The Order IRS Tax Transcript Request Form allows taxpayers to obtain a copy of their tax return information directly from the IRS. This form provides a detailed record of tax filings, including income, deductions, and credits, which is essential for verifying tax information or applying for loans. It offers a secure and official way to access past tax data without needing to retrieve original documents.

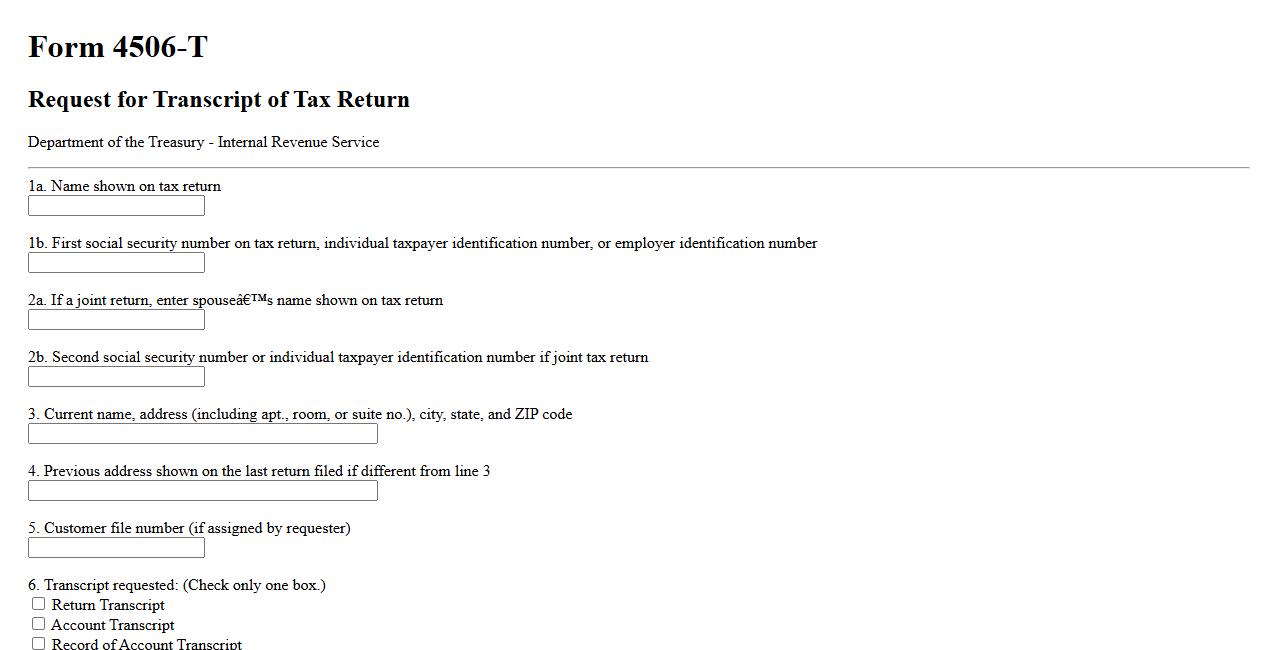

IRS Form 4506-T request form

The IRS Form 4506-T is a request form used to obtain a transcript of tax returns from the Internal Revenue Service. It allows individuals or third parties to receive tax return information for various purposes, such as loan applications or tax verification. This form ensures secure and accurate access to essential tax data.

