A Waiver of Insurance Coverage Requirement allows an individual or organization to be exempt from the standard mandate to carry insurance for a specific activity or contract. This waiver is typically granted when the risk is deemed minimal or when alternative risk management measures are in place. It ensures flexibility in compliance while maintaining necessary protections.

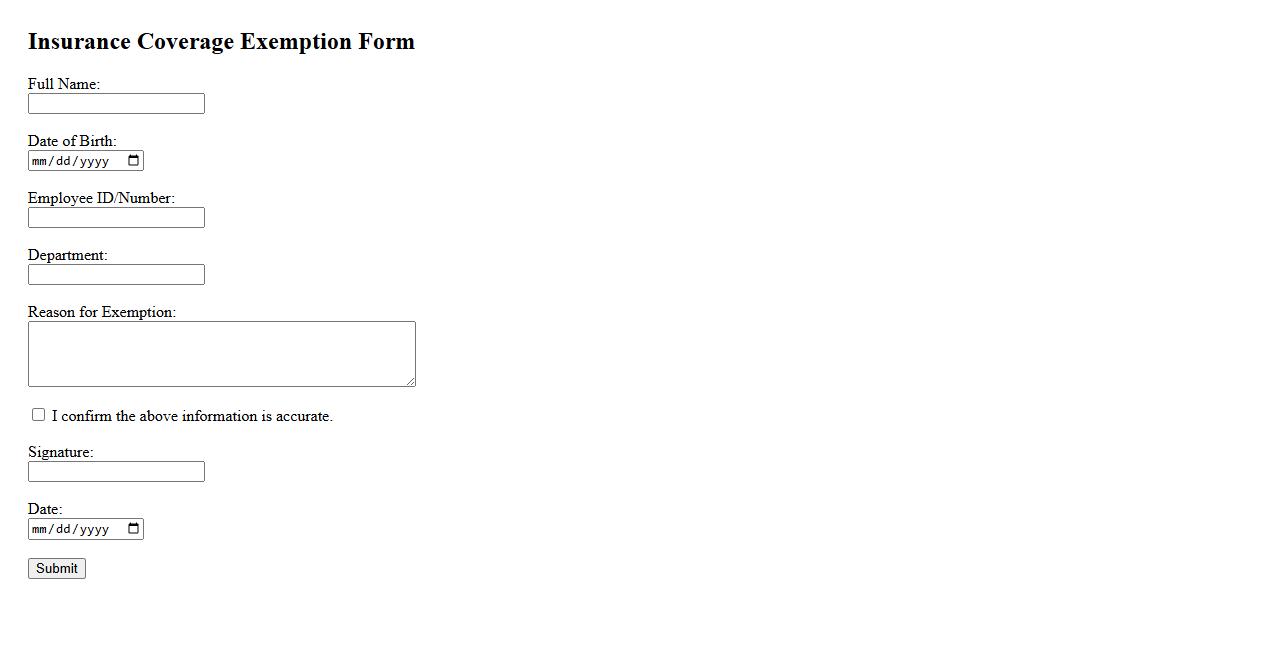

Insurance Coverage Exemption Form

The Insurance Coverage Exemption Form allows individuals to officially declare their exemption from mandatory insurance requirements. This form is essential for those who meet specific criteria and wish to avoid penalties or mandatory coverage fees. Proper submission ensures compliance with legal and regulatory standards.

