The Submission of Form I-864, Affidavit of Support Under Section 213A of the INA is a critical requirement for sponsors petitioning for a foreign relative's immigrant visa or adjustment of status. This form demonstrates the sponsor's financial ability to support the intending immigrant and prevents them from becoming a public charge. Proper submission ensures compliance with U.S. immigration law and supports the visa application's approval process.

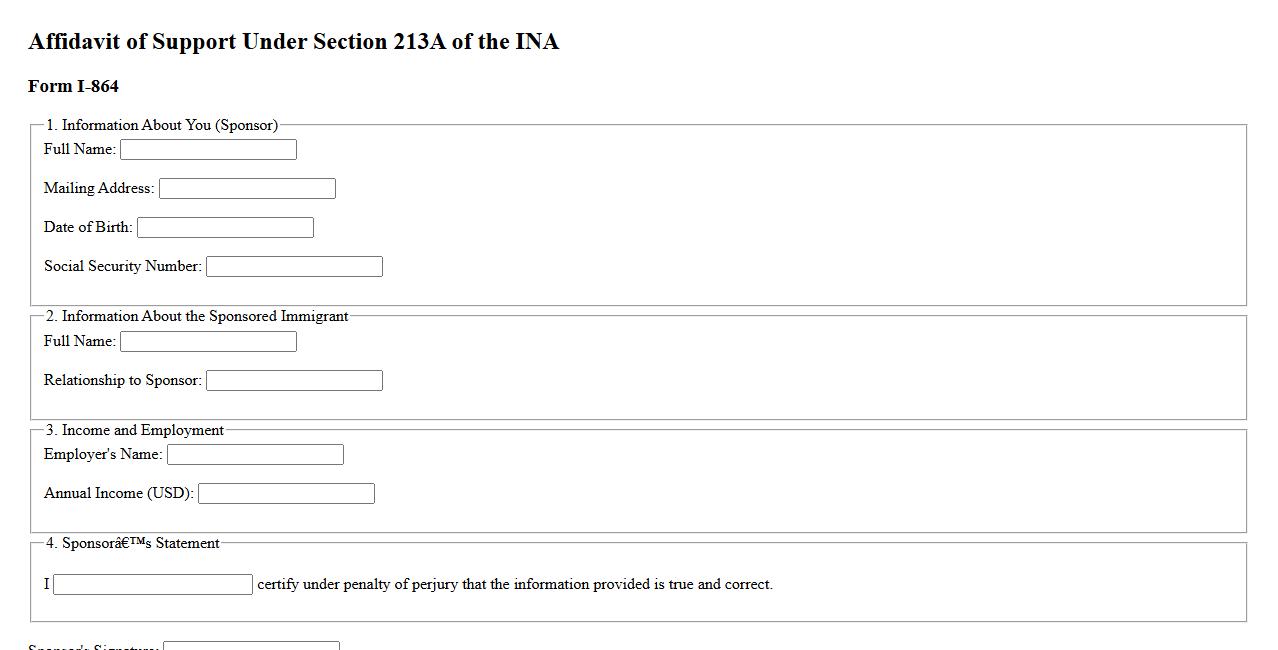

Affidavit of Support Form I-864

The Affidavit of Support Form I-864 is a legally binding document required by the U.S. government to demonstrate that an immigrant has adequate financial support. This form ensures the sponsor can support the intending immigrant and prevents them from becoming a public charge. It is a crucial part of the immigration process for family-based and certain employment-based visas.

