The Submission of Form I-912 Request for Fee Waiver allows eligible applicants to request a waiver of USCIS filing fees based on financial hardship. Proper documentation proving the applicant's income, public benefits status, or inability to pay must accompany the form to ensure consideration. Submitting the form accurately increases the chances of fee waiver approval, facilitating access to immigration benefits without financial burden.

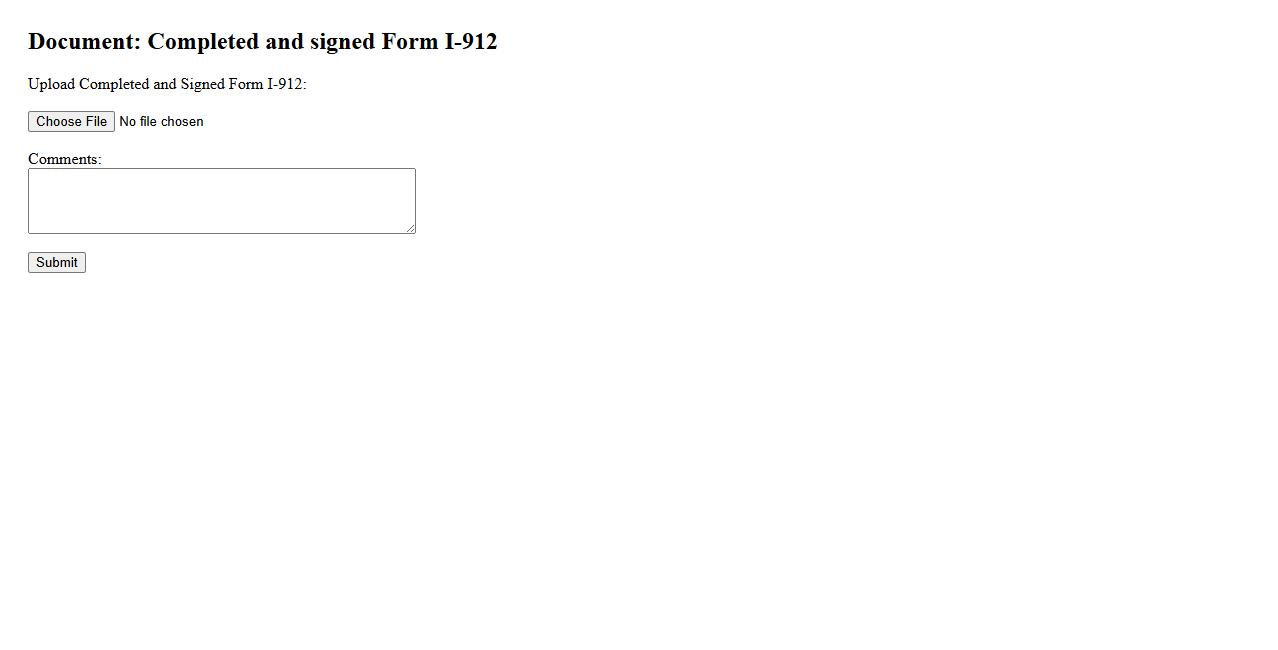

Completed and signed Form I-912

The Completed and signed Form I-912 is essential for requesting a fee waiver from U.S. Citizenship and Immigration Services. This form must be accurately filled out and signed to ensure eligibility for fee exemptions. Submitting the form correctly helps streamline the application process and avoid delays.

