Authorization for Salary Deduction is a formal agreement allowing an employer to deduct specific amounts from an employee's salary for various purposes such as loan repayments, insurance premiums, or benefits contributions. This authorization ensures transparency and consent between the employee and employer, outlining the exact amount and frequency of deductions. Employers must obtain written consent to comply with legal and ethical standards while managing salary deductions effectively.

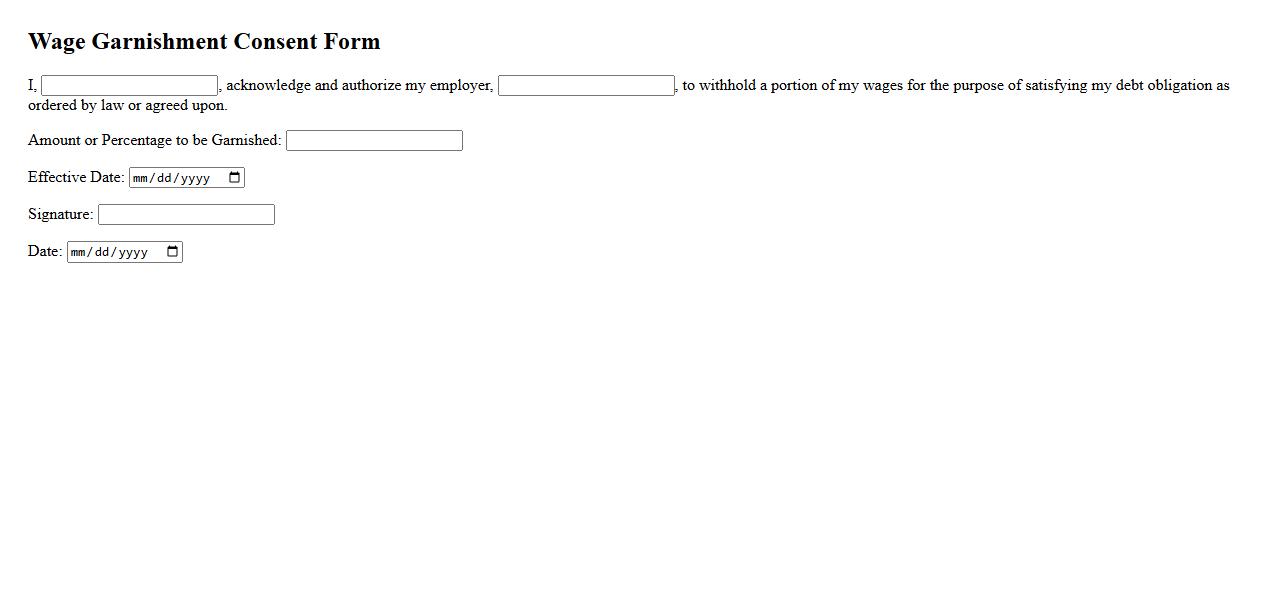

Wage Garnishment Consent

The Wage Garnishment Consent is a legal agreement allowing an employer to deduct a portion of an employee's wages to satisfy a debt. This consent ensures that the garnishment process follows federal and state regulations. It protects both the employer and employee by clearly outlining the terms of the deduction.