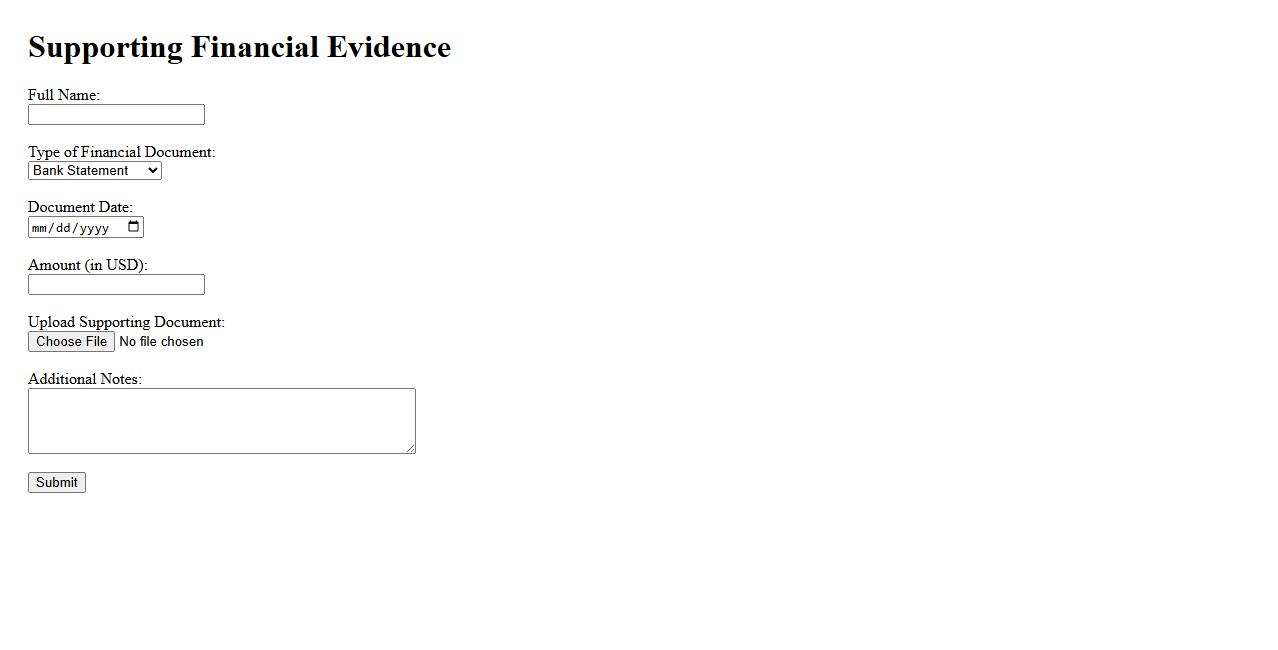

Supporting financial evidence

Supporting financial evidence is essential for verifying the accuracy of financial statements and claims. It includes documents like receipts, invoices, bank statements, and tax returns that validate transactions. Providing clear and organized evidence helps ensure transparency and accountability in financial reporting.

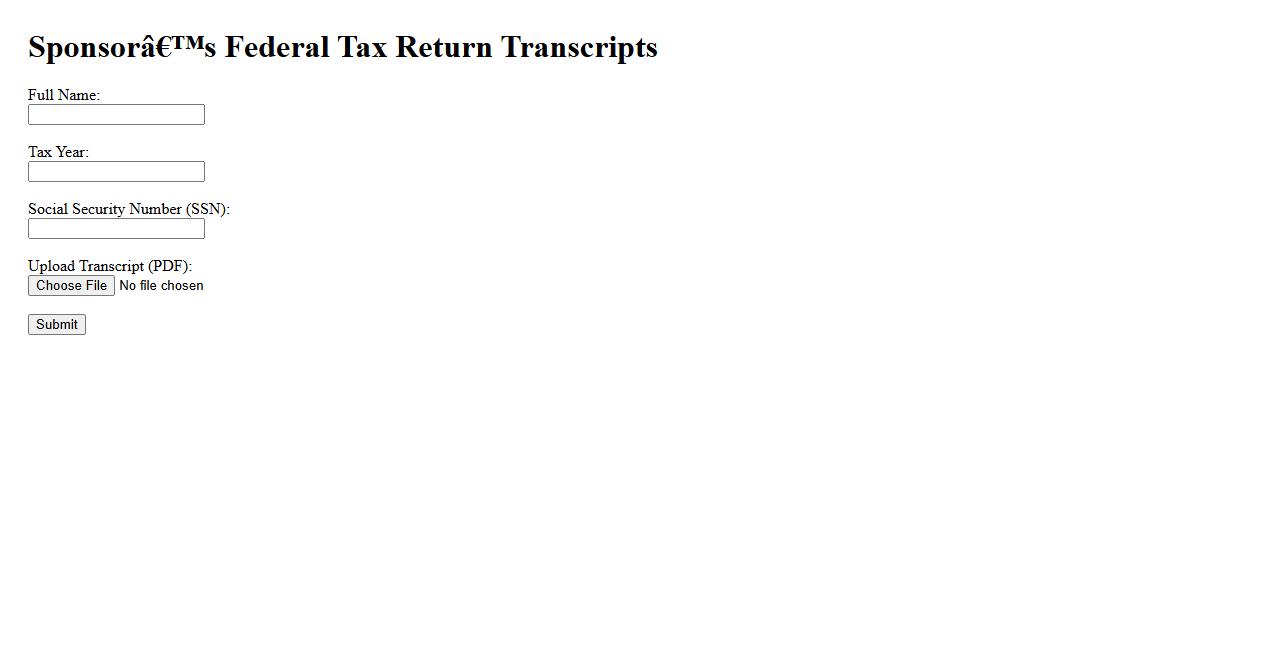

Sponsor’s federal tax return transcripts

Sponsor's federal tax return transcripts are official documents obtained from the IRS that detail a sponsor's tax filings. These transcripts provide verified information about income and taxes paid, essential for financial verification in various applications. They ensure accuracy and authenticity in assessing the sponsor's financial responsibility.

