The Submission of Form I-829, Petition by Investor to Remove Conditions on Permanent Resident Status is a critical step for immigrant investors seeking to transition from conditional to permanent residency in the United States. This petition must be filed within 90 days before the expiration of the investor's two-year conditional green card. Approval of Form I-829 demonstrates that the investor has met all investment and job creation requirements associated with the EB-5 Immigrant Investor Program.

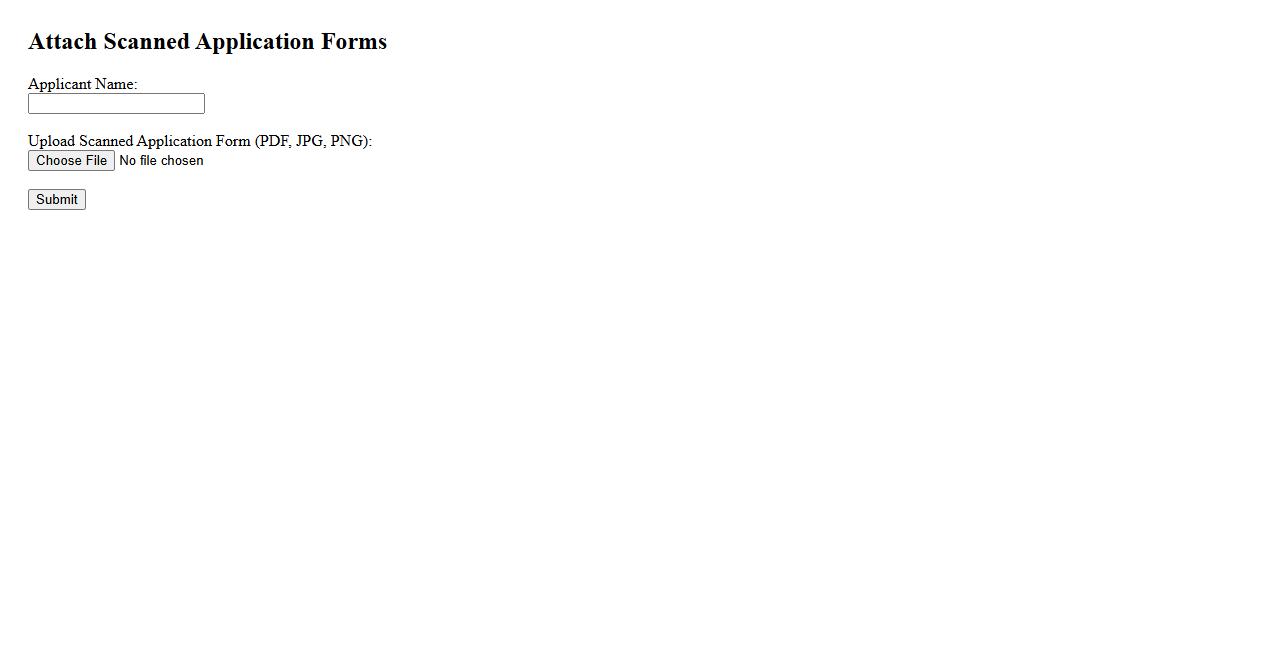

Scanned application forms

Scanned application forms provide a digital copy of physical documents, ensuring easy storage and retrieval. These images capture all entered information accurately, facilitating seamless processing and verification. Utilizing scanned application forms enhances efficiency in data management and reduces paper clutter.

