The Submission of Form I-751, Petition to Remove Conditions on Residence, is a critical step for conditional green card holders seeking to obtain permanent resident status. This form must be filed within 90 days before the conditional residency expires, providing evidence that the marriage was entered in good faith. Proper submission ensures the removal of conditions and continued lawful permanent residence in the United States.

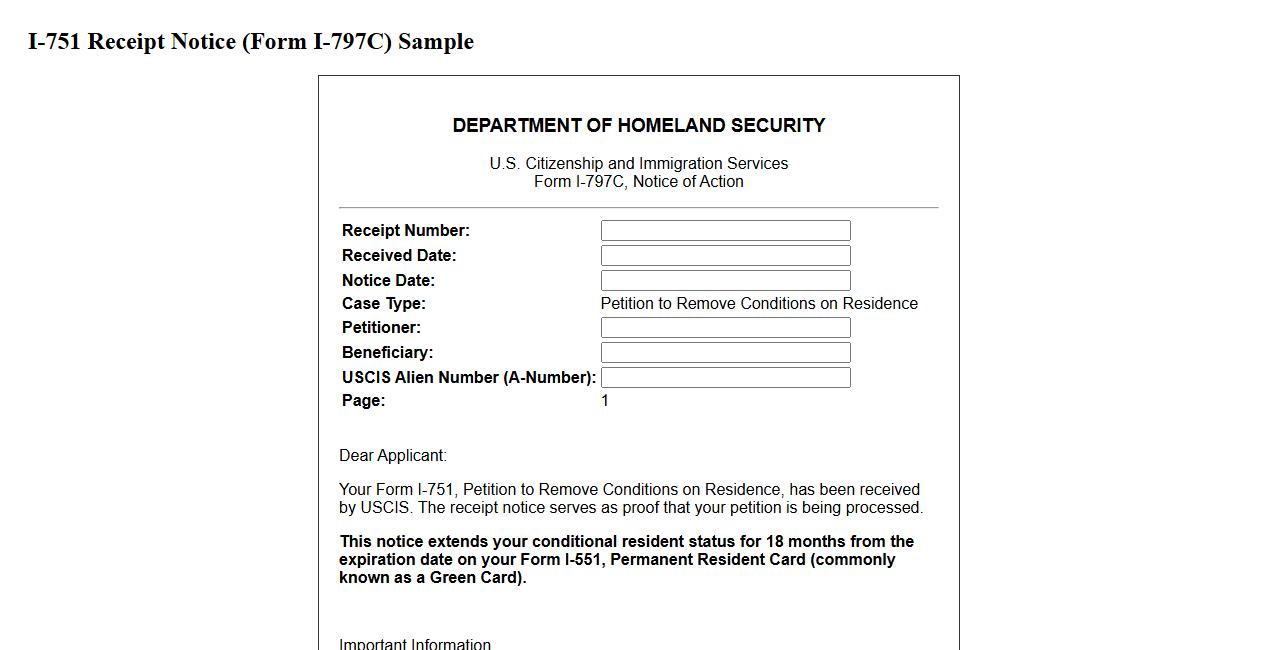

I-751 Receipt Notice (Form I-797C)

The I-751 Receipt Notice (Form I-797C) is an official document issued by USCIS confirming the acceptance of a petition to remove conditions on residence. It serves as proof that your application is being processed and includes important case details. Retain this notice for your records and future reference.

