also damage the debtor's credit and dissolve the settlement arrangement.

Debt Satisfaction and Release Upon Completion of Settlement Terms

Upon successful completion of the settlement terms, the debt is considered fully satisfied and released. The creditor agrees to forgive any remaining balance, and the debtor is no longer liable for the settled amount. The agreement may also require the creditor to provide a written confirmation of debt satisfaction.