The Order Credit Report Authorization Form is a crucial document that grants permission to obtain an individual's credit history from credit reporting agencies. It ensures compliance with legal requirements while protecting personal financial information. This form is commonly used by lenders, landlords, and employers to evaluate creditworthiness and make informed decisions.

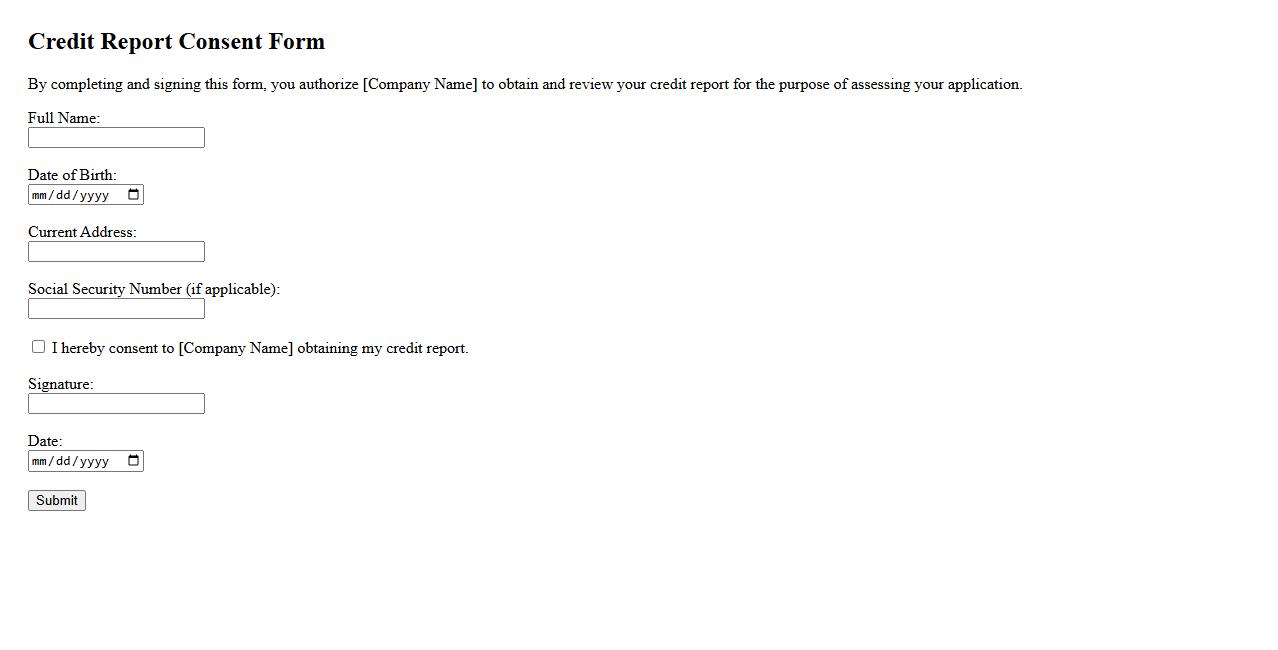

Credit Report Consent Form

The Credit Report Consent Form is a critical document that authorizes lenders or organizations to access an individual's credit information. This form ensures transparency and compliance with legal requirements when evaluating creditworthiness. By signing this form, individuals grant permission for their credit history to be reviewed securely and confidentially.

