The Statement of Child Care Expenses is a crucial document used to report costs incurred for child care during tax filings or legal proceedings. It details payments made to caregivers or child care providers, serving as proof of expenses for deductions or claims. Accurate completion of this statement ensures proper recognition of eligible child care costs.

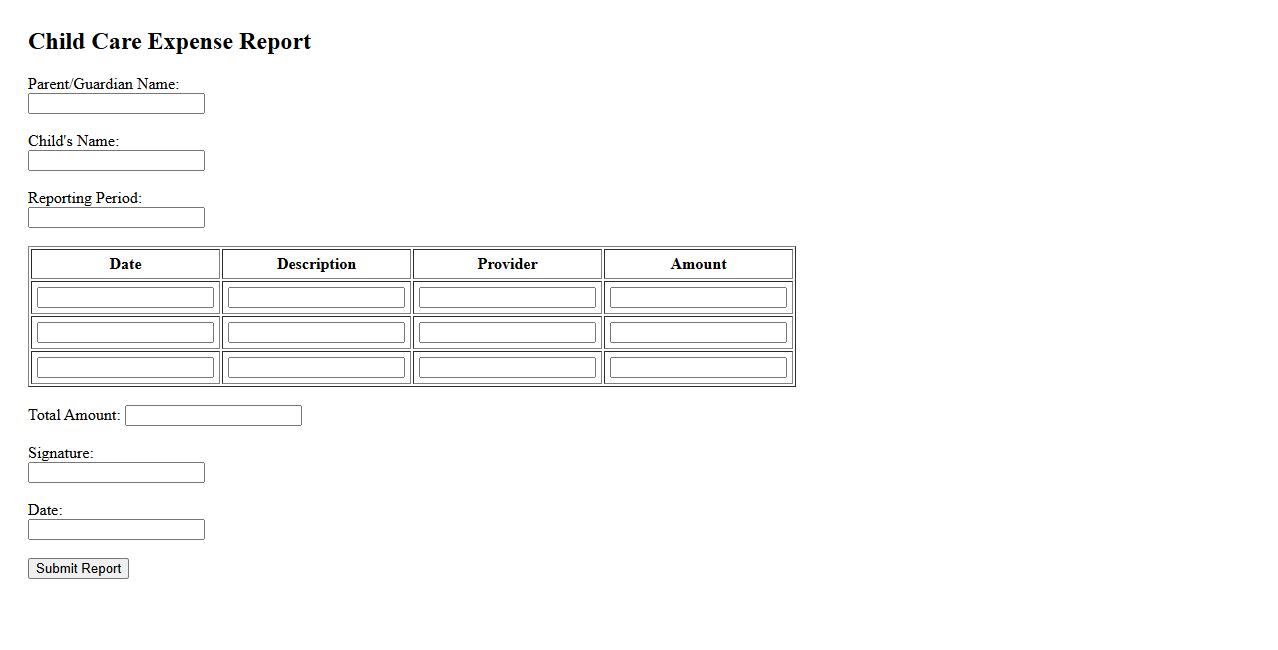

Child Care Expense Report

The Child Care Expense Report is a detailed form used to document childcare costs for reimbursement or tax purposes. It assists parents and guardians in tracking their expenses accurately. This report ensures proper financial management and compliance with relevant guidelines.

