A Notice of Deficiency is an official letter sent by the IRS indicating that a taxpayer owes additional taxes after an audit. This notice allows the taxpayer to dispute the proposed tax increase by filing a petition with the Tax Court. Understanding the implications of a Notice of Deficiency is crucial to protect your rights and avoid further penalties.

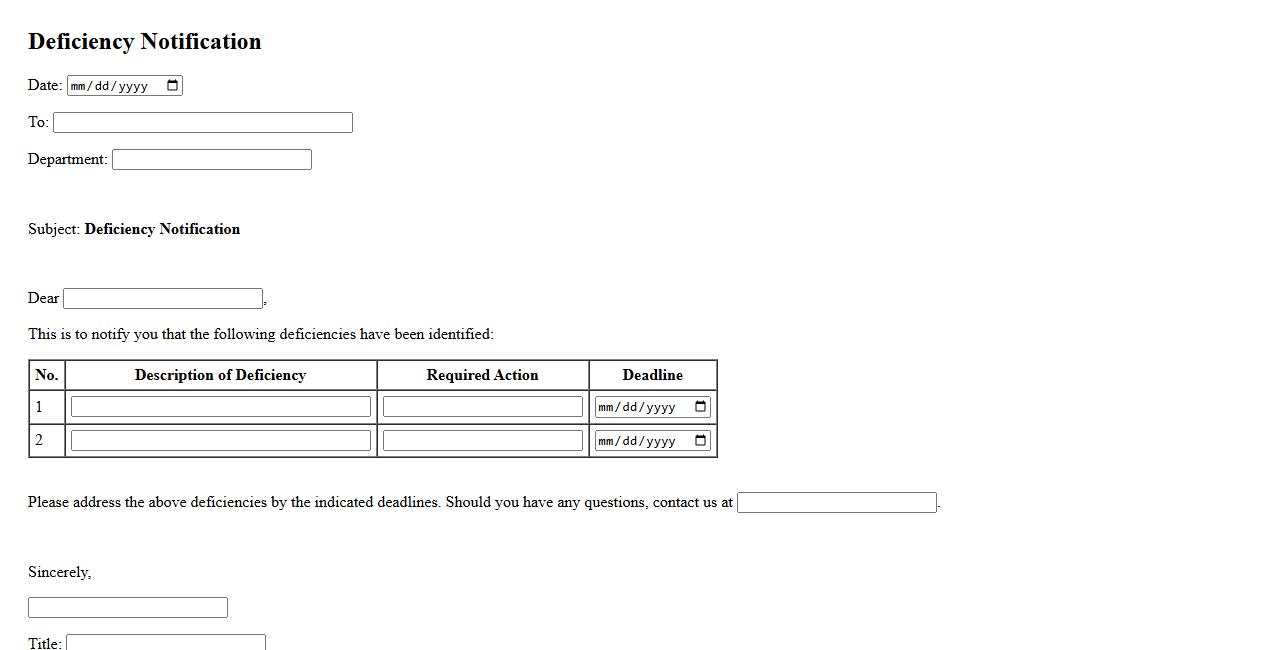

Deficiency Notification

A Deficiency Notification is a formal alert issued to identify and communicate gaps or shortcomings in processes, products, or services. It serves as a key tool for quality control and compliance, prompting necessary corrective actions. Timely issuance ensures efficient resolution and prevents further complications.

