An Invoice for Goods Sold is a document issued by a seller to a buyer detailing the products delivered and the amount due. It serves as a formal request for payment and includes item descriptions, quantities, prices, and payment terms. This invoice helps both parties maintain accurate financial records and ensures transparent business transactions.

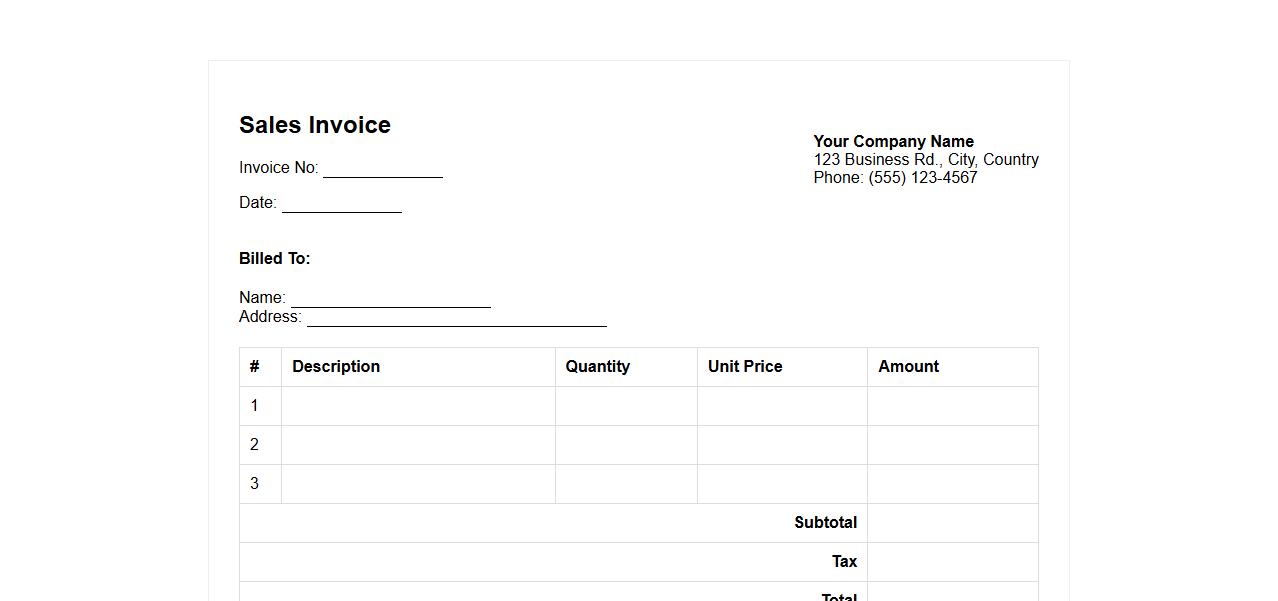

Sales Invoice

A sales invoice is a document issued by a seller to a buyer detailing products or services provided, quantities, and prices. It serves as a formal request for payment and proof of the transaction. This essential record helps businesses track sales and manage accounts receivable efficiently.

