Authorization to Obtain Credit Report is a formal consent allowing a lender or organization to access an individual's credit information. This authorization ensures compliance with legal requirements and protects the individual's privacy rights. Obtaining this consent is essential for conducting credit checks during loan approval or rental applications.

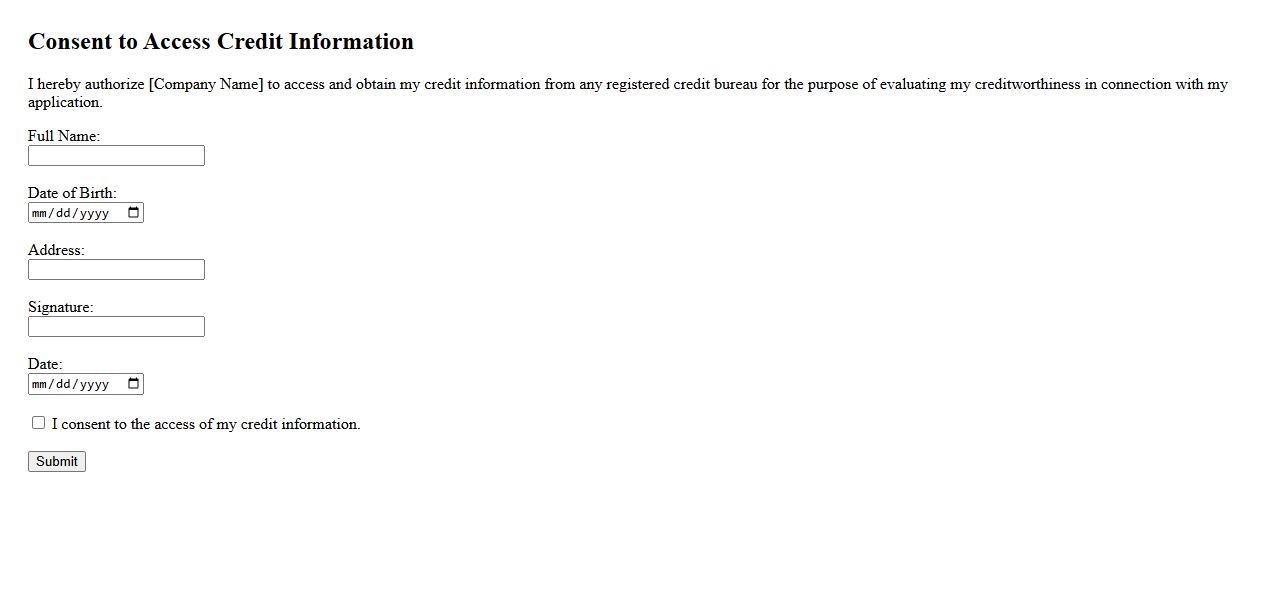

Consent to Access Credit Information

Consent to Access Credit Information is a crucial process that allows lenders or financial institutions to review an individual's credit history. This consent ensures transparency and compliance with privacy regulations before accessing personal credit data. Providing this approval enables informed decision-making for credit assessments and approvals.