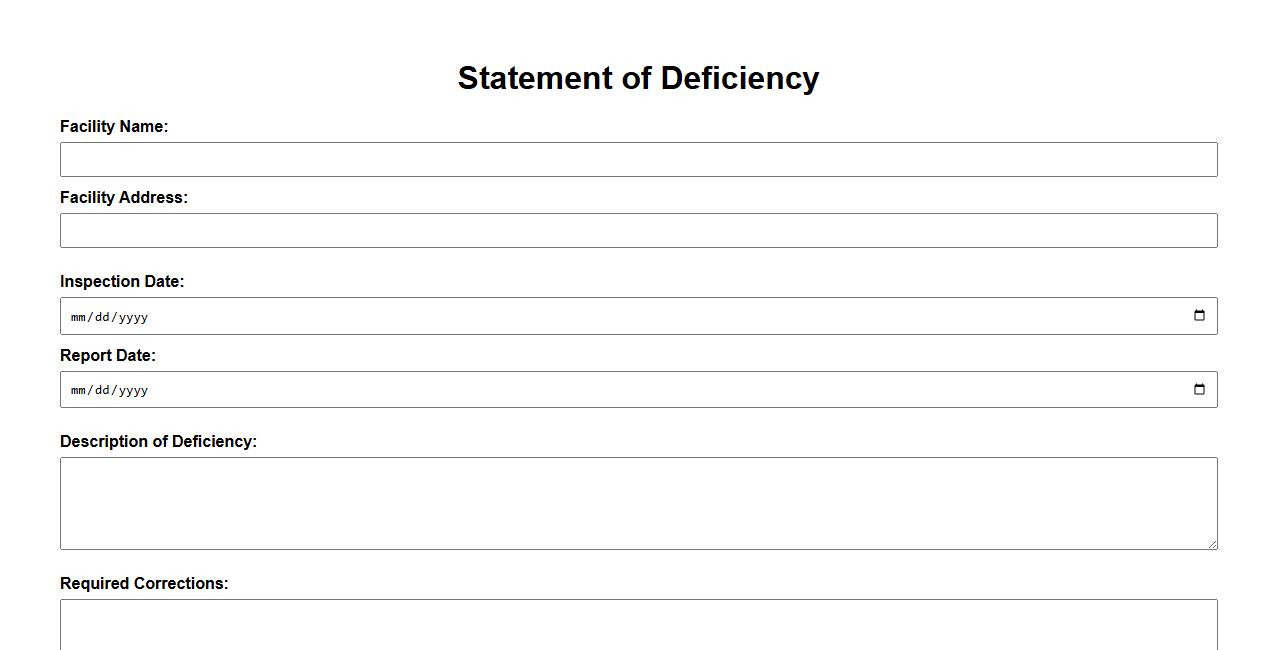

Statement of Deficiency

A Statement of Deficiency is an official document issued to highlight areas where an organization or individual fails to meet required standards. It outlines specific non-compliances and offers a clear path for corrective action. This statement ensures transparency and accountability in regulatory processes.

