A Certificate of Tax Residency is an official document issued by a tax authority to confirm an individual or entity's tax residency status in a specific country. This certificate helps prevent double taxation by proving eligibility for tax treaties between countries. It is essential for both personal tax compliance and international business operations.

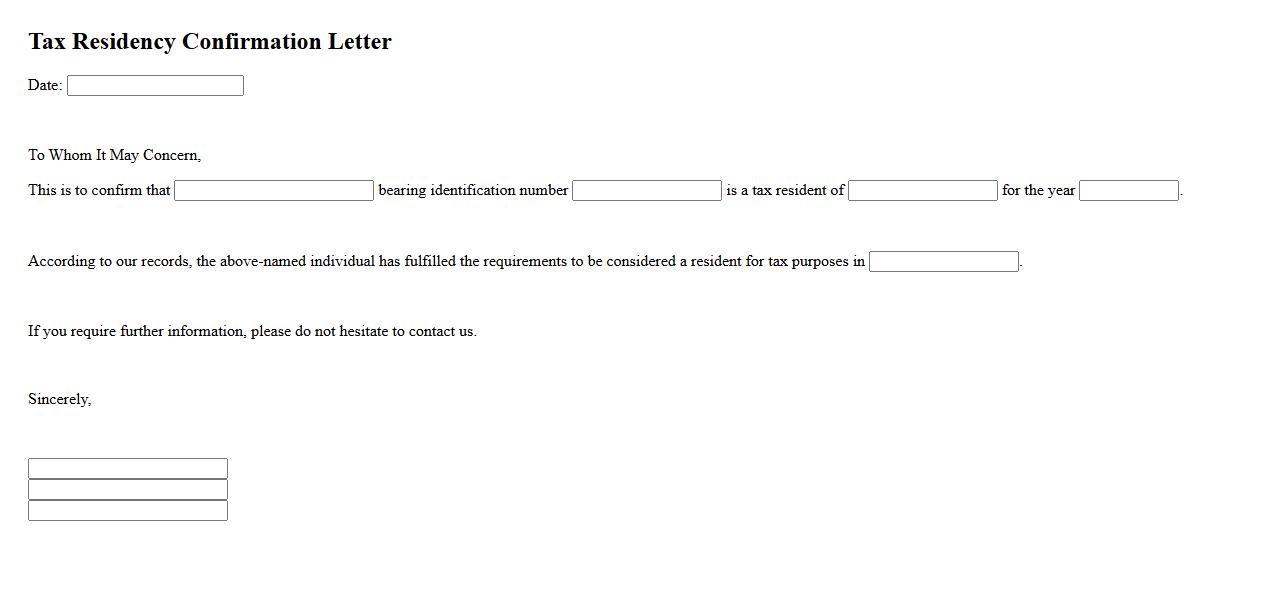

Tax Residency Confirmation Letter

A Tax Residency Confirmation Letter is an official document issued by tax authorities to verify an individual's or entity's tax residency status. This letter is essential for avoiding double taxation and claiming tax treaty benefits. It serves as proof of residency for tax purposes in international financial transactions.

