A Statement of Assets is a detailed document listing all the financial and physical assets owned by an individual or organization. It typically includes cash, investments, property, and other valuable possessions to provide a clear picture of net worth. This statement is essential for financial planning, loan applications, and legal purposes.

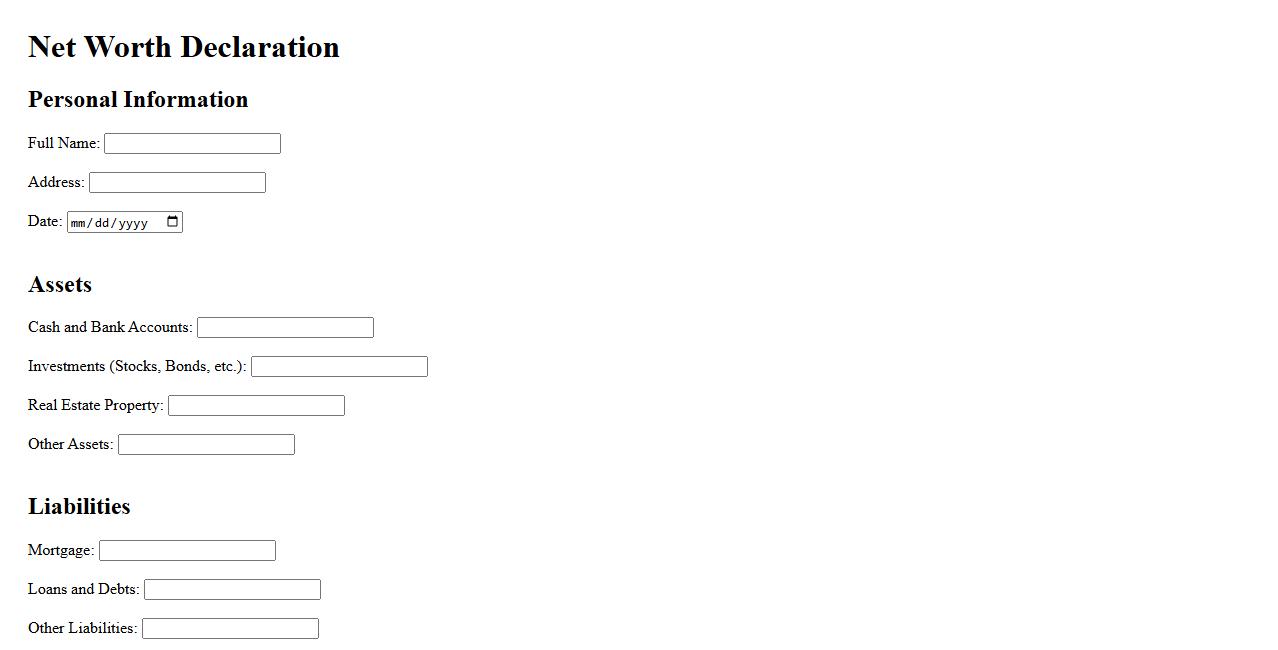

Net Worth Declaration

Net Worth Declaration is a document that outlines an individual's or entity's financial position by listing assets and liabilities. It is commonly used for legal, financial, or official purposes to provide transparency. This declaration helps in assessing financial stability and accountability.