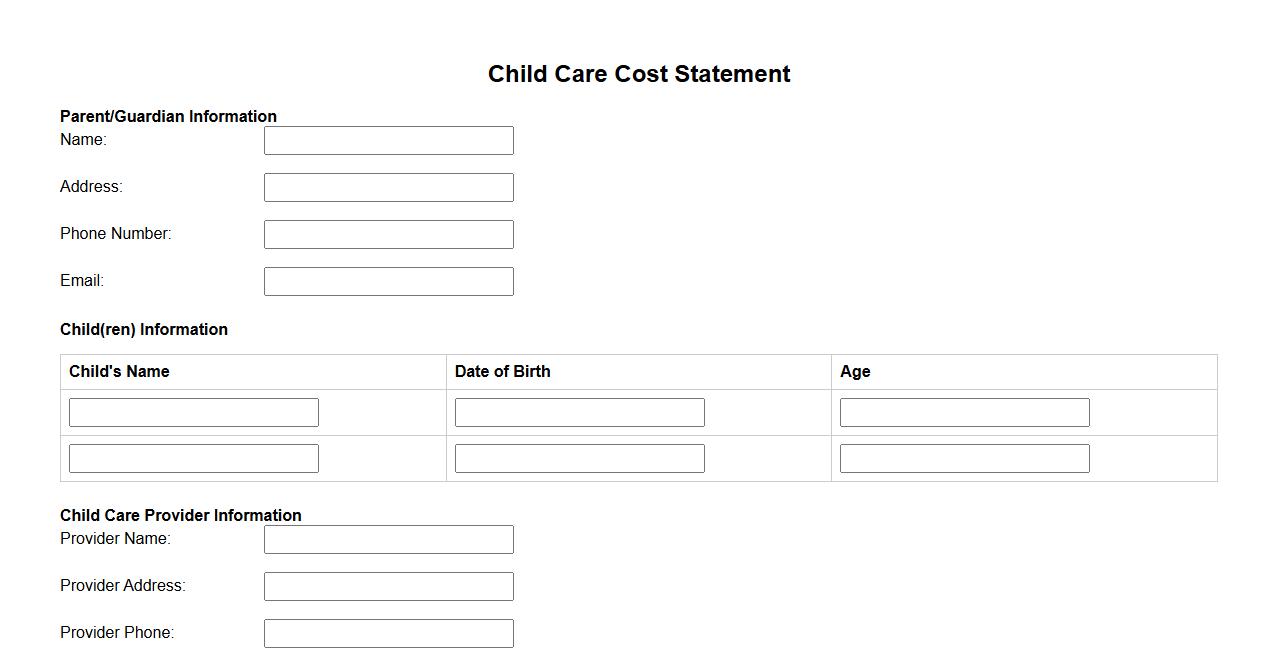

Child Care Cost Statement

The Child Care Cost Statement is a crucial document outlining the expenses associated with child care services. It helps parents and guardians accurately report and manage child care costs for budgeting or subsidy purposes. This statement ensures transparency and supports financial planning for families.