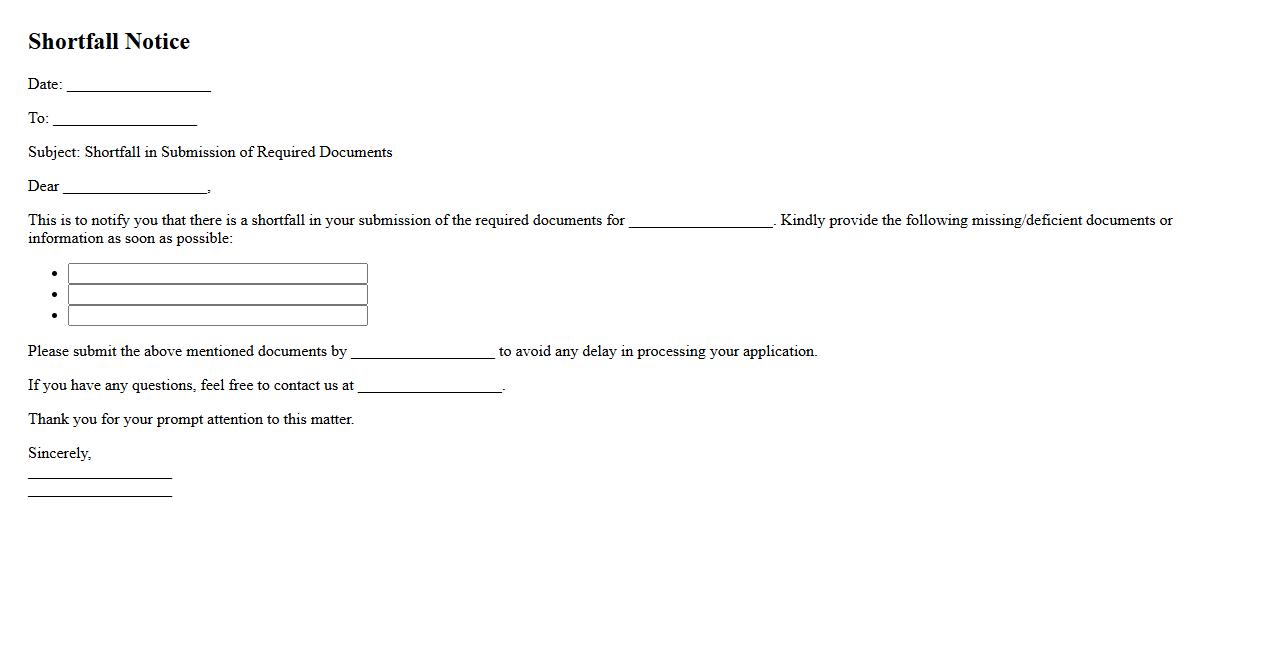

Shortfall Notice

A Shortfall Notice is a formal document issued when an account or payment falls below the required amount. It alerts the recipient to the discrepancy and prompts corrective action. This notice ensures timely resolution to maintain compliance and financial accuracy.

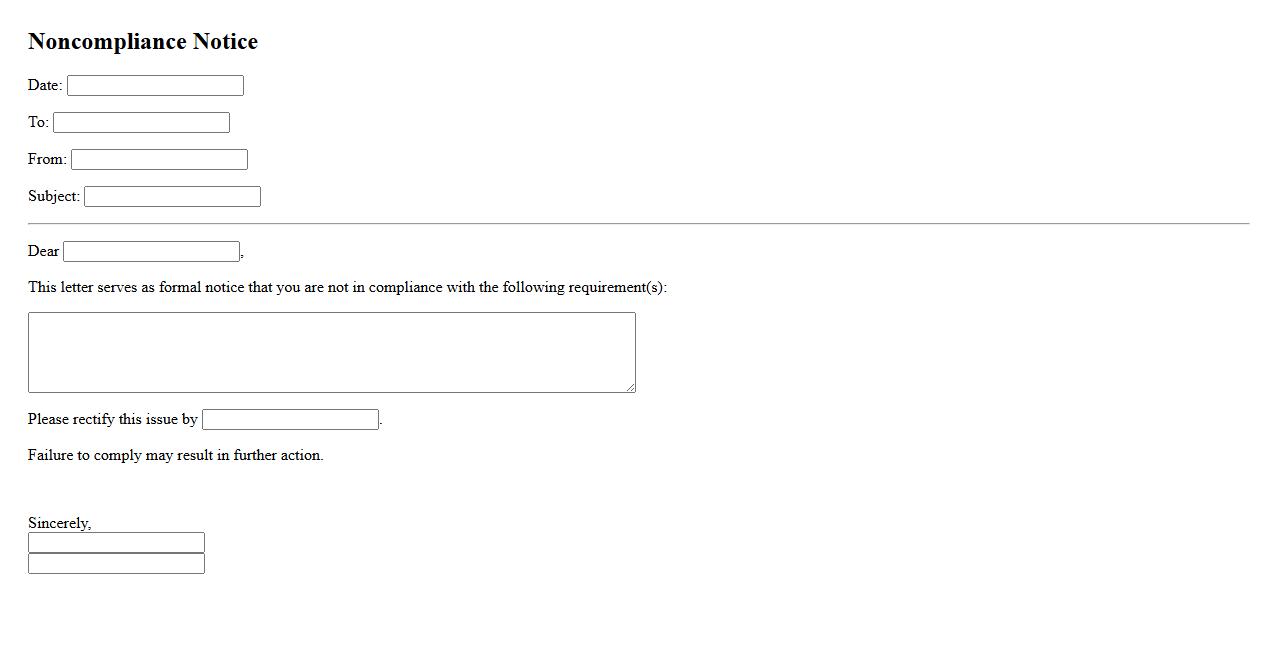

Noncompliance Notice

A Noncompliance Notice is an official document issued to inform an individual or organization that they have failed to meet specific requirements or regulations. It outlines the areas of noncompliance and provides instructions for corrective actions. Prompt attention to this notice is essential to avoid further penalties or enforcement actions.

