A Waiver for Joint Filing Requirement allows married taxpayers to file separate tax returns without being subject to the usual joint filing rules. This waiver is typically granted under specific circumstances where filing jointly would cause undue hardship or inaccurate tax liability. It ensures fair tax treatment while maintaining compliance with IRS regulations.

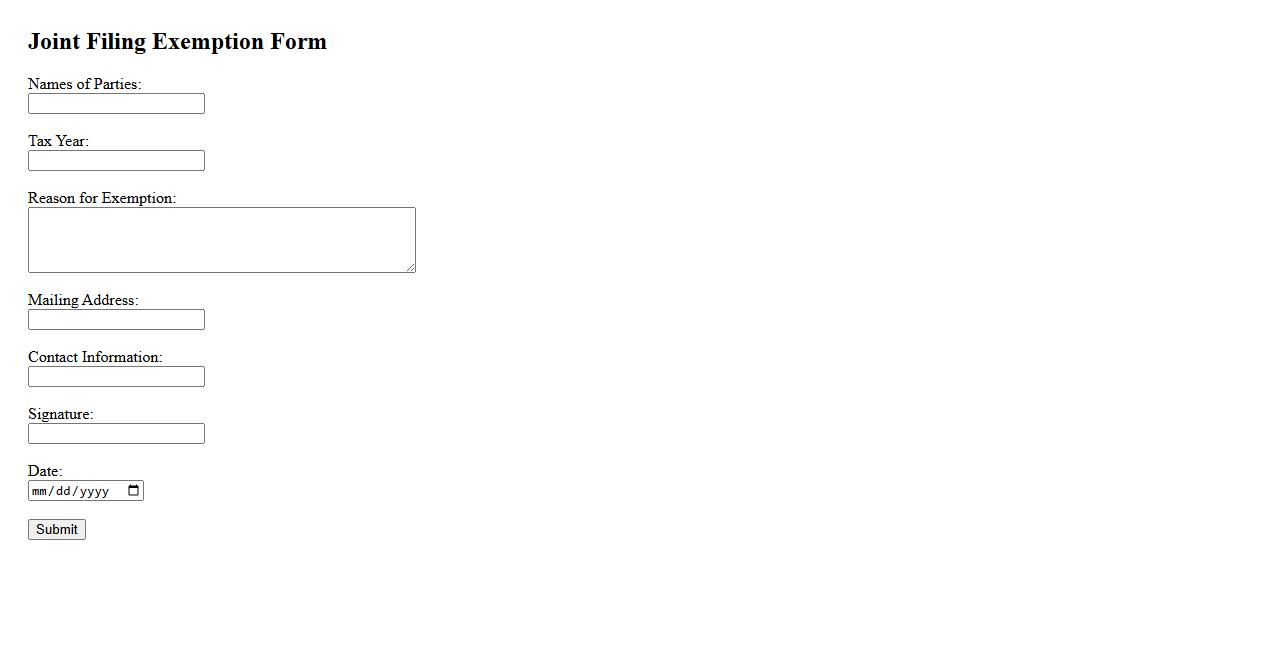

Joint Filing Exemption Form

The Joint Filing Exemption Form allows spouses to apply for tax exemption benefits when filing jointly. This form simplifies the tax process by ensuring accurate reporting and eligibility verification. Submitting this form can lead to potential tax savings and compliance with tax laws.