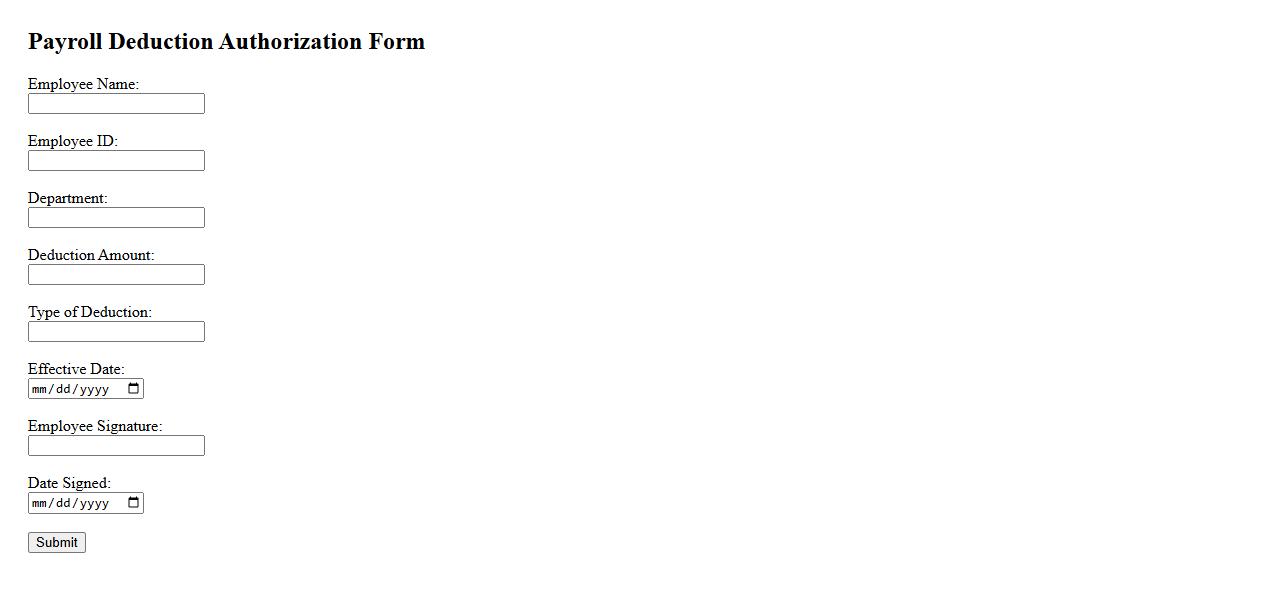

Payroll Deduction Authorization

Payroll Deduction Authorization is a formal agreement that allows an employer to subtract specific amounts from an employee's paycheck. This process simplifies the payment for benefits, loans, or other obligations directly from wages. It ensures accurate and timely deductions with the employee's consent.

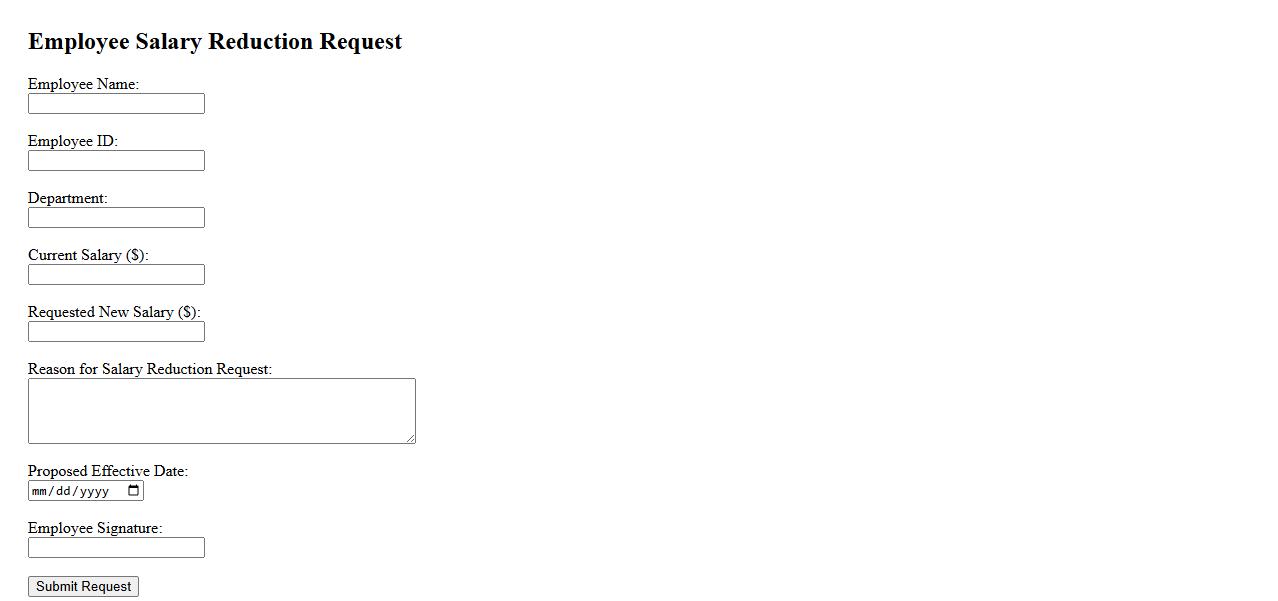

Employee Salary Reduction Request

An Employee Salary Reduction Request is a formal document submitted by an employee to their employer, requesting a temporary or permanent decrease in their salary. This request often aims to accommodate financial challenges or company restructuring. Proper documentation ensures clear communication and mutual agreement between both parties.