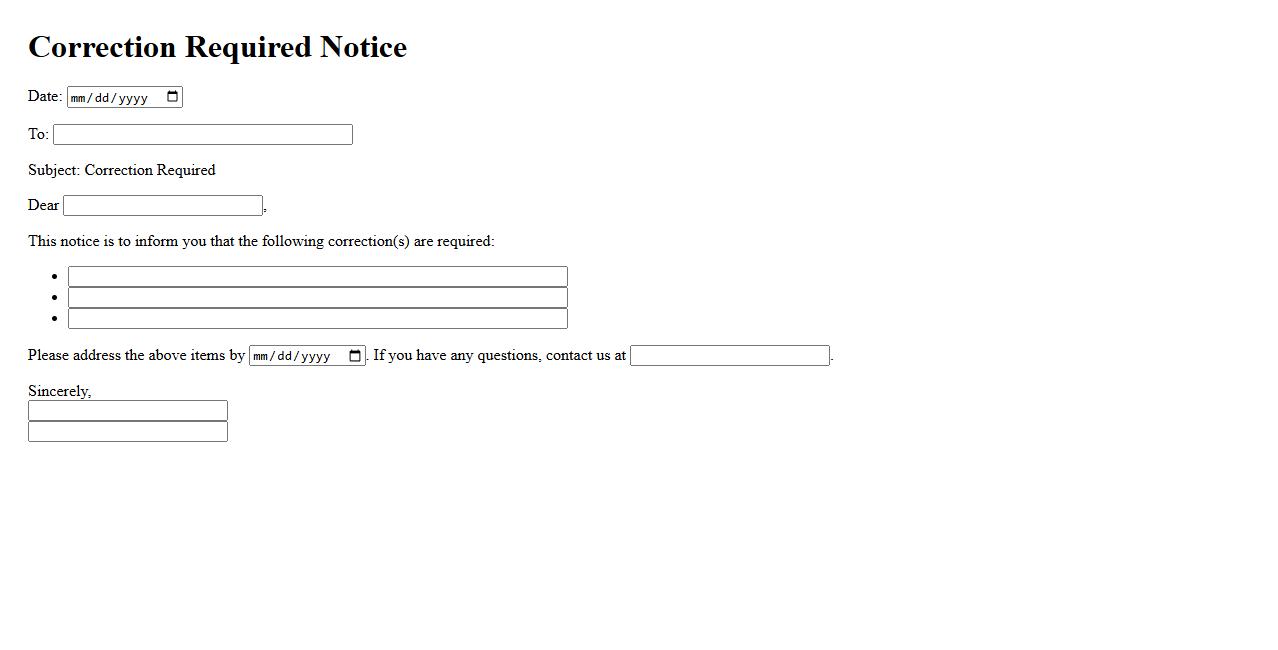

Correction Required Notice

The Correction Required Notice is an official document issued to highlight errors or discrepancies that need immediate attention. It ensures accurate record-keeping and compliance with relevant standards. Prompt action upon receiving this notice aids in maintaining operational efficiency and legal integrity.

