Authorization for Tax Information Disclosure allows individuals or entities to grant permission to authorized parties to access their confidential tax records. This authorization is essential for facilitating communication between taxpayers and third parties, such as tax professionals or legal representatives. Proper submission of this authorization ensures compliance with privacy laws while enabling efficient handling of tax matters.

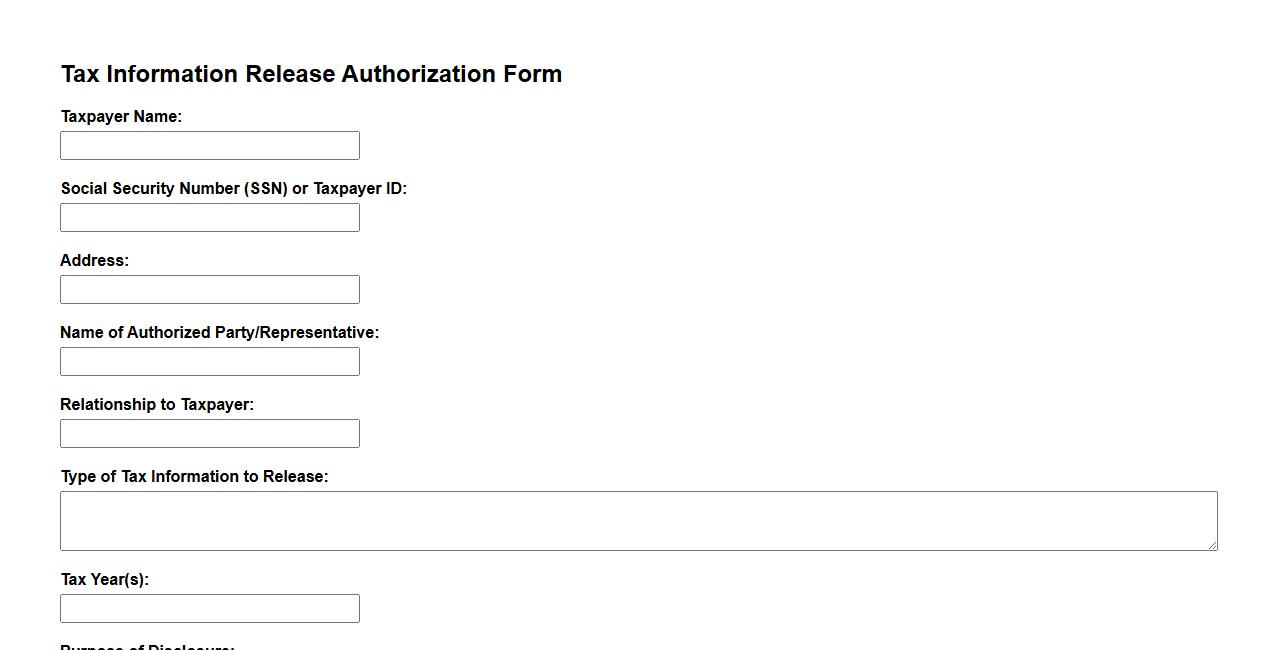

Tax Information Release Authorization Form

The Tax Information Release Authorization Form allows individuals to grant permission for their tax data to be shared with authorized third parties. This form ensures compliance with privacy laws while facilitating efficient handling of tax-related matters. Proper completion of the form is essential for secure and legal information exchange.

