A Declaration of Gift is a legal document used to formally transfer ownership of property or assets from one person to another without any exchange of money. This document ensures clarity and avoids future disputes by clearly stating the donor's intent and the details of the gifted item. Properly drafted Declaration of Gift forms are essential for smooth and legally recognized gifting transactions.

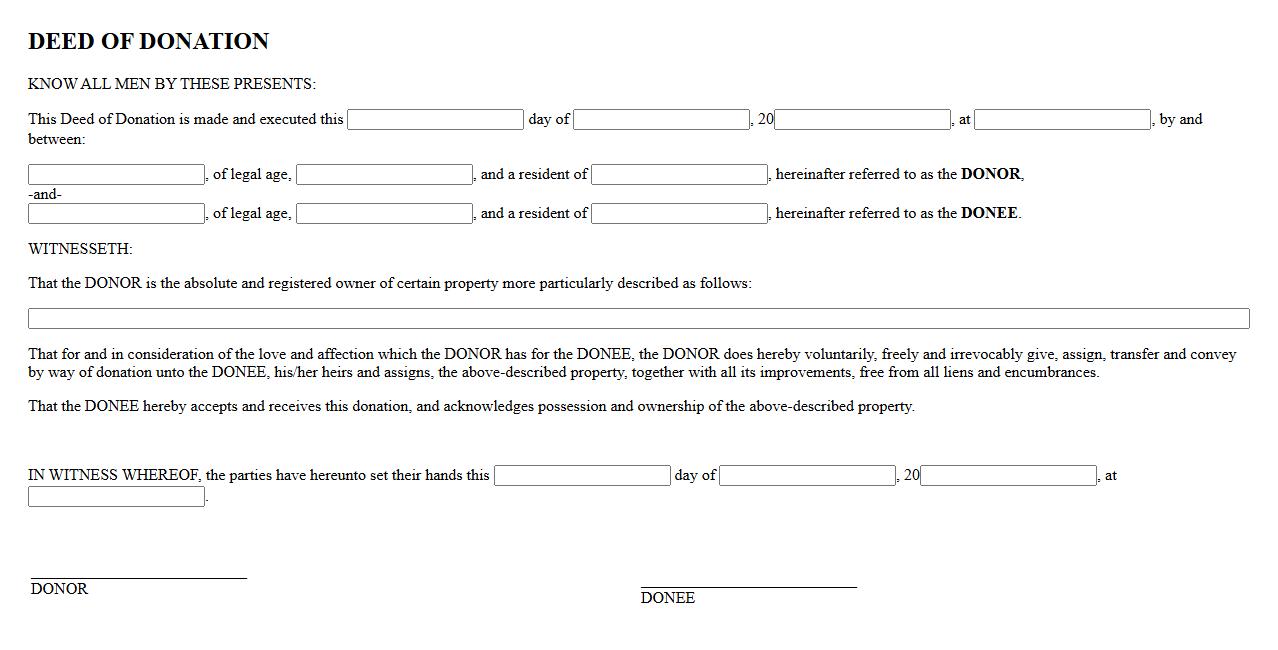

Deed of Donation

A Deed of Donation is a legal document that formally transfers ownership of property or assets from one party to another without any exchange of money. It serves as proof of the donor's intent to give the donation voluntarily and irrevocably. This document is essential for validating the donation in legal and tax matters.

