The registration of importer/exporter is a mandatory process for businesses involved in international trade to obtain a unique identification number from relevant government authorities. This registration enables companies to legally import or export goods, ensuring compliance with customs regulations and facilitating smooth shipment clearance. Proper registration of importer/exporter enhances credibility and streamlines documentation for cross-border transactions.

Importer/Exporter Registration Certificate

The Importer/Exporter Registration Certificate is an essential document required for businesses engaged in international trade. It ensures legal compliance and facilitates smooth customs procedures. Obtaining this certificate helps companies expand their market reach by enabling global import and export activities.

Business License

A business license is an official authorization issued by a government agency that permits individuals or companies to operate legally within a specific jurisdiction. It ensures compliance with local regulations, zoning laws, and tax requirements. Obtaining a business license is essential for establishing a legitimate and trustworthy enterprise.

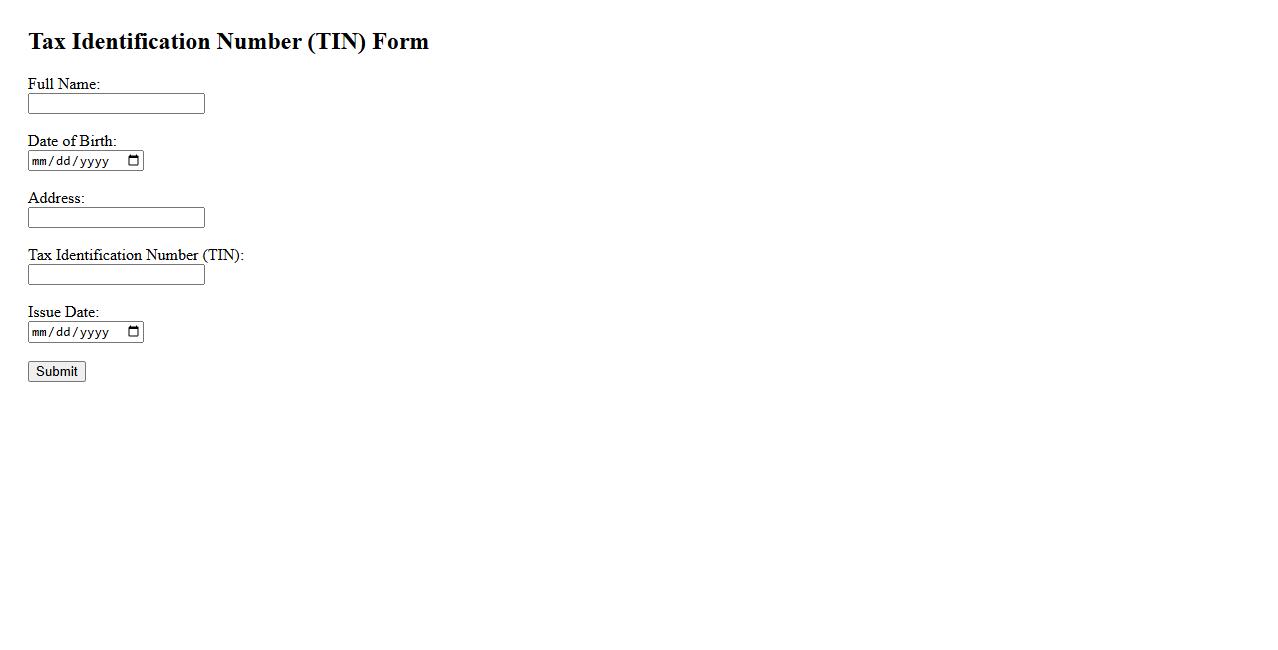

Tax Identification Number

The Tax Identification Number (TIN) is a unique identifier assigned to individuals and businesses for tax purposes. It is essential for filing tax returns and tracking tax obligations with government authorities. This number helps ensure accurate and efficient processing of tax-related information.