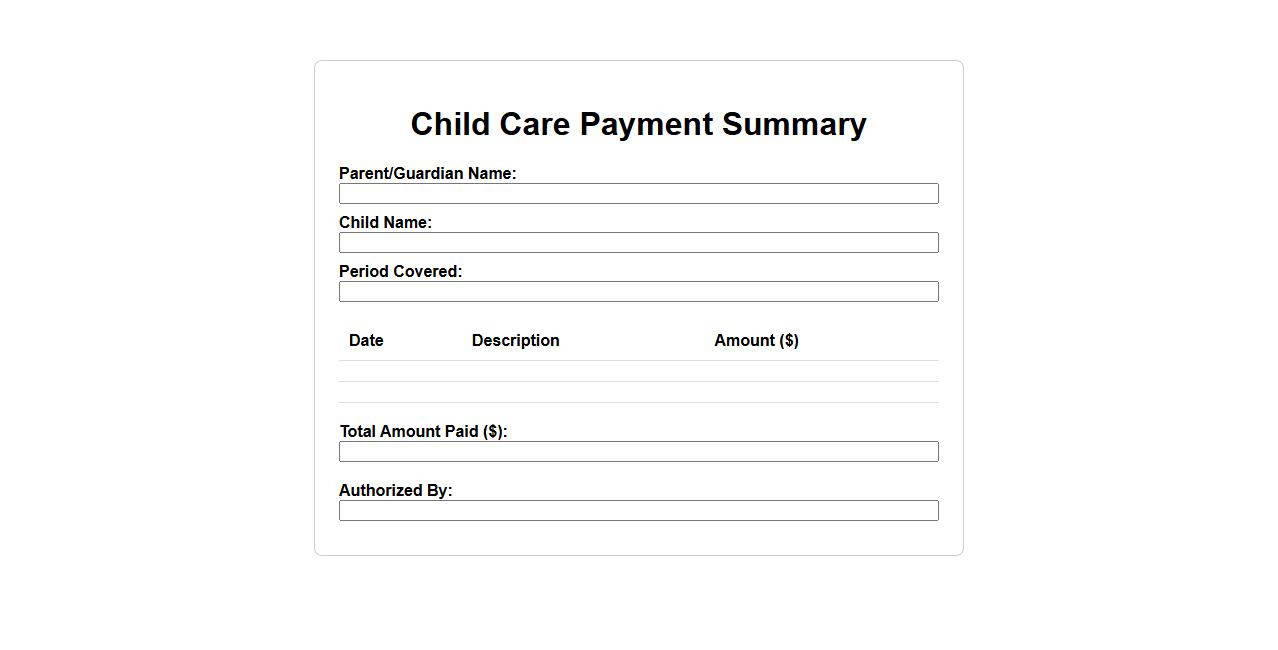

Child Care Payment Summary

The Child Care Payment Summary provides a clear overview of all transactions related to child care services. It helps parents and guardians track payments made, upcoming fees, and any outstanding balances. This summary ensures transparency and easy management of child care expenses.

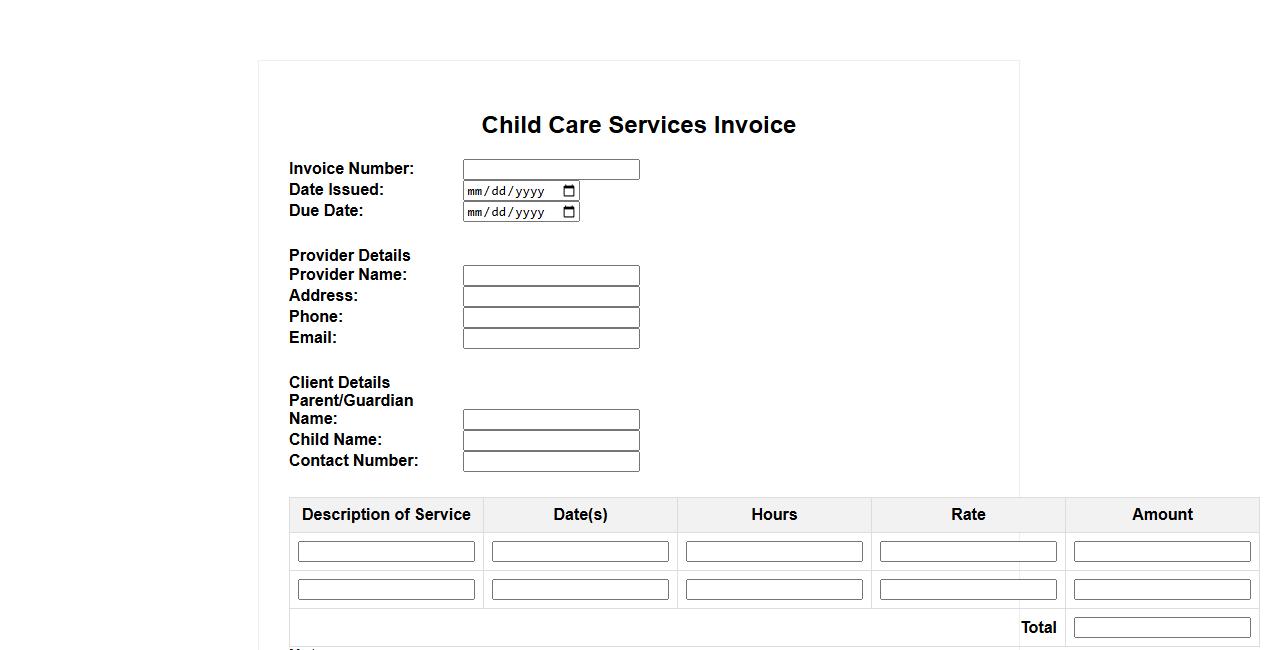

Child Care Services Invoice

An Child Care Services Invoice is a detailed document provided by child care centers to bill parents for services rendered. It itemizes fees such as daily care, meals, and additional activities, ensuring clear communication of costs. This invoice helps maintain transparent financial records between providers and families.

