A Request for Statement of Account is a formal inquiry made by a customer or client to obtain a detailed report of all transactions and balances within a specific account. This document helps verify payments, track outstanding dues, and ensure accurate financial records. Businesses and individuals often use it to reconcile accounts or resolve discrepancies.

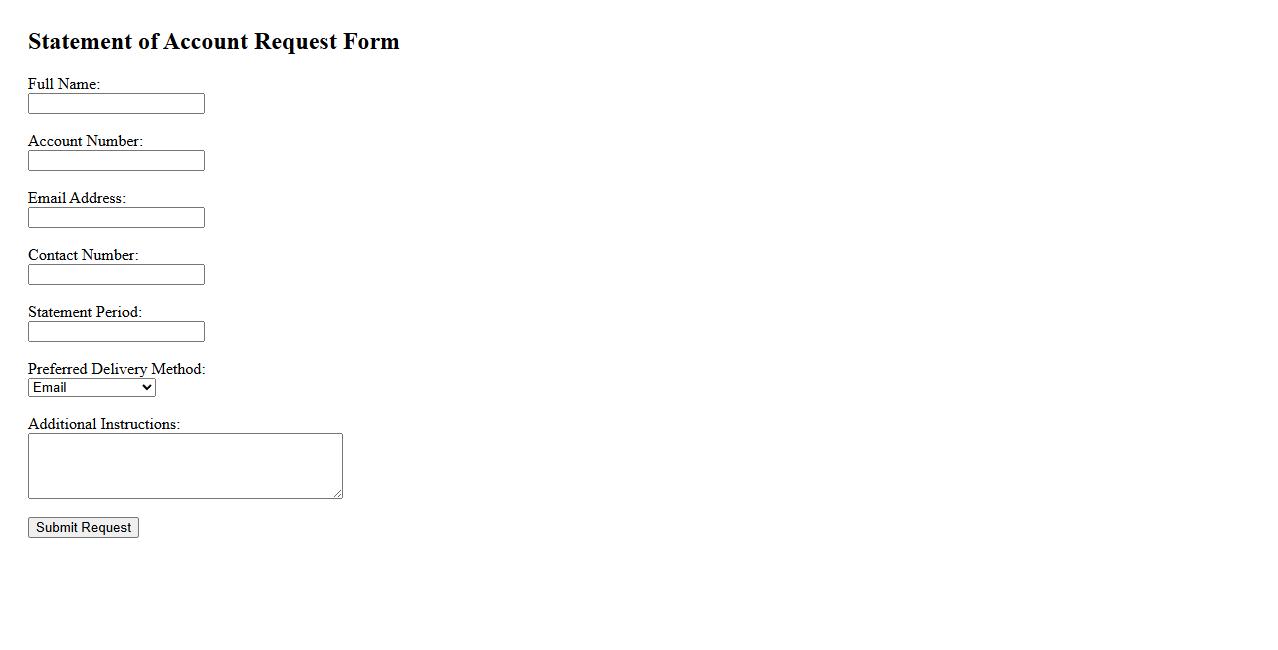

Statement of Account Request Form

The Statement of Account Request Form is used to formally request a detailed summary of financial transactions for a specific period. This form allows individuals or businesses to track payments, outstanding balances, and account activity. It ensures accurate record-keeping and easy financial management.