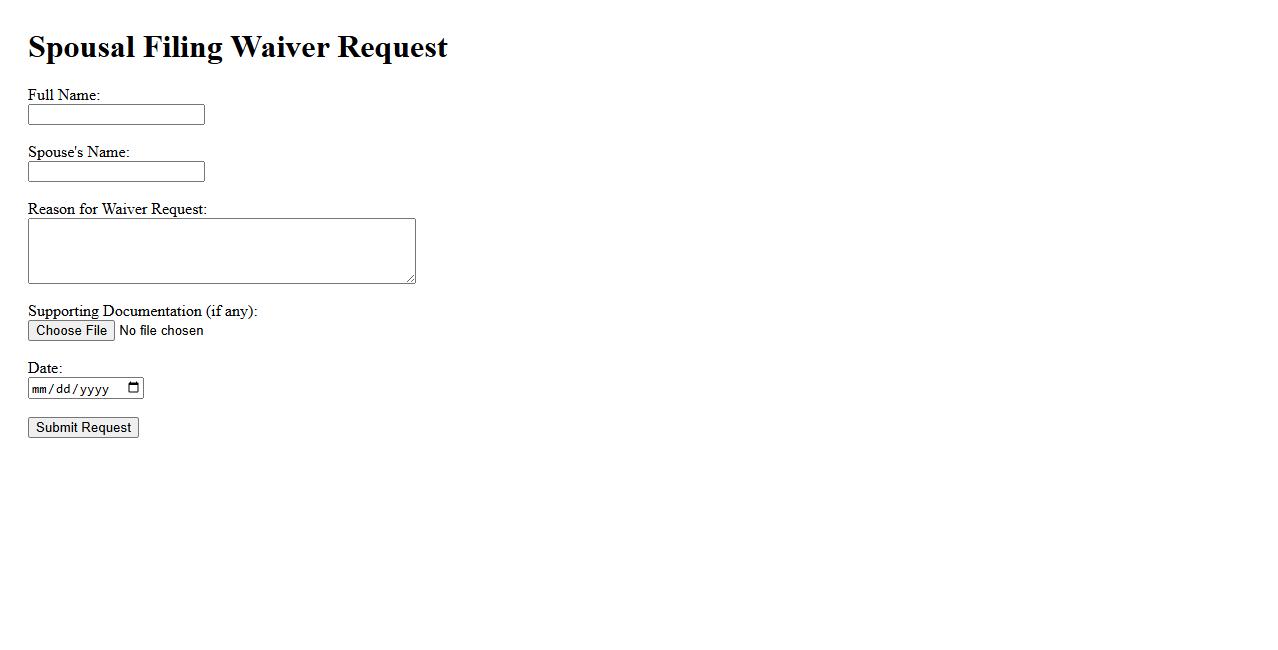

Spousal Filing Waiver Request

A Spousal Filing Waiver Request allows one spouse to waive their right to receive a portion of the other spouse's benefit or income. This request is typically used in situations where couples seek to waive joint filing requirements for tax or benefit purposes. Proper submission of the waiver ensures compliance with legal and financial regulations.

