Waiver of Overpayment Recovery allows beneficiaries to request forgiveness of the repayment of funds mistakenly paid by an agency, typically due to no fault of their own. This process requires demonstrating that recovering the overpaid amount would cause financial hardship or is against equity and good conscience. Approval of a waiver cancels the debt, relieving the individual from repayment obligations.

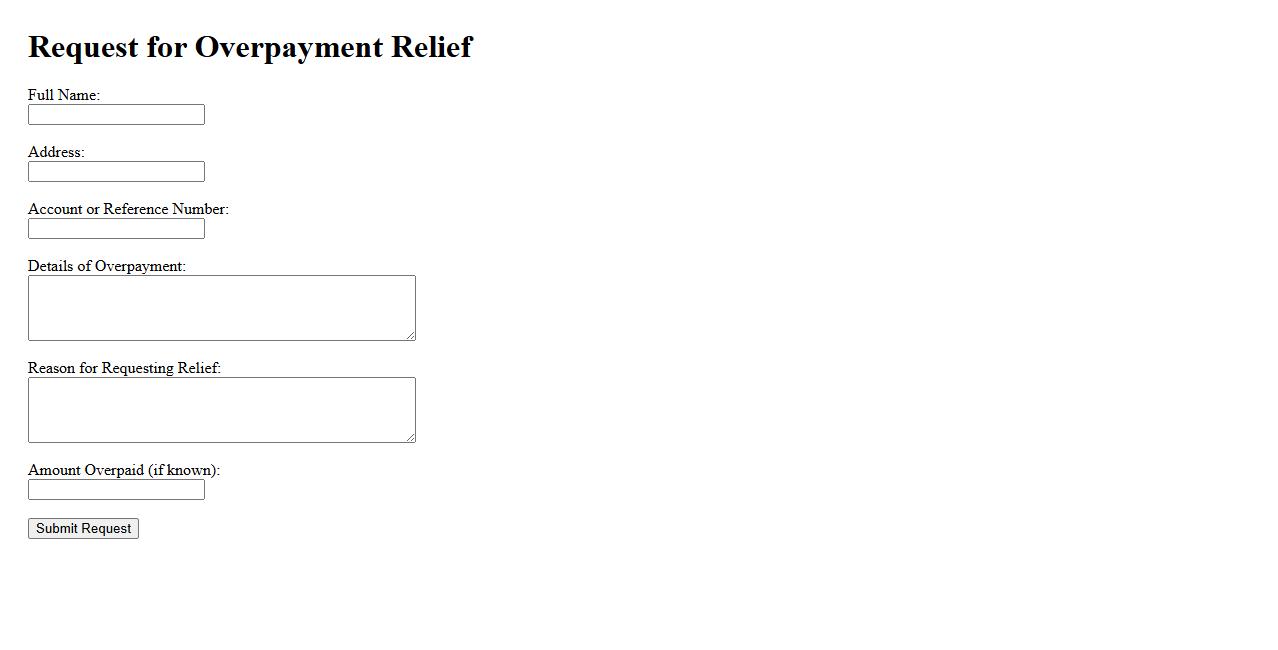

Request for Overpayment Relief

If you believe you have been charged incorrectly, you can submit a Request for Overpayment Relief. This process allows you to seek a refund or adjustment for any excess payments made. Ensure your request includes all necessary documentation to support your claim.