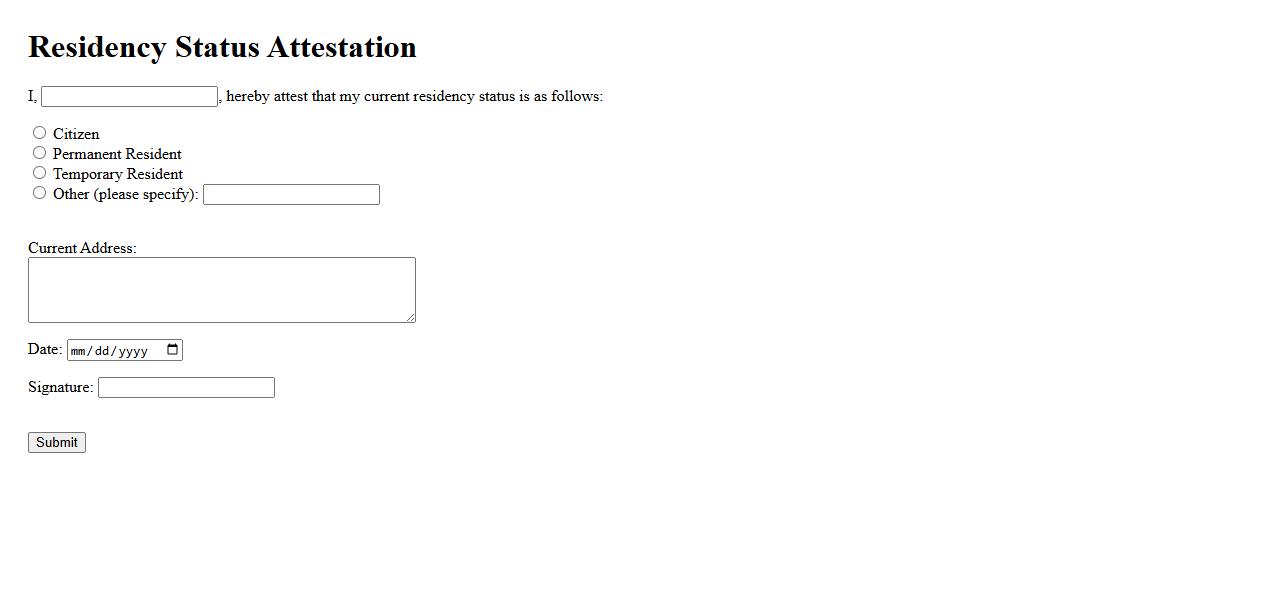

Residency Status Attestation

The Residency Status Attestation is an official document that verifies an individual's residential status for legal, tax, or administrative purposes. It is commonly required by government agencies and financial institutions to confirm eligibility or residency claims. This attestation ensures compliance with relevant regulations and simplifies verification processes.

