The Declaration of Assets is a formal document submitted by public officials or employees to disclose their financial holdings, including property, investments, and liabilities. This practice promotes transparency and accountability, helping to prevent corruption and conflicts of interest within government institutions. Regular submission of the Declaration of Assets ensures monitoring of any unexplained wealth or financial discrepancies over time.

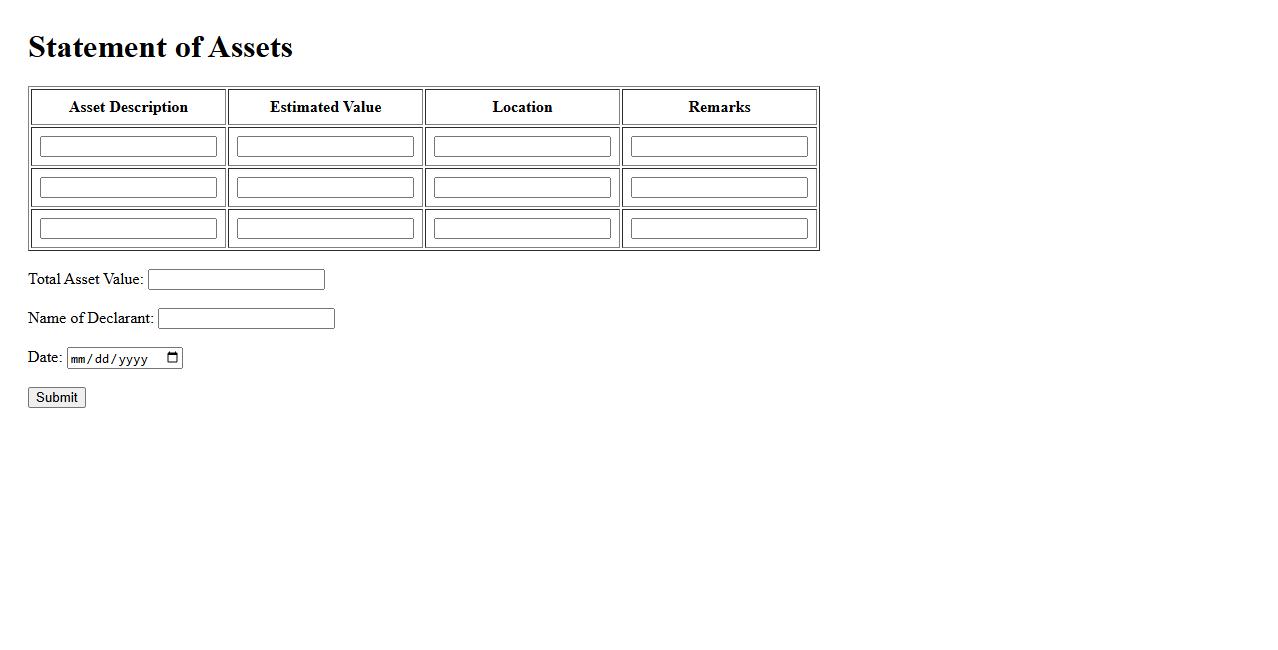

Statement of Assets

A Statement of Assets is a financial document that details an individual's or organization's owned resources at a specific point in time. It itemizes valuables such as property, investments, and cash holdings to provide a clear picture of net worth. This statement is essential for financial planning and accountability purposes.

Asset Disclosure Form

The Asset Disclosure Form is a crucial document used to declare an individual's or organization's financial assets. It ensures transparency and accountability by detailing all owned properties, investments, and other valuables. This form is often required by government agencies and financial institutions for regulatory compliance.