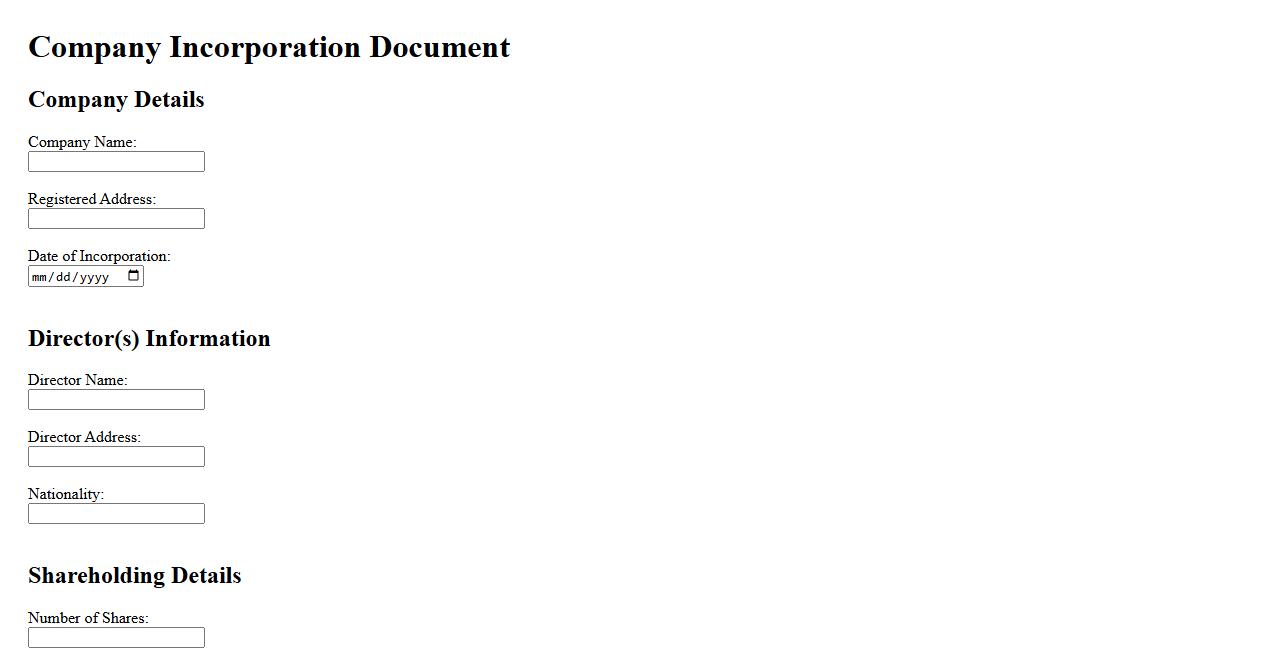

Company Incorporation Document

The Company Incorporation Document is a critical legal paper that establishes a company's existence and outlines its structure and purpose. This document typically includes essential information such as the company name, registered address, and details of the directors and shareholders. It serves as the foundation for a company's official registration and compliance with government regulations.