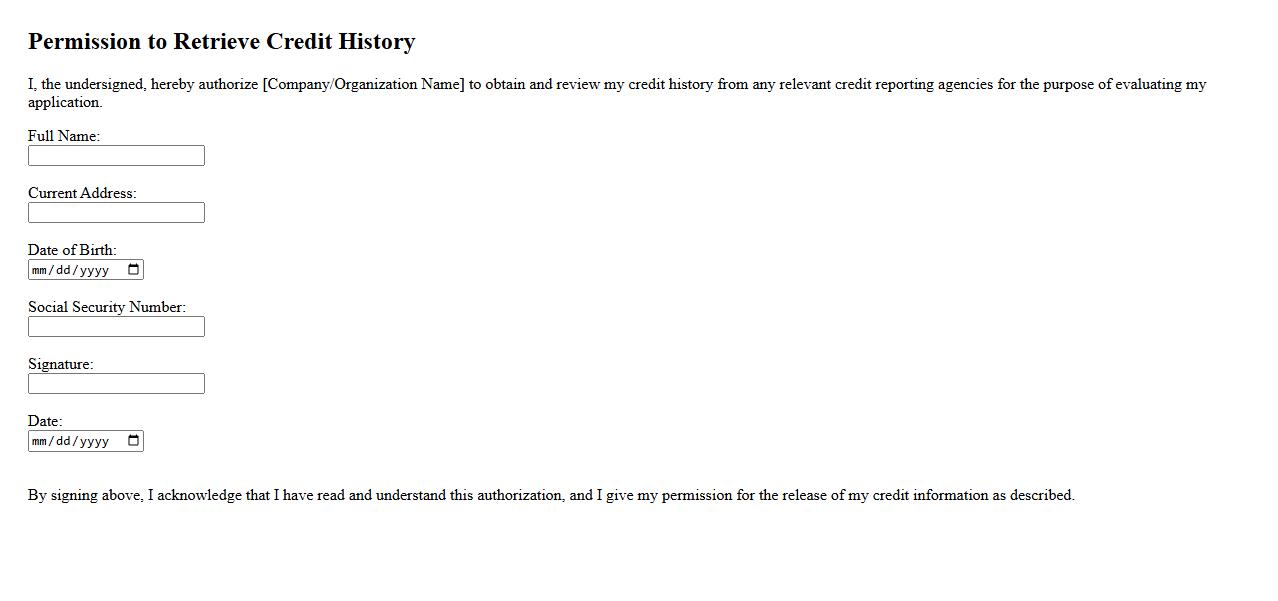

Permission to Retrieve Credit History

Permission to retrieve credit history is essential for businesses and financial institutions to access an individual's credit report legally. This consent allows them to evaluate creditworthiness and make informed decisions regarding loans or services. Without explicit permission, accessing someone's credit information is prohibited by privacy laws.

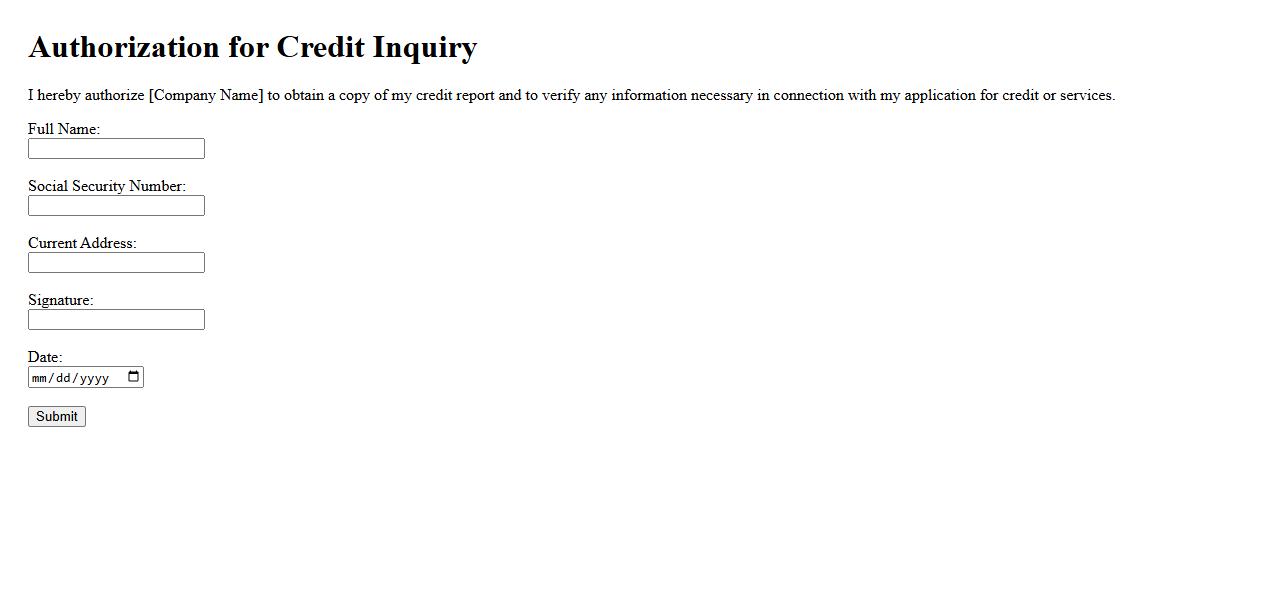

Authorization for Credit Inquiry

Authorization for Credit Inquiry is a formal consent granted by an individual, allowing a lender or organization to access their credit report. This process ensures transparency and compliance with privacy laws during credit evaluations. It is a crucial step in assessing creditworthiness for loans, credit cards, and other financial services.

