Your Order Student Loan Statement provides a detailed summary of your outstanding student loan balance, payment history, and interest accrued. This document helps you track your repayment progress and ensure accuracy in your loan account. Accessing your statement regularly allows you to manage your loans effectively and plan future payments.

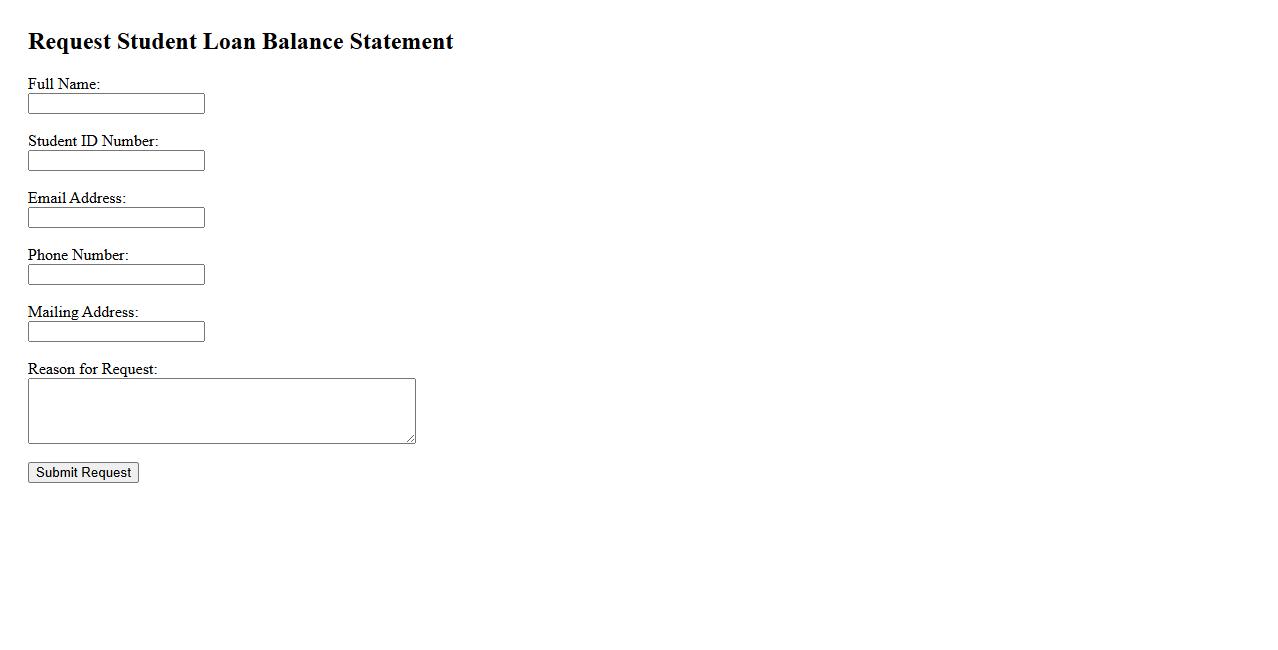

Request Student Loan Balance Statement

To obtain your student loan balance statement, you need to contact your loan servicer or access your online account. This document provides a detailed summary of your current loan balance, including principal, interest, and any outstanding fees. Regularly reviewing your balance statement helps you stay informed about your repayment status and plan your finances effectively.

