An Agreement to Repay Debt is a formal contract outlining the terms and conditions under which a borrower commits to repay a lender. This document specifies the repayment schedule, interest rates, and any penalties for late payments. Clear Agreement to Repay Debt helps protect both parties by ensuring mutual understanding and legal enforceability.

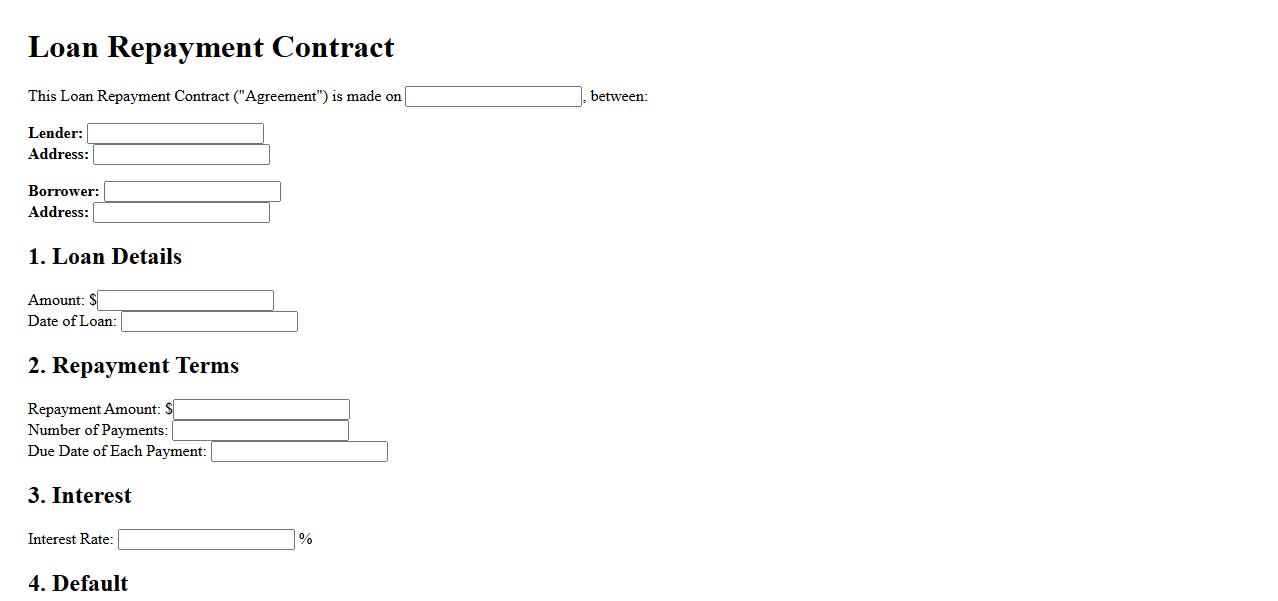

Loan Repayment Contract

A Loan Repayment Contract is a legal agreement outlining the terms under which a borrower agrees to repay a loan to the lender, including the repayment schedule, interest rate, and consequences of default. This document ensures clarity and protects the rights of both parties by defining their obligations. It is essential for formalizing loan arrangements and avoiding disputes.