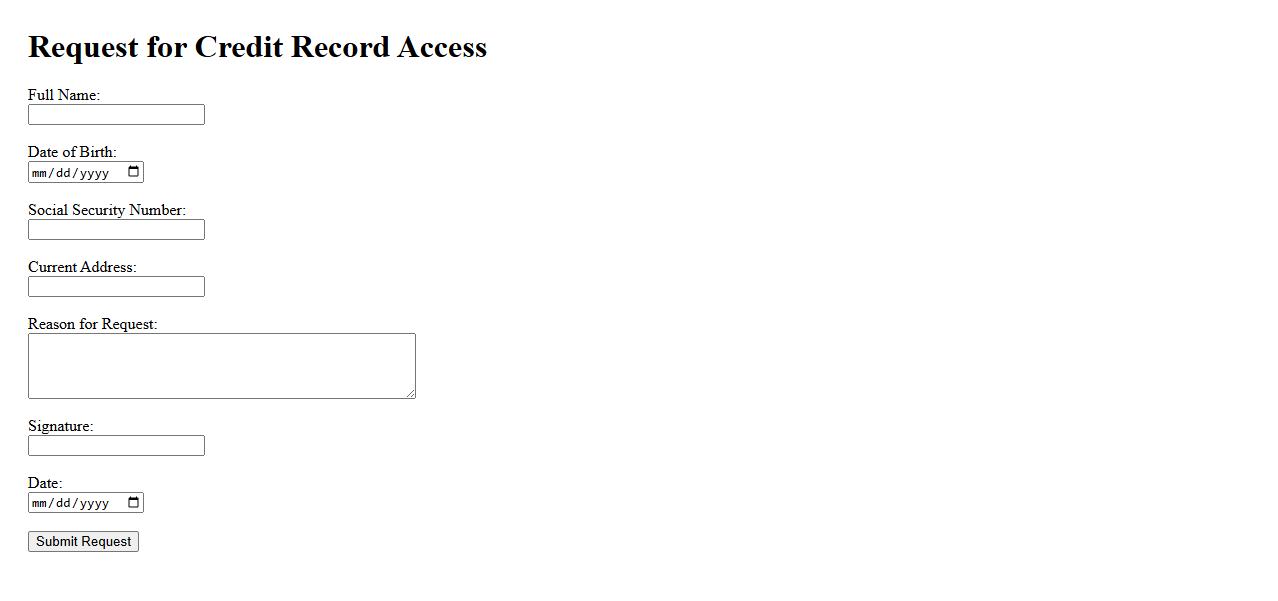

Request for Credit Record Access

Submitting a Request for Credit Record Access allows individuals or authorized entities to obtain detailed credit information. This process ensures transparency and helps in verifying financial reliability. Proper authorization is essential to protect sensitive data and comply with legal requirements.