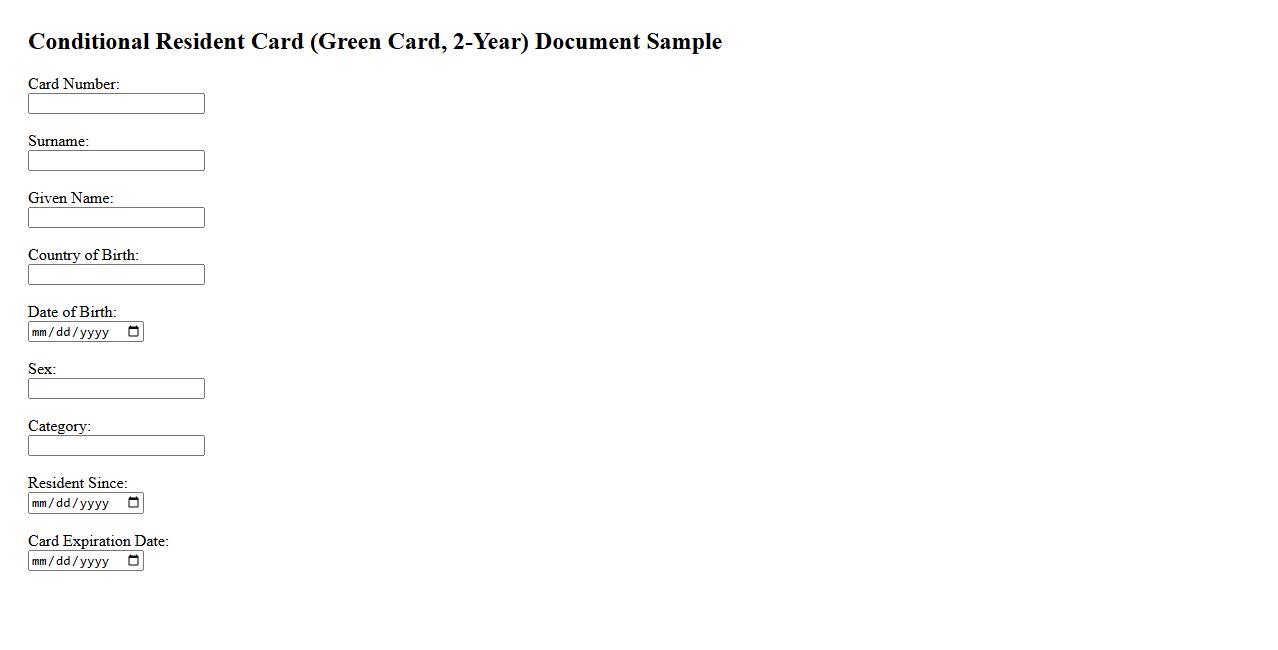

Conditional Resident Card (Green Card, 2-Year)

The Conditional Resident Card, also known as a 2-Year Green Card, is issued to individuals who obtain permanent residency based on a marriage that is less than two years old. This card grants conditional permanent resident status, requiring the holder to apply for removal of conditions before expiration. It serves as a temporary proof of residency while the applicant demonstrates the legitimacy of their marriage.

Marriage Certificate

A Marriage Certificate is an official document that legally certifies the union between two individuals. It serves as proof of marriage for legal, financial, and personal purposes. This certificate is essential for various administrative processes and rights as a married couple.

