A Declaration for Tax Purposes is an official document used to report income, assets, and other relevant financial information to tax authorities. It ensures compliance with tax regulations and helps determine the correct tax liability of individuals or businesses. Accurate submission of this declaration is essential to avoid penalties and maintain transparent financial records.

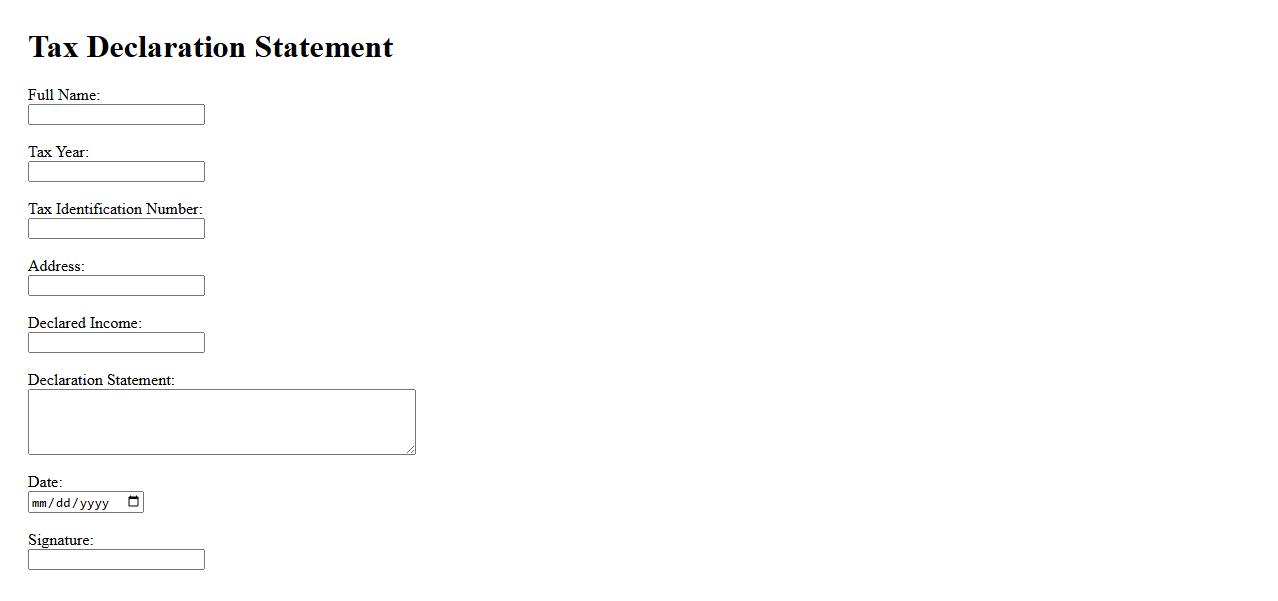

Tax Declaration Statement

The Tax Declaration Statement is an official document used to report an individual's or business's income, assets, and tax liabilities to the government. It ensures accurate assessment and transparency in tax obligations. This statement is essential for compliance with tax laws and facilitates proper tax collection.