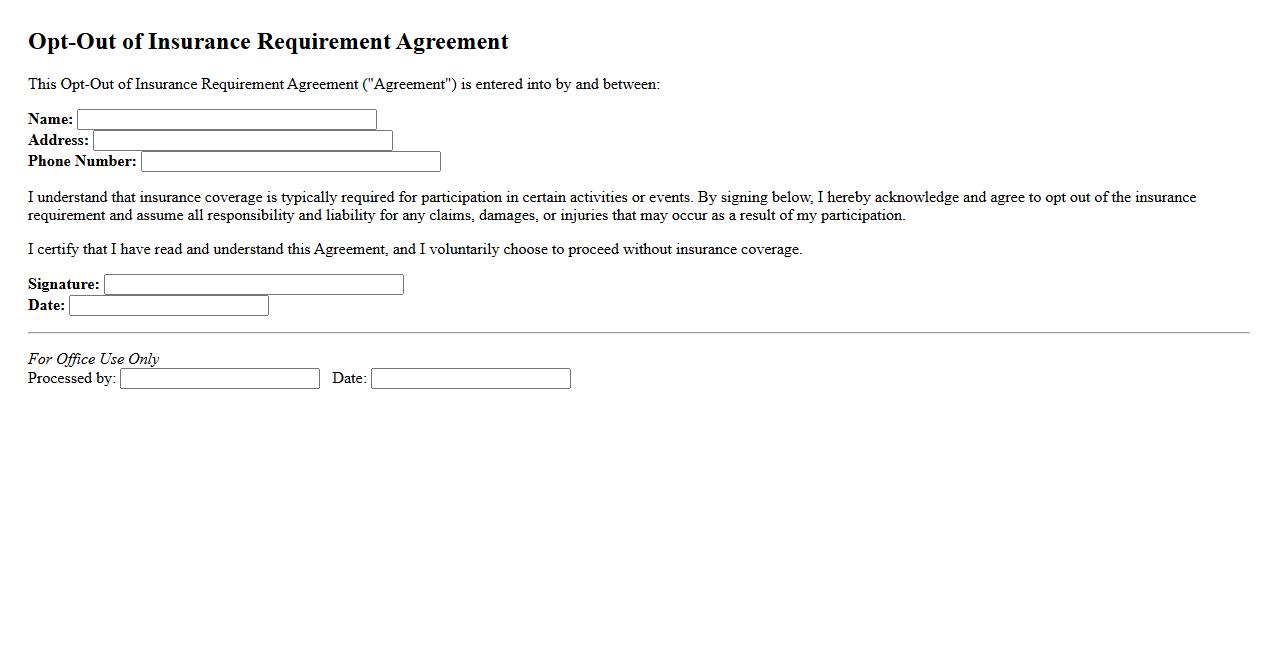

Opt-Out of Insurance Requirement Agreement

The Opt-Out of Insurance Requirement Agreement allows individuals to formally decline the mandatory insurance coverage typically required by an organization or institution. This agreement ensures that the participant understands the risks of opting out and accepts personal responsibility for any potential losses. It is essential for maintaining transparency and liability clarity between all parties involved.