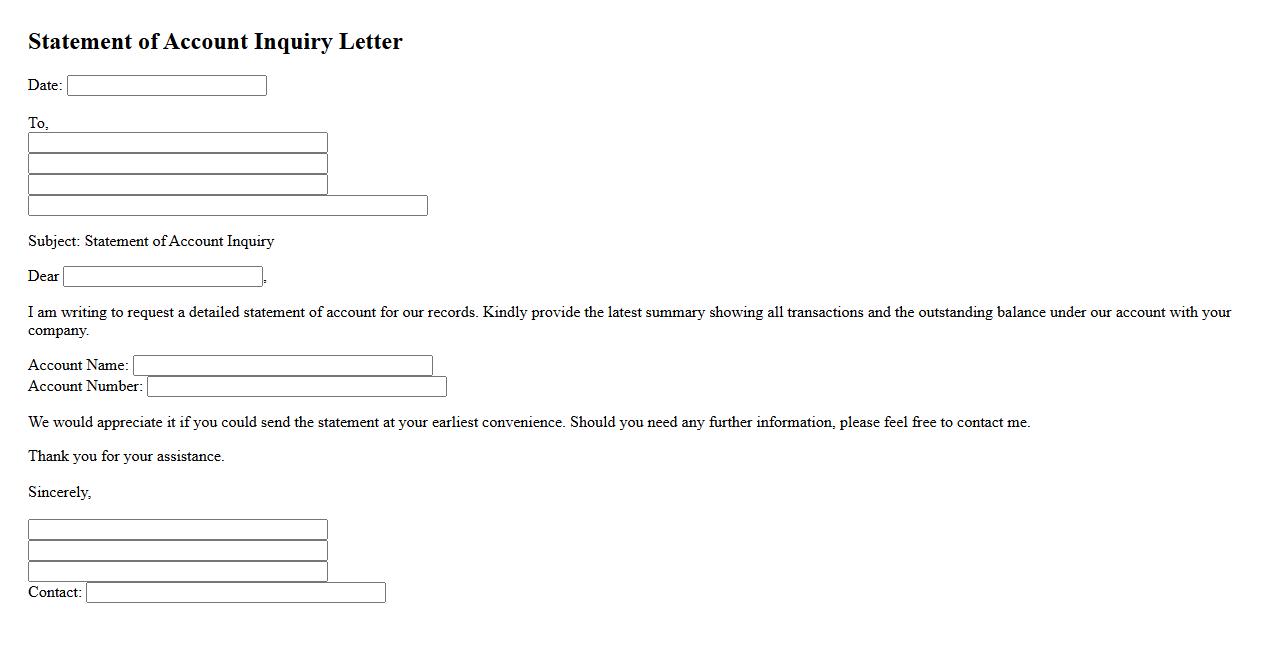

Statement of Account Inquiry Letter

A Statement of Account Inquiry Letter is a formal request sent to a company or financial institution to obtain detailed information about an account's transactions and balances. This letter helps clarify any discrepancies or confirm the accuracy of account records. It is essential for maintaining transparent financial communication.