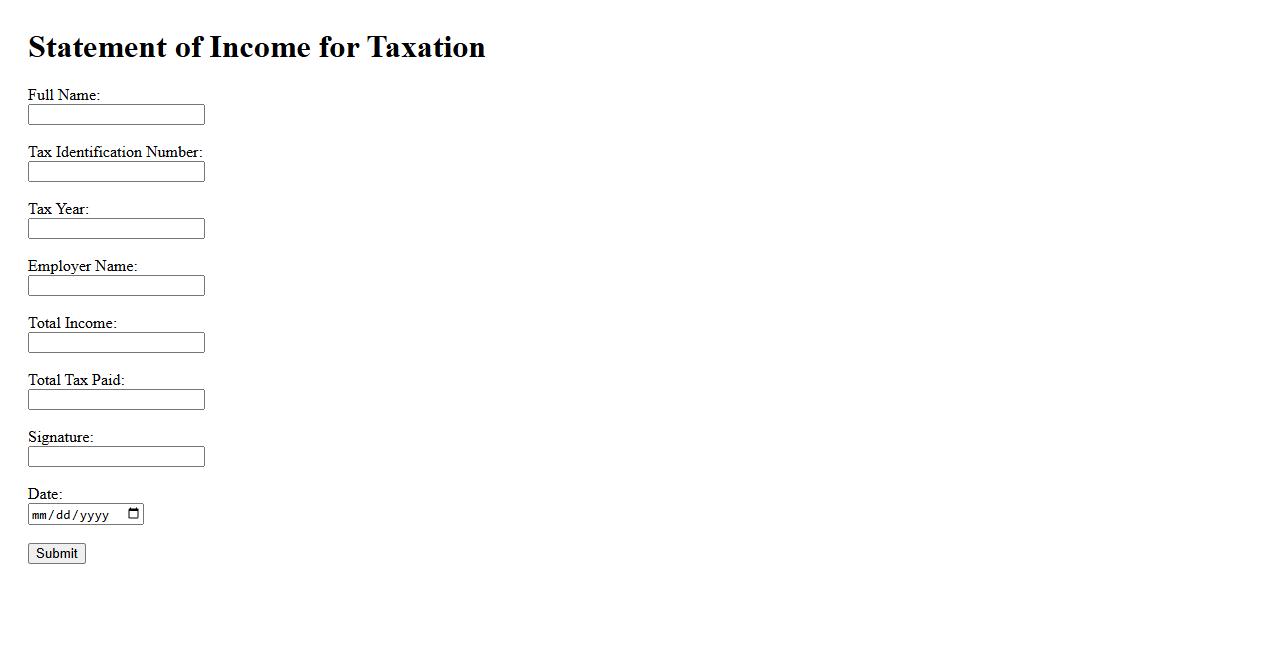

Statement of Income for Taxation

The Statement of Income for Taxation is a financial document that summarizes an individual's or business's income over a specific period for tax purposes. It provides detailed information on earnings, expenses, and deductions to calculate taxable income accurately. This statement is essential for filing tax returns and ensuring compliance with tax regulations.

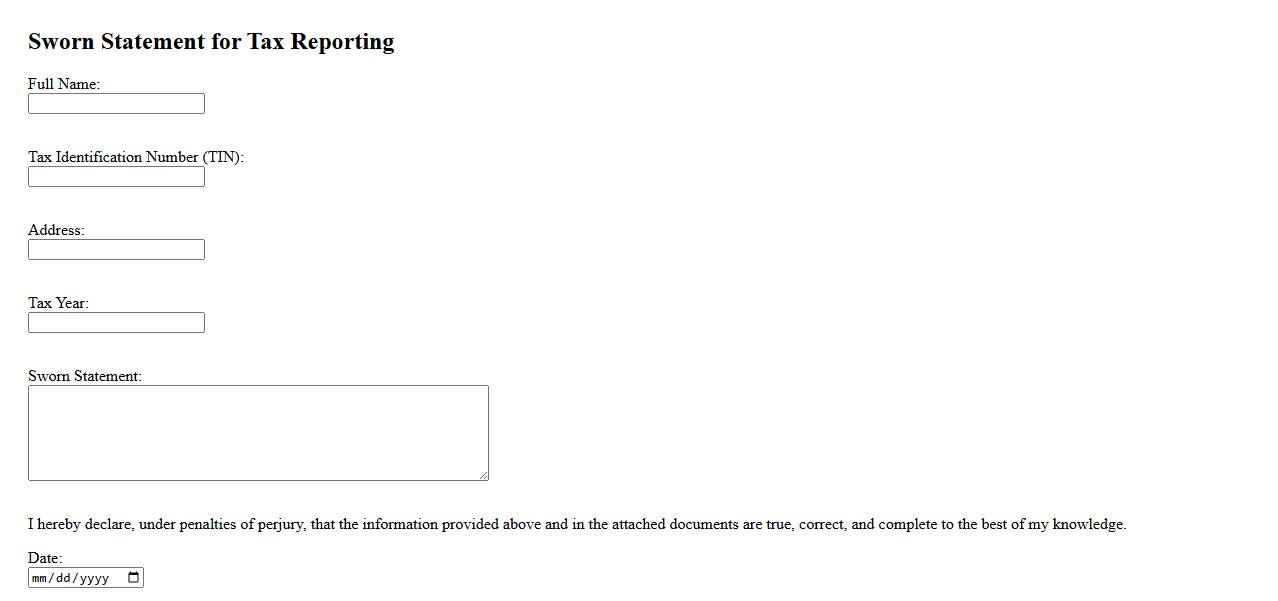

Sworn Statement for Tax Reporting

A Sworn Statement for Tax Reporting is a legally binding document where an individual or entity declares accurate financial information under oath for tax purposes. It ensures transparency and compliance with tax laws by providing truthful data to tax authorities. This statement helps prevent tax fraud and facilitates proper assessment of tax liabilities.