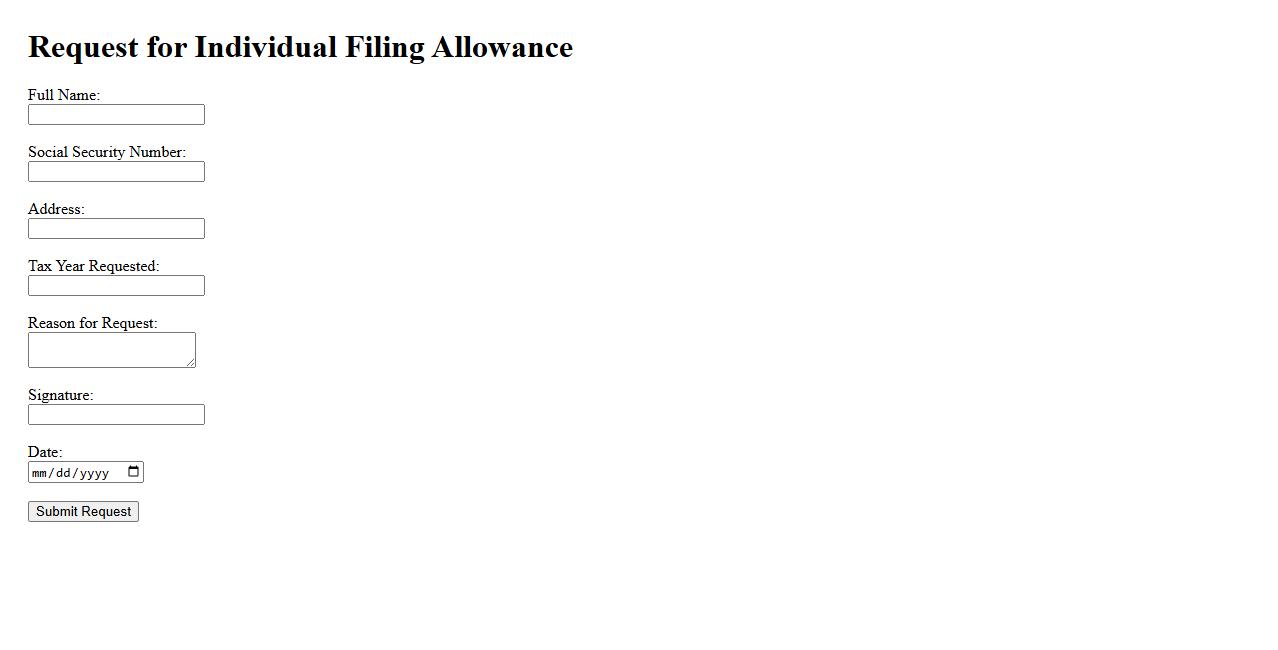

Request for Individual Filing Allowance

A Request for Individual Filing Allowance allows taxpayers to claim exemptions based on their specific personal and financial circumstances. This request is essential for accurate tax withholding and compliance with tax regulations. Submitting the request ensures that the appropriate amount is withheld from your income each pay period.

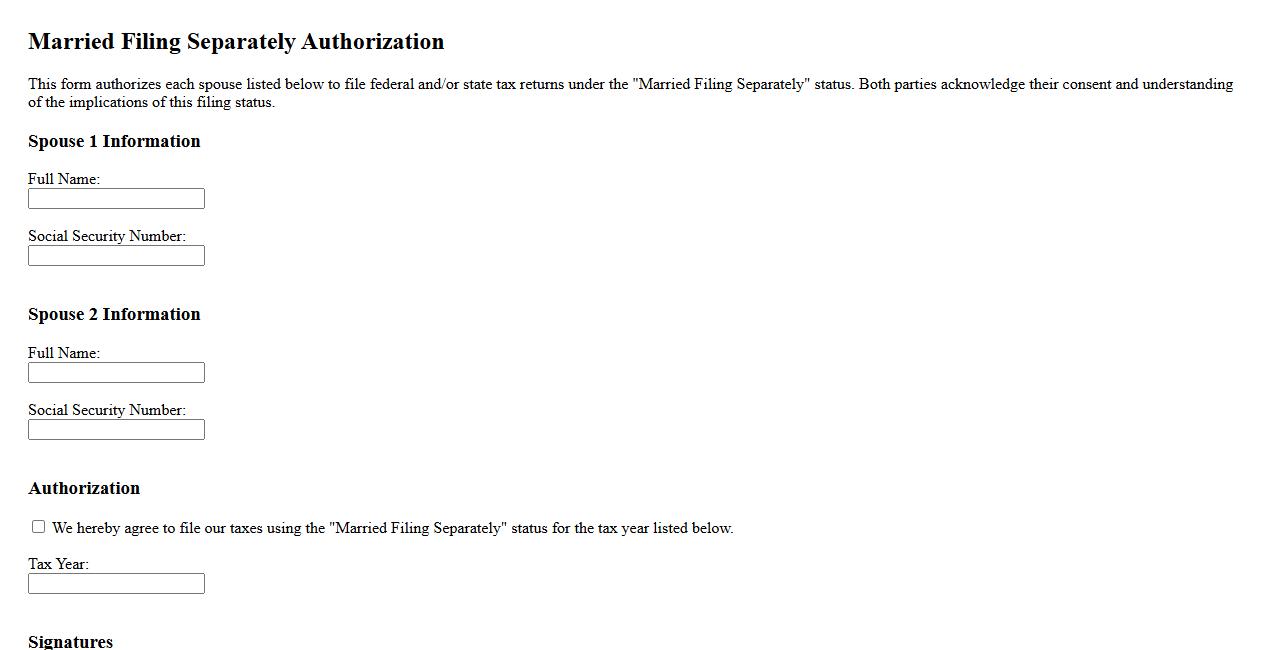

Married Filing Separately Authorization

The Married Filing Separately Authorization allows spouses to file their tax returns individually, rather than jointly. This option can provide specific tax benefits or simplify financial management in certain situations. It is essential to understand the implications and eligibility criteria before choosing this filing status.