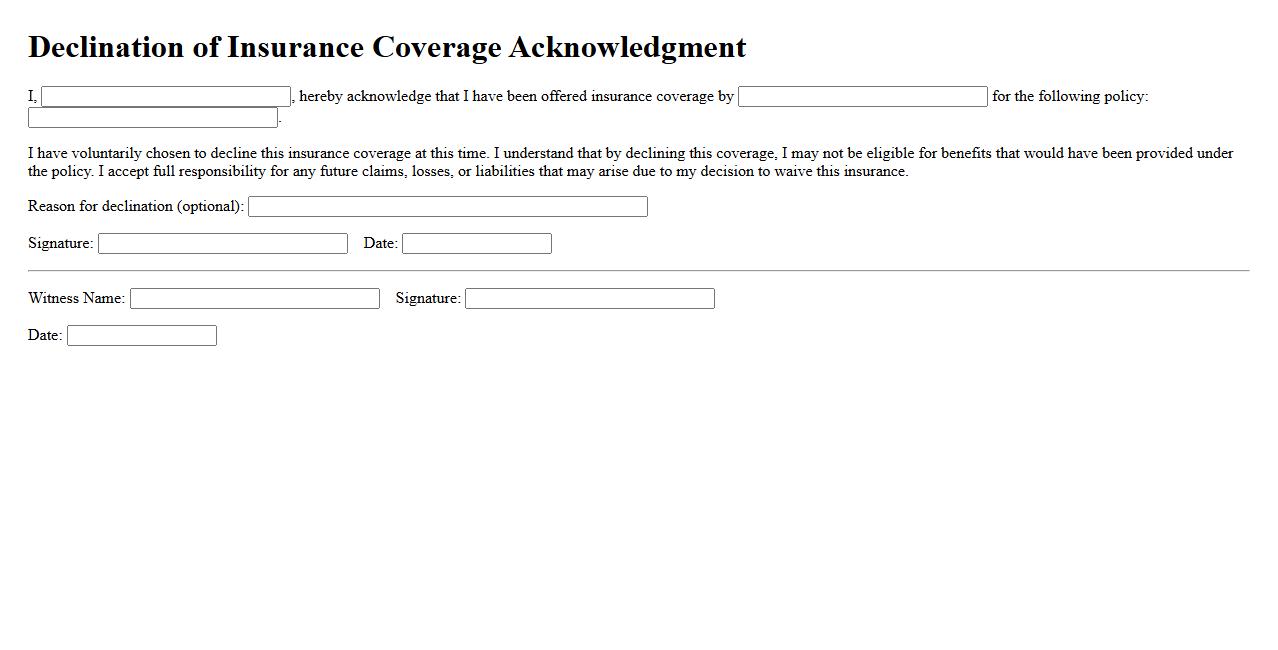

Declination of Insurance Coverage Acknowledgment

The Declination of Insurance Coverage Acknowledgment is a formal document where an individual confirms and accepts the decision not to obtain insurance coverage. This acknowledgment ensures that the person is fully aware of the risks involved and waives the right to insurance protection. It plays a crucial role in legal and administrative processes by clearly recording this intentional choice.

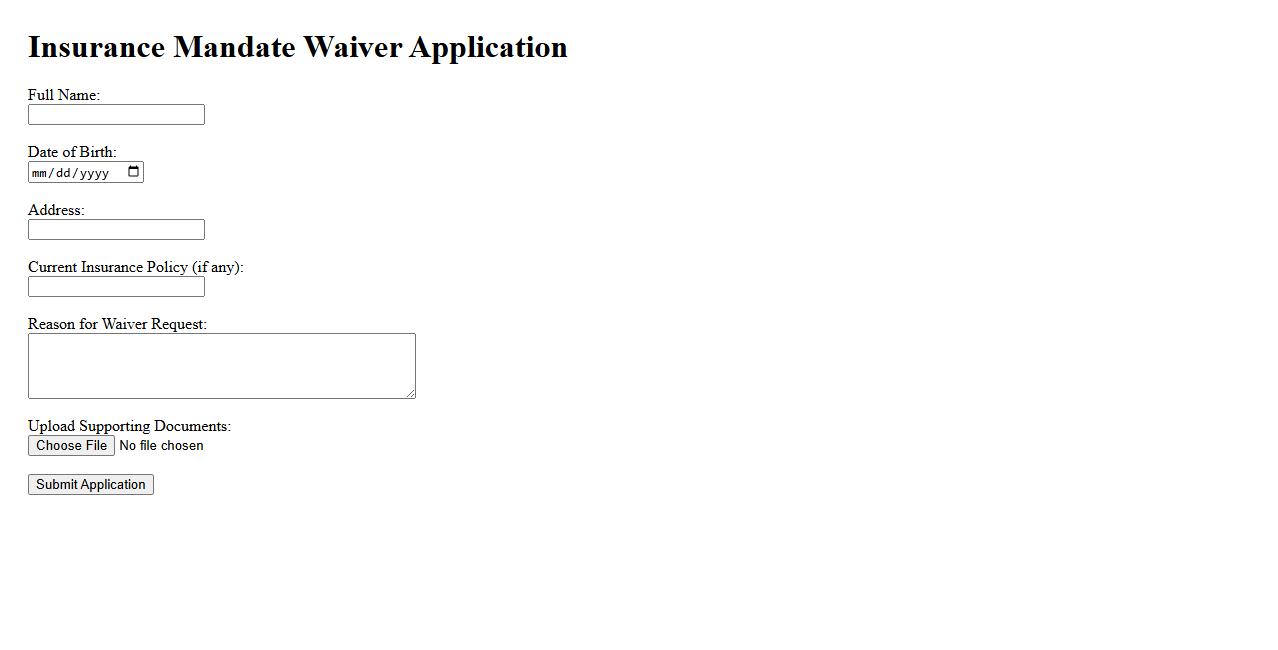

Insurance Mandate Waiver Application

The Insurance Mandate Waiver Application allows eligible individuals to request exemption from mandatory insurance coverage requirements. This application ensures users can formally declare their eligibility for a waiver based on specific criteria. Submitting the waiver helps avoid penalties associated with non-compliance.