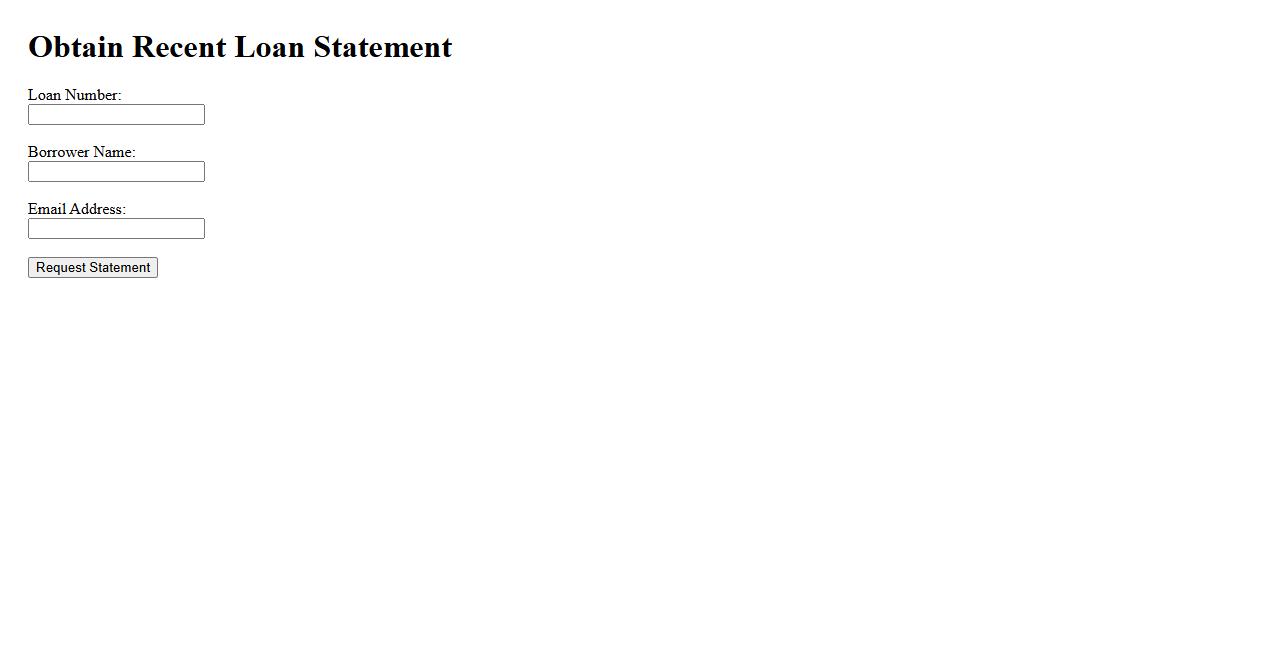

Obtain Recent Loan Statement

To obtain recent loan statement, you can access your online banking account or contact your loan provider directly. This statement provides detailed information about your loan balance, payment history, and upcoming due dates. Keeping track of your loan statements helps ensure timely payments and effective financial management.