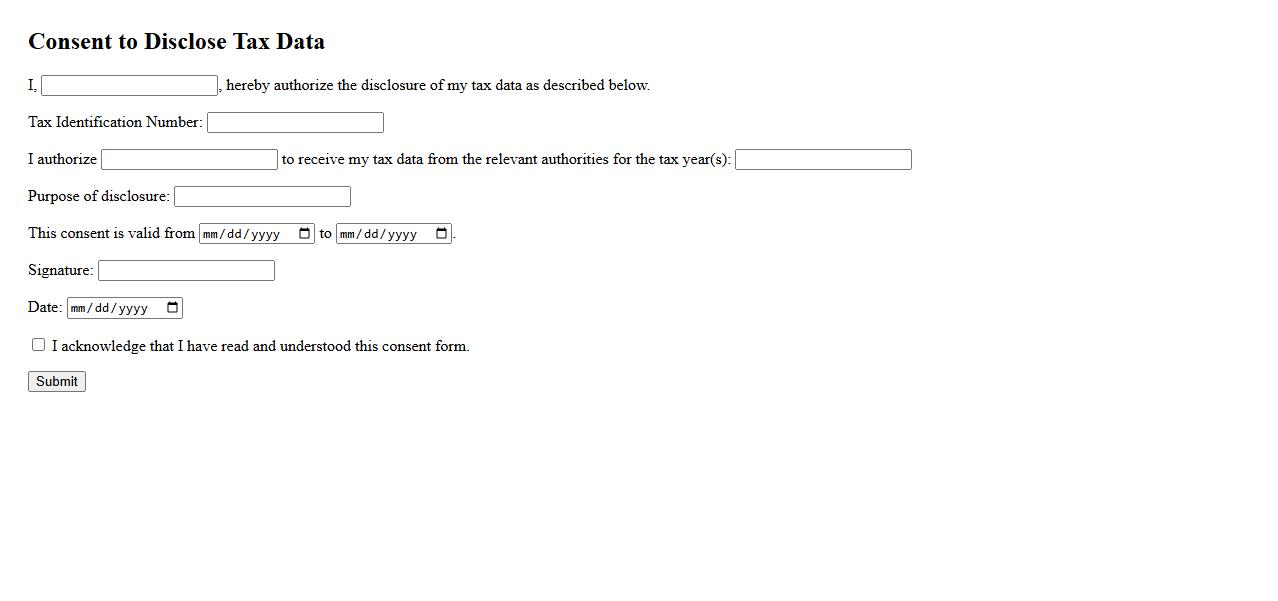

Consent to Disclose Tax Data

Consent to Disclose Tax Data is a legal authorization allowing individuals to permit the sharing of their tax information with designated parties. This consent ensures compliance with privacy laws while facilitating transparent communication between taxpayers and authorized entities. It is essential for processes like financial verification and tax filing assistance.

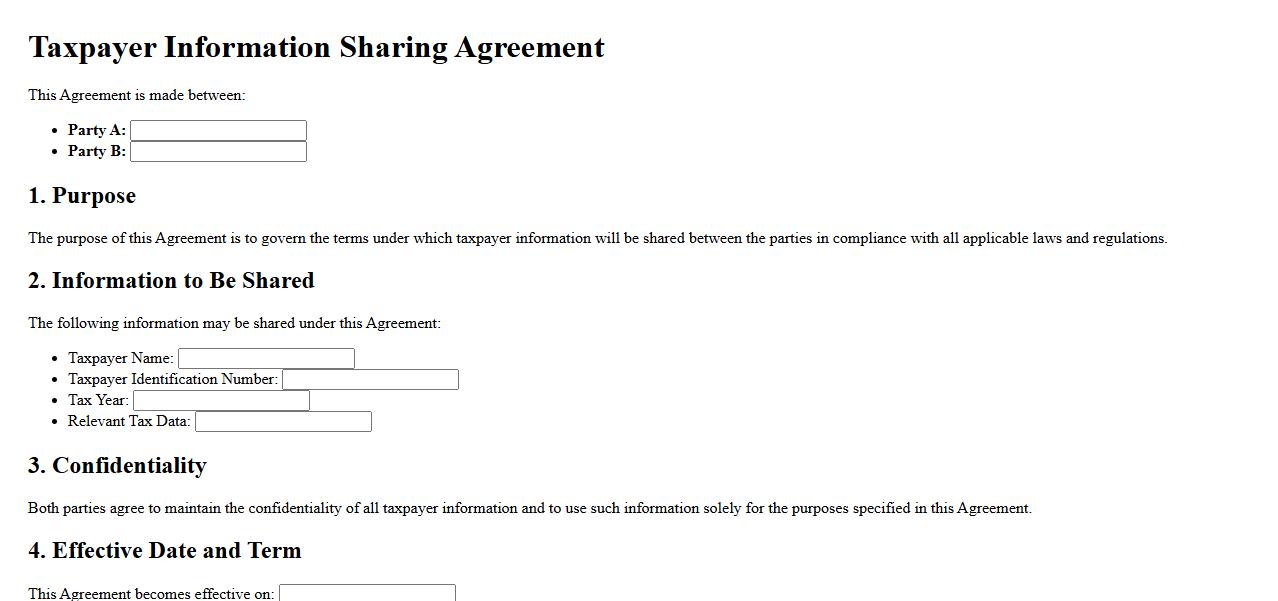

Taxpayer Information Sharing Agreement

The Taxpayer Information Sharing Agreement facilitates the secure exchange of tax-related data between authorized entities. This agreement ensures compliance with legal standards while protecting taxpayer confidentiality. It streamlines collaboration to improve tax administration and enforcement efforts.