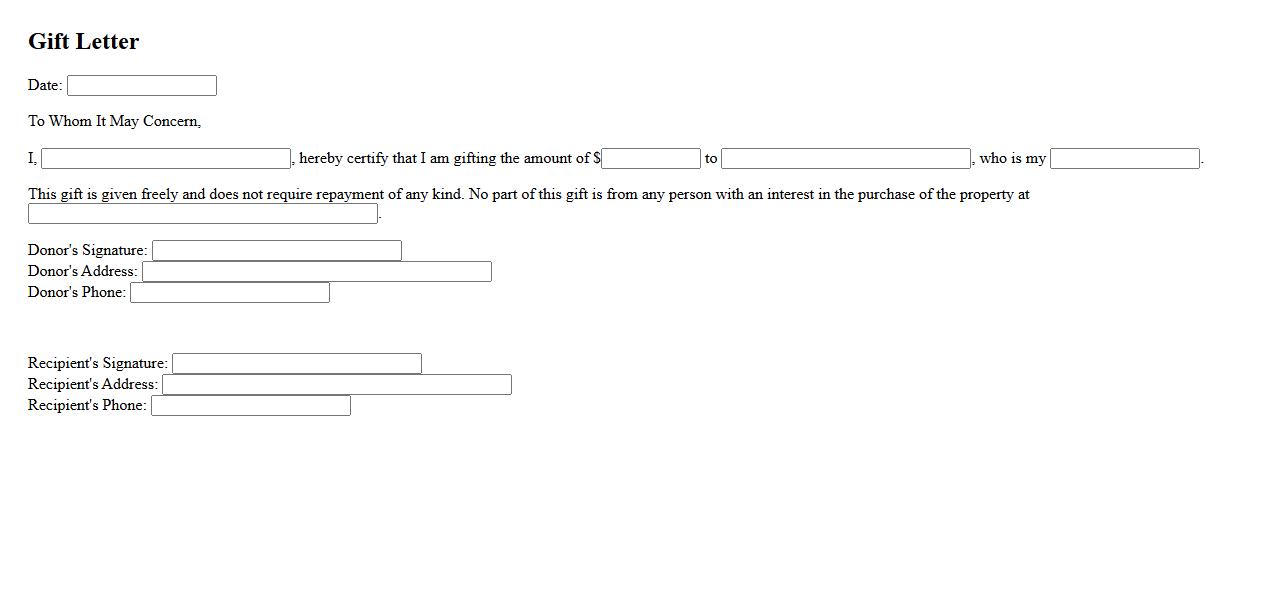

Gift Letter

A Gift Letter is a formal document used to declare that a monetary gift has been given without expectation of repayment. It is commonly required in real estate transactions to verify that funds used for a down payment are a genuine gift. This letter helps lenders confirm the source of funds and ensures transparency in financial dealings.