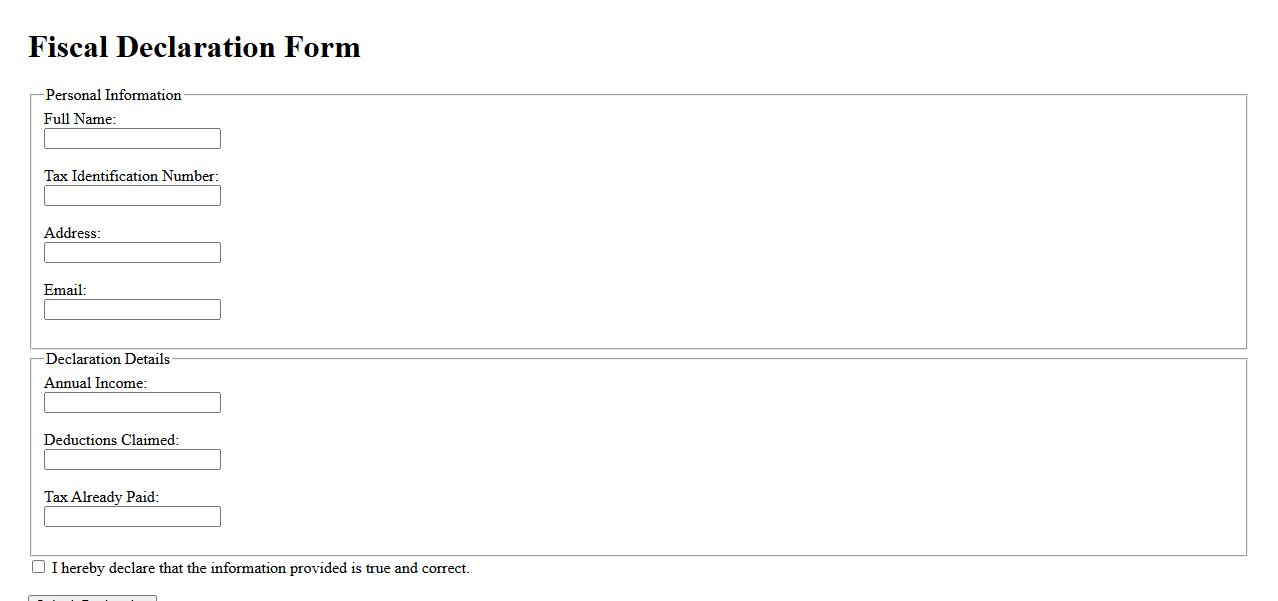

Fiscal Declaration Form

The Fiscal Declaration Form is an essential document used to report income, expenses, and tax-related information accurately. It ensures compliance with government regulations by providing a clear summary of financial activities. Proper completion of this form is crucial for accurate tax assessment and avoidance of penalties.