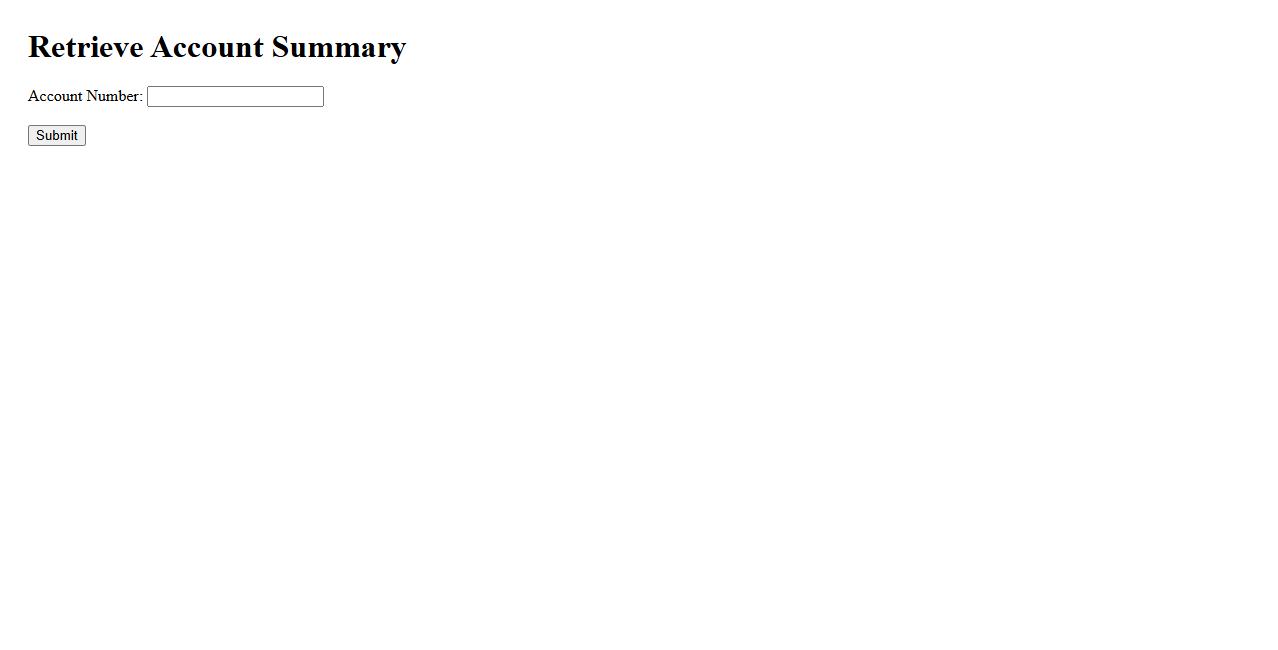

Retrieve Account Summary

To easily access your financial details, use the Retrieve Account Summary feature. This tool allows you to view your account balance, recent transactions, and other essential information at a glance. Stay informed and manage your finances efficiently with just a few clicks.

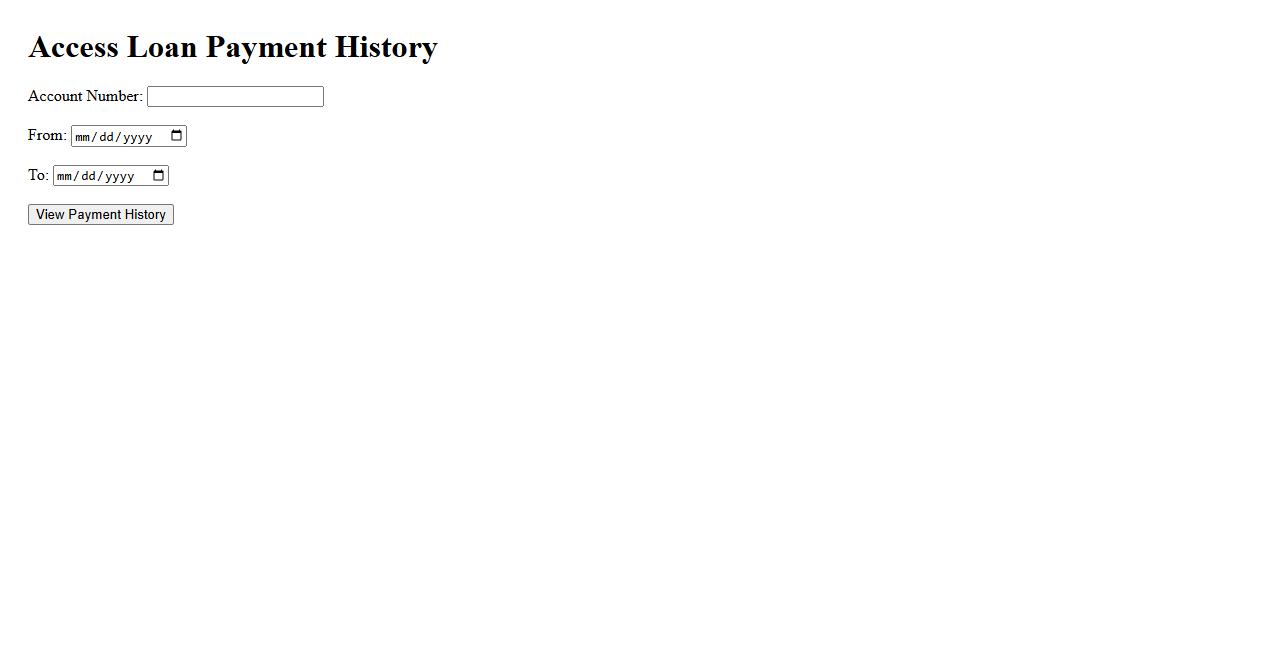

Access Loan Payment History

Access your loan payment history quickly and easily to keep track of all past payments. This feature provides a detailed record of transaction dates, amounts, and outstanding balances. Stay organized and manage your finances with confidence using this essential tool.

Download Loan Statement

To easily track your financial transactions, you can download loan statement directly from our online portal. This document provides a detailed summary of your loan activities, including payment history and outstanding balances. Accessing your statement helps you stay informed and manage your loan effectively.