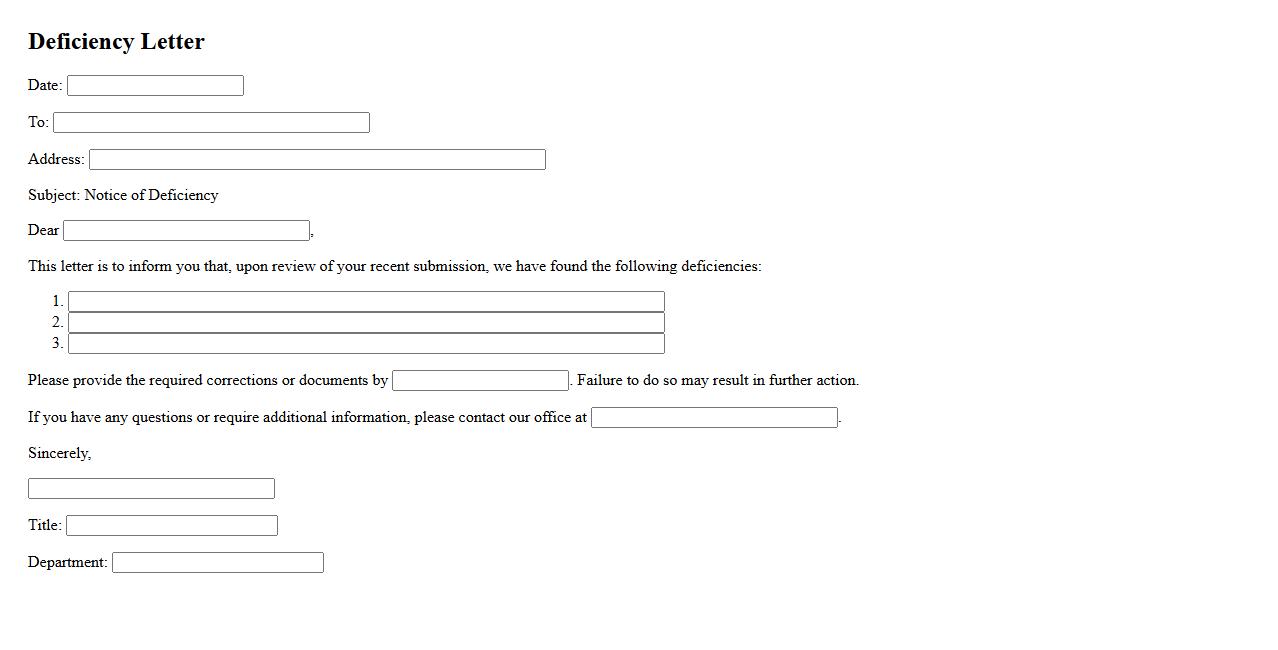

Deficiency Letter

A Deficiency Letter is a formal document issued to notify an individual or organization about missing or incomplete information required for a specific process. It outlines the exact deficiencies that need to be addressed to proceed further. Timely response to a deficiency letter ensures the continuation of applications or reviews without delay.

Deficiency Report

A Deficiency Report is a document used to identify and record shortcomings or non-compliance in processes, products, or services. It helps organizations track issues systematically and implement corrective actions. This report is essential for maintaining quality and ensuring regulatory compliance.