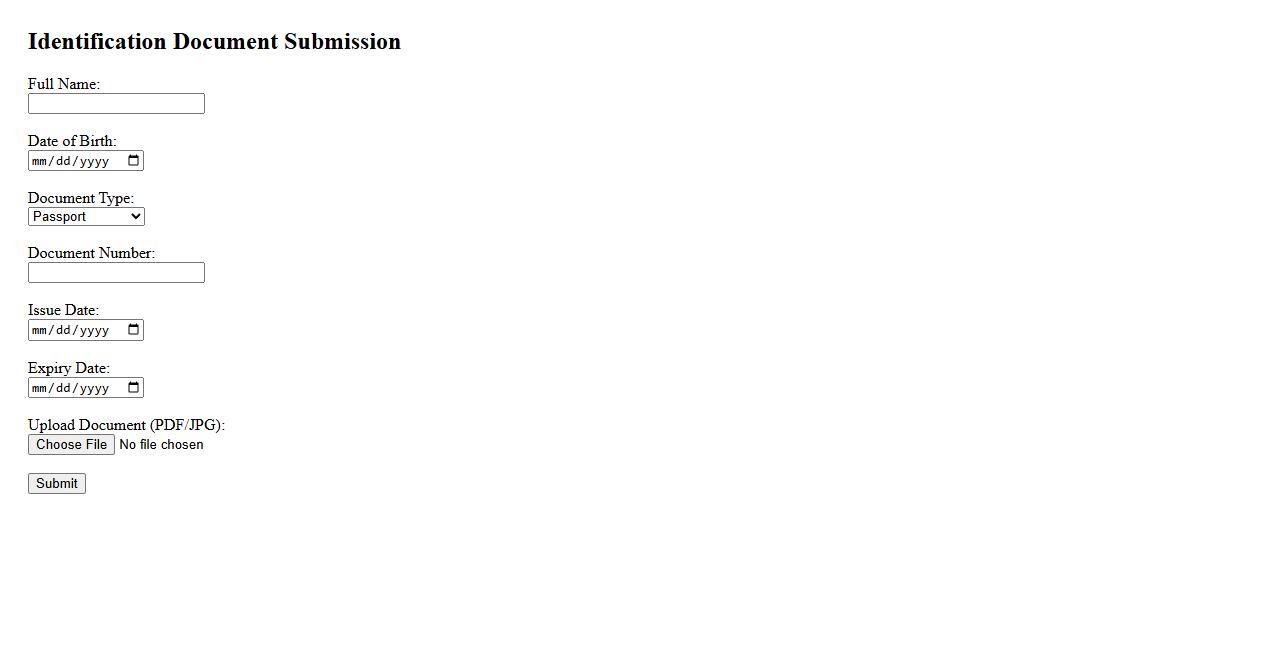

Identification documents

Identification documents are official papers used to verify a person's identity. They often include items such as passports, driver's licenses, and national ID cards. These documents are essential for accessing services, traveling, and proving legal status.

Proof of investment

Proof of investment is a crucial document that verifies the allocation of funds into a particular asset or project. It serves as evidence for both legal and financial purposes, ensuring transparency and accountability. Investors can use this proof to track their contributions and validate ownership.