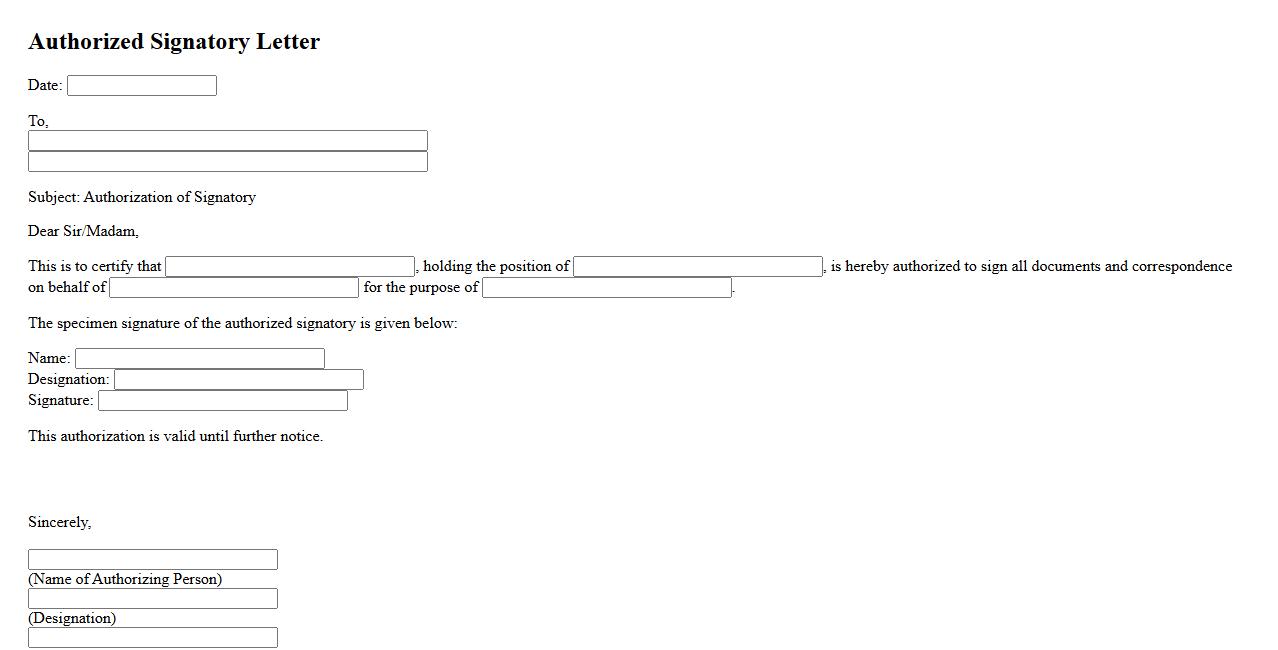

Authorized Signatory Letter

An Authorized Signatory Letter is a formal document that designates an individual with the legal authority to sign documents on behalf of a company or organization. This letter ensures that the authorized person's actions are recognized and legally binding. It is essential for maintaining clear accountability and validity in business transactions.

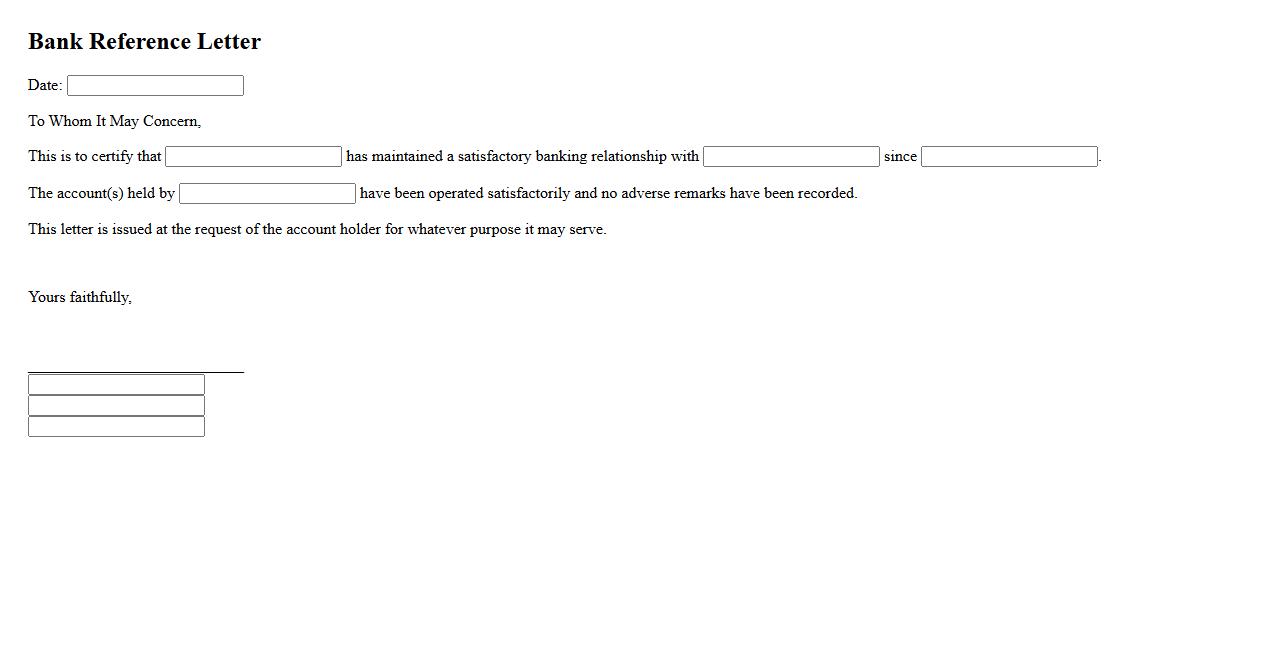

Bank Reference Letter

A Bank Reference Letter is an official document provided by a bank outlining a customer's financial history and reliability. It is often used to verify account status and creditworthiness for business or personal transactions. This letter helps build trust between the account holder and third parties.