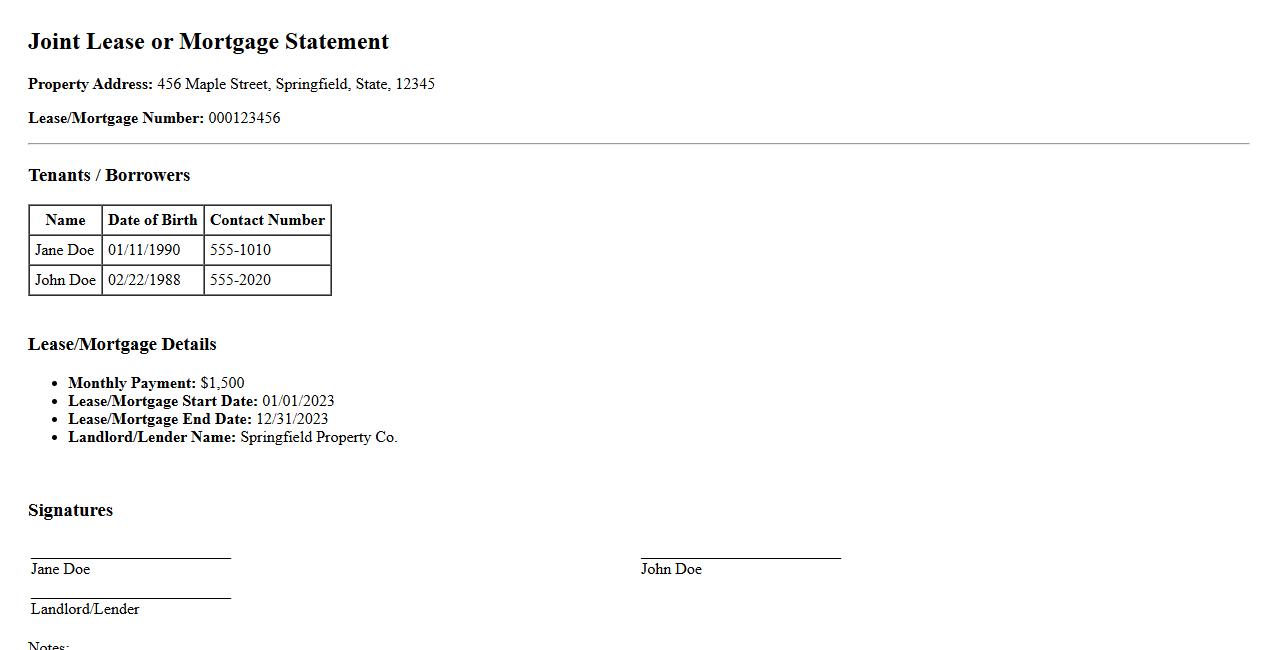

Joint Lease or Mortgage Statements

Review your joint lease or mortgage statements carefully to ensure accuracy and shared financial responsibility. These documents detail payment obligations and provide transparency between co-tenants or co-borrowers. Keeping accurate records helps avoid disputes and supports effective budgeting.

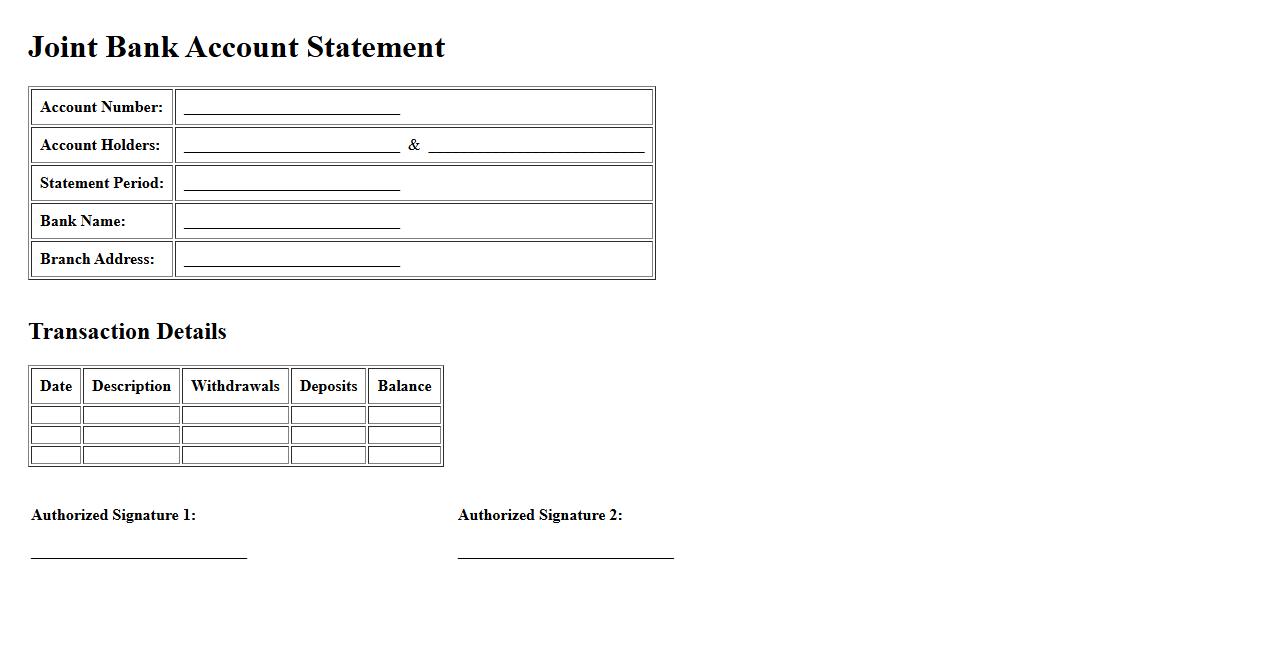

Joint Bank Account Statements

Joint Bank Account Statements provide a detailed record of all transactions made within a shared bank account. These statements help all account holders monitor income, expenses, and account balances collectively. They ensure transparency and simplify financial tracking for partners or family members managing finances together.