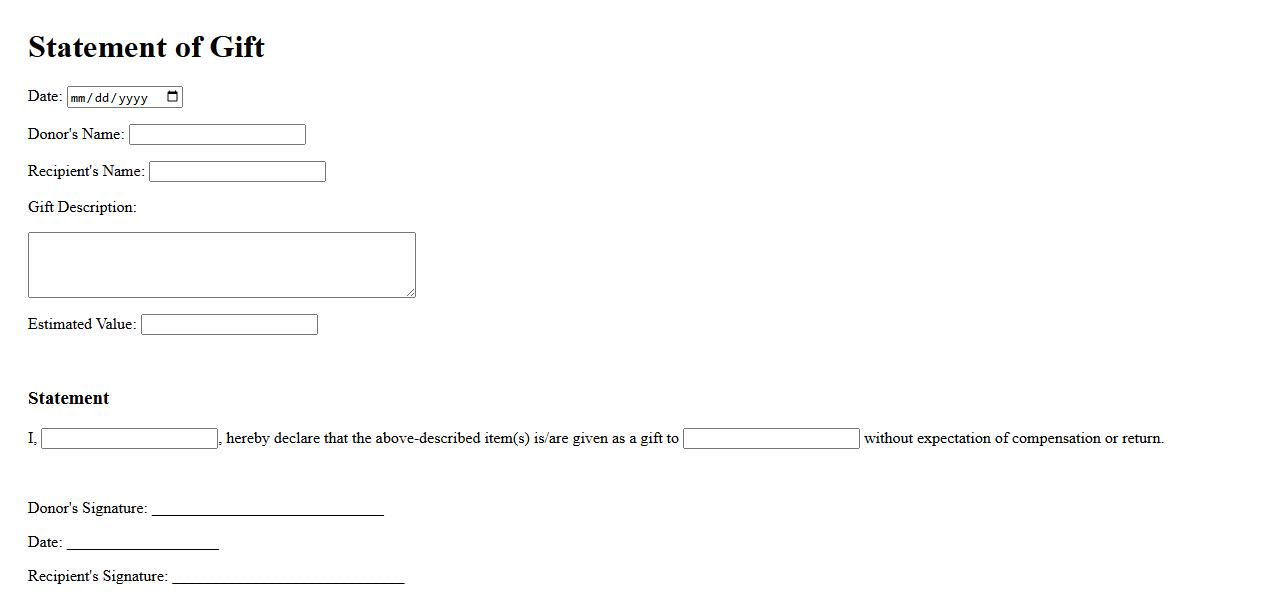

Statement of Gift

The Statement of Gift is a formal document used to declare the transfer of ownership of an asset without any exchange of money. It serves as proof that the item was given voluntarily, ensuring legal clarity for both the donor and the recipient. This statement helps prevent future disputes by clearly outlining the terms of the gift.

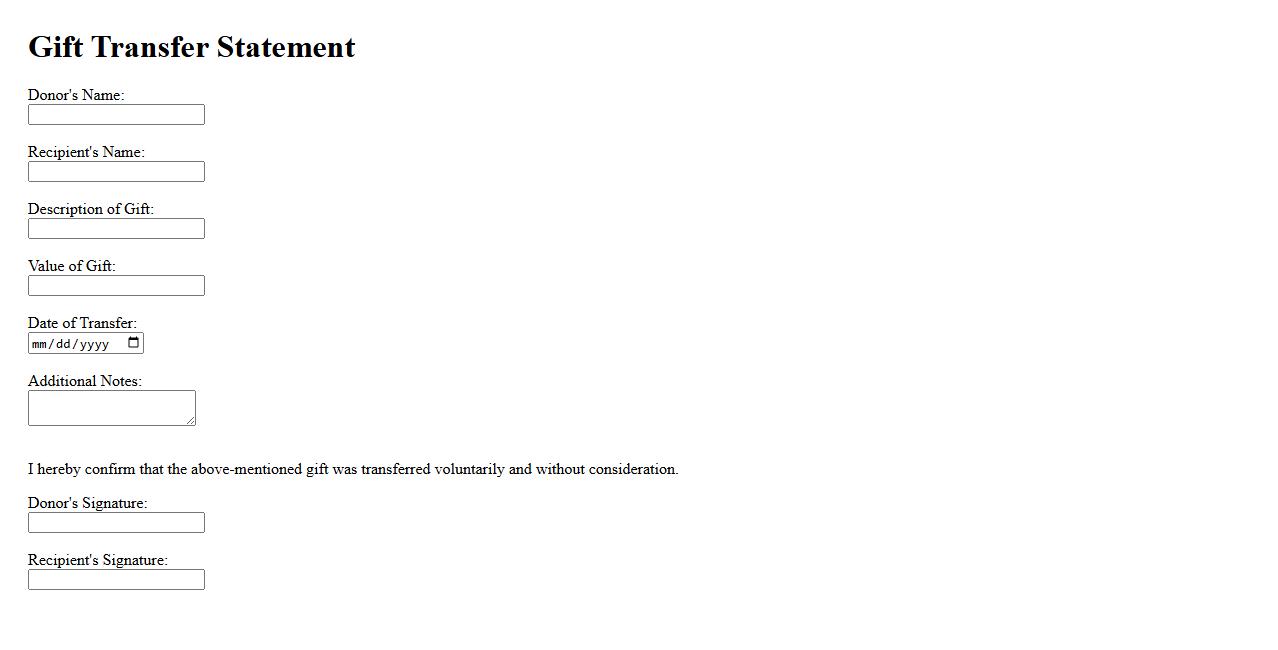

Gift Transfer Statement

The Gift Transfer Statement is a formal document that details the transfer of assets or property from one individual to another without any exchange of payment. It serves as proof of the transaction and is often required for legal or tax purposes. This statement ensures transparency and helps in maintaining accurate financial records.