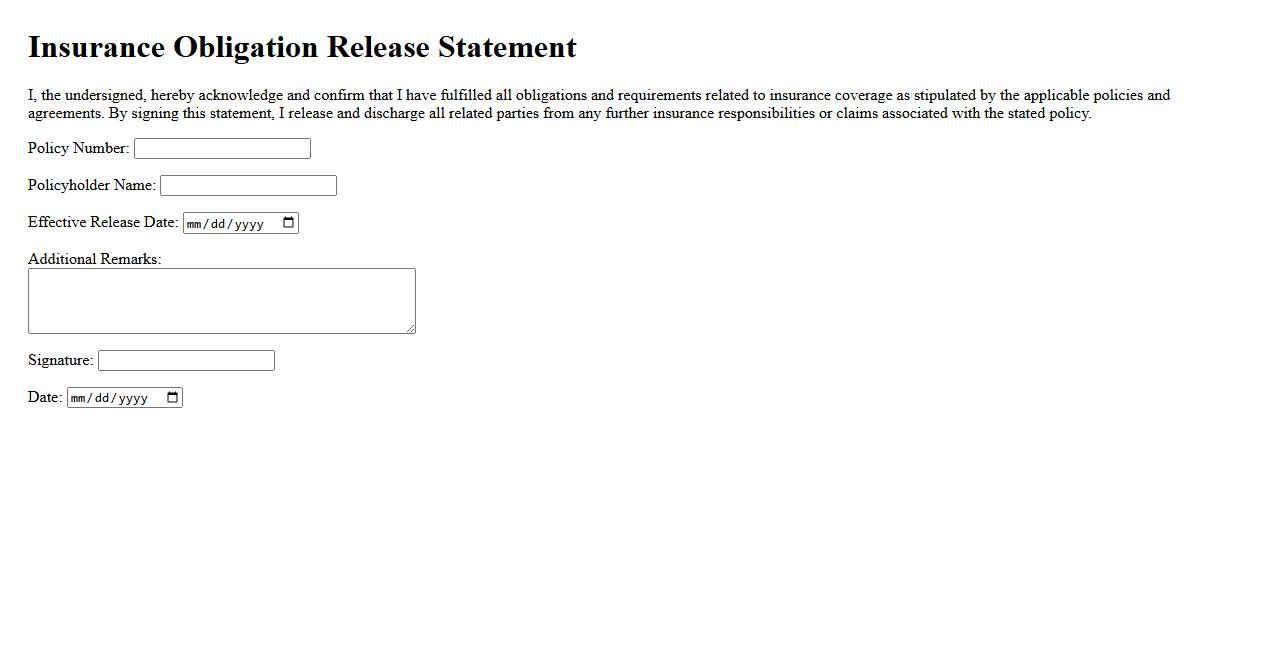

Insurance Obligation Release Statement

The Insurance Obligation Release Statement is a crucial document that formally waives an individual or entity's responsibility to maintain insurance coverage. It clearly outlines the terms under which insurance obligations are released, ensuring mutual understanding and legal protection for all parties involved. This statement helps prevent disputes by documenting the agreed-upon release in writing.

