The Declaration of Self-Employment Income is a vital document that details the earnings generated by an individual working independently without an employer. It is used to report income for tax purposes, ensuring compliance with legal requirements. Properly completing this declaration helps in accurately assessing tax liabilities and securing financial records.

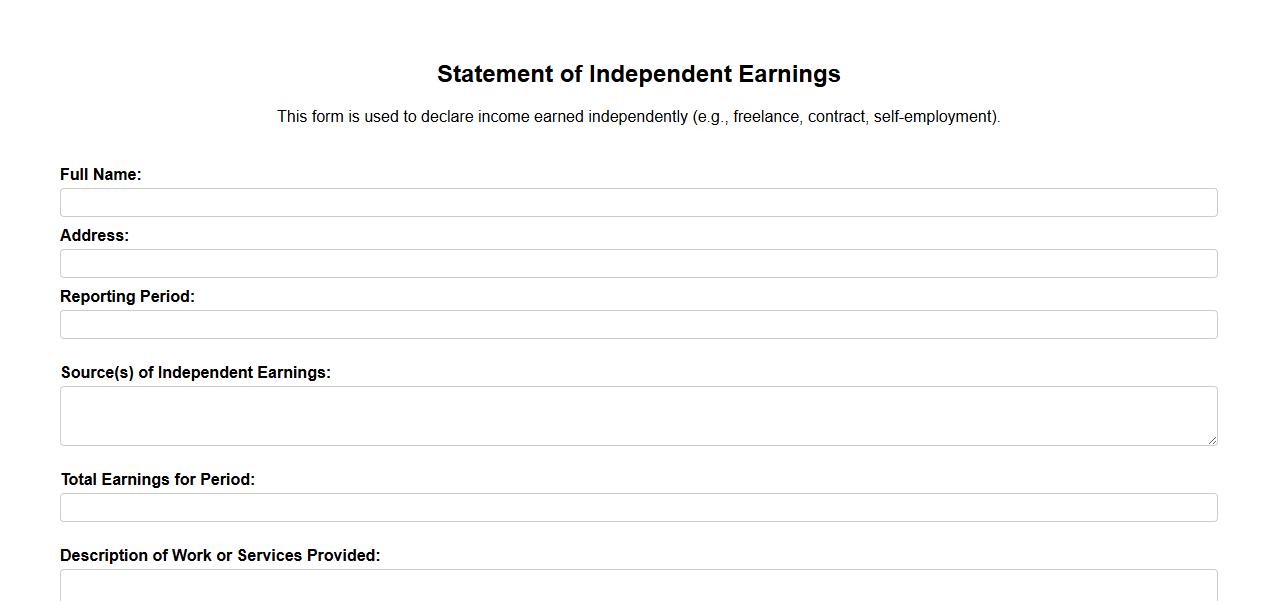

Statement of Independent Earnings

The Statement of Independent Earnings provides a detailed report of an individual's or entity's net income from freelance or self-employed activities. It highlights all sources of revenue, expenses, and profit or loss over a specific period. This statement is essential for accurate financial tracking and tax reporting.