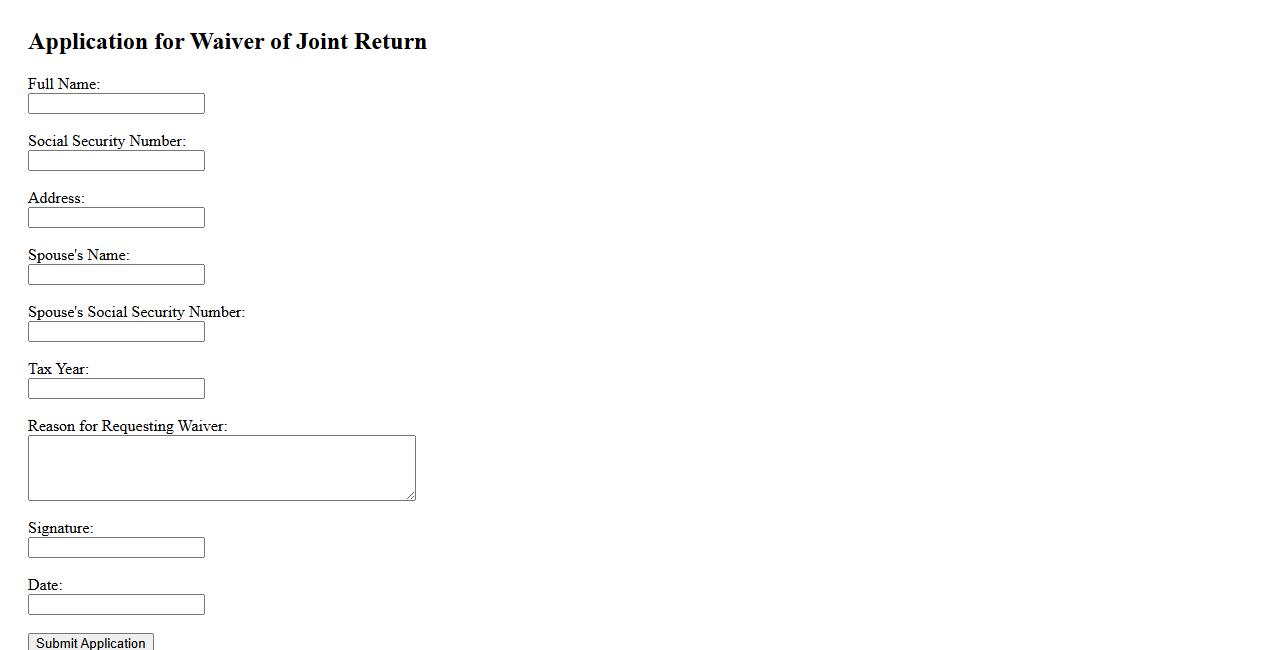

Application for Waiver of Joint Return

The Application for Waiver of Joint Return allows taxpayers to request relief from filing a joint tax return with their spouse. This waiver is typically filed when one spouse is unaware of the tax liability or income reported by the other. It helps protect the requesting spouse from being held responsible for the full tax debt.