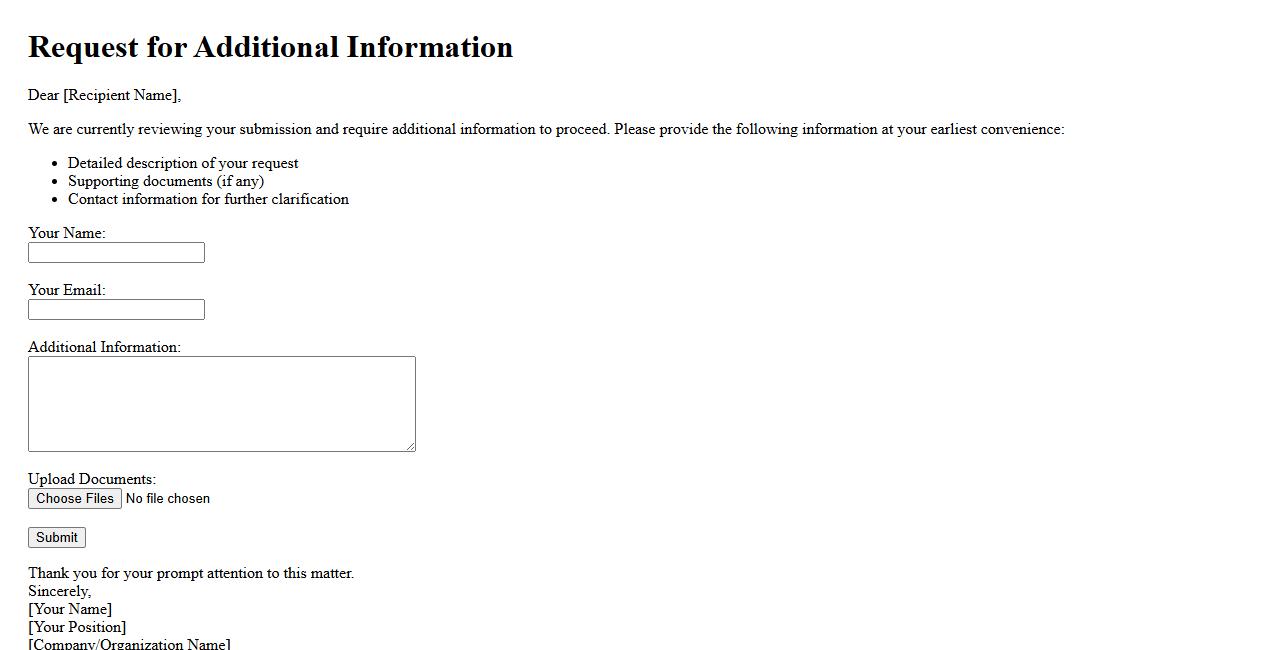

Request for Additional Information

A Request for Additional Information is a formal inquiry made to gather more details necessary to complete a task or decision. It ensures clarity and accuracy by addressing any uncertainties or missing data. This process helps streamline communication and improve outcomes.

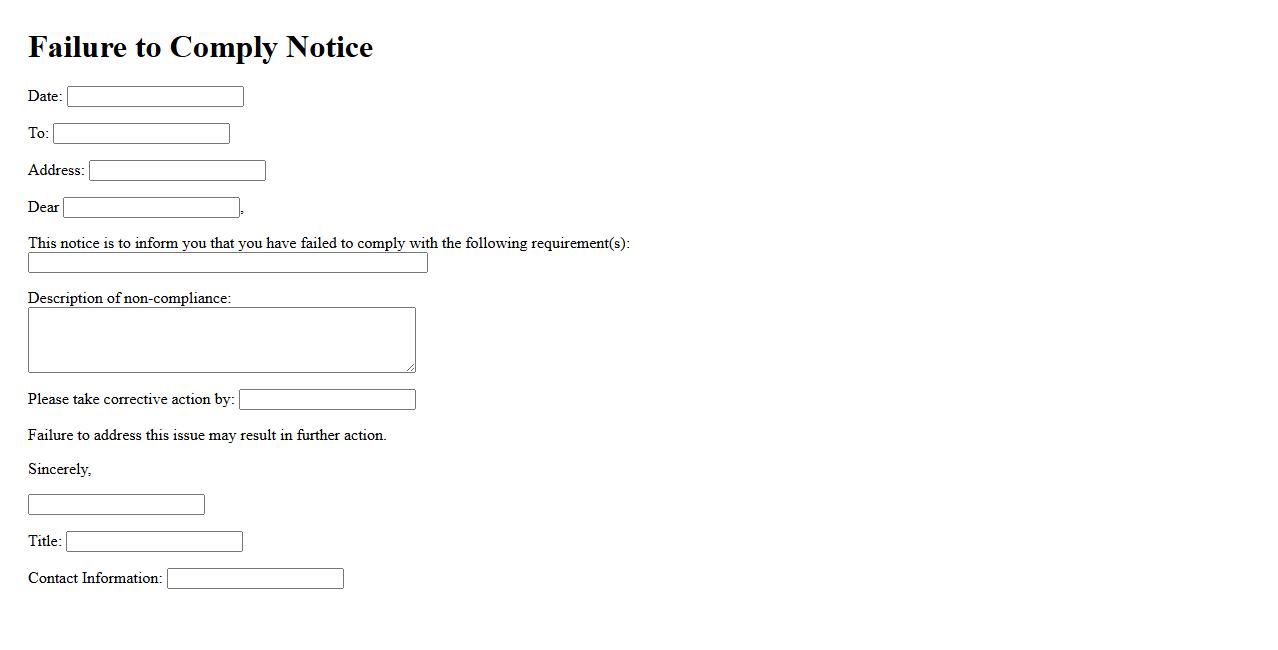

Failure to Comply Notice

A Failure to Comply Notice is a formal document issued when an individual or organization does not adhere to specified rules or regulations. It serves as a warning requiring corrective action within a set timeframe to avoid further penalties. Understanding this notice is crucial for maintaining compliance and avoiding legal consequences.