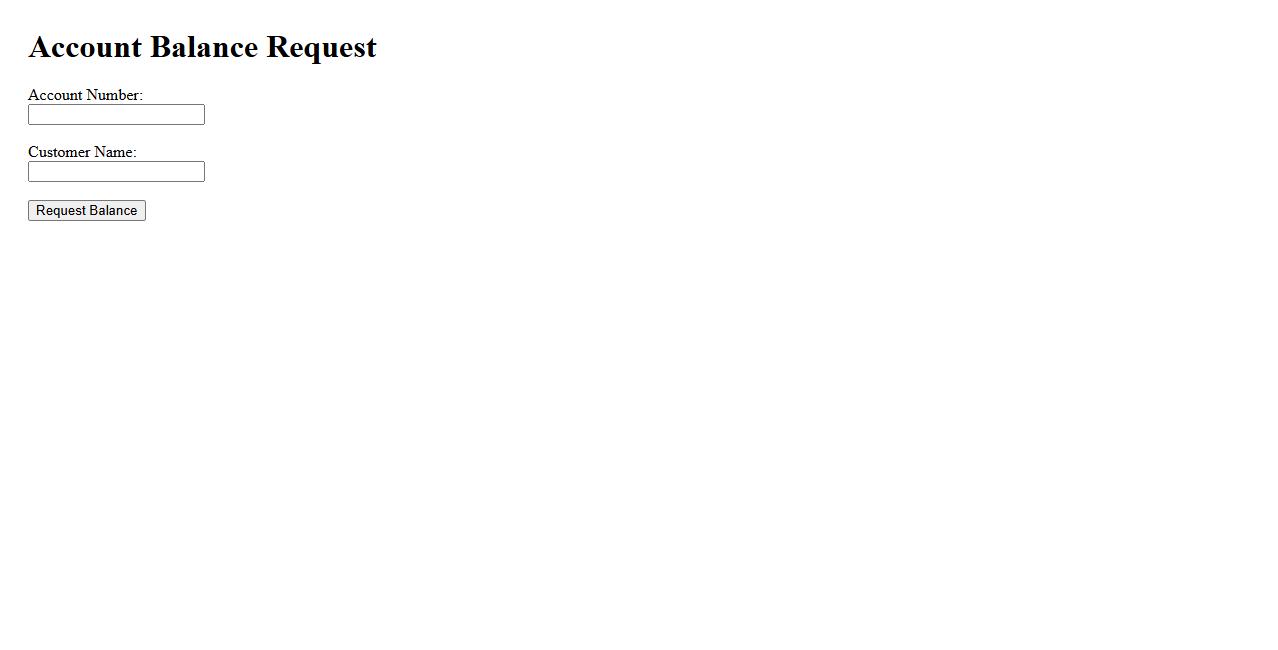

Account Balance Request

An Account Balance Request allows users to quickly check the current funds available in their account. This service provides real-time updates to help manage finances effectively. It is essential for tracking spending and ensuring sufficient funds for upcoming transactions.

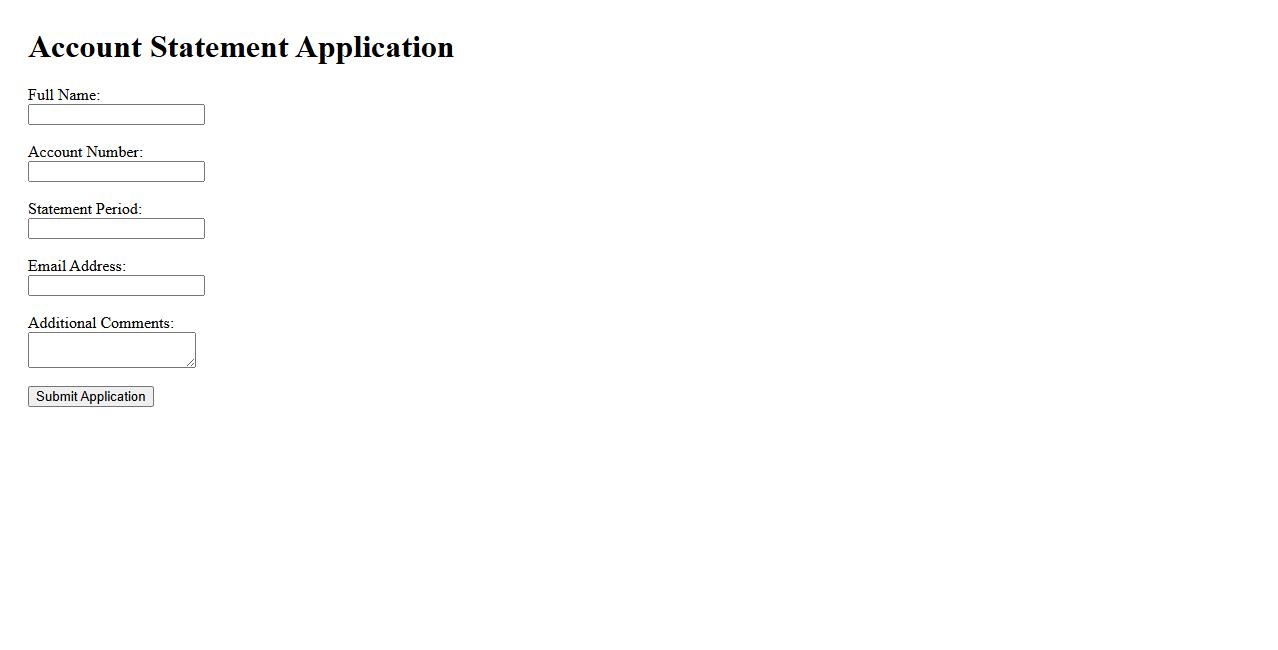

Account Statement Application

The Account Statement Application provides a convenient way to access and manage your financial records. It offers detailed transaction history, balance summaries, and downloadable reports. This tool enhances your ability to monitor and reconcile your accounts efficiently.