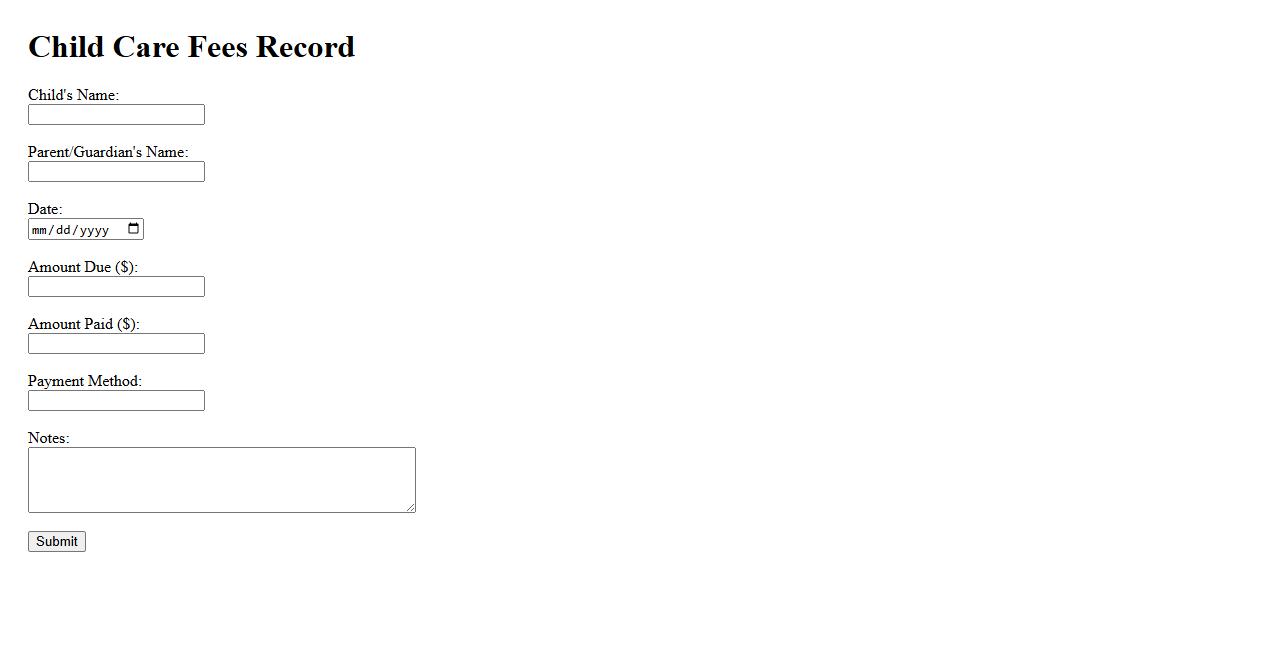

Child Care Fees Record

The Child Care Fees Record is an essential document that tracks all payments made for childcare services. It helps parents and providers maintain transparent financial accounts and ensures accurate billing. Keeping this record updated supports smooth communication and proper budgeting.