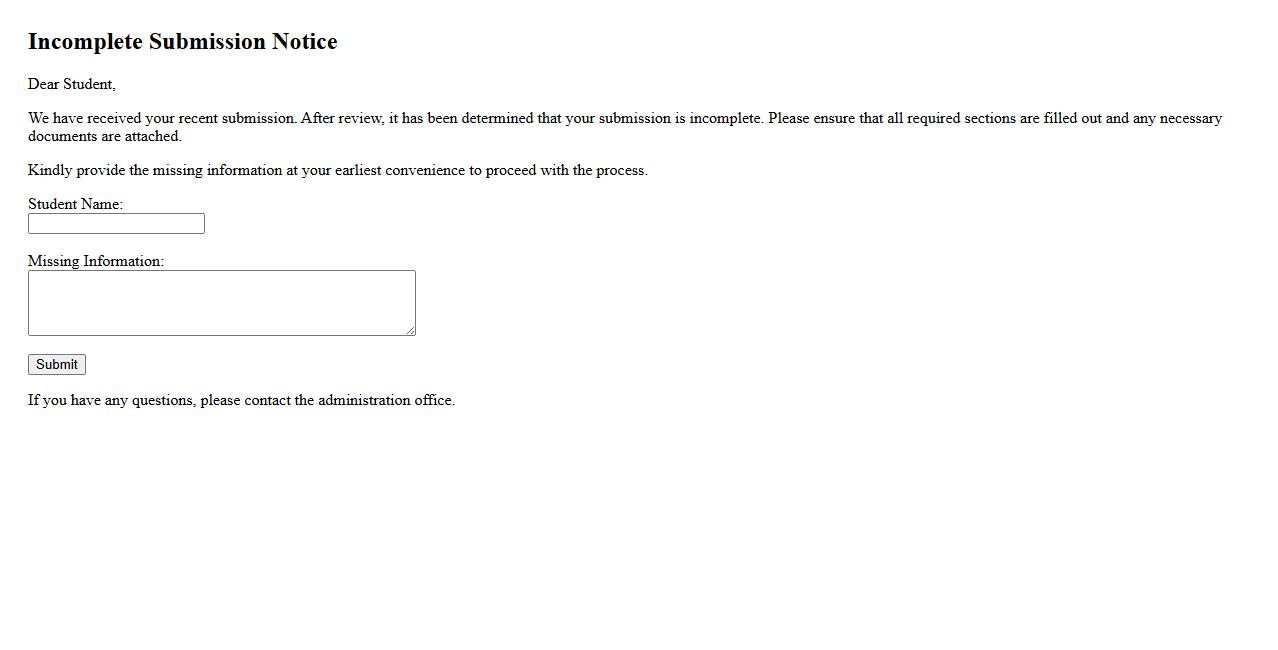

Incomplete Submission Notice

This Incomplete Submission Notice alerts users when their form or application has not been fully completed. It ensures all required fields are filled to avoid processing delays. Prompt correction helps in timely and accurate submission.

What is the primary purpose of a Notice of Deficiency in official proceedings?

The primary purpose of a Notice of Deficiency is to formally inform an individual or entity of a tax deficiency or similar issue identified by a government agency. This document serves as an official notification that additional amounts are owed beyond what was reported. It acts as a prelude to potential legal or administrative actions if the deficiency is not addressed.

Which parties are typically notified when a Notice of Deficiency is issued?

A Notice of Deficiency is typically issued to the taxpayer or entity directly responsible for the tax filings or records under review. In certain cases, legal representatives or authorized agents of the taxpayer may also be notified. This ensures clear communication to all relevant parties involved in the matter.

What specific deficiencies or errors does the document usually identify?

The Notice of Deficiency usually outlines specific tax underpayments, misreported income, or errors in claims or deductions. It details the amounts and reasons for the discrepancy as determined by an audit or review. This clarity helps the recipient understand the nature and basis of the deficiency.

What are the standard legal or procedural steps that follow the receipt of a Notice of Deficiency?

After receiving a Notice of Deficiency, the recipient is typically required to respond or contest the findings within a set period. If the notice is not challenged, the agency may proceed with additional collection actions or assessments. Legal options such as appeals or hearings are commonly available to dispute the deficiency.

What deadlines or response requirements are outlined within the Notice of Deficiency?

The Notice of Deficiency specifies critical deadlines for response or appeal, often ranging from 30 to 90 days depending on jurisdiction. Failure to respond within these timeframes may result in automatic acceptance of the deficiency and enforcement actions. Timely compliance is essential to preserve rights to contest the notice.