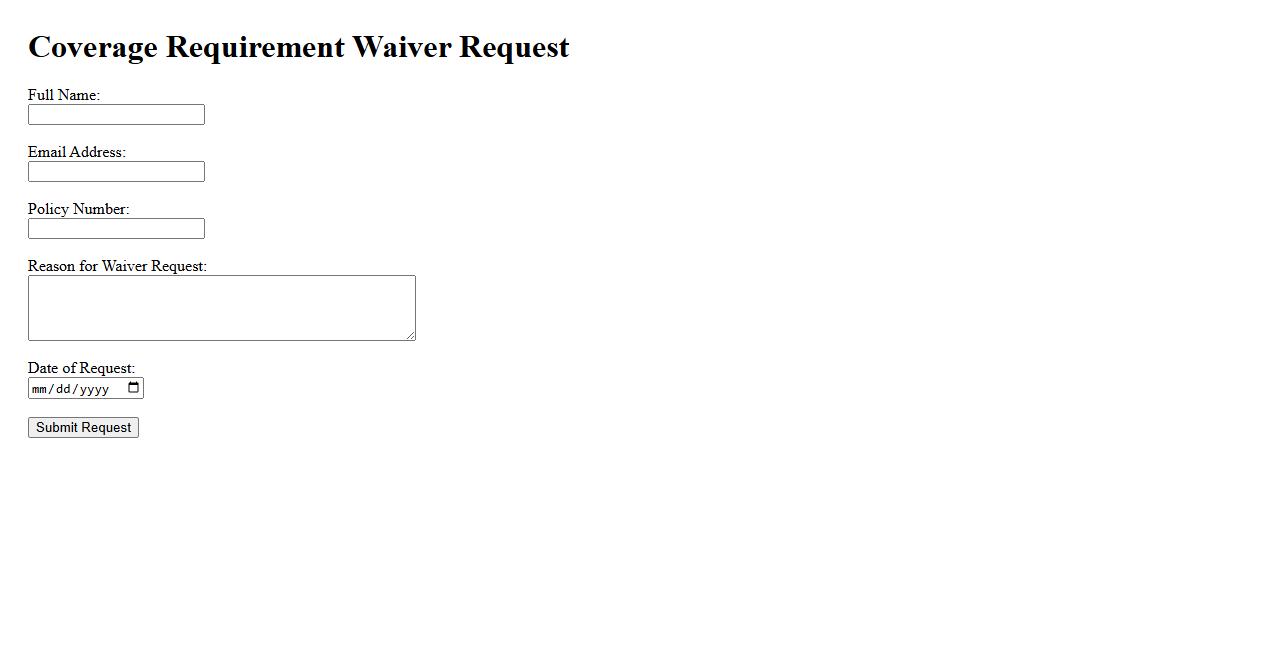

Coverage Requirement Waiver Request

A Coverage Requirement Waiver Request allows individuals to seek exemption from mandatory insurance or benefit coverage policies. This process typically requires submitting documentation proving eligibility for the waiver. Approval of the request ensures compliance flexibility while maintaining necessary protections.