Gift Declaration Form

The Gift Declaration Form is an essential document used to disclose any gifts received or given, ensuring transparency and compliance with organizational policies. This form helps prevent conflicts of interest and maintains ethical standards within institutions. Proper completion of the Gift Declaration Form safeguards both the giver and receiver from potential misunderstandings.

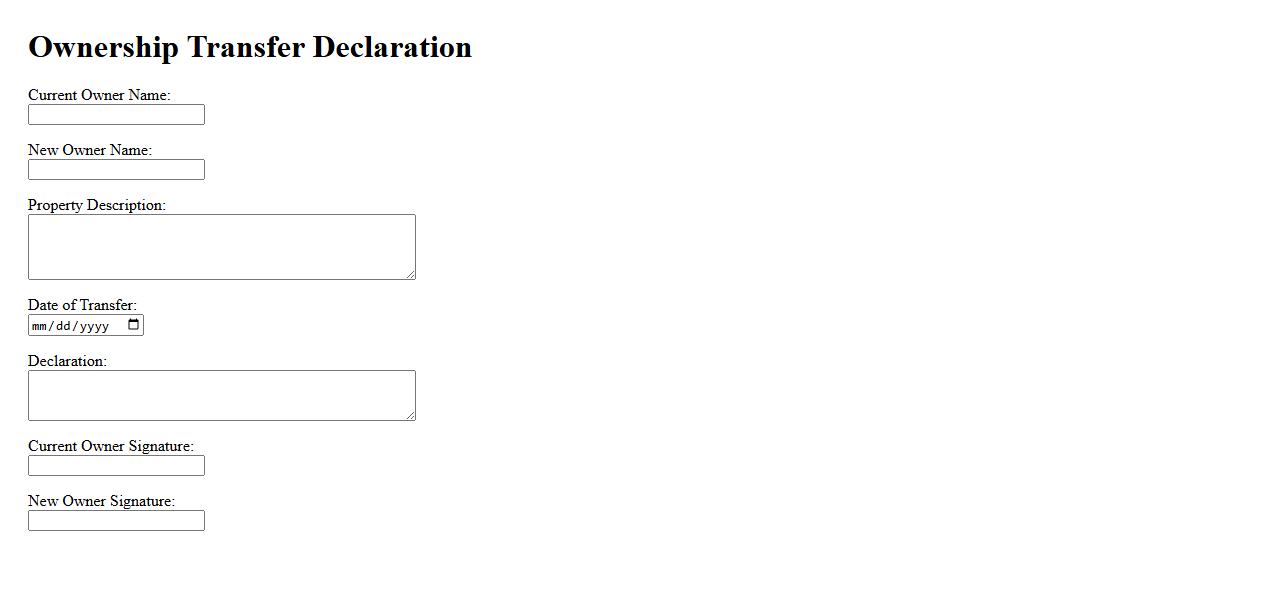

Ownership Transfer Declaration

The Ownership Transfer Declaration is a formal document used to legally transfer property rights from one party to another. It confirms the details of the transaction and ensures that the new owner is officially recognized. This declaration is essential for maintaining accurate records and protecting ownership rights.