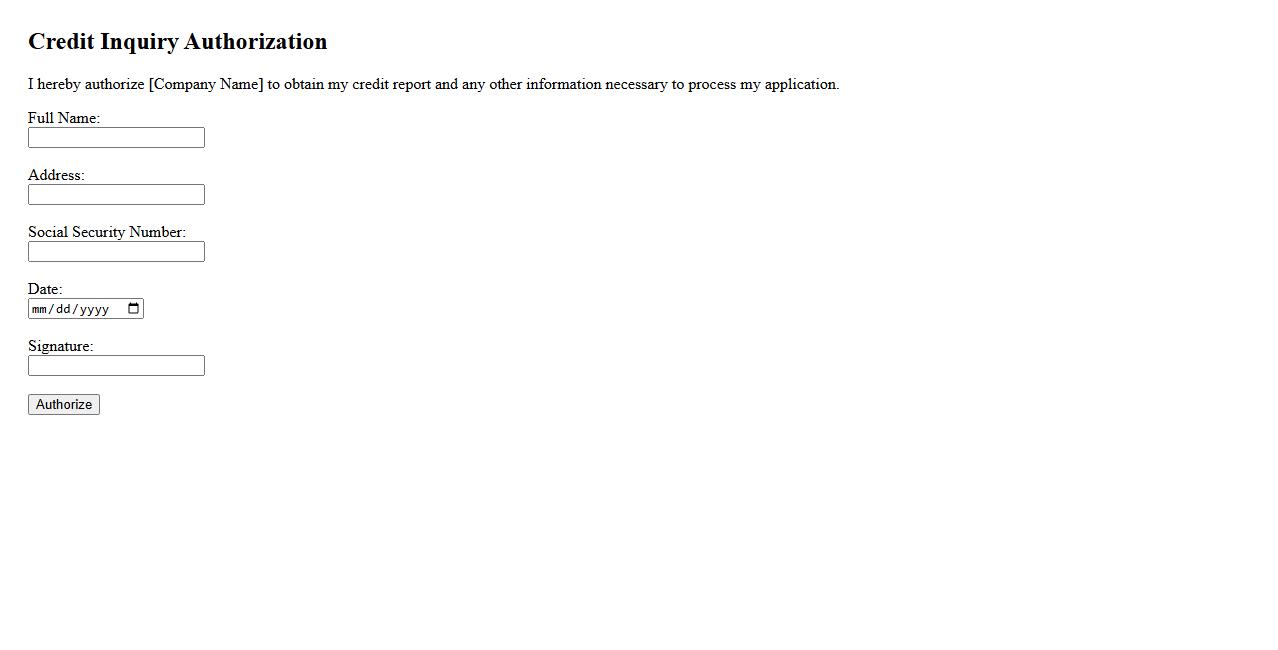

Credit Inquiry Authorization

Credit Inquiry Authorization is a formal consent allowing organizations to access your credit report for evaluation purposes. This authorization helps lenders assess your creditworthiness before approving loans or credit applications. Ensuring transparency, it protects your rights while enabling informed financial decisions.