Proof of U.S. citizenship or permanent resident status

Proof of U.S. citizenship or permanent resident status is essential for verifying an individual's legal right to live and work in the United States. Common documents include a U.S. passport, birth certificate, or a permanent resident card (Green Card). Providing these ensures compliance with government regulations and access to various services.

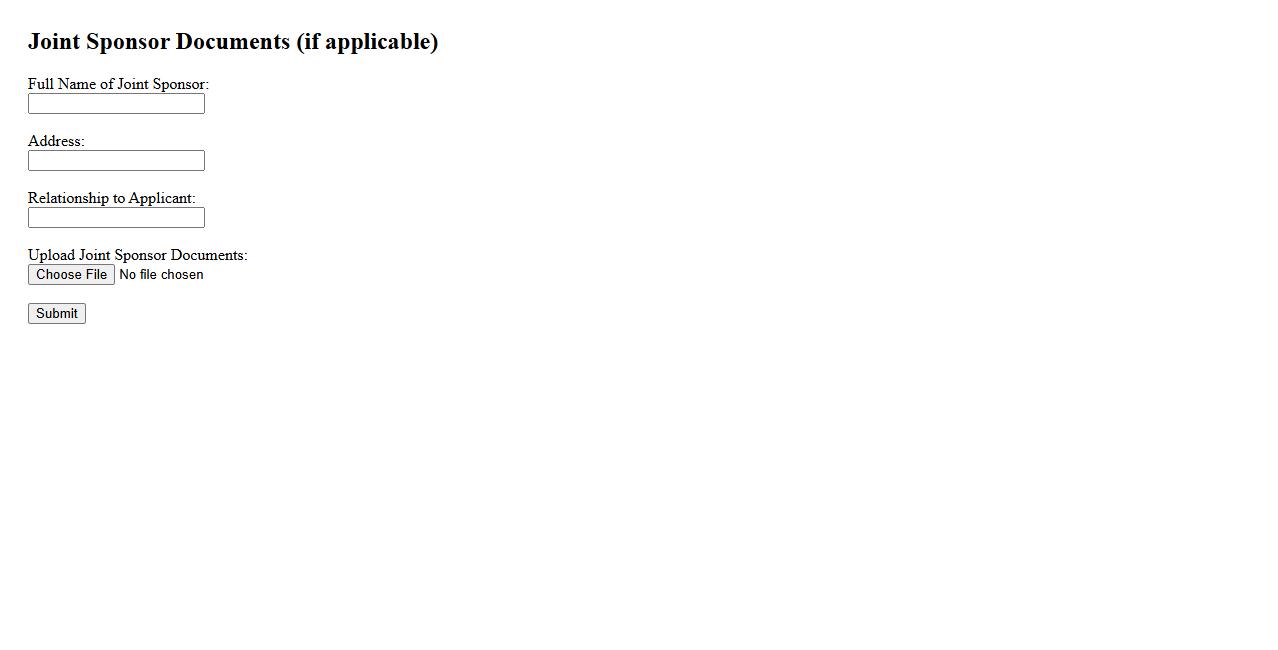

Joint sponsor documents (if applicable)

When applying for a visa or immigration benefits, joint sponsor documents may be required if the primary sponsor does not meet the income requirements. These documents typically include proof of income, tax returns, and a completed affidavit of support. Providing accurate joint sponsor documentation ensures the application process proceeds smoothly and meets legal financial obligations.