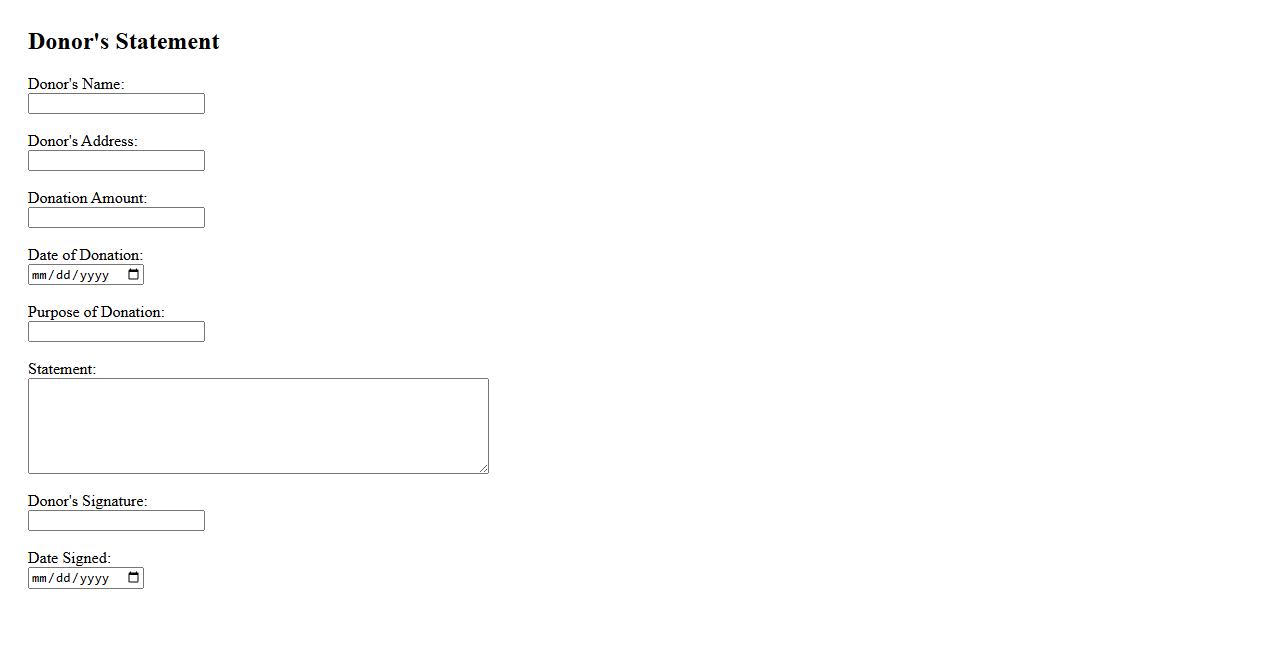

Donor's Statement

The Donor's Statement is a formal declaration expressing the intent and commitment of an individual or organization to provide a donation. It outlines the purpose, amount, and any specific conditions related to the contribution. This statement ensures transparency and establishes clear expectations between the donor and recipient.