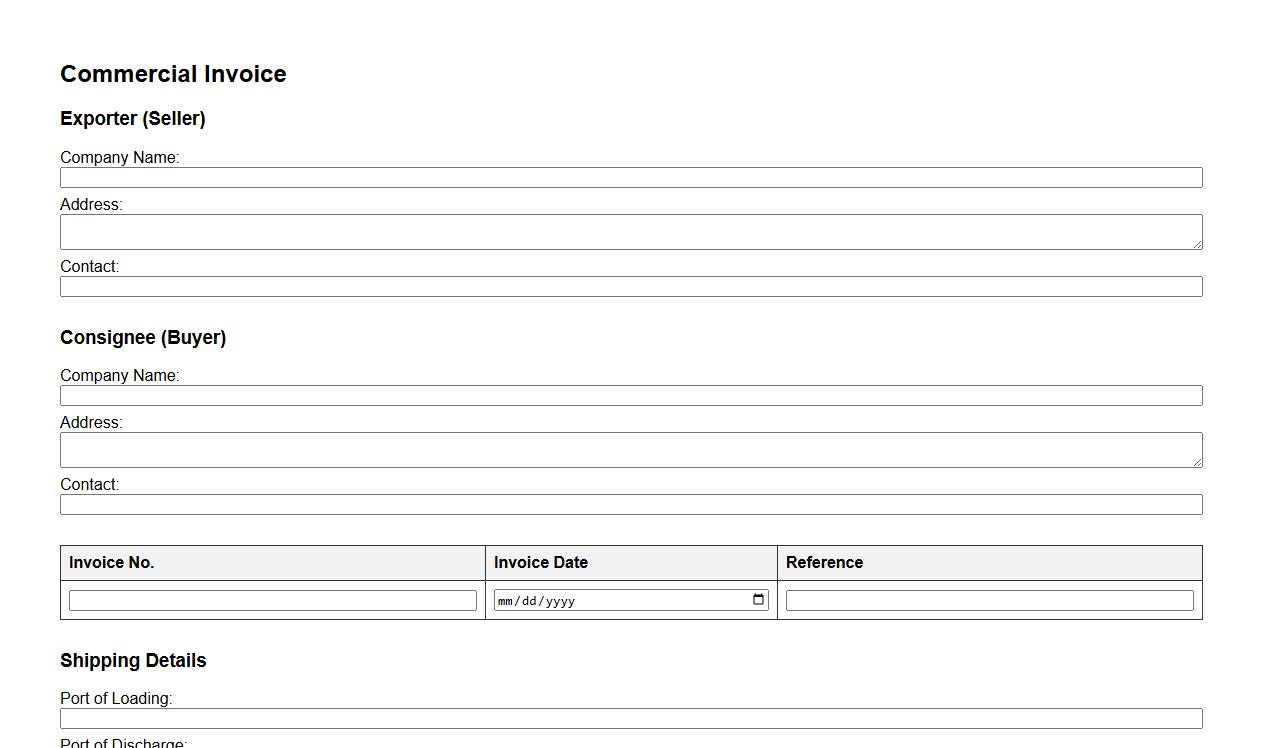

Commercial Invoice

A Commercial Invoice is a key document in international trade that details the transaction between the exporter and importer. It includes essential information such as the description of goods, their value, and terms of sale. This invoice is crucial for customs clearance and accurate duty assessment.

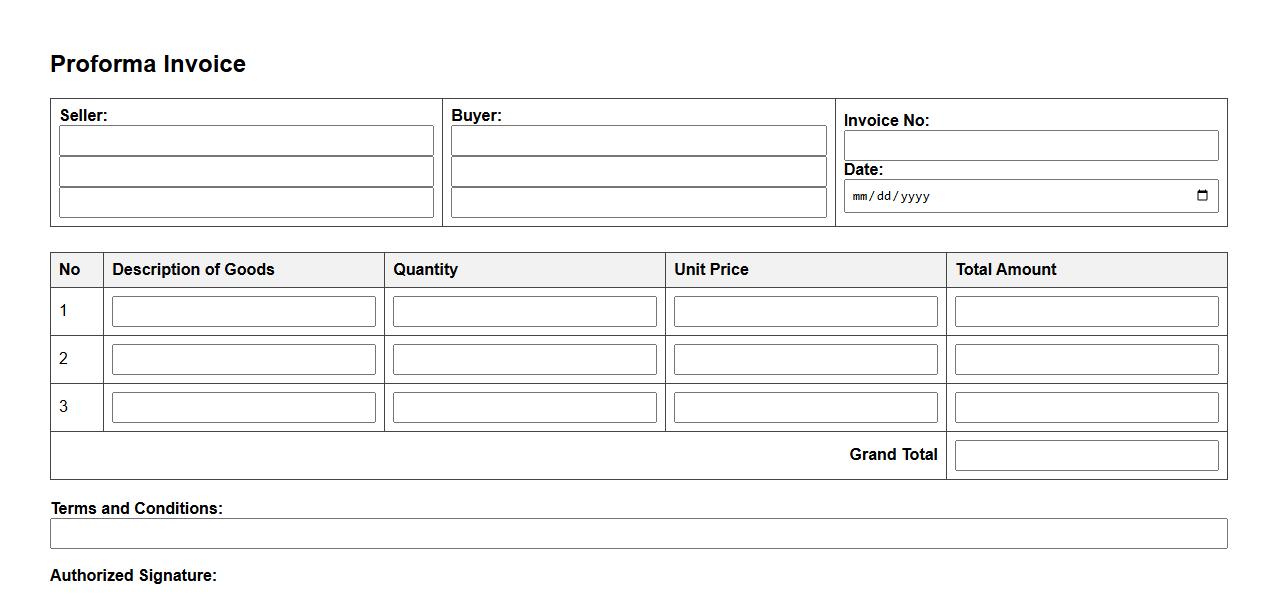

Proforma Invoice

A Proforma Invoice is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It details the items, quantities, and agreed prices, helping both parties finalize the transaction. This document is essential for customs purposes and financial arrangements before the actual invoice is issued.