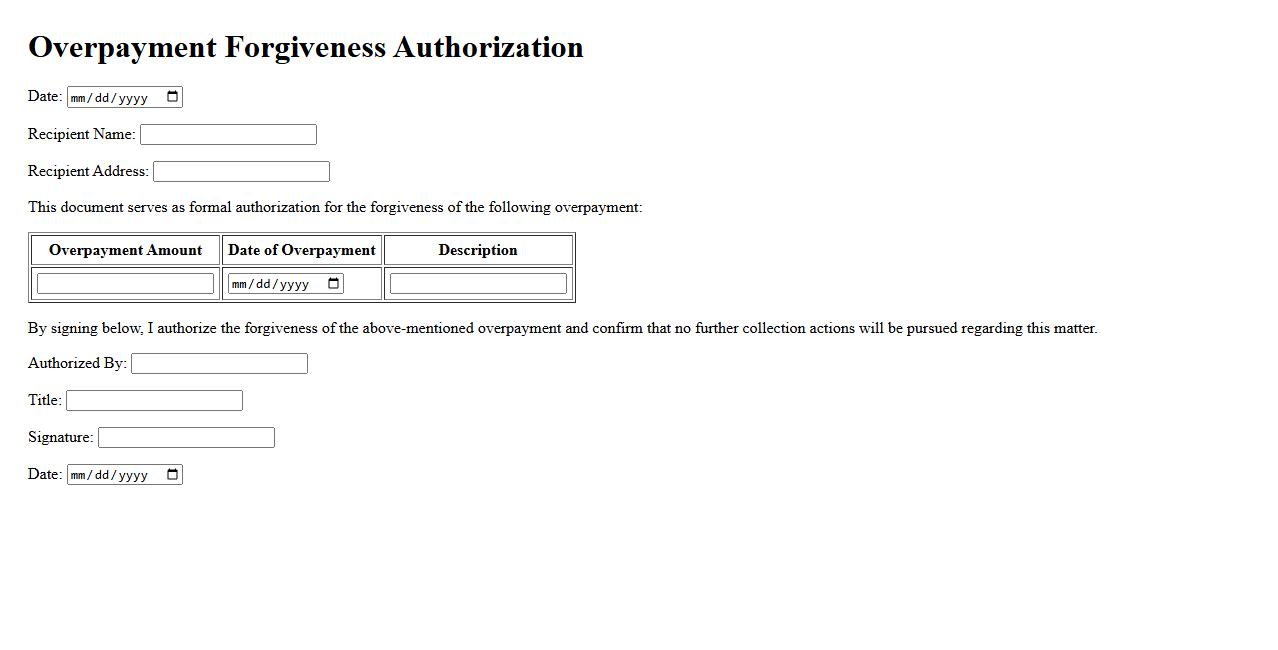

Overpayment Forgiveness Authorization

The Overpayment Forgiveness Authorization allows individuals to request the cancellation of excess payments made. This authorization ensures that any funds paid beyond the required amount are identified and forgiven efficiently. It protects consumers from unnecessary financial burdens due to overpayment errors.