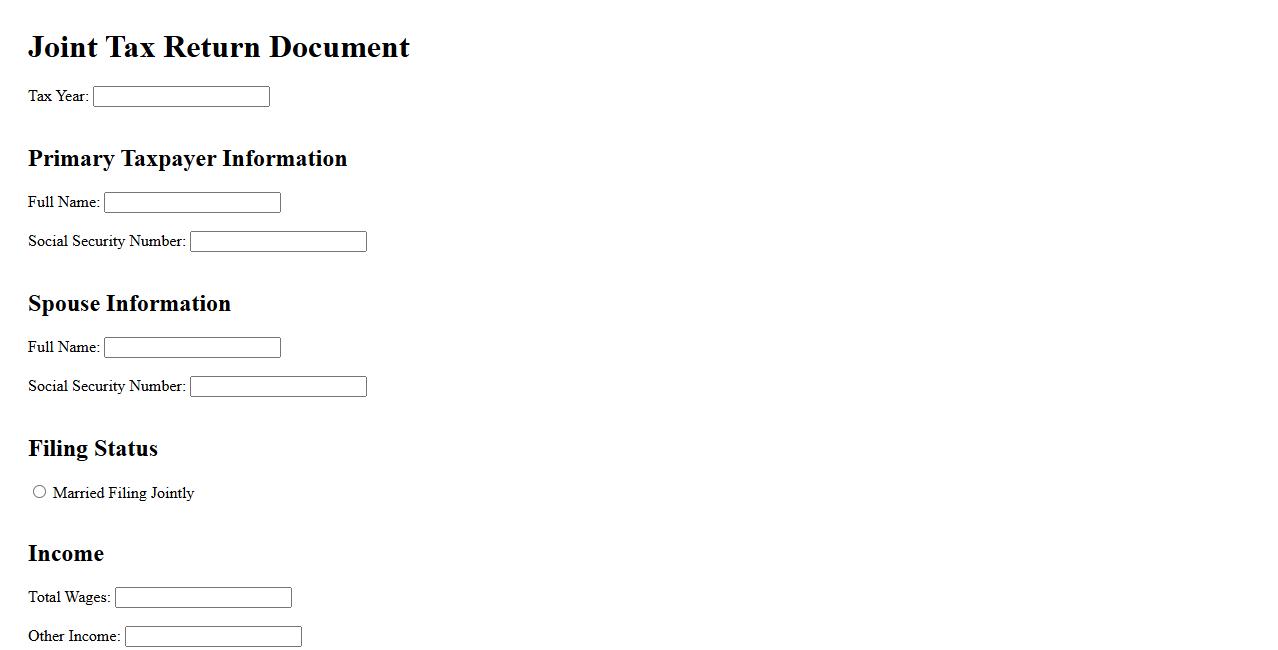

Joint Tax Returns

Filing joint tax returns allows married couples to combine their income and deductions, often resulting in tax benefits. This method simplifies the process by submitting a single tax return for both spouses. It can lead to lower tax rates and increased eligibility for credits and deductions.