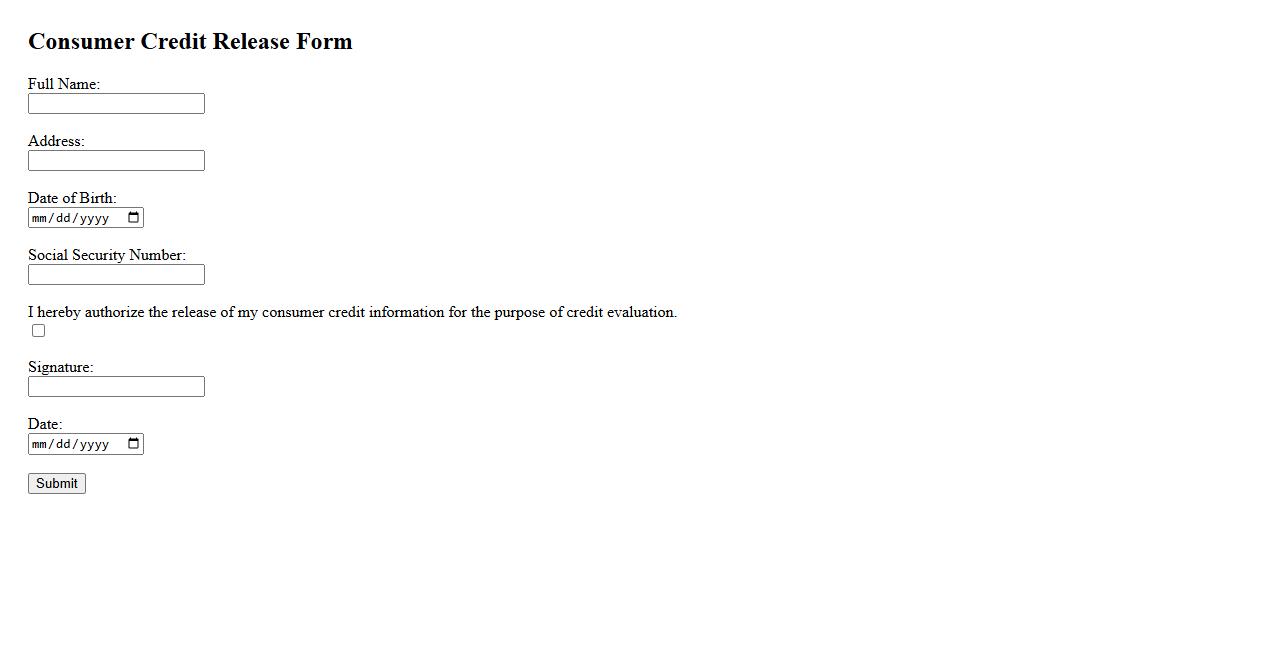

Consumer Credit Release Form

The Consumer Credit Release Form is a legal document that authorizes the release of an individual's credit information to a third party. It ensures compliance with privacy laws while allowing creditors or lenders to access necessary credit data. This form is essential for verifying creditworthiness during financial applications.

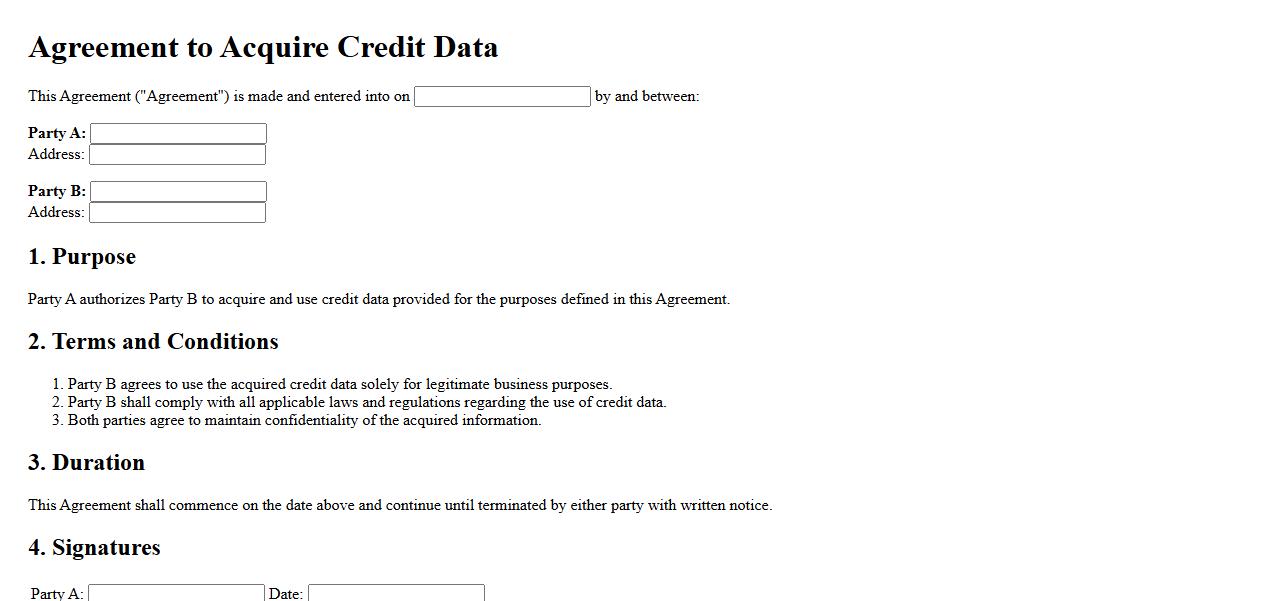

Agreement to Acquire Credit Data

An Agreement to Acquire Credit Data is a formal contract outlining the terms and conditions under which one party obtains credit information from another. This agreement ensures lawful use, confidentiality, and data accuracy. It is essential for businesses assessing creditworthiness and managing financial risk effectively.