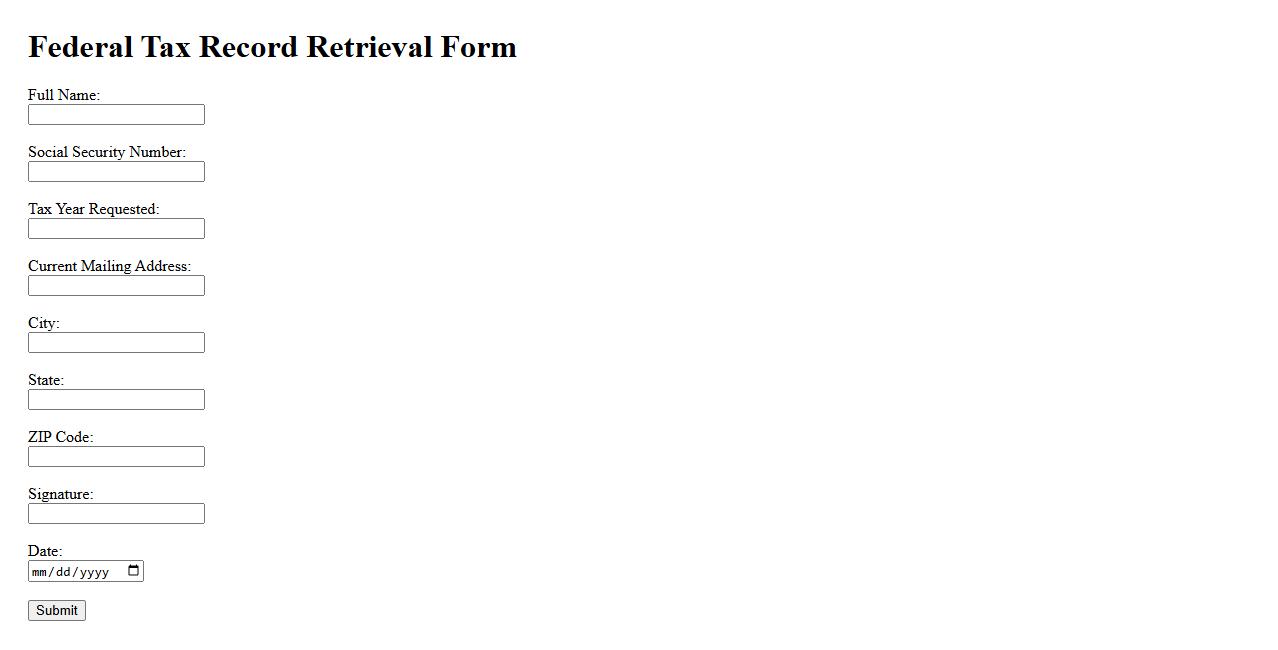

Federal tax record retrieval form

The Federal tax record retrieval form is used to request copies of previously filed tax documents from the Internal Revenue Service (IRS). This form assists individuals and businesses in obtaining important tax information for record-keeping or verification purposes. Properly completing the form ensures accurate and timely access to federal tax records.