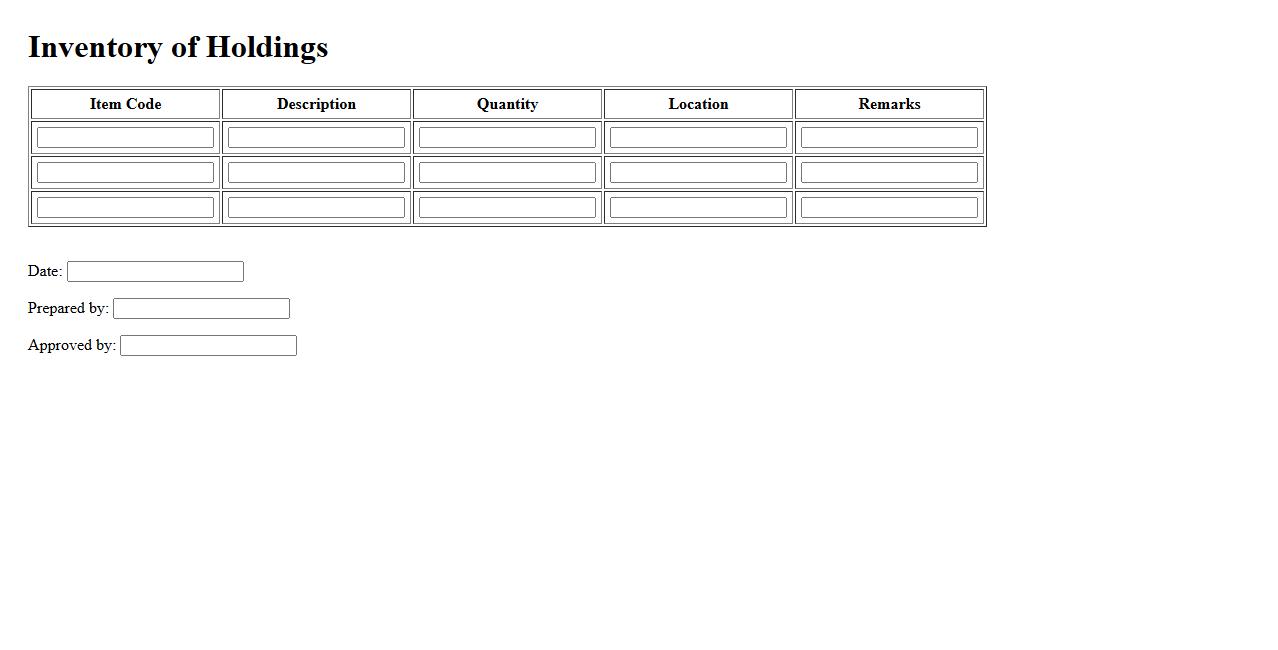

Inventory of Holdings

The Inventory of Holdings provides a detailed record of all assets and items currently owned or managed by an organization. It ensures accurate tracking and efficient management of resources. This comprehensive list helps in optimizing inventory control and decision-making processes.