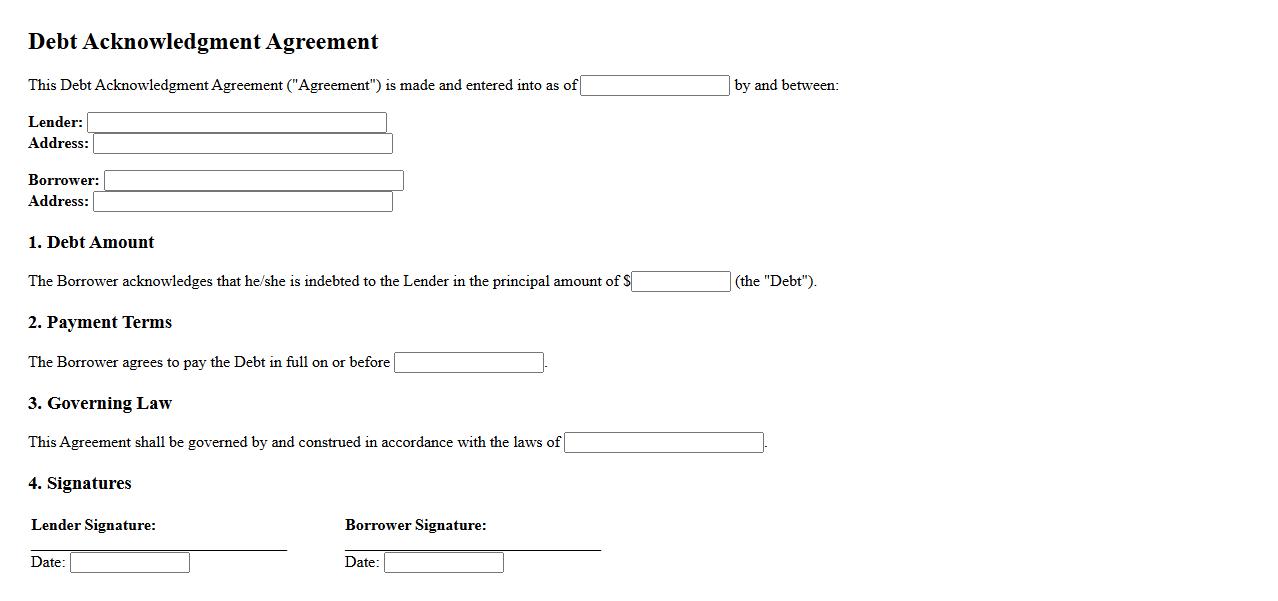

Debt Acknowledgment Agreement

A Debt Acknowledgment Agreement is a formal document where a debtor recognizes the existence of a debt owed to a creditor. This agreement outlines the terms and conditions for repayment, ensuring both parties have a clear understanding. It serves as a legal record to prevent future disputes and protect the rights of both involved.

