A Notice of Withholding is an official document issued by an employer or payer indicating the amount of income tax or other deductions withheld from an individual's paycheck or payment. It serves as proof for both employees and tax authorities that the correct amount has been withheld for tax purposes. This notice helps ensure accurate reporting and compliance with tax regulations.

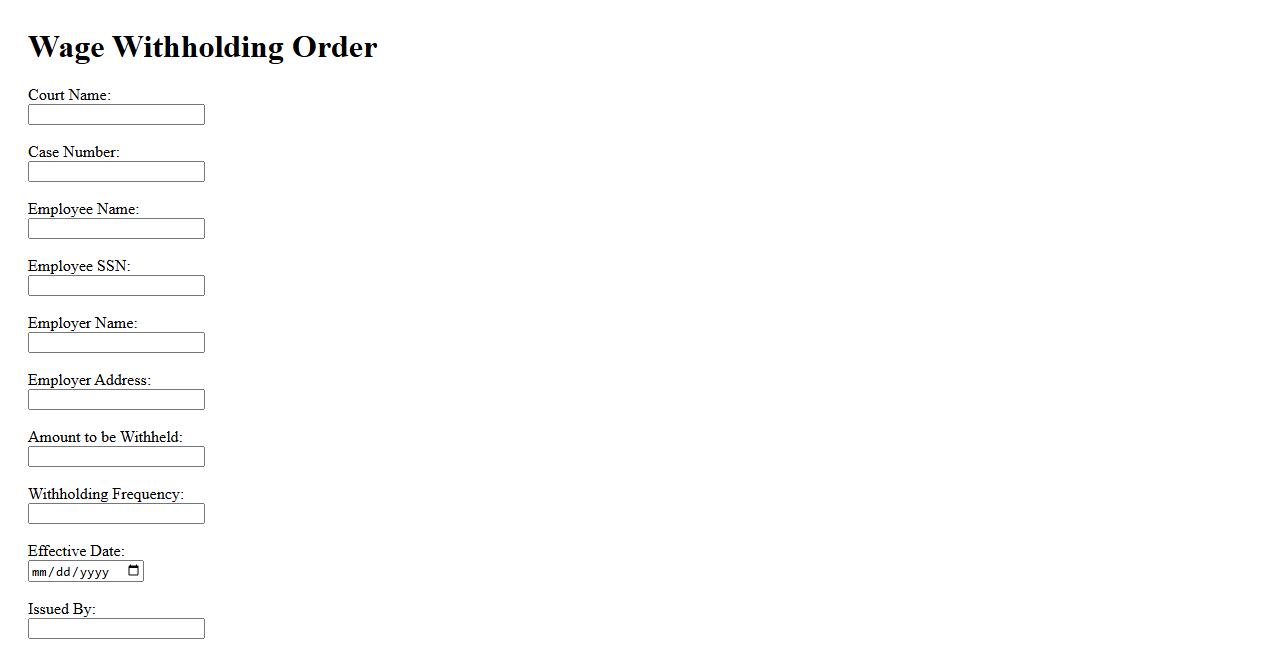

Wage Withholding Order

A Wage Withholding Order is a legal directive that requires an employer to deduct a portion of an employee's wages to satisfy a debt or financial obligation. This order is typically issued by a court to enforce child support, tax debts, or other court judgments. It ensures timely payment by directly withholding funds from the employee's paycheck.