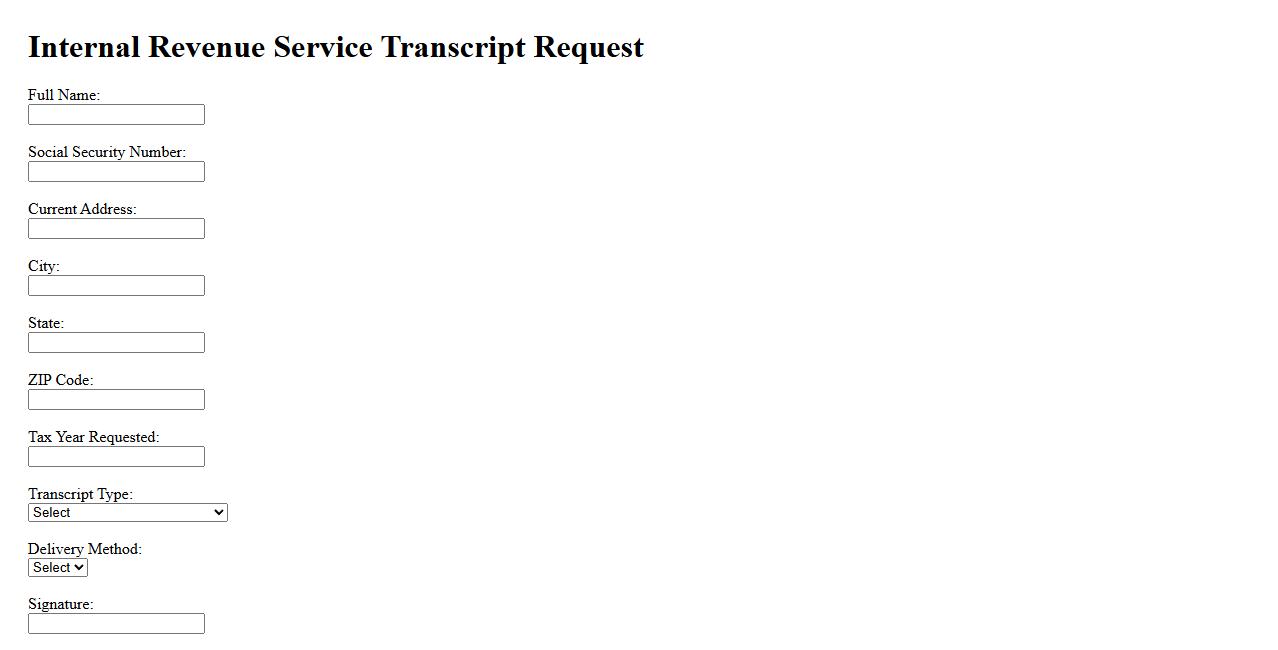

Internal Revenue Service transcript request

Requesting an Internal Revenue Service transcript provides a detailed record of your tax return information directly from the IRS. This document is useful for verifying income, resolving tax issues, or applying for loans and financial aid. Transcripts can be requested online, by mail, or by phone for convenience and accuracy.

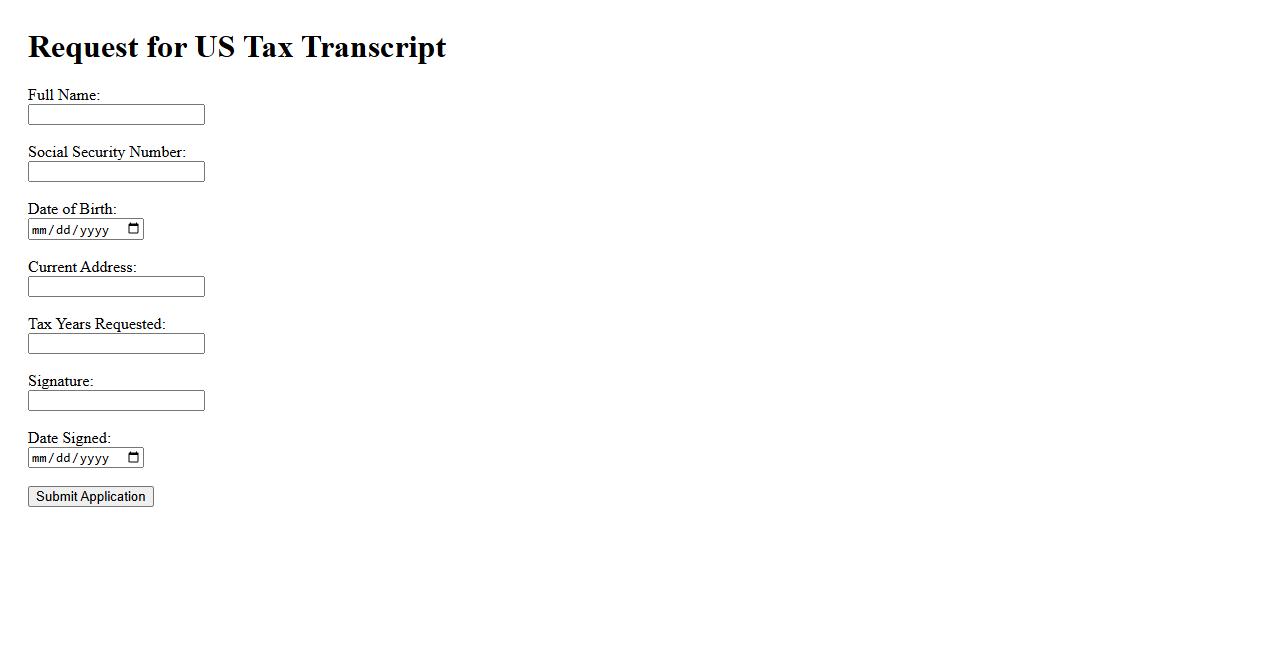

US tax transcript application

Applying for a US tax transcript allows individuals to obtain an official summary of their tax return information from the IRS. This document is essential for verifying income and tax details during processes like loan applications or tax audits. The application can be completed online, by mail, or by phone for convenient access.