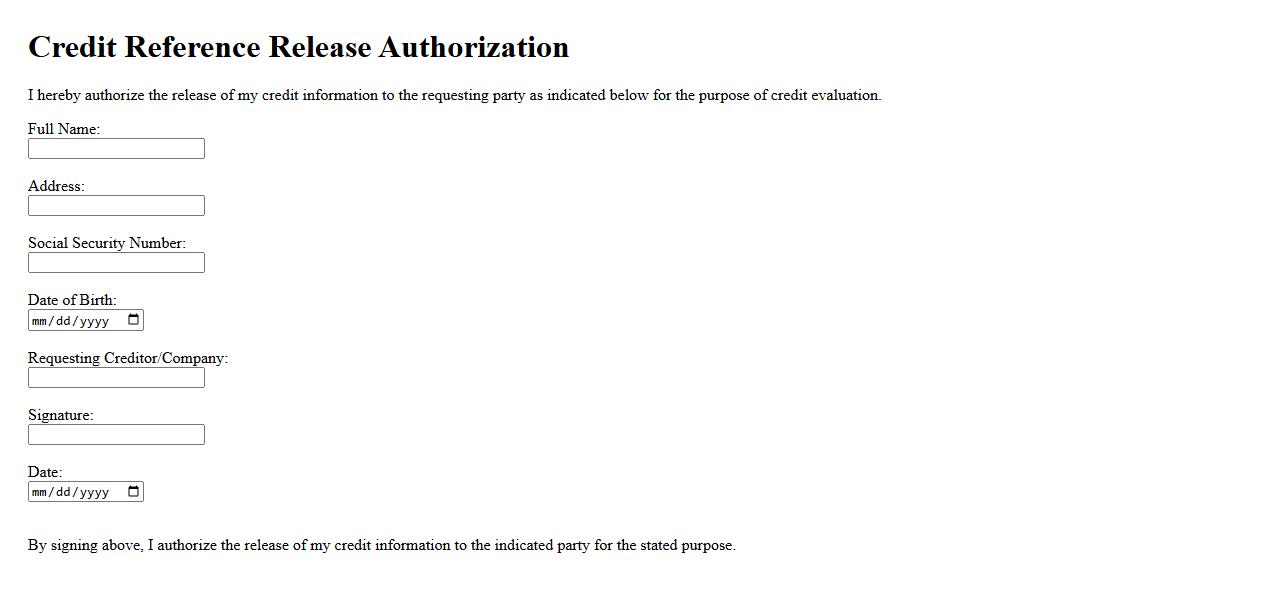

Credit Reference Release Authorization

The Credit Reference Release Authorization is a crucial document that grants permission to access an individual's credit information from credit bureaus. This authorization ensures transparency and compliance during financial assessments or loan applications. It helps lenders verify creditworthiness while protecting consumer rights.