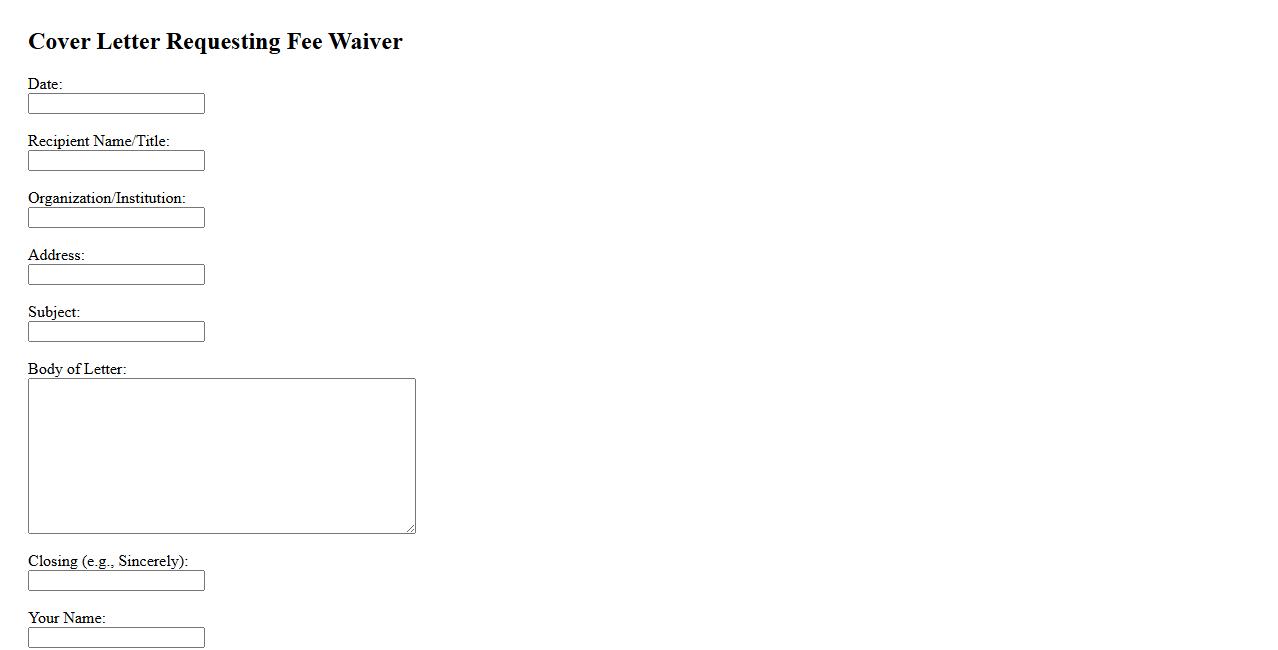

Cover letter requesting fee waiver

A cover letter requesting fee waiver is a formal document submitted to appeal for the reduction or elimination of fees. It clearly explains the applicant's financial situation and reasons for the waiver request. This letter aims to support the application by demonstrating genuine need and eligibility.