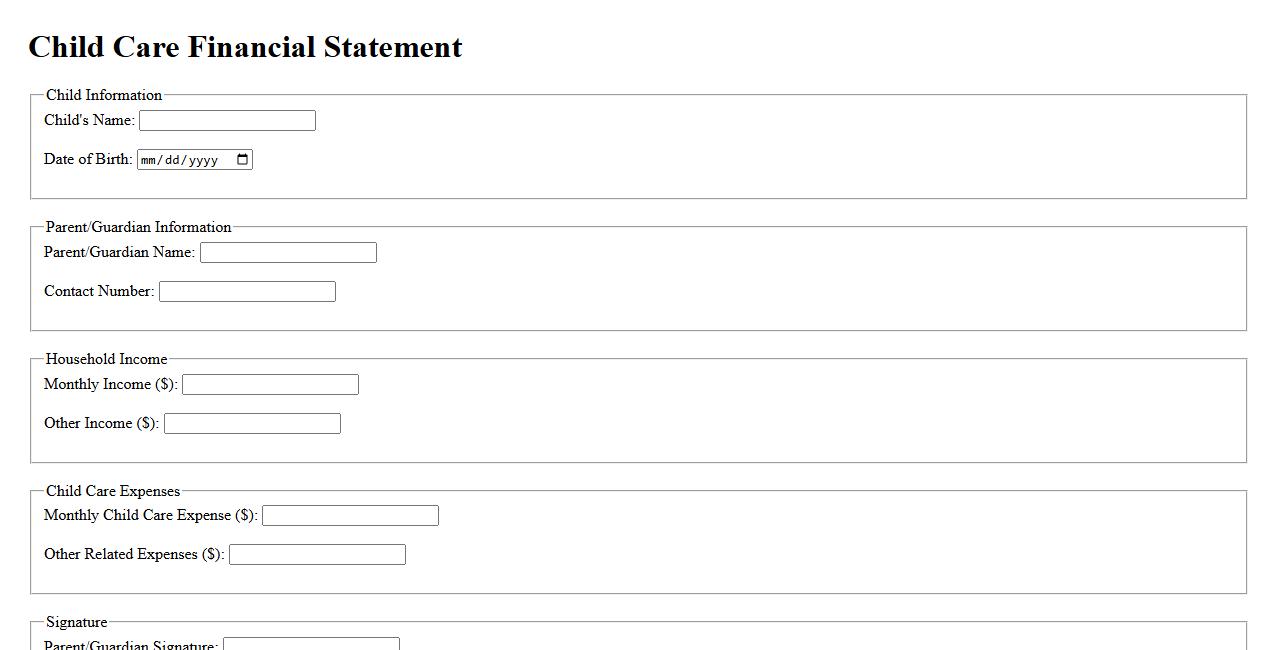

Child Care Financial Statement

A Child Care Financial Statement is a detailed form used to assess a family's financial situation when applying for child care assistance or subsidies. It provides essential information about income, expenses, and assets to determine eligibility for support programs. Accurate completion of this statement ensures appropriate financial aid is granted based on the family's needs.