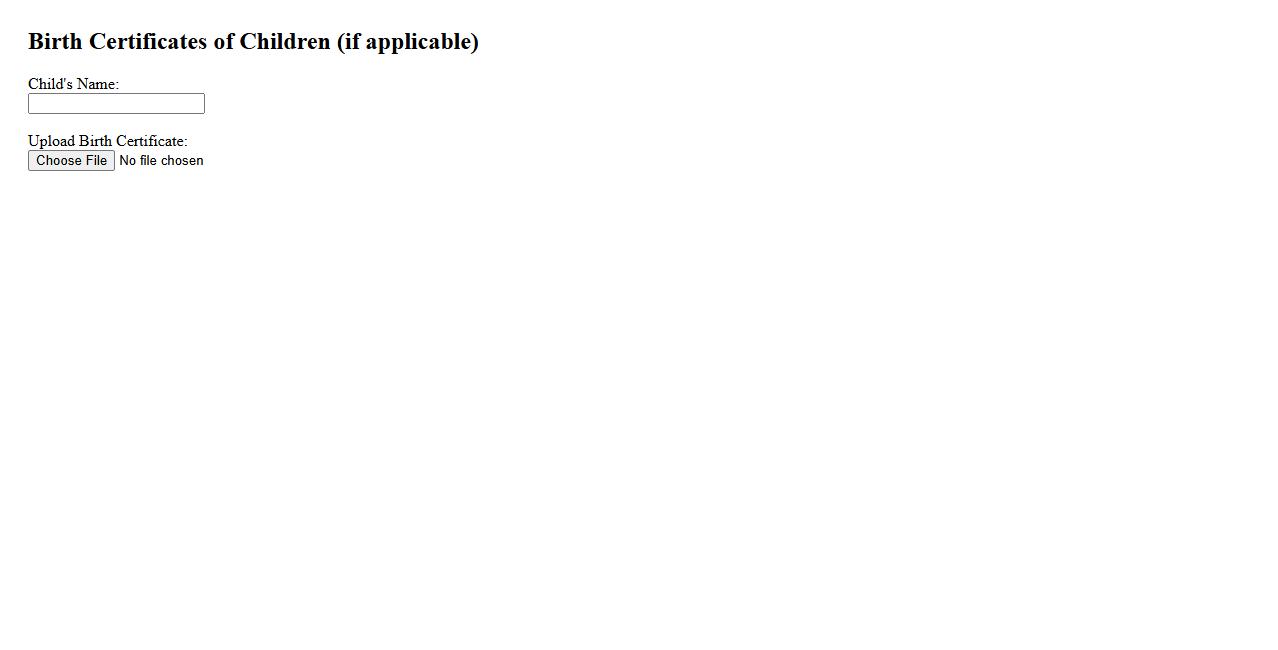

Birth Certificates of Children (if applicable)

Birth certificates are vital documents that officially record the birth of a child. They provide essential information such as the child's full name, date of birth, and parentage. Obtaining a birth certificate ensures legal recognition and access to various rights and services.