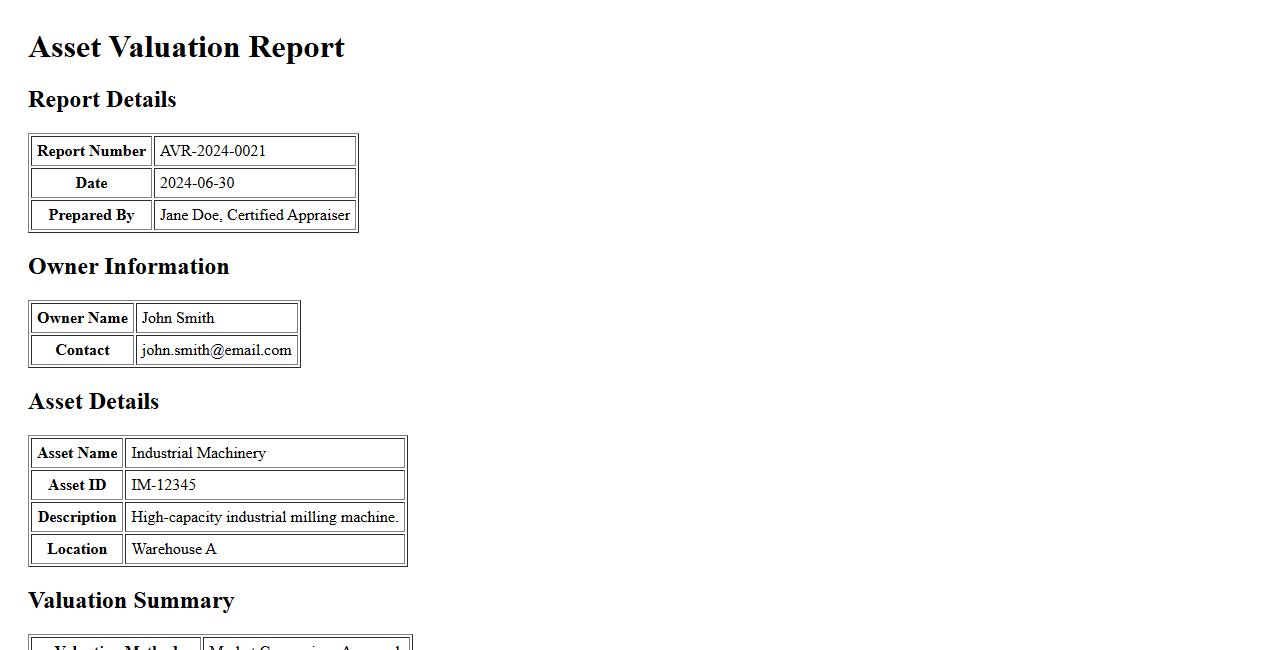

Asset Valuation Report

An Asset Valuation Report provides a detailed assessment of the current market value of a company's assets. It is essential for informed decision-making in investments, mergers, and financial reporting. Accurate valuation ensures transparency and supports strategic planning.

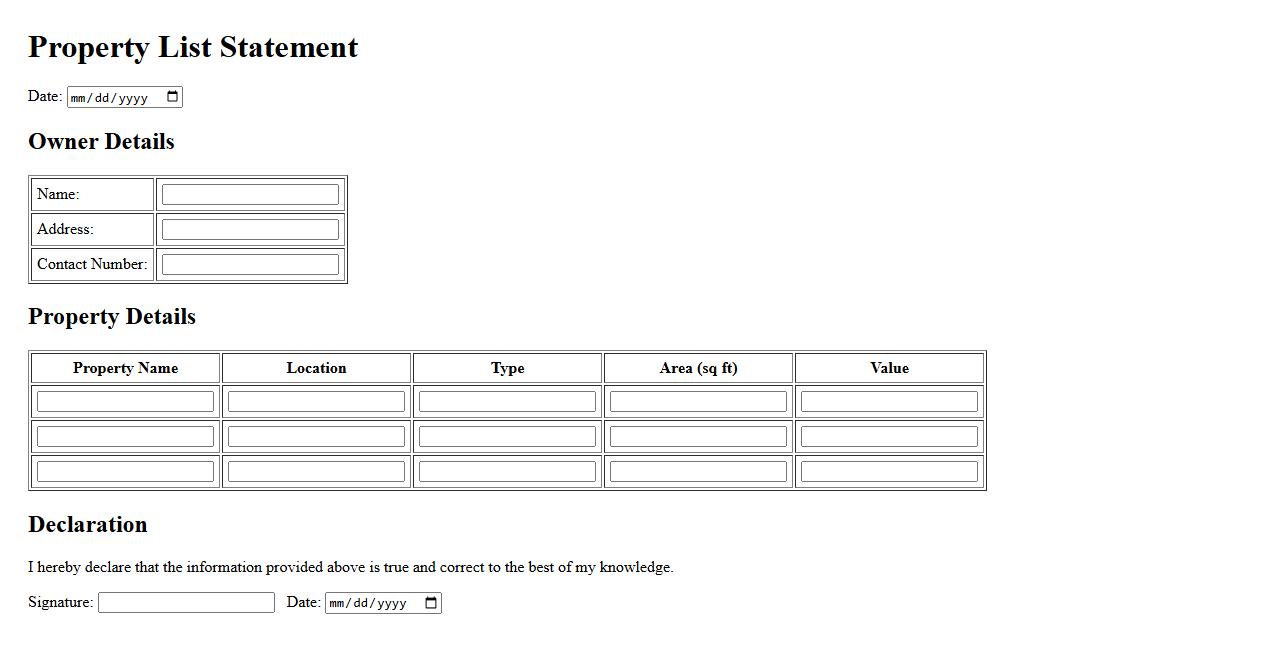

Property List Statement

The Property List Statement provides a detailed overview of all assets owned by an individual or entity. It is essential for financial reporting and legal documentation, ensuring transparency and accuracy. This statement helps in tracking property value and ownership status effectively.