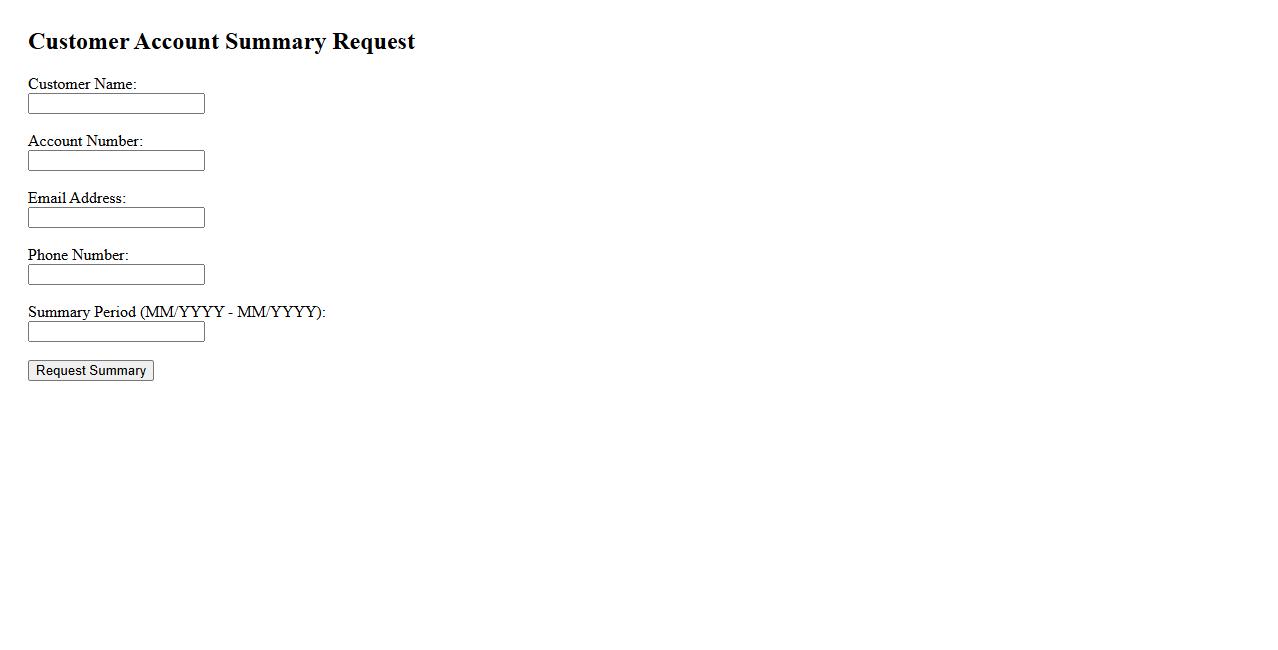

Customer Account Summary Request

A Customer Account Summary Request provides a concise overview of all transactions, balances, and account activities for a specific customer. This summary helps both customers and businesses review financial interactions efficiently. It is essential for accurate record-keeping and timely account management.