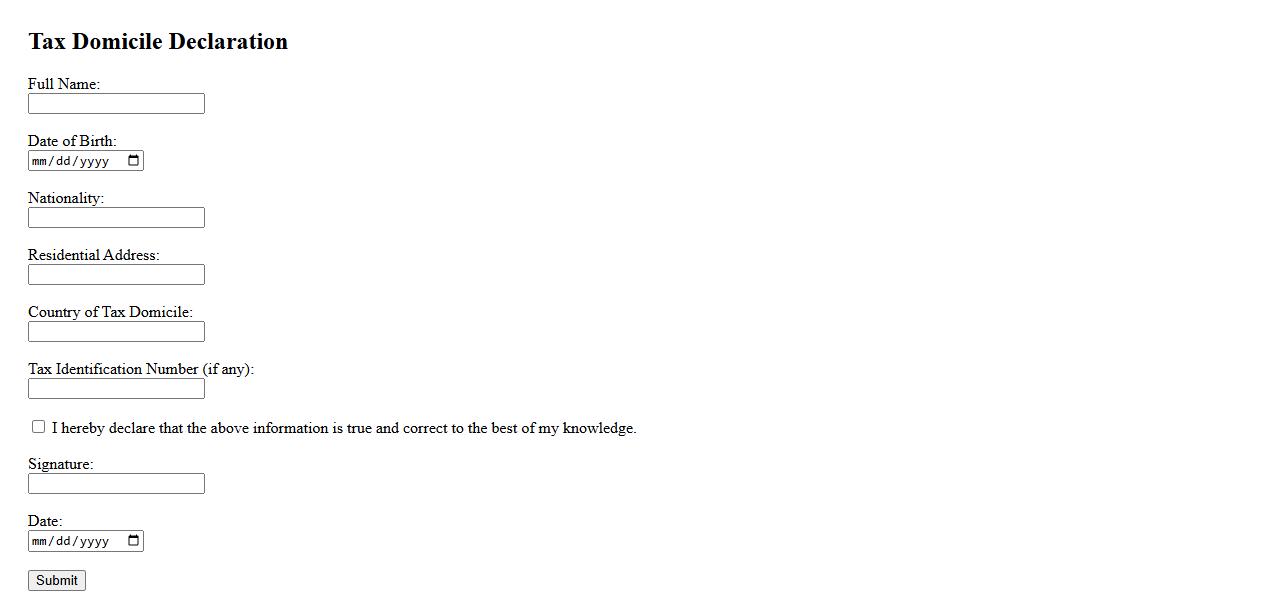

Tax Domicile Declaration

The Tax Domicile Declaration is an official statement confirming an individual's primary tax residence. It helps determine the correct jurisdiction for tax obligations and benefits. This document is essential for compliance with international tax regulations.

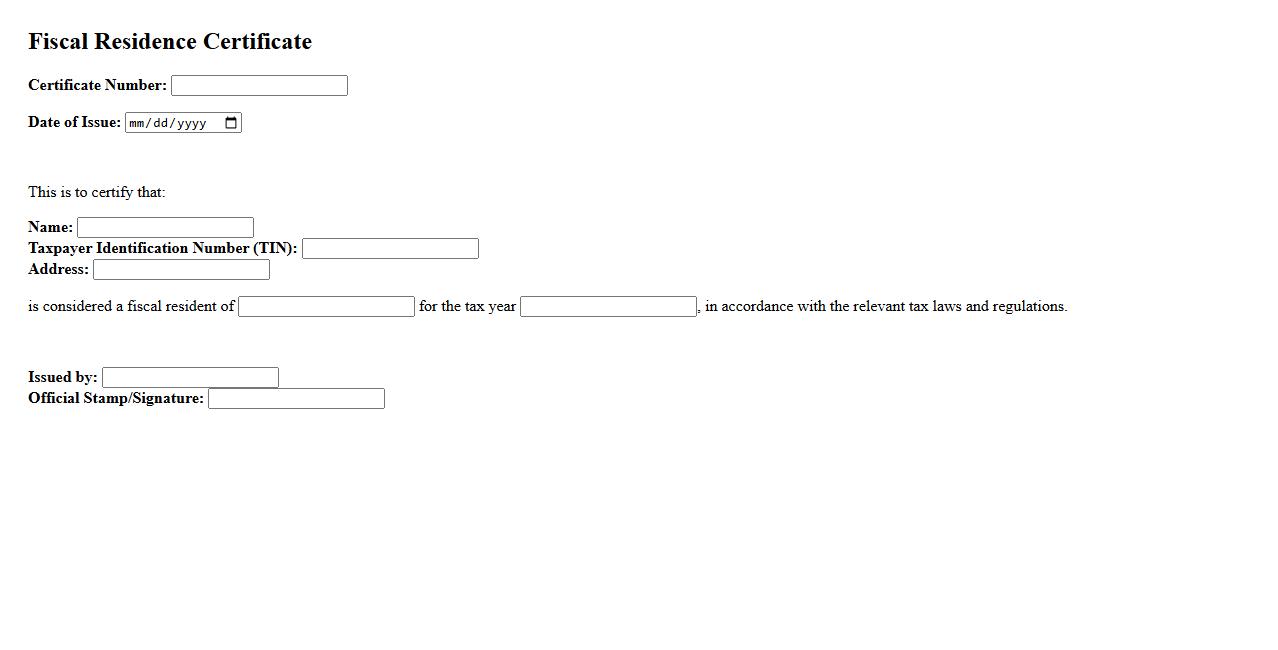

Fiscal Residence Certificate

A Fiscal Residence Certificate is an official document issued by tax authorities to confirm an individual's or entity's tax residency status. It is essential for benefiting from tax treaties and avoiding double taxation. This certificate provides legal proof required for international tax and financial transactions.