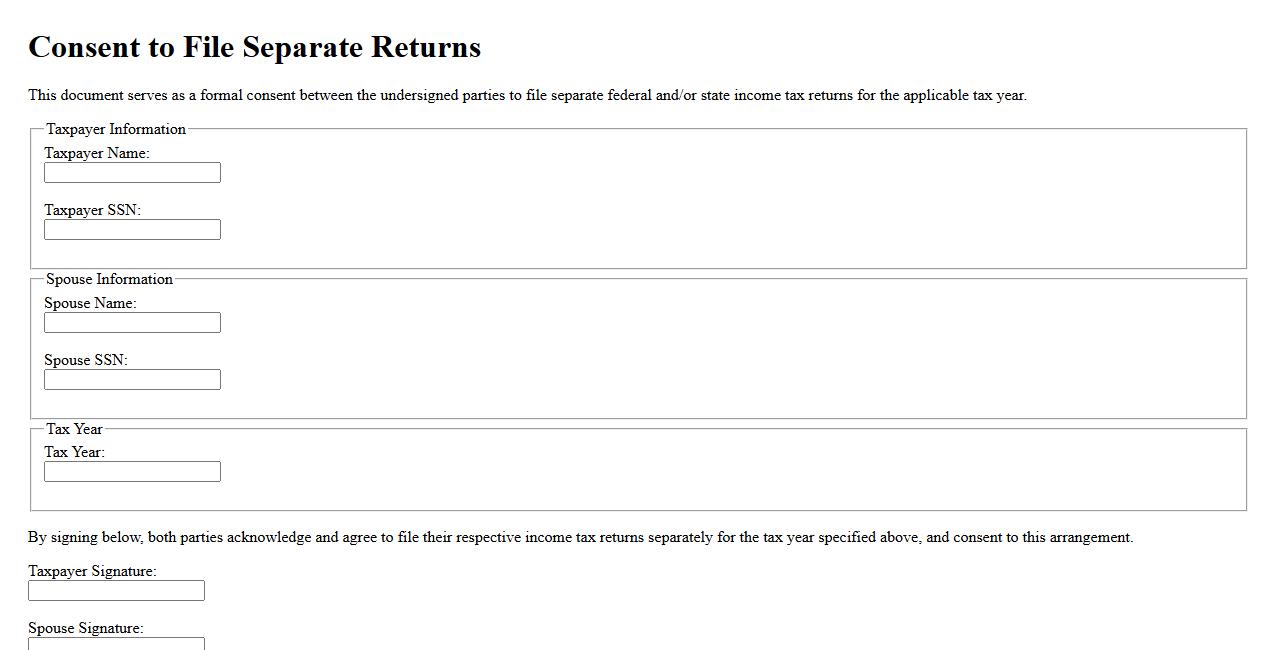

Consent to File Separate Returns

Consent to File Separate Returns refers to the agreement between spouses allowing them to submit individual tax returns instead of a joint one. This consent is crucial for certain tax situations where separate filings might offer benefits or meet legal requirements. Proper documentation ensures compliance with tax regulations and avoids potential issues with tax authorities.