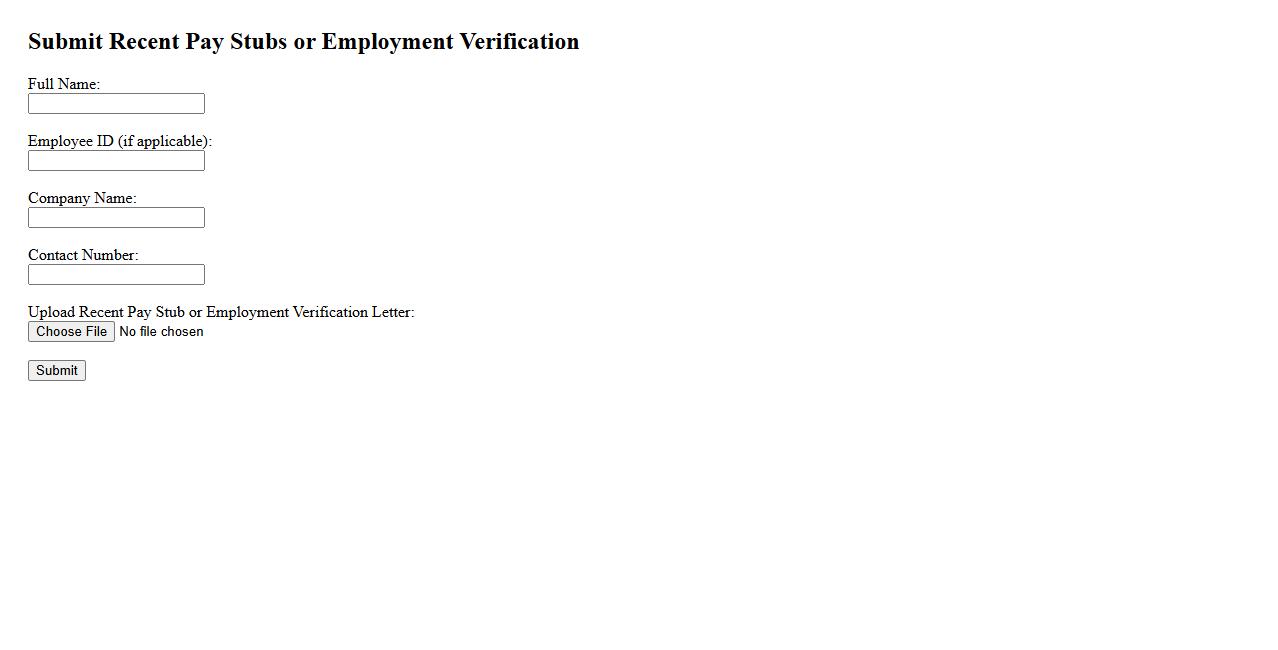

Recent pay stubs or employment verification

Recent pay stubs provide a detailed record of your earnings and deductions. They serve as essential employment verification documents when applying for loans, rentals, or other financial services. These documents help confirm your current income and job status quickly and reliably.

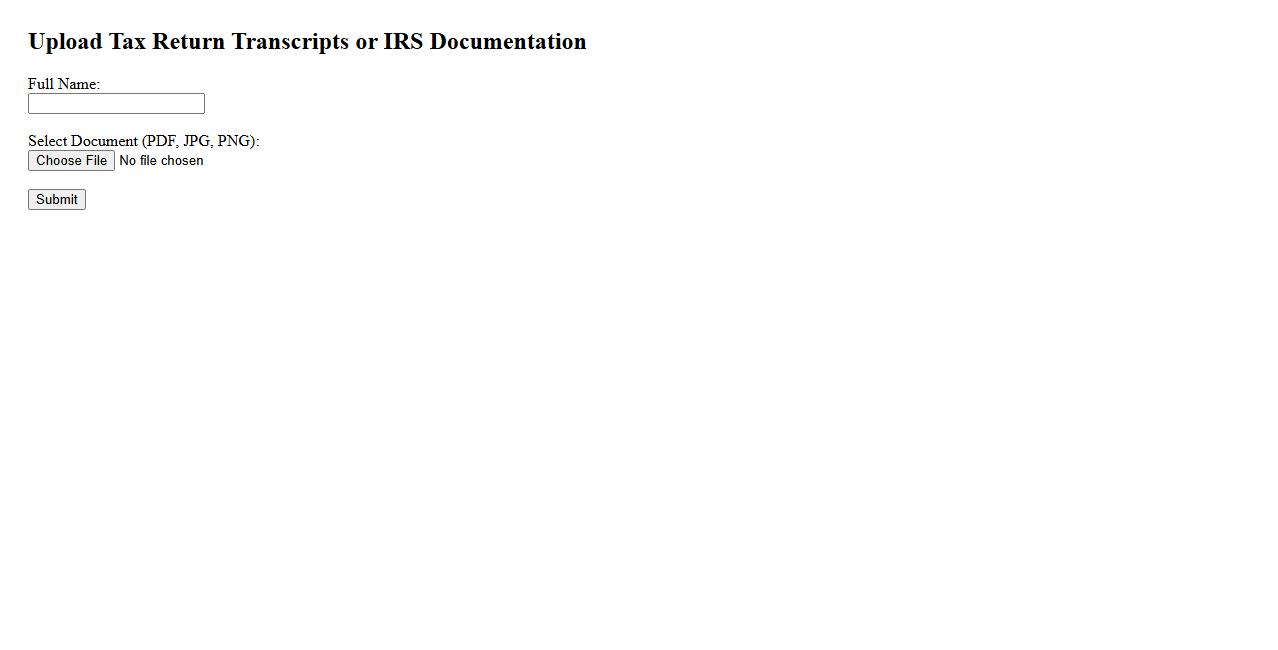

Tax return transcripts or IRS documentation

Tax return transcripts provide a summary of your filed tax return, including income, deductions, and credits reported to the IRS. These documents are essential for verifying income and tax information during financial aid applications or loan processing. Accessing IRS documentation helps ensure accurate and timely submission of required financial records.