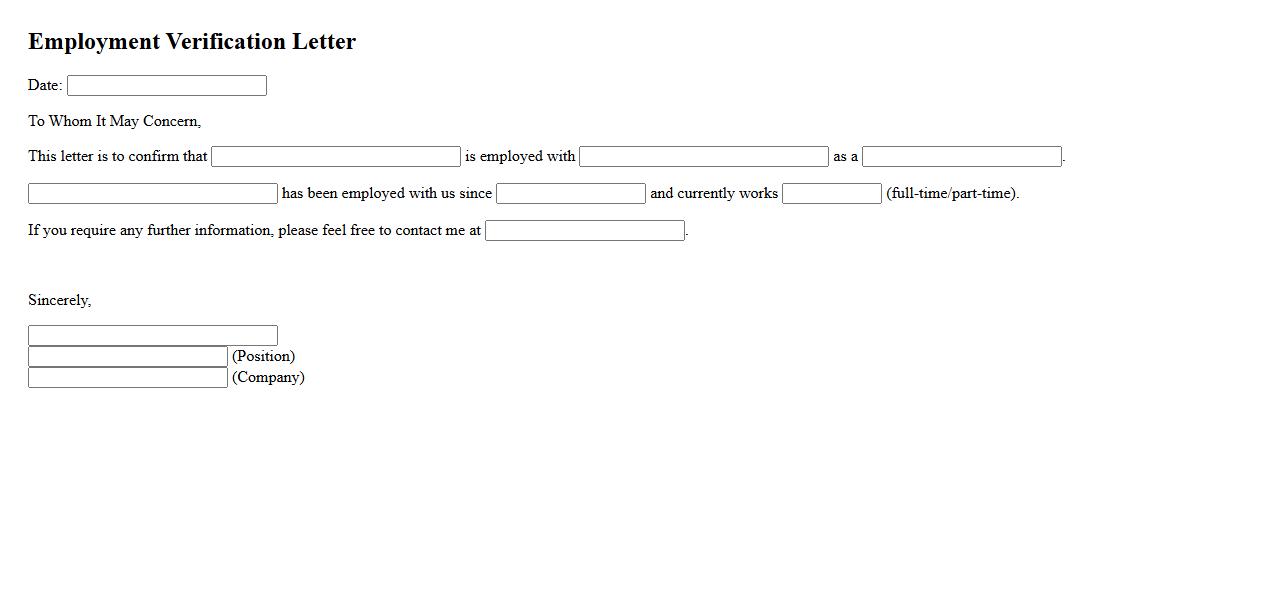

Employment verification letter

An employment verification letter is an official document provided by an employer confirming an individual's job status, position, and length of employment. This letter is often required for loan applications, rental agreements, or visa processes to validate income and employment details. It serves as a reliable proof of employment for various legal and financial purposes.