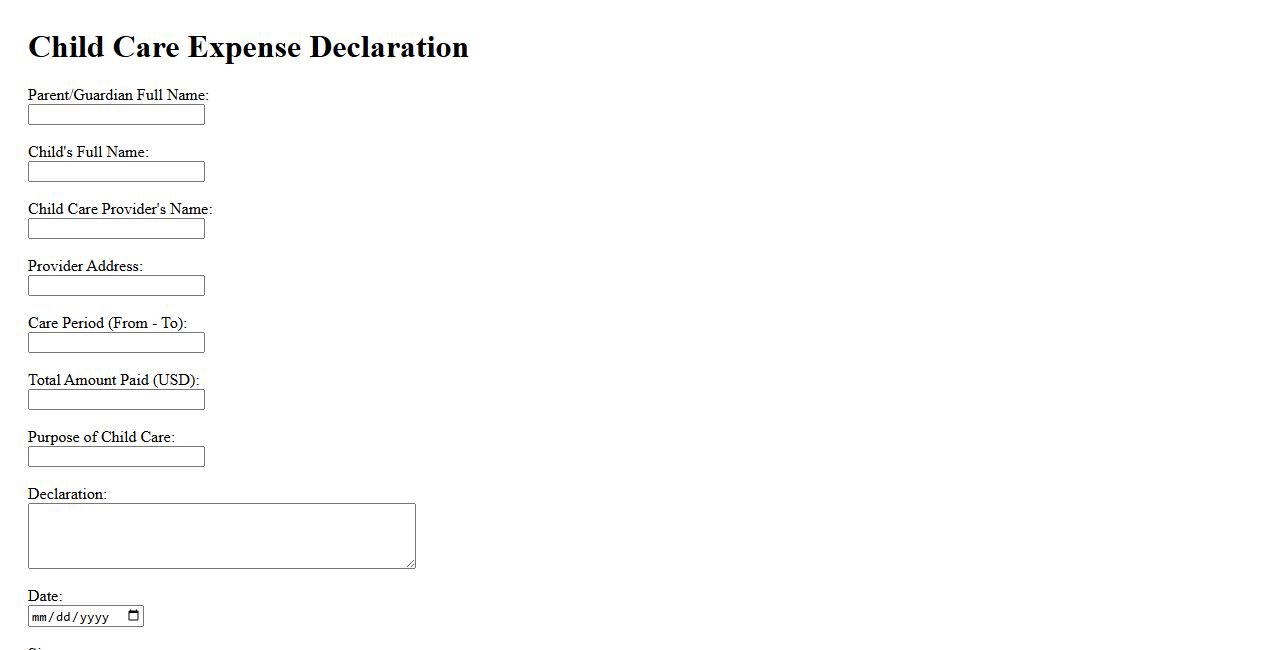

Child Care Expense Declaration

The Child Care Expense Declaration is a formal document that parents or guardians submit to report their child care costs. This declaration is essential for tax benefits and financial assistance applications. It ensures accurate verification of expenses incurred for child care services.

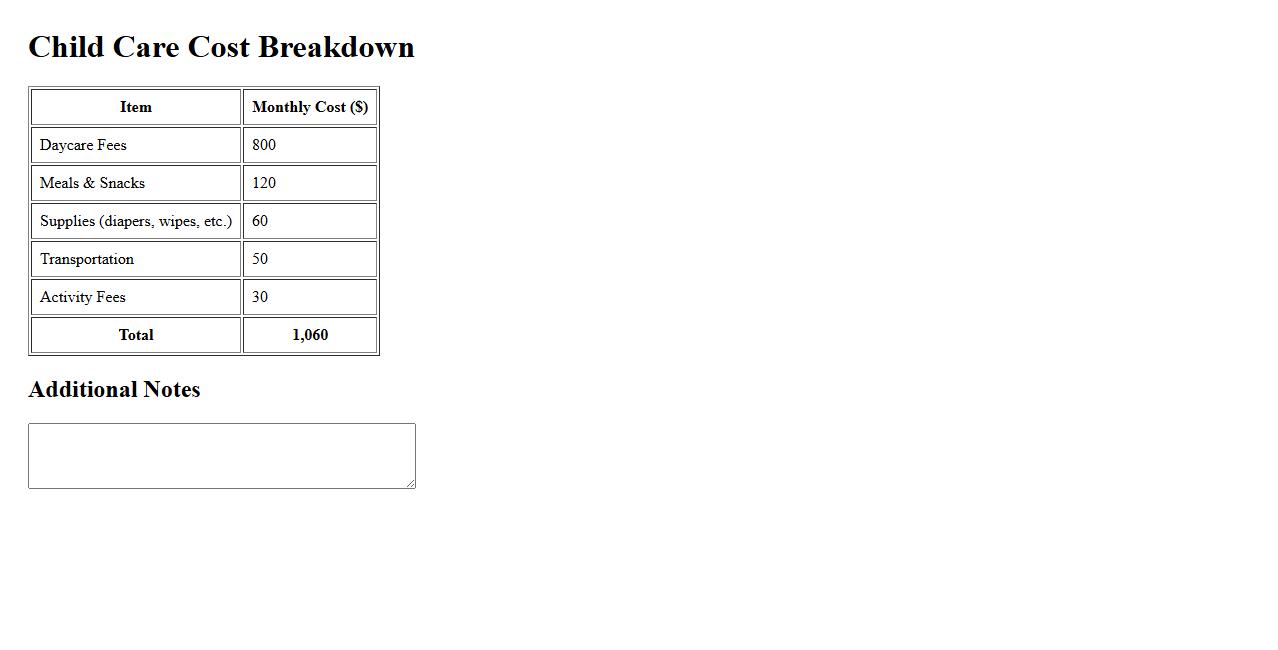

Child Care Cost Breakdown

The child care cost breakdown provides a detailed overview of the various expenses involved in caring for a child. It typically includes tuition, supplies, meals, and additional activity fees. Understanding these costs helps parents budget effectively and make informed decisions about their child's care.