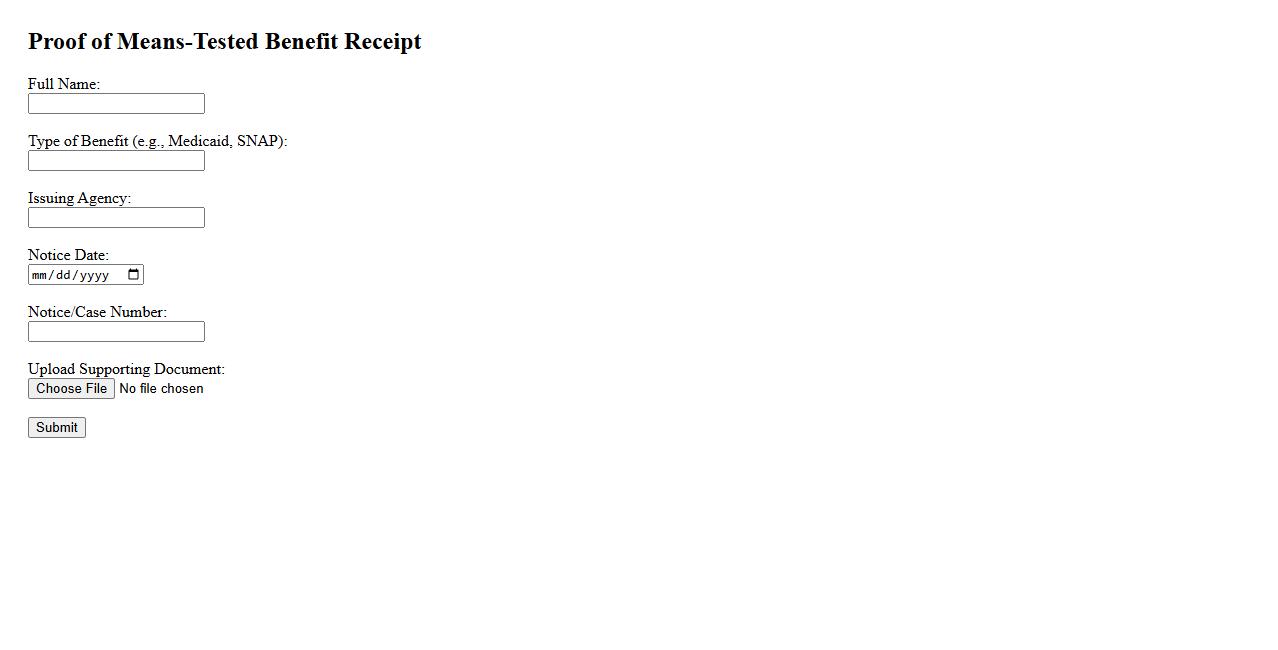

Proof of means-tested benefit receipt (e.g., Medicaid or SNAP notice)

Provide proof of means-tested benefit receipt such as a Medicaid or SNAP notice to verify your eligibility. This documentation confirms that you are receiving benefits based on your income level. It is essential for applications requiring financial assistance verification.