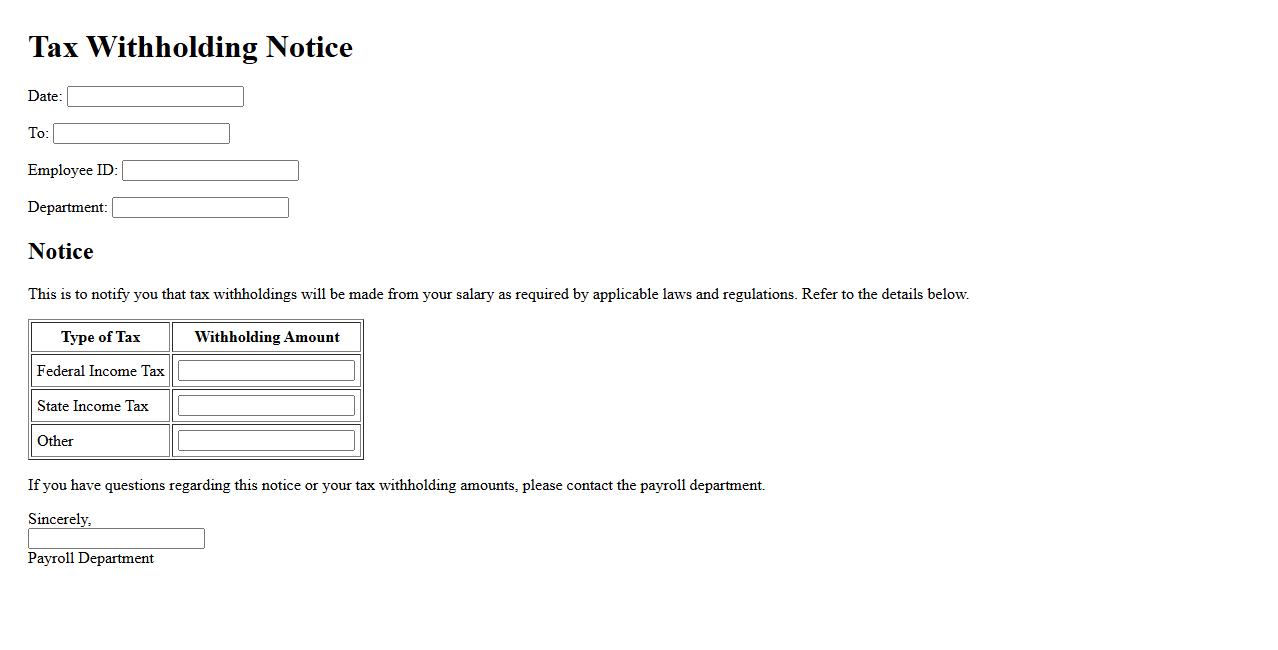

Tax Withholding Notice

A Tax Withholding Notice informs employees or payees about the amount of tax being withheld from their income. This document ensures transparency and helps individuals manage their tax obligations effectively. Receiving this notice is essential for accurate tax reporting and compliance.