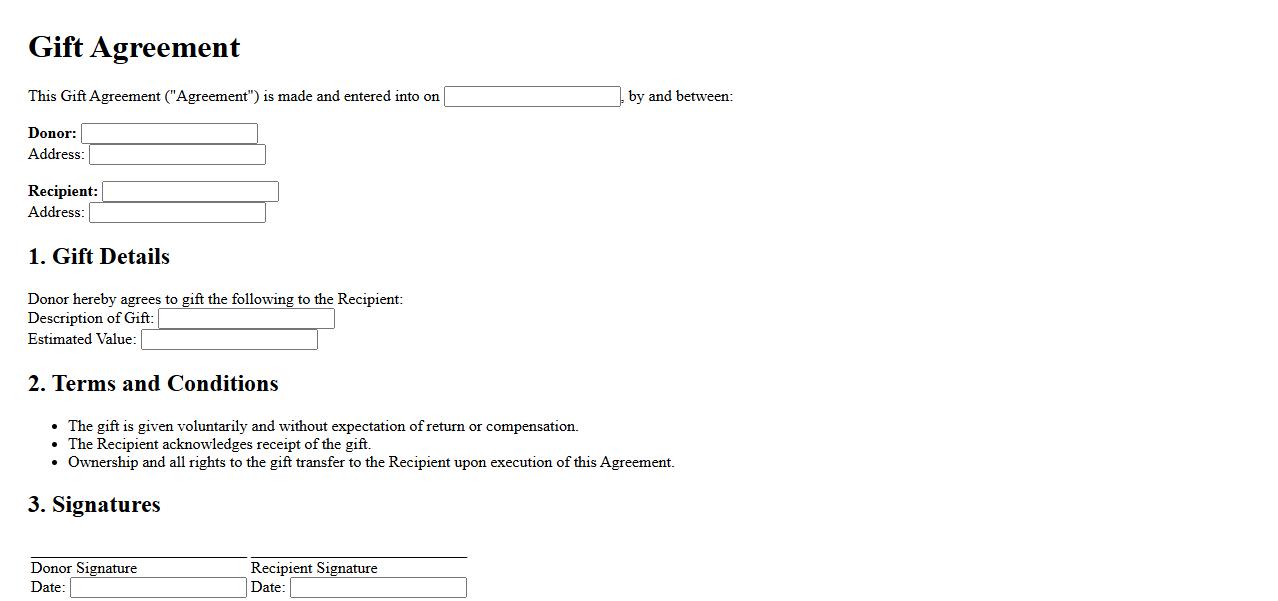

Gift Agreement

A Gift Agreement is a legal document that outlines the terms and conditions under which a gift is transferred from one party to another. It ensures clarity and protects the interests of both the donor and the recipient. This agreement is essential for formalizing substantial or valuable gifts.

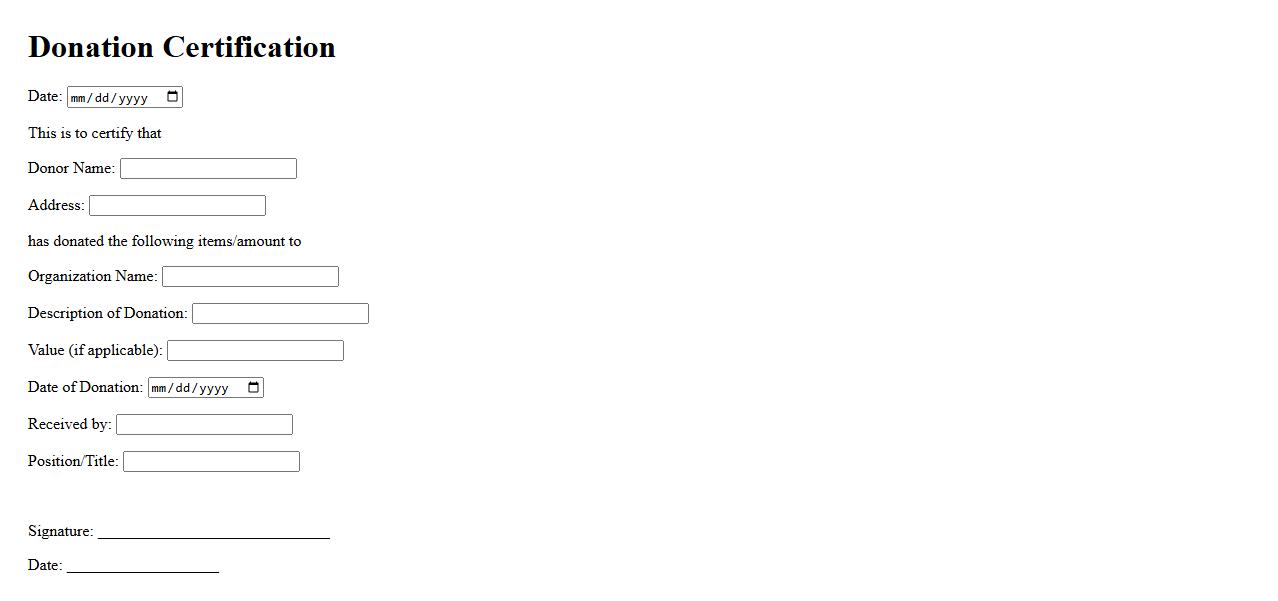

Donation Certification

Our Donation Certification provides official recognition for your generous contributions, ensuring transparency and trust. It serves as a valuable document for tax purposes and personal records. Secure your charitable giving with a certified acknowledgment today.