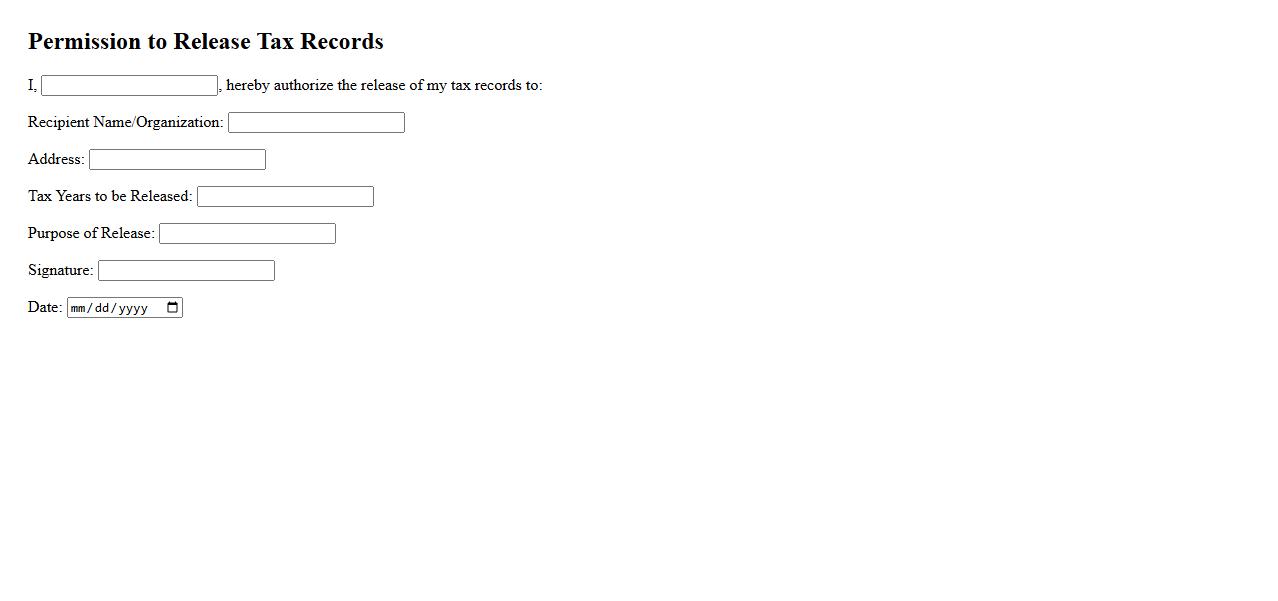

Permission to Release Tax Records

Granting permission to release tax records allows authorized parties to access your financial documents for verification or processing purposes. This consent is essential for tax professionals, lenders, or government agencies to review your tax information accurately. Ensuring proper authorization protects your privacy while facilitating necessary administrative tasks.