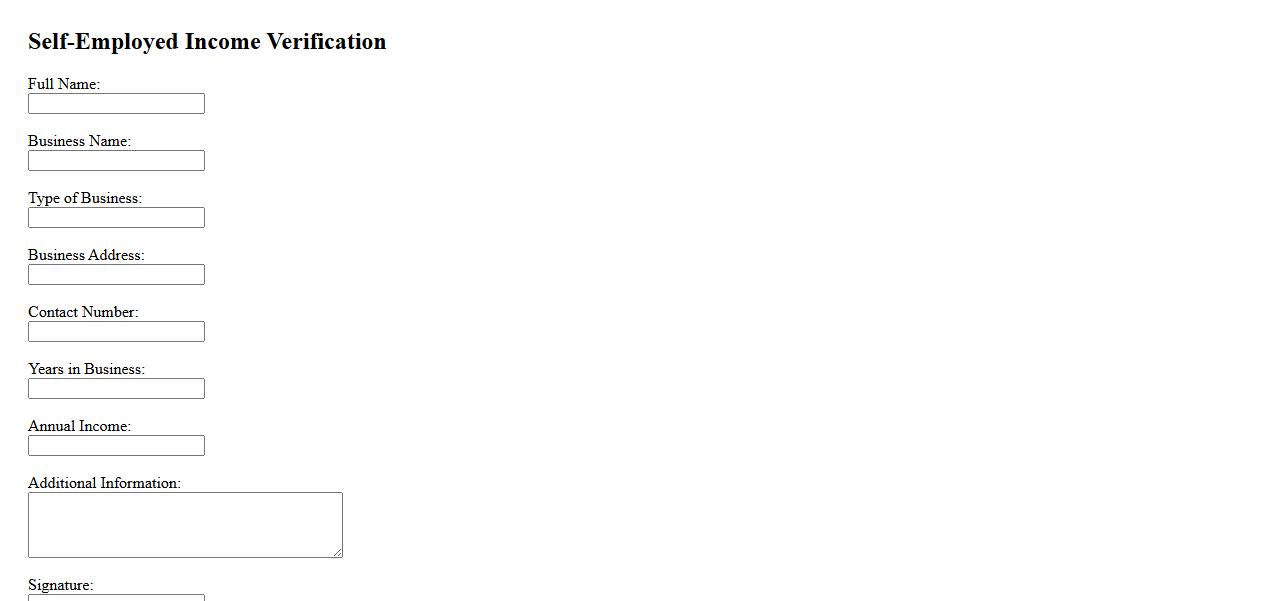

Self-Employed Income Verification

Self-Employed Income Verification is the process of confirming earnings for individuals who run their own businesses or freelance. This verification typically involves reviewing tax returns, bank statements, and profit and loss statements to ensure accurate income reporting. It is essential for securing loans, mortgages, or other financial approvals.

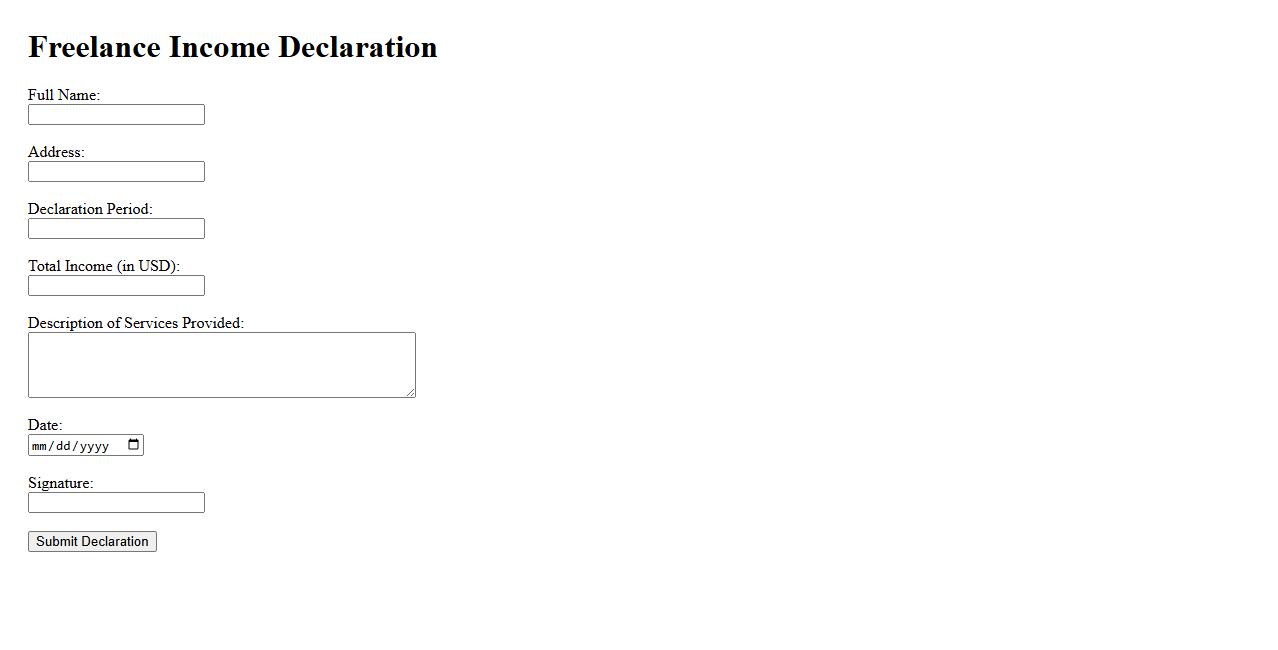

Freelance Income Declaration

Freelance Income Declaration is a crucial document for self-employed individuals to report their earnings accurately. It ensures compliance with tax regulations and helps maintain transparent financial records. Proper declaration facilitates smooth tax filing and avoids legal complications.