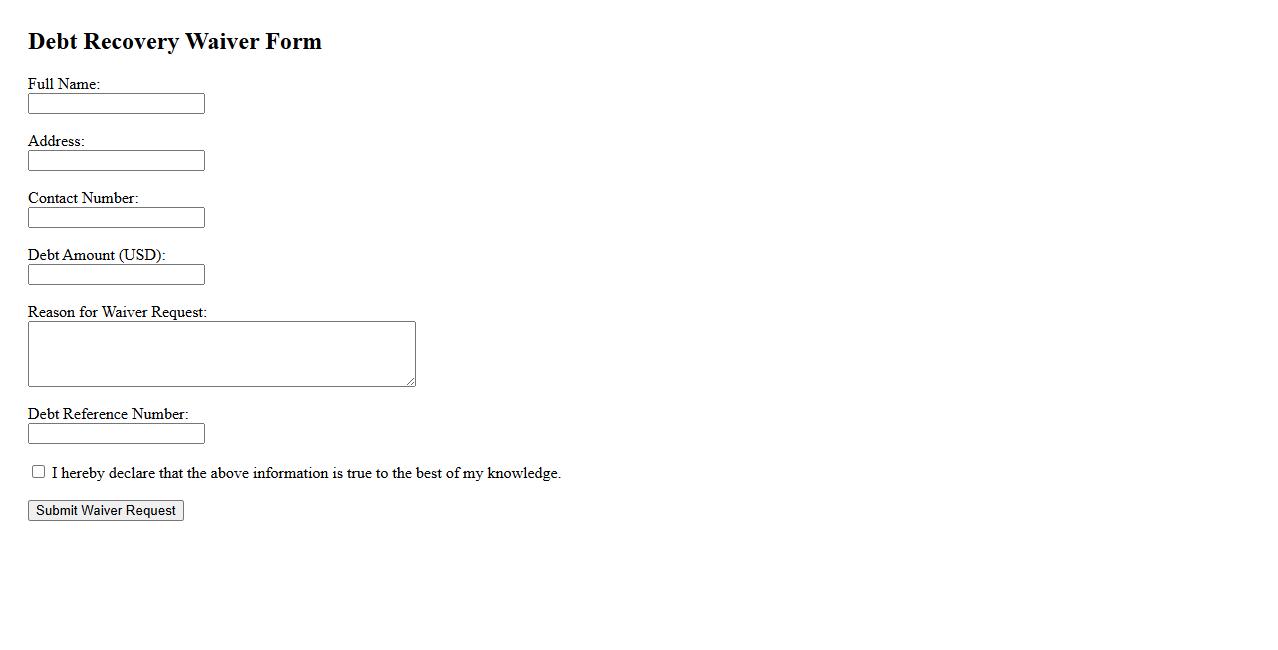

Debt Recovery Waiver Form

The Debt Recovery Waiver Form is a legal document used to relinquish the right to recover owed debts. It serves as a formal agreement between the debtor and creditor, ensuring clarity and mutual consent. This form helps prevent future disputes regarding outstanding debts.

Notice of Reimbursement Waiver

The Notice of Reimbursement Waiver informs individuals or entities that they voluntarily forgo their right to claim repayment for certain expenses. This document is crucial in legal and financial processes to avoid future disputes. It ensures transparency and clarity between parties involved in monetary transactions.

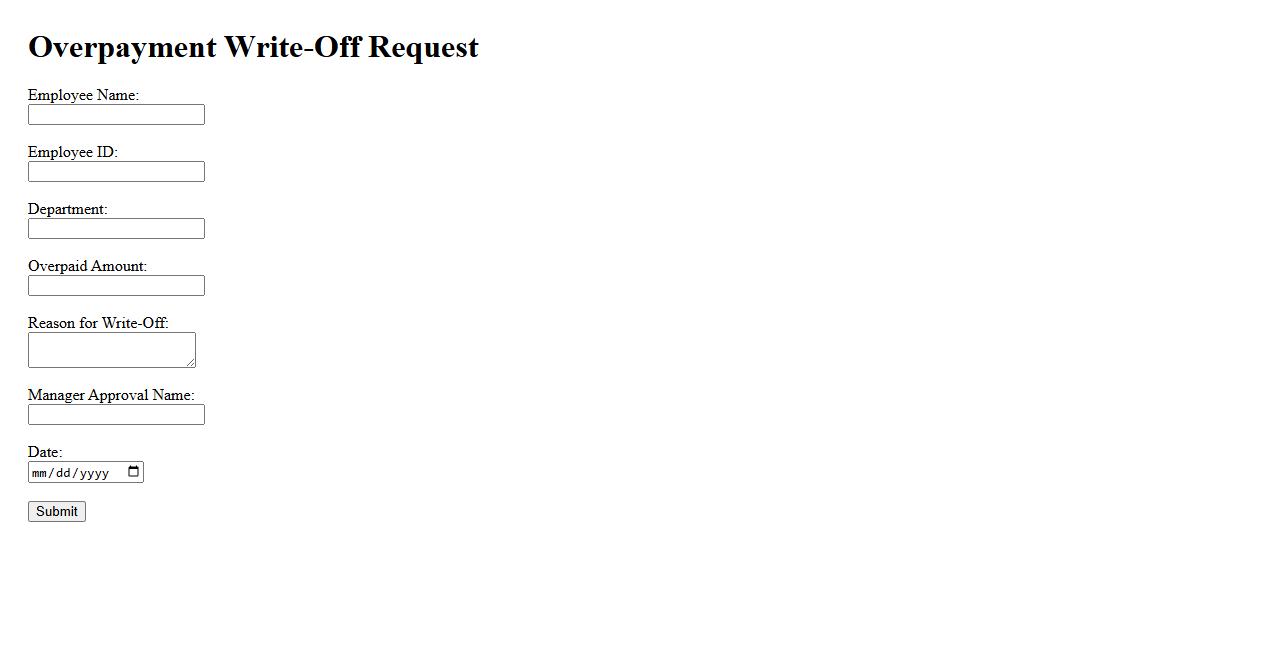

Overpayment Write-Off Request

An Overpayment Write-Off Request is a formal appeal submitted to adjust or remove excess payments made beyond the owed amount. This process ensures accurate financial records and prevents unnecessary account credits. Timely submission of such requests helps maintain transparent and fair billing practices.