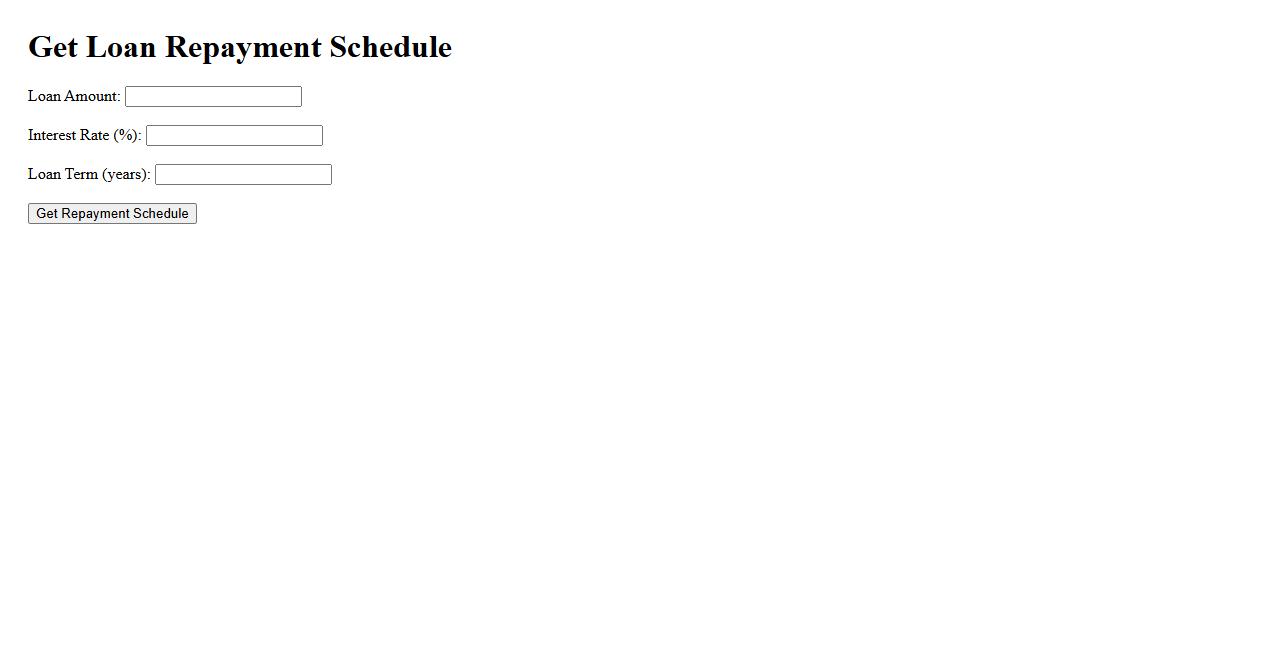

Get Loan Repayment Schedule

Understanding your loan repayment schedule is crucial for managing your finances effectively. It provides a clear timeline of payment amounts and due dates, helping you stay on track. Accessing your repayment schedule ensures you avoid missed payments and plan your budget accordingly.