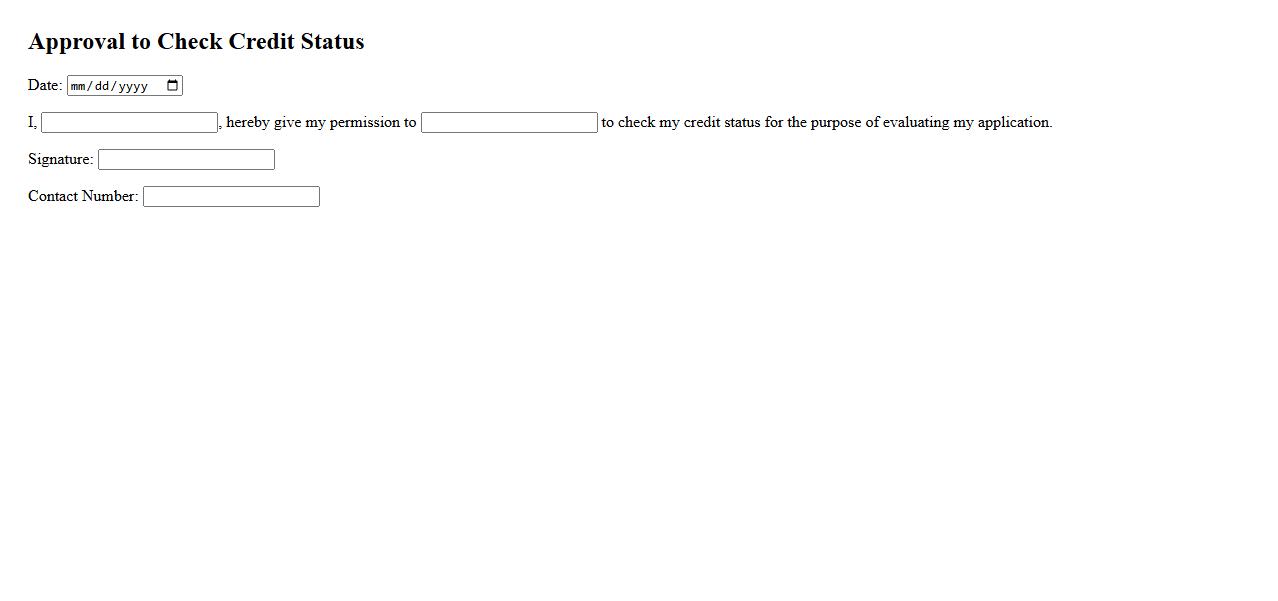

Approval to Check Credit Status

Approval to Check Credit Status is a crucial step in financial transactions, ensuring that the creditworthiness of an individual or business is verified before proceeding. This process helps lenders and service providers make informed decisions by evaluating credit history and risk. Obtaining approval to check credit status fosters transparency and trust between parties involved.

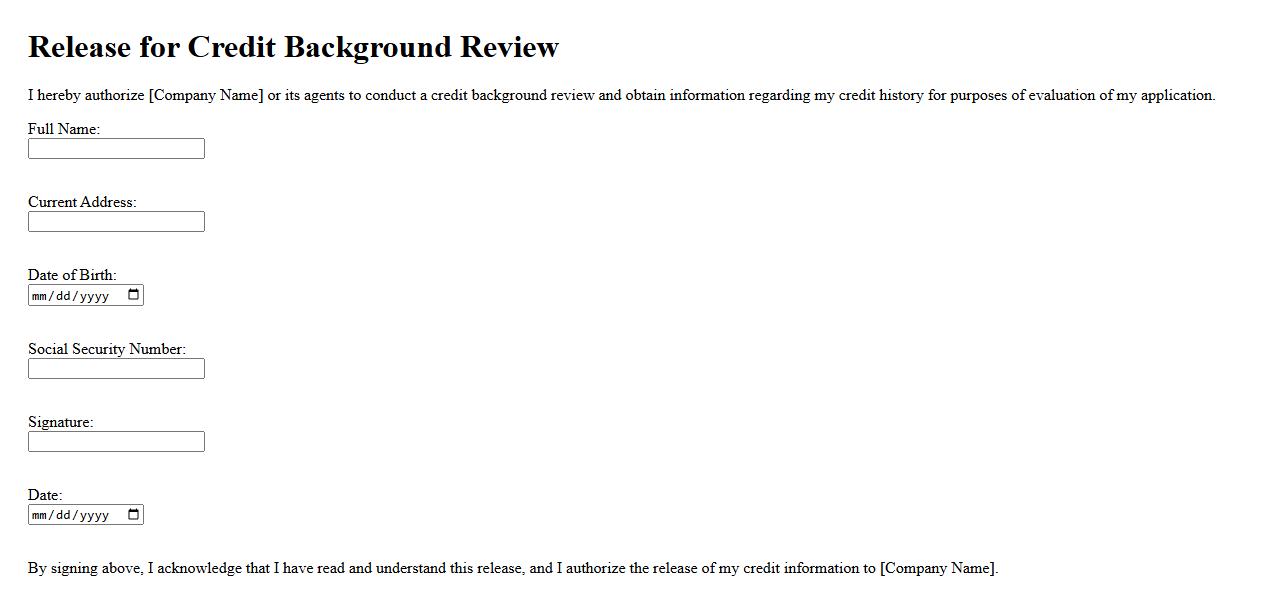

Release for Credit Background Review

The Release for Credit Background Review is a crucial document that grants permission to access an individual's credit history. It ensures compliance with legal standards while enabling thorough evaluation for loan, rental, or employment purposes. This release protects both the requester and the subject by maintaining transparency throughout the review process.