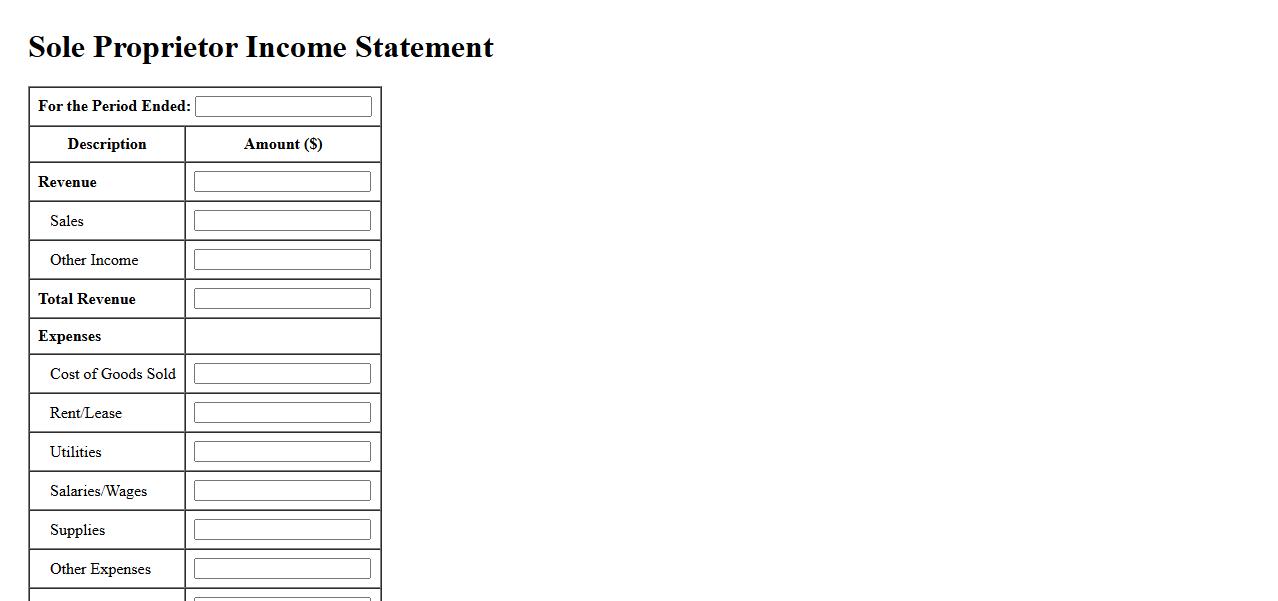

Sole Proprietor Income Statement

The Sole Proprietor Income Statement is a financial document that summarizes the revenues, expenses, and profits of a single-owner business over a specific period. It provides a clear overview of the business's financial performance and helps track profitability. This statement is crucial for making informed decisions and managing the sole proprietor's finances effectively.