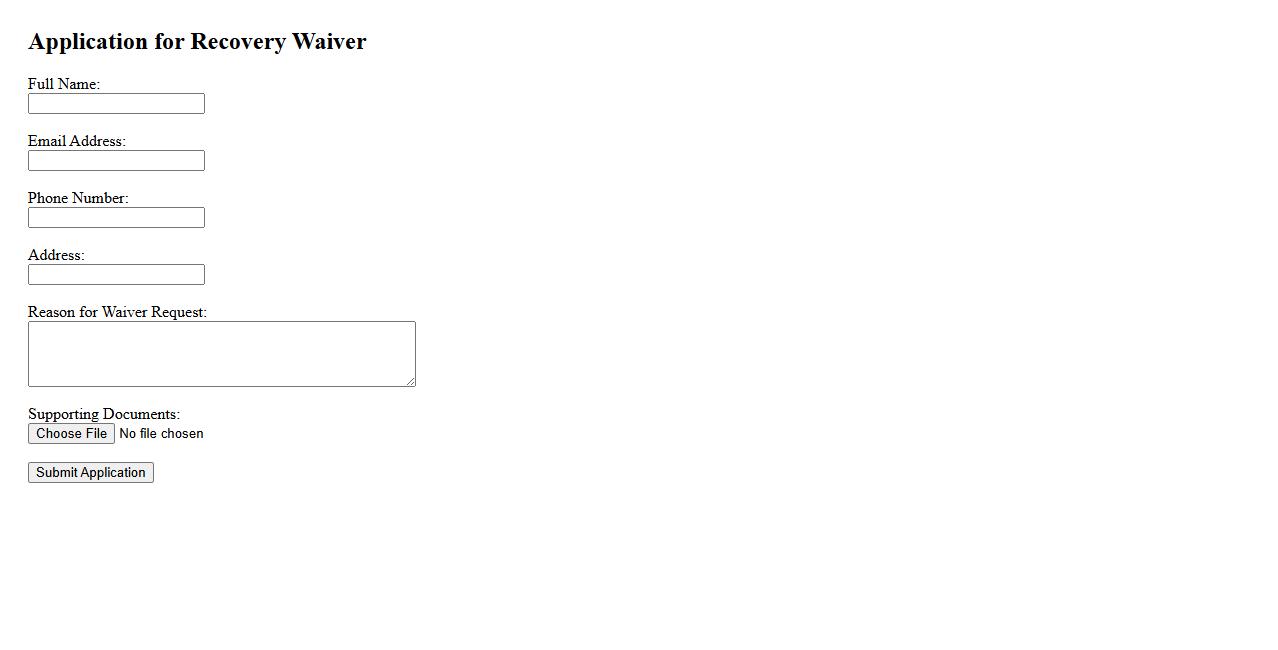

Application for Recovery Waiver

The Application for Recovery Waiver allows individuals to request exemption from certain recovery fees due to financial hardship or other qualifying circumstances. This application ensures fair treatment by evaluating each case on its merits. Timely submission is essential to benefit from potential fee waivers.