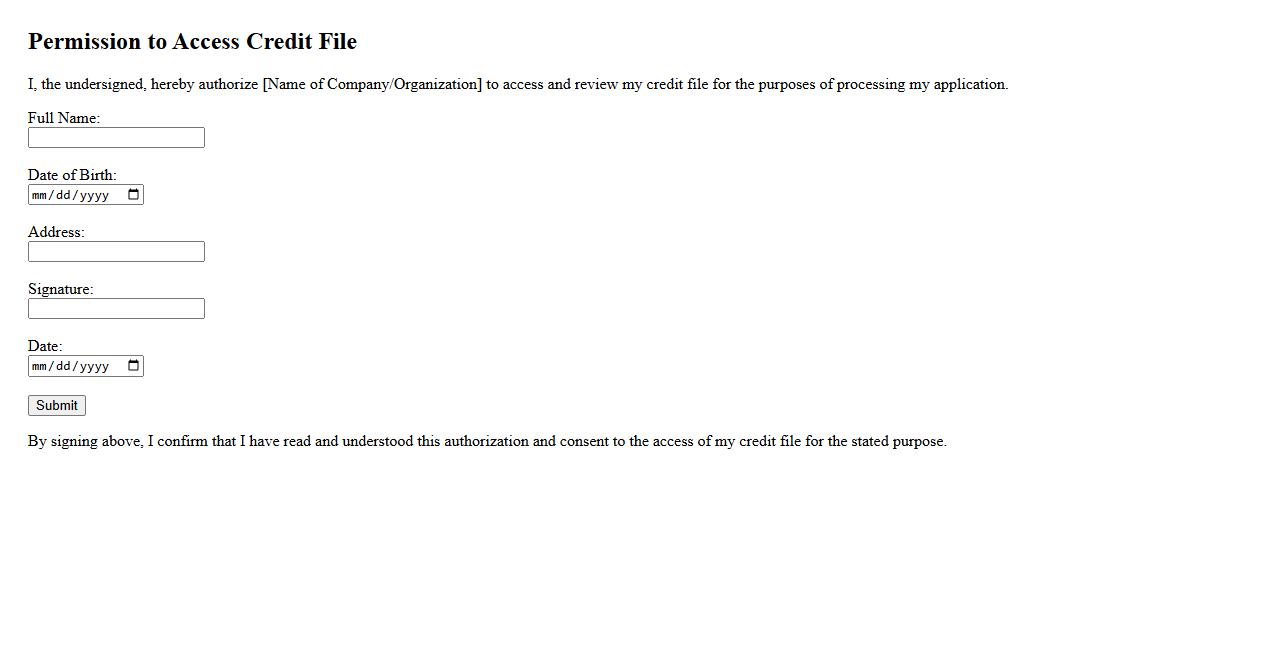

Permission to Access Credit File

Obtaining permission to access credit file is a crucial step in financial assessments. It allows lenders and authorized entities to review an individual's credit history to determine creditworthiness. This consent ensures transparency and compliance with privacy regulations during the credit evaluation process.

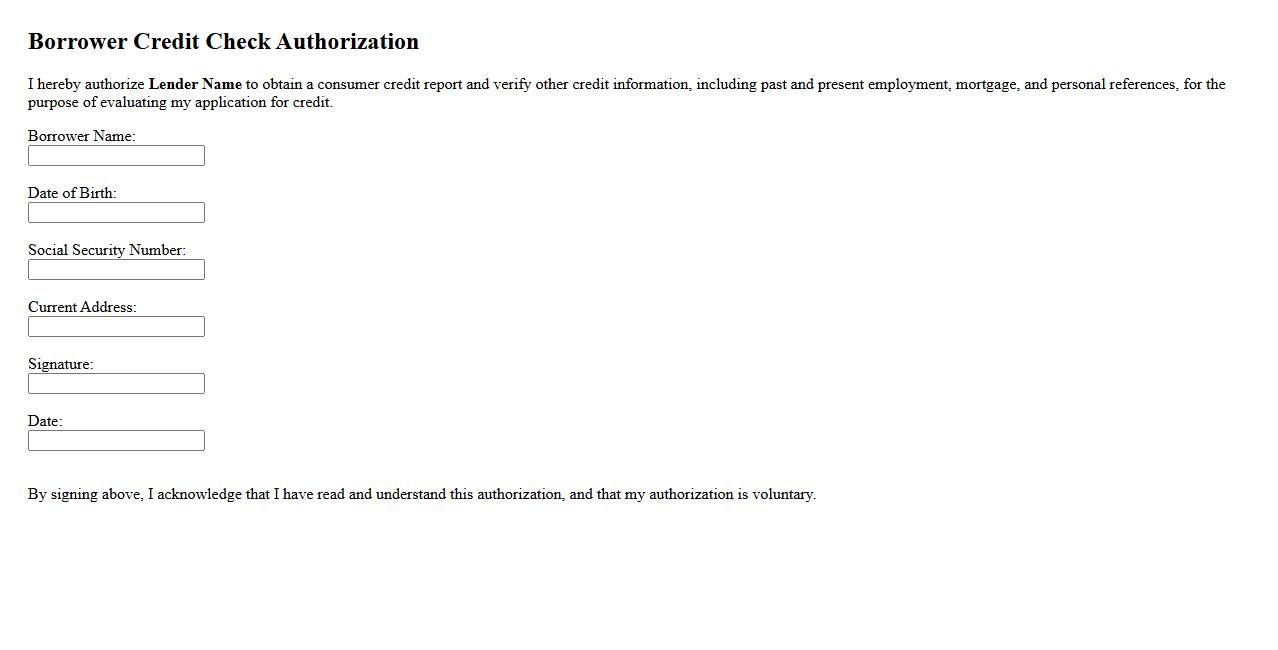

Borrower Credit Check Authorization

The Borrower Credit Check Authorization is a consent form allowing lenders to verify an applicant's credit history. This authorization helps assess the borrower's creditworthiness and financial responsibility. It ensures transparency and compliance during the loan approval process.