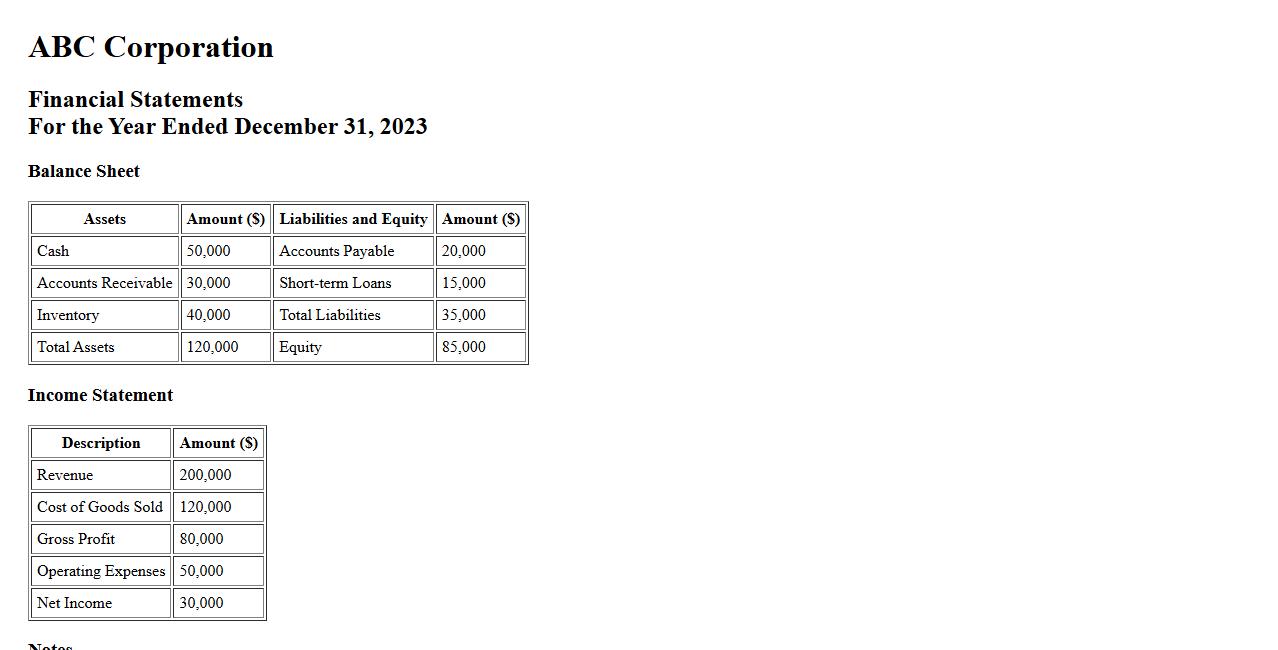

Financial statements

Financial statements provide a formal record of the financial activities and position of a business, person, or other entity. They include the balance sheet, income statement, and cash flow statement, offering insights into profitability, liquidity, and financial health. These documents are essential for investors, management, and regulatory agencies to make informed decisions.

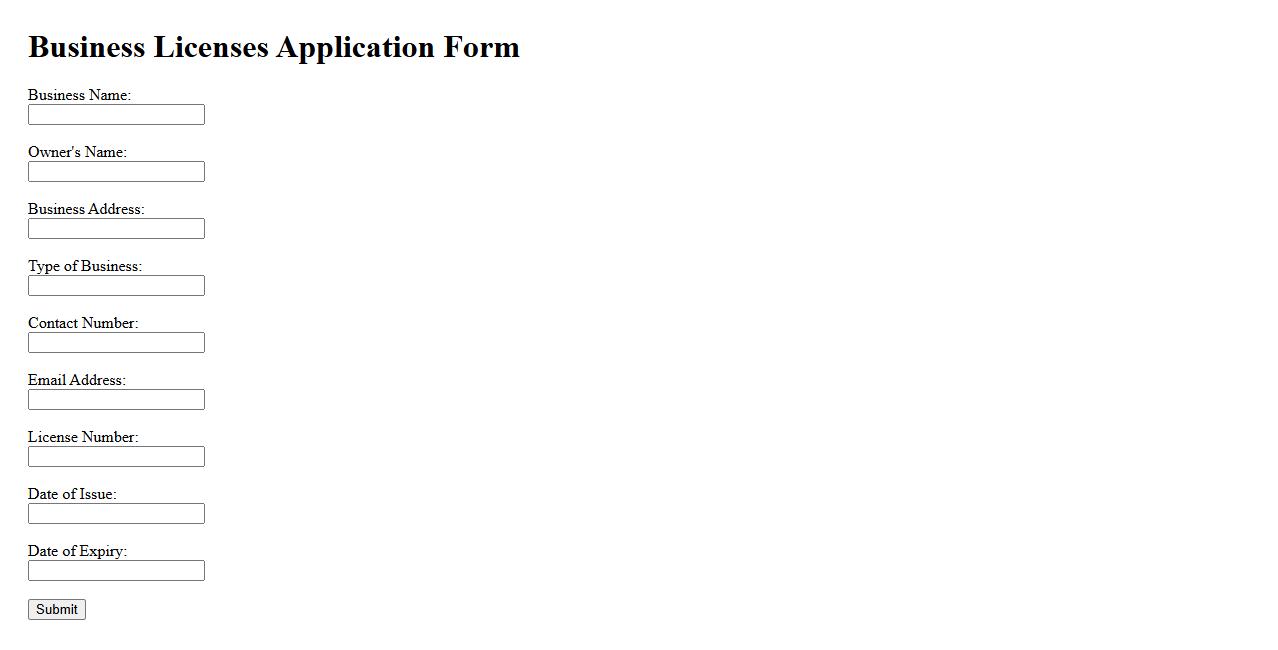

Business licenses

Business licenses are official permits issued by government authorities that allow individuals or companies to operate legally within a specific industry or location. These licenses ensure compliance with local regulations and help maintain standards of safety and quality. Obtaining the correct business license is essential for avoiding fines and legal issues.