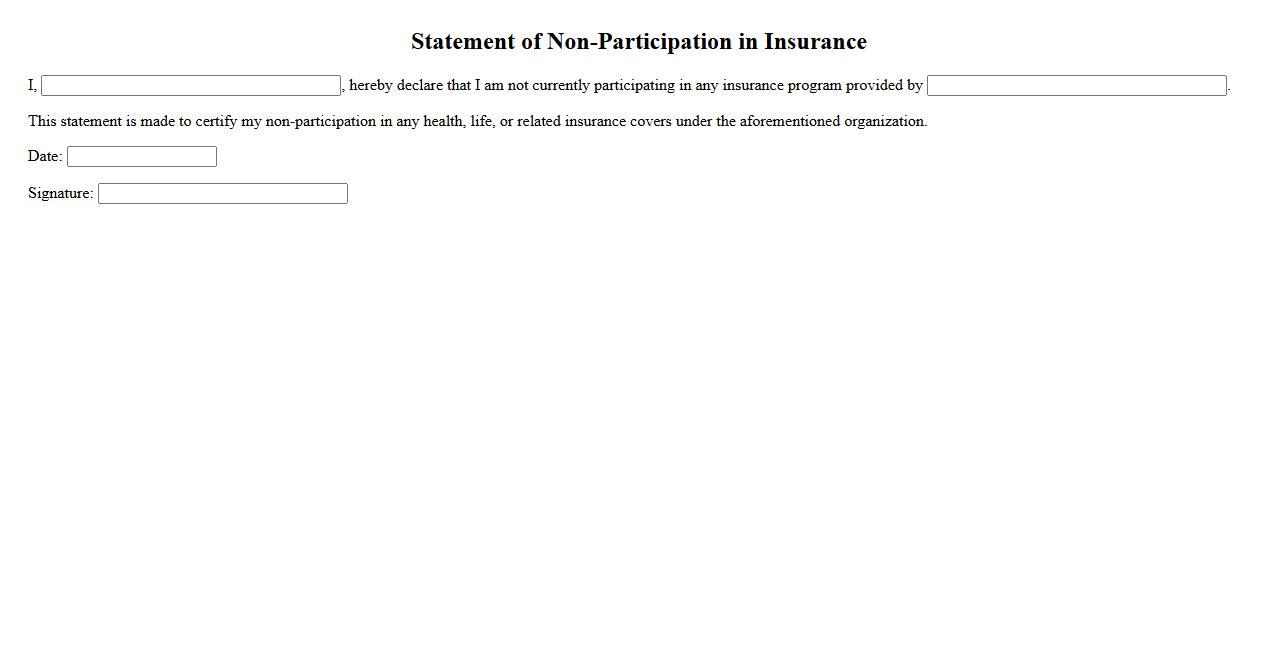

Statement of Non-Participation in Insurance

A Statement of Non-Participation in Insurance is a formal document declaring that an individual or entity does not engage in any insurance programs or policies. This statement is often required for legal, financial, or administrative purposes to clarify non-involvement. It serves as official evidence that no insurance coverage is held or accepted.

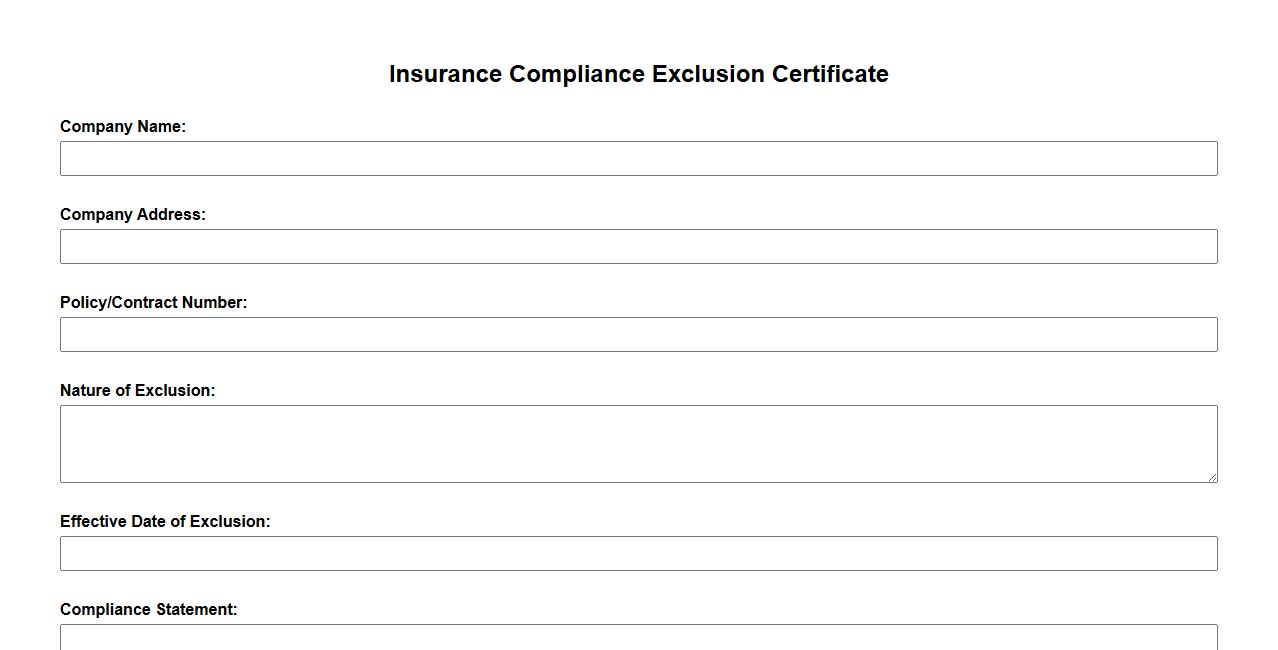

Insurance Compliance Exclusion Certificate

An Insurance Compliance Exclusion Certificate is a document verifying that a party is exempt from specific insurance requirements. This certificate ensures that businesses or individuals meet legal and contractual obligations without redundant coverage. It helps streamline compliance processes and avoid unnecessary insurance costs.