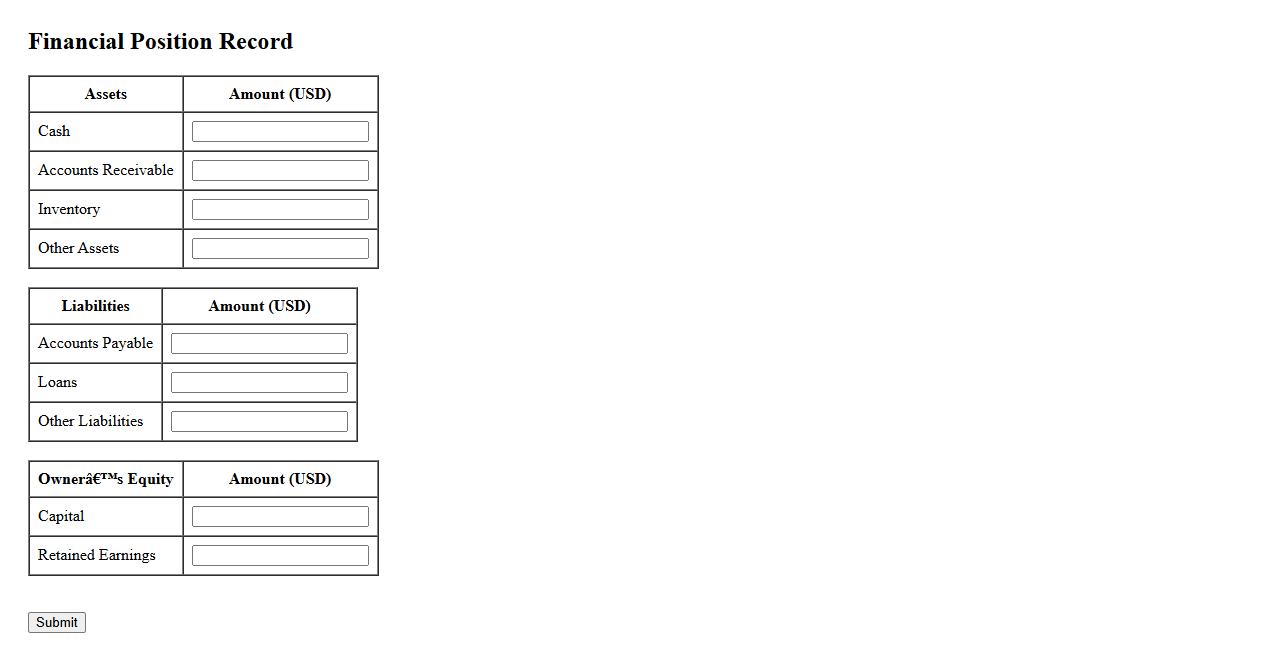

Financial Position Record

The Financial Position Record provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It is essential for assessing the overall financial health and stability of an organization. This record helps stakeholders make informed decisions based on the company's current economic standing.