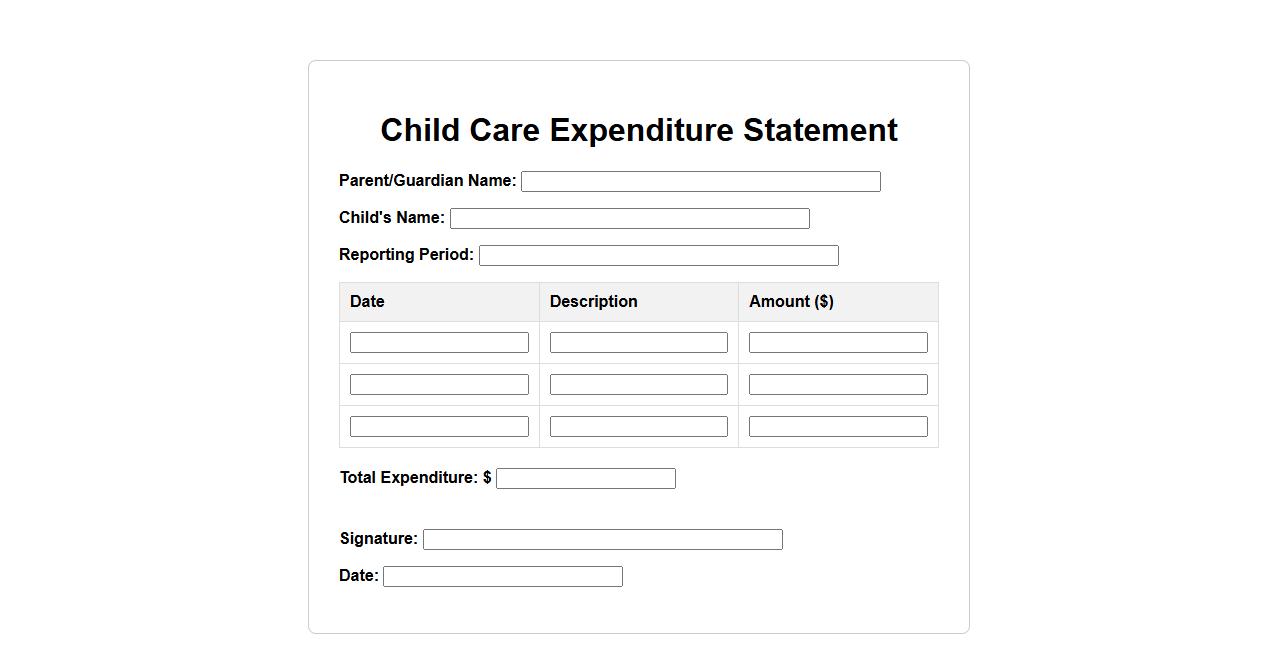

Child Care Expenditure Statement

The Child Care Expenditure Statement is a detailed record outlining the costs associated with childcare services. It helps parents and guardians track expenses, ensuring accurate budgeting and financial planning. This statement is essential for tax purposes, reimbursement claims, or financial assistance applications.