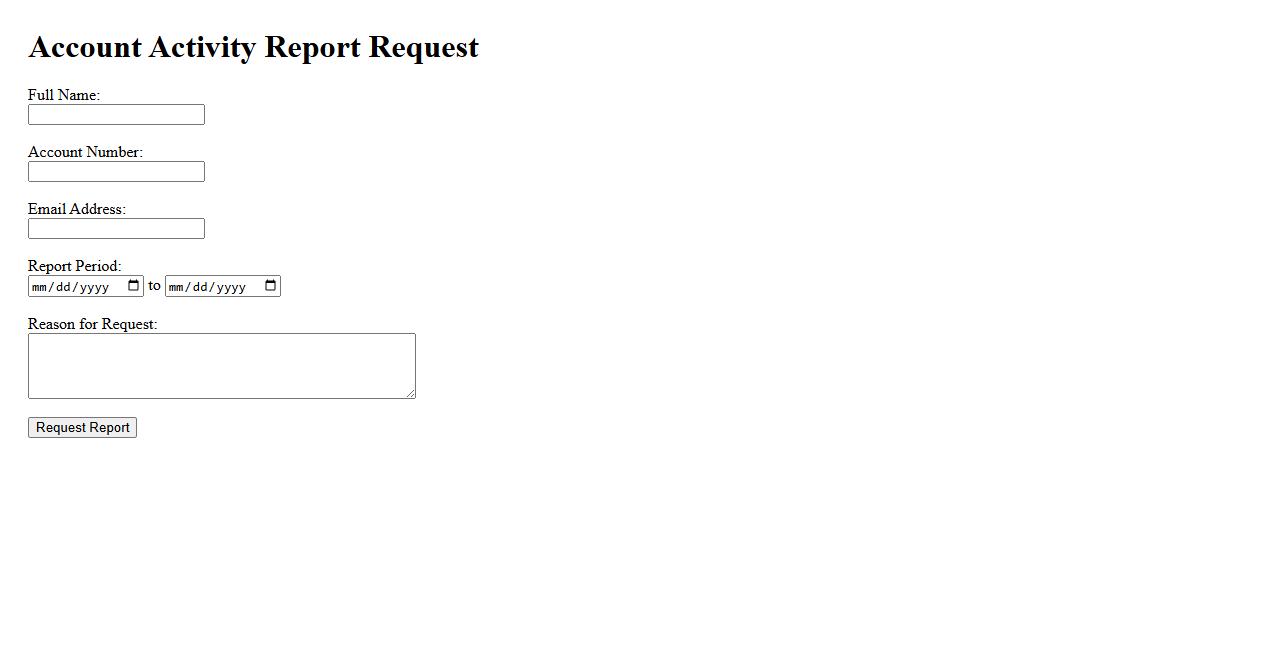

Account Activity Report Request

The Account Activity Report Request allows users to obtain detailed information about their recent transactions and account changes. This report helps in monitoring financial movements and verifying account accuracy. It is essential for maintaining up-to-date records and identifying any discrepancies promptly.