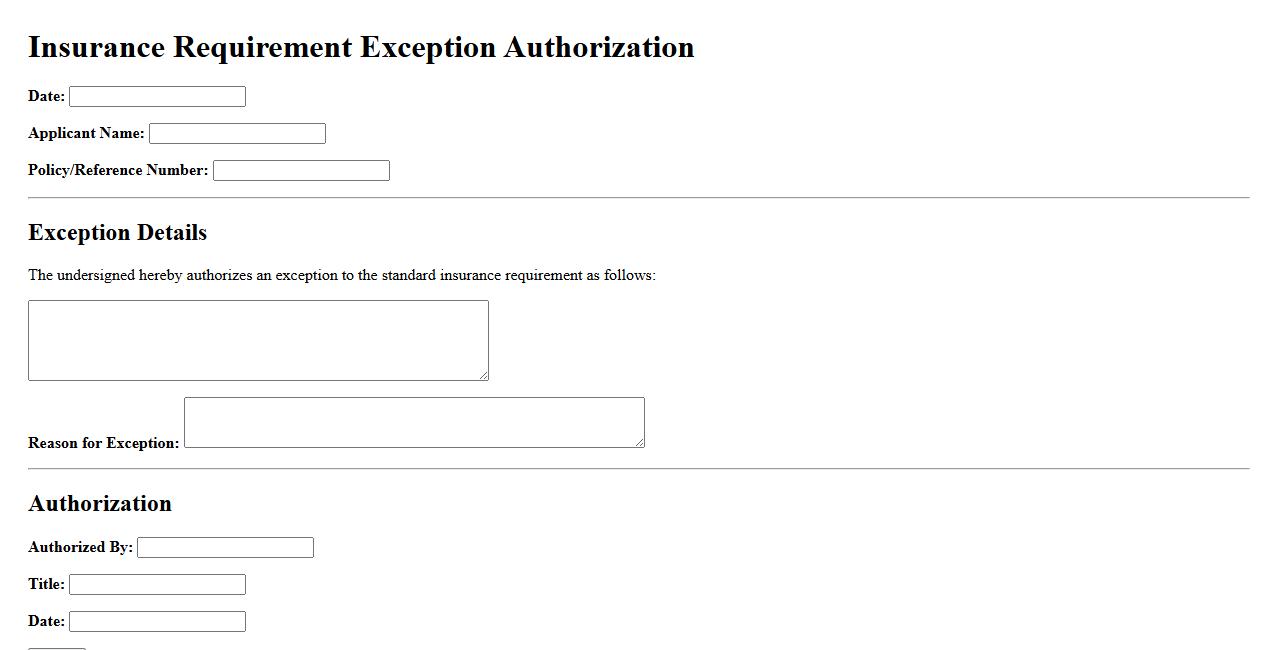

Insurance Requirement Exception Authorization

The Insurance Requirement Exception Authorization allows businesses or individuals to formally request an exemption from standard insurance coverage mandates. This process ensures that exceptions are granted under specific conditions, maintaining compliance while addressing unique circumstances. Approval of such authorization helps manage risk effectively without compromising legal obligations.