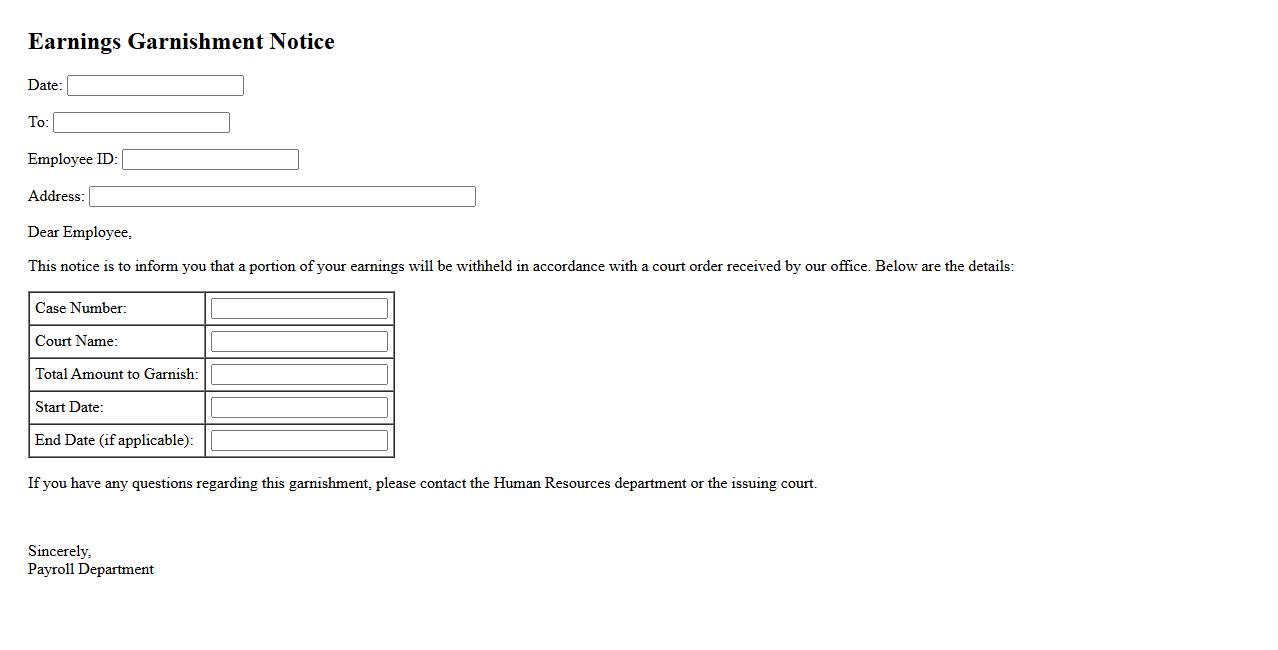

Earnings Garnishment Notice

An Earnings Garnishment Notice is a formal document informing an employee that a portion of their wages will be withheld to satisfy a debt. This legal order is typically issued by a court or government agency and must be complied with by the employer. It ensures creditors receive payments directly from the employee's paycheck until the debt is resolved.

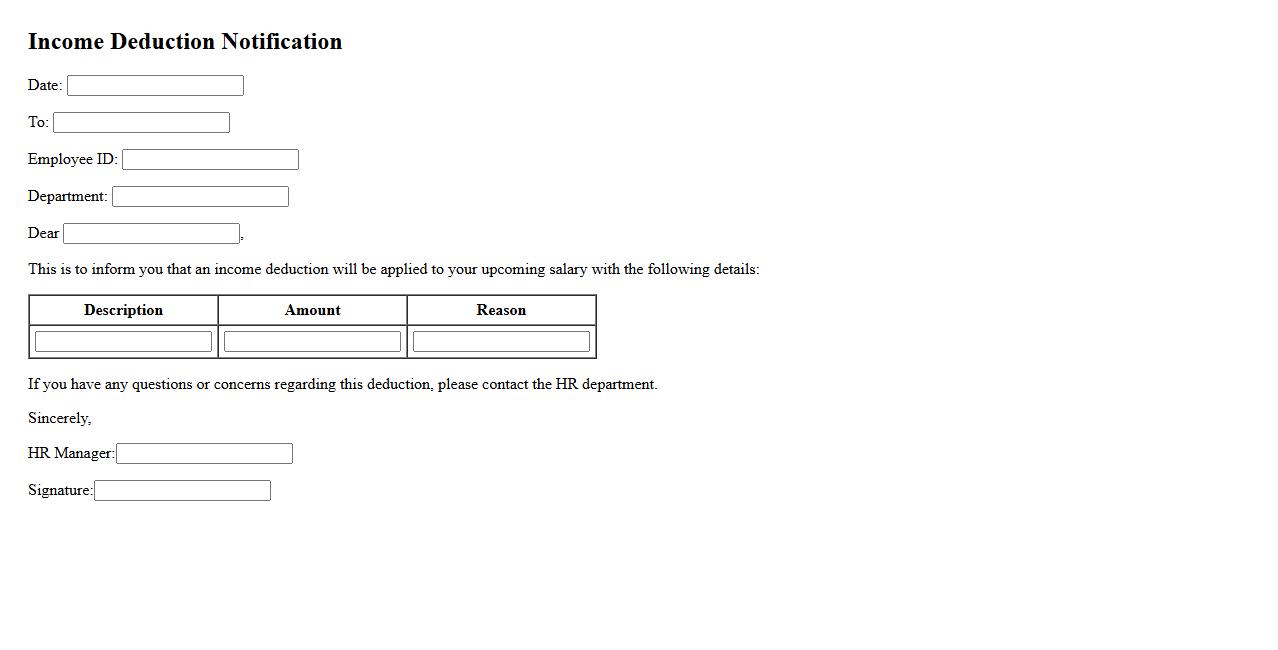

Income Deduction Notification

An Income Deduction Notification is an official document that informs an individual or employer about authorized deductions from their income. It outlines the amount to be withheld and the reasons for the deduction, such as taxes, garnishments, or loan repayments. This notification ensures transparency and compliance with legal financial obligations.