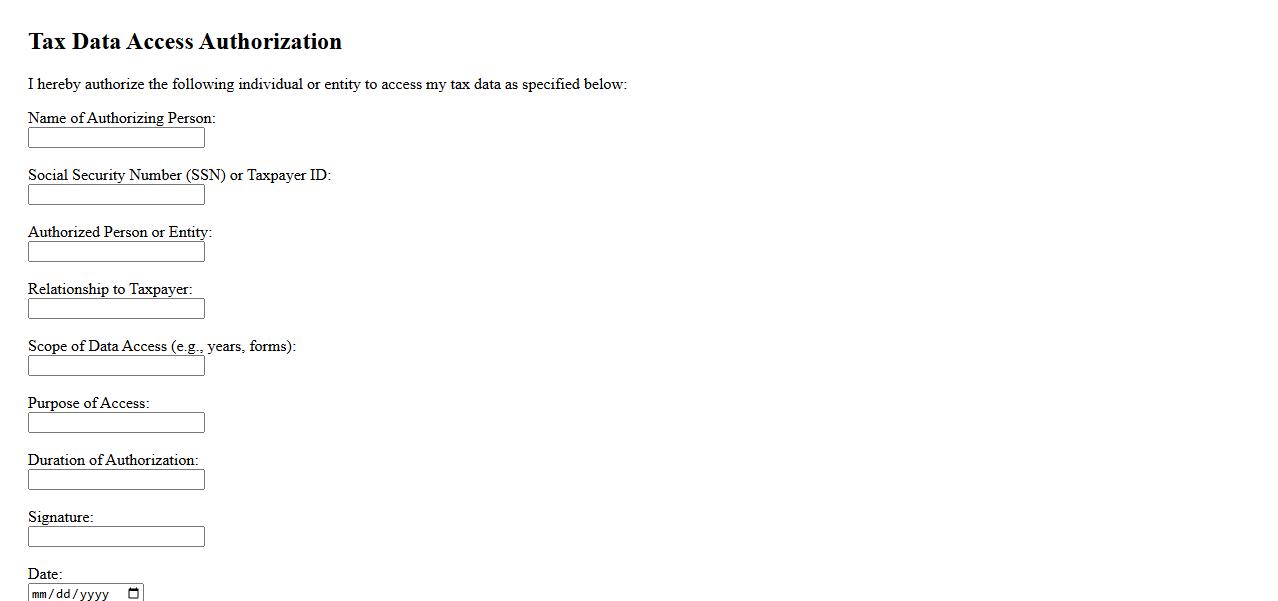

Tax Data Access Authorization

Tax Data Access Authorization ensures that individuals or entities grant permission to authorized parties to view and manage their tax information securely. This process protects sensitive data while allowing necessary access for tax filing or advisory purposes. Proper authorization helps maintain compliance with privacy regulations and enhances data transparency.

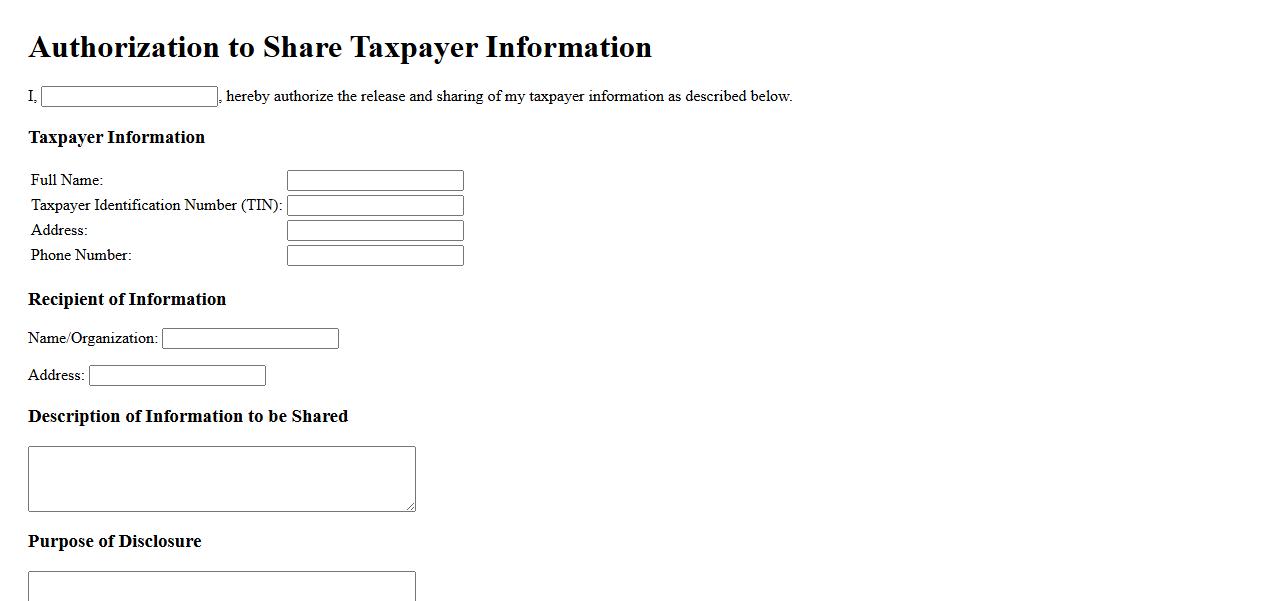

Authorization to Share Taxpayer Information

Authorization to Share Taxpayer Information is a formal consent allowing designated parties to access an individual's or business's tax data. This authorization ensures compliance with privacy laws while enabling authorized persons to handle tax matters efficiently. Proper documentation is essential to protect sensitive information and maintain transparency.