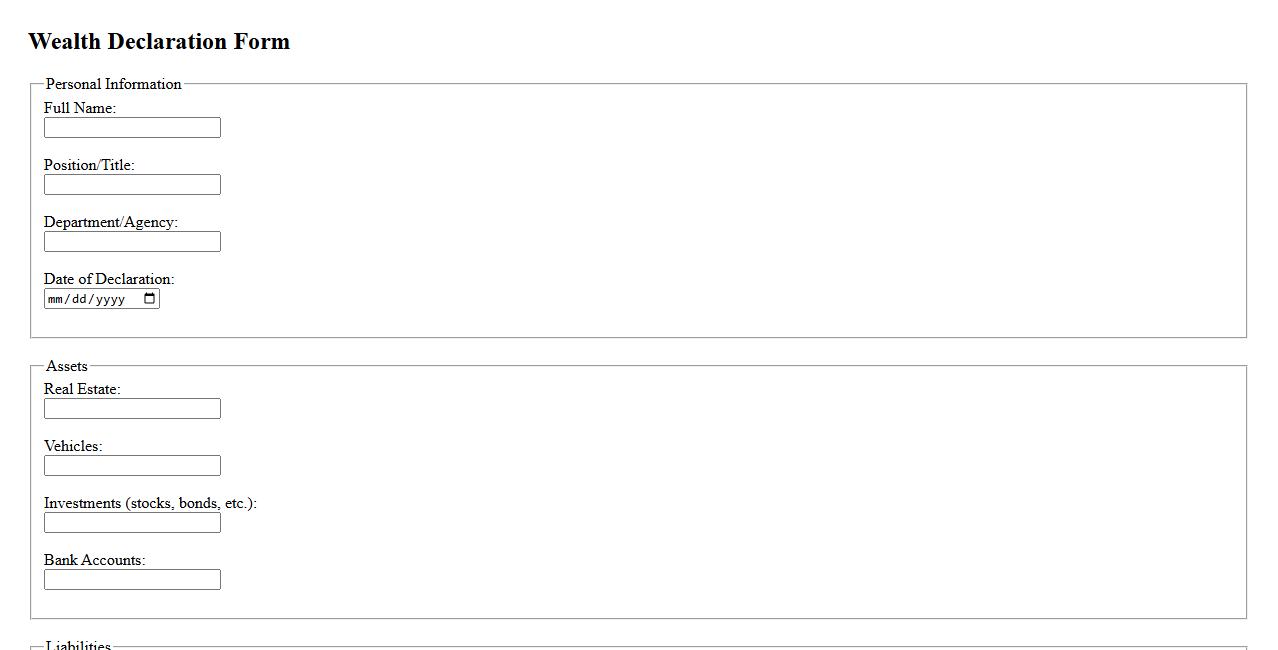

Wealth Declaration

Wealth Declaration is a formal statement detailing an individual's or entity's assets, liabilities, and financial interests. It promotes transparency and accountability, often required for legal or regulatory purposes. This declaration helps prevent corruption and ensures compliance with financial laws.