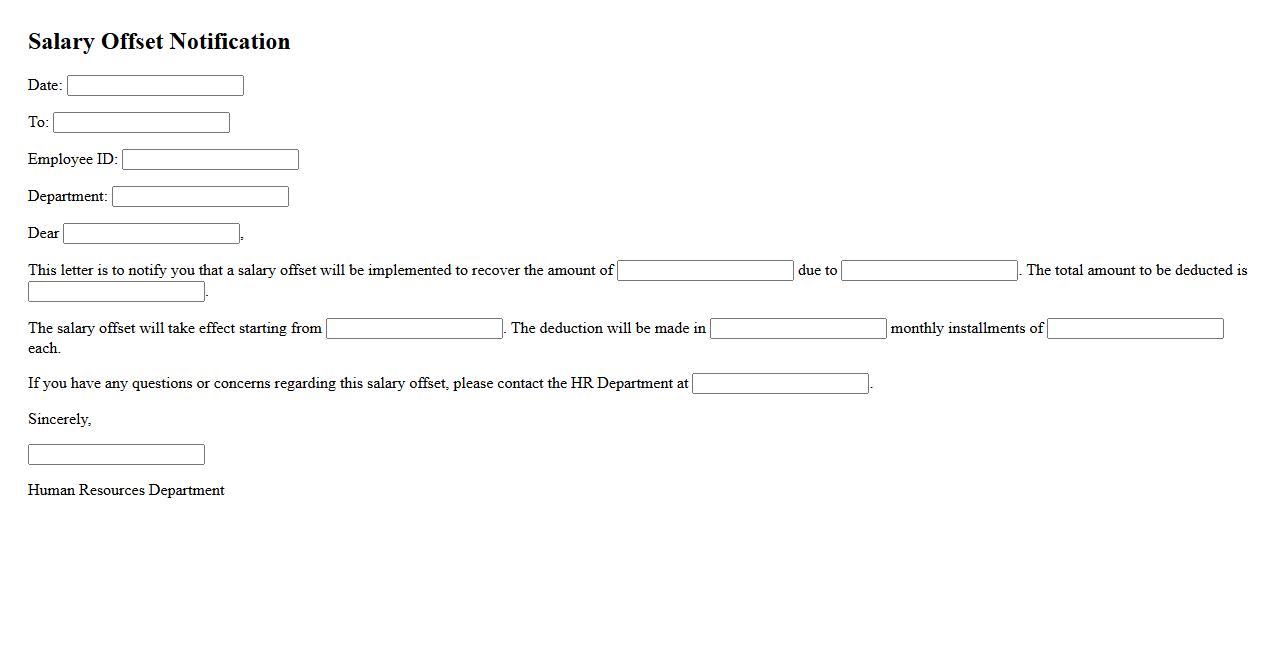

Salary Offset Notification

Salary Offset Notification informs employees about deductions from their pay to recover debts or overpayments. This notification ensures transparency by clearly explaining the reason and amount of the offset. It helps employees understand adjustments made to their salary promptly.