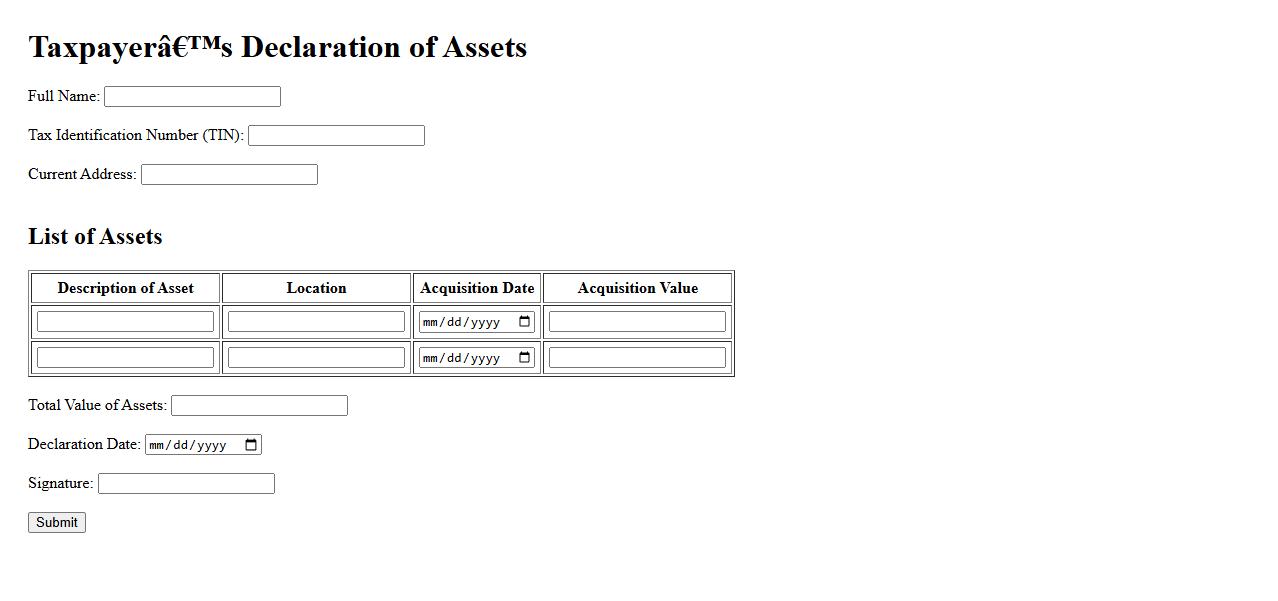

Taxpayer’s Declaration of Assets

The Taxpayer's Declaration of Assets is a formal document where individuals or entities disclose their financial holdings and properties. This declaration ensures transparency and compliance with tax regulations by providing accurate information on owned assets. It is essential for proper assessment of tax liabilities and for maintaining legal accountability.

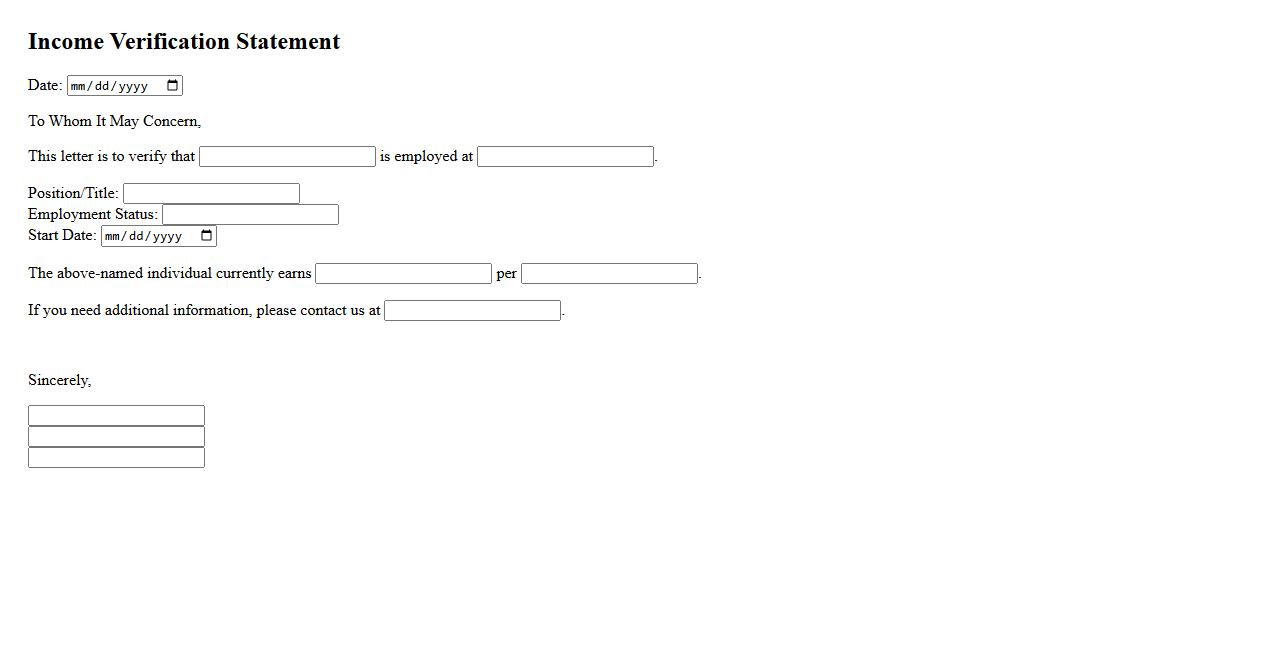

Income Verification Statement

An Income Verification Statement is an official document used to confirm an individual's earnings. It is often required by employers, lenders, or government agencies to validate income for loans, rentals, or benefits. This statement ensures transparency and accuracy in financial assessments.