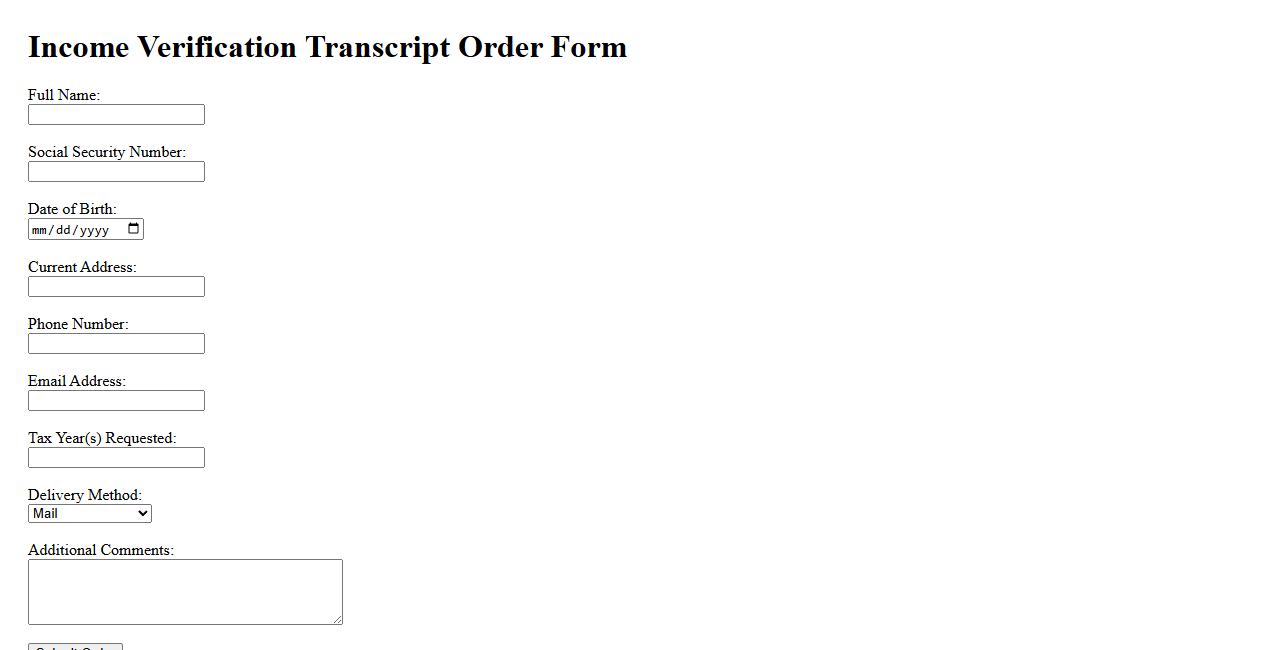

Income verification transcript order

To complete an income verification transcript order, individuals must request their IRS transcript to confirm earnings for loans, financial aid, or other official purposes. This document provides an accurate record of income directly from the IRS, ensuring authenticity and reliability. Ordering the transcript online or by mail is a straightforward process that helps verify reported income efficiently.