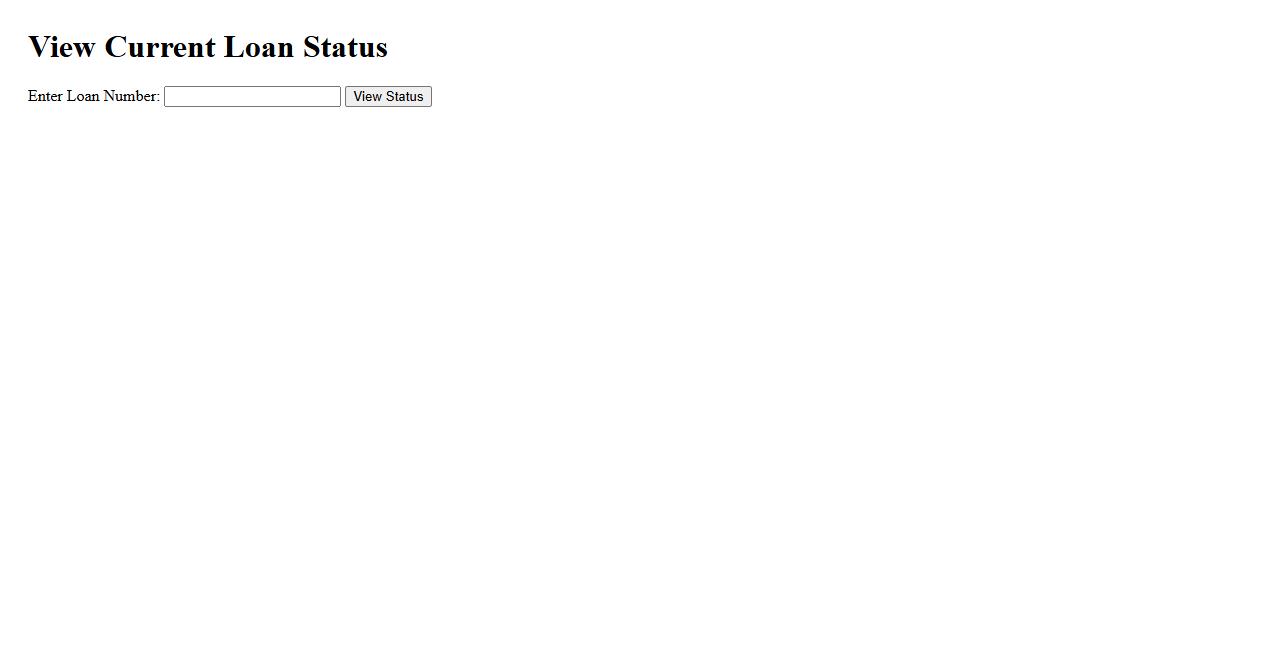

View Current Loan Status

Check your current loan status easily and stay informed about your repayment progress. Access detailed information on outstanding balances, payment schedules, and due dates. Stay updated to manage your loans effectively and avoid any missed payments.