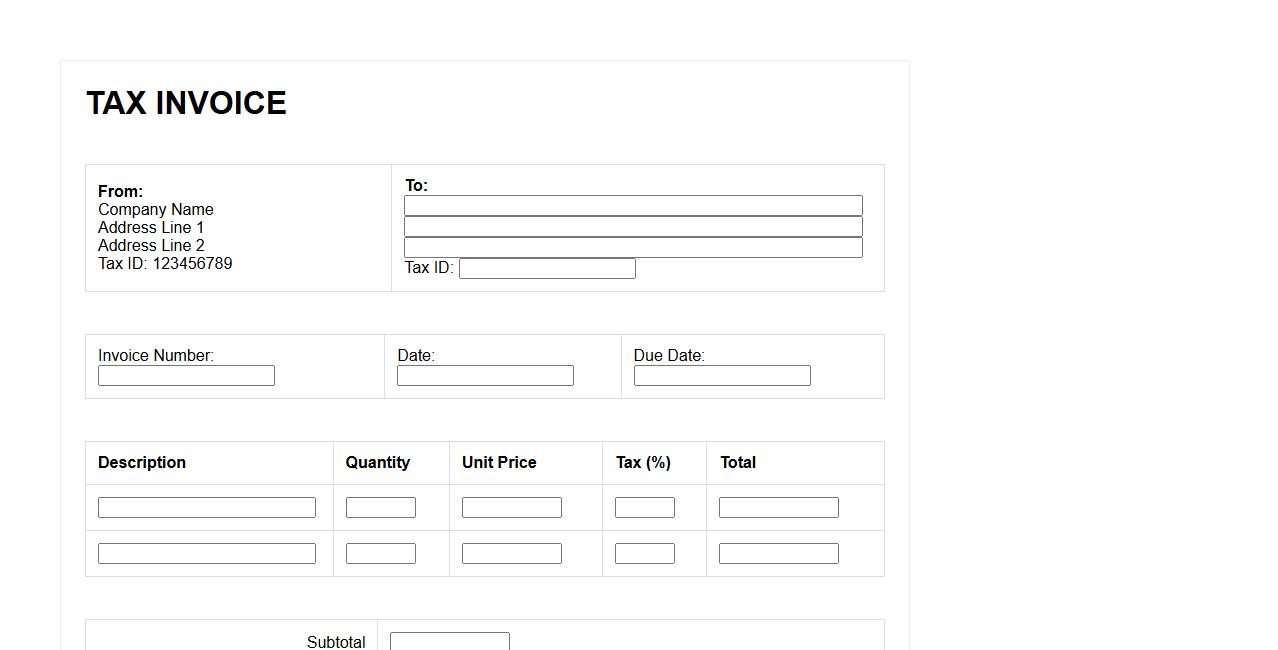

Tax Invoice

A Tax Invoice is a legal document issued by a seller to a buyer, detailing the goods or services provided and the tax amount charged. It serves as proof of a transaction and is essential for tax reporting and compliance. Properly maintaining tax invoices ensures transparency and accurate tax filing.