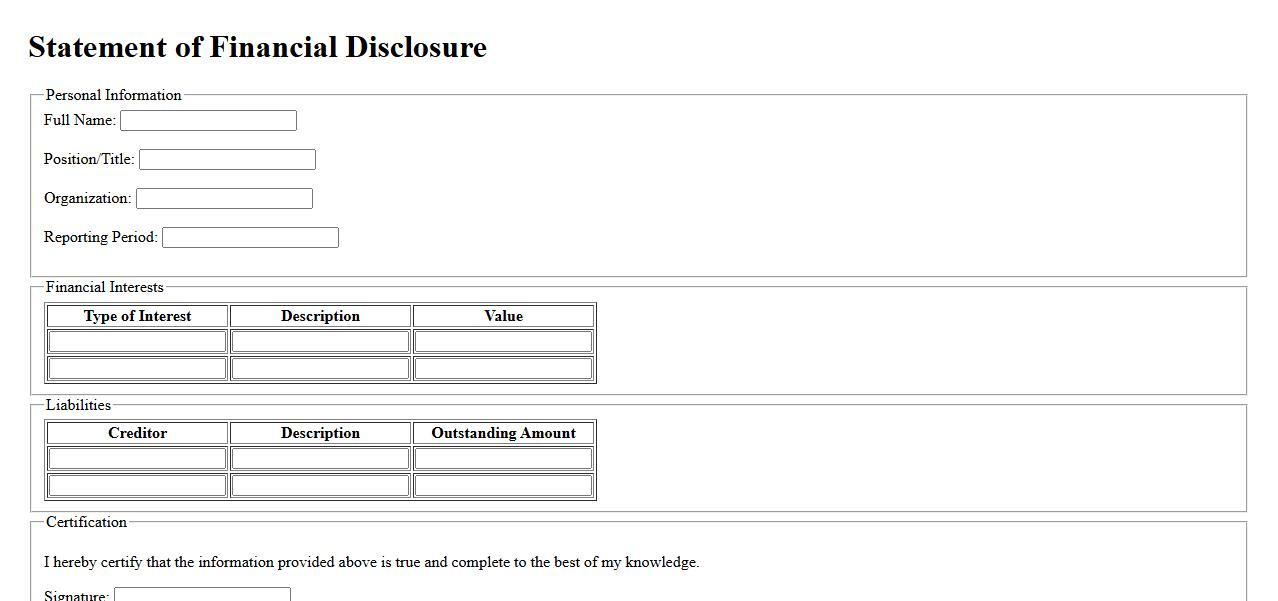

Statement of Financial Disclosure

A Statement of Financial Disclosure is a document that provides a comprehensive overview of an individual's financial status. It is commonly used to ensure transparency in various legal and professional contexts. This statement helps to reveal assets, liabilities, income, and other financial interests accurately.