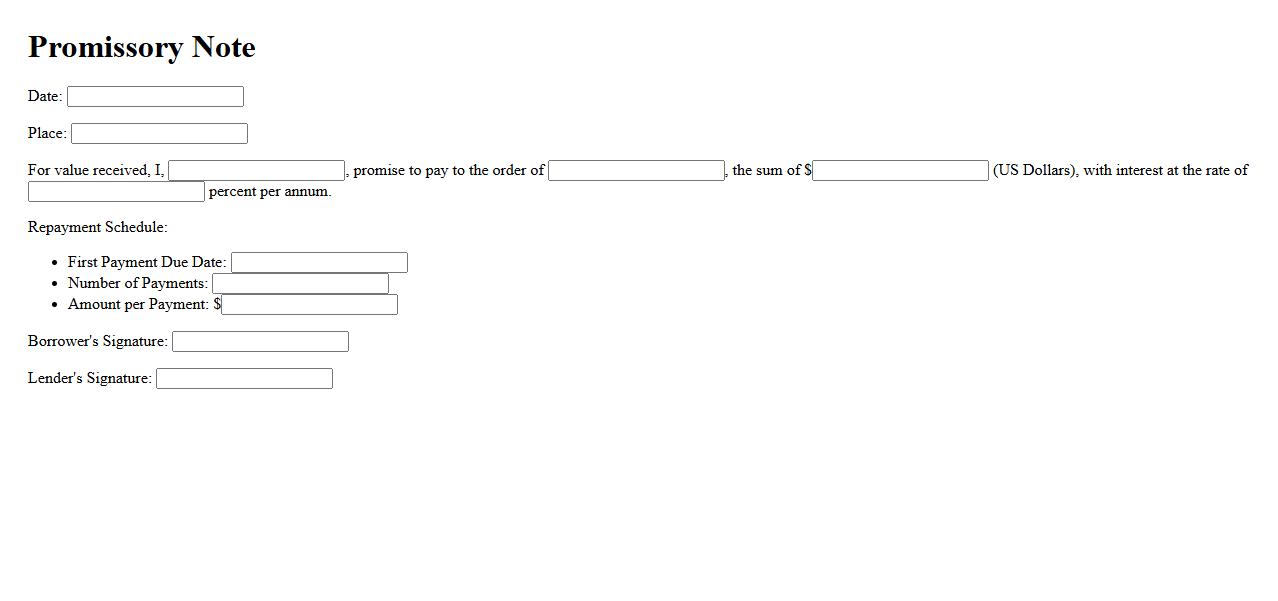

Promissory Note

A Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender. It includes details such as the principal amount, interest rate, repayment schedule, and maturity date. This note serves as a formal evidence of debt and protects the rights of both parties involved in the transaction.

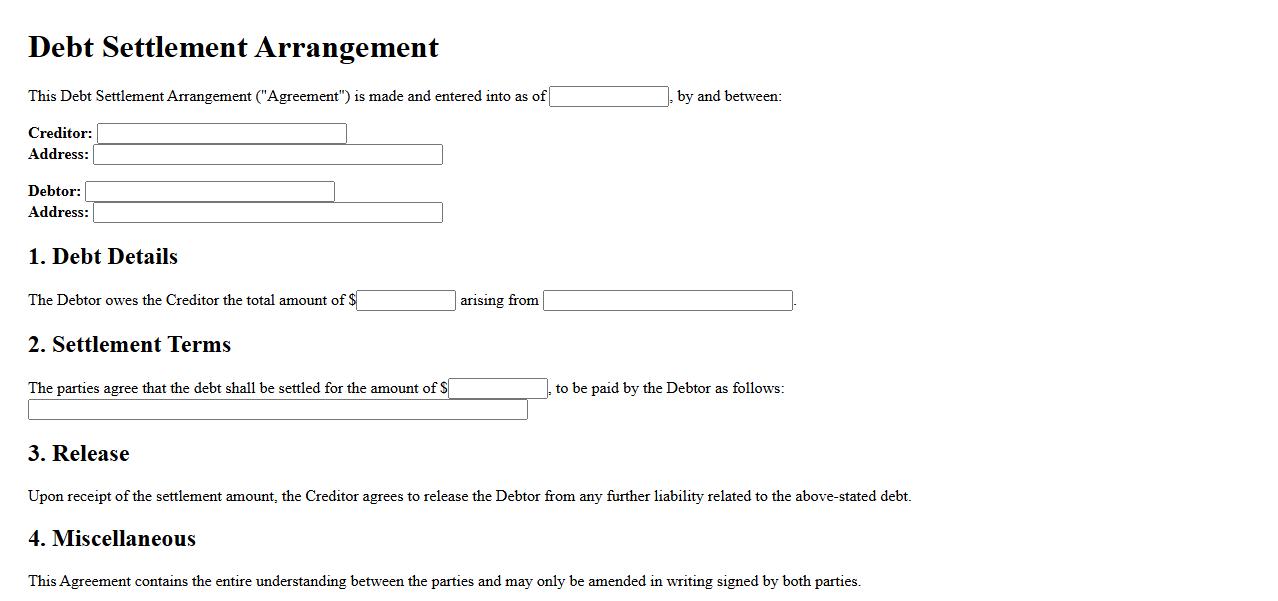

Debt Settlement Arrangement

A Debt Settlement Arrangement is a negotiated agreement where a borrower pays a reduced amount to settle their outstanding debts. It helps individuals avoid bankruptcy and regain financial stability by working directly with creditors. This solution often results in lower total payments and improved credit prospects over time.