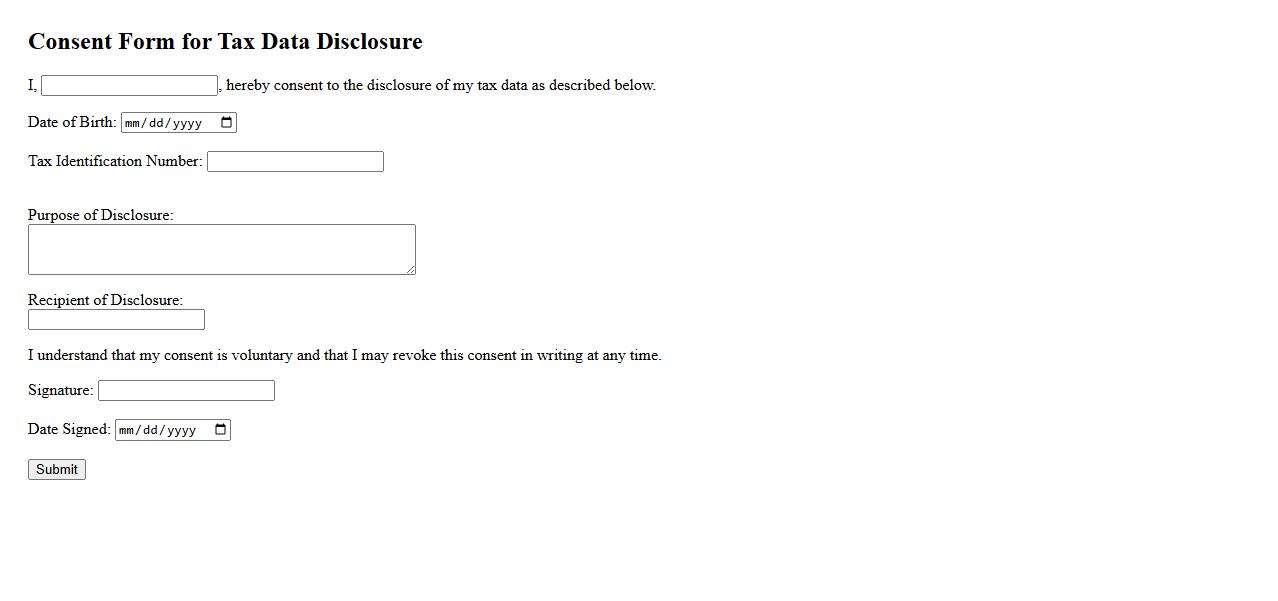

Consent Form for Tax Data Disclosure

A Consent Form for Tax Data Disclosure authorizes the release of your personal tax information to designated parties. This document ensures transparency and compliance with privacy regulations. Signing the form allows authorized entities to access and use your tax data securely.