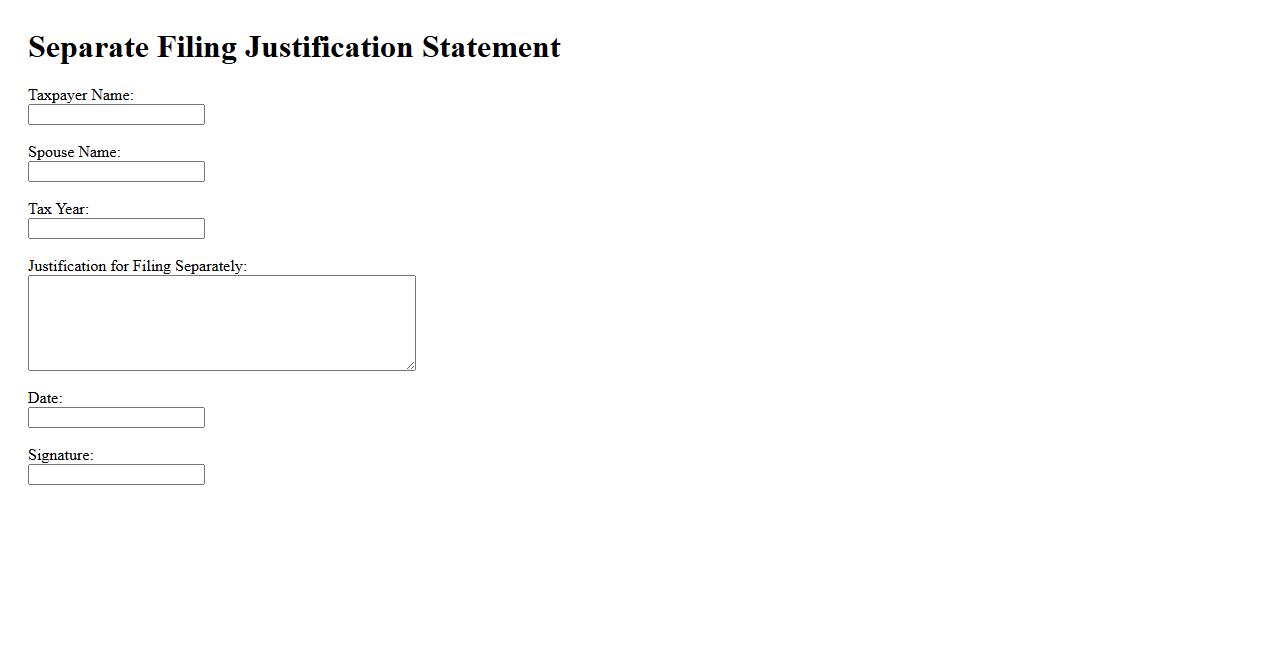

Separate Filing Justification Statement

The Separate Filing Justification Statement is a formal document used to explain why certain patent applications are filed separately rather than combined. It ensures compliance with patent office requirements by providing a clear rationale for the division. This statement helps prevent application rejections due to lack of unity or improper filing practices.

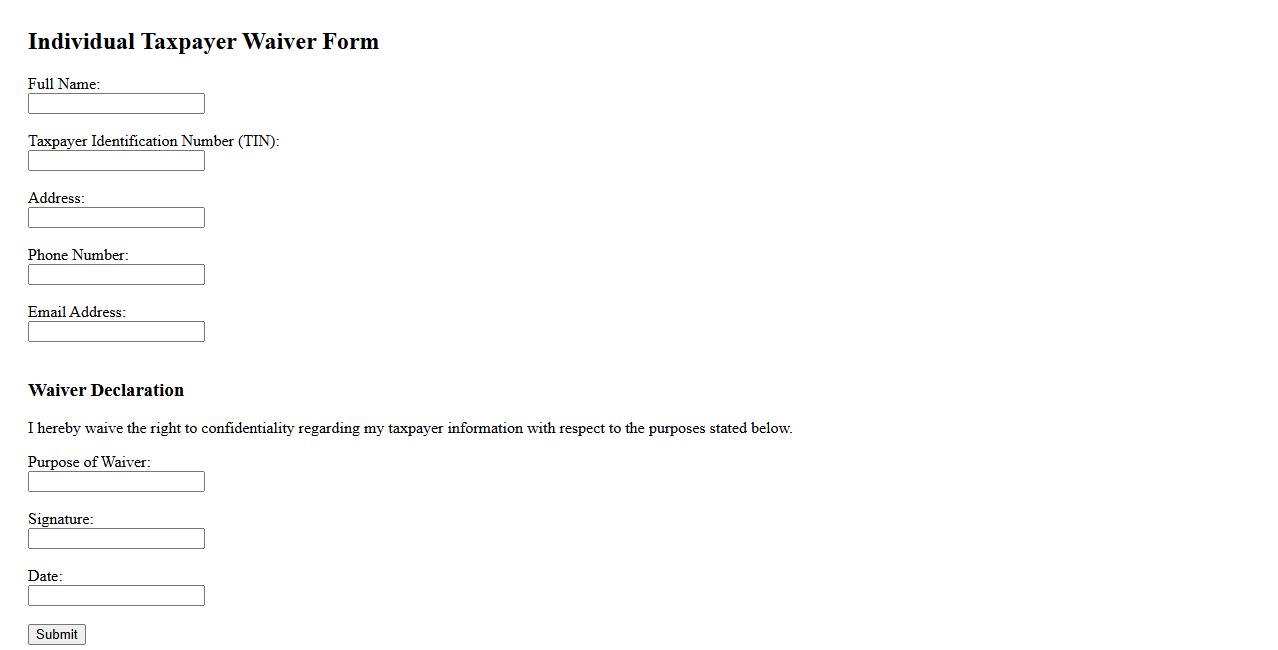

Individual Taxpayer Waiver Form

The Individual Taxpayer Waiver Form is a crucial document used to grant exemptions or waive specific tax obligations. It allows taxpayers to officially request relief from certain tax requirements under qualifying conditions. This form ensures proper documentation and compliance with tax authorities, streamlining the waiver process.