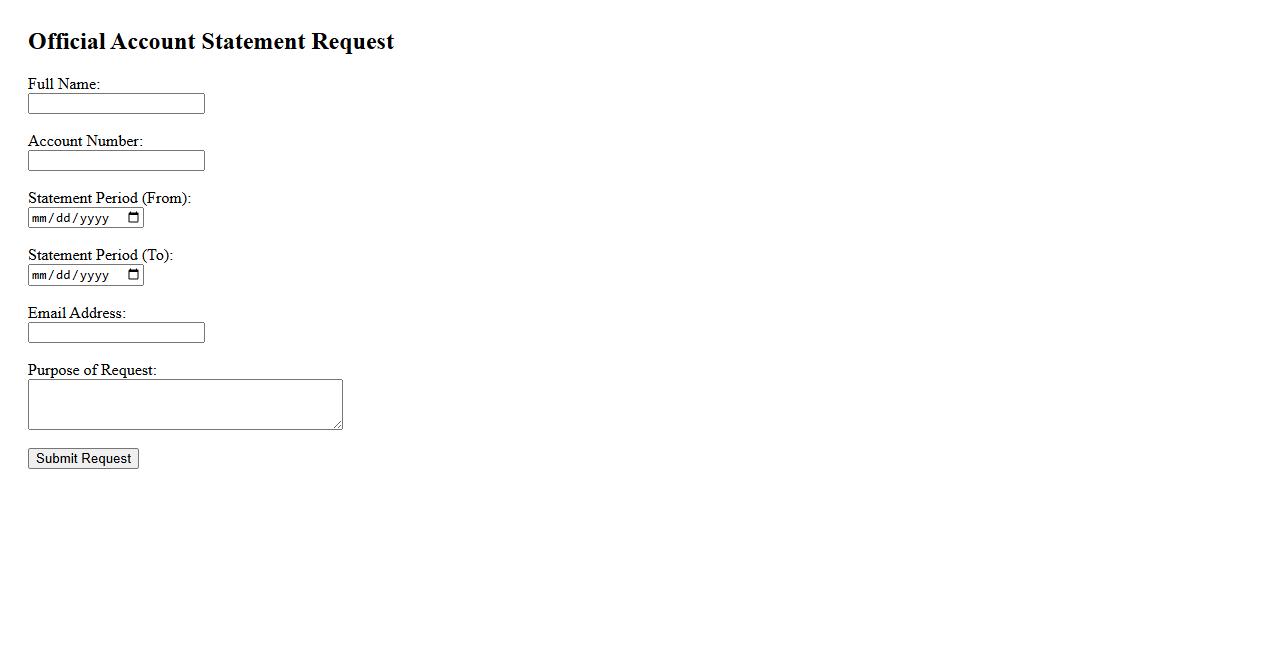

Official Account Statement Request

To obtain your Official Account Statement Request, please submit a formal application through our secure online portal or visit the nearest branch. This document provides a comprehensive summary of your financial transactions and balances over a specified period. It is essential for record-keeping, auditing, and financial planning purposes.