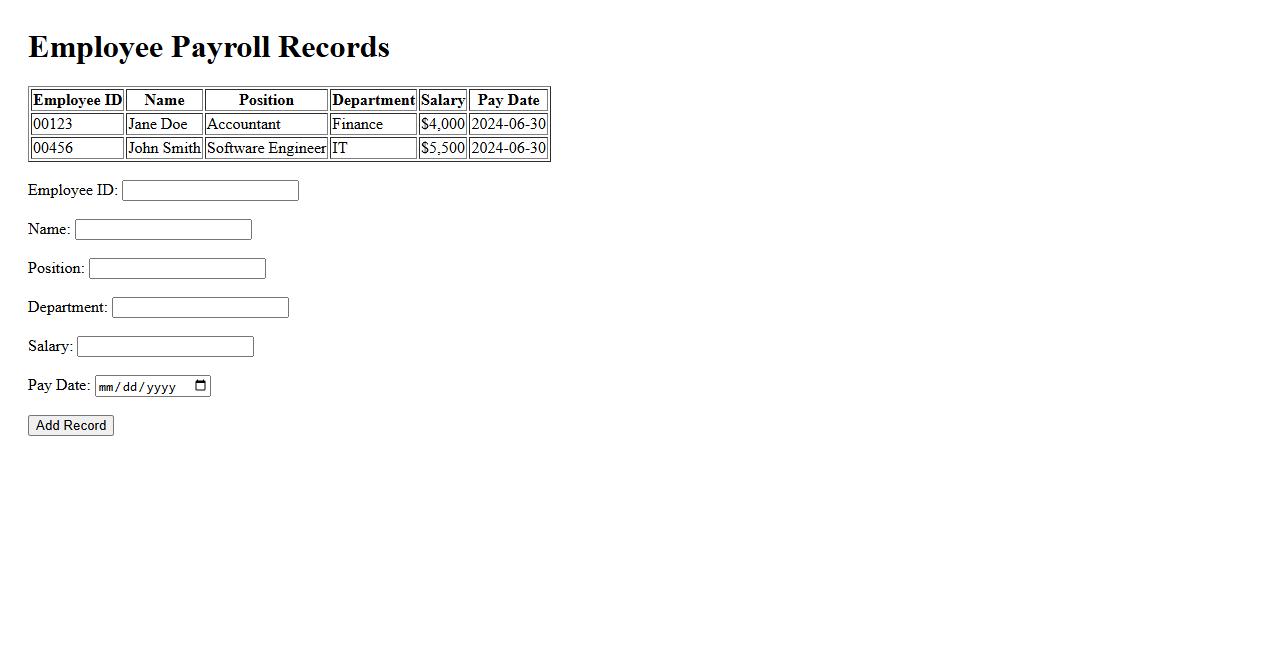

Employee payroll records

Employee payroll records are essential documents that detail the compensation, deductions, and payment history of each employee. Maintaining accurate payroll records ensures compliance with tax regulations and facilitates smooth financial management. These records help organizations track wages, benefits, and tax withholdings efficiently.