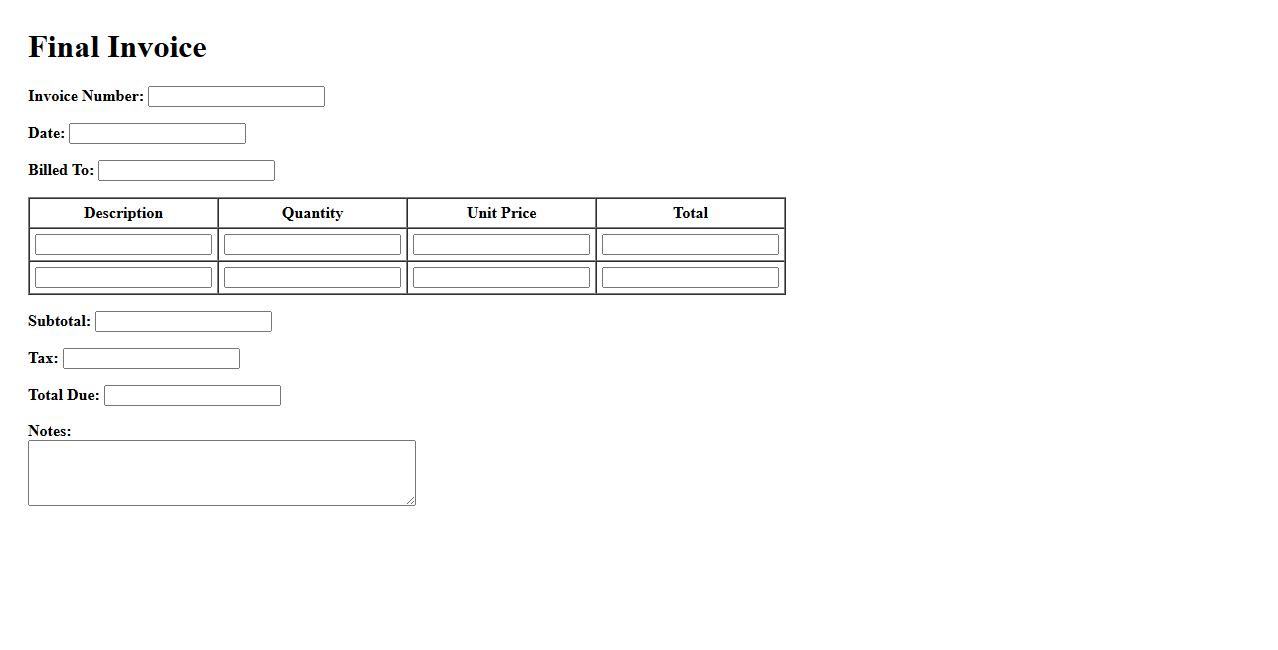

Final Invoice

The Final Invoice is the detailed document issued to confirm the completion of a transaction and request the remaining payment. It includes a summary of all charges, taxes, and adjustments made during the billing period. This invoice serves as the official record for both the buyer and seller to finalize the financial agreement.

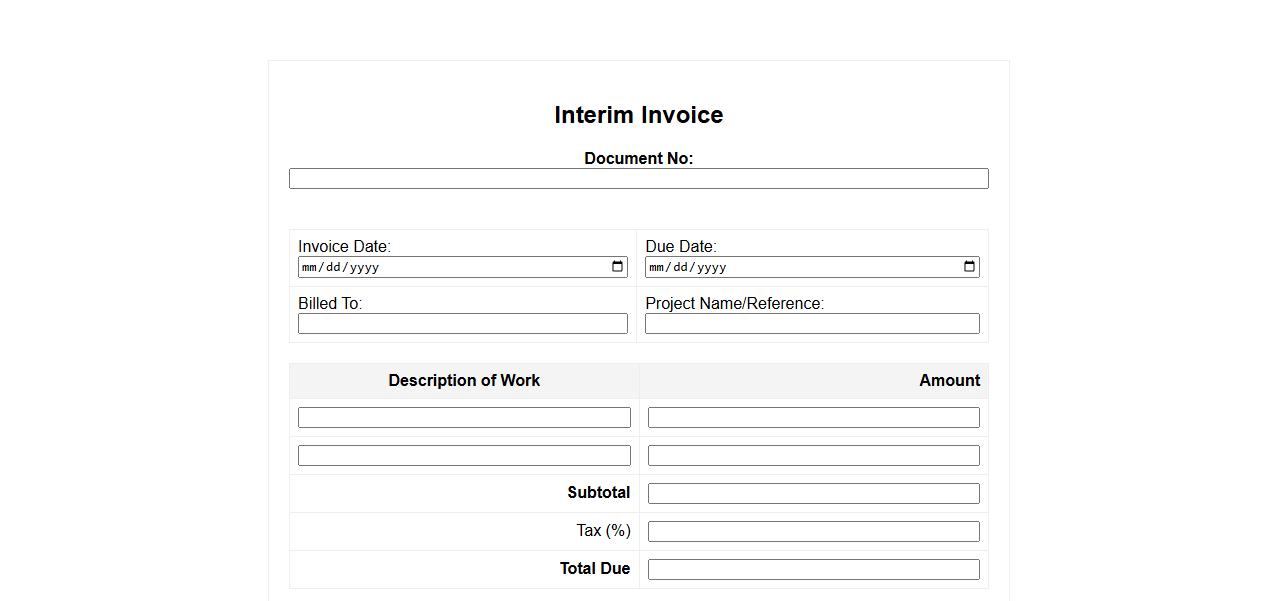

Interim Invoice

An Interim Invoice is a billing document issued before the completion of a project or service. It provides partial payment details based on progress made, helping maintain cash flow for businesses. This type of invoice ensures transparency and ongoing financial management during long-term contracts.