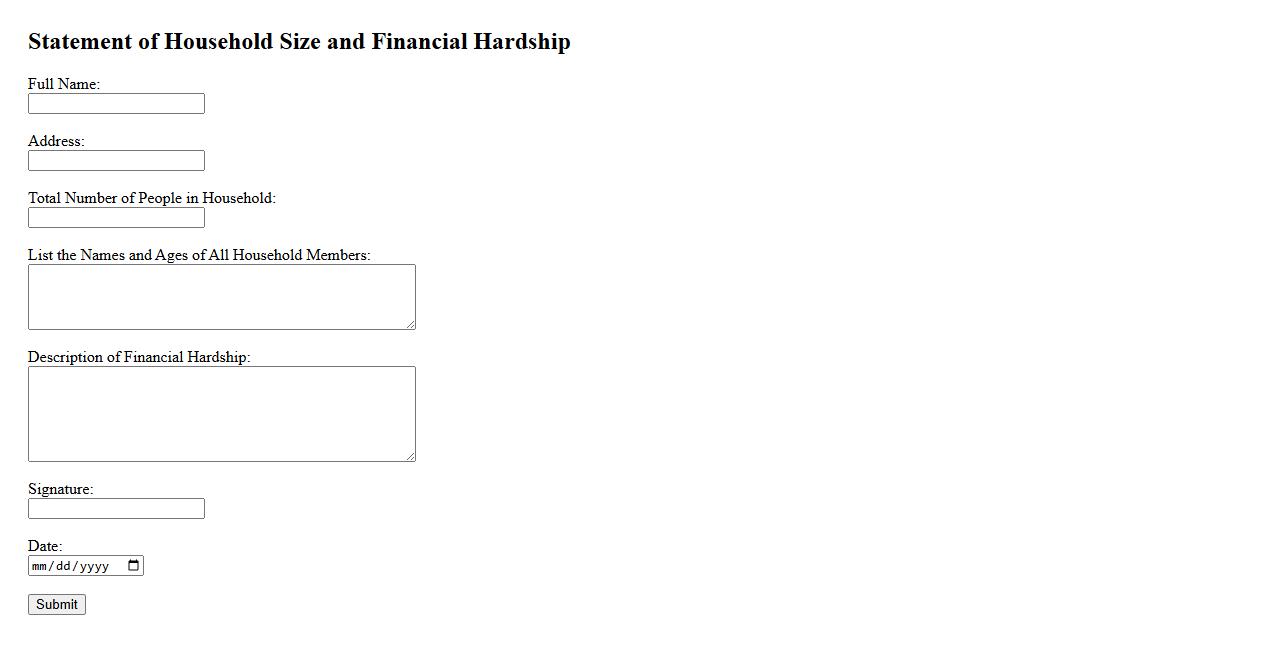

Statement of household size and financial hardship

A Statement of household size and financial hardship is a document used to verify the number of people in a household and demonstrate financial difficulties. It is often required for applications related to housing, benefits, or financial assistance programs. This statement helps agencies assess eligibility for support based on household composition and economic need.