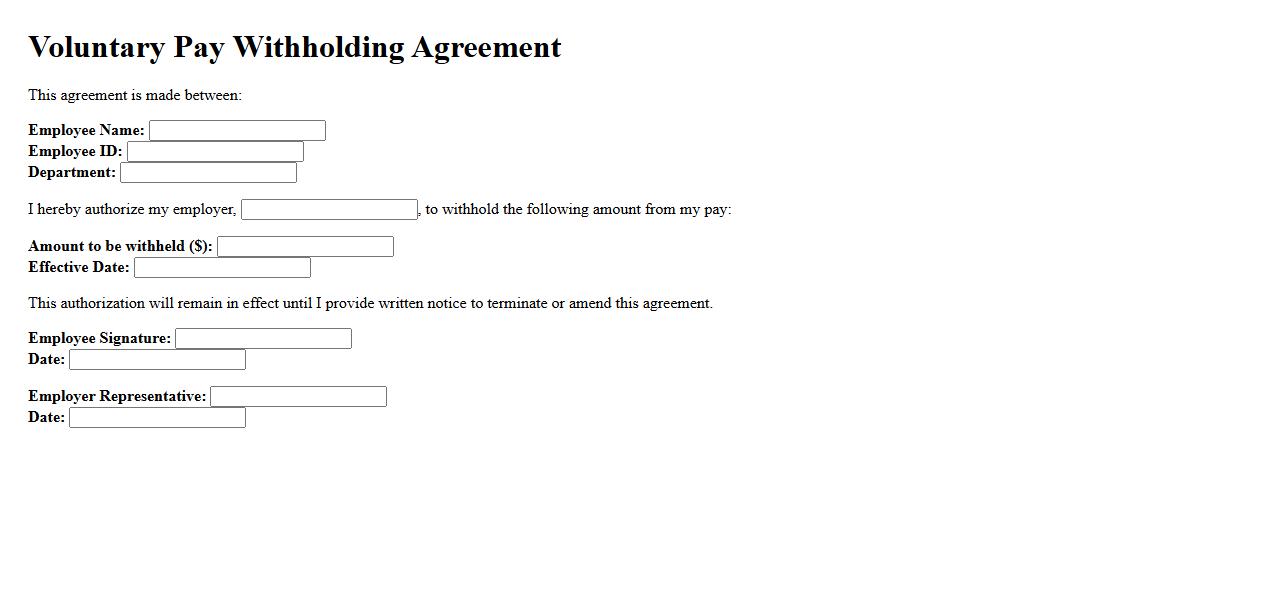

Voluntary Pay Withholding Agreement

A Voluntary Pay Withholding Agreement is a mutual arrangement between an employer and employee to deduct specified amounts from the employee's paycheck. This agreement is often used to repay debts or fulfill financial obligations systematically. It provides a clear, legally recognized method for managing payments directly through payroll.