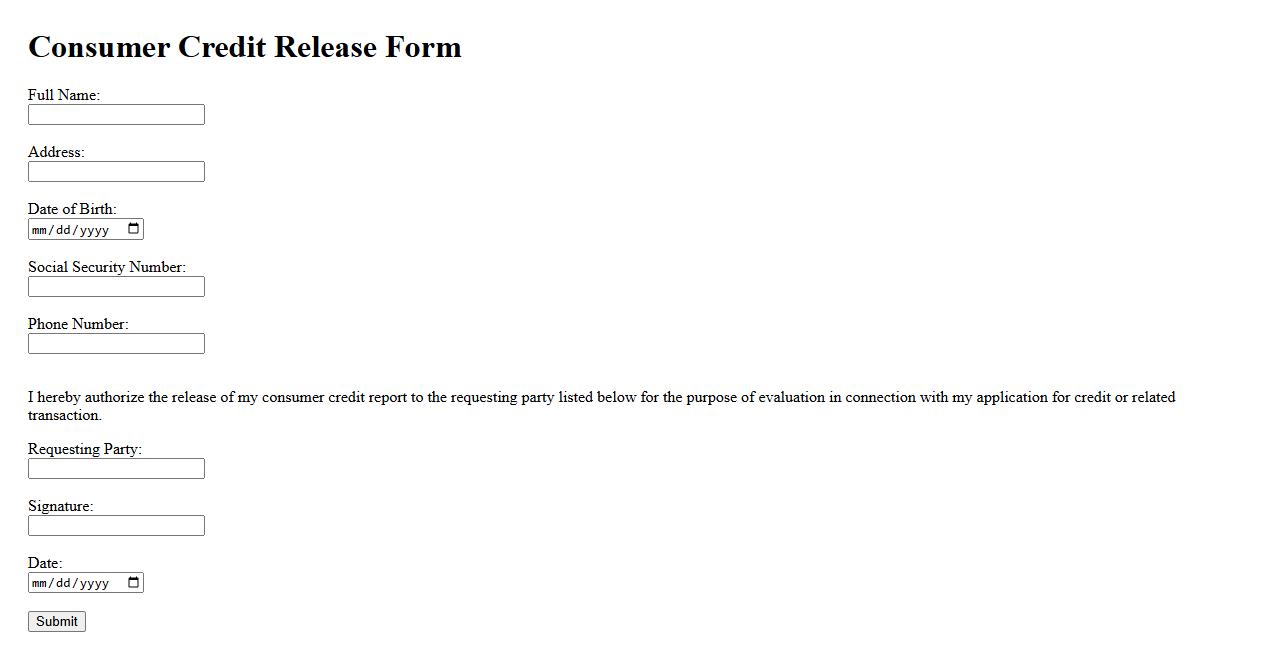

Consumer Credit Release Form

The Consumer Credit Release Form is a legal document that authorizes the release of an individual's credit information to specified parties. It ensures transparency and compliance with privacy regulations during credit checks. This form is essential for lenders, landlords, and employers to access accurate credit data.