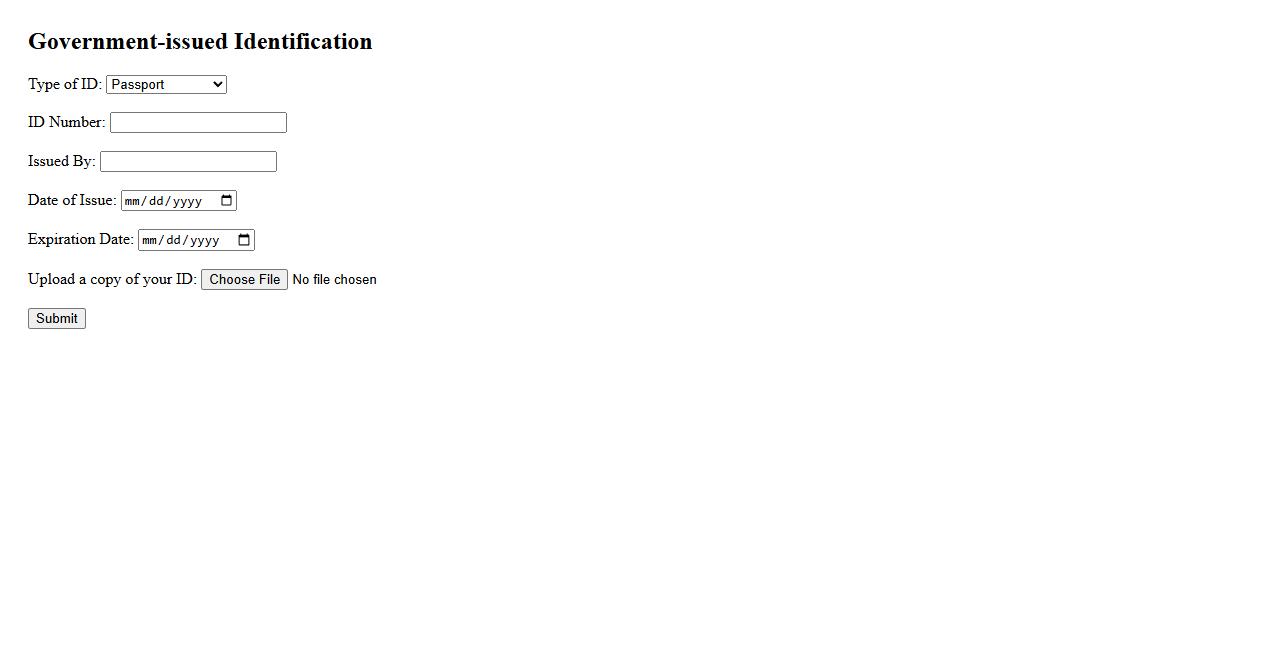

Government-issued identification

Government-issued identification is an official document used to verify a person's identity. Common forms include passports, driver's licenses, and national ID cards. These IDs are essential for accessing various services and proving citizenship or residency.

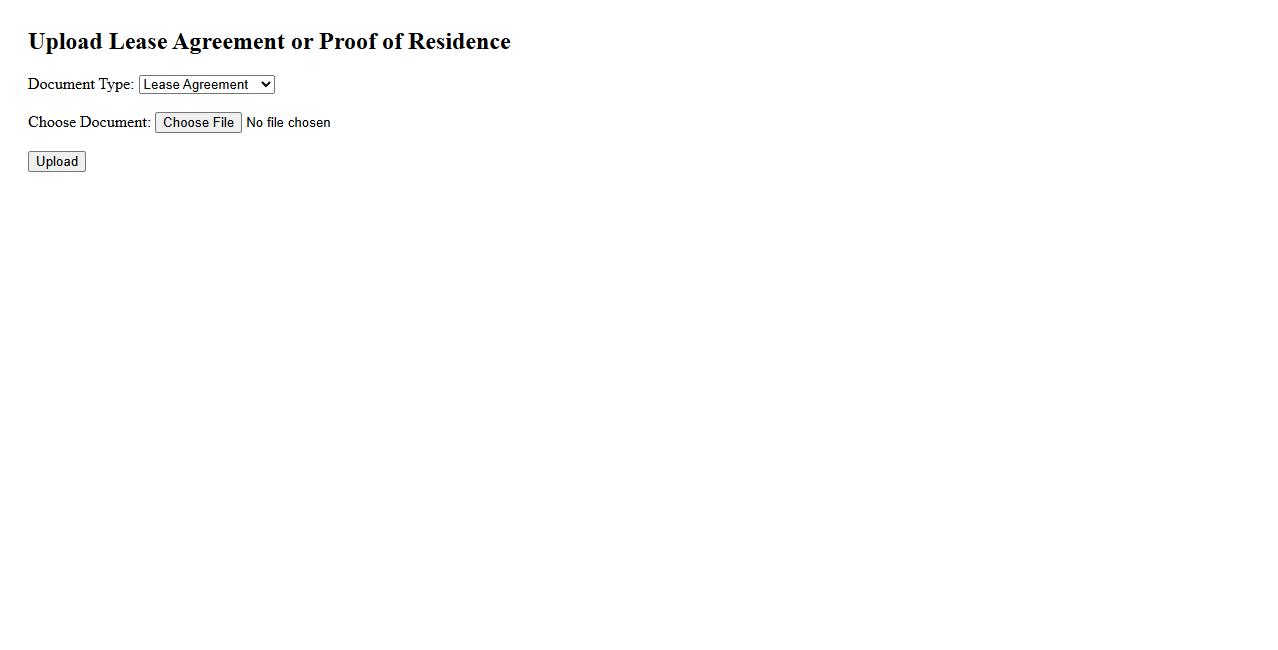

Lease agreement or proof of residence

A lease agreement or proof of residence is an essential document that verifies your current living situation. It typically includes details such as your landlord's information, rental term, and address. This documentation is often required for legal, employment, or service applications to confirm where you reside.