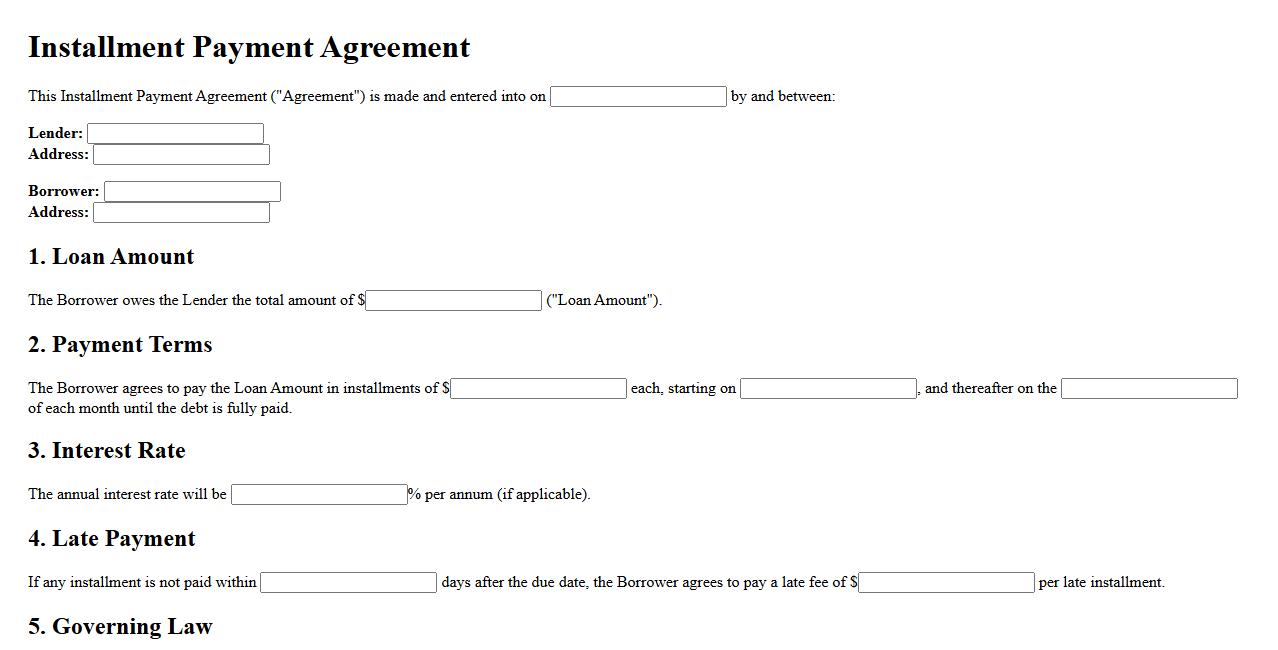

Installment Payment Agreement

An Installment Payment Agreement allows individuals or businesses to pay their debts over time through scheduled payments. This arrangement helps manage financial obligations without causing immediate financial strain. It is commonly used for taxes, loans, and other significant expenses requiring flexibility.