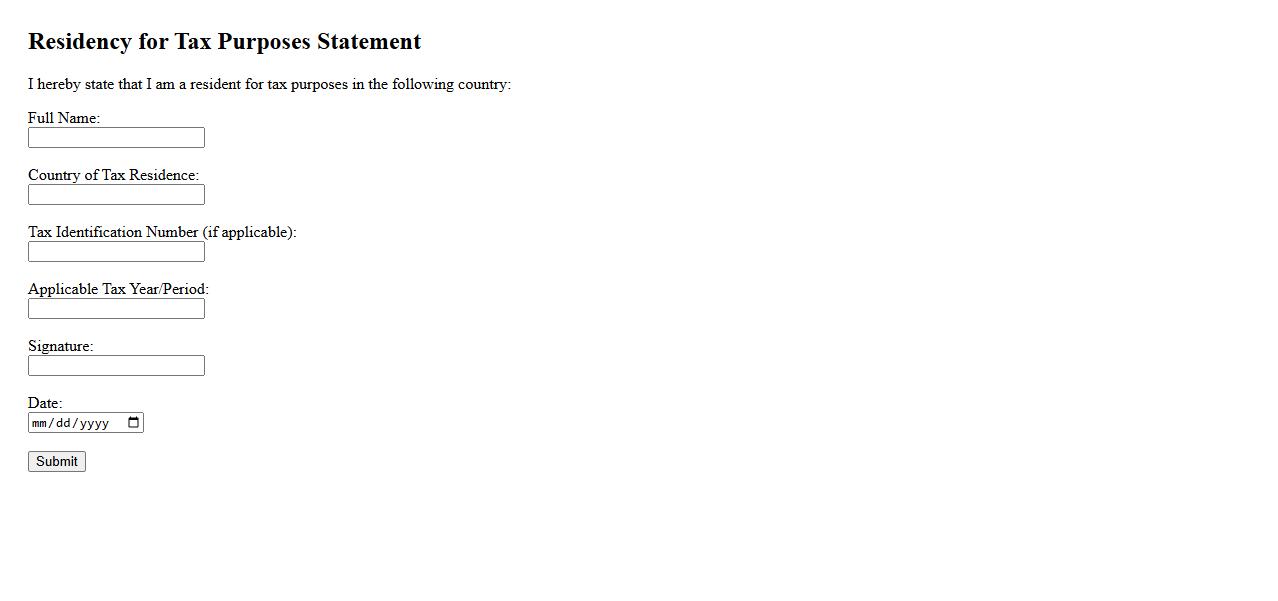

Residency for Tax Purposes Statement

The Residency for Tax Purposes Statement is a document used to confirm an individual's tax residency status. It is essential for determining the appropriate tax obligations and avoiding double taxation. This statement is often required by tax authorities and financial institutions.