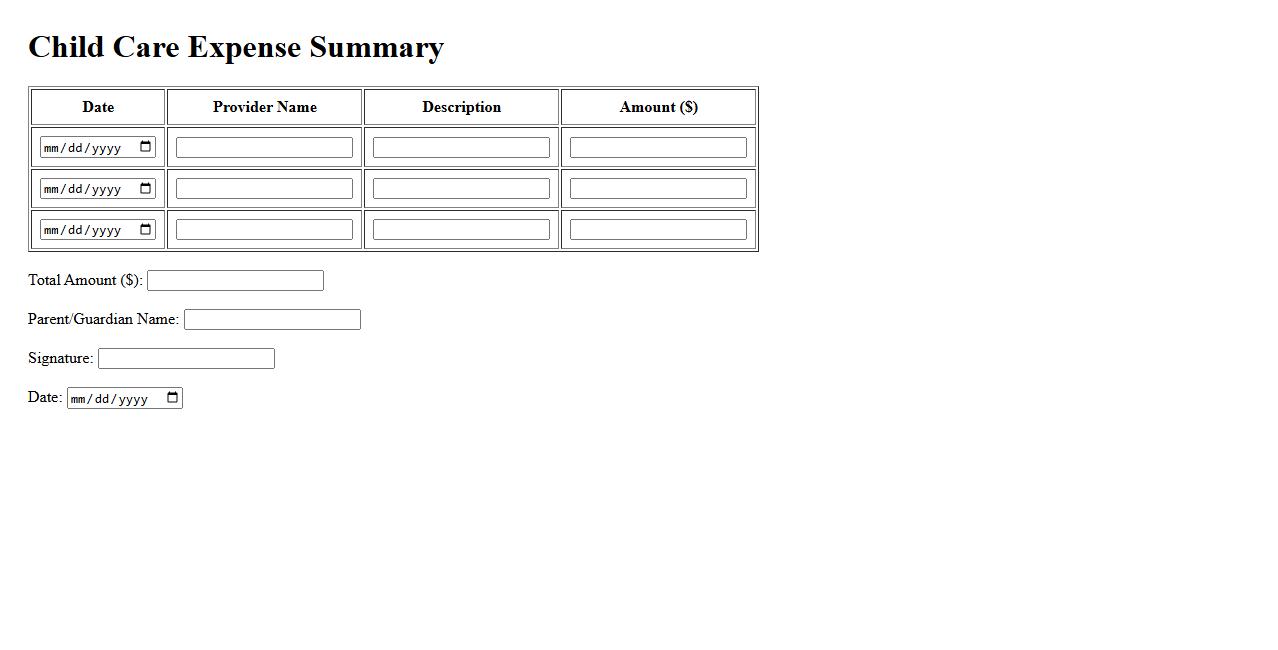

Child Care Expense Summary

The Child Care Expense Summary provides a concise overview of all child care costs incurred during a specific period. It helps parents and guardians track their expenses accurately for budgeting and tax purposes. This summary ensures transparency and easy reference for managing child care finances effectively.

What constitutes eligible child care expenses according to the Statement of Child Care Expenses?

Eligible child care expenses include payments made to caregivers for services that enable parents to work, attend school, or conduct other income-producing activities. These expenses typically cover fees paid for daycare centers, babysitters, and daycare homes. It is important that the costs are reasonable and relate directly to child care services.

Who qualifies as an eligible child care provider for these expense claims?

An eligible child care provider can be a person or organization that offers child care services in exchange for payment. This includes licensed daycares, nannies, babysitters, and relatives over 18 who are not dependents. Providers must not be the child's parent or legal guardian to qualify as eligible for claims.

What documentation is required to support a claim for child care expenses?

To support a child care expense claim, individuals must provide receipts detailing the provider's name, address, and the amount paid. The receipts should specify the dates of service and must authenticate the payment was made for child care. Keeping thorough and accurate documentation is essential for validating the expense.

How do shared custody arrangements affect the allocation of child care expenses?

In a shared custody arrangement, child care expenses are typically divided between parents based on the time each parent spends with the child. The claiming parent can only deduct expenses related to their custodial period unless both agree on a different allocation. Proper documentation of custody schedules is crucial for accurate expense claims.

What age limit applies to children for whom child care expenses can be claimed?

Child care expenses can generally be claimed for children under the age of 16 at the end of the year for which the expenses were incurred. Exceptions may apply for children with disabilities or special needs, potentially extending the age limit. Understanding these limits helps ensure compliance with eligibility requirements.