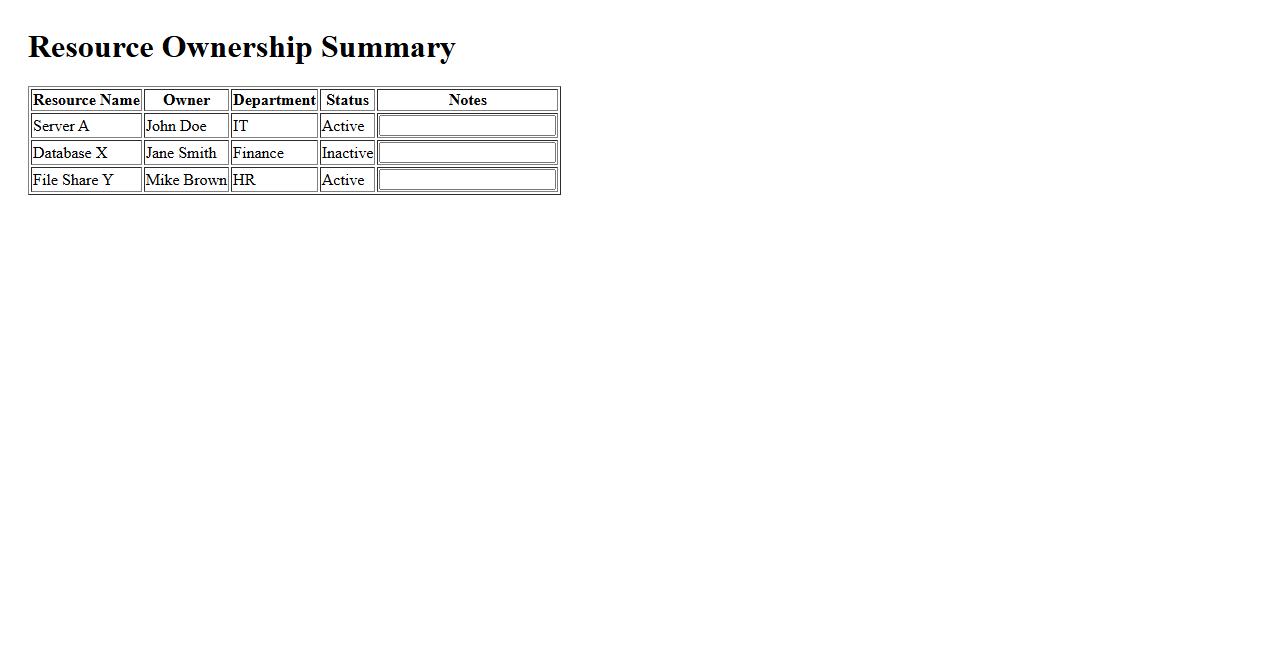

Resource Ownership Summary

The Resource Ownership Summary provides a clear overview of who controls and manages key assets within a project or organization. It helps in identifying accountability and ensures proper allocation of responsibilities. This summary is essential for maintaining transparent and efficient resource management.

Wealth Disclosure Form

The Wealth Disclosure Form is a critical document used to declare an individual's financial assets and sources of income. It ensures transparency and accountability in financial matters, particularly for public officials and employees. Completing this form helps prevent conflicts of interest and promotes ethical conduct.