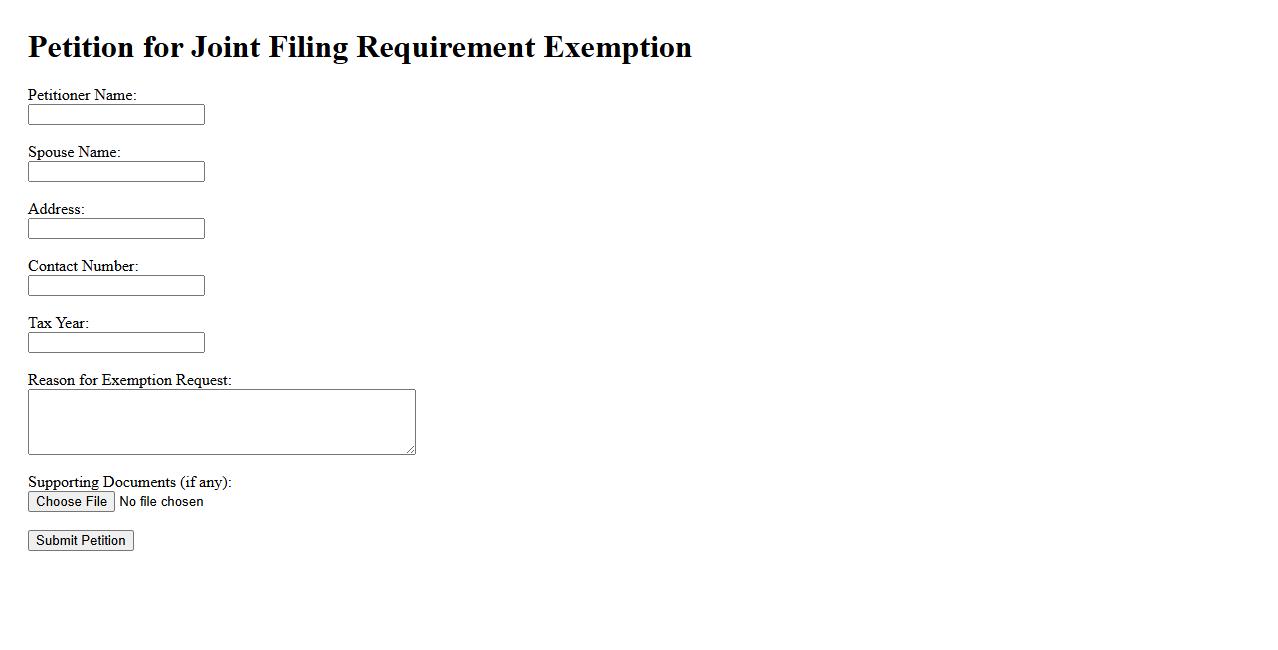

Petition for Joint Filing Requirement Exemption

The Petition for Joint Filing Requirement Exemption is a formal request submitted to waive the mandatory joint filing condition in specific legal or administrative processes. This petition highlights the circumstances under which individuals or entities seek exemption from the joint filing rule. It is essential for ensuring that unique situations are appropriately considered while maintaining compliance with relevant regulations.