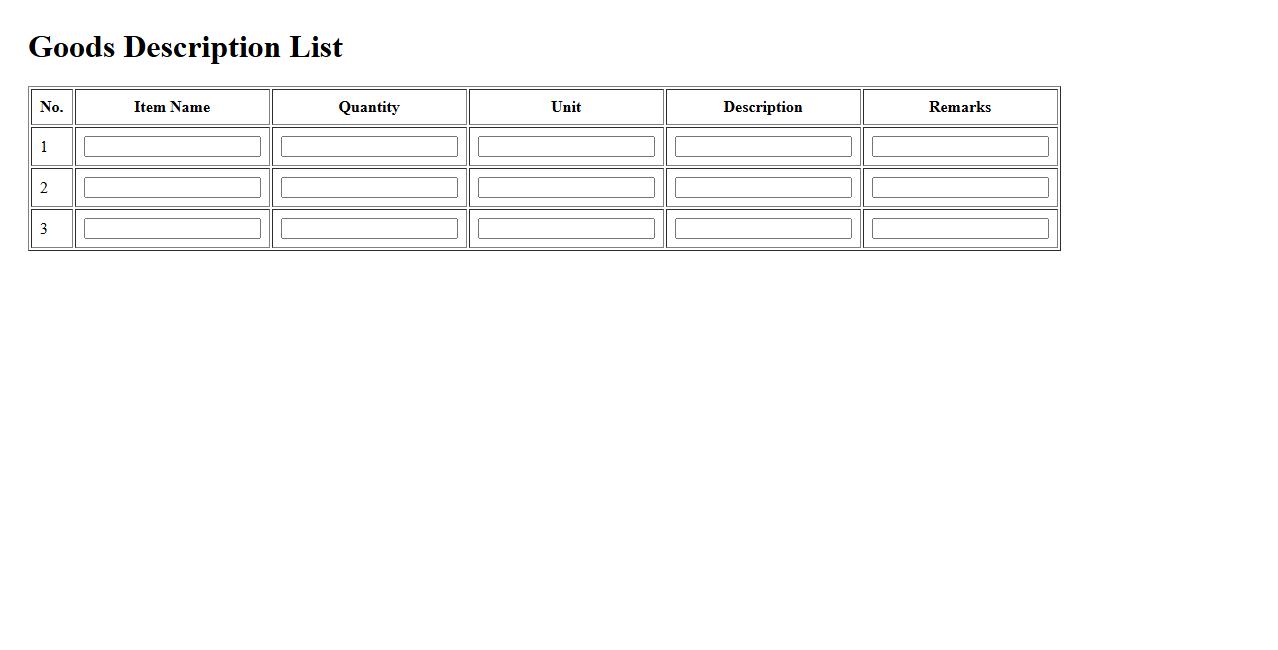

Goods Description List

The Goods Description List provides a detailed overview of products, highlighting key features and specifications. It helps customers quickly understand the essential attributes of each item. This organized format improves clarity and enhances the shopping experience.