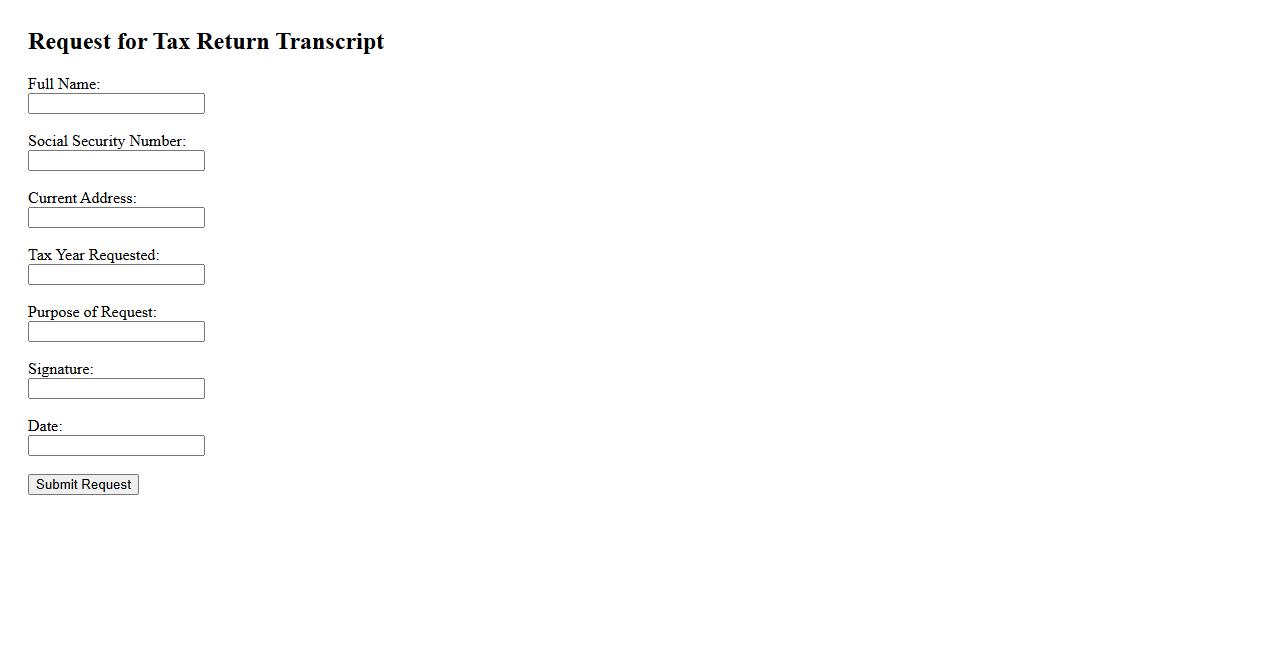

Request for tax return transcript

A Request for tax return transcript allows individuals to obtain an official summary of their filed tax returns directly from the IRS. This transcript provides essential details such as income, deductions, and credits without including sensitive information like Social Security numbers. It is commonly used for loan applications, tax preparation, and financial verification purposes.