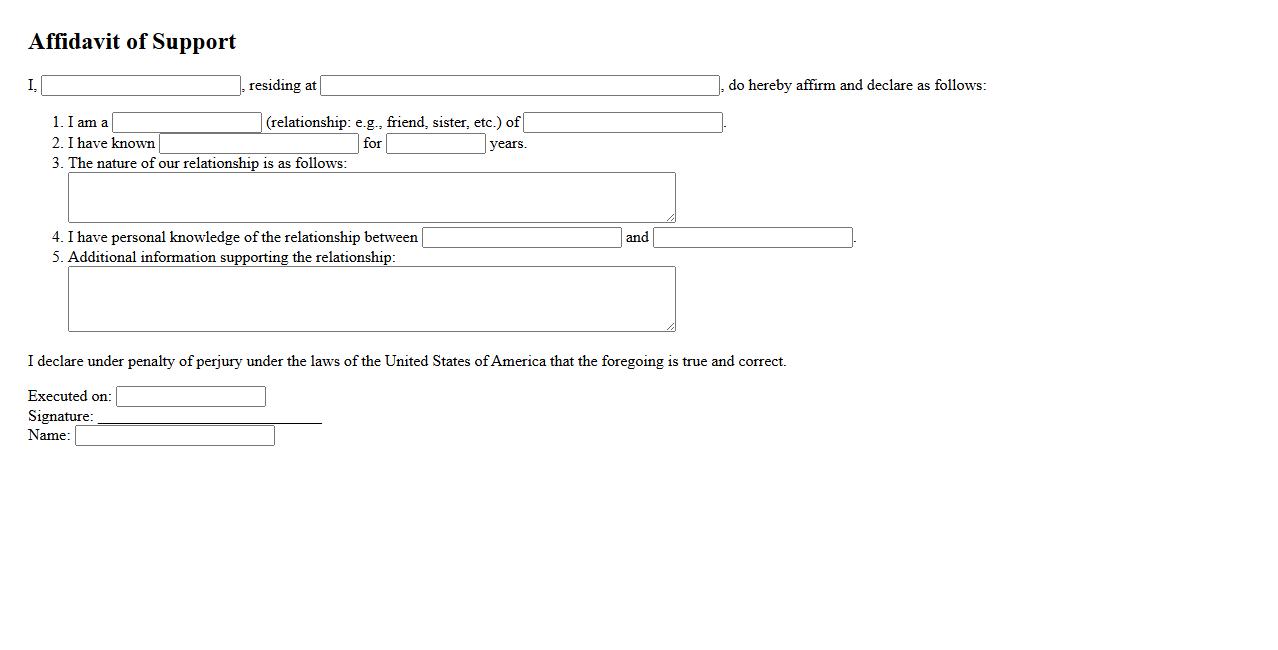

Affidavits from Friends and Family

Affidavits from friends and family provide personal testimonies that support legal cases or personal claims. These sworn statements offer credible evidence based on firsthand knowledge or experience. They are essential in verifying facts when official documents are unavailable or insufficient.

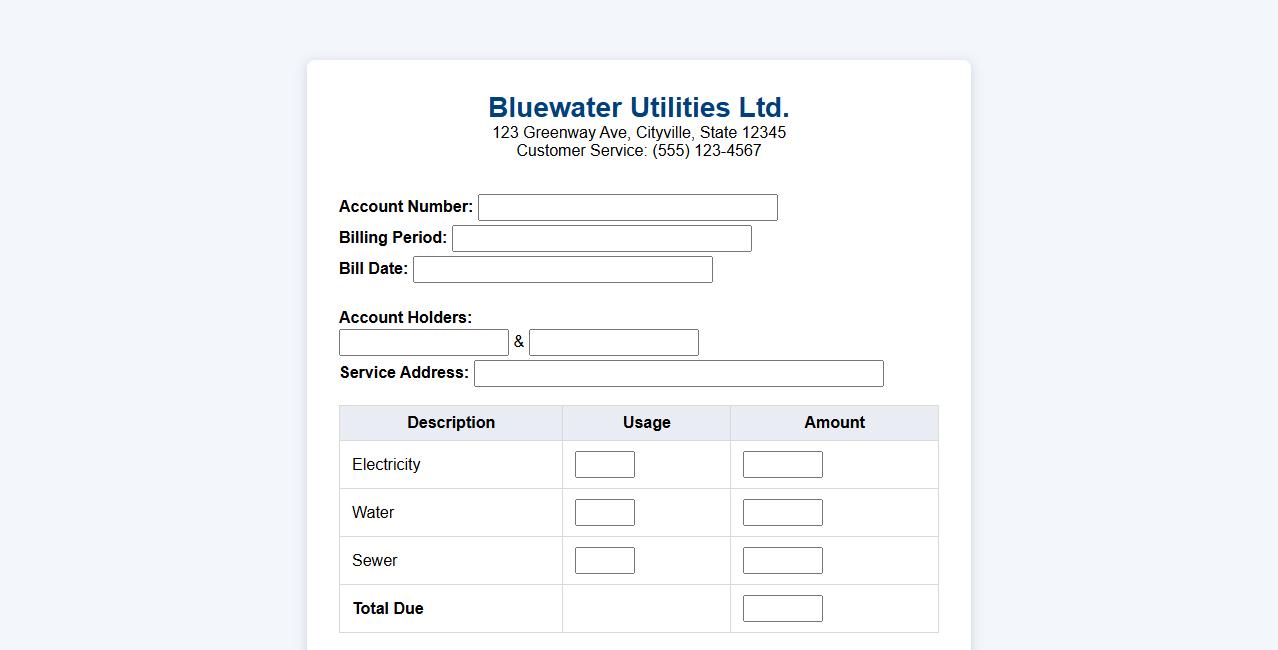

Utility Bills with Both Names

Utility bills with both names provide clear proof of shared responsibility between tenants or partners. Including both names ensures transparency for service providers and helps in managing payments efficiently. This practice can also support joint applications for services or credit.