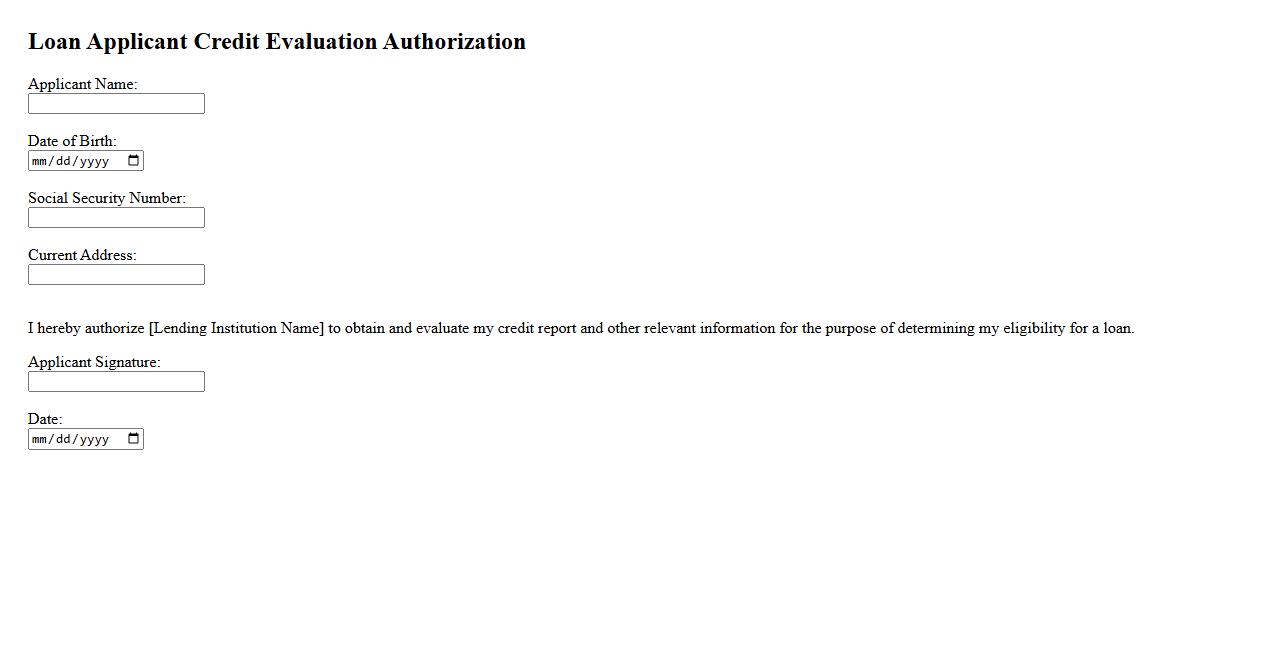

Loan Applicant Credit Evaluation Authorization

The Loan Applicant Credit Evaluation Authorization is a legal consent form allowing lenders to assess an applicant's credit history and financial background. This authorization is crucial for determining loan eligibility and terms. It ensures transparency and compliance with financial regulations during the credit evaluation process.