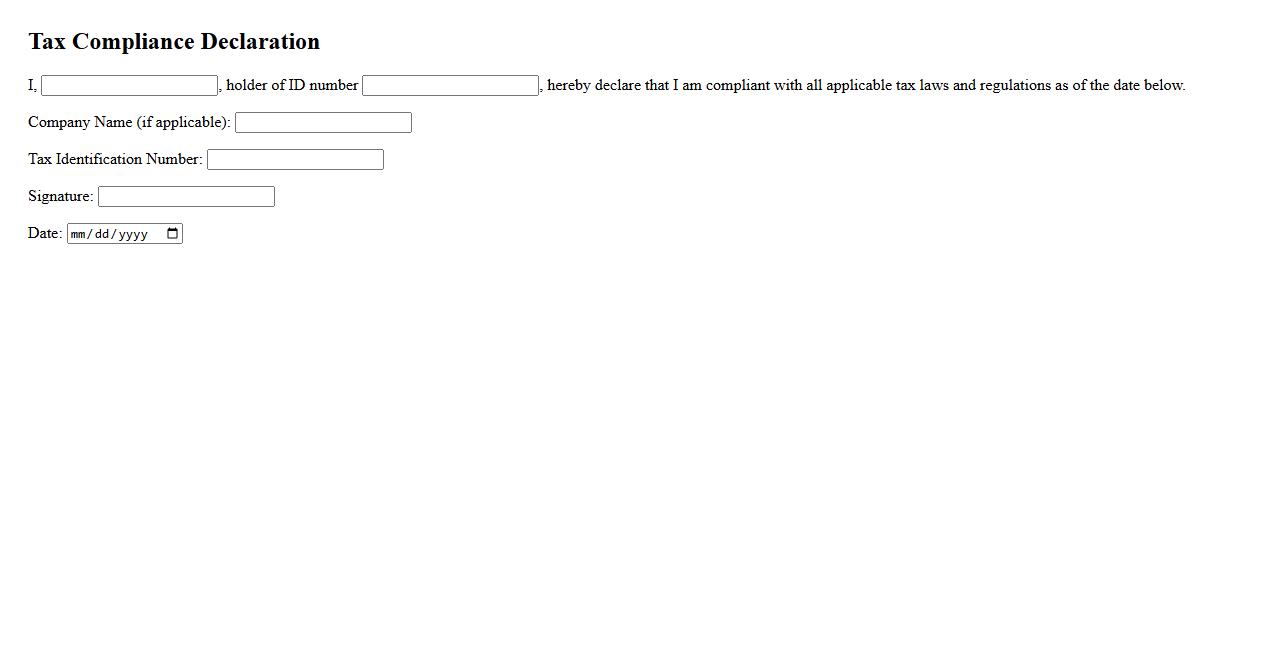

Tax Compliance Declaration

A Tax Compliance Declaration is an official statement confirming that an individual or business meets all tax obligations according to applicable laws. It ensures transparency and accountability in financial reporting. This declaration is often required for regulatory, contractual, or audit purposes.

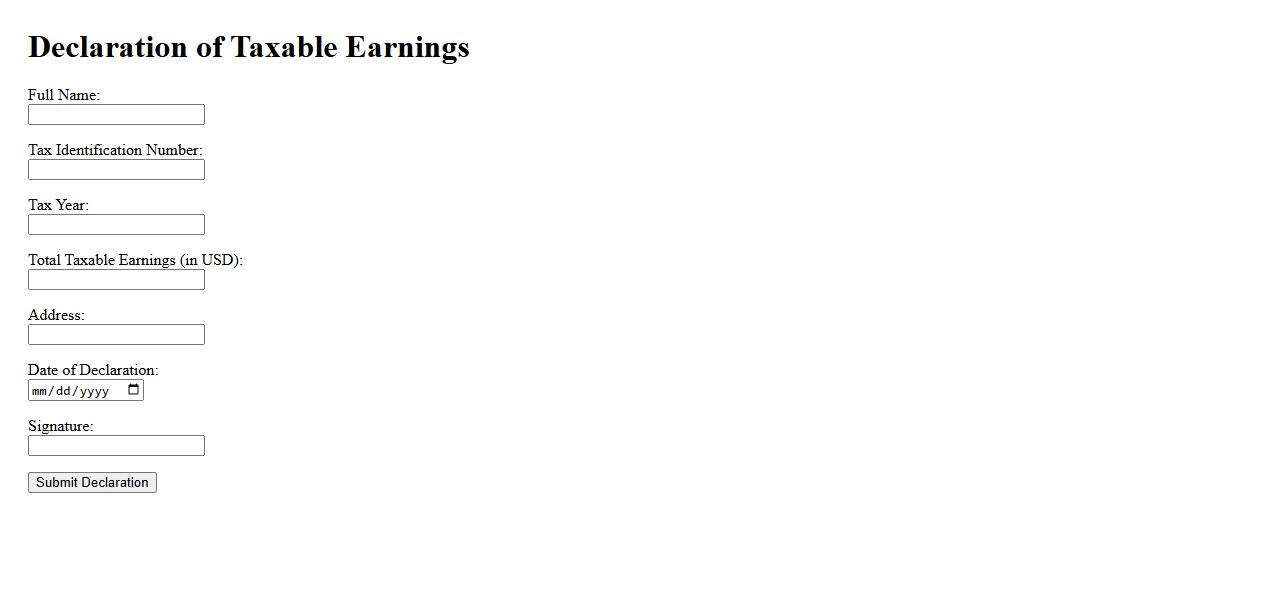

Declaration of Taxable Earnings

The Declaration of Taxable Earnings is a formal document where individuals or businesses report their income subject to taxation. This declaration ensures accurate calculation of tax liabilities in compliance with legal requirements. Proper submission of this document is essential to avoid penalties and ensure financial transparency.