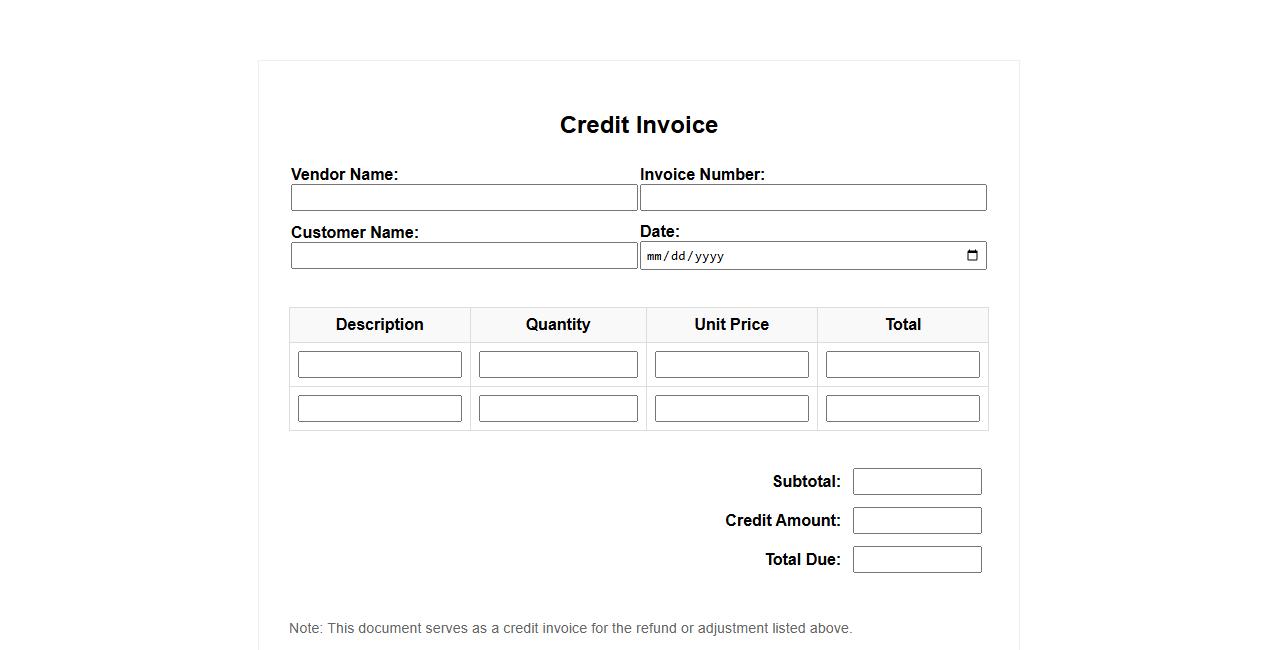

Credit Invoice

A Credit Invoice is a document issued by a seller to a buyer, reducing the amount owed on a previous invoice. It serves to correct billing errors, provide refunds, or acknowledge returned goods. This important financial record helps maintain accurate accounting and clear transaction histories.