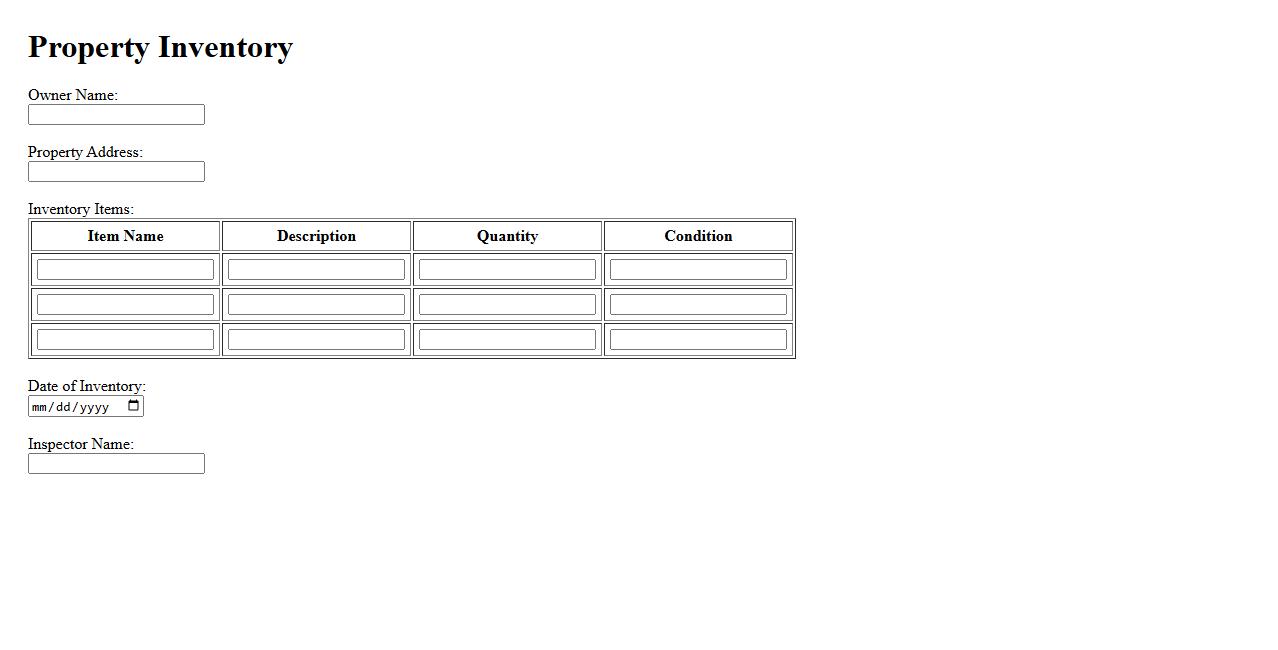

Property Inventory

A Property Inventory is a detailed list documenting the condition and contents of a property at a specific time. It helps landlords and tenants avoid disputes by providing clear evidence of the property's state. This inventory is essential for smooth rental agreements and property management.

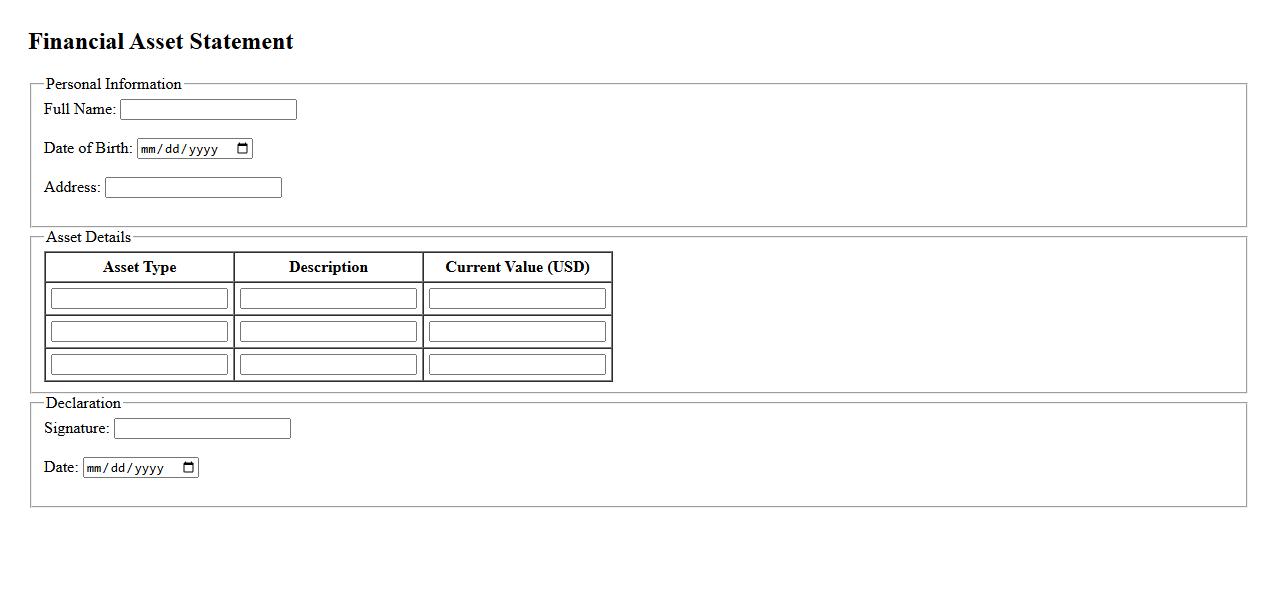

Financial Asset Statement

The Financial Asset Statement provides a detailed summary of an individual's or organization's financial holdings, including cash, investments, and other valuable assets. It serves as a critical tool for assessing financial health and making informed investment decisions. Regular updates ensure accurate tracking of asset performance over time.