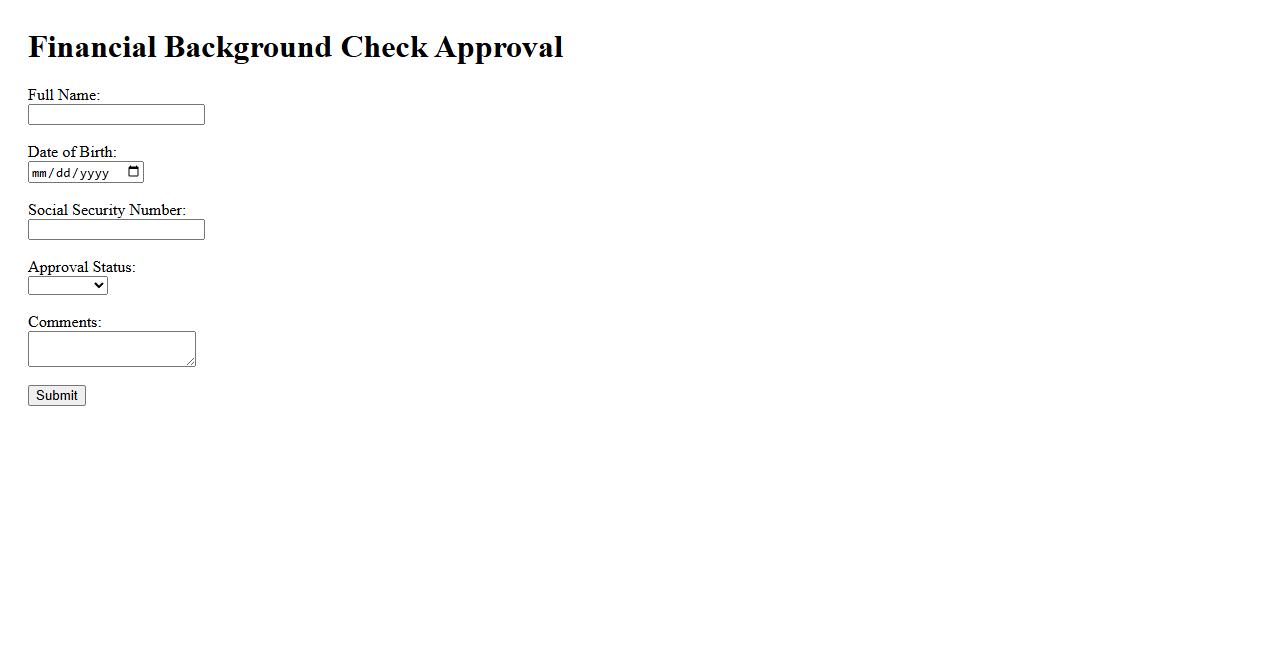

Financial Background Check Approval

A Financial Background Check Approval ensures that an individual's financial history has been thoroughly reviewed and verified. This process helps organizations assess creditworthiness and detect any potential financial risks. Obtaining approval is essential for loans, rentals, and other financial agreements.