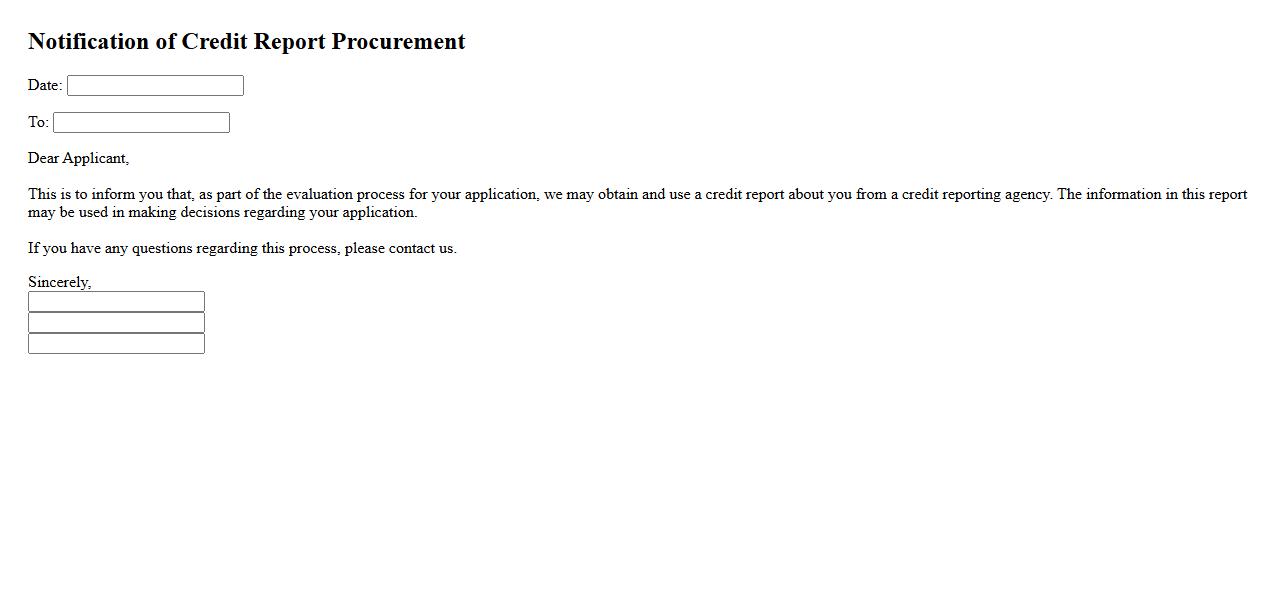

Notification of Credit Report Procurement

Notification of Credit Report Procurement is an important communication informing an individual that their credit report has been requested. This process helps maintain transparency and allows consumers to monitor any unauthorized credit inquiries. Timely notifications empower individuals to protect their financial information effectively.

What specific purpose is the credit report being requested for in the document?

The credit report is requested for the purpose of evaluating creditworthiness. It is primarily used to assess the individual's ability to meet financial obligations. This ensures informed decisions in lending or service agreements.

Which parties are authorized to access or obtain the credit report?

The document authorizes financial institutions, creditors, and authorized agents to access the credit report. These parties use the information to verify credit history. Access is limited to those involved in the evaluation process.

What personal information will be collected and shared as stated in the authorization?

The authorization allows collection of personal data including identification details, credit history, and financial records. This information is shared with authorized parties for credit assessment. It ensures accurate verification of the individual's credit profile.

How long is the authorization to obtain the credit report valid according to the document?

The authorization is typically valid for a specified period, often ranging from 30 to 90 days. This time frame allows adequate evaluation while protecting individual privacy. After expiration, additional consent is required to obtain further reports.

What rights does the individual have regarding revocation or denial of this authorization?

The individual holds the right to revoke or deny authorization at any time before the report is accessed. This protects personal privacy and control over credit information. However, revocation may impact credit approval processes.