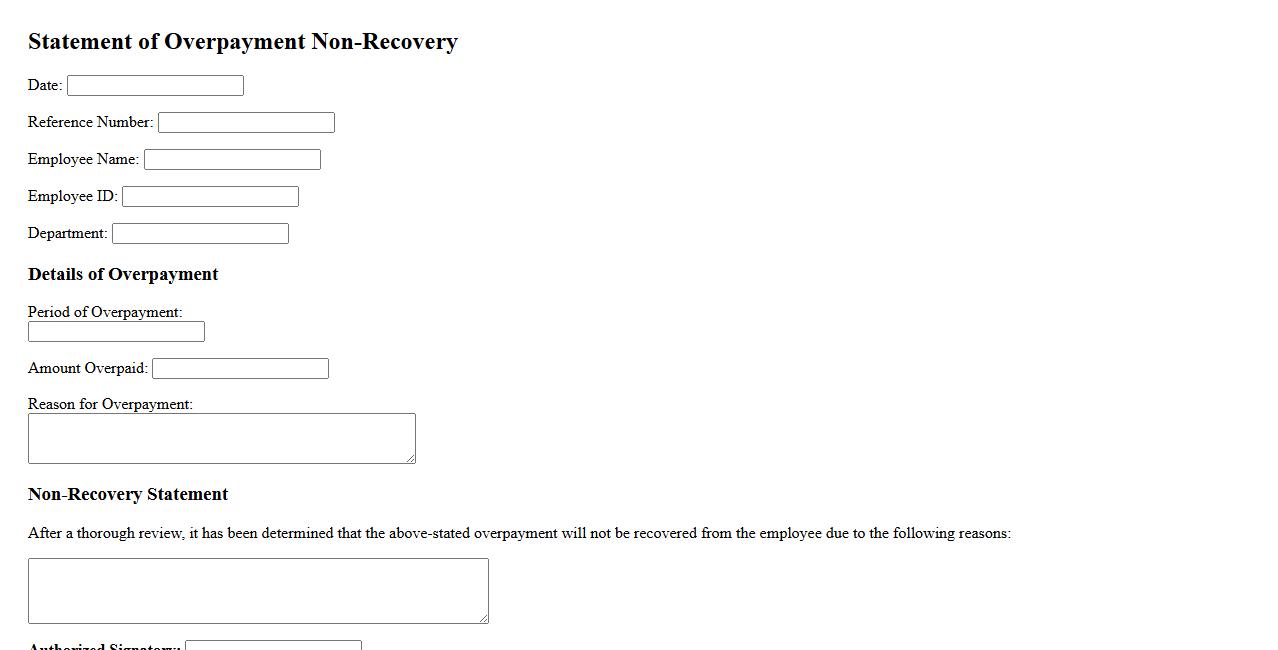

Statement of Overpayment Non-Recovery

A Statement of Overpayment Non-Recovery is a formal document issued when an individual or entity is not required to repay an overpaid amount. This statement verifies that the overpayment will not be recovered due to specific circumstances such as administrative errors or legal exemptions. It ensures clarity and transparency in financial or benefit transactions.