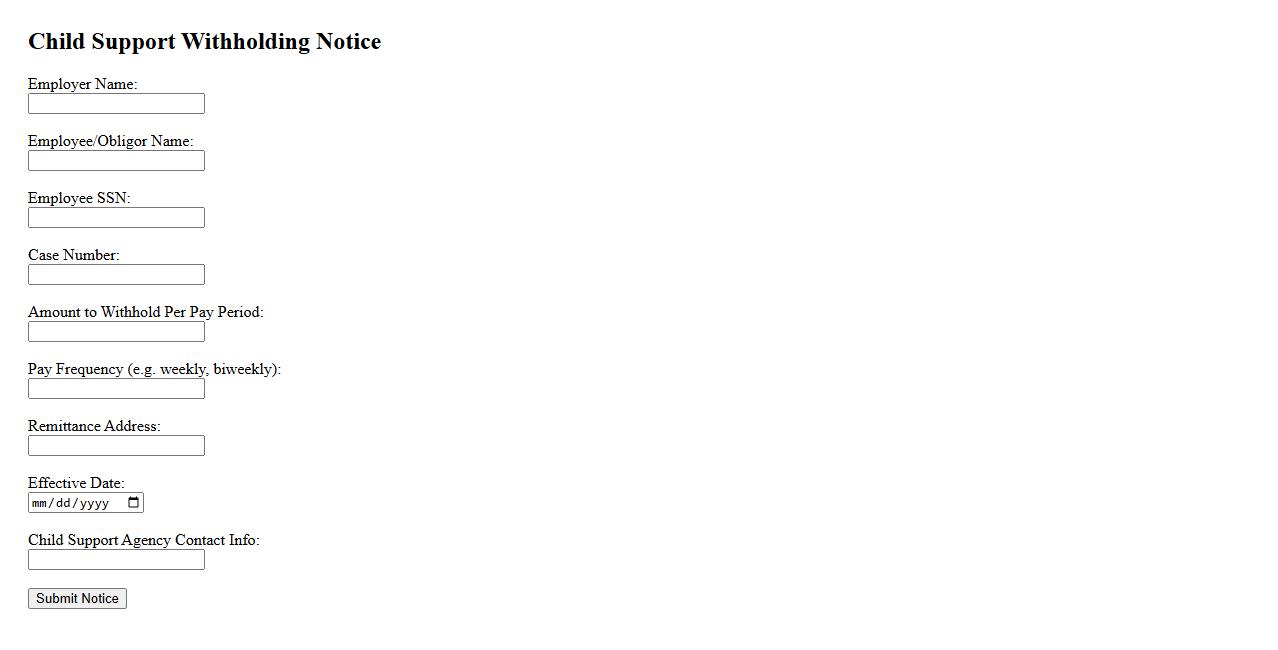

Child Support Withholding Notice

The Child Support Withholding Notice is an official document that informs employers to deduct child support payments directly from an employee's wages. This notice ensures timely and consistent financial support for the child's well-being. Employers are legally obligated to comply with this withholding order to help enforce child support obligations.