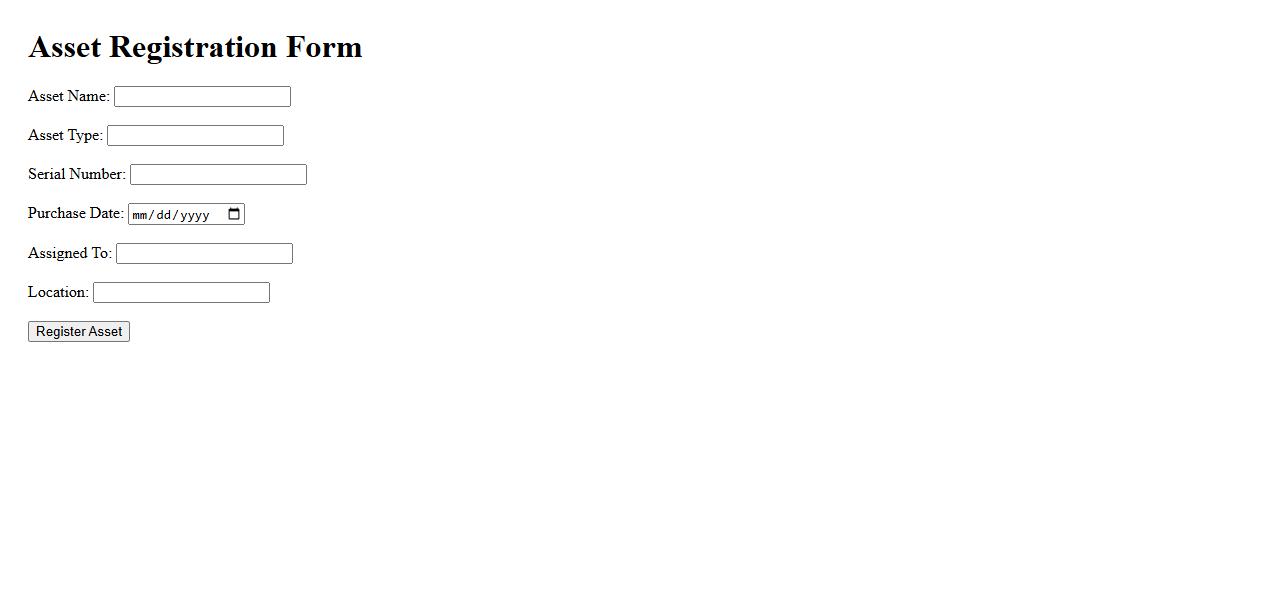

Asset Registration

Asset Registration is the process of officially recording and documenting company assets to ensure proper tracking and management. This procedure helps in maintaining accurate records for financial reporting and asset lifecycle management. Effective asset registration supports accountability and regulatory compliance.