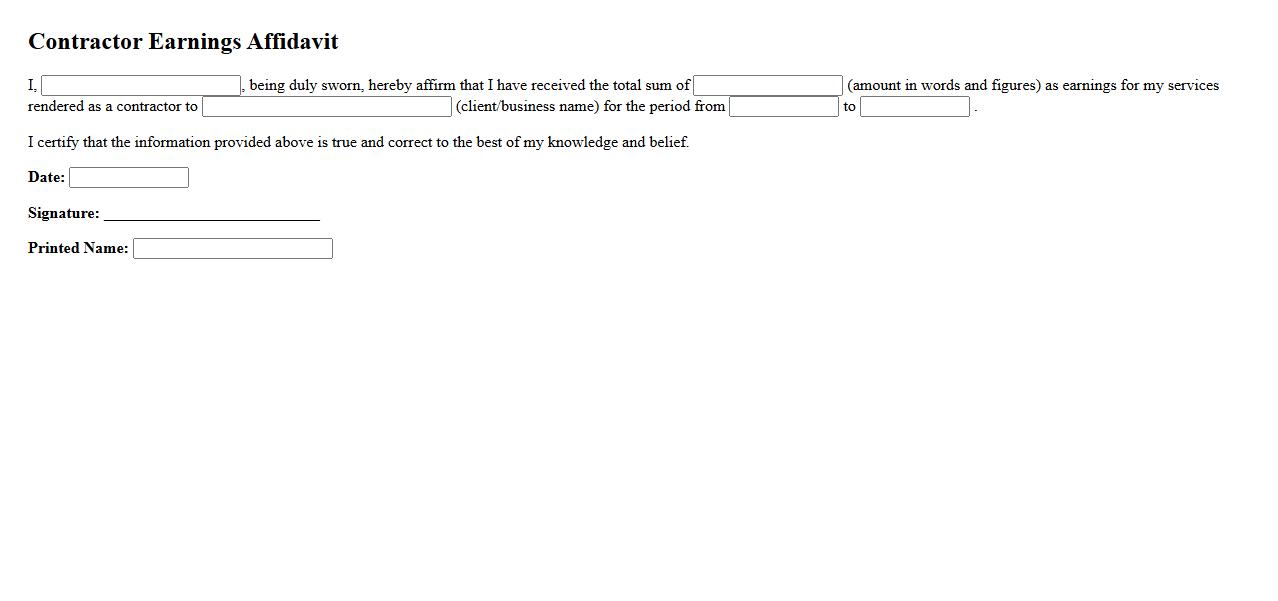

Contractor Earnings Affidavit

An Contractor Earnings Affidavit is a legal document that verifies a contractor's income and earnings. It is often required for loan applications, tax purposes, or legal proceedings. This affidavit helps establish credible proof of financial stability and business revenue.

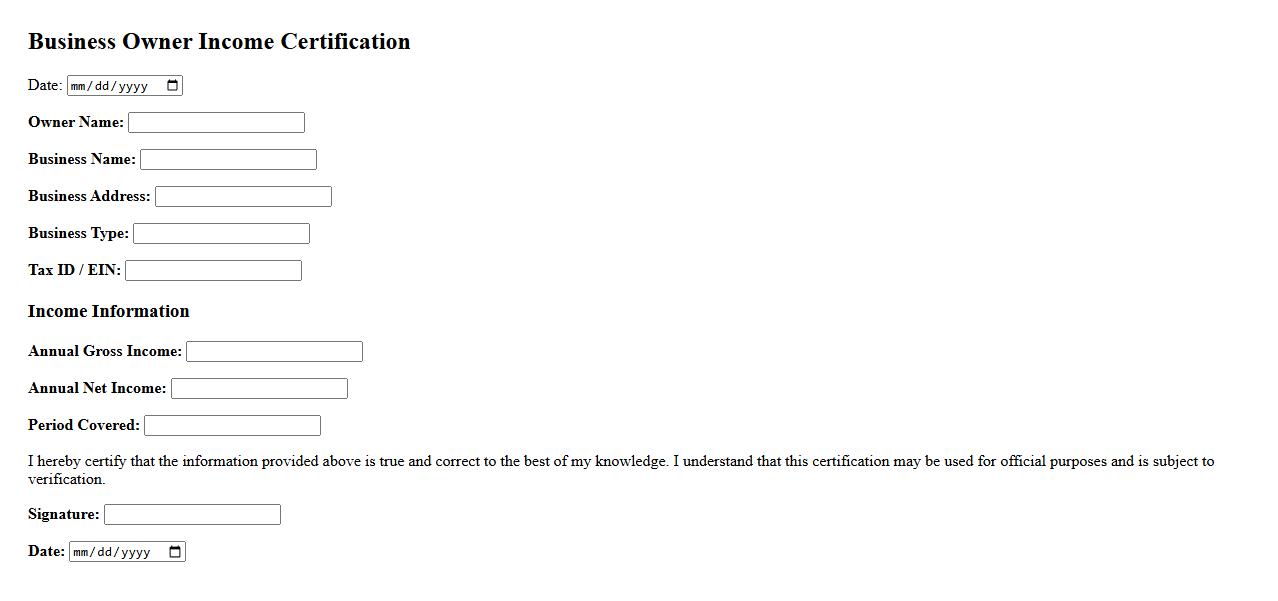

Business Owner Income Certification

The Business Owner Income Certification is an official document verifying the income earned by a business owner. It is essential for financial applications, including loans and leases, providing proof of earnings. This certification helps establish credibility and financial stability for the owner's business activities.