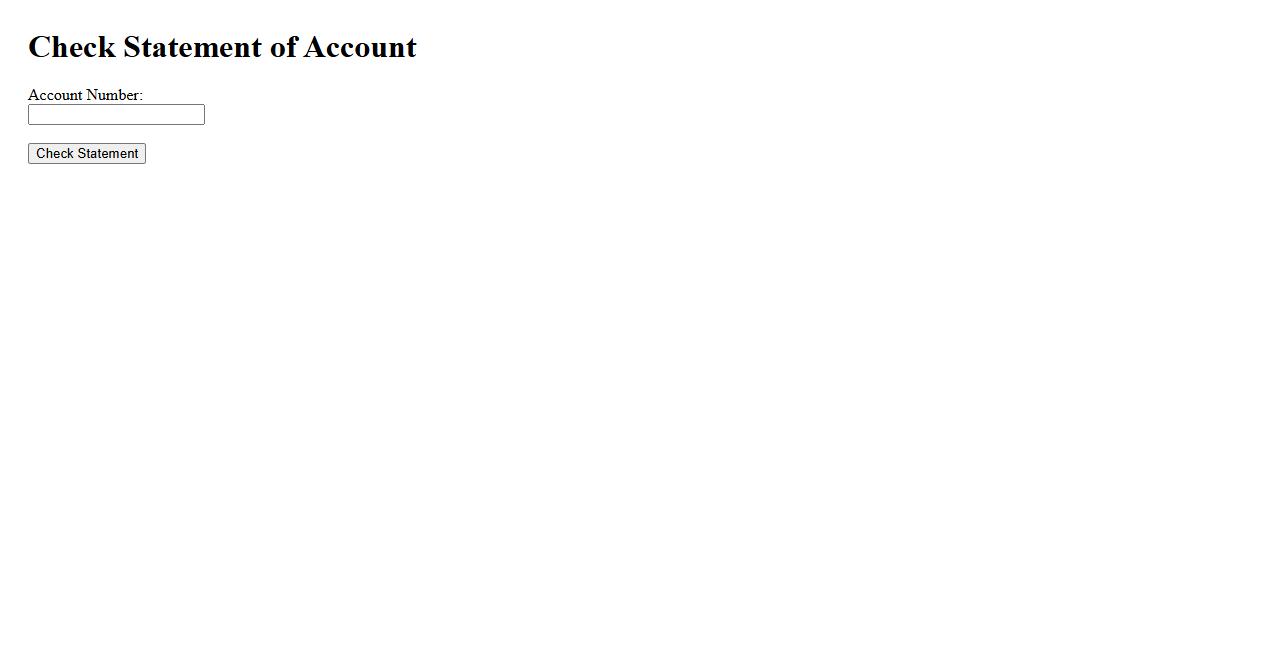

Check Statement of Account

Review your Statement of Account regularly to stay updated on your financial transactions and balances. This document provides a detailed summary of all credits, debits, and outstanding amounts. Keeping track of your statement helps ensure accuracy and manage your finances effectively.

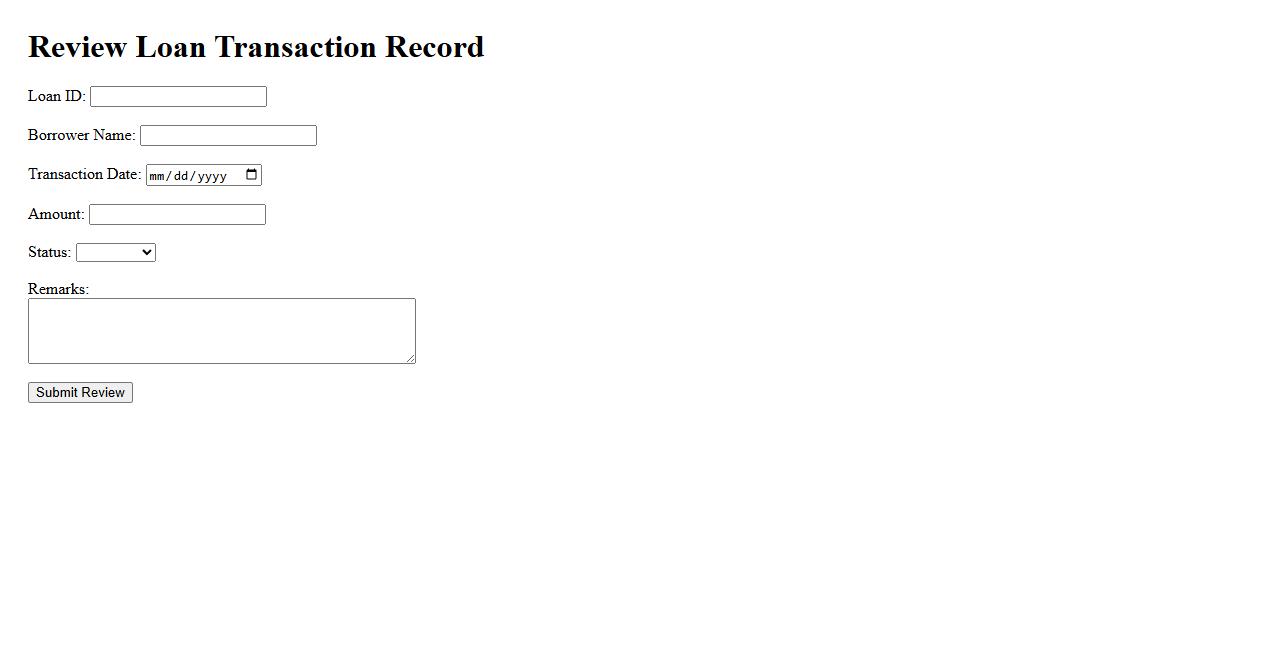

Review Loan Transaction Record

The Review Loan Transaction Record feature allows users to accurately track and verify all loan-related activities. It ensures transparency by displaying detailed information about each transaction, including dates, amounts, and statuses. This helps users maintain organized financial records and make informed decisions.