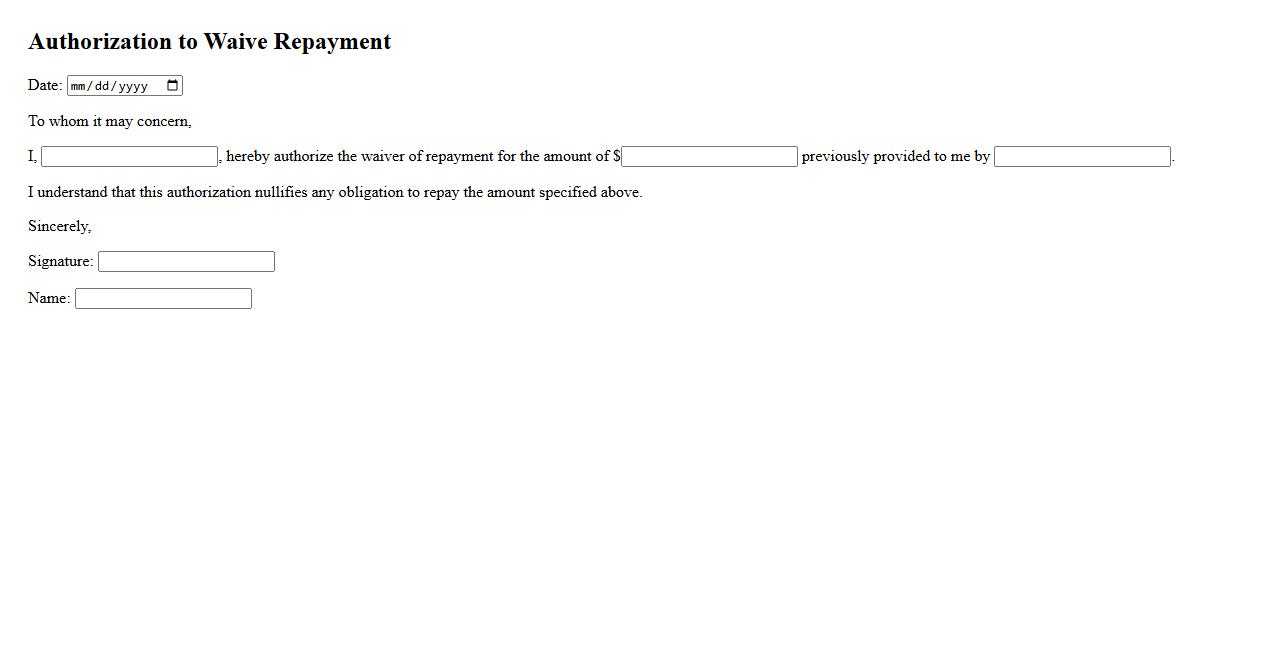

Authorization to Waive Repayment

Authorization to Waive Repayment refers to the formal approval granted by an authorized entity to forgive the obligation of repaying a debt or loan. This process typically involves reviewing the circumstances and determining that repayment is not feasible or equitable. It ensures clear documentation and legal acknowledgment of the waived repayment terms.

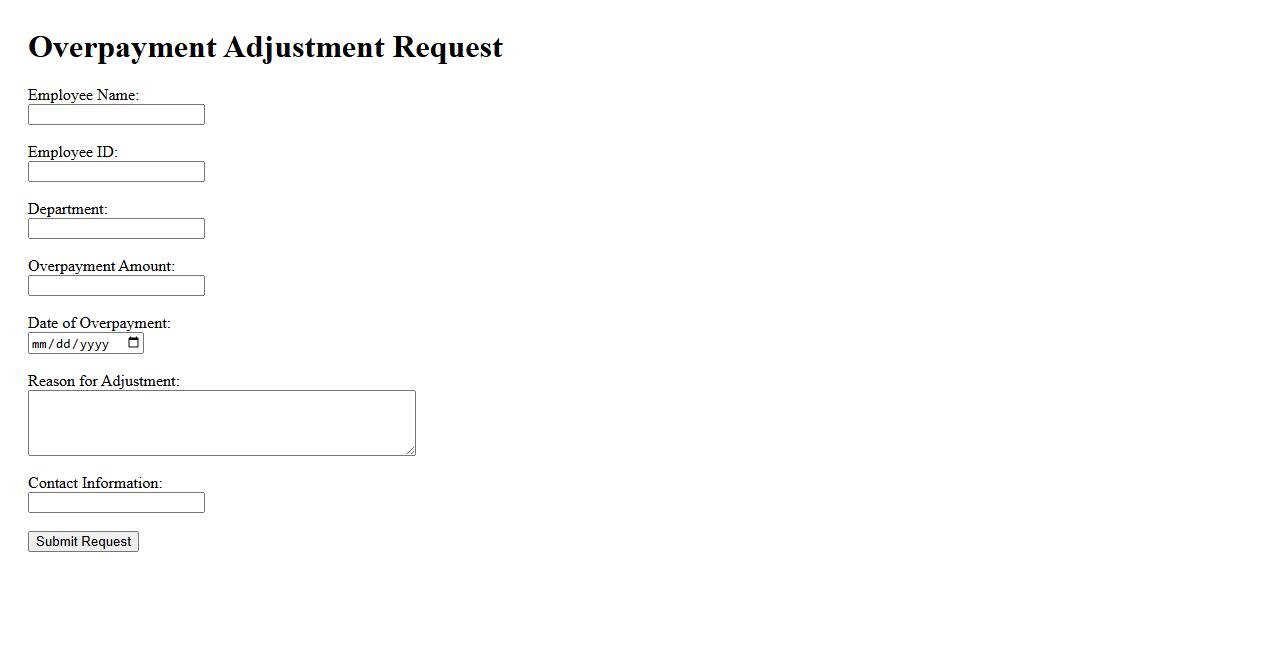

Overpayment Adjustment Request

An Overpayment Adjustment Request is a formal process used to correct billing errors where payments exceed the amount due. This request helps ensure accurate account balances and proper financial records. Timely submission is important for resolving discrepancies efficiently.