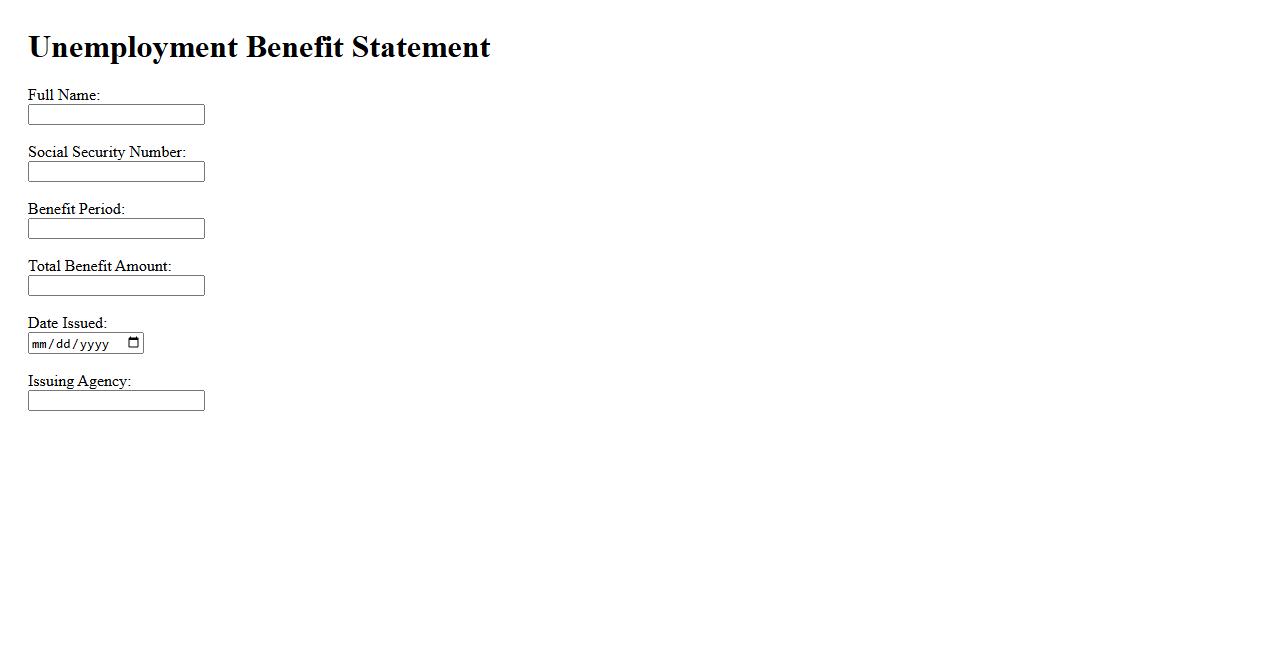

Unemployment benefit statements

Unemployment benefit statements provide detailed information on the payments received by individuals during periods of joblessness. These documents are essential for tax reporting and eligibility verification for continued support. Maintaining accurate records helps ensure smooth processing of claims and compliance with government regulations.