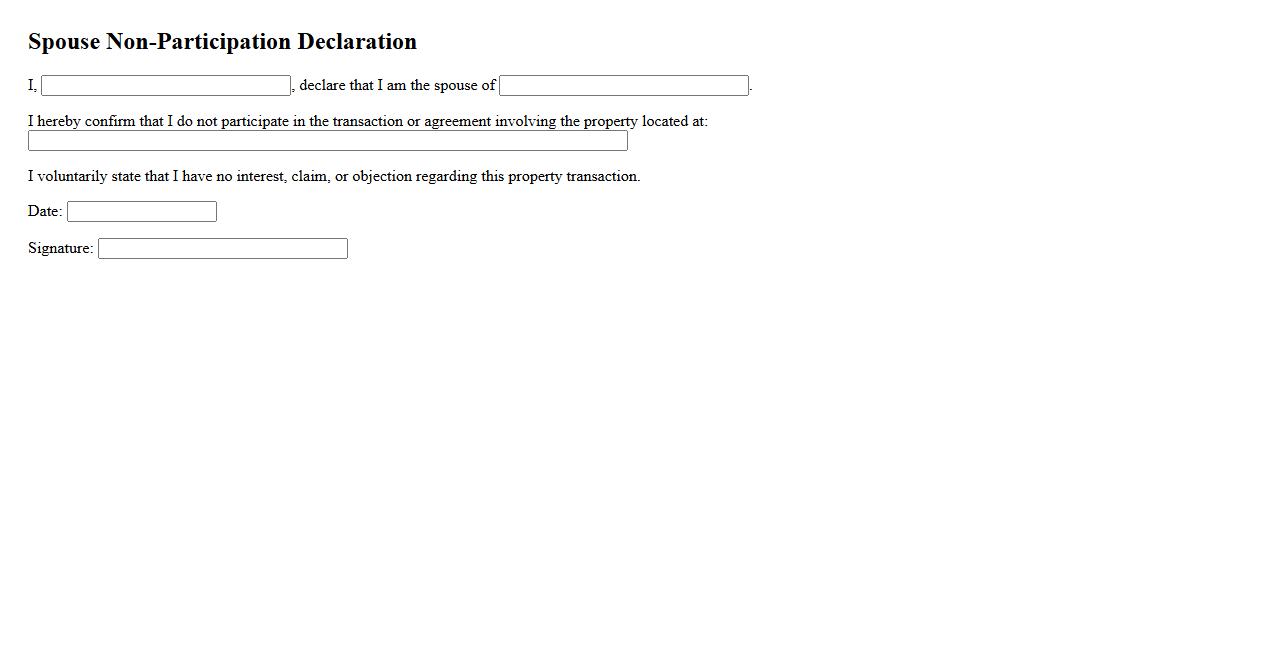

Spouse Non-Participation Declaration

The Spouse Non-Participation Declaration is a legal document confirming that one spouse chooses not to engage in a specific transaction or agreement. This declaration helps clarify individual responsibilities and protect both parties' rights. It is essential in ensuring transparency and preventing disputes in financial or property matters.

What are the eligibility criteria for requesting a waiver of the joint filing requirement?

To request a waiver of the joint filing requirement, individuals must demonstrate that filing jointly is impractical or unfair. Eligibility criteria often include cases such as abuse, abandonment, or where the non-requesting spouse cannot be located. Applicants must provide sufficient evidence to meet these conditions.

Under what circumstances can a joint filing requirement be waived according to the document?

A joint filing requirement can be waived in specific situations such as spousal abuse, abandonment, or if the spouse refuses to file jointly. Other circumstances include when the applicant is unable to locate their spouse despite diligent efforts. These exceptions are designed to protect applicants from hardship or unfair treatment.

What documentation or evidence must be provided to support a waiver request?

Supporting a waiver request requires documentary evidence like police reports, court orders, or affidavits proving abuse, abandonment, or inability to find the spouse. Detailed written statements explaining the situation and efforts made to contact the spouse should also be included. The more comprehensive the evidence, the higher the chance of approval.

Who has the authority to approve or deny a waiver of the joint filing requirement?

The authority to approve or deny a waiver of the joint filing requirement typically lies with the relevant tax agency or governing body managing tax filings. Decision-makers review the submitted evidence to ensure compliance with legal standards. Their judgment determines whether the waiver is warranted based on the applicant's circumstances.

What are the implications or consequences if a waiver for the joint filing requirement is granted?

If a waiver is granted, the applicant can file separately without the joint signature, which may impact tax liability and refund eligibility. It may also affect audits, credits, or deductions associated with joint returns. Ultimately, the waiver allows for fair treatment while adhering to tax regulations.