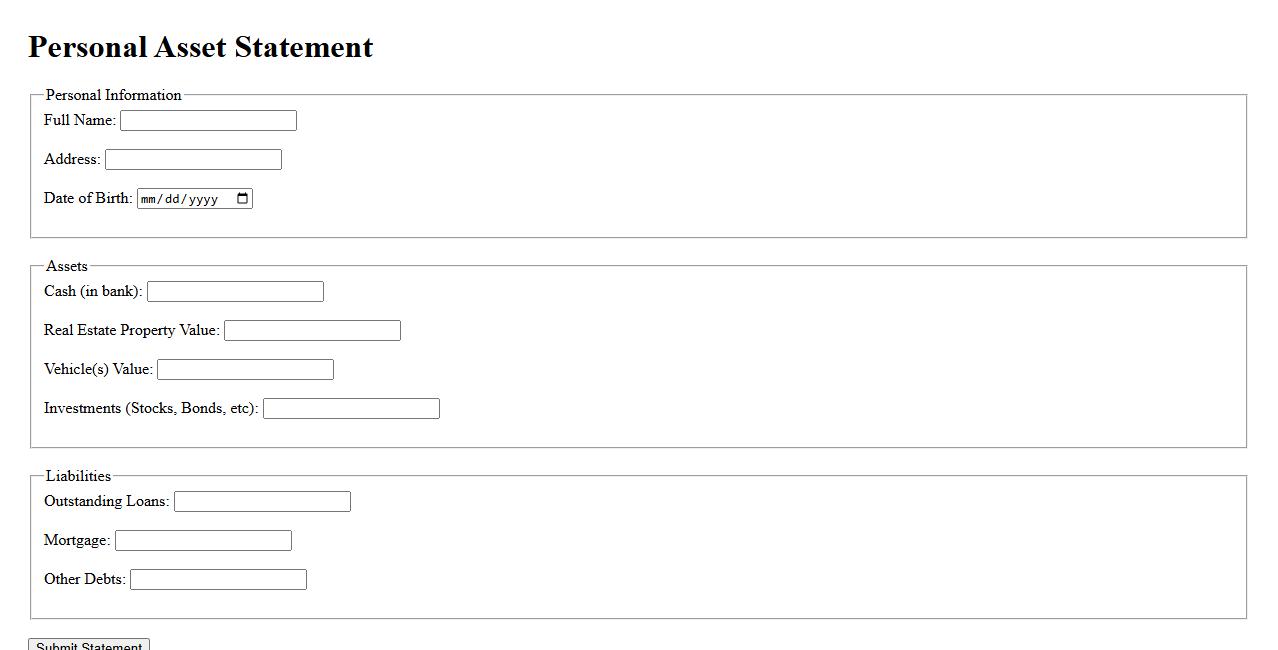

Personal Asset Statement

A Personal Asset Statement is a detailed document that outlines an individual's financial holdings and liabilities. It provides a clear snapshot of net worth by listing assets such as cash, investments, property, and other valuables alongside any debts. This statement is essential for loan applications, financial planning, and wealth management.

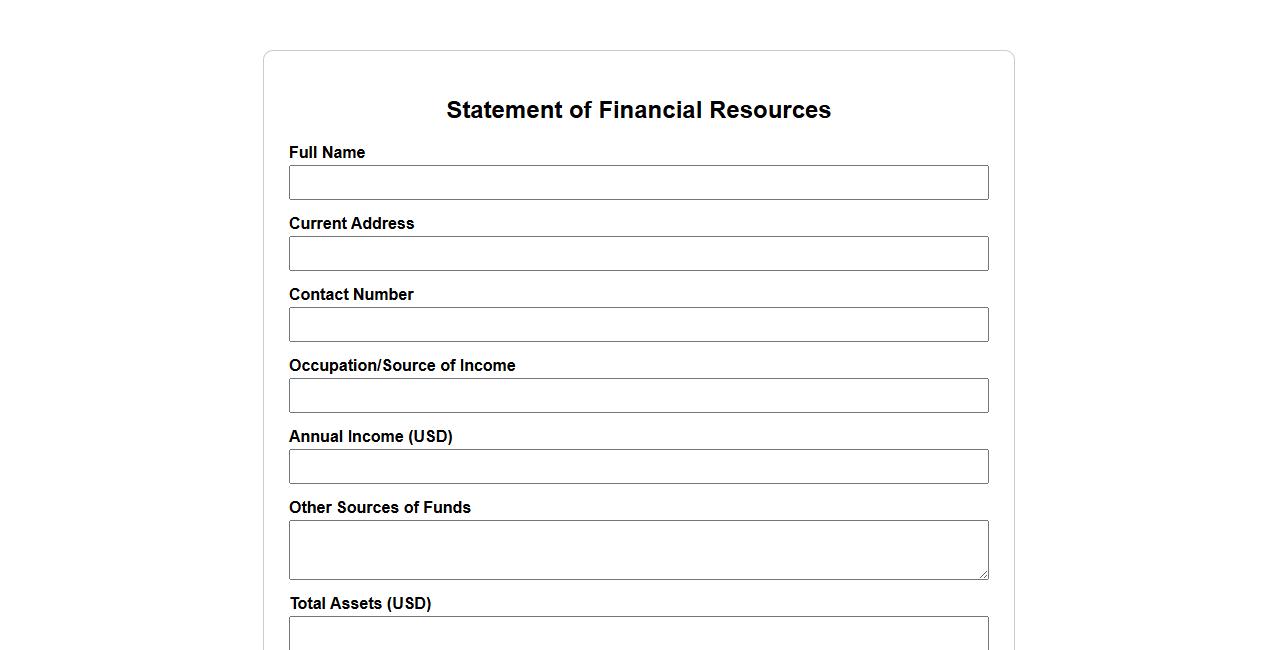

Statement of Financial Resources

The Statement of Financial Resources provides a detailed overview of an individual's or organization's available assets and funds. It is essential for assessing financial stability and planning future investments. This document helps stakeholders make informed decisions based on current financial capacity.