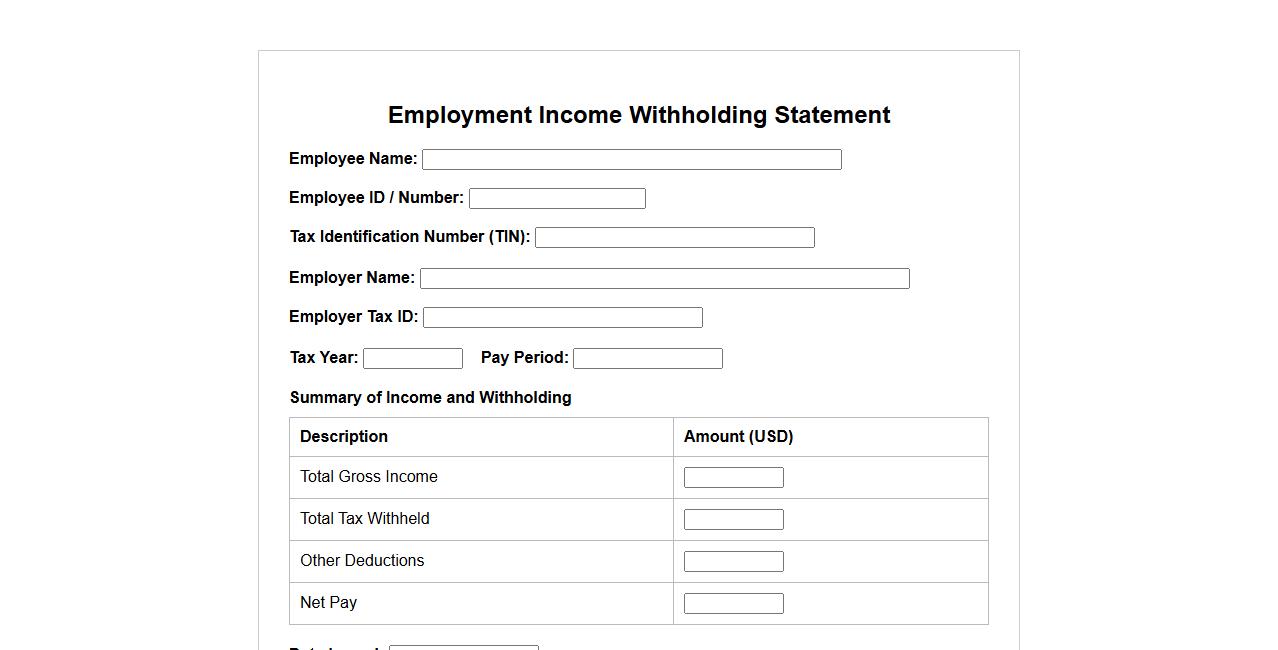

Employment Income Withholding Statement

The Employment Income Withholding Statement is a document provided by employers to employees detailing the amounts withheld from their paycheck for taxes and other deductions. It serves as an official record for both payroll and tax reporting purposes. This statement helps employees understand their earnings and the corresponding withholdings throughout the year.

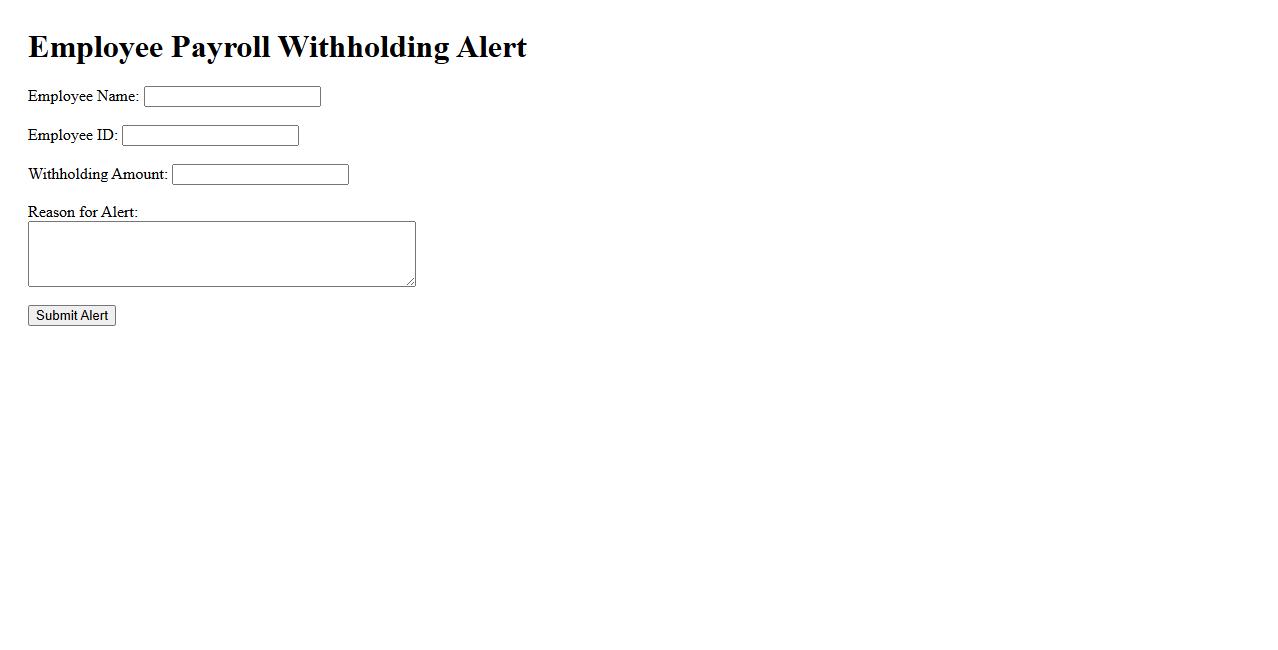

Employee Payroll Withholding Alert

Employee Payroll Withholding Alert is a critical notification system designed to ensure accurate deduction of taxes and benefits from employee paychecks. It helps organizations maintain compliance with government regulations by alerting payroll departments to any changes or errors in withholding amounts. This proactive approach minimizes payroll discrepancies and supports timely financial reporting.