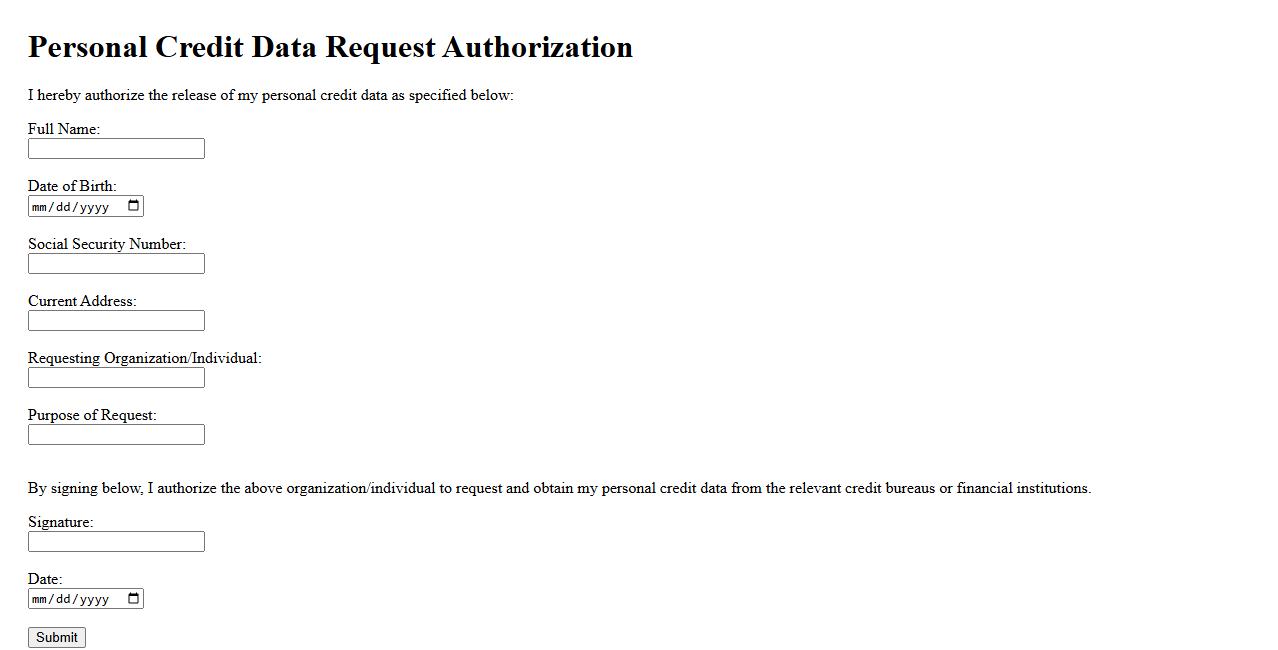

Personal Credit Data Request Authorization

By submitting a Personal Credit Data Request Authorization, individuals grant permission for their credit information to be accessed and reviewed. This authorization is essential for businesses to verify creditworthiness accurately and securely. It ensures compliance with legal standards while protecting personal data privacy.

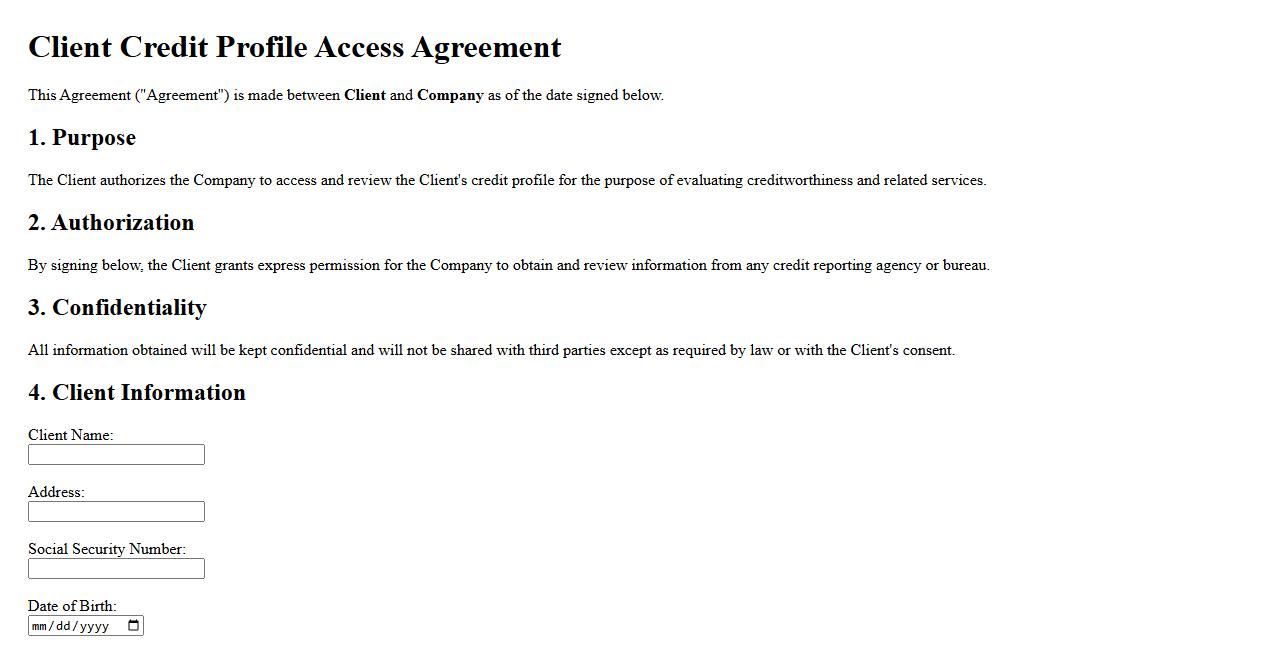

Client Credit Profile Access Agreement

The Client Credit Profile Access Agreement outlines the terms under which a client permits access to their credit information for evaluation purposes. This agreement ensures transparency and compliance with legal standards when sharing sensitive credit data. It is essential for maintaining trust between clients and service providers during financial assessments.