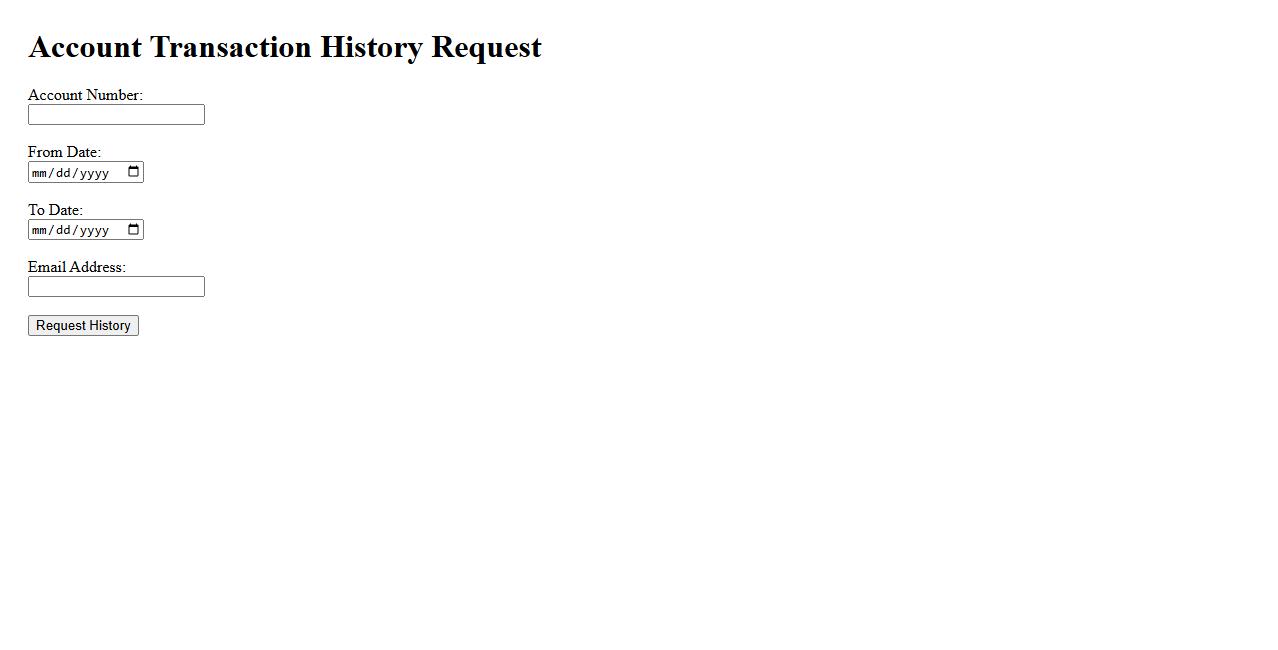

Account Transaction History Request

Requesting your Account Transaction History provides a detailed record of all financial activities within your account over a specified period. This history helps you track deposits, withdrawals, and transfers to maintain accurate financial records. Accessing this information is essential for budgeting and auditing purposes.

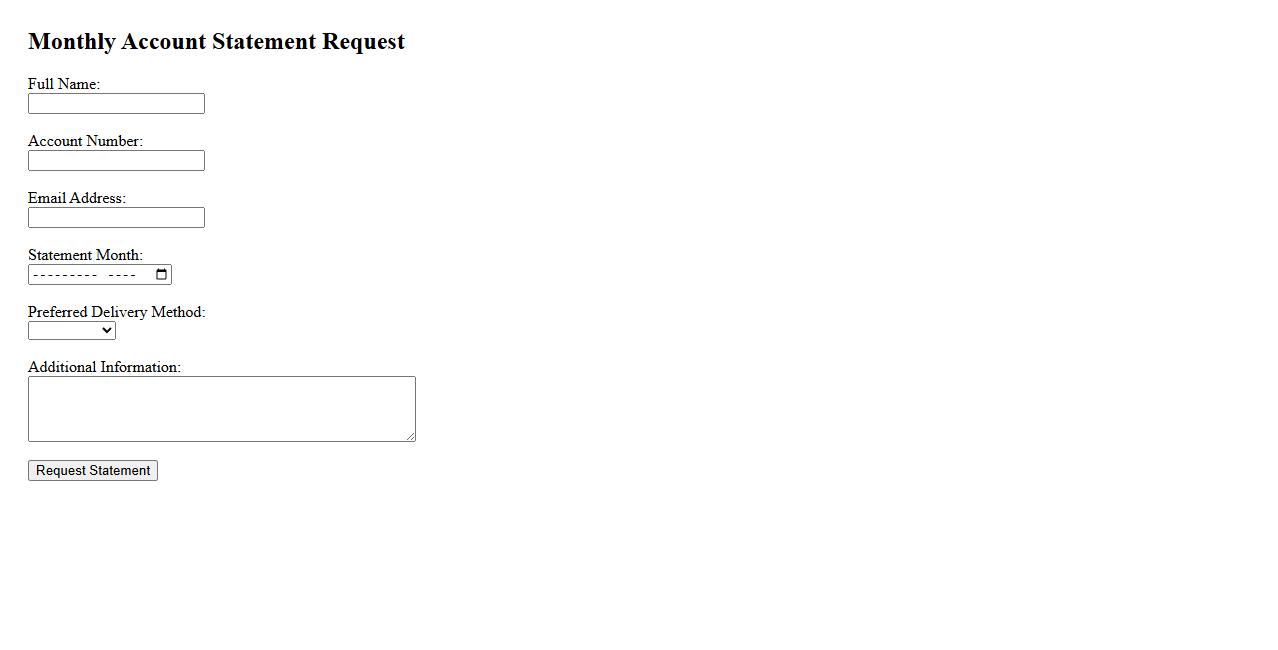

Monthly Account Statement Request

To receive your Monthly Account Statement request, please provide your account details and preferred delivery method. This statement offers a comprehensive summary of your account activity for the month. It helps you stay informed and track your financial transactions effectively.