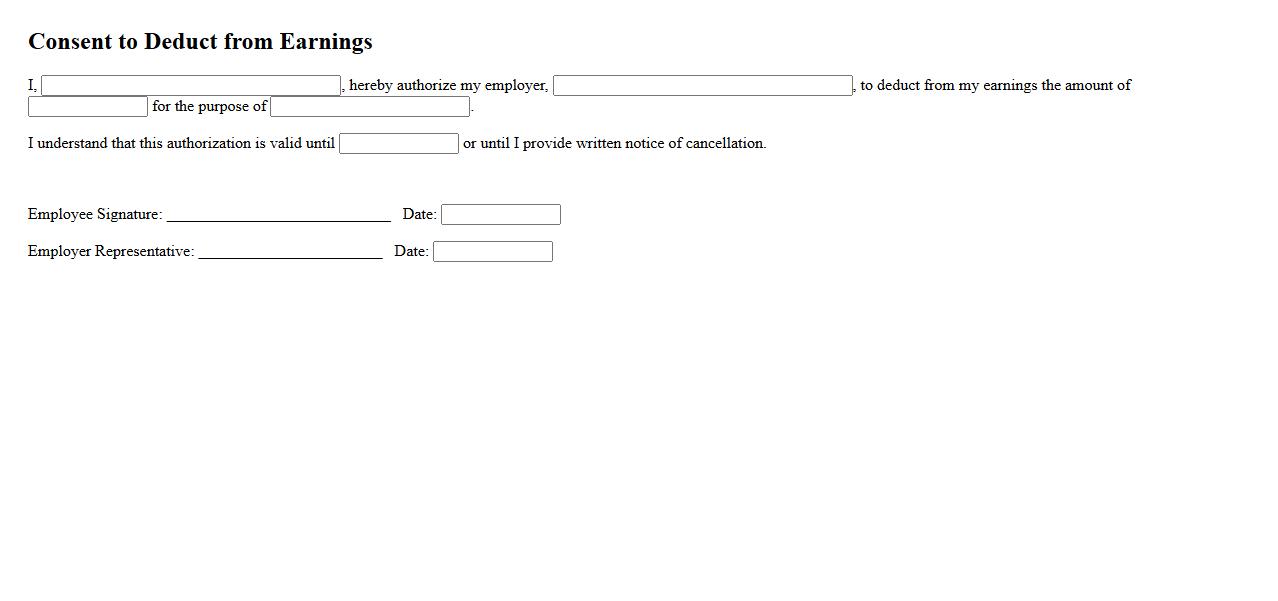

Consent to Deduct from Earnings

Consent to Deduct from Earnings is a formal agreement allowing an employer to withhold specified amounts directly from an employee's salary. This ensures timely repayment of loans, fines, or other financial obligations without the need for separate transactions. It protects both parties by providing clear authorization and transparency in deductions.

Permission for Wage Adjustment

Permission for Wage Adjustment is a formal authorization required to modify an employee's salary or hourly rate. This process ensures that changes comply with company policies and legal regulations. Proper documentation safeguards both employer and employee rights during the adjustment.