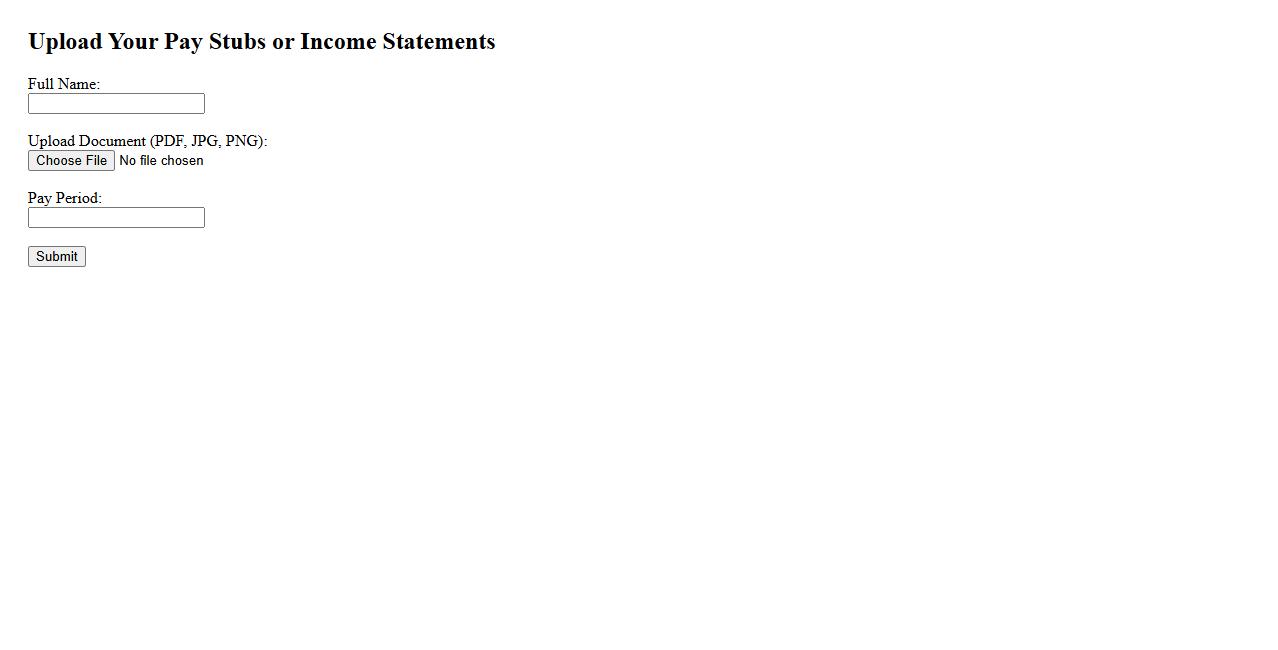

Pay stubs or income statements

Pay stubs or income statements provide detailed records of an employee's earnings, deductions, and net pay for a specific pay period. These documents are essential for verifying income, managing taxes, and tracking financial history. They serve as proof of employment and income for various financial and legal purposes.

Household member’s evidence (Form I-864A if used)

Household member's evidence is critical when submitting Form I-864A, which demonstrates the combined financial resources of a household to support a visa applicant. This evidence includes proof of income, tax returns, and employment verification for each contributing member. Proper documentation ensures the affidavit of support meets USCIS requirements for financial sponsorship.

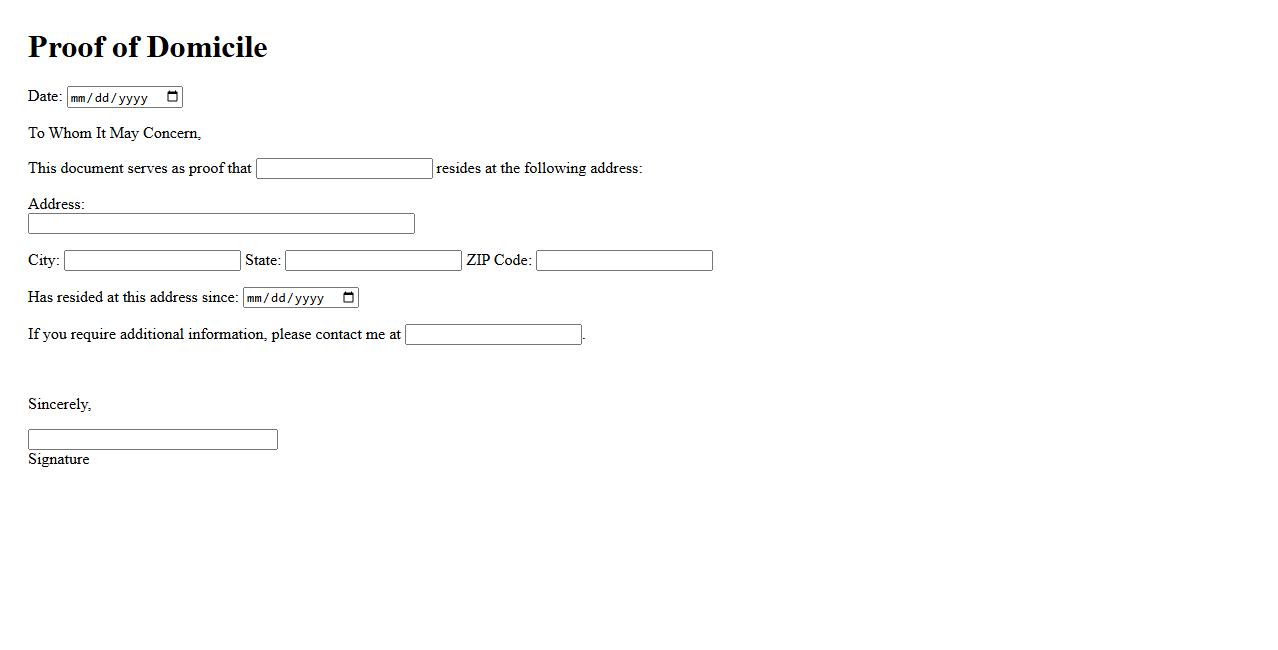

Proof of domicile in the United States

Proof of domicile in the United States is an essential document that verifies a person's legal residence within a specific state or locality. It is often required for various purposes such as driver's license applications, voter registration, and tax filings. Common documents used as proof include utility bills, lease agreements, and state-issued identification cards.