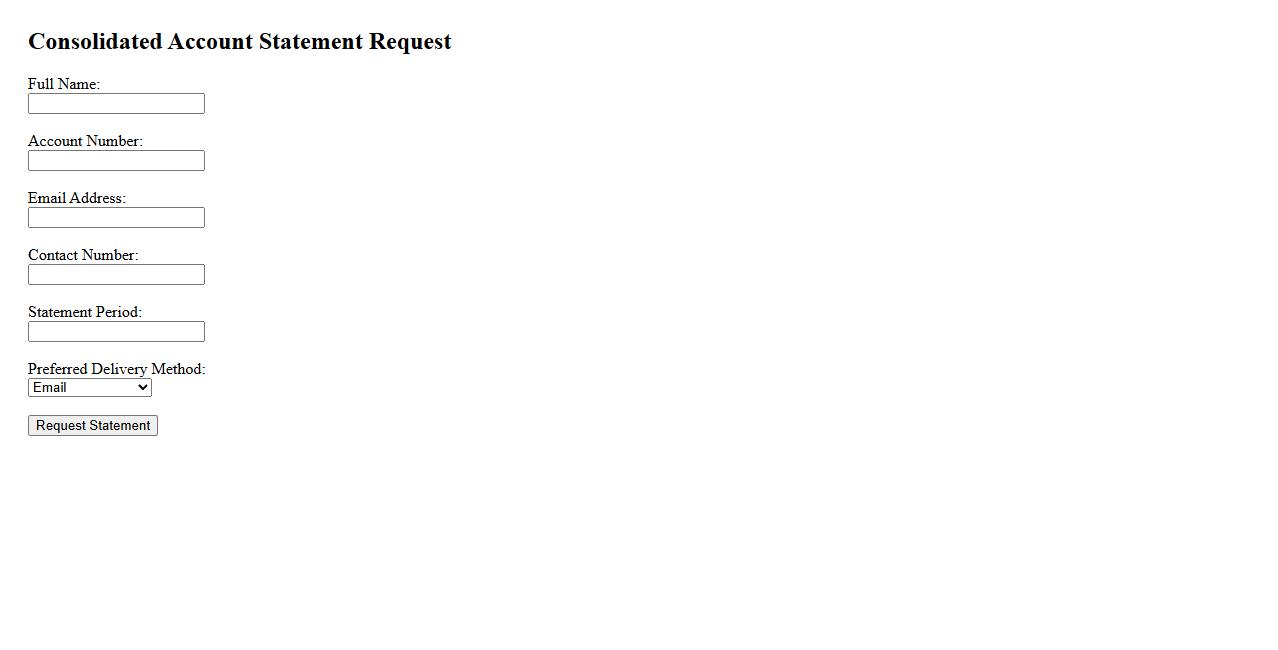

Consolidated Account Statement Request

A Consolidated Account Statement Request allows investors to receive a single document summarizing all their mutual fund and investment holdings across various accounts. This statement provides a clear overview of portfolio performance and transaction history, simplifying financial management. It is an essential tool for tracking investments efficiently.

What is the purpose of a Request for Statement of Account document?

The Request for Statement of Account serves to formally ask for a detailed record of all transactions between two parties. It helps verify outstanding balances and reconcile financial records accurately. This document ensures clarity and accountability in financial dealings.

Which details must be included when drafting a Request for Statement of Account?

A well-drafted Request for Statement of Account should include the account holder's name, account number, and date range for the transactions. It must also specify any outstanding amounts and request a detailed transaction breakdown. Including contact information facilitates a smooth follow-up process.

Who is the intended recipient of a Request for Statement of Account?

The recipient is usually the financial institution, vendor, or service provider maintaining the account records. This document is directed to the party responsible for maintaining accurate transaction data. Clear addressing ensures timely and correct response from the right entity.

How does a Request for Statement of Account ensure financial transparency?

By requesting a detailed transaction summary, a Request for Statement of Account promotes financial transparency between parties. It allows for cross-verification of records, reducing the risk of errors or discrepancies. This fosters trust and accountability in financial relationships.

In what situations should a Request for Statement of Account be issued?

A Request for Statement of Account should be issued during account reconciliation, dispute resolution, or financial auditing. It is also useful when verifying outstanding balances before payments. Timely requests help maintain up-to-date financial records and prevent misunderstandings.