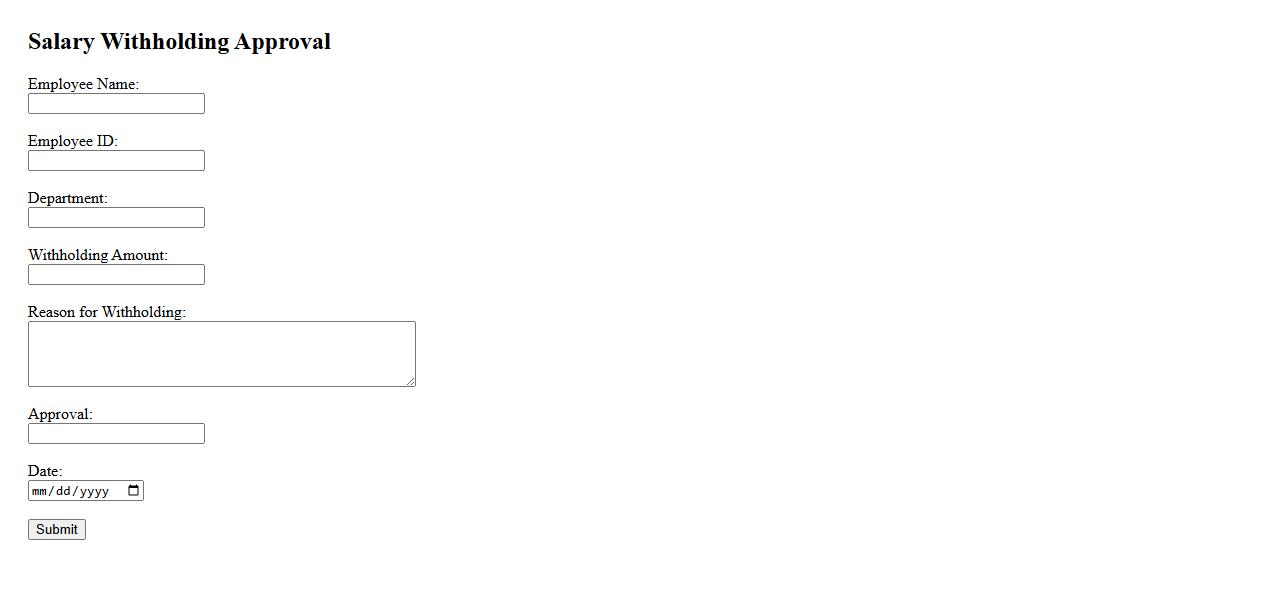

Salary Withholding Approval

Salary Withholding Approval is the formal authorization for an employer to deduct a portion of an employee's salary for specific purposes, such as taxes or loan repayments. This process ensures compliance with legal and financial obligations while maintaining transparency between employers and employees. Proper approval safeguards both parties and streamlines payroll management.

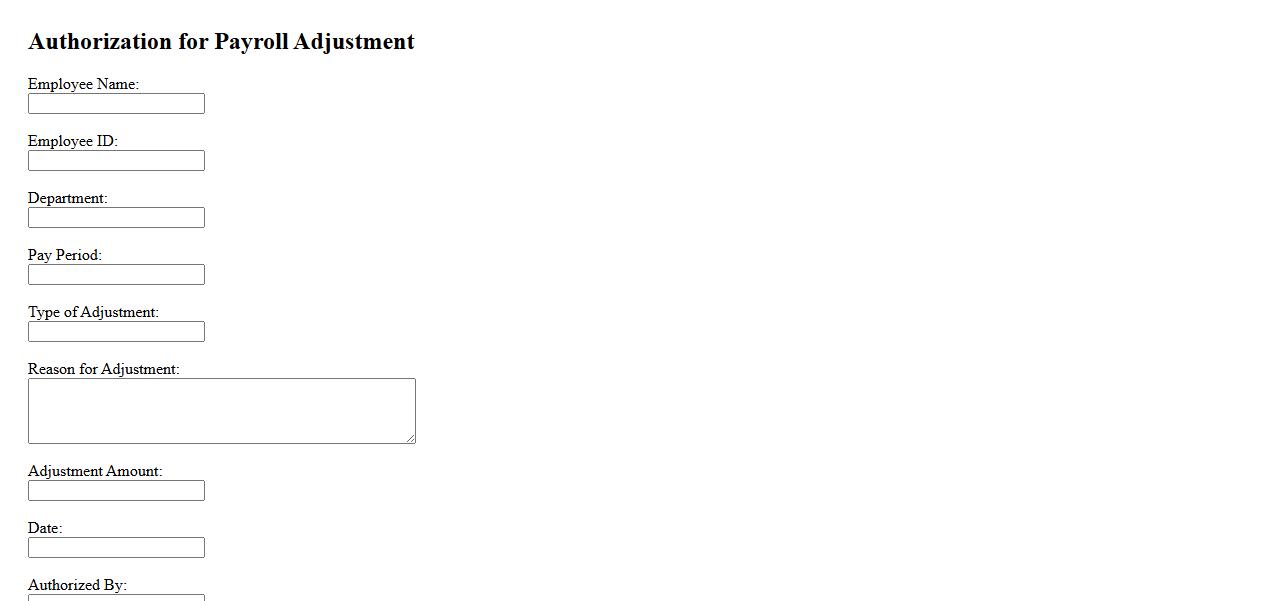

Authorization for Payroll Adjustment

Authorization for Payroll Adjustment is a formal process that ensures any changes to employee payroll are properly approved and documented. This procedure helps maintain accuracy and compliance with company policies and legal regulations. Proper authorization minimizes errors and protects both the employer and employee from discrepancies.

Earnings Deduction Consent Form

The Earnings Deduction Consent Form is a legal document that authorizes an employer to deduct specified amounts directly from an employee's paycheck. This form ensures clear communication and agreement between both parties regarding payroll deductions. It is essential for maintaining transparency and compliance with employment regulations.