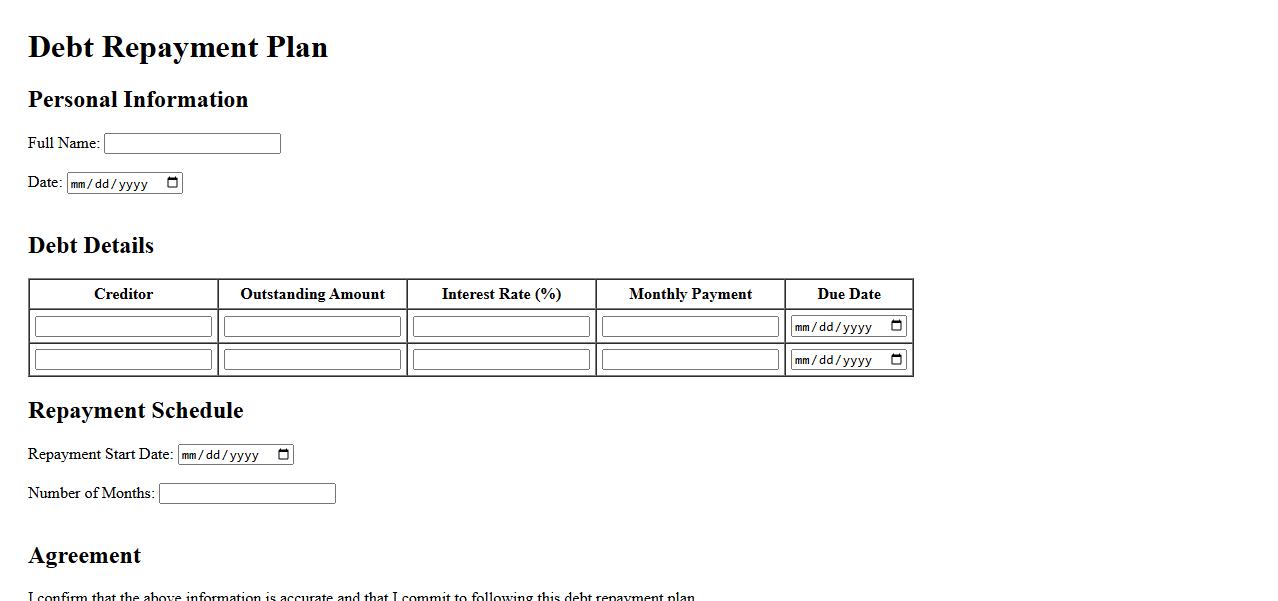

Debt Repayment Plan

A Debt Repayment Plan is a structured approach to paying off outstanding debts systematically. It helps individuals manage their finances by setting clear payment goals and timelines. This plan aims to reduce debt efficiently while avoiding additional interest or penalties.

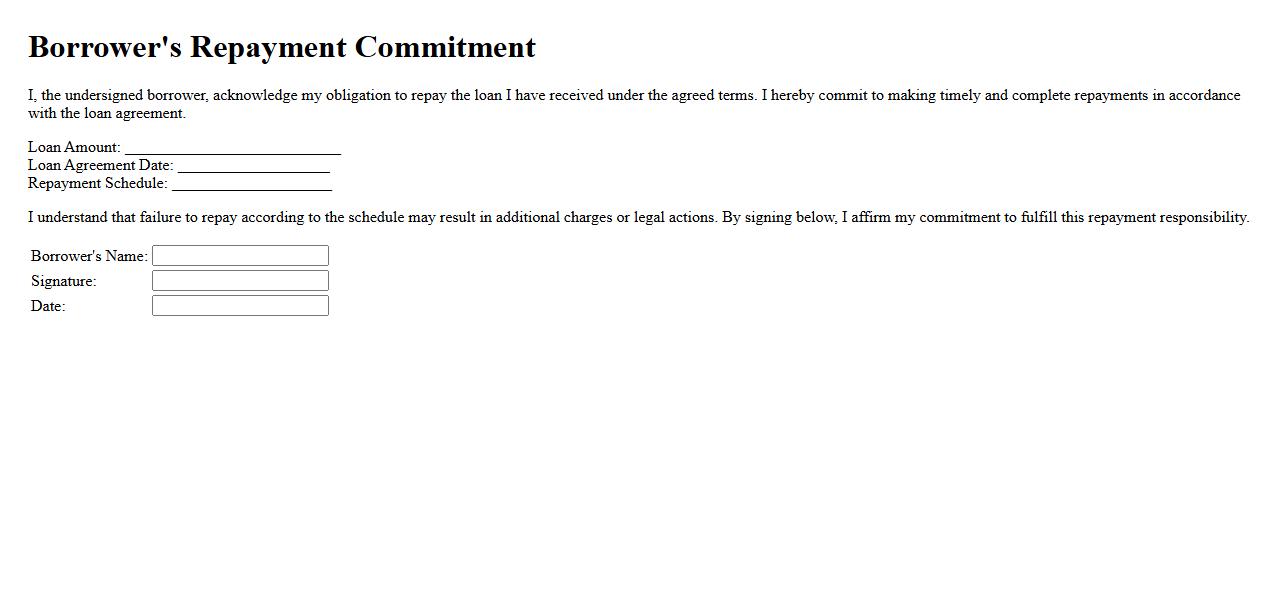

Borrower's Repayment Commitment

The Borrower's Repayment Commitment ensures that the borrower agrees to repay the loan according to the agreed terms. This commitment highlights the borrower's responsibility to make timely payments, maintaining trust with the lender. Adhering to the repayment schedule helps avoid penalties and supports a positive credit history.