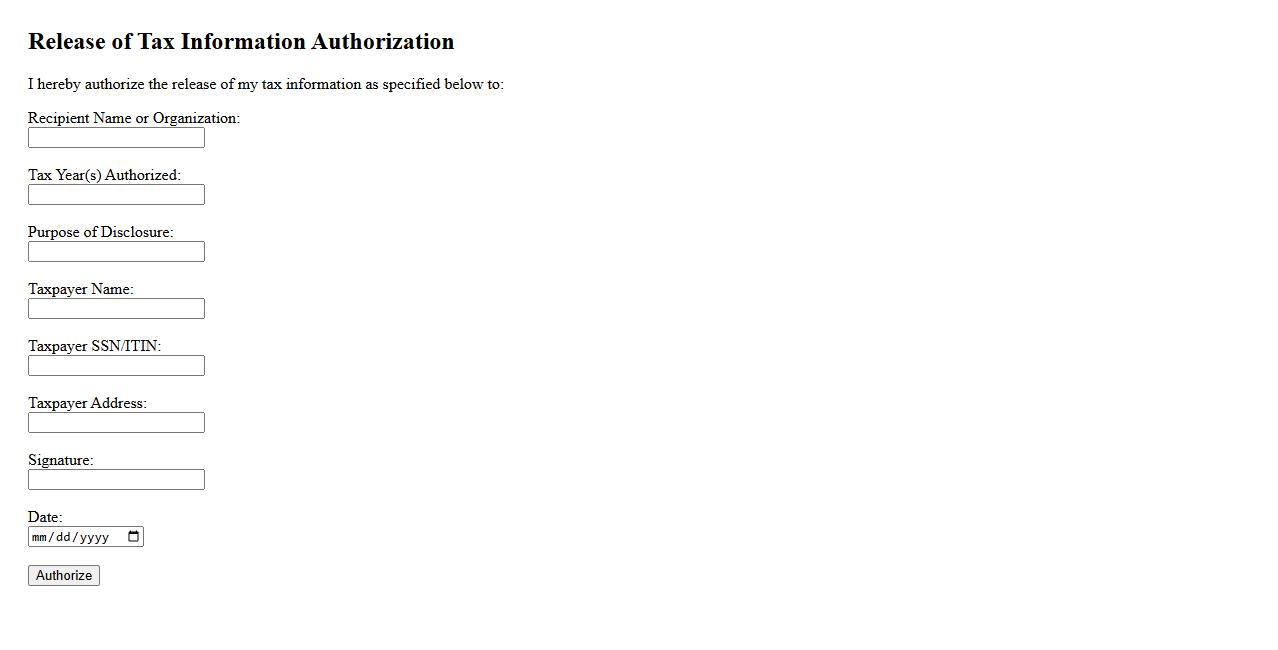

Release of Tax Information Authorization

The Release of Tax Information Authorization allows individuals or entities to grant permission for their tax data to be shared with designated parties. This authorization ensures that sensitive financial information is handled securely and in compliance with legal requirements. It is essential for facilitating communication between taxpayers and authorized representatives.

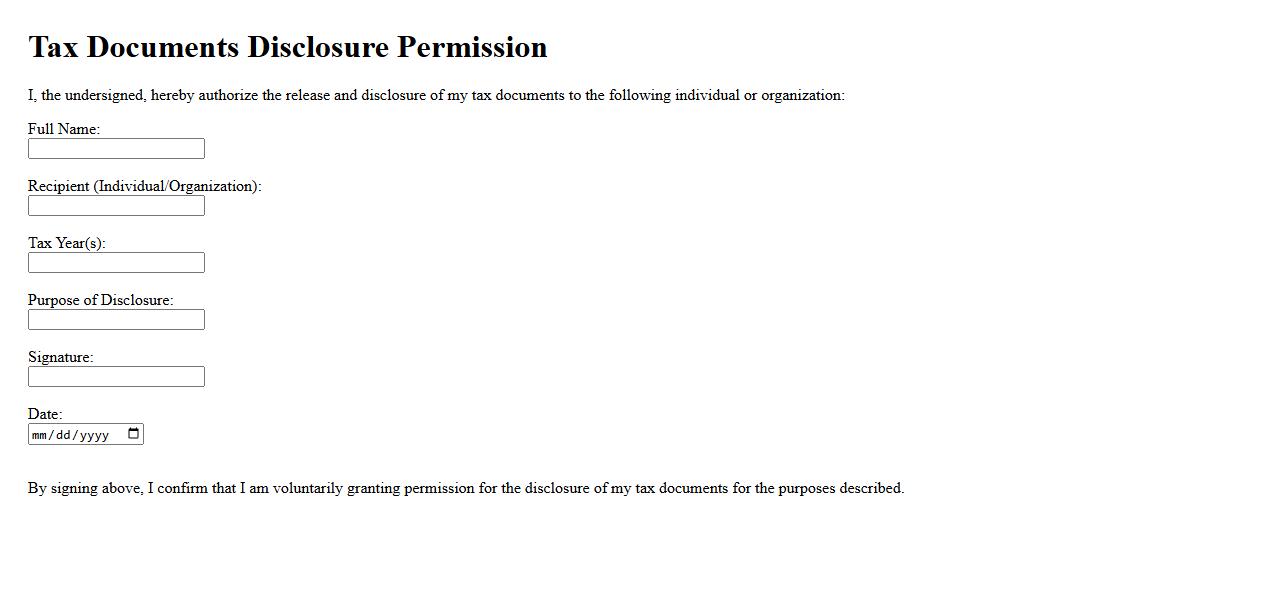

Tax Documents Disclosure Permission

The Tax Documents Disclosure Permission allows authorized parties to access your tax records securely and legally. This consent ensures compliance with privacy laws while facilitating efficient information sharing. It is essential for accurate financial reporting and verification processes.