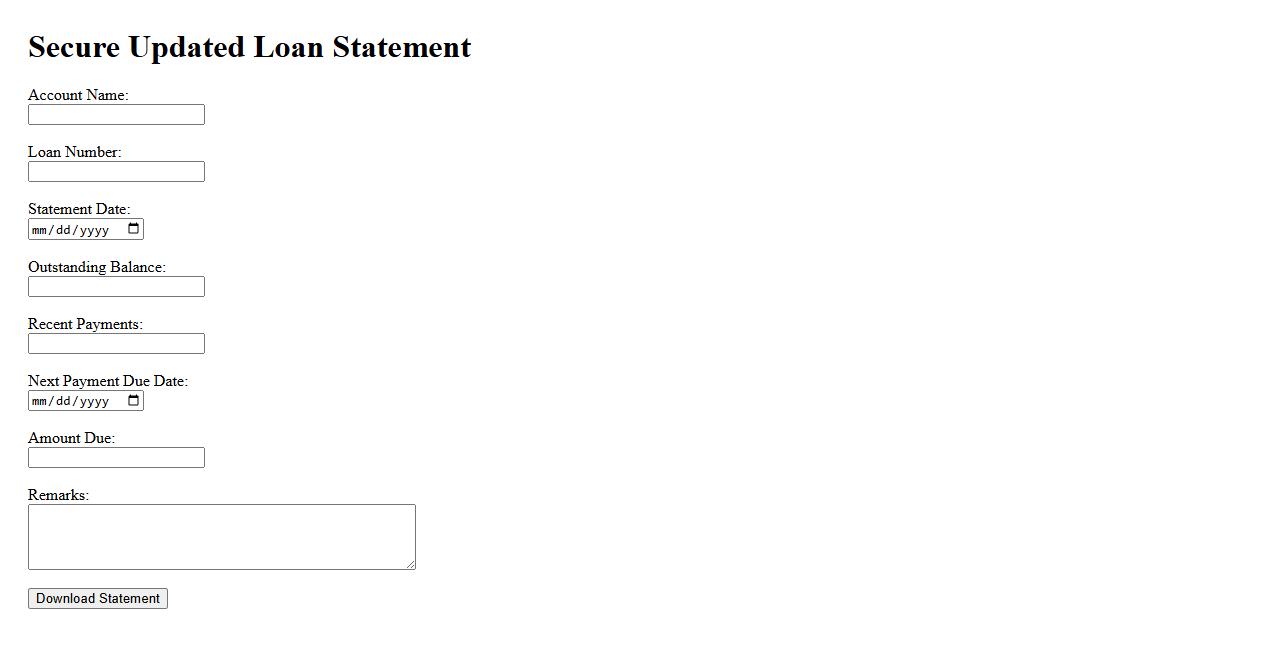

Secure Updated Loan Statement

Access your Secure Updated Loan Statement anytime to monitor your loan details with confidence. This statement provides the latest transaction history and balance information, ensuring accuracy and transparency. Stay informed and manage your finances effectively with real-time updates.

What specific information is required to generate an Order Student Loan Statement?

To generate an Order Student Loan Statement, key details such as the borrower's full name, account number, and current loan balance are necessary. Additionally, the loan type and date range for the statement period are required to ensure accuracy. Without these specifics, the statement cannot be accurately produced or processed.

Which sections or details are typically included in a standard Student Loan Statement document?

A standard Student Loan Statement usually includes the loan balance, payment history, and interest rate. It also features the due date for the next payment and any applicable fees or charges. This comprehensive information helps borrowers stay informed about their loan status.

How can one verify the authenticity or accuracy of the Order Student Loan Statement?

To verify the authenticity of an Order Student Loan Statement, one should cross-check the document with official loan servicer records. Checking for authorized logos, contact information, and matching account numbers ensures validity. Additionally, contacting the loan provider directly can confirm the statement's accuracy.

What formats are available for receiving the Student Loan Statement (e.g., digital, print)?

Student Loan Statements are commonly available in both digital and print formats. Digital copies can be accessed through secure online portals or emailed as PDFs, offering convenience and quick retrieval. Printed statements are typically mailed upon request or as part of regular billing cycles.

Who is authorized to request and access an official Order Student Loan Statement?

Only the borrower or an authorized representative with proper consent can request and access an official Order Student Loan Statement. Lenders and loan servicers also have access to these statements for servicing purposes. Protecting this information ensures compliance with privacy laws and borrower confidentiality.