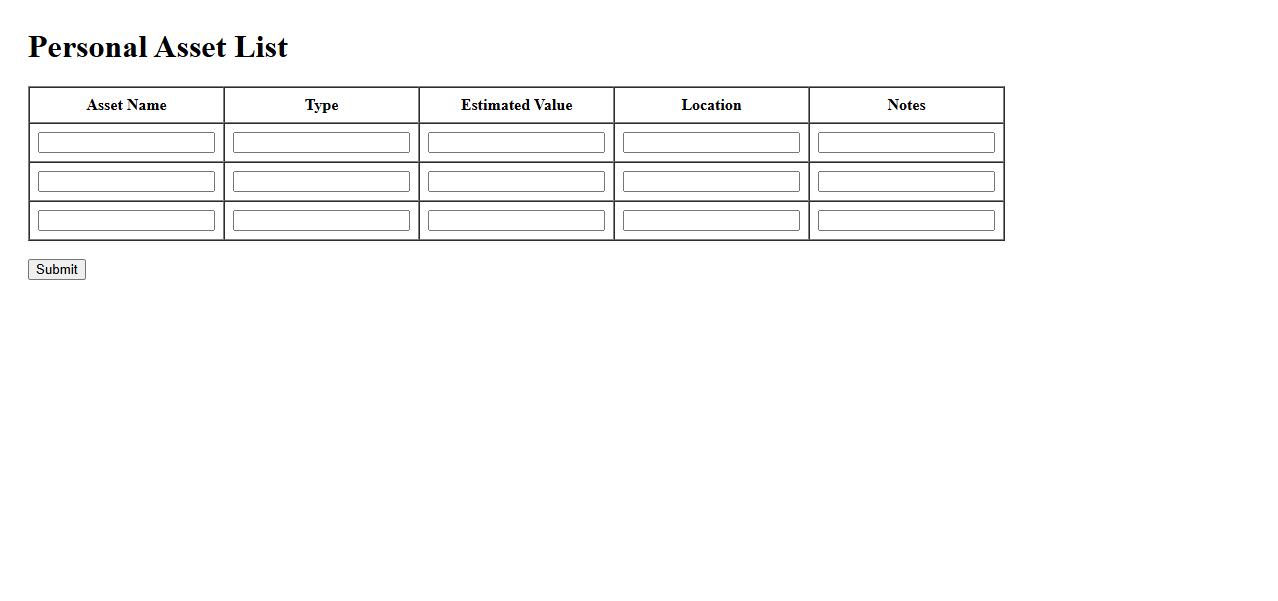

Personal Asset List

A Personal Asset List is a detailed record of an individual's valuable items and properties. It helps in organizing and tracking assets for financial planning and insurance purposes. Maintaining an updated asset list ensures accurate documentation and easy access during emergencies.

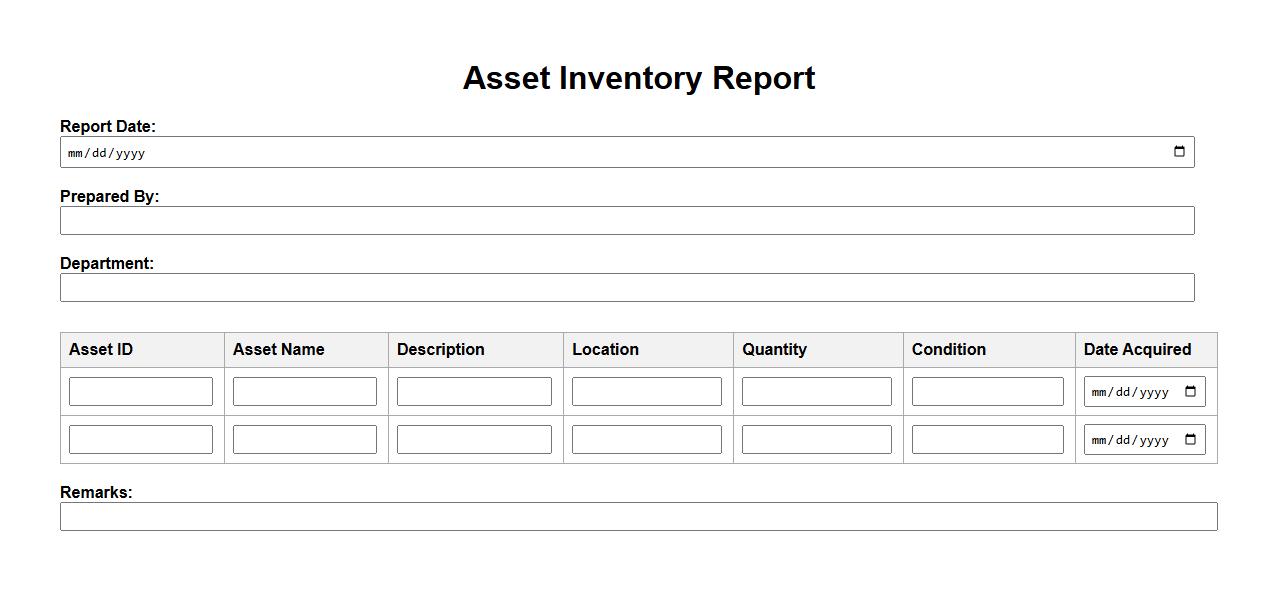

Asset Inventory Report

An Asset Inventory Report provides a detailed overview of all assets within an organization, including their status, location, and value. This report aids in effective asset management and ensures accurate tracking for auditing and financial purposes. Regular updates of the asset inventory report help optimize resource allocation and enhance operational efficiency.

Asset Ownership Declaration

The Asset Ownership Declaration is an official document that details an individual's or organization's assets. It is used to ensure transparency and accountability in financial or legal matters. This declaration helps prevent conflicts of interest and supports compliance with regulatory requirements.