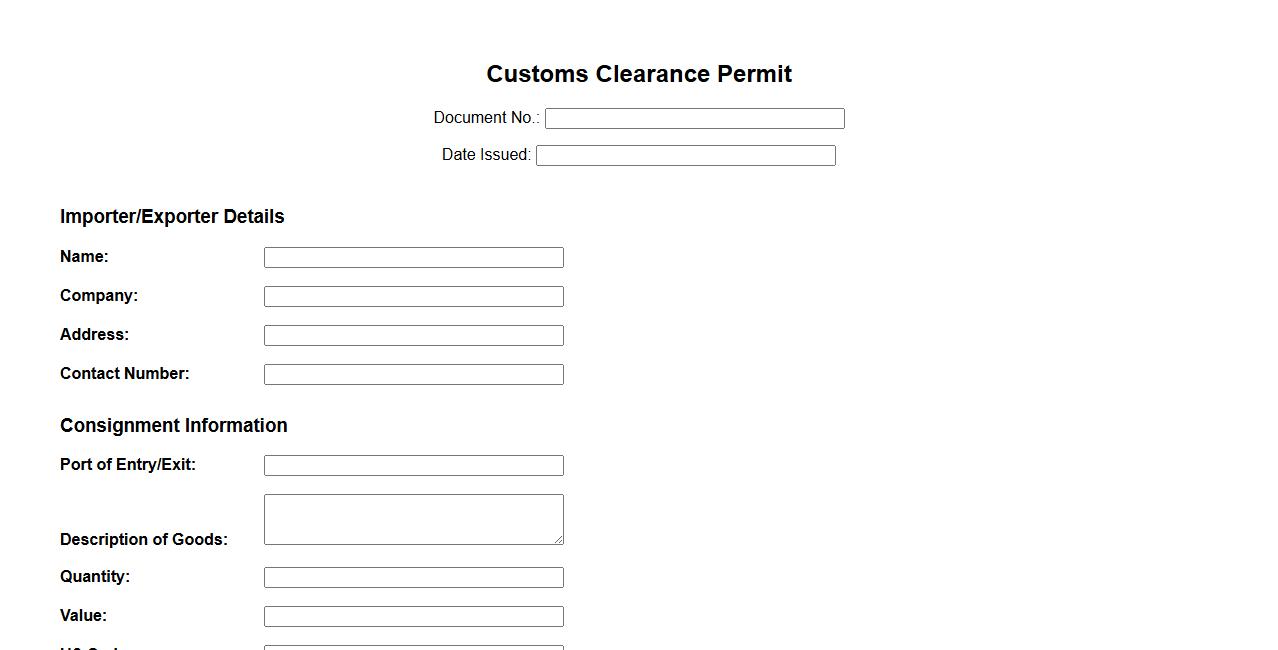

Customs Clearance Permit

The Customs Clearance Permit is a crucial document required for the legal import and export of goods across international borders. It ensures compliance with customs regulations and facilitates smooth processing of shipments. Obtaining this permit helps avoid delays, fines, and confiscation of merchandise.

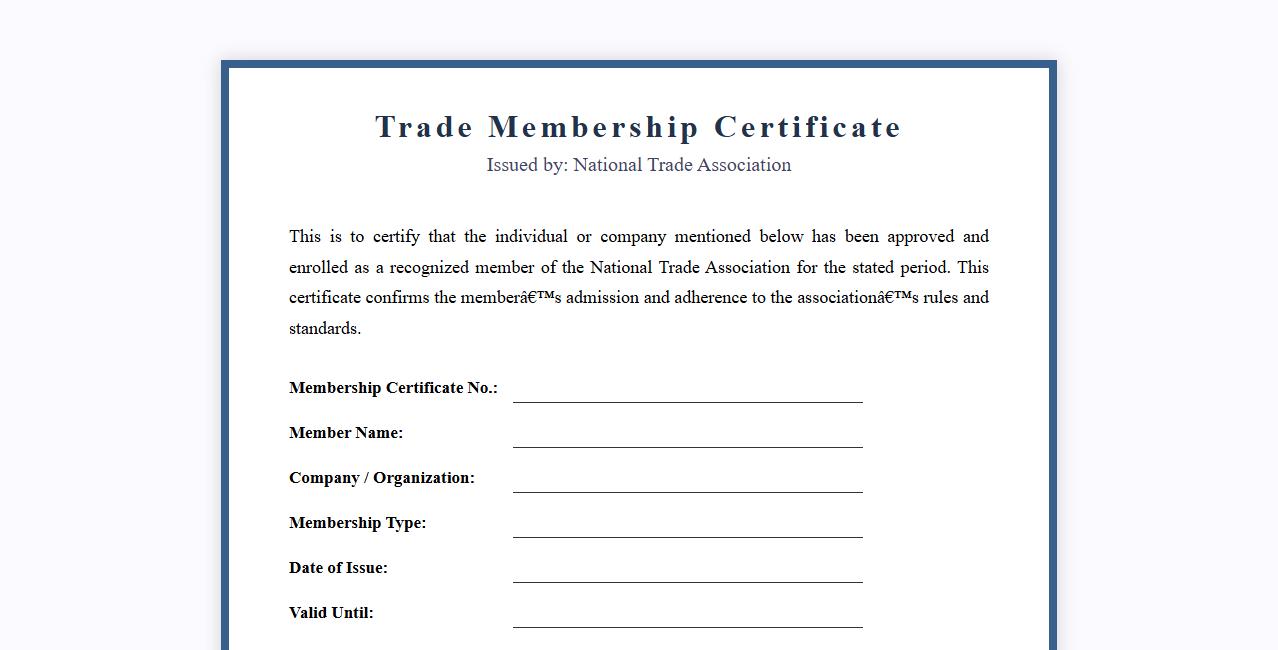

Trade Membership Certificate

The Trade Membership Certificate is an official document that validates a business's affiliation with a recognized trade organization. It serves as proof of credibility and commitment to industry standards. Holding this certificate enhances trust with clients and partners alike.