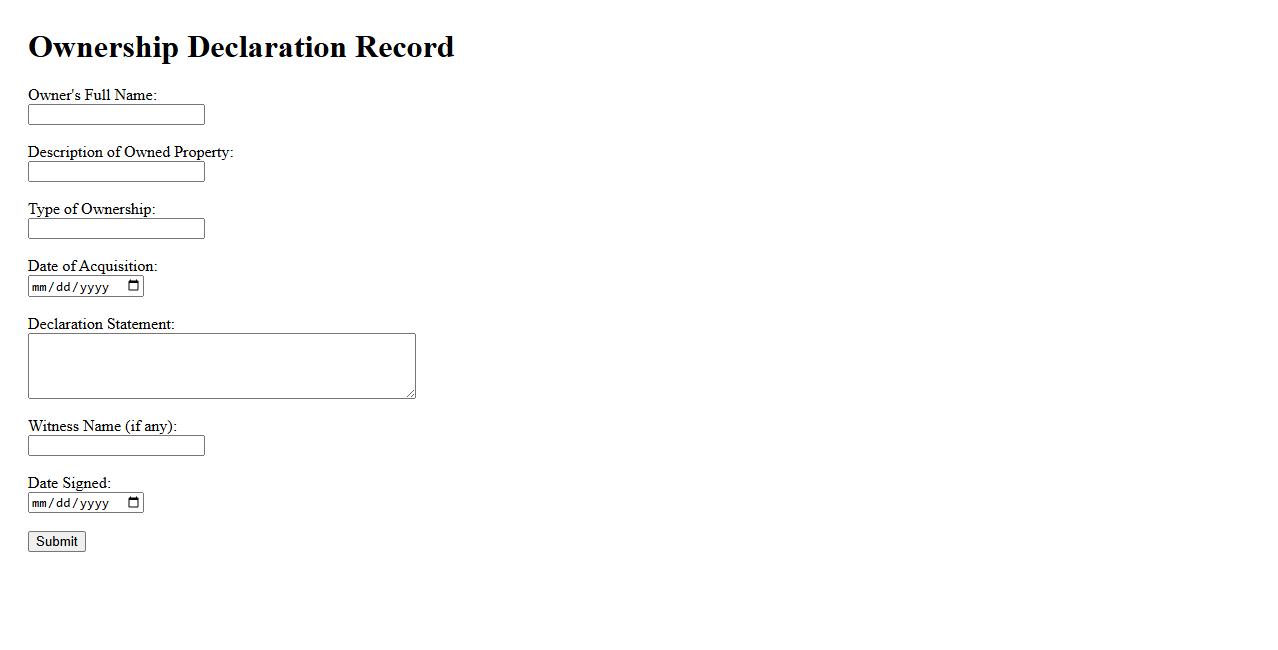

Ownership Declaration Record

The Ownership Declaration Record is an official document that confirms the ownership status of a property or asset. It is used to establish legal rights and responsibilities, ensuring clear evidence of possession. This record is essential for transactions, disputes, and regulatory compliance.

What items are typically included in a Statement of Assets?

A Statement of Assets typically includes cash, bank balances, investments, and account receivables. It also lists fixed assets such as real estate, vehicles, machinery, and equipment. Additionally, intangible assets like patents and trademarks may be featured on the document.

How does a Statement of Assets contribute to financial transparency?

A Statement of Assets provides a clear record of an individual's or organization's holdings, promoting accountability. It allows stakeholders to verify the legitimacy and scope of reported resources. This transparency helps prevent fraud and builds trust among investors, regulators, and the public.

In what scenarios is a Statement of Assets required or beneficial?

A Statement of Assets is required during loan applications to assess creditworthiness. It is also beneficial in legal cases such as divorce or bankruptcy to divide property fairly. Moreover, companies use it for annual financial reporting and audits to maintain compliance.

What distinguishes liquid from non-liquid assets on a Statement of Assets?

Liquid assets can be quickly converted into cash without significant loss of value, such as checking accounts and stocks. Non-liquid assets like property, machinery, or long-term investments are harder to convert rapidly. This distinction affects how assets are valued and managed on the statement.

How is asset valuation determined and reported in a Statement of Assets?

Asset valuation on a Statement of Assets is typically based on fair market value or historical cost adjusted for depreciation. Professional appraisals may be used for fixed and intangible assets to ensure accuracy. The reported value must be transparent and consistently applied for reliable financial analysis.