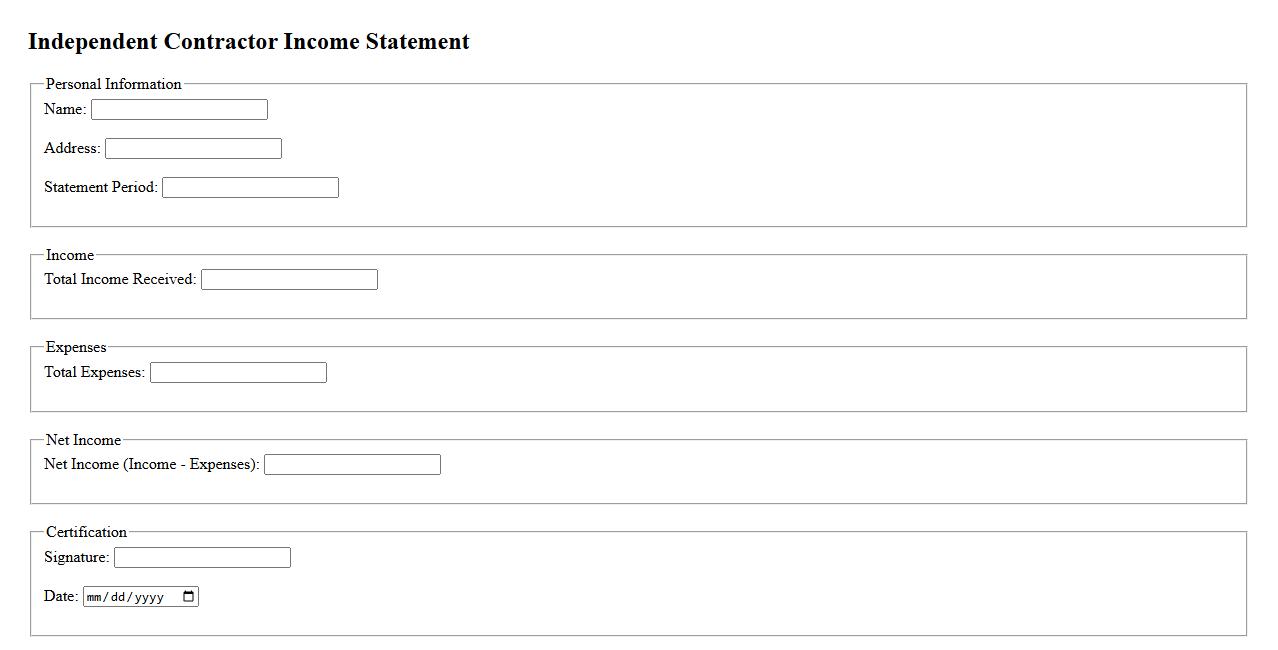

Independent Contractor Income Statement

An Independent Contractor Income Statement provides a detailed summary of earnings and expenses for individuals working independently. It helps track financial performance and manage tax obligations accurately. This statement is essential for maintaining organized records and ensuring proper income reporting.