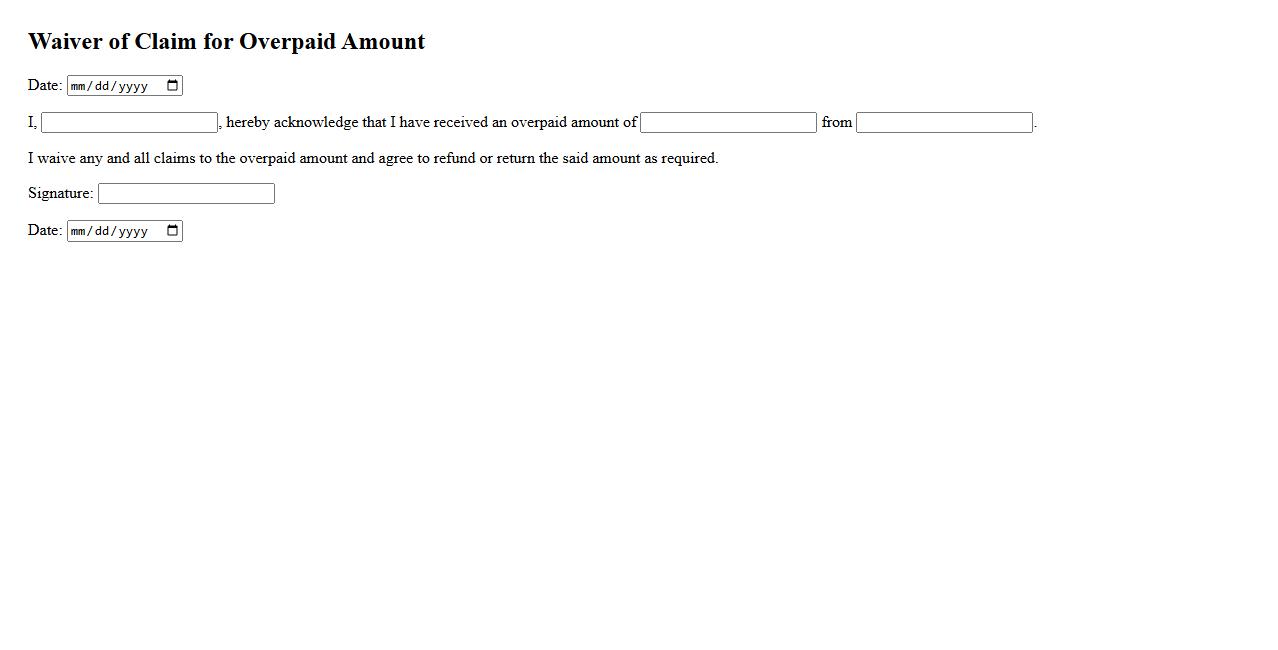

Waiver of Claim for Overpaid Amount

The Waiver of Claim for Overpaid Amount is a legal document used to relinquish the right to recover funds that were paid in excess. It ensures that the payer acknowledges the overpayment but agrees not to seek reimbursement. This waiver protects both parties from future disputes related to the excess payment.

What are the eligibility criteria for requesting a waiver of overpayment recovery?

The eligibility criteria for requesting a waiver include proof that recovery would cause financial hardship or be unjust. The claimant must show they were not at fault in causing the overpayment. Additionally, the request must be submitted within the agency's specified timeframe.

How does the agency determine if recovery of the overpayment would be against equity and good conscience?

The agency evaluates whether reclaiming the overpayment would be unfair or inequitable under the circumstances. They consider factors such as the claimant's financial situation and reliance on the funds. The determination rests on whether recovery would violate principles of equity and good conscience.

What documentation must be submitted with a waiver of overpayment recovery request?

Claimants must provide evidence demonstrating financial hardship or lack of fault in the overpayment. Supporting documents typically include income statements, bank statements, and explanations of circumstances. Proper documentation is essential to support the waiver request.

What are the potential consequences if a waiver of overpayment recovery is denied?

If a waiver is denied, the claimant may be required to repay the full amount of the overpayment. Failure to repay could result in wage garnishments or offset of future benefits. Additionally, there may be an impact on the claimant's financial stability.

How does the decision-making process for a waiver of overpayment recovery work, and can it be appealed?

The agency reviews the waiver request and supporting documentation carefully before making a determination. If the waiver is denied, the claimant generally has the right to appeal the decision. The appeal process allows for reconsideration based on additional evidence or arguments.