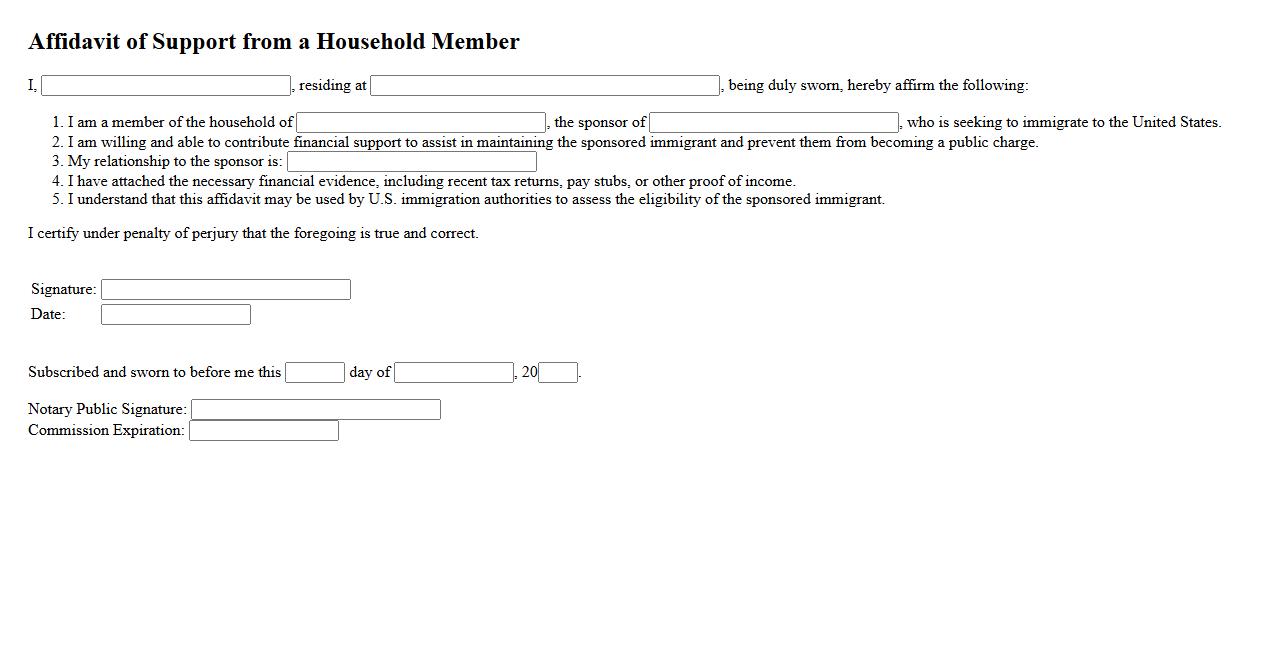

Affidavit of support from a household member

An affidavit of support from a household member is a legal document in which a person living in the same residence pledges financial responsibility for someone applying for immigration or financial assistance. This affidavit ensures that the applicant will not become a public charge. It is crucial for verifying the sponsor's ability to provide adequate support within the household.

What criteria must applicants meet to qualify for a fee waiver using Form I-912?

Applicants must demonstrate financial hardship to qualify for a fee waiver using Form I-912. Eligibility typically includes individuals receiving means-tested benefits or who have household incomes at or below 150% of the Federal Poverty Guidelines. Additionally, applicants may qualify if they face unforeseen emergencies that impact their ability to pay.

Which supporting documents are required when submitting Form I-912?

Supporting documents must clearly verify the applicant's financial situation. These can include evidence of participation in means-tested programs like Medicaid or SNAP, tax returns, pay stubs, or a letter describing financial hardship. Proper submission of these documents helps USCIS accurately evaluate the fee waiver request.

How does the applicant demonstrate household income eligibility on Form I-912?

Applicants show household income eligibility by providing proof of all household members' combined earnings. This may include recent pay statements, federal tax returns, or a letter from an employer. The income must be at or below 150% of the Federal Poverty Guidelines to qualify for the fee waiver.

What types of immigration forms can be submitted with a Form I-912 request?

Form I-912 can be submitted with a wide range of USCIS immigration forms that require filing fees. Common forms include applications for adjustment of status, naturalization, and employment authorization. The fee waiver request should be submitted simultaneously with or within the same package as the primary immigration form.

How does submitting Form I-912 affect the processing of the original immigration benefit application?

Submitting Form I-912 may delay the processing of the original immigration benefit application as USCIS reviews the fee waiver eligibility. If the fee waiver is approved, the application proceeds without the fee payment. However, if denied, the applicant must pay the required fee promptly to avoid application denial or delays.