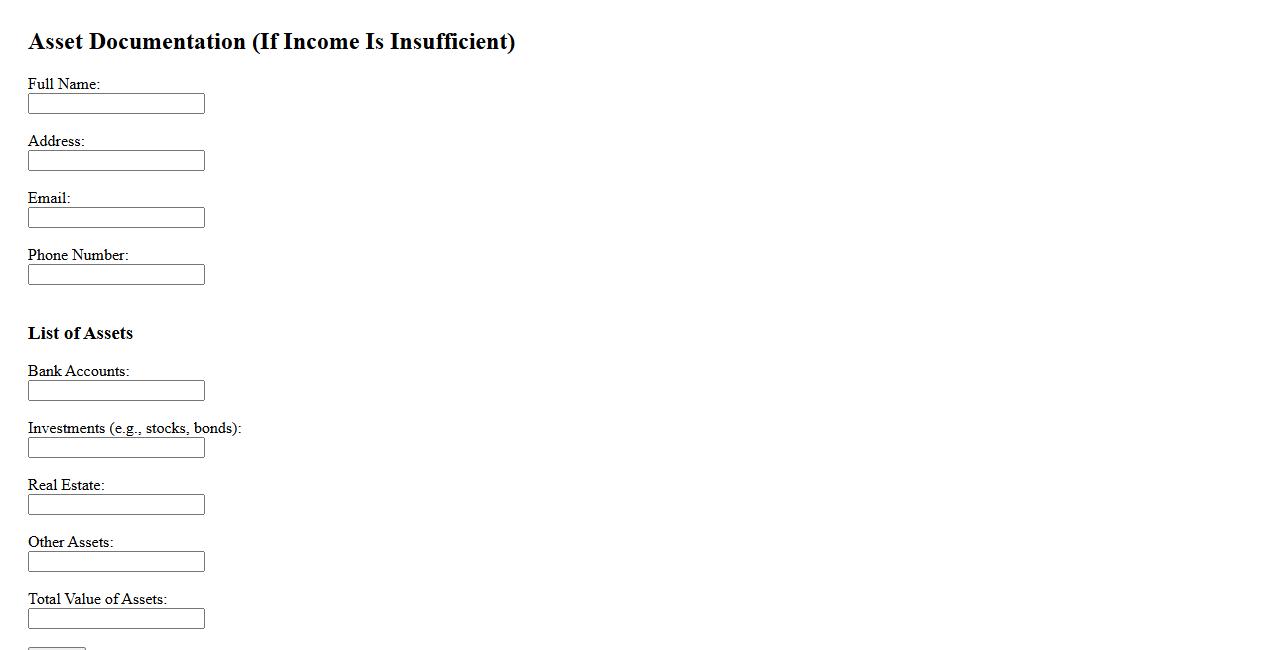

Asset documentation (if income is insufficient)

Asset documentation is essential when income alone does not meet the required criteria for financial assessments. It involves providing detailed records of valuable possessions to support loan applications or credit approvals. This documentation helps verify the applicant's overall financial stability beyond just income statements.

What is the primary legal purpose of submitting Form I-864, Affidavit of Support, under Section 213A of the INA?

The primary legal purpose of submitting Form I-864 is to demonstrate that the intending immigrant has adequate financial support and is unlikely to become a public charge. This form is a binding contract between the sponsor and the U.S. government to ensure financial assistance. It protects the public welfare system by legally obligating the sponsor to support the immigrant.

Who qualifies as a "sponsor" for Form I-864, and what are the eligibility requirements?

A sponsor is typically a U.S. citizen or lawful permanent resident who is 18 years or older. The sponsor must have a domicile in the United States or its territories at the time of filing. Additionally, the sponsor must meet minimum income requirements based on the federal poverty guidelines to qualify.

What financial obligations does the sponsor assume upon signing Form I-864?

By signing Form I-864, the sponsor accepts a legally enforceable obligation to provide financial support. This includes maintaining the immigrant at an income not below 125% of the federal poverty level. The obligation continues until the immigrant becomes a U.S. citizen, can be credited with 40 quarters of work, departs the U.S. permanently, or dies.

What income documentation or evidence must be submitted with Form I-864 to demonstrate financial capability?

The sponsor must submit evidence of income such as recent federal tax returns, W-2 forms, or an official letter from an employer. Additional documents may include pay stubs or proof of assets if income alone is insufficient. These documents verify the sponsor's ability to meet the financial requirements.

Under what circumstances can the financial support obligation created by Form I-864 end or be terminated?

The financial obligation typically ends when the immigrant becomes a U.S. citizen or has worked 40 quarters in the U.S. It also terminates if the immigrant permanently leaves the United States or dies. The sponsor remains responsible until one of these conditions is fully met.