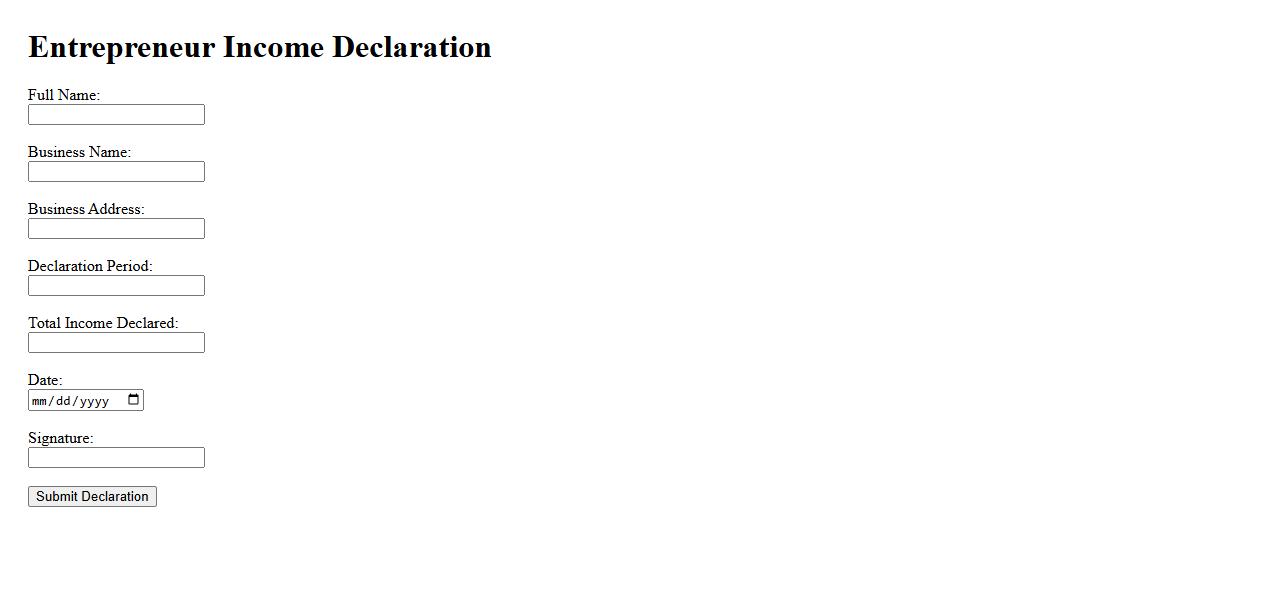

Entrepreneur Income Declaration

An Entrepreneur Income Declaration is a formal statement outlining the earnings of a business owner. It is essential for tax reporting, loan applications, and financial transparency. This document helps verify income stability and business profitability.

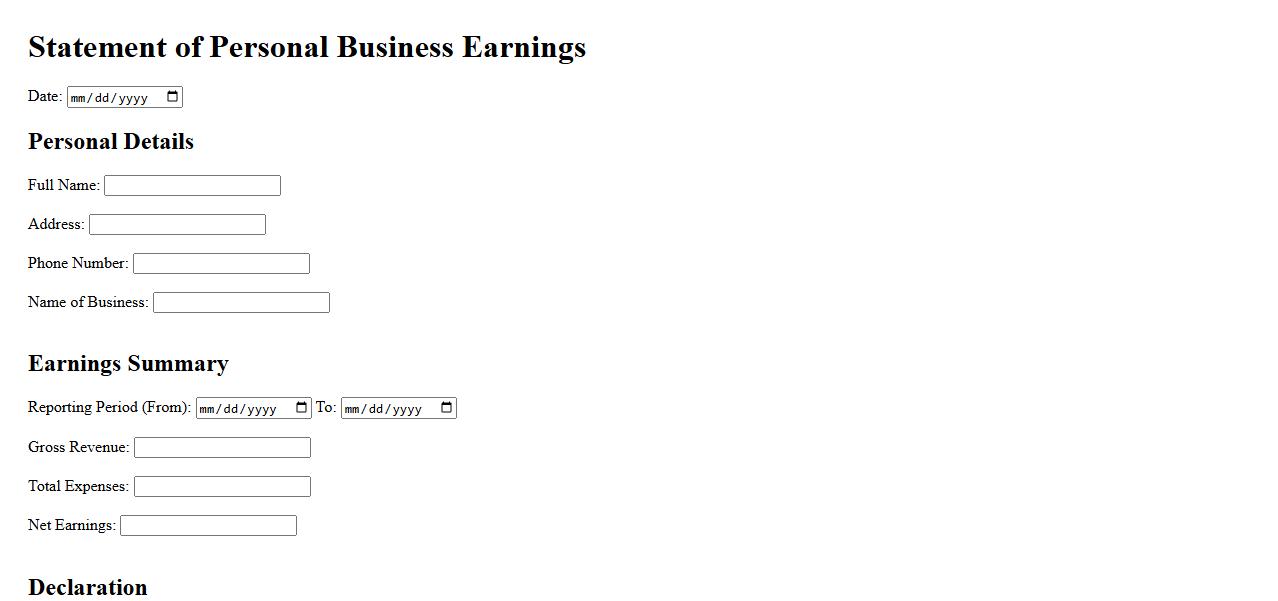

Statement of Personal Business Earnings

The Statement of Personal Business Earnings is a financial document that summarizes an individual's income generated from their business activities. It provides a clear overview of profits and losses, helping to evaluate business performance. This statement is essential for tax reporting and financial planning.