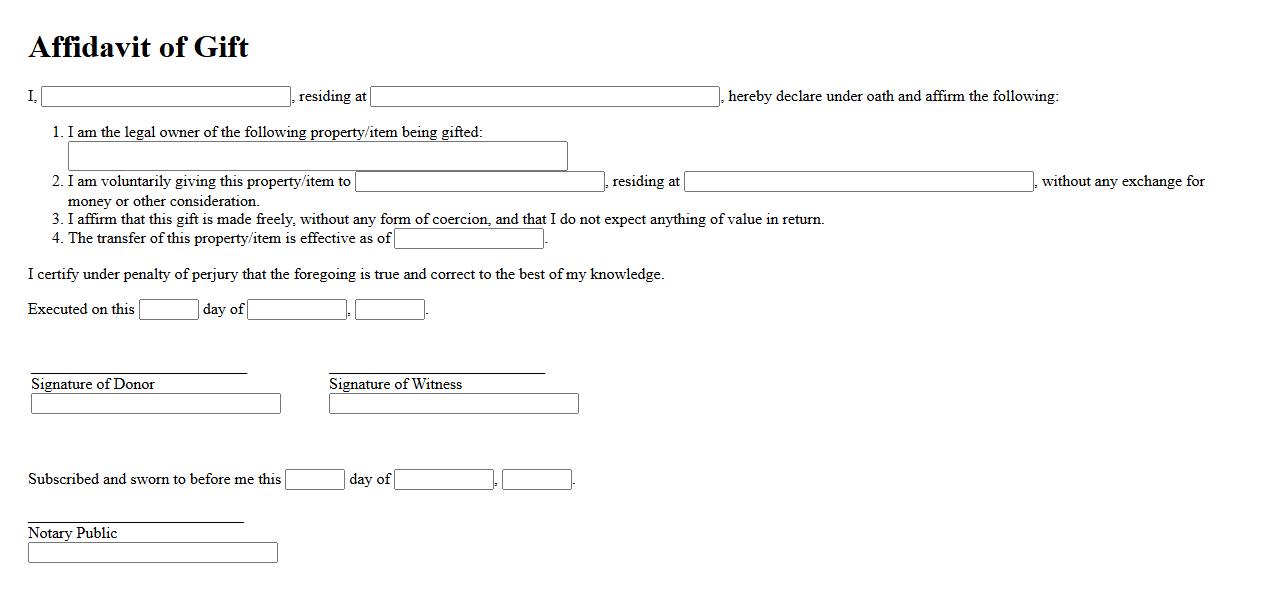

Affidavit of Gift

An Affidavit of Gift is a legal document used to voluntarily transfer ownership of property or assets without monetary exchange. It serves as proof that the transfer is a gift and not a sale. This affidavit is often required for tax and legal purposes to establish the donor's intent.

What constitutes a "gift" under the Declaration of Gift?

A gift under the Declaration of Gift is a voluntary and gratuitous transfer of ownership from one person to another. It involves the donor's intent to give without expecting any form of compensation. The property or item given must be delivered and accepted to complete the gift transaction.

Who are the legal parties involved in a Declaration of Gift?

The primary legal parties involved are the donor, who gives the gift, and the donee, who receives the gift. Both parties must have legal capacity to enter into the transaction. Sometimes, witnesses or notarization may be required to validate the document.

What are the essential elements required for a valid Declaration of Gift?

A valid Declaration of Gift requires clear intent to donate, the delivery of the gift, and the acceptance by the donee. The gift must be made without any conditions or monetary exchange. The transaction should be documented appropriately, often through a written declaration.

How does the Declaration of Gift affect ownership or title transfer?

Upon execution, the Declaration of Gift legally transfers ownership from the donor to the donee. This transfer is immediate and irrevocable once the gift is accepted. It changes the donee's legal title, giving them full rights to the property gifted.

What conditions or limitations, if any, can be attached to a Declaration of Gift?

Conditions or limitations can be imposed if expressly stated in the declaration document. These may include restrictions on use, sale, or transfer of the gifted property. However, such conditions must comply with legal standards and not defeat the purpose of the gift.