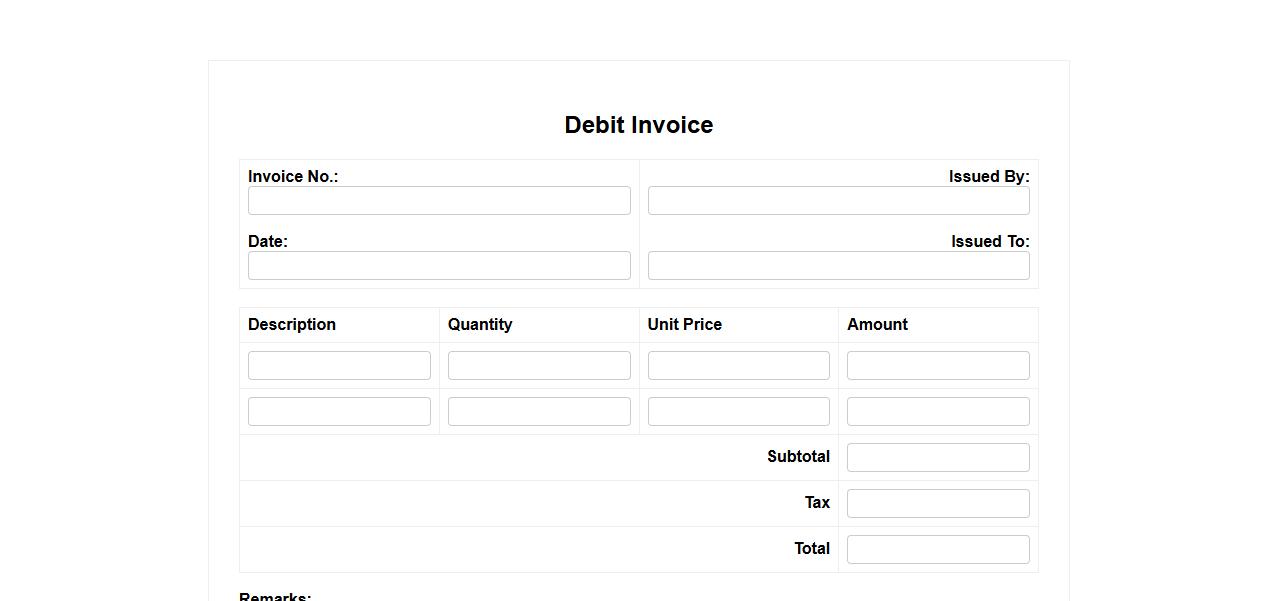

Debit Invoice

A debit invoice is a document issued by a seller to notify a buyer of an additional amount owed, typically due to extra services or corrections to a previous invoice. It serves as a formal request for payment and ensures transparency in financial transactions. Debit invoices help maintain accurate accounting records between businesses and clients.

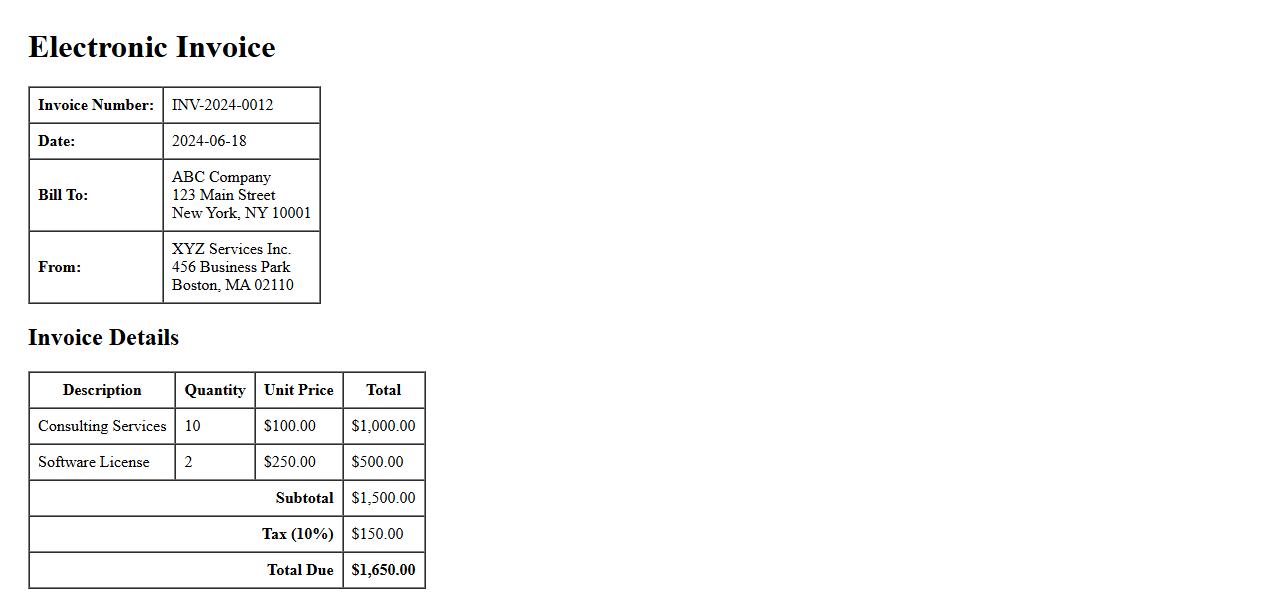

Electronic Invoice

An Electronic Invoice is a digital document that itemizes and records a transaction between a buyer and a seller. It streamlines billing processes by automating data entry and reducing paper usage. This method enhances accuracy, speeds up payment cycles, and improves record-keeping efficiency.