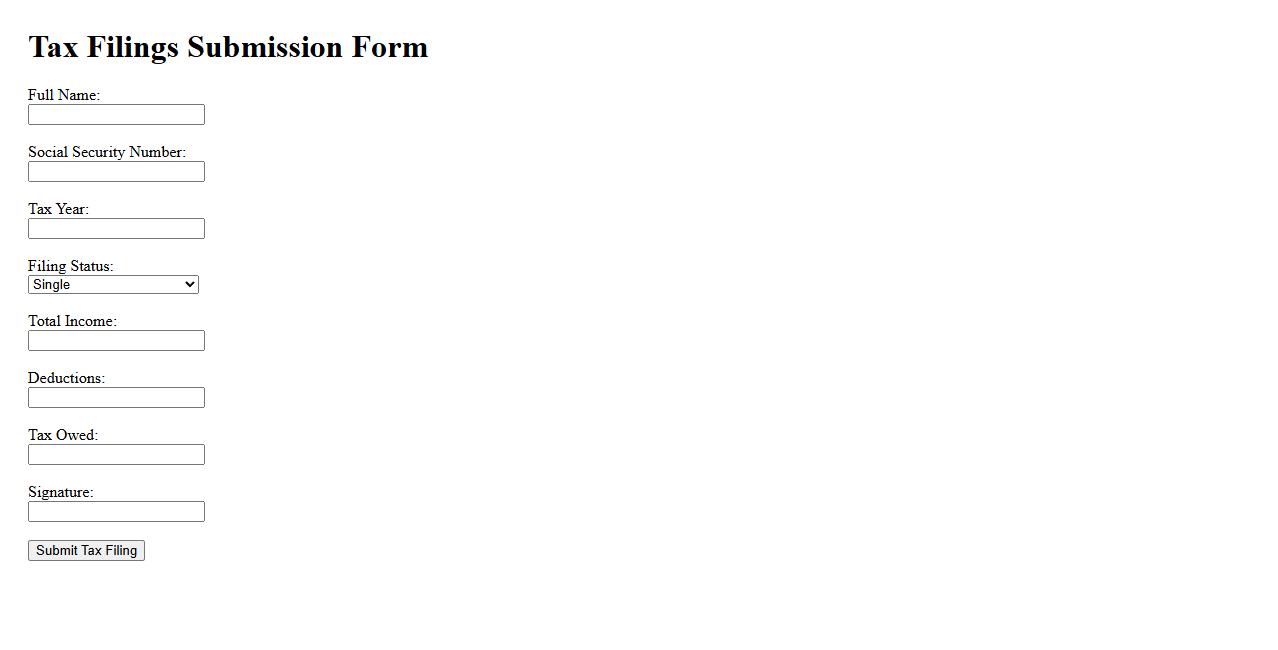

Tax filings

Tax filings are essential documents submitted to tax authorities to report income, expenses, and other pertinent financial information. Accurate tax filings ensure compliance with legal obligations and help avoid penalties or audits. Timely submissions contribute to efficient financial management and transparency.

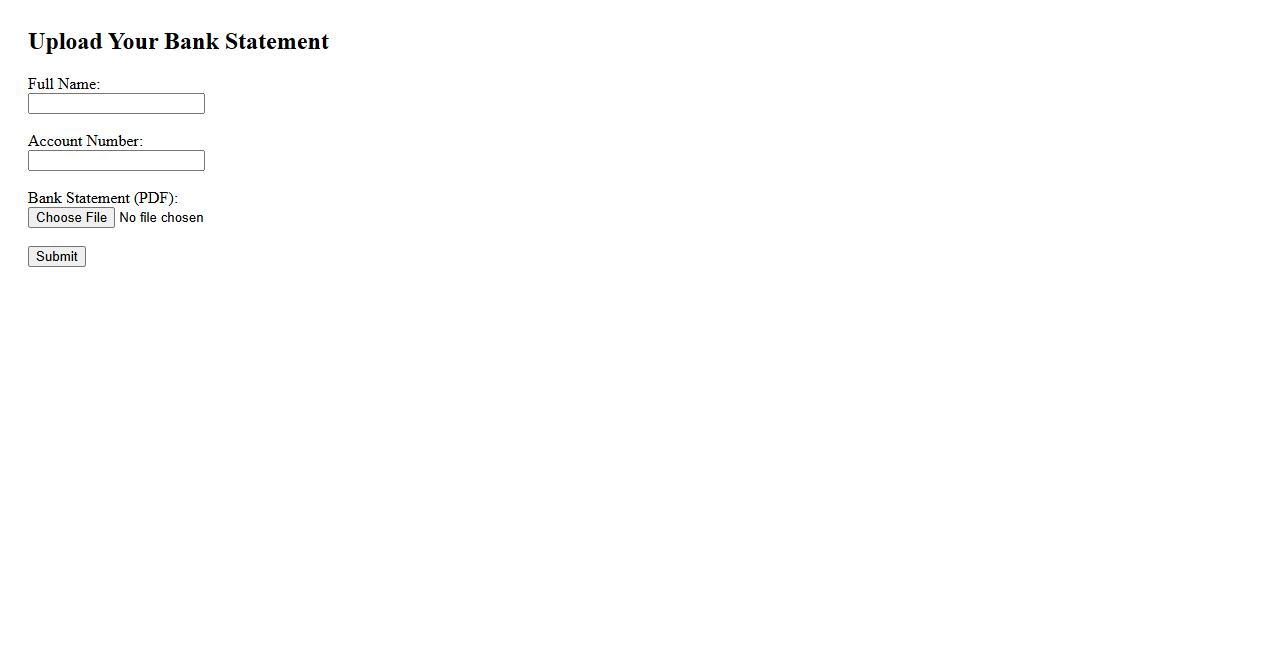

Bank statements

Bank statements provide a detailed record of all transactions within a bank account over a specific period. They help individuals track their spending, verify deposits, and detect any unauthorized activity. Regularly reviewing bank statements ensures better financial management and accurate budgeting.