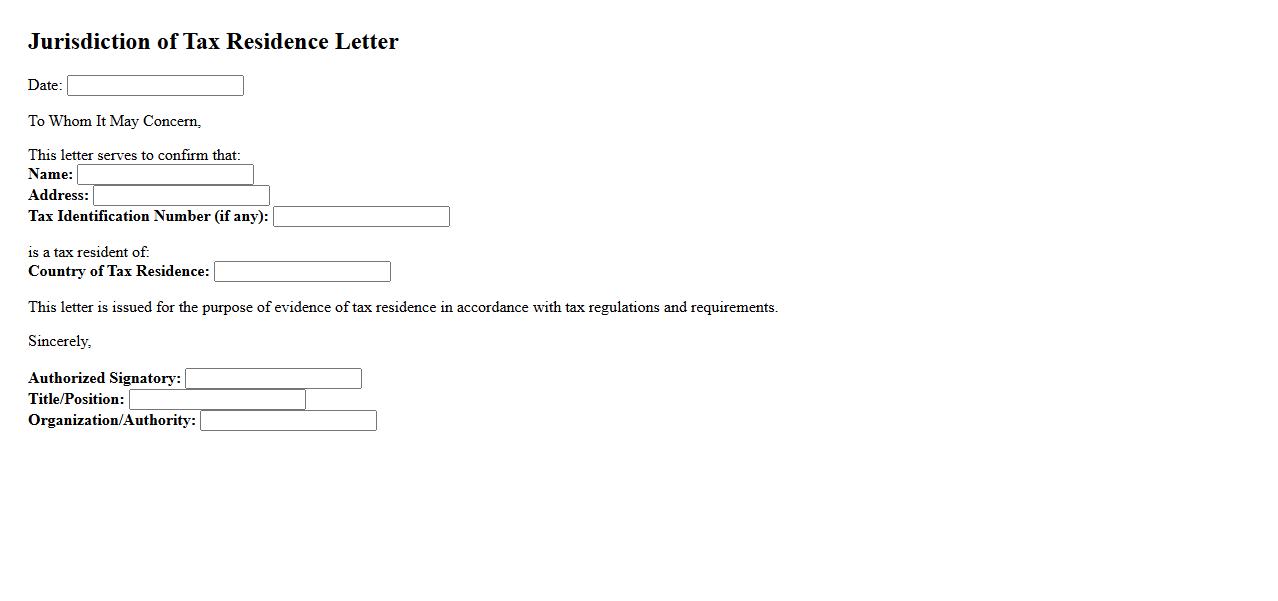

Jurisdiction of Tax Residence Letter

The Jurisdiction of Tax Residence Letter is an official document that certifies an individual's or entity's tax residency status within a specific jurisdiction. It is often required for tax compliance and to avoid double taxation in international financial matters. This letter confirms the applicable tax laws and treaties governing the taxpayer's obligations.

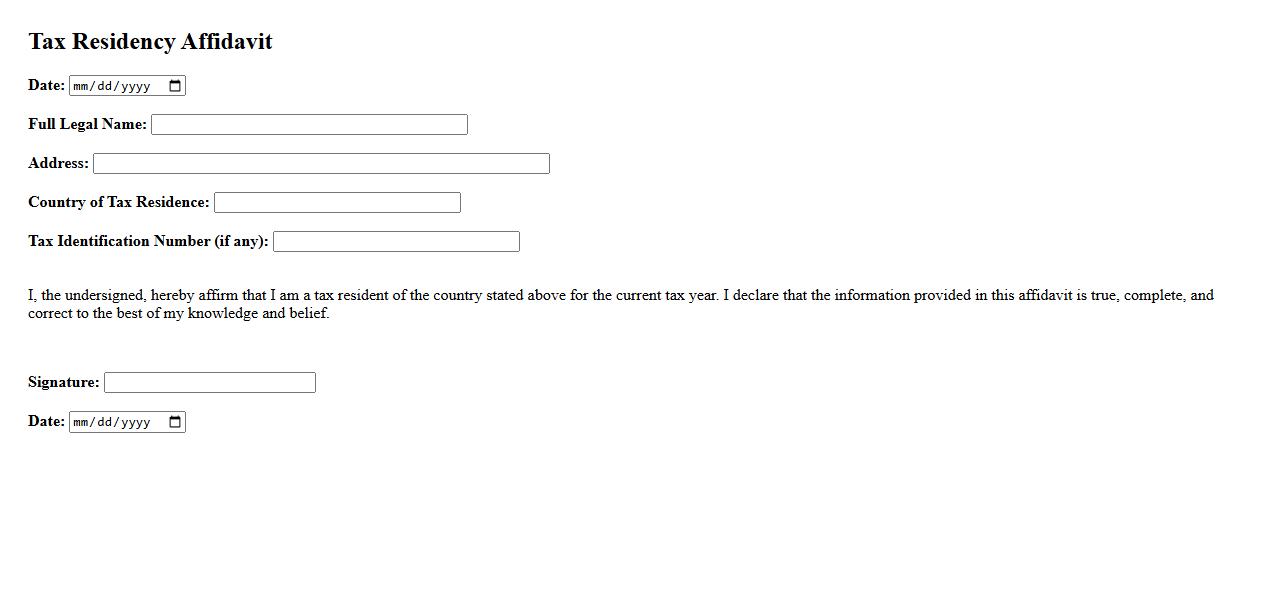

Tax Residency Affidavit

A Tax Residency Affidavit is a legal document used to certify an individual's tax residency status in a specific country. This affidavit helps in determining the applicable tax obligations and benefits according to international tax treaties. It is essential for avoiding double taxation and ensuring compliance with tax regulations.