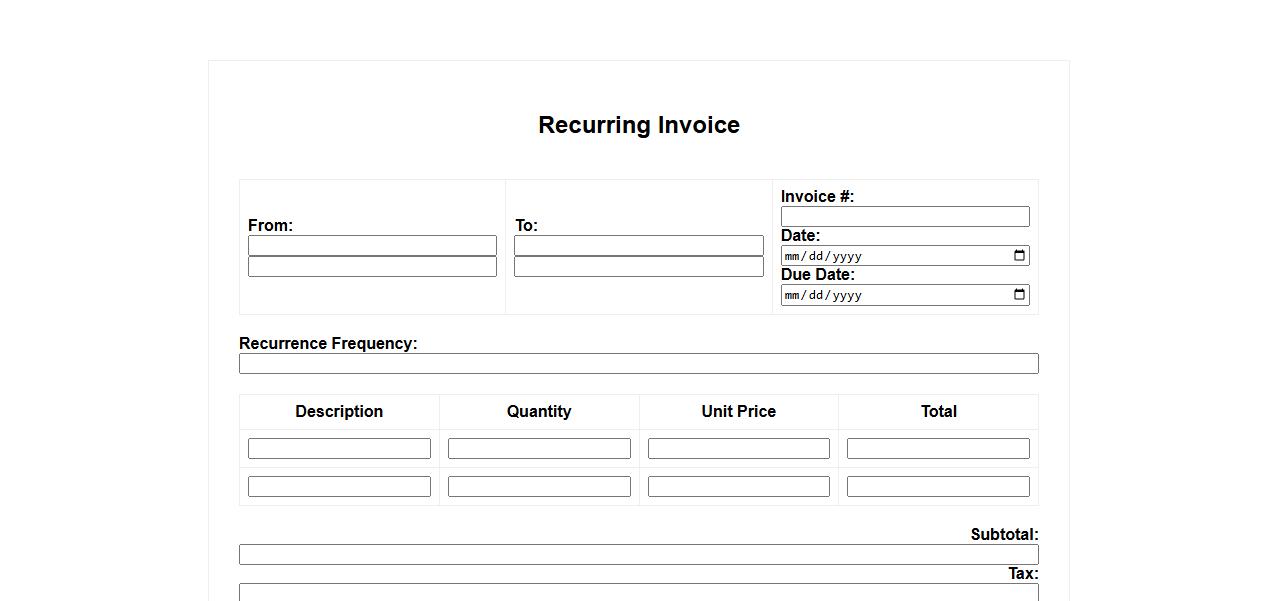

Recurring Invoice

A recurring invoice is a billing document sent out at regular intervals for ongoing services or products. It automates the payment process, ensuring timely and consistent revenue. This method enhances efficiency and reduces manual errors in financial management.

What essential information should an invoice for goods sold include?

An invoice for goods sold must include the seller's and buyer's contact details, including company names and addresses. It should clearly state the description of goods sold, quantities, unit prices, and total amount payable. Additionally, the invoice needs to display the invoice date, unique invoice number, and applicable taxes.

How does an invoice establish the terms of payment between buyer and seller?

The invoice specifies the payment due date and accepted payment methods, providing clarity to both parties. It often includes payment terms like net 30 or early payment discounts to outline expectations. By documenting these conditions, the invoice acts as a formal agreement for settling the transaction.

In what ways does an invoice for goods sold serve as a legal document?

An invoice serves as a proof of transaction, recording the sale and agreeing on the goods and price. It can be used in court to resolve disputes by showing the agreed terms and evidence of delivery. This establishes the seller's right to receive payment and the buyer's obligation to pay.

What role does an invoice play in tracking inventory and sales transactions?

Invoices help businesses maintain accurate records of inventory levels by documenting goods sold and delivered. They provide a trail for reconciling sales and updating stock counts in real time. This tracking supports efficient inventory management and demand forecasting.

How does the accuracy of an invoice impact financial reporting and reconciliation?

Accurate invoices ensure correct financial recordkeeping, which is critical for reliable financial statements. Errors on invoices can lead to discrepancies between accounts receivable and actual cash flow. Precise invoicing facilitates smooth reconciliation processes and compliance with accounting standards.