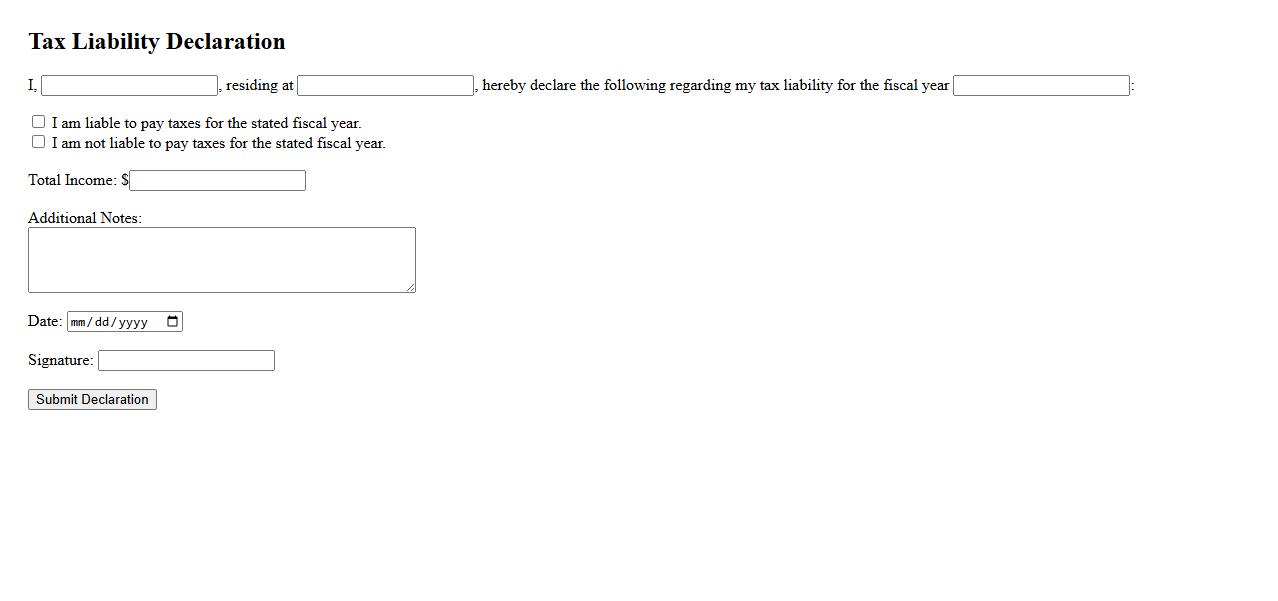

Tax Liability Declaration

A Tax Liability Declaration is a formal statement outlining an individual or organization's outstanding tax obligations. It ensures transparency and compliance with tax authorities by disclosing all relevant financial liabilities. This declaration helps prevent legal issues and facilitates accurate tax assessments.

What is the main purpose of the Declaration for Tax Purposes document?

The primary purpose of the Declaration for Tax Purposes is to provide accurate information about an individual's or business's financial status to tax authorities. This document helps ensure proper tax assessment and compliance with relevant tax laws. It serves as an official record for determining tax obligations.

Which personal or business details must be provided in the declaration?

The declaration requires detailed personal or business information, including full name, address, tax identification number, and contact details. For businesses, additional data such as registration number and business activities are mandatory. These details enable tax authorities to correctly identify the declarant.

How does the document determine tax residency status?

The declaration includes criteria to assess the tax residency status based on factors like duration of stay, place of habitual residence, or center of economic interests. Tax residency status influences tax liabilities and applicable exemptions. This determination is crucial for applying the correct tax regulations.

What types of income or assets must be disclosed in the declaration?

Individuals and businesses must disclose all relevant income sources such as salaries, dividends, rental income, and capital gains. Additionally, significant assets like real estate, investments, and bank accounts might need to be reported. Accurate disclosure ensures transparent financial reporting for tax purposes.

What are the legal implications of submitting false information on the declaration?

Submitting false information on the declaration can result in severe legal consequences including fines, penalties, and possible criminal charges. It undermines tax authority efforts and can lead to audits or investigations. Ensuring honesty and accuracy is critical to avoid legal repercussions.