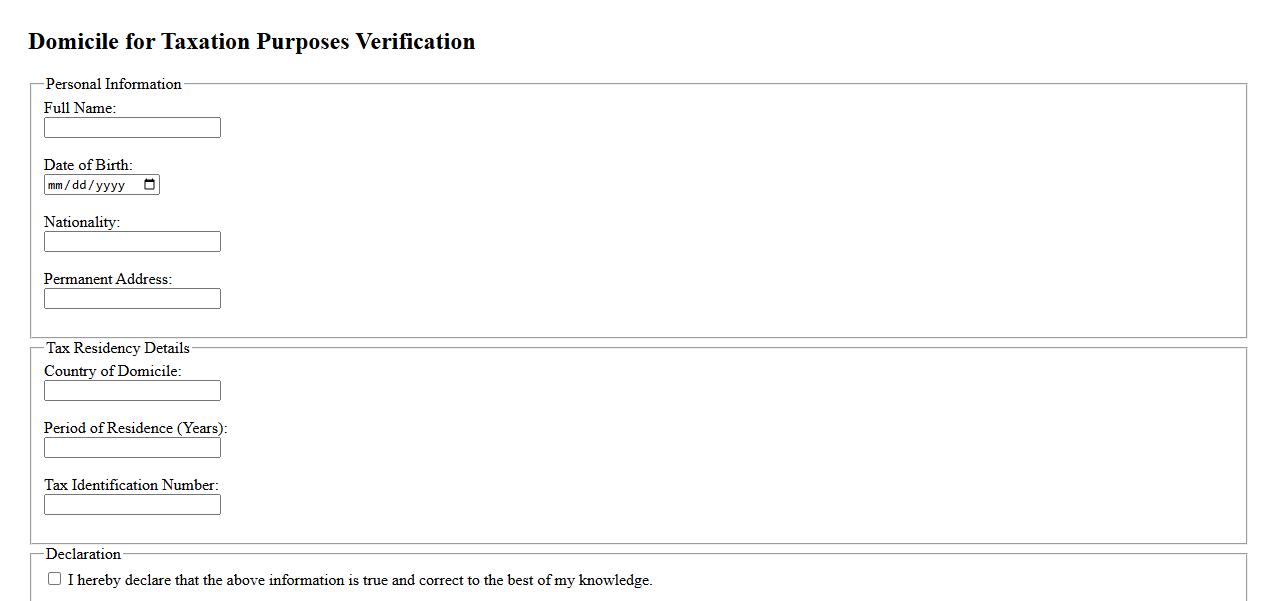

Domicile for Taxation Purposes Verification

The domicile for taxation purposes verification is a crucial process to determine an individual's or entity's tax residency status. It ensures compliance with tax laws by confirming the correct jurisdiction responsible for taxation. This verification helps prevent tax evasion and double taxation issues.