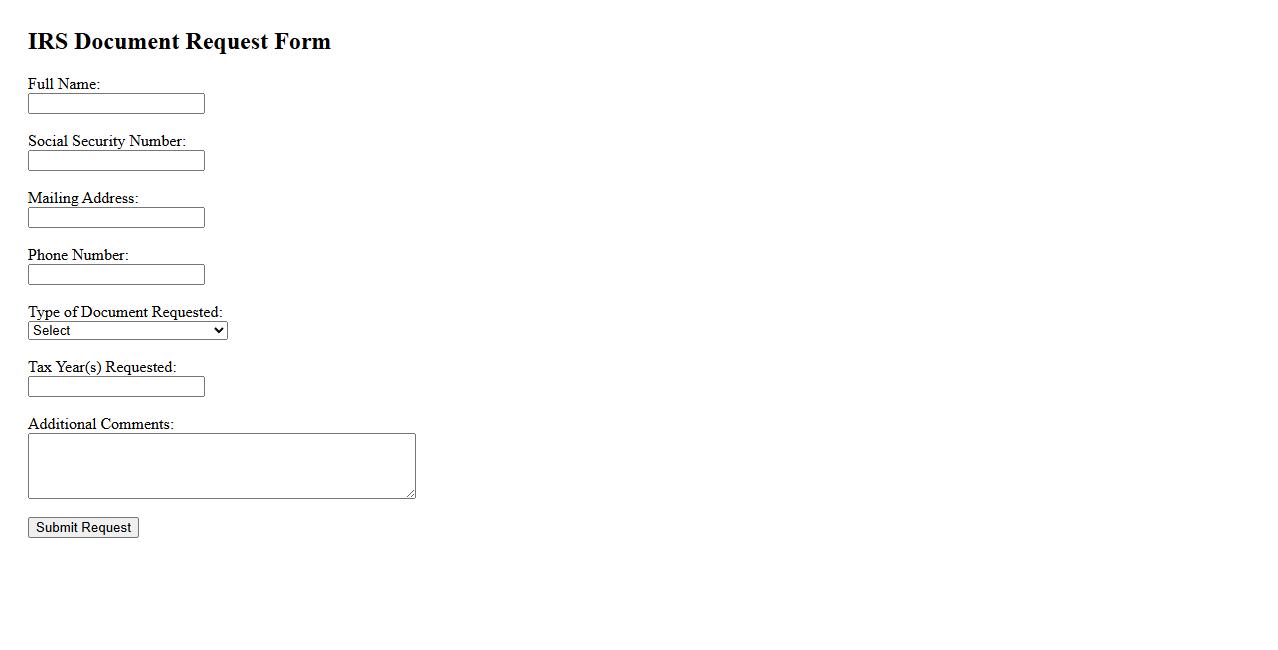

IRS document request form

The IRS document request form is used to request specific tax-related documents directly from the Internal Revenue Service. This form facilitates the retrieval of records such as tax returns, transcripts, and other essential tax documents. It helps individuals and businesses to obtain accurate information for tax preparation or audit purposes.

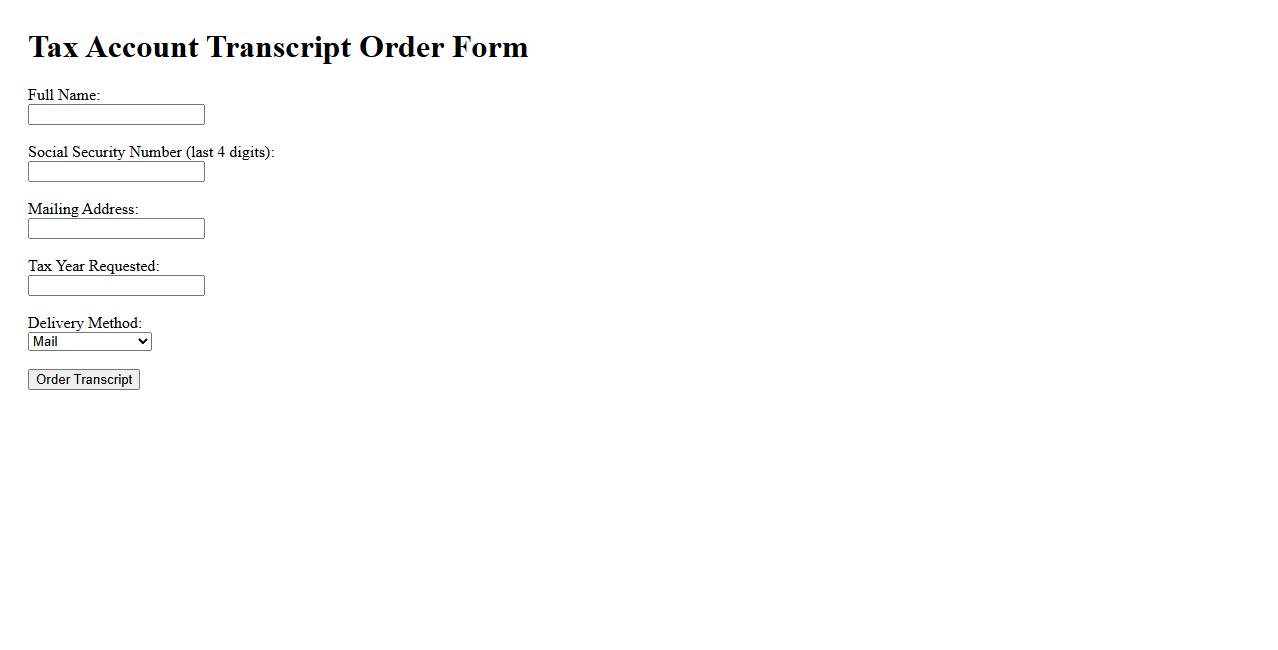

Tax account transcript order

Requesting a tax account transcript provides a detailed summary of your tax return information as filed with the IRS. This document includes key data such as your filing status, income, and payment history. It is essential for verifying tax details or resolving discrepancies with the tax authority.