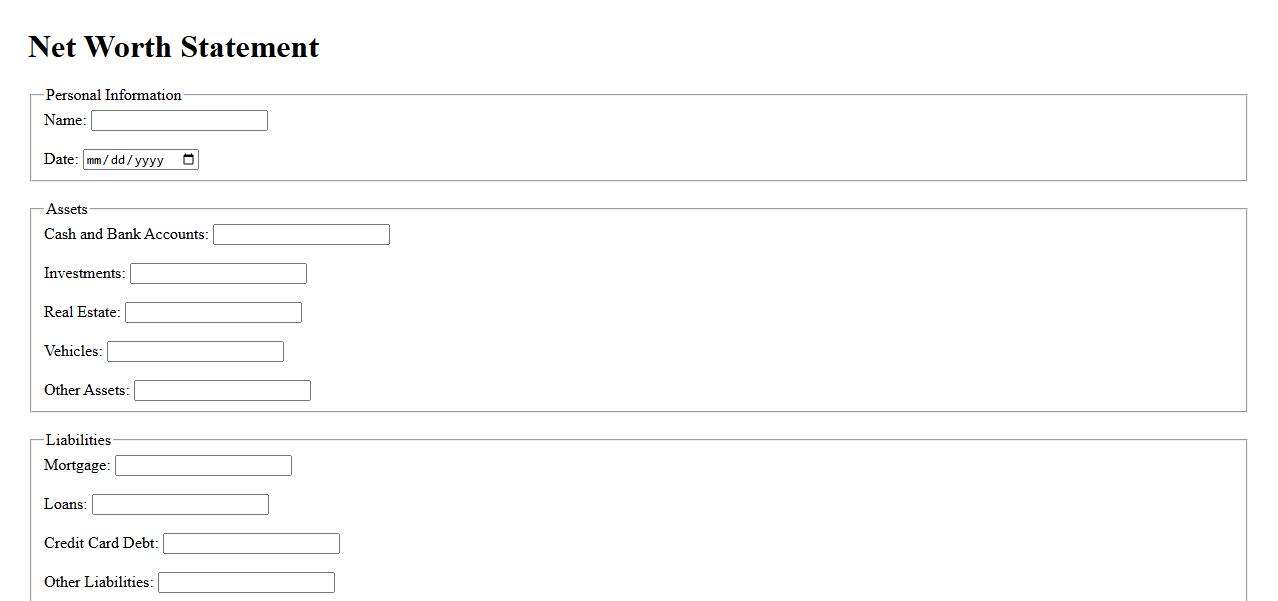

Net Worth Statement

A Net Worth Statement provides a comprehensive summary of an individual's or organization's financial position by listing assets and liabilities. This document helps in understanding overall wealth and financial health at a specific point in time. It is essential for personal financial planning and business assessments.

What information must be disclosed in a Declaration of Assets?

A Declaration of Assets requires detailed disclosure of all financial holdings, including bank accounts, properties, investments, and liabilities. It should include accurate descriptions and estimated values of each asset. This transparency is essential to ensure legal compliance and prevent corruption.

Who is legally required to submit a Declaration of Assets?

The submission of a Declaration of Assets is typically mandated for public officials, government employees, and certain private sector individuals in fiduciary roles. This legal requirement helps maintain integrity and accountability in public service. It also applies to candidates running for public office in many jurisdictions.

How frequently must the Declaration of Assets be updated?

The Declaration of Assets must generally be updated annually, or whenever there is a significant change in an individual's financial status. Updates are also required at the start and end of public service or employment. Timely updates ensure continued transparency and accurate record-keeping.

What are the potential consequences of failing to submit a Declaration of Assets?

Failing to submit a Declaration of Assets can lead to administrative penalties, including fines or suspension from public service. In certain cases, it may result in legal prosecution or dismissal from office. These consequences reinforce the importance of compliance and accountability.

Which assets are exempt from being reported in a Declaration of Assets?

Typically, personal properties such as clothing, household items, and low-value personal effects are exempt from disclosure in a Declaration of Assets. Assets held in trust or certain retirement benefits may also be excluded, depending on local laws. Understanding these exemptions helps avoid unnecessary reporting of insignificant items.