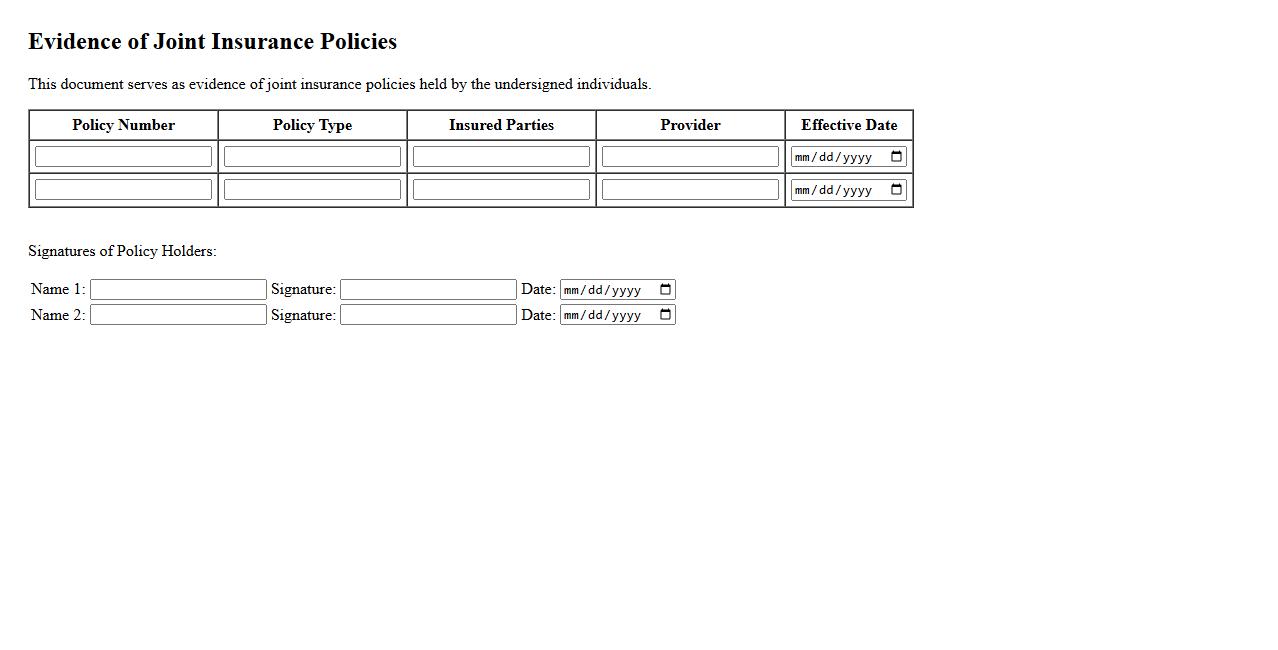

Evidence of Joint Insurance Policies

Understanding the evidence of joint insurance policies is crucial for verifying coverage shared by multiple parties. These documents confirm the agreement and terms between all insured individuals. Proper documentation ensures clarity and protection for everyone involved.

What is the primary purpose of Form I-751 in the context of conditional residence?

The primary purpose of Form I-751 is to remove the conditions on residence for individuals with conditional permanent resident status. Conditional residence is typically granted for two years, and this form allows applicants to apply for permanent residency. Filing Form I-751 is essential to transition from conditional to lawful permanent resident status.

Which supporting documents must be submitted to prove a bona fide marriage when filing Form I-751?

To prove a bona fide marriage when filing Form I-751, applicants must submit evidence showing the legitimacy of the marriage. This includes joint financial documents like bank statements, leases or mortgage agreements, insurance policies, and photographs together. Affidavits from friends and family attesting to the authenticity of the relationship may also strengthen the case.

What are the eligibility requirements for filing Form I-751 jointly versus requesting a waiver?

Applicants must file Form I-751 jointly with their spouse during the 90-day period before the conditional resident status expires. A waiver may be requested if the marriage ended due to divorce, abuse, or extreme hardship, allowing the applicant to file individually. Proper eligibility for a waiver requires evidence supporting the circumstances preventing joint filing.

How does failure to timely submit Form I-751 impact conditional resident status?

Failure to timely submit Form I-751 on or before the expiration date of conditional residence can lead to termination of status. This results in the loss of lawful permanent residency and may initiate removal proceedings. It is crucial to file within the designated 90-day window to maintain legal residency status.

What is the significance of biometrics in the Form I-751 petition process?

Biometrics collection plays a critical role in identity verification during the Form I-751 process. Applicants are required to attend a biometrics appointment for fingerprinting and photograph capture. This step helps ensure security and prevents identity fraud in the petition evaluation process.