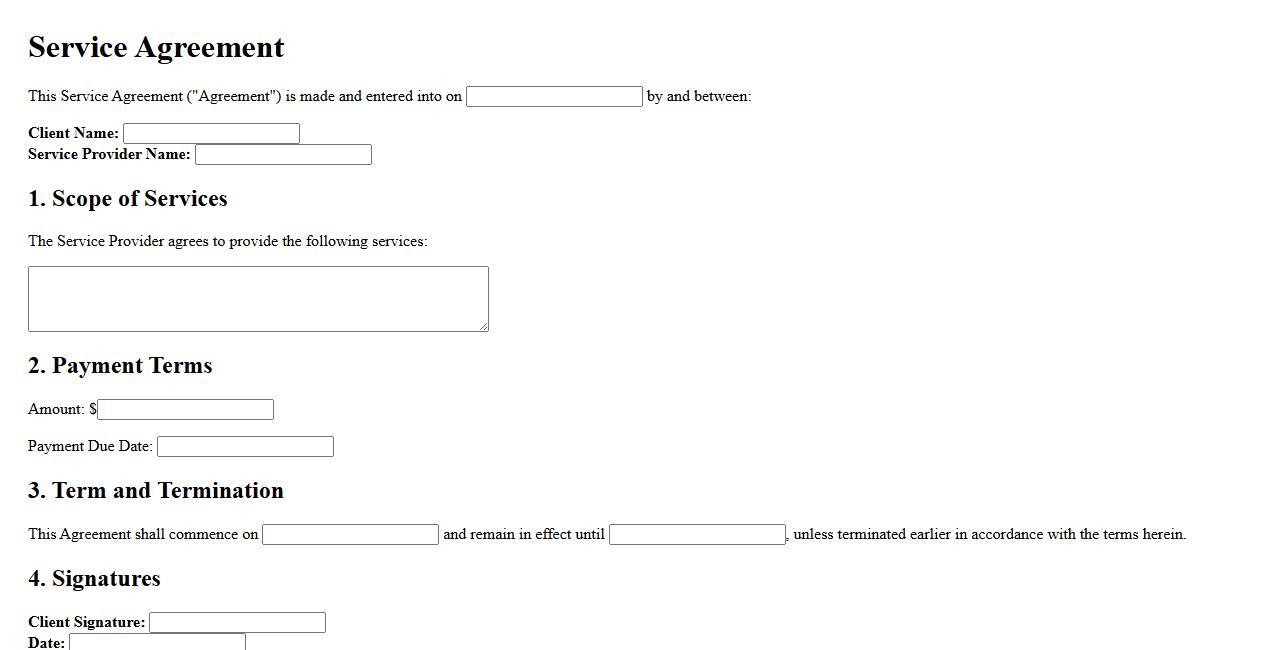

Contracts or agreements

Contracts or agreements are legally binding documents that outline the terms and conditions agreed upon by parties. They establish clear obligations and protect the interests of all involved, ensuring mutual understanding and compliance. These essential tools facilitate smooth business transactions and personal arrangements.