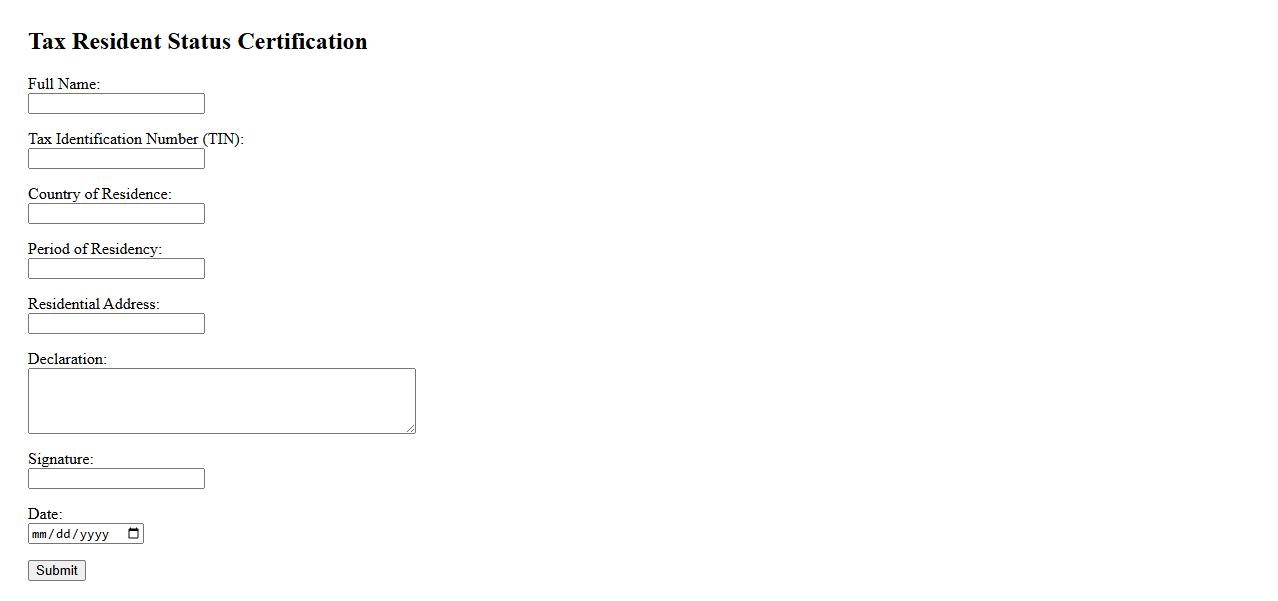

Tax Resident Status Certification

Obtaining a Tax Resident Status Certification is essential for individuals or businesses to confirm their tax residency in a particular country. This certification helps prevent double taxation and ensures compliance with international tax regulations. It serves as official proof for tax authorities and financial institutions.

Certificate of Fiscal Domicile

The Certificate of Fiscal Domicile is an official document issued by tax authorities to confirm an individual's or entity's tax residence. It is essential for complying with international tax regulations and avoiding double taxation. This certificate helps establish the applicable tax jurisdiction and supports transparent financial transactions.

What is the primary purpose of a Certificate of Tax Residency?

The Certificate of Tax Residency (CTR) serves as official proof that an individual or entity is a resident for tax purposes in a specific country. This document helps in avoiding double taxation by verifying where taxes must be paid. It also facilitates the application of tax treaties between countries, reducing withholding taxes on cross-border income.

Which government authority is responsible for issuing a Certificate of Tax Residency?

The tax authority or revenue department of a country is responsible for issuing the Certificate of Tax Residency. This authority verifies the applicant's residency status based on established tax laws and regulations. Individuals or entities typically apply through this governmental agency to obtain the official certificate.

What supporting documents are typically required to obtain a Certificate of Tax Residency?

Applicants must usually submit evidence such as proof of residency, like utility bills or lease agreements, and tax returns filed in the country of residence. Additional documents may include identification proofs and business registration certificates for companies. These documents help the tax authority verify genuine residency status before issuing the certificate.

How does the validity period of a Certificate of Tax Residency impact international tax obligations?

The validity period of the Certificate of Tax Residency sets the timeframe during which the certificate is recognized by foreign tax authorities. A limited validity period ensures that residency is current and accurate, affecting eligibility for tax treaty benefits. Expired certificates may lead to increased withholding taxes until a new certificate is provided.

In what scenarios is a Certificate of Tax Residency commonly submitted to foreign tax authorities?

A Certificate of Tax Residency is commonly submitted when claiming reduced withholding tax rates on dividends, interests, and royalties under tax treaties. It is also required during cross-border business transactions to prove the taxpayer's residency and avoid double taxation. Additionally, foreign tax authorities may request it for audit or compliance purposes to verify correct tax treatment.