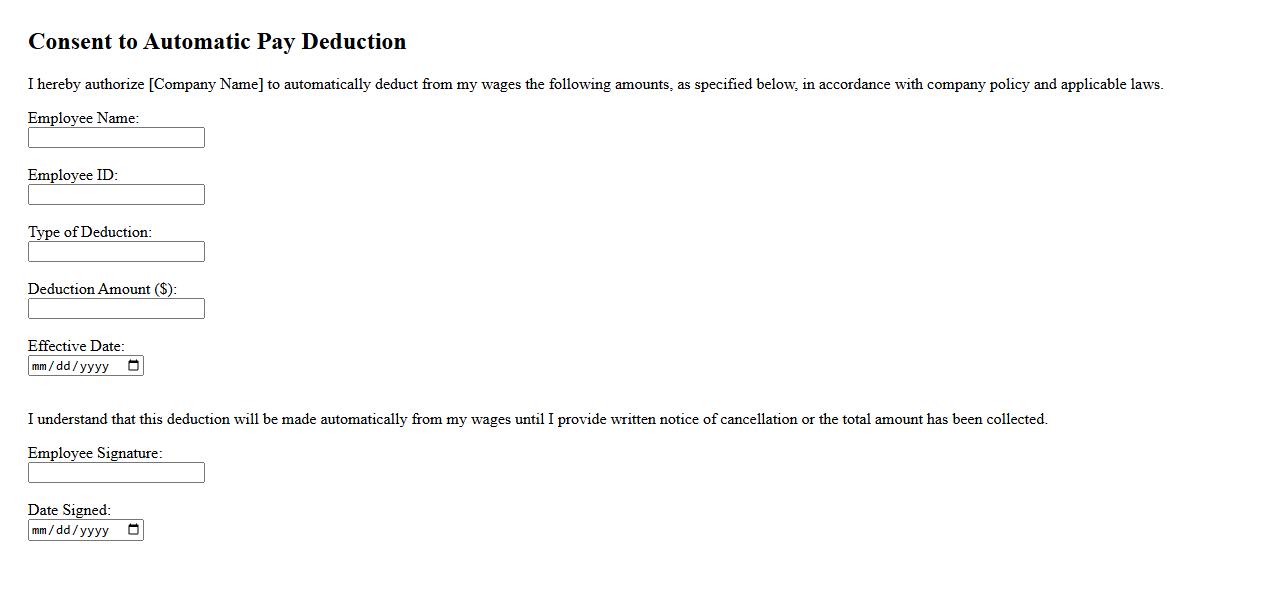

Consent to Automatic Pay Deduction

Consent to Automatic Pay Deduction ensures employees authorize their employer to withdraw specified amounts directly from their paycheck. This agreement simplifies bill payments and loan repayments by automating the process. It provides convenience while maintaining transparency and control over deductions.

What is the specific reason for the salary deduction authorization?

The salary deduction authorization is typically granted for agreed-upon expenses such as loan repayments, insurance premiums, or union dues. This authorization ensures that the employer has the legal right to deduct these amounts directly from the employee's salary. Clear documentation outlining the purpose of the deduction is essential for transparency and compliance.

What exact amount or percentage will be deducted from the employee's salary?

The deduction amount can be a fixed sum or a specific percentage of the employee's monthly salary, as stipulated in the authorization agreement. It is crucial that the exact figures are clearly stated and communicated to avoid any disputes. Regular updates should be provided if the amount or percentage changes over time.

Over what period or frequency will the salary deductions occur?

The deduction frequency generally aligns with the employee's payroll schedule, often occurring monthly or biweekly. The agreed period should be explicitly mentioned in the authorization document to maintain clarity. This ensures the employee and employer have consistent expectations regarding the timing of deductions.

Who is authorized to process and receive the deducted amounts?

The authorized recipient is usually the creditor, financial institution, or organization specified in the deduction agreement. The employer acts as the intermediary responsible for processing these deductions from the employee's salary. Proper authorization ensures that the funds are securely and accurately transferred to the intended party.

What process exists for the employee to revoke or modify the authorization?

Employees typically have the right to revoke or modify their salary deduction authorization by submitting a formal written request. This request should be processed according to the company's policies and within a specified notice period. Clear instructions and accessible communication channels help protect employee rights and ensure smooth adjustments.