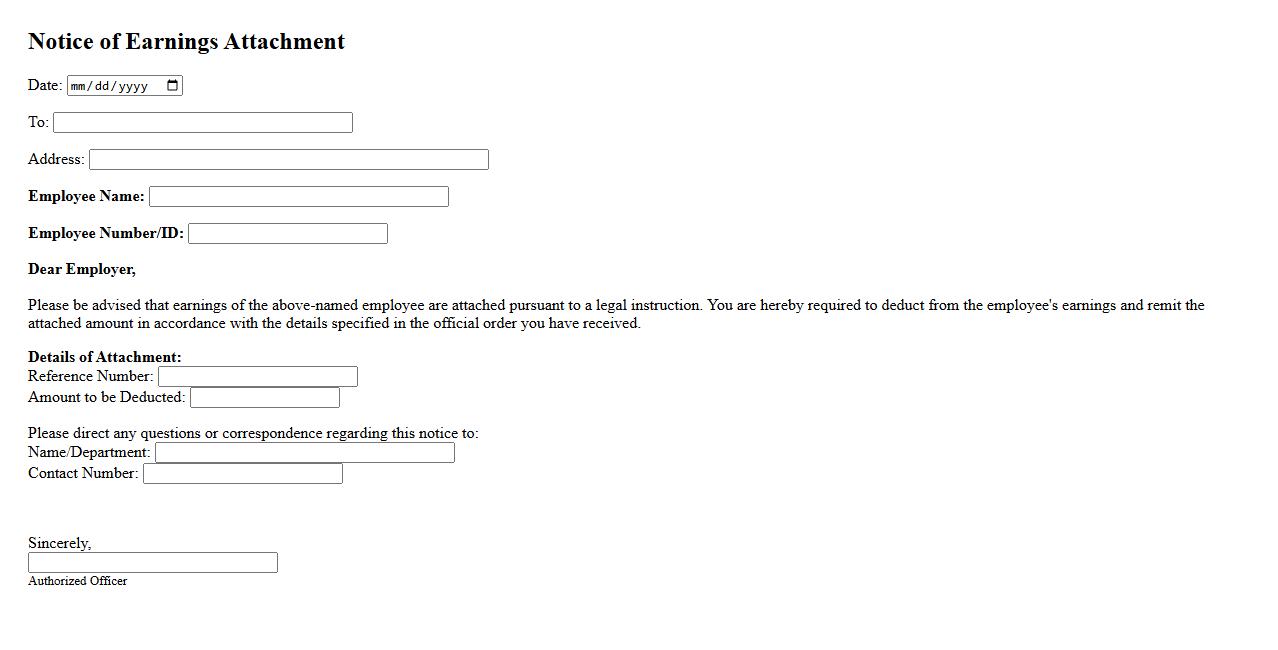

Notice of Earnings Attachment

Notice of Earnings Attachment is a legal document informing an employer that part of an employee's wages must be withheld to satisfy a debt. This notice ensures compliance with court orders or government agencies for debt repayment. Employers must act promptly to deduct and remit the specified amount accordingly.