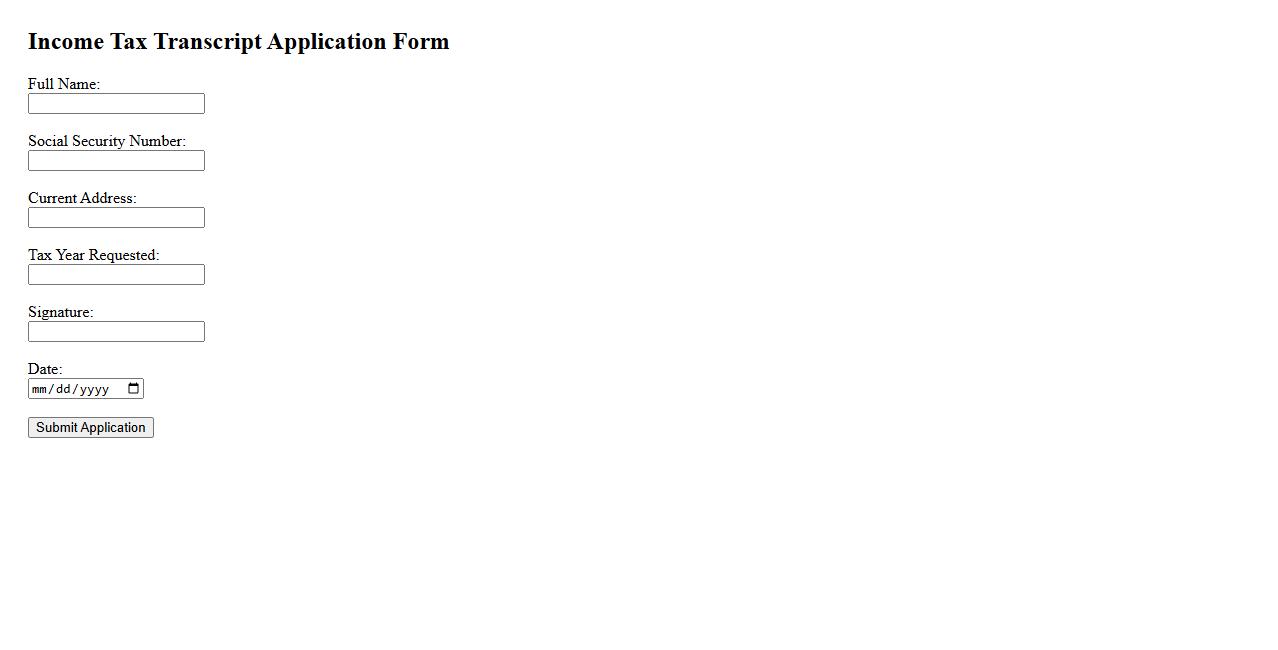

Income tax transcript application

Applying for an Income Tax Transcript allows individuals to obtain a detailed record of their tax returns and account activity from the IRS. This transcript includes important information such as reported income, tax payments, and refund details. It is often required for loan applications, tax preparation, and financial verification purposes.