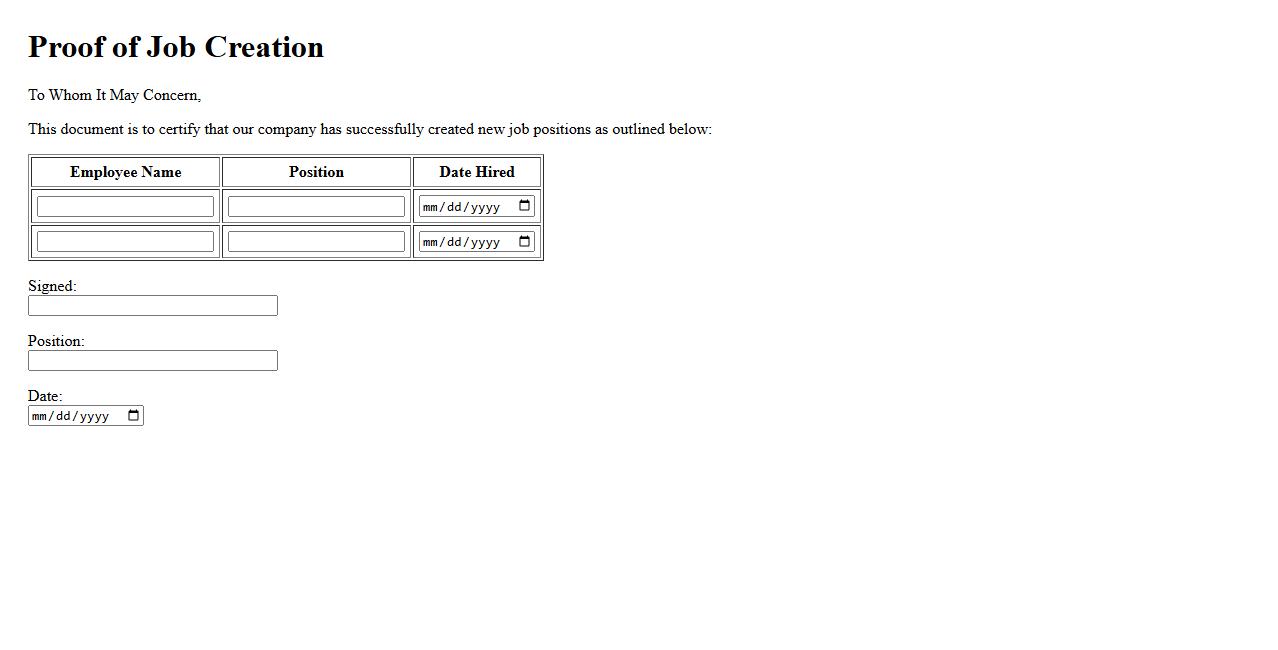

Proof of job creation

Proof of job creation is essential for demonstrating a company's impact on employment. This documentation typically includes records such as payroll reports, employment contracts, and tax filings. Providing clear evidence supports compliance with regulatory requirements and validates business growth efforts.

What evidence must accompany Form I-829 to demonstrate the investment has been sustained and the required jobs have been created?

To successfully file Form I-829, applicants must submit evidence demonstrating the sustained investment throughout the conditional residency period. This includes documentation proving capital was invested in a qualifying commercial enterprise and that the enterprise has created or will create at least 10 full-time jobs for qualifying employees. Essential evidence may include tax returns, payroll records, and financial statements verifying job creation and the ongoing business operation.

Who is eligible to file Form I-829, Petition by Investor to Remove Conditions on Permanent Resident Status?

Investors conditional permanent residents who obtained status through the EB-5 Immigrant Investor Program are eligible to file Form I-829. The petitioner must demonstrate that the investment was sustained and the necessary job creation requirements were met. Only the principal investor, not dependents, can file this petition to remove the conditions on their permanent residence.

What is the filing window for submitting Form I-829 after obtaining conditional permanent resident status?

Form I-829 must be filed within the 90-day period immediately preceding the second anniversary of the investor's admission as a conditional permanent resident. Early or late submissions outside this timeframe can result in denial or loss of conditional resident status. Timely filing ensures seamless transition to permanent residency without conditional restrictions.

How does criminal history or prior immigration violations affect Form I-829 eligibility?

Criminal history and prior immigration violations can significantly impact eligibility to file Form I-829. USCIS evaluates the moral character and admissibility of the petitioner, and certain offenses may result in the denial of the petition. It is critical to disclose all relevant information and consult legal guidance to address potential issues before filing.

What are the consequences of failing to timely file Form I-829 for both principal investors and their dependents?

Failing to file Form I-829 within the required period results in loss of conditional permanent resident status for the principal investor. This also affects any dependents by causing them to lose their conditional residency and potentially face removal proceedings. Timely filing is essential to avoid deportation and maintain eligibility for permanent residency benefits.