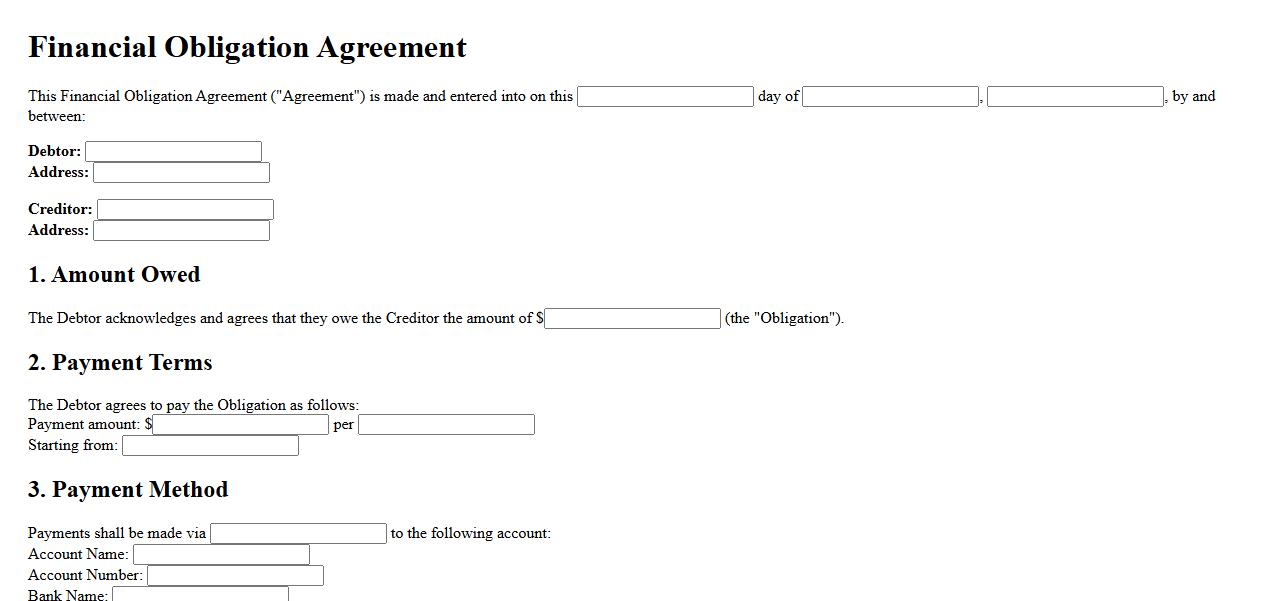

Financial Obligation Agreement

A Financial Obligation Agreement is a legal contract outlining the responsibilities and duties related to monetary commitments between parties. It clearly specifies payment terms, amounts, and deadlines to ensure mutual understanding and avoid disputes. This agreement is essential for maintaining transparency and trust in financial transactions.