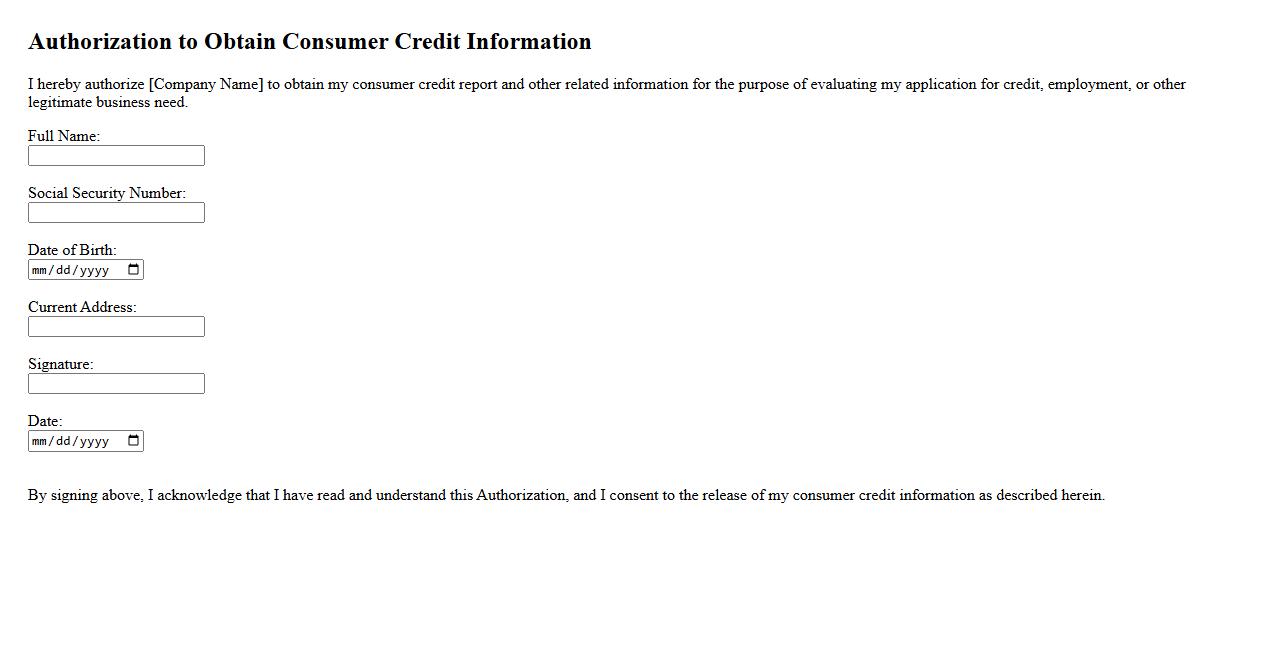

Authorization to Obtain Consumer Credit Information

Authorization to Obtain Consumer Credit Information grants permission for a third party to access an individual's credit report from credit bureaus. This authorization is essential for lenders and financial institutions to evaluate creditworthiness. It ensures compliance with privacy regulations while facilitating informed credit decisions.

What specific type of credit report is being authorized for order in this form?

The form authorizes the order of a consumer credit report. This report typically includes detailed information about the individual's credit history. It is used by third parties to assess creditworthiness.

Who is granted permission to access and obtain the credit report according to the authorization?

The authorization grants permission to a specified credit reporting agency or third-party company. These entities can access and obtain the credit report as outlined in the form. This ensures compliance with privacy and legal standards.

How long is the authorization for the credit report valid once the form is signed?

The authorization is generally valid for a specific period, usually 30 to 90 days from the signing date. This duration allows the authorized party sufficient time to access and use the credit report. After the expiration, a new authorization must be obtained.

What personal information is required from the individual to process the credit report request?

Essential personal information includes the individual's full name, date of birth, Social Security number, and address. This data is critical to accurately identify the person and retrieve their credit information. It helps prevent errors and ensure data integrity.

What purpose or intended use for the credit report is specified in the authorization form?

The authorization form specifies a clear purpose such as employment screening, loan approval, or rental application. This defines the context in which the credit report will be used. Clear purpose ensures compliance with legal requirements and informs the consumer.