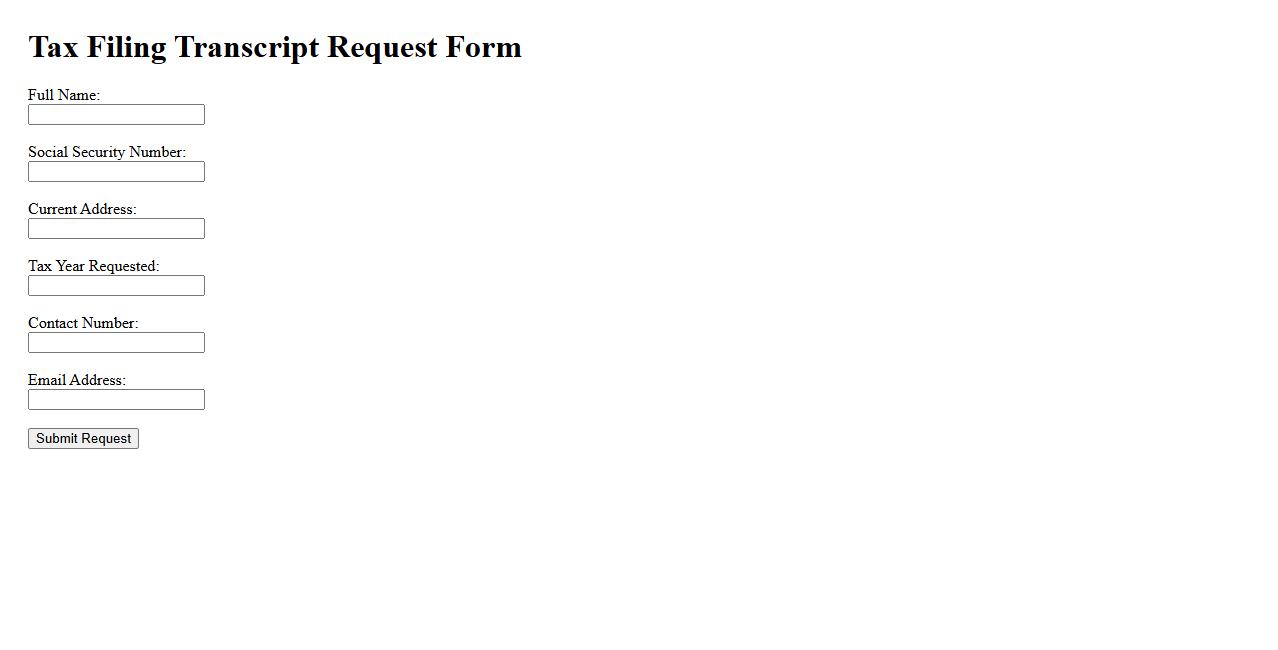

Tax filing transcript request form

The Tax filing transcript request form allows taxpayers to obtain a summary of their tax return information from the IRS. This transcript is useful for loan applications, tax preparation, and verifying income. Completing the form accurately ensures timely access to your tax records.

What is the primary purpose of the IRS Tax Transcript Request Form?

The IRS Tax Transcript Request Form is designed to allow taxpayers to obtain a summary of their tax return information directly from the IRS. This form provides an official record of past tax filings, which can be useful for loan applications, tax preparation, and verifying income. Its primary goal is to ensure taxpayers have easy access to their tax data without submitting a full return.

Which specific tax years or types of transcripts can be requested using the form?

The form can be used to request transcripts for a variety of tax years and transcript types, including tax return transcripts, account transcripts, wage and income transcripts, and verification of non-filing letters. Typically, transcripts are available for the current tax year and the previous three years. This flexibility helps taxpayers retrieve the precise information they need for different fiscal periods.

What personal identification information is required to complete the request?

To complete the IRS Tax Transcript Request Form, taxpayers must provide key personal identification details such as their full name, Social Security number, date of birth, and mailing address. This information ensures that the transcript is delivered securely and accurately to the rightful individual. Additionally, a recent tax filing status may be requested to verify identity further.

Are there limitations on who can request someone else's transcript using the form?

Yes, there are strict limitations on third-party requests to protect taxpayer privacy. Typically, only the taxpayer or an authorized representative with proper power of attorney can request another person's transcript. The IRS requires documented authorization to prevent unauthorized access to sensitive tax information.

What methods are available for submitting the completed IRS Tax Transcript Request Form?

The IRS allows the completed Tax Transcript Request Form to be submitted via several methods, including mail, fax, and online through the IRS website. Online requests are often the fastest and most convenient option, providing immediate access to transcripts. Mailing and fax methods remain available for those preferring or requiring paper submissions.