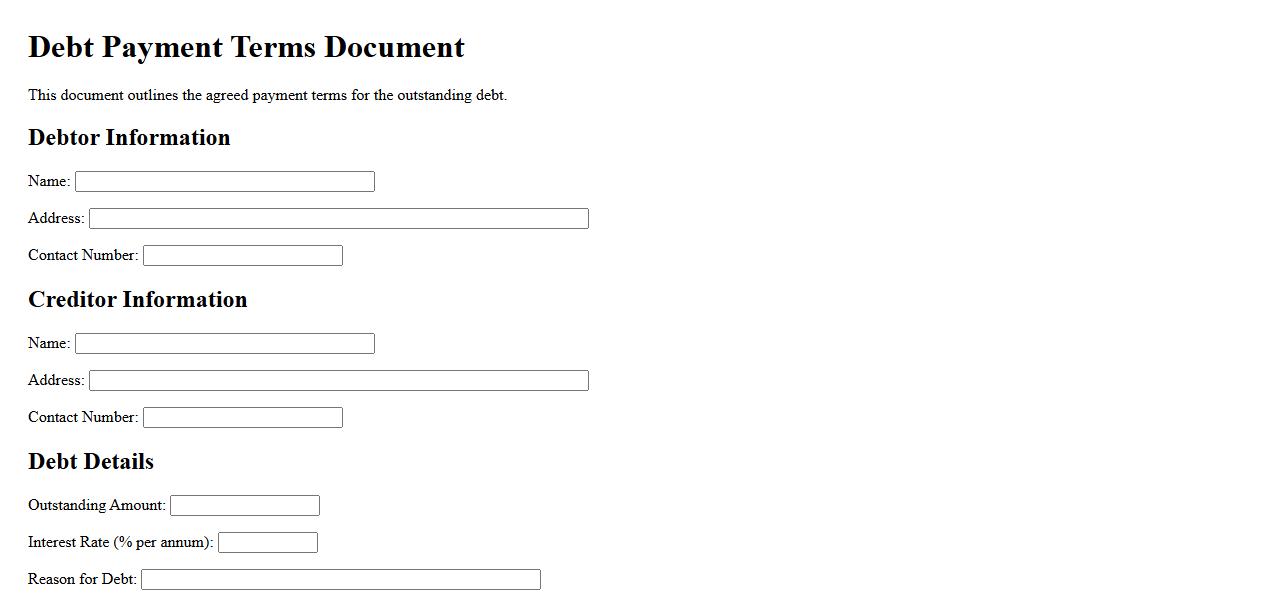

Debt Payment Terms Document

The Debt Payment Terms Document clearly outlines the conditions under which a borrower agrees to repay a debt, including the schedule, amount, and interest rates. This agreement ensures both parties have a mutual understanding, reducing the risk of disputes. It serves as a legally binding reference throughout the repayment period.

Repayment Schedule Agreement

A Repayment Schedule Agreement is a formal document outlining the terms and timeline for repaying a debt. It ensures both parties clearly understand the payment amounts, due dates, and duration of the repayment period. This agreement helps prevent misunderstandings and provides a structured approach to settling financial obligations.

Key Terms and Conditions in the Agreement to Repay Debt

The agreement outlines the obligations of the debtor to repay the specified debt within the agreed timeframe. It includes conditions regarding interest rates, late payment penalties, and the exact repayment methods. These terms ensure clarity and legal enforceability of the repayment obligations.

Parties Involved and Their Roles

The agreement specifies the debtor and creditor as the primary parties involved. The debtor is responsible for repaying the debt under the agreed terms, while the creditor is entitled to receive repayments and enforce the agreement. Each party's duties are clearly detailed to maintain accountability.

Total Amount of Debt Including Interest and Fees

The document states the total debt amount to be repaid, which incorporates the principal sum plus any applicable interest or fees. This ensures the debtor understands the full financial obligation. Transparency in the debt amount discourages disputes regarding owed sums.

Repayment Schedule and Methods

The repayment schedule specifies the timing and frequency of payments, such as weekly, monthly, or lump-sum installments. It also defines acceptable payment methods like bank transfers, checks, or cash payments. This structured approach facilitates timely and organized repayments.

Consequences of Default or Missed Payments

The agreement details the penalties and actions triggered by missed or late payments, including additional fees or legal consequences. It may also outline acceleration clauses requiring immediate full payment upon default. These provisions serve to protect the creditor's interests and encourage compliance.