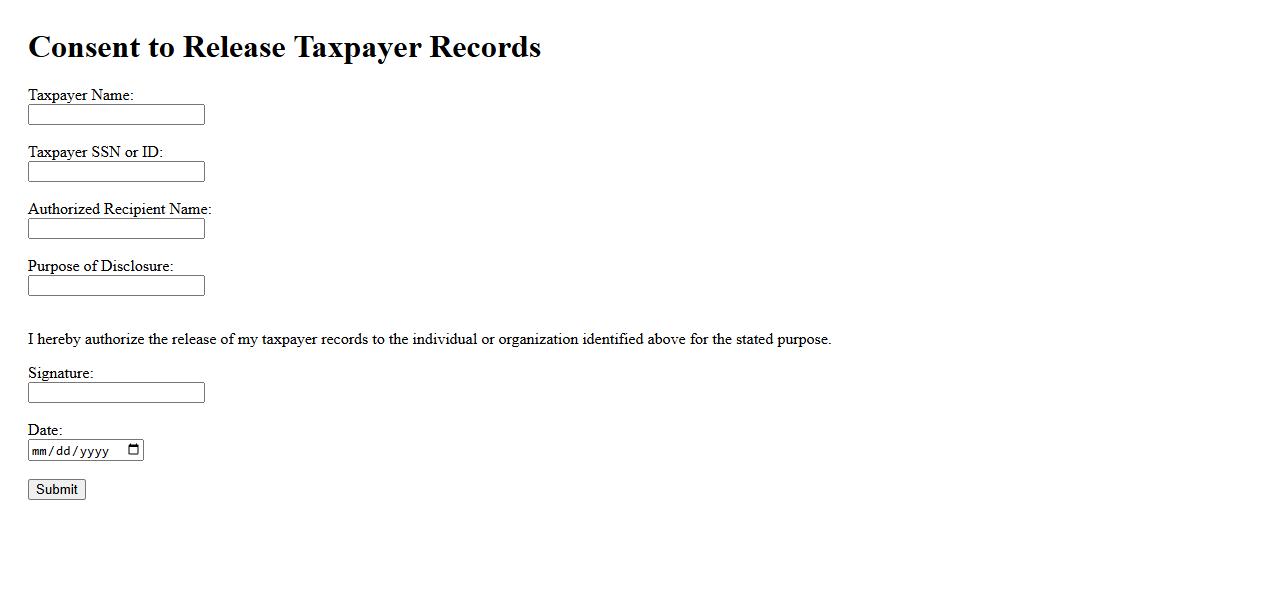

Consent to Release Taxpayer Records

Consent to Release Taxpayer Records allows an individual to authorize a third party to access their tax information. This authorization ensures privacy while enabling necessary communication with tax authorities. It is essential for resolving tax matters efficiently and securely.

What specific tax information is authorized for disclosure under this document?

The document authorizes the disclosure of federal and state tax return information. This may include income details, filing status, and tax payment history. Only the information explicitly listed in the authorization is permitted for release.

Who is permitted to receive the disclosed tax information according to the authorization?

The authorization specifies designated individuals or organizations allowed to receive the tax information. These recipients can include tax professionals, legal representatives, or specified third parties. Disclosure to any other party is prohibited without additional consent.

For what purpose(s) is the disclosed tax information allowed to be used?

The tax information disclosed is strictly for the purposes outlined in the document, such as tax preparation, legal representation, or financial assessment. Use beyond these stated purposes is not authorized. This ensures compliance with privacy regulations and safeguards sensitive data.

What is the validity period or expiration date of this authorization for disclosure?

The authorization includes a clear validity period or expiration date upon which the disclosure rights lapse. After this date, the authorized parties can no longer access the tax information without renewed consent. This period typically aligns with the completion of the intended use.

Can the authorization be revoked, and if so, what is the process for revocation?

The authorization can be revoked at any time by the taxpayer through a formal written request. Revocation must be submitted to the party initially authorized to disclose the tax information. Upon receipt, all disclosures must cease immediately to protect taxpayer confidentiality.