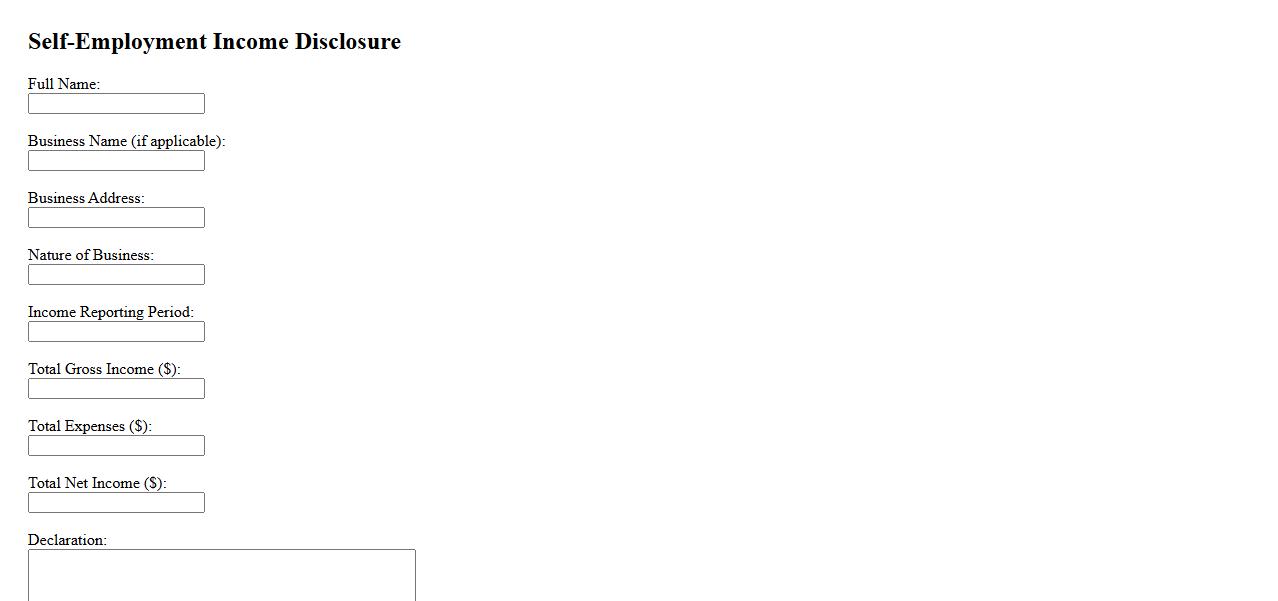

Self-Employment Income Disclosure

Self-Employment Income Disclosure is a transparent declaration of earnings generated through individual business activities. This disclosure is crucial for tax reporting and financial assessments. It ensures accurate documentation of income for regulatory and personal financial management purposes.

What is the primary purpose of the Declaration of Self-Employment Income?

The primary purpose of the Declaration of Self-Employment Income is to provide an accurate report of income earned from self-employment activities. This document is essential for tax assessment, loan applications, and financial verification. It helps authorities and financial institutions evaluate the financial status of self-employed individuals.

Which types of income sources must be included in the declaration?

The declaration must include all income sources generated from self-employment activities, such as freelance work, consulting, and small business earnings. It should also cover any irregular income that contributes to the total earnings. Omitting any source may lead to inaccuracies and potential legal consequences.

What supporting documentation is typically required with a self-employment income declaration?

Supporting documentation usually includes bank statements, invoices, tax returns, and profit and loss statements. These documents help substantiate the income reported in the declaration. Accurate and comprehensive documentation ensures the credibility of the income figures provided.

How does the declaration verify the accuracy of the reported income?

The declaration verifies income accuracy through cross-referencing reported figures with supporting evidence such as tax filings and financial records. Authorities may also conduct audits or request additional documentation to confirm authenticity. This process ensures transparency and prevents income misrepresentation.

Who is authorized to sign and submit the Declaration of Self-Employment Income?

The Declaration of Self-Employment Income must be signed and submitted by the self-employed individual or their authorized representative. This signature certifies that the information provided is true and accurate. Submission is typically done to tax authorities or financial institutions as required.