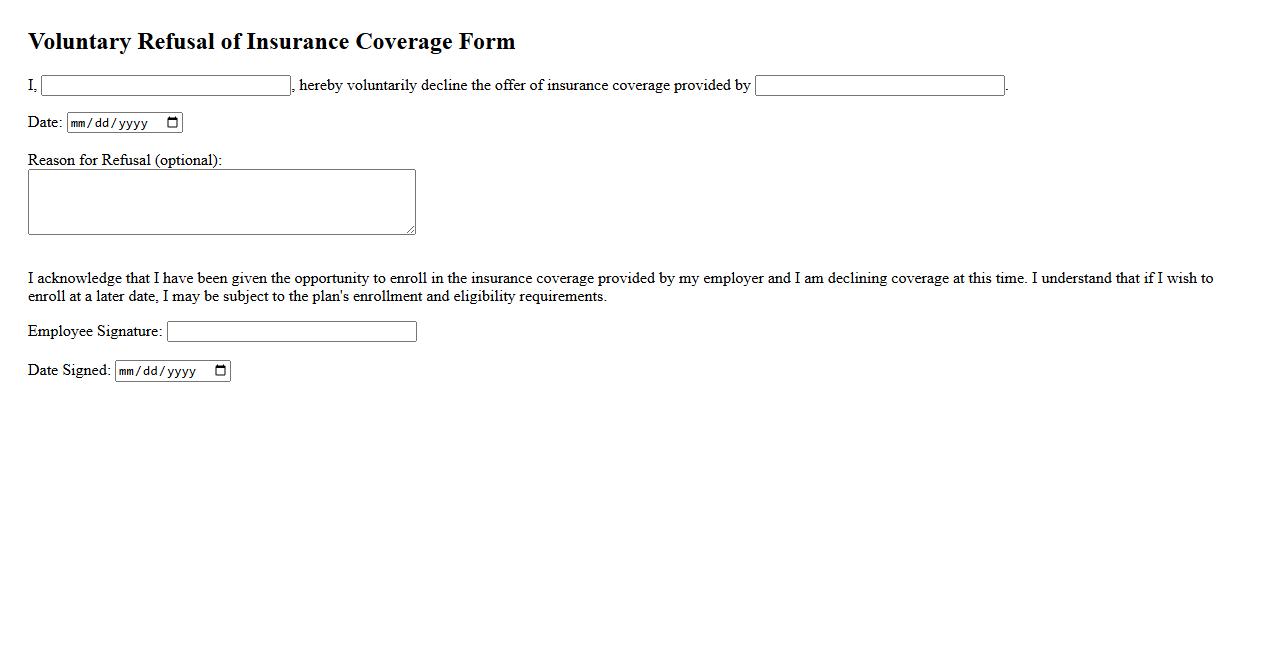

Voluntary Refusal of Insurance Coverage Form

The Voluntary Refusal of Insurance Coverage Form is a document used to formally decline insurance coverage offered by a provider. This form ensures that the individual acknowledges the risks associated with refusing coverage. Completing this form is essential for record-keeping and legal purposes in insurance transactions.

What qualifies an individual or entity for a Waiver of Insurance Coverage Requirement under this document?

To qualify for a Waiver of Insurance Coverage Requirement, an individual or entity must demonstrate a valid rationale supported by comprehensive evidence. Typically, eligibility hinges on the ability to prove that maintaining standard insurance coverage imposes undue hardship or is redundant due to alternative protections. The document specifies strict criteria, including financial status and risk assessment, to ensure waivers are granted responsibly.

Which types of insurance coverage are eligible for waiver according to the document's provisions?

The document allows waivers primarily for liability insurance, property insurance, and professional indemnity coverage. These coverages are evaluated based on their relevance, necessity, and the claimant's ability to mitigate associated risks through other means. Exclusions and special cases are outlined to prevent waivers for critical or statutorily mandated policies.

What documentation or evidence must be provided to support a waiver request outlined in the document?

Supporting a waiver request requires submission of detailed financial statements, risk assessments, and alternative coverage documentation. Applicants must provide evidence that convincingly demonstrates why the waiver is justified and aligns with the regulatory standards outlined. Additionally, any previous insurance claims history and relevant correspondence must be included to complete the application.

What are the potential legal or financial implications of obtaining a waiver as described in the document?

Obtaining a waiver can expose the individual or entity to increased financial liability and legal risks if unforeseen events occur without sufficient insurance protection. The document warns that waivers do not absolve responsibility, and claimants may be personally accountable for damages or losses. Moreover, waivers could affect contractual relationships and compliance with regulatory requirements.

Under what conditions can a previously granted waiver of insurance coverage be revoked or terminated?

A waiver may be revoked or terminated if the individual or entity fails to comply with the document's terms or if there is a significant change in risk circumstances. Additionally, new regulatory mandates or evidence of misrepresentation during the waiver application can trigger cancellation. Continuous monitoring and periodic reviews are instituted to ensure that waived coverage remains justified and compliant.