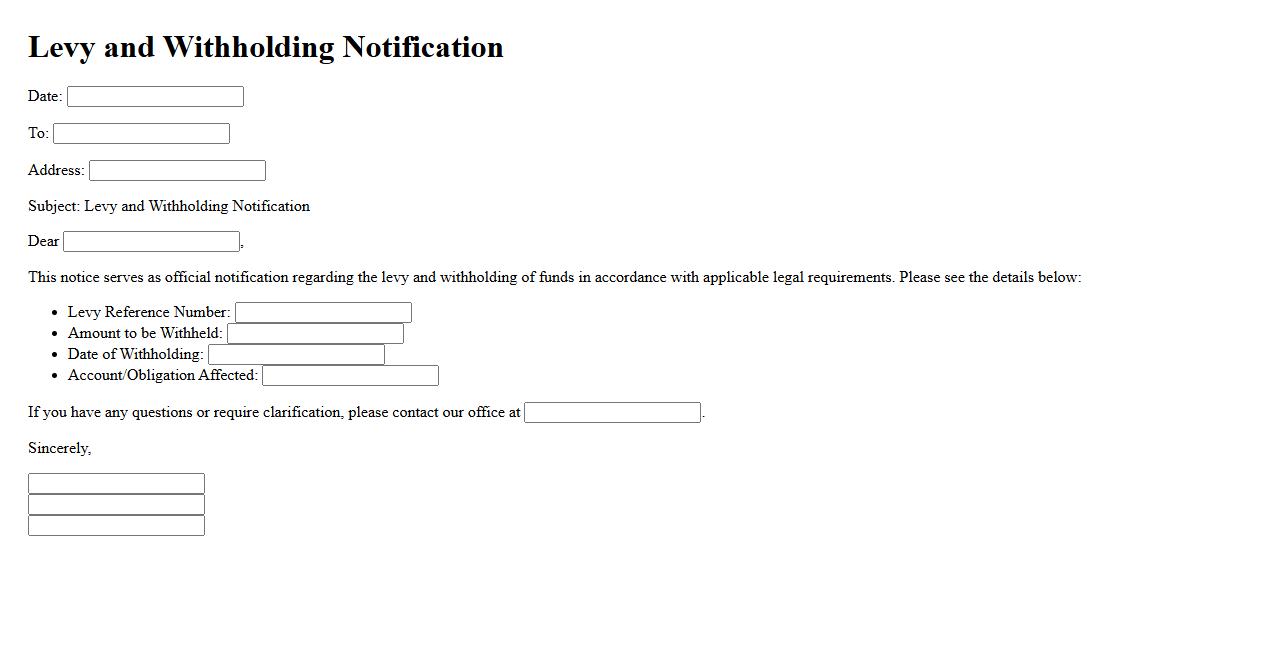

Levy and Withholding Notification

Levy and Withholding Notification informs individuals or businesses about government actions to collect overdue taxes through asset seizure or wage garnishment. This notification outlines the amounts owed and the legal basis for the levy or withholding. Prompt attention to this notice is essential to avoid further financial consequences.

What is the main purpose of a Notice of Withholding?

The main purpose of a Notice of Withholding is to formally inform an individual or entity that a portion of their payment will be withheld. This is typically done to comply with legal requirements such as tax regulations or debt collection. The notice ensures transparency and serves as a legal record of the withholding action.

Which parties are legally authorized to issue a Notice of Withholding?

Authorized parties to issue a Notice of Withholding usually include employers, government agencies, and financial institutions. These entities have the legal authority to deduct amounts for taxes, child support, or outstanding debts. Proper authorization is essential for the notice to be valid and enforceable.

What specific details must be included in a valid Notice of Withholding document?

A valid Notice of Withholding must include the recipient's name, the amount to be withheld, the reason for withholding, and the effective date. It should also detail any relevant legal references or statutes that authorize the withholding. Clear contact information for inquiries should be provided to maintain transparency.

How does the Notice of Withholding affect the obligations of the recipient?

Upon receiving a Notice of Withholding, the recipient's obligation to pay the specified amount is typically satisfied through the withholding process. This means the recipient cannot claim the withheld amount as income or require its payment directly. The notice legally redirects payment responsibilities to the withholding party.

What steps must be taken by the recipient after receiving a Notice of Withholding?

After receiving a Notice of Withholding, the recipient should carefully review the document for accuracy and completeness. It is important to consult a financial advisor or legal counsel if there are questions or disputes. The recipient must also adjust their financial records to reflect the withheld amount appropriately.