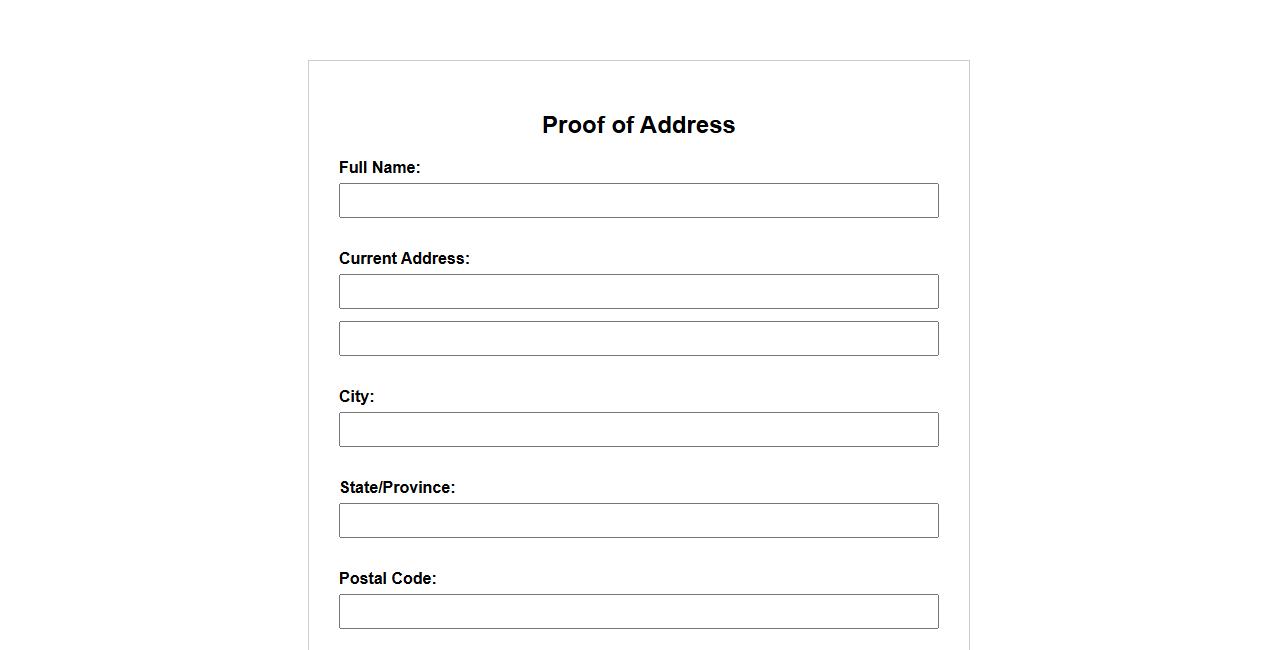

Proof of Address

Proof of Address is a document used to verify a person's residential location. It is commonly required for official processes such as opening a bank account or applying for government services. Acceptable forms include utility bills, lease agreements, or official correspondence.

What are the mandatory documents required for the registration of an importer/exporter?

The mandatory documents for importer/exporter registration include a valid business license, proof of identity, and tax registration certificates. Applicants must also provide bank statements and details of the company's authorized signatories. These documents ensure compliance with regulatory standards and verify the legitimacy of the business.

Which authority or agency is responsible for processing importer/exporter registration?

The customs department or designated trade authority is responsible for processing importer/exporter registration. Typically, this agency oversees regulatory compliance and issues necessary permits. Coordination with other government bodies may also be required for smooth registration approvals.

How does the validity period of an importer/exporter registration impact renewal requirements?

The validity period of an importer/exporter registration defines how long the registration remains active. Renewal must be completed before expiration to maintain uninterrupted trading rights. Failure to renew on time can result in suspension or penalties affecting business operations.

What identification numbers or codes must be included on import/export documents during registration?

Identification numbers such as the Importer Exporter Code (IEC), Tax Identification Number (TIN), and customs registration numbers must be included on all import/export documents. These codes facilitate tracking and regulatory compliance in international trade. Correct documentation minimizes delays during customs clearance.

What conditions can lead to the suspension or cancellation of a registered importer/exporter?

Conditions like non-compliance with customs regulations, fraudulent activities, or failure to pay duties can lead to suspension or cancellation of registration. Authorities also revoke registrations if documentation is falsified or if the entity ceases business operations. Maintaining transparent and lawful practices is essential to avoid these penalties.